UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

13E-3

RULE 13E-3 TRANSACTION STATEMENT UNDER

SECTION 13(E) OF THE SECURITIES EXCHANGE ACT OF 1934

Consolidated

Communications Holdings, Inc.

(Name of the Issuer)

Consolidated

Communications Holdings, Inc.

Condor Holdings LLC

Condor Merger Sub Inc.

Searchlight III CVL, L.P.

Searchlight III CVL GP, LLC

(Names of Persons Filing Statement)

Common Stock, $0.01 par value

(Title of Class of Securities)

209034107

(CUSIP Number of Class of Securities)

J.

Garrett Van Osdell

Chief Legal Officer

Consolidated Communications Holdings, Inc.

2116 South 17th Street

Mattoon, Illinois 61938-5973

(217) 235-3311

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications

on Behalf of the Persons Filing Statement)

With copies to

Robert I. Townsend, III

O. Keith Hallam, III

Cravath, Swaine & Moore LLP

825 8th Avenue

New York, NY 10019

(212) 474-1000 |

Steven A. Cohen

Victor

Goldfeld

Wachtell, Lipton, Rosen & Katz

51 West 52nd Street

New York, NY 10019

(212) 403-1000 |

Ryan J. Maierson

Ryan

J. Lynch

Latham & Watkins LLP

811 Main Street

Houston, TX 77002

(713) 546-7420 |

This statement is filed in connection with (check

the appropriate box):

| a. |

x |

The filing of solicitation materials

or an information statement subject to Regulation 14A, Regulation 14C or Rule 13e-3(c) under the Securities Exchange Act of 1934. |

| b. |

¨ |

The filing of a registration statement under the Securities

Act of 1933. |

| c. |

¨ |

A tender offer. |

| d. |

¨ |

None of the above. |

Check the following box if the soliciting materials

or information statement referred to in checking box (a) are preliminary copies: x

Check the following box if the filing is a final

amendment reporting the results of the transaction: ¨

INTRODUCTION

This Rule 13e-3 transaction statement on Schedule

13E-3, together with the exhibits hereto (this “Schedule 13E-3” or “Transaction Statement”), is being filed with

the Securities and Exchange Commission (the “SEC”) pursuant to Section 13(e) of the Securities Exchange Act of 1934, as amended

(together with the rules and regulations promulgated thereunder, the “Exchange Act”), jointly by the following persons (each,

a “Filing Person,” and collectively, the “Filing Persons”): (i) Consolidated Communications Holdings, Inc. (“Consolidated”

or the “Company”), a Delaware corporation and the issuer of the common stock, par value $0.01 per share (the “Shares”),

that is subject to the Rule 13e-3 transaction, (ii) Condor Holdings LLC, a Delaware limited liability company (“Parent”),

(iii) Condor Merger Sub Inc., a Delaware corporation and a wholly owned subsidiary of Parent (“Merger Sub”), (iv) Searchlight

III CVL, L.P., a Delaware partnership and the sole member of Parent (“Searchlight III CVL”) and (v) Searchlight III CVL GP,

LLC, a Delaware limited liability company and the general partner of Searchlight III CVL (“Searchlight III CVL GP”). Parent,

Merger Sub, Searchlight III CVL and Searchlight III CVL GP are Filing Persons of this Transaction Statement because they are affiliates

of the Company under the SEC rules governing “going-private” transactions.

On

October 15, 2023, the Company entered into an Agreement and Plan of Merger (as amended, restated, supplemented or otherwise modified

from time to time, the “Merger Agreement”) with Parent and Merger Sub, pursuant to which, subject to the terms and

conditions thereof, Merger Sub will merge with and into the Company (the “Merger”) with the Company continuing as the surviving

corporation and a wholly owned subsidiary of Searchlight III CVL.

In

connection with the Merger Agreement, Parent has obtained equity financing commitments from British Columbia Investment Management

Corporation, in respect of a pooled investment portfolio formed under the Pooled Investment Portfolios Regulation (British Columbia)

and known as the “2020 Private Equity Fund” (“BCI”) and certain affiliates of Parent (together with BCI, the

“Guarantors”) in an aggregate amount of $370,000,000 to fund the transactions contemplated by the Merger Agreement (the “Equity

Commitment Letters”). The consummation of the Merger is not subject to a financing condition. The Company is entitled to specific

performance, subject to the terms and conditions of the Merger Agreement and the applicable equity commitments, to require each Guarantor

to fund its respective equity commitment and Parent to close the Merger, if, among other things, all closing conditions are met. In addition,

concurrently with the execution of the Merger Agreement, each of the Guarantors also entered into a limited guaranty with the Company

(the “Limited Guaranties”) pursuant to which the Guarantors have each provided a limited guaranty with respect to the payment

of their pro rata portion of certain payment obligations of Parent and Merger Sub that may be owed to the Company under the Merger Agreement

up to the applicable aggregate amount set forth in the Limited Guaranties.

Subject

to the terms and conditions set forth in the Merger Agreement, at the effective time of the Merger (the “Effective Time”),

each Share issued and outstanding immediately prior to the Effective Time (other than Shares (i) held by Parent, Merger Sub, or any subsidiary

of the Company or Parent, (ii) held by the Company as treasury shares or (iii) held by any person who properly exercises appraisal rights

under Delaware law (collectively, the “Excluded Shares”)) shall be converted into the right to receive an amount in cash

equal to $4.70 per share, without interest (the “Merger Consideration”), subject to any withholding of taxes required by

applicable law.

In addition, pursuant to the Merger Agreement,

at the Effective Time, (i) each award of restricted shares of Company common stock subject to time-based vesting conditions that is held

by a non-employee director or by certain affiliates of Parent (each, a “director Company RSA”) will vest and be converted

into the right to receive a cash payment equal to (a) the Merger Consideration multiplied by (b) the number of shares of Company common

stock subject to such director Company RSA, (ii) each other award of restricted shares of Company common stock that remains subject solely

to service-based vesting conditions (each, a “Company RSA”) will be converted into an award representing the right to receive

an amount in cash (without interest) (a “contingent cash award”) with a value equal to (a) the Merger Consideration multiplied

by (b) the number of shares of Company common stock subject to such Company RSA and (iii) each performance-based award of restricted

shares of Company common stock (each, a “Company PSA”) will be converted into a contingent cash award with a value equal

to (a) the Merger Consideration multiplied by (b) the number of shares of Company common stock subject to such Company PSA. The number

of shares of Company common stock subject to a Company PSA will be determined based on the number of shares of Company common stock that

would have been earned under such Company PSA based on the actual level of achievement of the performance goals (other than the total

shareholder return modifier, which will be deemed to be achieved at the target level (i.e., 100%)) through the end of the performance

period (as determined by the board of directors of the surviving corporation (or the appropriate committee thereof) in reasonable good

faith).

Each contingent cash award will be subject to

the same terms and conditions (other than the total shareholder return modifier), including vesting conditions, applicable to the underlying

Company RSA or Company PSA from which it was converted (including any accelerated vesting terms and conditions).

Concurrently with the execution of the Merger

Agreement, the Company entered into a voting agreement (the “Voting Agreement”) with Searchlight III CVL, which, directly

or indirectly, beneficially owns approximately 33.8% of the outstanding Shares, pursuant to which, among other things, Searchlight III

CVL has agreed to vote (or cause to be voted) all of the Shares held by Searchlight III CVL or Searchlight Capital Partners, L.P. in

favor of the adoption of the Merger Agreement and approval of the Merger and the other transactions contemplated by the Merger Agreement.

Concurrently with the filing of this Schedule

13E-3, the Company is filing with the SEC a preliminary proxy statement (the “Proxy Statement”) under Regulation 14A of the

Exchange Act, relating to a special meeting of the stockholders of the Company (the “Special Meeting”) at which the stockholders

of the Company will consider and vote upon a proposal to adopt the Merger Agreement and cast an advisory (non-binding) vote to approve

the compensation that may be paid or become payable to the named executive officers of the Company in connection with the consummation

of the Merger. The adoption of the Merger Agreement will require the affirmative vote (in person or by proxy) of the holders of (a) a

majority of the voting power represented by the Shares that are entitled to vote thereon in accordance with the Delaware General Corporation

Law and (b) a majority of the voting power represented by the Shares that are entitled to vote thereon in accordance with the DGCL and

held by Unaffiliated Stockholders (as defined in the Proxy Statement). A copy of the Proxy Statement is attached hereto as Exhibit (a)(2)(i)

and incorporated herein by reference. A copy of the Merger Agreement is attached hereto as Exhibit (d)(i) and is also included as Annex

A to the Proxy Statement and incorporated herein by reference.

