United

States

Securities

and Exchange Commission

Washington,

D.C. 20549

SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

(Amendment

No. )

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| |

|

| ☐ |

Confidential, For Use of the Commission Only (as permitted

by Rule 14a-6(e)(2)) |

| |

|

| ☒ |

Definitive Proxy Statement |

| |

|

| ☐ |

Definitive Additional Materials |

| |

|

| ☐ |

Soliciting Materials Pursuant

to Rule 14a-12 |

CINGULATE

INC.

(Name

of Registrant as Specified in Its Charter)

(Name

of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment

of Filing Fee (Check all boxes that apply):

| ☒ |

No fee required. |

| |

|

| ☐ |

Fee paid previously with preliminary materials |

| |

|

| ☐ |

Fee computed on table in exhibit required by Item 25(b)

per Exchange Act Rules 14a-6(i)(1) and 0-11 |

CINGULATE

INC.

1901 W. 47th Place

Kansas

City, Kansas 66205

NOTICE

OF SPECIAL MEETING OF STOCKHOLDERS

To

be held on November 3, 2023

To

the Stockholders of Cingulate Inc.

NOTICE

IS HEREBY GIVEN that a Special Meeting of Stockholders (the “Special Meeting”) of Cingulate Inc. (the “Company”)

will be held on November 3, 2023, beginning at 10:00 a.m. Central Time. The Special Meeting will be held solely in a virtual meeting

format online at www.meetnow.global/MUFPRUD. You will not be able to attend the Special Meeting at a physical location.

At the Special Meeting, stockholders will act on the following matters:

| |

● |

To

adopt and approve an amendment to our Amended and Restated Certificate of Incorporation to effect a reverse stock split of our issued

shares of common stock, at a specific ratio, ranging from one-for-two (1:2) to one-for-forty (1:40), at any time prior

to the one-year anniversary date of the Special Meeting, with the exact ratio to be determined by the Board of Directors without

further approval or authorization of our stockholders; and |

| |

|

|

| |

● |

To

approve, for the purpose of complying with the applicable provisions of The Nasdaq Stock Market LLC (“Nasdaq”) Listing

Rule 5635(d), the issuance of up to 10,387,812 shares of our common stock issuable upon the exercise of our Series A warrants and

Series B warrants issued to an institutional investor in connection with our offering that closed on September 13, 2023. |

Pursuant

to the Company’s Amended and Restated Bylaws, as amended (the “Bylaws”), the Board has fixed the close of business

on September 12, 2023 as the record date for determination of the stockholders entitled to vote at the Special Meeting and any adjournments

or postponements thereof.

Your

vote is important. Whether or not you plan to attend the Special Meeting, please submit your proxy to vote electronically via the Internet

or by telephone, or please complete, sign, date and return the accompanying proxy card or voting instruction card in the enclosed postage-paid

envelope. If you attend the Special Meeting and prefer to vote during the Special Meeting, you may do so even if you have already submitted

a proxy to vote your shares. You may revoke your proxy in the manner described in the proxy statement at any time before it has been

voted at the Special Meeting.

| |

By Order of the Board of Directors |

| |

|

| |

/s/

Craig S. Gilgallon |

| |

Craig S. Gilgallon |

| |

Executive Vice President, General Counsel and Secretary |

| October

2, 2023 |

|

Kansas

City, Kansas |

|

TABLE

OF CONTENTS

CINGULATE

INC.

1901

W. 47th Place

Kansas

City, Kansas 66205

PROXY

STATEMENT

This

proxy statement contains information related to our Special Meeting of Stockholders to be held on November 3, 2023 at 10:00 a.m. Central

Time, or at such other time and place to which the Special Meeting may be adjourned or postponed (the “Special Meeting”).

The enclosed proxy is solicited by the Board of Directors (the “Board”) of Cingulate Inc. (the “Company”). The

proxy materials relating to the Special Meeting are being mailed to stockholders entitled to vote at the meeting on or about October

2, 2023. A list of record holders of the Company’s common stock entitled to vote at the Special Meeting will be available

for examination by any stockholder, for any purpose germane to the Special Meeting, at our principal offices at 1901 W. 47th Place, Kansas

City, Kansas 66205, during normal business hours for ten days prior to the Special Meeting and available during the Special Meeting.

IMPORTANT

NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON NOVEMBER 3, 2023: This Notice

of Special Meeting of Stockholders, Proxy Statement and the proxy card are available online at: www.envisionreports.com/CING.

Under Securities and Exchange Commission rules, we are providing access to our proxy materials both by sending you this full set of proxy

materials, and by notifying you of the availability of our proxy materials on the Internet.

ABOUT

THE MEETING

When

and where will the Special Meeting be held?

The

Special Meeting will be held on November 3, 2023, at 10:00 a.m., Central Time, in a virtual meeting format online at www.meetnow.global/MUFPRUD,

and at any adjournment or postponement thereof. You will not be able to attend the Special Meeting at a physical location.

What

is the purpose of the Special Meeting?

We

are calling the Special Meeting to seek the approval of our stockholders:

| |

● |

To

adopt and approve an amendment to our Amended and Restated Certificate of Incorporation (the “Charter”) to effect a reverse

stock split of our issued shares of common stock, at a specific ratio, ranging from one-for-two (1:2) to one-for-forty

(1:40), at any time prior to the one-year anniversary date of the Special Meeting, with the exact ratio to be determined by the

Board without further approval or authorization of our stockholders (the “Reverse Split”); and |

| |

|

|

| |

● |

To approve, for the purpose

of complying with the applicable provisions of the Nasdaq Stock Market LLC (“Nasdaq”) Listing Rule 5635(d), the issuance

of up to 10,387,812 shares of our common stock issuable upon the exercise of our Series A warrants and Series B warrants issued to

an institutional investor in connection with our offering that closed on September 13, 2023. |

What

are the Board’s recommendations?

The

Board recommends you vote:

| |

● |

FOR the Reverse

Split and amendment to our Charter effecting the Reverse Split; and |

| |

|

|

| |

● |

FOR the approval,

for the purpose of complying with the applicable provisions of Nasdaq Listing Rule 5635(d), of the issuance of up to 10,387,812 shares

of our common stock issuable upon the exercise of our Series A warrants and Series B warrants issued to an institutional investor

in connection with our offering that closed on September 13, 2023. |

If

you are a stockholder of record and you return a properly executed proxy card or submit a proxy to vote over the Internet but do not

mark the boxes showing how you wish to vote, your shares will be voted in accordance with the recommendations of the Board, as set forth

above.

No

other matters may be brought before the Special Meeting.

Who

is entitled to vote at the Special Meeting?

Only

stockholders of record at the close of business on the record date, September 12, 2023, are entitled to receive notice of, and to vote

the shares of common stock that they held on that date at, the Special Meeting, or any adjournment or postponement thereof. Holders of

our common stock are entitled to one vote per share on each matter to be voted upon.

As

of the record date, we had 15,658,798 outstanding shares of common stock.

You

do not need to attend the Special Meeting to vote your shares. Instead, you may vote your shares by marking, signing, dating and returning

the enclosed proxy card or voting by telephone or through the internet.

What

constitutes a quorum?

The

presence at the Special Meeting, in person or by proxy, of the holders of one third of our common stock outstanding on the record date

will constitute a quorum for the Special Meeting. Pursuant to the General Corporation Law of the State of Delaware, abstentions will

be counted for the purpose of determining whether a quorum is present. If brokers have, and exercise, discretionary authority on at least

one item on the agenda for the Special Meeting, uninstructed shares for which broker non-votes occur will constitute voting power present

for the discretionary matter and will therefore count towards the quorum.

Do

I need to attend the Special Meeting?

No.

It is not necessary for you to attend the virtual Special Meeting in order to vote your shares. You may vote by telephone, through the

Internet or by mail, as described in more detail below.

How

do I vote my shares without attending the Special Meeting?

Stockholder

of record: shares registered in your name. If you are a stockholder of record, you may authorize a proxy to vote on your behalf

at the Special Meeting in any of the following ways:

By

Telephone or via the Internet. You can submit a proxy to vote your shares by telephone or via the Internet by following the instructions

on the enclosed proxy card. Proxies submitted by telephone or via the Internet must be received by 11:59 p.m., Central Time, on the day

before the Special Meeting. Have your proxy card in hand as you will be prompted to enter your control number.

By

Mail. You can submit a proxy to vote your shares by mail if you received a printed proxy card by completing, signing, dating and

promptly returning your proxy card in the postage-prepaid envelope provided with the materials. Proxies submitted by mail must be received

by the close of business on November 2, 2023 in order to ensure that your vote is counted.

To

facilitate timely receipt of your proxy, we encourage you to promptly vote via the Internet or telephone following the instructions on

the enclosed proxy card. If you are submitting your proxy by telephone or through the Internet, your voting instructions must be received

by 11:59 p.m., Central Time on the day before the Special Meeting.