The board of directors of the Company (the “Board”)

formed a special committee of independent and disinterested members of the Board (the “Special Committee”) to, among other

things, evaluate the Merger, and the Special Committee has unanimously determined that it was fair to and in the best interests of the

Company and the Unaffiliated Stockholders for the Company to enter into the Merger Agreement and unanimously recommended that the Board:

(i) approve and declare advisable the Merger Agreement and the transactions contemplated by the Merger Agreement, (ii) approve the execution,

delivery and performance of the Merger Agreement by the Company and the consummation of the Merger and the other transactions contemplated

by the Merger Agreement, (iii) direct that the Merger Agreement be submitted to the holders of Shares entitled to vote thereon for its

adoption and (iv) recommend the adoption of the Merger Agreement and approval of the Merger and the other transactions contemplated by

the Merger Agreement by the holders of Shares.

The Board, acting upon the recommendation of the

Special Committee, by unanimous vote of those directors present at a special meeting of the Board (excluding the Searchlight Directors,

who recused themselves), determined that it was fair to and in the best interests of the Company and the Unaffiliated Stockholders for

the Company to enter into the Merger Agreement and approved and declared advisable the Merger Agreement and the transactions contemplated

by the Merger Agreement and (i) approved the execution, delivery and performance of the Merger Agreement by the Company and the consummation

of the Merger and the other transactions contemplated by the Merger Agreement, (ii) directed that the Merger Agreement be submitted to

the holders of Shares entitled to vote thereon for its adoption and (iii) recommended the adoption of the Merger Agreement and approval

of the Merger and the other transactions contemplated by the Merger Agreement by the holders of Shares.

The Merger is subject to the satisfaction or waiver

of the conditions set forth in the Merger Agreement, including the approval and adoption of the Merger Agreement by the Company’s

stockholders.

The cross-references below are being supplied

pursuant to General Instruction G to Schedule 13E-3 and show the location in the Proxy Statement of the information required to be included

in response to the items of Schedule 13E-3. Pursuant to General Instruction F to Schedule 13E-3, the information contained in the Proxy

Statement, including all appendices thereto, is incorporated in its entirety herein by reference, and the responses to each item in this

Schedule 13E-3 are qualified in their entirety by the information contained in the Proxy Statement and the appendices thereto.

As of the date hereof, the Proxy Statement is

in preliminary form and is subject to completion and/or amendment. This Schedule 13E-3 will be amended to reflect such completion or

amendment of the Proxy Statement. Capitalized terms used but not expressly defined in this Schedule 13E-3 shall have the respective meanings

given to them in the Proxy Statement.

The information concerning the Company contained

in, or incorporated by reference into this Schedule 13E-3 and the Proxy Statement was supplied by the Company. Similarly, all information

concerning each other Filing Person contained in, or incorporated by reference into this Schedule 13E-3 and the Proxy Statement was supplied

by such Filing Person. No Filing Person, including the Company, is responsible for the accuracy of any information supplied by any other

Filing Person.

Item

1. Summary Term Sheet

The information set forth in the Proxy Statement

under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE

SPECIAL MEETING AND THE MERGER”

Item

2. Subject Company Information

(a)

Name and Address. The information set forth in the Proxy Statement under the following caption is incorporated herein

by reference:

“THE PARTIES TO THE MERGER”

(b)

Securities. The information set forth in the Proxy Statement under the following captions is incorporated herein by

reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE

SPECIAL MEETING AND THE MERGER”

“THE SPECIAL MEETING — Record

Date and Stockholders Entitled to Vote”

“OTHER IMPORTANT INFORMATION REGARDING

THE COMPANY — Beneficial Ownership of Common Stock by Management and Directors”

“OTHER IMPORTANT INFORMATION REGARDING

THE COMPANY — Market Price of Shares and Dividends”

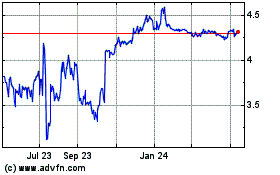

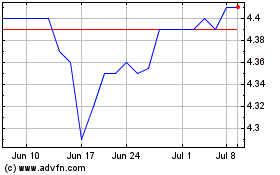

(c) Trading

Market and Price. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference:

“SUMMARY TERM SHEET”

“OTHER IMPORTANT INFORMATION REGARDING

THE COMPANY — Market Price of Shares and Dividends”

(d)

Dividends. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference:

“OTHER IMPORTANT INFORMATION REGARDING

THE COMPANY — Market Price of Shares and Dividends”

(e)

Prior Public Offerings. The information set forth in the Proxy Statement under the following caption is incorporated

herein by reference:

“OTHER IMPORTANT INFORMATION REGARDING

THE COMPANY — Prior Public Offerings”

(f) Prior

Stock Purchases. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference:

“OTHER IMPORTANT INFORMATION REGARDING

THE COMPANY — Certain Transactions in the Shares of Company Common Stock”

“OTHER IMPORTANT INFORMATION REGARDING

THE COMPANY — Past Contacts, Transactions, Negotiations and Agreements”

Item

3. Identity and Background of Filing Person

(a)–(c)

Name and Address; Business and Background of Entities; Business and Background of Natural Persons. Consolidated Communications

Holdings, Inc. is the subject company. The information set forth in the Proxy Statement under the following captions is incorporated

herein by reference:

“SUMMARY TERM SHEET”

“THE PARTIES TO THE MERGER”

“OTHER IMPORTANT INFORMATION REGARDING

THE COMPANY”

“OTHER IMPORTANT INFORMATION REGARDING

PARENT”

“WHERE YOU CAN FIND ADDITIONAL

INFORMATION”

Item

4. Terms of the Transaction

(a)(1)

Tender Offers. Not Applicable.

(a)(2)

Merger or Similar Transactions. The information set forth in the Proxy Statement under the following captions is incorporated

herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE

SPECIAL MEETING AND THE MERGER”

“SPECIAL FACTORS — Background

of the Merger”

“SPECIAL FACTORS — Recommendation

of the Special Committee”

“SPECIAL FACTORS — Recommendation

of the Board”

“SPECIAL FACTORS — Reasons

for the Merger”

“SPECIAL FACTORS — Certain

Financial Forecasts”

“SPECIAL FACTORS — Opinion

of Rothschild & Co US Inc.”

“SPECIAL FACTORS — Purpose

and Reasons of the Company for the Merger”

“SPECIAL FACTORS — Position

of the Company as to the Fairness of the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Searchlight Entities for the Merger”

“SPECIAL FACTORS — Position

of the Searchlight Entities as to the Fairness of the Merger”

“SPECIAL FACTORS — Plans

for the Company After the Merger”

“SPECIAL FACTORS — Certain

Effects of the Merger”

“SPECIAL FACTORS — Effects

on the Company if the Merger Is Not Consummated”

“SPECIAL FACTORS — Alternatives

to the Merger”

“SPECIAL FACTORS — Financing

of the Merger”

“SPECIAL FACTORS — Interests

of the Company’s Directors and Executive Officers in the Merger”

“SPECIAL FACTORS — Material

U.S. Federal Income Tax Consequences of the Merger”

“SPECIAL FACTORS — Regulatory

Approvals in Connection with the Merger”

“SPECIAL FACTORS — Delisting

and Deregistration of Company Common Stock”

“SPECIAL FACTORS — Accounting

Treatment”

“THE SPECIAL MEETING — Vote

Required”

“THE MERGER AGREEMENT”

“THE VOTING AGREEMENT”

“DELISTING AND DEREGISTRATION

OF COMMON STOCK”

Annex A — Agreement

and Plan of Merger

(c)

Different Terms. The information set forth in the Proxy Statement under the following captions is incorporated herein

by reference:

“SUMMARY TERM SHEET”

“SPECIAL FACTORS — Plans

for the Company After the Merger”

“SPECIAL FACTORS — Certain

Effects of the Merger”