Submitting

your proxy by mail, by telephone or through the Internet will not prevent you from casting your vote at the Special Meeting. You are

encouraged to submit a proxy by mail, by telephone or through the Internet even if you plan to attend the Special Meeting via the virtual

meeting website to ensure that your shares are represented at the Special Meeting.

Beneficial

owner: shares registered in the name of bank, broker or other nominee. If you are a beneficial owner of shares registered

in the name of your bank, broker or other nominee, you should have received voting instructions from that organization rather than from

us. Simply complete and mail the voting instruction form to ensure that your vote is counted. Alternatively, you may vote by telephone

or over the Internet as instructed by your bank, broker or other nominee. Follow the instructions from your broker, bank or other nominee

included with this proxy statement, or contact your bank, broker or other nominee to request a proxy form.

Even

if you plan to attend the Special Meeting live via the Internet, we encourage you to vote in advance by Internet, telephone, or mail

so that your vote will be counted if you later decide not to attend the Special Meeting live via the Internet.

May

I change my vote after I have mailed my proxy card or after I have submitted my proxy by telephone or through the Internet?

Yes.

You may revoke your proxy or change your vote at any time before the proxy is exercised at the Special Meeting. You may revoke your proxy

by delivering a signed written notice of revocation stating that the proxy is revoked and bearing a date later than the date of the proxy

to the Company’s Secretary, Craig S. Gilgallon, at Cingulate Inc., 1901 W. 47th Place, 3rd Floor, Kansas

City, Kansas 66205. You may also revoke your proxy or change your vote by submitting another proxy by telephone or through the Internet

in accordance with the instructions on the enclosed proxy card. You may also submit a later-dated proxy card relating to the same shares.

If you voted by completing, signing, dating and returning the enclosed proxy card, you should retain a copy of the voter control number

found on the proxy card in the event that you later decide to revoke your proxy or change your vote by telephone or through the Internet.

Alternatively, your proxy may be revoked or changed by attending the Special Meeting via the virtual meeting website and voting at the

meeting by following the internet voting instructions on your proxy card. However, simply attending the Special Meeting without voting

will not revoke or change your proxy. “Street name” holders of shares of our common stock should contact their bank, broker,

trust or other nominee to obtain instructions as to how to revoke or change their proxies.

What

is the difference between holding shares as a stockholder of record and as a beneficial owner?

Many

of our stockholders hold their shares through a broker, bank or other nominee rather than directly in their own name. As summarized below,

there are some distinctions between shares held of record and those owned beneficially.

Stockholder

of Record

If

your shares are registered directly in your name with our transfer agent, Computershare, you are considered, with respect to those shares,

the stockholder of record. As the stockholder of record, you have the right to directly grant your voting proxy or to vote in person

at the Special Meeting.

Beneficial

Owner

If

your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held

in street name, and these proxy materials are being forwarded to you by your broker, bank or nominee which is considered, with respect

to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker as to how to vote and are

also invited to attend the Special Meeting. However, because you are not the stockholder of record, you may not vote these shares in

person at the Special Meeting unless you obtain a signed proxy from the record holder giving you the right to vote the shares. If you

do not provide the stockholder of record with voting instructions or otherwise obtain a signed proxy from the record holder giving you

the right to vote the shares, broker non-votes may occur for the shares that you beneficially own. The effect of broker non-votes is

more specifically described in “What vote is required to approve each proposal?” below.

What

vote is required to approve each proposal?

Assuming

that a quorum is present, the following votes will be required:

| |

● |

With respect to the proposal

to adopt and approve an amendment to our Charter to authorize the Board to effect the Reverse Split (“Proposal 1”), the

affirmative vote of a majority of the votes cast by all stockholders present in person or represented by proxy at the Special Meeting

and entitled to vote on the proposal is required to approve this proposal. Shares that are not represented at the Special Meeting,

abstentions, if any, and, if this proposal is deemed to be “non-routine,” broker non-votes with respect to this proposal

will not affect the outcome of the vote on this proposal. If this proposal is deemed to be “routine,” no broker non-votes

will occur on this proposal. |

| |

|

|

| |

● |

With respect to the proposal

to approve, for the purpose of complying with the applicable provisions of Nasdaq Listing Rule 5635(d), the issuance of up to 10,387,812

shares of our common stock issuable upon the exercise of our Series A warrants and Series B warrants issued to an institutional investor

in connection with our offering that closed on September 13, 2023 (“Proposal 2”), the affirmative vote of a majority

of the votes cast by all stockholders present in person or represented by proxy at the Special Meeting and entitled to vote on the

proposal is required to approve this proposal. Shares that are not represented at the Special Meeting, abstentions, if any, and,

if this proposal is deemed to be “non-routine,” broker non-votes with respect to this proposal will not affect the outcome

of the vote on this proposal. If this proposal is deemed to be “routine,” no broker non-votes will occur on this proposal.

|

Under

the General Corporation Law of the State of Delaware, holders of the common stock will not have any dissenters’ rights of appraisal

in connection with any of the matters to be voted on at the meeting.

What

is a “broker non-vote”?

Banks

and brokers acting as nominees are permitted to use discretionary voting authority to vote proxies for proposals that are deemed “routine”

by the New York Stock Exchange, which means that they can submit a proxy or cast a ballot on behalf of stockholders who do not provide

a specific voting instruction. Brokers and banks are not permitted to use discretionary voting authority to vote proxies for proposals

that are deemed “non-routine” by the New York Stock Exchange. The determination of which proposals are deemed “routine”

versus “non-routine” may not be made by the New York Stock Exchange until after the date on which this Proxy Statement has

been mailed to you. As such, it is important that you provide voting instructions to your bank, broker or other nominee, if you wish

to ensure that your shares are present and voted at the Special Meeting on all matters and if you wish to direct the voting of your shares

on “routine” matters.

When

there is at least one “routine” matter to be considered at a meeting, a broker “non-vote” occurs when a proposal

is deemed “non-routine” and a nominee holding shares for a beneficial owner does not have discretionary voting authority

with respect to the “non-routine” matter being considered and has not received instructions from the beneficial owner.

Under

the applicable rules governing brokers, we believe the proposal to adopt and approve an amendment to our Charter to effect the Reverse

Split at the discretion of the Board (Proposal 1) is likely to be considered a “routine” matter. If such proposal is “routine,”

a bank or broker may be able to vote on Proposal 1 even if it does not receive instructions from you, so long as it holds your shares

in its name. If, however, Proposal 1 is deemed by the New York Stock Exchange to be a “non-routine” matter, brokers will

not be permitted to vote on Proposal 1 if the broker has not received instructions from the beneficial owner.

The

approval of the proposal to approve, for the purpose of complying with the applicable provisions of Nasdaq Listing Rule 5635(d), the

issuance of up to 10,387,812 shares of our common stock issuable upon the exercise of our Series A warrants and Series B warrants issued

to an institutional investor in connection with our offering that closed on September 13, 2023(Proposal 2) is generally not considered

to be a “routine” matter and banks or brokers are not permitted to vote on these matters if the bank or broker has not received

instructions from the beneficial owner. Accordingly, it is particularly important that beneficial owners instruct their brokers how they

wish to vote their shares for Proposal 2.

Who

will count the votes?

Our

transfer agent, Computershare, will serve as inspector of election at the Special Meeting and will tabulate and certify the votes.

Where

can I find the voting results of the Special Meeting?

The

preliminary voting results will be announced at the Special Meeting, and we will publish final results in a Current Report on Form 8-K

filed with the SEC within four business days of the Special Meeting.

How

are we soliciting this proxy?

We

are soliciting this proxy on behalf of our Board and will pay all expenses associated therewith. Some of our officers, directors and

other employees also may, but without compensation other than their regular compensation, solicit proxies by further mailing or personal

conversations, or by telephone, facsimile or other electronic means.

We

will also, upon request, reimburse brokers and other persons holding stock in their names, or in the names of nominees, for their reasonable

out-of-pocket expenses for forwarding proxy materials to the beneficial owners of the capital stock and to obtain proxies.

PROPOSAL

1: ADOPTION AND APPROVAL OF AN AMENDMENT TO OUR CHARTER TO

EFFECT A REVERSE STOCK SPLIT OF OUR ISSUED SHARES OF COMMON STOCK, AT A

SPECIFIC RATIO, RANGING FROM ONE-FOR-TWO (1:2) TO ONE-FOR-FORTY (1:40),

AT ANY TIME PRIOR TO THE ONE-YEAR ANNIVERSARY DATE OF THE SPECIAL

MEETING, WITH THE EXACT RATIO TO BE DETERMINED BY THE BOARD WITHOUT

FURTHER APPROVAL OR AUTHORIZATION OF OUR STOCKHOLDERS

Overview

Our

Board has determined that it is advisable and in the best interests of the Company and its stockholders to authorize our Board to amend

our Charter to effect a reverse stock split (the “Charter Amendment”) of our issued shares of common stock at a specific

ratio, ranging from one-for-two (1:2) to one-for-forty (1:40) (the “Approved Split Ratios”), to be determined

by the Board without further approval or authorization of our stockholders (the “Reverse Split”). A vote for this Proposal

1 will constitute adoption and approval of the Charter Amendment and the Reverse Split that, once effected by filing the Charter Amendment

with the Secretary of State of the State of Delaware, will combine between two and forty shares of our common stock into

one share of our common stock. If implemented, the Reverse Split will have the effect of decreasing the number of shares of our common

stock issued, but will have no effect on the number of shares of common stock we are authorized to issue.