“SPECIAL FACTORS — Interests

of the Company’s Directors and Executive Officers in the Merger”

“SPECIAL FACTORS — Financing

of the Merger”

“THE MERGER AGREEMENT —

Consideration To Be Received in the Merger”

“THE MERGER AGREEMENT — Treatment

of Company Equity Awards”

“THE VOTING AGREEMENT”

“PROPOSAL 2: ADVISORY COMPENSATION

PROPOSAL”

Annex A — Agreement

and Plan of Merger

Annex B — Voting

Agreement

(d)

Appraisal Rights. The information set forth in the Proxy Statement under the following captions is incorporated herein

by reference:

“SPECIAL FACTORS — Appraisal

Rights”

“THE SPECIAL MEETING — Appraisal

Rights”

Annex A — Agreement

and Plan of Merger

(e) Provisions

for Unaffiliated Security Holders. The information set forth in the Proxy Statement under the following captions is incorporated

herein by reference:

“SPECIAL FACTORS — Recommendation

of the Special Committee”

“SPECIAL FACTORS — Recommendation

of the Board”

“SPECIAL FACTORS — Reasons

for the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Company for the Merger”

“SPECIAL FACTORS — Position

of the Company as to the Fairness of the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Searchlight Entities for the Merger”

“SPECIAL FACTORS — Position

of the Searchlight Entities as to the Fairness of the Merger”

“SPECIAL FACTORS — Provisions

for Unaffiliated Stockholders”

(f) Eligibility

for Listing or Trading. Not Applicable.

Item

5. Past Contacts, Transactions, Negotiations and Agreements

(a)

Transactions. The information set forth in the Proxy Statement under the following captions is incorporated herein

by reference:

“SUMMARY TERM SHEET”

“SPECIAL FACTORS — Background

of the Merger”

“SPECIAL FACTORS — Interests

of the Company’s Directors and Executive Officers in the Merger”

“SPECIAL FACTORS — Financing

of the Merger”

“THE MERGER AGREEMENT”

“THE VOTING AGREEMENT”

“OTHER IMPORTANT INFORMATION REGARDING

THE COMPANY — Certain Transactions in the Shares of Company Common Stock”

“OTHER IMPORTANT INFORMATION REGARDING

THE COMPANY — Past Contacts, Transactions, Negotiations and Agreements”

“WHERE YOU CAN FIND ADDITIONAL

INFORMATION”

Annex A — Agreement

and Plan of Merger

Annex B — Voting

Agreement

(b)

Significant Corporate Events. The information set forth in the Proxy Statement under the following captions is incorporated

herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE

SPECIAL MEETING AND THE MERGER”

“SPECIAL FACTORS — Background

of the Merger”

“SPECIAL FACTORS — Reasons

for the Merger”

“SPECIAL FACTORS — Plans

for the Company After the Merger”

“SPECIAL FACTORS — Certain

Effects of the Merger”

“SPECIAL FACTORS — Financing

of the Merger”

“SPECIAL FACTORS — Interests

of the Company’s Directors and Executive Officers in the Merger”

“THE MERGER AGREEMENT”

“THE MERGER AGREEMENT — Treatment

of Company Equity Awards”

“THE VOTING AGREEMENT”

“PROPOSAL 2: ADVISORY COMPENSATION

PROPOSAL”

“OTHER IMPORTANT INFORMATION REGARDING

THE COMPANY — Past Contacts, Transactions, Negotiations and Agreements”

Annex A — Agreement

and Plan of Merger

Annex B — Voting

Agreement

(c) Negotiations

or Contacts. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SPECIAL FACTORS — Background

of the Merger”

“SPECIAL FACTORS — Interests

of the Company’s Directors and Executive Officers in the Merger”

“OTHER IMPORTANT INFORMATION REGARDING

THE COMPANY — Past Contacts, Transactions, Negotiations and Agreements”

(d)

Conflicts of interest. Not Applicable.

(e)

Agreements Involving the Subject Company’s Securities. The information set forth in the Proxy Statement under

the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE

SPECIAL MEETING AND THE MERGER”

“SPECIAL FACTORS — Background

of the Merger”

“SPECIAL FACTORS — Recommendation

of the Special Committee”

“SPECIAL FACTORS — Recommendation

of the Board”

“SPECIAL FACTORS — Reasons

for the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Company for the Merger”

“SPECIAL FACTORS — Position

of the Company as to the Fairness of the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Searchlight Entities for the Merger”

“SPECIAL FACTORS — Position

of the Searchlight Entities as to the Fairness of the Merger”

“SPECIAL FACTORS — Plans

for the Company After the Merger”

“SPECIAL FACTORS — Certain

Effects of the Merger”

“SPECIAL FACTORS — Interests

of the Company’s Directors and Executive Officers in the Merger”

“SPECIAL FACTORS — Financing

of the Merger”

“THE MERGER AGREEMENT”

“THE MERGER AGREEMENT — Parent

Vote”

“THE MERGER AGREEMENT — Treatment

of Series A Preferred Stock”

“THE MERGER AGREEMENT — Treatment

of Company Equity Awards”

“THE VOTING AGREEMENT”

“PROPOSAL 2: ADVISORY COMPENSATION

PROPOSAL”

“OTHER IMPORTANT INFORMATION REGARDING

THE COMPANY — Certain Transactions in the Shares of Company Common Stock”

“OTHER IMPORTANT INFORMATION REGARDING

THE COMPANY — Past Contacts, Transactions, Negotiations and Agreements”

“WHERE YOU CAN FIND ADDITIONAL

INFORMATION”

Annex A — Agreement

and Plan of Merger

Annex B — Voting

Agreement

Item

6. Purposes of the Transaction and Plans or Proposals

(a)

Purposes. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“QUESTIONS AND ANSWERS ABOUT THE

SPECIAL MEETING AND THE MERGER”

“SPECIAL FACTORS — Recommendation

of the Special Committee”

“SPECIAL FACTORS — Recommendation

of the Board”

“SPECIAL FACTORS — Reasons

for the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Company for the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Searchlight Entities for the Merger”

“SPECIAL FACTORS — Plans

for the Company After the Merger”

“SPECIAL FACTORS — Delisting

and Deregistration of Company Common Stock”

“DELISTING AND DEREGISTRATION

OF COMMON STOCK”

(b)

Use of Securities Acquired. The information set forth in the Proxy Statement under the following captions is incorporated

herein by reference:

“QUESTIONS AND ANSWERS ABOUT THE

SPECIAL MEETING AND THE MERGER”

“SPECIAL FACTORS — Plans

for the Company After the Merger”

“SPECIAL FACTORS — Certain

Effects of the Merger”

“SPECIAL FACTORS — Delisting

and Deregistration of Company Common Stock”

“THE MERGER AGREEMENT”

“THE MERGER AGREEMENT — Consideration

To Be Received in the Merger”

"DELISTING AND DEREGISTRATION OF COMMON STOCK"

Annex A — Agreement

and Plan of Merger

(c)(1)–(8)

Plans. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE

SPECIAL MEETING AND THE MERGER”

“SPECIAL FACTORS — Background

of the Merger”

“SPECIAL FACTORS — Recommendation

of the Special Committee”

“SPECIAL FACTORS — Recommendation

of the Board”

“SPECIAL FACTORS — Reasons

for the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Company for the Merger”

“SPECIAL FACTORS — Position

of the Company as to the Fairness of the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Searchlight Entities for the Merger”

“SPECIAL FACTORS — Position

of the Searchlight Entities as to the Fairness of the Merger”

“SPECIAL FACTORS — Plans

for the Company After the Merger”

“SPECIAL FACTORS — Certain

Effects of the Merger”

“SPECIAL FACTORS — Interests

of the Company’s Directors and Executive Officers in the Merger”

“SPECIAL FACTORS — Financing

of the Merger”

“SPECIAL FACTORS — Delisting

and Deregistration of Company Common Stock”

“THE MERGER AGREEMENT”

“THE MERGER AGREEMENT — Parent

Vote”

“THE MERGER AGREEMENT — Treatment

of Series A Preferred Stock”

“THE MERGER AGREEMENT — Treatment

of Company Equity Awards”

“THE VOTING AGREEMENT”

“THE SPECIAL MEETING”

“PROPOSAL 2: ADVISORY COMPENSATION

PROPOSAL”

“DELISTING AND DEREGISTRATION

OF COMMON STOCK”

Annex A — Agreement

and Plan of Merger

Annex B — Voting

Agreement

Item

7. Purposes, Alternatives, Reasons and Effects

(a)

Purposes. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE

SPECIAL MEETING AND THE MERGER”

“SPECIAL FACTORS — Background

of the Merger”

“SPECIAL FACTORS — Recommendation

of the Special Committee”

“SPECIAL FACTORS — Recommendation

of the Board”

“SPECIAL FACTORS — Reasons

for the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Company for the Merger”

“SPECIAL FACTORS — Position

of the Company as to the Fairness of the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Searchlight Entities for the Merger”

“SPECIAL FACTORS — Position

of the Searchlight Entities as to the Fairness of the Merger”

“SPECIAL FACTORS — Plans

for the Company After the Merger”

“SPECIAL FACTORS — Certain

Effects of the Merger”

(b)

Alternatives. The information set forth in the Proxy Statement under the following captions is incorporated herein

by reference:

“SPECIAL FACTORS — Background

of the Merger”

“SPECIAL FACTORS — Reasons

for the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Company for the Merger”

“SPECIAL FACTORS — Opinion

of Rothschild & Co US Inc.”