Accordingly,

stockholders are asked to adopt and approve the Charter Amendment set forth in Appendix A to effect the Reverse Split as set forth

in the Charter Amendment, subject to the Board’s determination, in its sole discretion, whether or not to implement the Reverse

Split, as well as the specific ratio within the range of the Approved Split Ratios, and provided that the Reverse Split must be effected

on or prior to the one-year anniversary date of the Special Meeting. As set forth on Appendix A, by approving this Proposal 1,

the stockholders will be deemed to have adopted and approved an amendment to effect the Reverse Split withing the range of the Approved

Split Ratios.

If

adopted and approved by our stockholders, the Reverse Split would be effected at an Approved Split Ratio approved by the Board prior

to the one-year anniversary date of the Special Meeting, if at all. To effect the Reverse Stock Split, the Charter Amendment setting

forth the Approved Split Ratio approved by the Board would be filed with the Secretary of State of the State of Delaware and any amendment

to effect the Reverse Split at the other Approved Split Ratios would be abandoned. The Board reserves the right to elect to abandon the

Charter Amendment and the Reverse Split at any of the Approved Split Ratios if it determines, in its sole discretion, that the Reverse

Split is no longer in the best interests of the Company and its stockholders.

Purpose

and Rationale for the Reverse Split

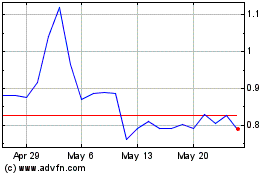

Avoid

Delisting from Nasdaq. On July 28, 2023, we received a written notice from the Listing Qualifications Department (the “Staff”)

of Nasdaq indicating that the Company is not in compliance with the $1.00 Minimum Bid Price requirement set forth in Nasdaq Listing Rule

5550(a)(2) for continued listing on Nasdaq (the “Minimum Bid Price Requirement”). The Notice does not result in the immediate

delisting of the Company’s common stock and warrants from Nasdaq. We were provided a compliance period of 180 calendar days from

the date of the Minimum Bid Price Requirement notice, or until January 24, 2024, to regain compliance with the Minimum Bid Price Requirement,

pursuant to Nasdaq Listing Rule 5810(c)(3)(A). If at any time during this period the bid price of the Company’s common stock closes

at or above $1.00 per share for a minimum of 10 consecutive business days, the Staff will provide the Company with a written confirmation

of compliance and the matter will be closed. Alternatively, if we fail to regain compliance with Rule 5550(a)(2) prior to the expiration

of the initial 180 calendar day period, we may be eligible for an additional 180 calendar day compliance period, provided (i) we meet

the continued listing requirement for market value of publicly held shares and all other applicable requirements for initial listing

on Nasdaq (except for the Minimum Bid Price Requirement) and (ii) we provide written notice to Nasdaq of our intention to cure the deficiency

during the second compliance period by effecting a reverse stock split, if necessary.

If

we do not regain compliance within the allotted compliance periods, including any extensions that may be granted by Nasdaq, Nasdaq will

provide notice that our common stock will be subject to delisting. We would then be entitled to appeal that determination to a Nasdaq

hearings panel.

Failure

to approve the Reverse Split may potentially have serious, adverse effects on us and our stockholders. Our common stock could be delisted

from Nasdaq because shares of our common stock may continue to trade below the requisite $1.00 per share price needed to maintain our

listing in accordance with the Minimum Bid Price Requirement. Our shares may then trade on the OTC Bulletin Board or other small trading

markets, such as the pink sheets. In that event, our common stock could trade thinly as a microcap or penny stock, adversely decrease

to nominal levels of trading and may be avoided by retail and institutional investors, resulting in the impaired liquidity of our common

stock.

As

of September 20, 2023, our common stock closed at $0.746 per share on Nasdaq. The Reverse Split, if effected, is expected to have

the immediate effect of increasing the price of our common stock as reported on Nasdaq, therefore reducing the risk that our common stock

could be delisted from Nasdaq. Accordingly, the Board has approved resolutions proposing the Charter Amendment to effect the Reverse

Split and directed that it be submitted to our stockholders for approval at the Special Meeting.