“SPECIAL FACTORS — Position

of the Company as to the Fairness of the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Searchlight Entities for the Merger”

“SPECIAL FACTORS — Position

of the Searchlight Entities as to the Fairness of the Merger”

“SPECIAL FACTORS — Alternatives

to the Merger”

(c)

Reasons. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SPECIAL FACTORS — Background

of the Merger”

“SPECIAL FACTORS — Opinion

of Rothschild & Co US Inc.”

“SPECIAL FACTORS — Reasons

for the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Company for the Merger”

“SPECIAL FACTORS — Position

of the Company as to the Fairness of the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Searchlight Entities for the Merger”

“SPECIAL FACTORS — Position

of the Searchlight Entities as to the Fairness of the Merger”

“SPECIAL FACTORS — Plans

for the Company After the Merger”

“SPECIAL FACTORS — Certain

Effects of the Merger”

“SPECIAL FACTORS — Alternatives

to the Merger”

Annex C — Opinion

of Rothschild & Co US Inc.

(d)

Effects. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE

SPECIAL MEETING AND THE MERGER”

“SPECIAL FACTORS — Background

of the Merger”

“SPECIAL FACTORS — Recommendation

of the Special Committee”

“SPECIAL FACTORS — Recommendation

of the Board”

“SPECIAL FACTORS — Reasons

for the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Company for the Merger”

“SPECIAL FACTORS — Position

of the Company as to the Fairness of the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Searchlight Entities for the Merger”

“SPECIAL FACTORS — Position

of the Searchlight Entities as to the Fairness of the Merger”

“SPECIAL FACTORS — Plans

for the Company After the Merger”

“SPECIAL FACTORS — Certain

Effects of the Merger”

“SPECIAL FACTORS — Effects

on the Company if the Merger Is Not Consummated”

“SPECIAL FACTORS — Alternatives

to the Merger”

“SPECIAL FACTORS — Financing

of the Merger”

“SPECIAL FACTORS — Interests

of the Company’s Directors and Executive Officers in the Merger”

“SPECIAL FACTORS — Material

U.S. Federal Income Tax Consequences of the Merger”

“SPECIAL FACTORS — Delisting

and Deregistration of Company Common Stock”

“SPECIAL FACTORS — Accounting

Treatment”

“THE MERGER AGREEMENT — Effects

of the Merger”

“THE MERGER AGREEMENT — Directors

and Officers of the Surviving Corporation”

“THE MERGER AGREEMENT — Consideration

To Be Received in the Merger”

“THE MERGER AGREEMENT — Excluded

Shares”

“THE MERGER AGREEMENT — Treatment

of Series A Preferred Stock”

“THE MERGER AGREEMENT — Treatment

of Company Equity Awards”

“THE MERGER AGREEMENT — Payment

for Securities; Surrender of Certificates”

“THE MERGER AGREEMENT — Termination

of Exchange Fund”

“THE MERGER AGREEMENT — Dissenting

Shares”

“THE MERGER AGREEMENT — Indemnification

and Insurance”

“THE MERGER AGREEMENT — Employee

Benefit Matters”

“THE MERGER AGREEMENT — Fees

and Expenses”

“THE MERGER AGREEMENT — Withholding

Taxes”

“PROPOSAL 2: ADVISORY COMPENSATION

PROPOSAL”

“DELISTING AND DEREGISTRATION

OF COMMON STOCK”

Annex A — Agreement

and Plan of Merger

Item

8. Fairness of the Transaction

(a)–(b)

Fairness; Factors Considered in Determining Fairness. The information set forth in the Proxy Statement under the following

captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE

SPECIAL MEETING AND THE MERGER”

“SPECIAL FACTORS — Background

of the Merger”

“SPECIAL FACTORS — Recommendation

of the Special Committee”

“SPECIAL FACTORS — Recommendation

of the Board”

“SPECIAL FACTORS — Reasons

for the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Company for the Merger”

“SPECIAL FACTORS — Position

of the Company as to the Fairness of the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Searchlight Entities for the Merger”

“SPECIAL FACTORS — Position

of the Searchlight as to the Fairness of the Merger”

“SPECIAL FACTORS — Opinion

of Rothschild & Co US Inc.”

“SPECIAL FACTORS — Interests

of the Company’s Directors and Executive Officers in the Merger”

“THE MERGER AGREEMENT — Indemnification

and Insurance”

Annex C — Opinion

of Rothschild & Co US Inc.

The discussion materials prepared

by Rothschild & Co US Inc. and provided to the Special Committee, dated May 16, 2023, June 6, 2023, June 22, 2023, September 6, 2023,

September 13, 2023, September 23, 2023 and October 14, 2023, are attached hereto as Exhibit (c)(ii) through and including Exhibit (c)(viii)

and are each incorporated by reference herein.

(c)

Approval of Security Holders. The information set forth in the Proxy Statement under the following captions is incorporated

herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE

SPECIAL MEETING AND THE MERGER”

“SPECIAL FACTORS — Background

of the Merger”

“SPECIAL FACTORS — Reasons

for the Merger”

“THE MERGER AGREEMENT — Company

Stockholder Meeting; Proxy Statement”

“THE MERGER AGREEMENT — Conditions

of the Merger”

“THE SPECIAL MEETING — Record

Date and Stockholders Entitled to Vote”

“THE SPECIAL MEETING — Quorum”

“THE SPECIAL MEETING — Vote

Required”

“THE SPECIAL MEETING — Voting

Procedures”

“THE SPECIAL MEETING — How

Proxies Are Voted”

“THE SPECIAL MEETING — Revocation

of Proxies”

Annex A — Agreement

and Plan of Merger

(d)

Unaffiliated Representative. The information set forth in the Proxy Statement under the following captions is incorporated

herein by reference:

“SUMMARY TERM SHEET”

“SPECIAL FACTORS — Background

of the Merger”

“SPECIAL FACTORS — Recommendation

of the Special Committee”

“SPECIAL FACTORS — Recommendation

of the Board”

“SPECIAL FACTORS — Reasons

for the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Company for the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Searchlight Entities for the Merger”

“SPECIAL FACTORS — Position

of the Company as to the Fairness of the Merger”

“SPECIAL FACTORS — Position

of the Searchlight Entities as to the Fairness of the Merger”

(e)

Approval of Directors. The information set forth in the Proxy Statement under the following captions is incorporated

herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE

SPECIAL MEETING AND THE MERGER”

“SPECIAL FACTORS — Background

of the Merger”

“SPECIAL FACTORS — Recommendation

of the Special Committee”

“SPECIAL FACTORS — Recommendation

of the Board”

“SPECIAL FACTORS — Reasons

for the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Company for the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Searchlight Entities for the Merger”

“SPECIAL FACTORS — Position

of the Company as to the Fairness of the Merger”

“SPECIAL FACTORS — Position

of the Searchlight Entities as to the Fairness of the Merger”

(f) Other

Offers. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SPECIAL FACTORS — Background

of the Merger”

“SPECIAL FACTORS — Recommendation

of the Special Committee”

“SPECIAL FACTORS — Recommendation

of the Board”

“SPECIAL FACTORS — Reasons

for the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Company for the Merger”

“SPECIAL FACTORS — Position

of the Company as to the Fairness of the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Searchlight Entities for the Merger”

“SPECIAL FACTORS — Position

of the Searchlight Entities as to the Fairness of the Merger”

“SPECIAL FACTORS — Alternatives

to the Merger”

“THE MERGER AGREEMENT — No

Solicitation; Change in Board Recommendation”

Annex A — Agreement

and Plan of Merger

Item

9. Reports, Opinions, Appraisals and Negotiations

(a)–(c)

Report, Opinion or Appraisal; Preparer and Summary of the Report, Opinion or Appraisal; Availability of Documents. The information

set forth in the Proxy Statement under the following captions is incorporated herein by reference.