Management

and the Board have considered the potential harm to us and our stockholders should Nasdaq delist our common stock from trading. Delisting

could adversely affect the liquidity of our common stock since alternatives, such as the OTC Bulletin Board and the pink sheets, are

generally considered to be less efficient markets. An investor likely would find it less convenient to sell, or to obtain accurate quotations

in seeking to buy, our common stock on an over-the-counter market. Many investors likely would not buy or sell our common stock due to

difficulty in accessing over-the-counter markets, policies preventing them from trading in securities not listed on a national exchange,

or other reasons.

Other

Effects. The Board also believes that the increased market price of our common stock expected as a result of implementing the Reverse

Split could improve the marketability and liquidity of our common stock and will encourage interest and trading in our common stock.

The Reverse Split, if effected, could allow a broader range of institutions to invest in our common stock (namely, funds that are prohibited

from buying stock whose price is below a certain threshold), potentially increasing the trading volume and liquidity of our common stock.

The Reverse Split could help increase analyst and broker’s interest in common stock, as their policies can discourage them from

following or recommending companies with low stock prices. Because of the trading volatility often associated with low-priced stocks,

many brokerage houses and institutional investors have internal policies and practices that either prohibit them from investing in low-priced

stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers. Some of those policies and practices

may make the processing of trades in low-priced stocks economically unattractive to brokers. Additionally, because brokers’ commissions

on low-priced stocks generally represent a higher percentage of the stock price than commissions on higher-priced stocks, a low average

price per share of our common stock can result in individual stockholders paying transaction costs representing a higher percentage of

their total share value than would be the case if the share price were higher.

Our

Board does not intend for this transaction to be the first step in a series of plans or proposals effect a “going private transaction”

within the meaning of Rule 13e-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

In

addition, because the number of authorized shares of our common stock will not be reduced, the Reverse Split will result in an effective

increase in the authorized number of shares of our common stock. The effect of the relative increase in the amount of authorized and

unissued shares of our common stock would allow us to issue additional shares of common stock in connection with future financings, employee

and director benefit programs and other desirable corporate activities, without requiring our stockholders to approve an increase in

the authorized number of shares of common stock each time such an action is contemplated.

Risks

of the Proposed Reverse Split

We

cannot assure you that the proposed Reverse Split will increase the price of our common stock and have the desired effect of regaining

and maintaining compliance with Nasdaq listing rules.

If

the Reverse Split is implemented, our Board expects that it will increase the market price of our common stock so that we are able to

regain and maintain compliance with the Nasdaq minimum bid price requirement. However, the effect of the Reverse Split upon the market

price of our common stock cannot be predicted with any certainty, and the history of similar stock splits for companies in like circumstances

is varied. It is possible that (i) the per share price of our common stock after the Reverse Split will not rise in proportion to the

reduction in the number of shares of our common stock outstanding resulting from the Reverse Split, (ii) the market price per post-Reverse

Split share may not exceed or remain in excess of the $1.00 minimum bid price for a sustained period of time, or (iii) the Reverse Split

may not result in a per share price that would attract brokers and investors who do not trade in lower priced stocks. Even if the Reverse

Split is implemented, the market price of our common stock may decrease due to factors unrelated to the Reverse Split. In any case, the

market price of our common stock will be based on other factors which may be unrelated to the number of shares outstanding, including

our future performance. If the Reverse Split is consummated and the trading price of our common stock declines, the percentage decline

as an absolute number and as a percentage of our overall market capitalization may be greater than would occur in the absence of the

Reverse Split. Even if the market price per post-Reverse Split share of our common stock remains in excess of $1.00 per share, we may

be delisted due to a failure to meet other continued listing requirements, including the minimum stockholders’ equity requirement

under Nasdaq Listing Rule 5550(b)(1) and Nasdaq requirements related to the minimum number of shares that must be in the public float

and the minimum market value of the public float.

A

decline in the market price of our common stock after the Reverse Split is implemented may result in a greater percentage decline than

would occur in the absence of a reverse stock split.

If

the Reverse Split is implemented and the market price of our common stock declines, the percentage decline may be greater than would

occur in the absence of a reverse stock split. The market price of our common stock will, however, also be based upon our performance

and other factors, which are unrelated to the number of shares of common stock outstanding.

The

proposed Reverse Split may decrease the liquidity of our common stock.

The

liquidity of our common stock may be harmed by the proposed Reverse Split given the reduced number of shares of common stock that would

be outstanding after the Reverse Split, particularly if the stock price does not increase as a result of the Reverse Split.

Determination

of the Ratio for the Reverse Split

If

Proposal 1 is approved by stockholders and the Board determines that it is in the best interests of the Company and its stockholders

to move forward with the Reverse Split, the Approved Split Ratio will be selected by the Board, in its sole discretion. However, the

Approved Split Ratio will not be less than a ratio of one-for-two (1:2) or exceed a ratio of one-for-forty (1:40). In determining

which Approved Split Ratio to use, the Board will consider numerous factors, including the historical and projected performance of our

common stock, prevailing market conditions and general economic trends, and will place emphasis on the expected closing price of our

common stock in the period following the effectiveness of the Reverse Split. The Board will also consider the impact of the Approved

Split Ratios on investor interest. The purpose of selecting a range is to give the Board the flexibility to meet business needs as they

arise, to take advantage of favorable opportunities and to respond to a changing corporate environment. Based on the number of shares

of common stock issued and outstanding as of September 20, 2023, after completion of the Reverse Split, we will have between 434,470

and 8,689,399 shares of common stock issued and outstanding, depending on the Approved Split Ratio selected by the Board.

Principal

Effects of the Reverse Split

After

the effective date of the proposed Reverse Split, each stockholder will own a reduced number of shares of common stock. Except for adjustments

that may result from the treatment of fractional shares as described below, the proposed Reverse Split will affect all stockholders uniformly.

The proportionate voting rights and other rights and preferences of the holders of our common stock will not be affected by the proposed

Reverse Split except for adjustments that may result from the treatment of fractional shares as described below For example, a holder

of 2% of the voting power of the outstanding shares of our common stock immediately prior to the Reverse Split would continue to hold

2% of the voting power of the outstanding shares of our common stock immediately after the Reverse Split. The number of stockholders

of record also will not be affected by the proposed Reverse Split.

The

following table contains approximate number of issued and outstanding shares of common stock, and the estimated per share trading price

following a 1:2 to 1:40 Reverse Split as of September 20, 2023, without giving effect to any adjustments for fractional

shares of common stock or the issuance of any derivative securities.

After

Each Reverse Split Ratio

| | |

Current | | |

1:2 | | |

1:10 | | |

1:20 | | |

1:40 | |

| Common

stock Authorized(1) | |

| 240,000,000 | | |

| 240,000,000 | | |

| 240,000,000 | | |

| 240,000,000 | | |

| 240,000,000 | |

| Common

Stock Issued and Outstanding | |

| 17,378,798 | | |

| 8,689,399 | | |

| 1,737,880 | | |

| 868,940 | | |

| 434,470 | |

| Number

of Shares of Common Stock Reserved for Issuance (2) | |

| 30,563,823 | | |

| 15,281,912 | | |

| 3,056,382 | | |

| 1,528,191 | | |

| 764,096 | |

| Number

of Shares of Common Stock Authorized but Unissued and Unreserved | |

| 192,057,379 | | |

| 216,028,690 | | |

| 235,205,738 | | |

| 237,602,869 | | |

| 238,801,434 | |

| Price per share, based on

the closing price of our common stock on September 20, 2023 (3) | |

$ | 0.746 | | |

| 1.492 | | |

| 7.460 | | |

| 14.920 | | |

| 29.840 | |

(1)

The Reverse Split will not have any impact in the number of shares of common stock we are authorized to issue under our Charter.

(2)

Includes (i) warrants to purchase an aggregate of 15,734,070 shares of common stock with a weighted average exercise price of $2.32 per

share, (ii) 12,043,443 shares of common stock issuable upon the exercise of pre-funded warrants with a weighted average exercise price

of $0.0001 per share, (iii) 1,424,995 shares of common stock issuable upon exercise of stock options, with a weighted average exercise

price of $3.03 per share, under the 2021 Omnibus Equity Incentive Plan (the “2021 Plan”) and (iv) 1,361,315 shares of common

stock reserved for future issuance under the 2021 Plan.

(3)

The price per share indicated reflects solely the application of the applicable Reverse Split ratio to the closing price of the common

stock on September 20, 2023.

After

the effective date of the Reverse Split, our common stock would have a new committee on uniform securities identification procedures

(CUSIP) number, a number used to identify our common stock.