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE

SPECIAL MEETING AND THE MERGER”

“SPECIAL FACTORS — Background

of the Merger”

“SPECIAL FACTORS — Recommendation

of the Special Committee”

“SPECIAL FACTORS — Recommendation

of the Board”

“SPECIAL FACTORS — Reasons

for the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Company for the Merger”

“SPECIAL FACTORS — Position

of the Company as to the Fairness of the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Searchlight Entities for the Merger”

“SPECIAL FACTORS — Position

of the Searchlight Entities as to the Fairness of the Merger”

“SPECIAL FACTORS — Opinion

of Rothschild & Co US Inc.”

“WHERE YOU CAN FIND ADDITIONAL

INFORMATION”

Annex C — Opinion

of Rothschild & Co US Inc.

The discussion materials prepared

by Rothschild & Co US Inc. and provided to the Special Committee, dated May 16, 2023, June 6, 2023, June 22, 2023, September 6, 2023,

September 13, 2023, September 23, 2023 and October 14, 2023, are attached hereto as Exhibit (c)(ii) through and including Exhibit (c)(viii)

and are each incorporated by reference herein.

The reports, opinions or appraisals

referenced in this Item 9 are filed herewith or incorporated by reference herein and will be made available for inspection and copying

at the principal executive offices of the Company during its regular business hours by any interested holder of Shares or representative

who has been designated in writing, and copies may be obtained by requesting them in writing from the Company at the email address provided

under the caption “Where You Can Find Additional Information” in the proxy statement, which is incorporated herein

by reference.

Item

10. Source and Amount of Funds or Other Consideration

(a)-(b)

Source of Funds; Conditions. The information set forth in the Proxy Statement under the following captions is incorporated

herein by reference:

“SUMMARY TERM SHEET”

“SPECIAL FACTORS — Reasons

for the Merger”

“SPECIAL FACTORS — Financing

of the Merger”

“SPECIAL FACTORS — Interests

of the Company’s Directors and Executive Officers in the Merger”

“THE MERGER AGREEMENT — Closing

and Effective Time of the Merger”

“THE MERGER AGREEMENT — Covenants

Regarding Conduct of Business by the Company Pending the Closing”

“THE MERGER AGREEMENT — Conditions

of the Merger”

Annex A — Agreement

and Plan of Merger

(c)

Expenses. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SPECIAL FACTORS — Fees

and Expenses”

“THE MERGER AGREEMENT — Termination

of the Merger Agreement”

“THE MERGER AGREEMENT — Termination

Fees”

“THE MERGER AGREEMENT — Fees

and Expenses”

“THE SPECIAL MEETING — Solicitation

of Proxies”

Annex A — Agreement

and Plan of Merger

(d)

Borrowed Funds.

“SPECIAL FACTORS — Financing

of the Merger”

Item

11. Interest in Securities of the Subject Company

(a) Securities

Ownership. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“SPECIAL FACTORS — Interests

of the Company’s Directors and Executive Officers in the Merger”

“THE VOTING AGREEMENT”

“THE SPECIAL MEETING — Record

Date and Stockholders Entitled to Vote”

“THE SPECIAL MEETING — Quorum”

“OTHER IMPORTANT INFORMATION REGARDING

THE COMPANY—Beneficial Ownership of Common Stock by Management and Directors”

Annex B — Voting

Agreement

(b)

Securities Transactions. The information set forth in the Proxy Statement under the following captions is incorporated

herein by reference:

“SPECIAL FACTORS — Background

of the Merger”

“SPECIAL FACTORS — Interests

of the Company’s Directors and Executive Officers in the Merger”

“THE MERGER AGREEMENT”

“THE VOTING AGREEMENT”

“OTHER IMPORTANT INFORMATION REGARDING

THE COMPANY — Certain Transactions in the Shares of the Company Common Stock”

Annex A — Agreement

and Plan of Merger

Annex B — Voting

Agreement

Item

12. The Solicitation or Recommendation

(d)

Intent to Tender or Vote in a Going-Private Transaction. The information set forth in the Proxy Statement under the

following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE

SPECIAL MEETING AND THE MERGER”

“SPECIAL FACTORS — Background

of the Merger”

“SPECIAL FACTORS — Recommendation

of the Special Committee”

“SPECIAL FACTORS — Recommendation

of the Board”

“SPECIAL FACTORS — Reasons

for the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Company for the Merger”

“SPECIAL FACTORS — Position

of the Company as to the Fairness of the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Searchlight Entities for the Merger”

“SPECIAL FACTORS — Position

of the Searchlight Entities as to the Fairness of the Merger”

“SPECIAL FACTORS — Interests

of the Company’s Directors and Executive Officers in the Merger”

“THE MERGER AGREEMENT — Parent

Vote”

“THE VOTING AGREEMENT”

“THE SPECIAL MEETING — Record

Date and Stockholders Entitled to Vote”

“THE SPECIAL MEETING — Quorum”

“THE SPECIAL MEETING — Voting

by Company Directors, Executive Officers and Principal Securityholders”

“OTHER IMPORTANT INFORMATION REGARDING

THE COMPANY—Beneficial Ownership of Common Stock by Management and Directors”

Annex B — Voting

Agreement

(e)

Recommendation of Others. The information set forth in the Proxy Statement under the following captions is incorporated

herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE

SPECIAL MEETING AND THE MERGER”

“SPECIAL FACTORS — Background

of the Merger”

“SPECIAL FACTORS — Recommendation

of the Special Committee”

“SPECIAL FACTORS — Recommendation

of the Board”

“SPECIAL FACTORS — Reasons

for the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Company for the Merger”

“SPECIAL FACTORS — Position

of the Company as to the Fairness of the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Searchlight Entities for the Merger”

“SPECIAL FACTORS — Position

of the Searchlight Entities as to the Fairness of the Merger”

Item

13. Financial Statements

(a)

Financial Information. The audited financial statements set forth in the Company’s Annual Report on Form 10-K

for the fiscal year ended December 31, 2022, originally filed on March 6, 2023 (see pages F-1 through F-45 therein) and the unaudited

condensed consolidated statements of operations, condensed consolidated statements of comprehensive income, condensed consolidated balance

sheets, condensed consolidated statements of changes in mezzanine equity and shareholders’ equity and condensed consolidated statements

of cash flows set forth in the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2023, originally filed

on November 7, 2023 (see pages 1 through 26 therein) are incorporated herein by reference. The information set forth in the Proxy Statement

under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“SPECIAL FACTORS —

Certain Financial Forecasts”

“SPECIAL FACTORS — Opinion

of Rothschild & Co US Inc.”

“OTHER IMPORTANT INFORMATION REGARDING

THE COMPANY – Selected Historical Consolidated Financial Data”

“OTHER IMPORTANT INFORMATION REGARDING

THE COMPANY – Book Value per Share”

“WHERE YOU CAN FIND ADDITIONAL

INFORMATION”

(b)

Pro Forma Information. Not Applicable.

Item

14. Persons/Assets, Retained, Employed, Compensated or Used

(a)-(b)

Solicitations or Recommendations; Employees and Corporate Assets. The information set forth in the Proxy Statement

under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE

SPECIAL MEETING AND THE MERGER”

“SPECIAL FACTORS — Background

of the Merger”

“SPECIAL FACTORS — Recommendation

of the Special Committee”

“SPECIAL FACTORS — Recommendation

of the Board”

“SPECIAL FACTORS — Reasons

for the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Company for the Merger”

“SPECIAL FACTORS — Position

of the Company as to the Fairness of the Merger”

“SPECIAL FACTORS — Purpose

and Reasons of the Searchlight Entities for the Merger”

“SPECIAL FACTORS — Position

of the Searchlight Entities as to the Fairness of the Merger”

“SPECIAL FACTORS — Fees

and Expenses”

“THE MERGER AGREEMENT — Fees

and Expenses”

"THE SPECIAL MEETING"

“THE SPECIAL MEETING — Solicitation

of Proxies”

Item

15. Additional Information

(b)

The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“SPECIAL FACTORS — Interests

of the Company’s Directors and Executive Officers in the Merger”

“SPECIAL FACTORS — Certain

Effects of the Merger”

“THE MERGER AGREEMENT — Consideration

To Be Received in the Merger”

“THE MERGER AGREEMENT — Treatment

of Company Equity Awards”

“PROPOSAL 2: ADVISORY COMPENSATION

PROPOSAL”

Annex A — Agreement

and Plan of Merger

(c)

Other Material Information. The entirety of the Proxy Statement, including all appendices thereto, is incorporated

herein by reference.

Item

16. Exhibits

The following exhibits are filed herewith:

| Exhibit

No. |

Description |

| (a)(2)(i) |

Preliminary Proxy Statement

of Consolidated Communications Holdings, Inc. (included in the Schedule 14A filed on November 20, 2023, and incorporated

herein by reference) (the “Preliminary Proxy Statement”). |

| (a)(2)(ii) |

Form of Proxy Card (included

in the Preliminary Proxy Statement and incorporated herein by reference). |

| (a)(2)(iii) |

Letter to Stockholders

(included in the Preliminary Proxy Statement and incorporated herein by reference). |

| (a)(2)(iv) |

Notice of Special Meeting

of Stockholders (included in the Preliminary Proxy Statement and incorporated herein by reference). |

| (a)(5)(i) |

Press Release, dated October

16, 2023 (incorporated by reference to Exhibit 99.1 to the Current Report on Form 8-K filed by Consolidated Communications Holdings,

Inc. with the Commission on October 16, 2023). |

| (a)(5)(ii) |

Investor Presentation

(incorporated by reference to Exhibit 99.2 to the Current Report on Form 8-K filed by Consolidated Communications Holdings, Inc.

with the Commission on October 16, 2023). |

| (c)(i) |

Opinion of Rothschild

& Co US Inc., dated as of October 15, 2023 |

| (c)(ii) |

Discussion materials prepared

by Rothschild & Co US Inc., dated May 16, 2023, for the Special Committee of the Board of Directors of Consolidated Communications

Holdings, Inc. |

| (c)(iii) |

Discussion materials prepared

by Rothschild & Co US Inc., dated June 6, 2023, for the Special Committee of the Board of Directors of Consolidated Communications

Holdings, Inc. |

| (c)(iv) |

Discussion materials prepared

by Rothschild & Co US Inc., dated June 22, 2023, for the Special Committee of the Board of Directors of Consolidated Communications

Holdings, Inc. |

| (c)(v) |

Discussion

materials prepared by Rothschild & Co US Inc., dated September 6, 2023, for the Special Committee of the Board of Directors of

Consolidated Communications Holdings, Inc. |

| (c)(vi) |

Discussion materials prepared

by Rothschild & Co US Inc., dated September 13, 2023, for the Special Committee of the Board of Directors of Consolidated Communications

Holdings, Inc. |

| (c)(vii) |

Discussion materials prepared

by Rothschild & Co US Inc., dated September 23, 2023, for the Special Committee of the Board of Directors of Consolidated Communications

Holdings, Inc. |

| (c)(viii) |

Discussion materials prepared

by Rothschild & Co US Inc., dated October 14, 2023, for the Special Committee of the Board of Directors of Consolidated Communications

Holdings, Inc. |

| (c)(ix) |

Discussion materials prepared by Goldman Sachs & Co. LLC and J.P. Morgan Securities LLC, dated

March 15, 2023, for Condor Holdings LLC, Condor Merger Sub Inc., Searchlight III CVL, L.P. and Searchlight III CVL GP, LLC |

| (d)(i) |

Agreement and Plan of

Merger, dated October 15, 2023, by and among Condor Holdings LLC, Condor Merger Sub Inc. and Consolidated Communications Holdings,

Inc. (incorporated by reference to Exhibit 2.1 to the Current Report on Form 8-K filed by Consolidated Communications Holdings, Inc.

with the Commission on October 16, 2023). |

| (d)(ii) |

Voting Agreement, dated

October 15, 2023, by and between Consolidated Communications Holdings, Inc., and Searchlight III CVL, L.P (incorporated by reference

to Exhibit 10.1 to the Current Report on Form 8-K filed by Consolidated Communications Holdings, Inc. with the Commission on October

16, 2023). |

| (d)(iii) |

Interim Investors’

Agreement, dated October 15, 2023, by and between Condor Holdings LLC, Condor Merger Sub Inc., Searchlight Capital III, L.P., Searchlight

III CVL, L.P and British Columbia Investment Management Corporation. |

| (d)(iv) |

Equity Commitment Letter,

dated October 15, 2023, by and between Condor Holdings LLC, Searchlight Capital III, L.P. and Searchlight Capital III PV, L.P. |

| (d)(v) |

Limited Guaranty, dated

October 15, 2023, by and between Consolidated Communications Holdings, Inc., Searchlight Capital III, L.P. and Searchlight Capital

III PV, L.P. |

| (d)(vi) |

Governance Agreement,

dated as of September 13, 2020, by and between Consolidated Communications Holdings, Inc. and Searchlight III CVL, L.P. (incorporated

by reference to Exhibit 10.2 to the Current Report on Form 8-K filed by Consolidated Communications Holdings, Inc. with the Commission

on September 13, 2020). |

| (d)(vii) |

Registration Rights Agreement,

dated as of October 2, 2020, by and between Consolidated Communications Holdings, Inc. and Searchlight III CVL, L.P. (incorporated

by reference to Exhibit 10.2 to the Current Report on Form 8-K filed by Consolidated Communications Holdings, Inc. with the Commission

on October 2, 2020). |

| (d)(viii) |

Waiver, dated as of November

22, 2022, made by Searchlight III CVL, L.P. (incorporated by reference to Exhibit 10.2 to the Current Report on Form 8-K filed by

Consolidated Communications Holdings, Inc. with the Commission on November 22, 2022). |

| (f) |

Section 262 of the DGCL

(included in the Preliminary Proxy Statement and incorporated herein by reference). |

| (g) |

Not Applicable. |

| 107 |

Filing Fee Table. |

SIGNATURES

After due inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

| | CONSOLIDATED COMMUNICATIONS HOLDINGS,

INC. |

| By: | /s/ C. Robert Udell, Jr. |

| Name: | C. Robert Udell, Jr. |

| | Title: | President and Chief Executive Officer |

Date:

November 20, 2023

After due inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

| | CONDOR HOLDINGS LLC |

| | |

| | By: Searchlight III CVL L.P., its sole member |

| | By: Searchlight III CVL GP, LLC, its general partner |

| Name: | Andrew Frey |

| | Title: | Authorized Person |

Date:

November 20, 2023

After due inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

| Name: | Andrew Frey |

| | Title: | Authorized Person |

Date: November 20, 2023

After due inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

| | SEARCHLIGHT III CVL, L.P. |

| | |

| | By: Searchlight III CVL GP, LLC, its general partner |

| Name: | Andrew Frey |

| | Title: | Authorized Person |

Date: November 20, 2023

After due inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

| | SEARCHLIGHT III CVL GP, LLC |

| Name: | Andrew Frey |

| | Title: | Authorized Person |

Date: November 20, 2023

Exhibit (c)(i)

| October 15, 2023

The Special Committee of the Board of Directors

Consolidated Communications Holdings, Inc.

2116 South 17th Street

Mattoon, Illinois 61938

Members of the Special Committee:

We understand that Condor Holdings LLC (the "Parent"), Condor Merger Sub Inc., a

wholly owned subsidiary of the Parent ("Merger Sub"), and Consolidated Communications

Holdings, Inc. (the "Company"), propose to enter into an Agreement and Plan of Merger (the

"Agreement"), which provides, among other things, for the merger of Merger Sub with and into the

Company with the Company surviving the merger (the "Surviving Corporation") as a wholly owned

subsidiary of the Parent (the "Transaction"), and that, in connection with the Transaction, each

issued and outstanding share of common stock, par value $0.01 per share, of the Company (the

"Company Shares") ( other than (i) shares held by the Company as treasury stock, (ii) shares held by

Merger Sub, (iii) shares held by any direct or indirect wholly owned subsidiary of the Company or

Parent (other than Merger Sub), (iv) shares subject to Company Awards (as defined in the

Agreement), (v) shares held directly by Parent, which shares shall be automatically converted into

validly issued, fully paid and nonassessable shares of common stock, no par value per share, of the

Surviving Corporation (the "Rollover Shares") and (vi) Dissenting Shares (as defined in the

Agreement) ((i) through (vi), collectively, the "Excluded Shares")) will be cancelled and converted

into the right to receive $4.70 in cash (the "Merger Consideration"). The terms and conditions of the

Transaction are more fully set forth in the Agreement.

The special committee of the board of directors (the "Board") of the Company (such

committee, the "Special Committee") has requested our opinion as to whether the Merger

Consideration payable to the holders of Company Shares (other than the Excluded Shares) in the

Transaction pursuant to the Agreement is fair, from a financial point of view, to the Unaffiliated

Stockholders (as defined in the Agreement).

In arriving at our opinion set forth below, we have, among other things: (i) reviewed a draft

of the Agreement dated October 15, 2023; (ii) reviewed certain publicly available business and

financial information that we deemed to be generally relevant concerning the Company and the

industry in which it operates, including certain publicly available research analyst reports and the

reported price and historical trading activity for the Company Shares; (iii) compared the proposed

financial terms of the Transaction with the publicly available financial terms of certain transactions

involving companies we deemed generally relevant and the consideration received in such

transactions; (iv) compared the financial and operating performance of the Company with publicly

available information concerning certain other public companies we deemed generally relevant,

including data related to public market trading levels and implied trading multiples; (v) reviewed

certain internal financial and operating information with respect to the business, operations and

prospects of the Company, including certain financial forecasts relating to the Company prepared by

the management of the Company and approved for our use by the Special Committee (the

"Forecasts"); and (vi) performed such other financial studies and analyses and considered such other

information as we deemed appropriate for the purposes of this opinion. In addition, we have held

discussions with certain members of the management of the Company regarding the Transaction, |

| Special Committee of the Board of Directors

Consolidated Communications Holdings, Inc.

October 15, 2023

Page 2

the past and current business operations and financial condition and prospects of the Company, the

Forecasts and certain other matters we believed necessary or appropriate to our inquiry.

In arriving at our opinion, we have, with your consent, relied upon and assumed, without

independent verification, the accuracy and completeness of all information that was publicly

available or was furnished or made available to us by the Company and its associates, affiliates and

advisors, or otherwise reviewed by or for us, and we have not assumed any responsibility or liability

therefor. We have not conducted any valuation or appraisal of any assets or liabilities of the

Company (including, without limitation, real property owned by the Company or to which the

Company holds a leasehold interest), nor have any such valuations or appraisals been provided to us,

and we do not express any opinion as to the value of such assets or liabilities. We have not

evaluated the solvency or fair value of the Company or Parent under any state, federal or other laws

relating to bankruptcy, insolvency or similar matters. In addition, we have not assumed any

obligation to conduct any physical inspection of the properties or the facilities of the Company or

Parent. At your direction , we have used and relied upon the Forecasts for purposes of our opinion.

In relying on the Forecasts, we have assumed, at your direction and at the direction of the Company,

that they have been reasonably prepared by the management of the Company based on assumptions

reflecting the best currently available estimates and judgments by the Company's management and

by the Special Committee as to the expected future results of operations and financial condition of

the Company. We express no view as to the reasonableness of the Forecasts and the assumptions

on which they are based.

We have assumed that the transactions contemplated by the Agreement will be

consummated as contemplated in the Agreement without any waiver or amendment of any terms or

conditions, including, among other things, that the parties will comply with all material terms of the

Agreement and that in connection with the receipt of all necessary governmental, regulatory or other

approvals and consents required for the Transaction, no material delays, limitations, conditions or

restrictions will be imposed. For purposes of rendering this opinion, we have assumed that there

has not occurred any material change in the assets, financial condition, results of operations,

business or prospects of the Company since the date of the most recent financial statements and

other information, financial or otherwise, relating to the Company made available to us, and that

there is no information or any facts that would make any of the information reviewed by us

incomplete or misleading. We do not express any opinion as to any tax or other consequences that

may result from the Transaction, nor does our opinion address any legal, tax, regulatory or

accounting matters. We have relied as to all legal, tax and regulatory matters relevant to rendering

our opinion upon the assessments made by the Company and its other advisors with respect to such

issues. In arriving at our opinion, we have not taken into account any litigation, regulatory or other

proceeding that is pending or may be brought against the Company or any of its affiliates. In

addition, we have relied upon and assumed, without independent verification, that the final form of

the Agreement will not differ in any material respect from the draft of the Agreement reviewed by

us.

Our opinion is necessarily based on securities markets, economic, monetary, financial and

other general business and financial conditions as they exist and can be evaluated on, and the

information made available to us as of, the date hereof and the conditions and prospects, financial

and otherwise, of the Company as they were reflected in the information provided to us and as they |

| Special Committee of the Board of Directors

Consolidated Communications Holdings, Inc.

October 15, 2023

Page 3

were represented to us in discussions with the management of the Company. We are expressing no

opinion herein as to the price at which the Company Shares will trade at any future time. Our

opinion is limited to the fairness, from a financial point of view, to the Unaffiliated Stockholders of

the Merger Consideration payable to the holders of Company Shares (other than the Excluded

Shares) in the Transaction pursuant to the Agreement. We do not express any opinion as to the

Company's, the Board's or the Special Committee's underlying business decisions to engage in the

Transaction or the relative merits of the Transaction as compared to any alternative transaction. We

were not requested to solicit, and did not solicit, interest from other parties with respect to a

Transaction. We have not been asked to, nor do we, offer any opinion as to the terms, other than

the Merger Consideration to the extent expressly set forth herein, of the Transaction, the Agreement

or any other agreement entered into in connection with the Transaction.

We and our affiliates are engaged in a wide range of financial advisory and investment

banking activities. In addition, in the ordinary course of their asset management, merchant banking

and other business activities, our affiliates may trade in the securities of the Company, Parent,

Searchlight Capital Partners, L.P., an affiliate of Parent ("Searchlight"), British Columbia Investment

Management Corporation, an affiliate of Parent ("BCI"), and any of their respective affiliates, for

their own accounts or for the accounts of their affiliates and customers, and may at any time hold a

long or short position in such securities. We are acting as financial advisor to the Special Committee

with respect to the Transaction and will receive a fee from the Company for our services, a portion

of which is payable upon delivery of this opinion and the remaining portion of which is contingent

upon the consummation of the Transaction. In addition, the Company has agreed to reimburse

certain of our expenses and indemnify us against certain liabilities that may arise out of our

engagement. We and/or our affiliates are currently providing certain financial advisory services to

affiliates and/ or portfolio companies of Searchlight in connection with matters unrelated to the

Transaction for which we and/ or our affiliates may receive fees for our services, including

representing an affiliate of Searchlight in connection with an acquisition of Gresham House plc. We

and our affiliates may in the future provide financial services to the Company, Parent, Searchlight,

BCI and/ or their respective affiliates in the ordinary course of our businesses from time to time and

may receive fees for the rendering of such services.

This opinion is provided for the benefit of the Special Committee in connection with and

for the purpose of its evaluation of the Transaction. This opinion should not be construed as

creating any fiduciary duty on our part to any party. This opinion does not constitute a

recommendation to the Special Committee as to whether to approve the Transaction or a

recommendation as to whether or not any holder of Company Shares should vote or otherwise act

with respect to the Transaction or any other matter. In addition, the Special Committee has not

asked us to address, and this opinion does not address, (i) the fairness to, or any other consideration

of, the holders of any class of securities (other than the Unaffiliated Stockholders and then only to

the extent expressly set forth herein) or creditors or other constituencies of the Company, (ii) the

fairness to, or any other consideration of, (x) the holders of Series A Perpetual Preferred Stock, par

value $0.01 per share, of the Company or (y) the holders of the Rollover Shares or (iii) the fairness

of the amount or nature of any compensation to be paid or payable to any of the officers, directors

or employees of Parent, the Company, or any class of such persons, whether relative to the Merger

Consideration pursuant to the Agreement or otherwise. |

| Special Committee of the Board of Directors

Consolidated Communications Holdings, Inc.

October 15, 2023

Page 4

This opinion is given and speaks only as of the date hereof. It should be understood that

subsequent developments may affect this opinion and the assumptions used in preparing it, and we

do not have any obligation to update, revise, or reaffirm this opinion. This opinion has been

approved by the Global Advisory Commitment Committee of Rothschild & Co US Inc.

On the basis of and subject to the foregoing, it is our opinion that, as of the date hereof, the

Merger Consideration payable to the holders of Company Shares (other than the Excluded Shares)

in the Transaction pursuant to the Agreement is fair, from a financial point of view, to the

Unaffiliated Stockholders.

Very truly yours,

/s/ Rothschild & Co US Inc.

ROTHSCHILD & CO US INC. |

Exhibit (c)(ii)

| Preliminary and Confidential Draft

Project [ C ]

Kick-off materials

1

May 16th, 2023

Preliminary Draft |

| Preliminary Draft

Agenda

Working group introductions

1

Process discussion

3

Phase I deliverables and indicative timeline

4

Administrative items

2

Next steps

5 |

| Preliminary Draft

Special Committee working group

Special Committee working group

Management team (“Management”) For reference only

◼ Bob Udell, President, CEO and Director

◼ Fred Graffam, EVP & CFO

◼ Gaurav Juneja, President of Consumer

◼ John Lunny, CTO

◼ Dan Stoll, President of Commercial-Carrier

◼ Jennifer Spaude, SVP of Corporate Communications & IR

◼ Garrett Van Osdell, Chief Legal Officer & Corporate Secretary

◼ Gabe Waggoner, EVP of Operations

◼ Robert Currey, Chairman of Board

◼ Thomas Gerke, Director

◼ Roger Moore, Director

◼ Maribeth Rahe, Director

Special Committee (“SC”)

◼ Jonathan Herbst, Partner & Head of North America

Media & Telecommunications

◼ James Ben, Partner & Head of North America M&A

◼ Michael Speller, Partner & Head of North America Debt

Advisory

◼ Ben Goldenberg, Director

◼ Charles Huyghues-Despointes, Director

◼ Keith Knobelauch, Vice President

◼ Marcos Robertson-Lavalle, Associate

◼ Patrick Cooney, Associate

◼ Derek Cunningham, Associate

◼ Austin Gausditis, Analyst

◼ Adrian Scott, Analyst

◼ Jamie Lynch, Analyst

◼ Aimee Hou, Analyst

ProjectSeashoreSupport@Rothschildandco.com

Rothschild & Co (“R&Co”)

◼ Robert Townsend, Partner and Co-Head of the Global M&A Practice

◼ Andrew Elken, Partner

◼ Alexander Greenberg, Associate

◼ Christopher Doherty, Associate

Cravath, Swaine & Moore (“Cravath”)

1 Working group introductions

3 |

| Preliminary Draft

Administrative items

4

2 Administrative items

S M T W Th F Sa

30 1 2 3 4 5 6

7 8 9 10 11 12 13

14 15 16 17 18 19 20

21 22 23 24 25 26 27

28 29 30 31 1 2 3

S M T W Th F Sa

28 29 30 31 1 2 3

4 5 6 7 8 9 10

11 12 13 14 15 16 17

18 19 20 21 22 23 24

25 26 27 28 29 30 1

S M T W Th F Sa

2 3 4 5 6 7 8

9 10 11 12 13 14 15

16 17 18 19 20 21 22

23 24 25 26 27 28 29

30 31 1 2 3 4 5

S M T W Th F Sa

30 31 1 2 3 4 5

6 7 8 9 10 11 12

13 14 15 16 17 18 19

20 21 22 23 24 25 26

27 28 29 30 31 1 2

May June July August

*

Key administrative items upon project kickoff

◼ Establish project name / confidential naming considerations

□ Project Seashore

□ Condor, Seagull, Blue Jay

◼ Establish internal communications protocols

□ Among SC / R&Co / Cravath

□ With Management

□ With other professionals

◼ Establish external communications protocols

□ With stakeholders (shareholders / creditors)

□ Interaction with interested party (“IP”)

□ Inbounds / interaction from 3rd parties

◼ Establish SC meeting cadence

□ Weekly update calls

□ Key deliverables dates (face-to-face meetings)

Project Kickoff U.S. Holidays

*

Weekly touchpoints Q2 earnings (est., TBC) |

| Preliminary Draft

Situation update

5

Review of Special Committee charter and objectives

Debrief on discussions with IP to date (review of communication, key touchpoints, etc.), if any

Other shareholder feedback, if any

Update on inbound inquiry or interaction, if any

Update on creditor discussions or interaction, if any

2 Administrative items

1

2

3

4

5 |

| Preliminary Draft

◼ Ensure full understanding of

proposal

◼ Develop an understanding of

management’s business plan

◼ Determine standalone / intrinsic

valuation of Company

◼ Shareholder value vs. proposal

◼ Determine required regulatory

approvals

◼ Establish contact with IP to clarify proposed terms of proposal

◼ Review of management plan, model and forecast assumptions / sensitivities

◼ Management meeting / Q&A

◼ Benchmarking against peers / industry performance

◼ Capital needs for achievement of current Management plan / capital

requirements to accelerate build plan

◼ Traditional valuation methodologies

Evaluation of

proposal /

standalone value

after evaluation of

proposal

Assessment of

alternatives

◼ Alternative potential buyer universe (ability to transact, timing)

◼ Viability of potential asset sales (separability, timing and tax leakage)

◼ Capital markets assessments (ability to secure committed financing to

refinance or solicit CoC waiver consent)

◼ Regulatory considerations

◼ Analyze potential alternative

transactions / strategies

◼ Factors impacting probability of

success

B

Special Committee process overview

6

Key objectives Key workstreams

A

Determine

appropriate

response to IP

◼ Develop appropriate

communication strategy contingent

on outcome of

previous steps

◼ Process overlay, establish ground rules

Step 2

◼ Prepare formal response materials

◼ Determine best path for Special

Committee to pursue Execution ◼ Establish process strategy and key milestones

Step 3 Step 1

3 Process discussion |

| Preliminary Draft

7

Business plan assessment – work plan

Process discussion

Capital requirements of management plan

◼ Assess runway to fund its current business plan (and potential

variations to the plan)

◼ Consider the timing of capex spend and how this may impact

long-term plan, future funding requirements, etc.

◼ Quantify the amount of incremental capital the business would

need to fund the current plan

◼ Evaluate how accessible the revolving credit facility may be

given existing debt covenants

Fiber deployment / legacy business strategy

◼ Key revenue growth drivers for business

□ Residential / commercial fiber build plan, penetration rates

and unit economics

□ Carrier revenue plan and long-term outlook

◼ Assessment of profitability and long-term outlook for target

EBITDA margins

◼ Capex strategy and market focus

Analysis of business plan / Model review

3

◼ Historical operating KPIs / financial results

◼ Long-term business plan

◼ Budget vs. actuals

◼ Detailed 2023 / 2024 budget

◼ Summary of fiber deployment strategy and progress to date

◼ Market penetration summary

◼ Strategic operations materials (i.e., headcount plans, market

focuses, etc.)

◼ Commercial diligence / industry reports (e.g., Altman report,

etc.)

◼ Board presentations related to business plan

◼ Details on funding of pension / OPEB

◼ Preferred stock calculation (if sold)

□ Call protection

□ Breakage calculation

◼ Pro forma capitalization table

◼ Lender register (from admin agent) and bondholders list (via

an information agent)

Formal diligence list to be shared following today’s meeting

Key diligence items |

| Preliminary Draft

Assessment of alternatives – Preliminary universe

8

Alternative Key points

Status quo /

remain

publicly

traded

company

Execute on

plan

◼ Intrinsic valuation and discounted future share price

◼ Ability to self-sustain without supplemental financing

◼ Upside / downside risks to achievement of forecast plan

Potential

monetization

of assets