Our

common stock is currently registered under Section 12(b) of the Exchange Act, and we are subject to the periodic reporting and other

requirements of the Exchange Act. The proposed Reverse Split will not affect the registration of our common stock under the Exchange

Act. Our common stock would continue to be reported on Nasdaq under the symbol “CING,” assuming that we are able to regain

compliance with the Minimum Bid Price Requirement, although it is likely that Nasdaq would add the letter “D” to the end

of the trading symbol for a period of twenty trading days after the effective date of the Reverse Split to indicate that the Reverse

Split had occurred.

Effect

on Outstanding Derivative Securities

The

Reverse Split will require that proportionate adjustments be made to the per share exercise price and the number of shares issuable upon

the exercise of the following outstanding derivative securities issued by us, in accordance with the Approved Split Ratio (all figures

are as of September 20, 2023 and are on a pre-Reverse Split basis), including:

| ● | 15,734,070

shares of common stock issuable upon the exercise of outstanding warrants, with a weighted

average exercise price of $2.32 per share; |

| | | |

| ● | 12,043,443

shares of common stock issuable upon the exercise of outstanding pre-funded warrants, with

a weighted average exercise price of $0.0001 per share; |

| ● | 1,424,995

shares of common stock issuable upon exercise of stock options, with a weighted average exercise

price of $3.03 per share, under the 2021 Plan; and |

| | | |

| ● | 1,361,315

shares of common stock reserved for future issuance under the 2021 Plan. |

The

adjustments to the above securities, as required by the Reverse Split and in accordance with the Approved Split Ratio, would result in

approximately the same aggregate price being required to be paid under such securities upon exercise, and approximately the same value

of shares of common stock being delivered upon such exercise or conversion, immediately following the Reverse Split as was the case immediately

preceding the Reverse Split.

Effect on our Equity Incentive Plan

As

of September 20, 2023, we had 1,424,995 shares of common stock reserved for issuance pursuant to the exercise of outstanding options

issued under our 2021 Plan, as well as 1,361,315 shares of common stock available for issuance under the 2021 Plan. Pursuant to the terms

of the 2021 Plan, the Board, or a designated committee thereof, as applicable, will adjust the number of shares of common stock underlying

outstanding stock options, the exercise price per share of outstanding stock options and other terms of outstanding awards issued pursuant

to the 2021 Plan to equitably reflect the effects of the Reverse Split. Furthermore, the number of shares available for future grant

under the 2021 Plan will be similarly adjusted.

Effective

Date

The

proposed Reverse Split would become effective on the date of filing of the Charter Amendment with the office of the Secretary of State

of the State of Delaware unless another effective date is set forth in the Charter Amendment. On the effective date, shares of common

stock issued immediately prior thereto will be combined and reclassified, automatically and without any action on the part of our stockholders,

into new shares of common stock in accordance with the Approved Split Ratio set forth in this Proposal 1. If the proposed Charter Amendment

is not adopted and approved by our stockholders, the Reverse Split will not occur.

Treatment

of Fractional Shares

No

fractional shares of common stock will be issued as a result of the Reverse Split. Instead, record holders of our common stock who otherwise

would be entitled to receive a fractional share because they hold a number of shares not evenly divisible by the Approved Split Ratio

will automatically be entitled to receive an additional fraction of a share of common stock to round up to the next whole share. In any

event, cash will not be paid for fractional shares.

Record

and Beneficial Stockholders

If

the Charter Amendment is adopted and approved and the Reverse Split is authorized by our stockholders and our Board elects to implement

the Reverse Split, stockholders of record holding some or all of their shares of common stock electronically in book-entry form under

the direct registration system for securities will receive a transaction statement at their address of record indicating the number of

shares of common stock they hold after the Reverse Split. Non-registered stockholders holding common stock through a bank, broker or

other nominee should note that such banks, brokers or other nominees may have different procedures for processing the consolidation than

those that would be put in place by us for registered stockholders. If you hold your shares with such a bank, broker or other nominee

and if you have questions in this regard, you are encouraged to contact your nominee.

If

the Charter Amendment is adopted and approved and the Reverse Split is authorized by the stockholders and our Board elects to implement

the Reverse Split, stockholders of record holding some or all of their shares in certificated form (i.e., shares represented by one

or more physical stock certificates) will be requested to exchange their old stock certificate(s) (“Old Certificate(s)”)

for shares held in book-entry form at our transfer agent, Computershare, in their direct registration system representing the appropriate

number of whole shares of our common stock resulting from the Reverse Split. Stockholders of record upon the effective time of the Reverse

Split will be furnished the necessary materials and instructions for the surrender and exchange of their Old Certificate(s) at the appropriate

time by our transfer agent. As soon as practicable after the effective time of the Reverse Split, our transfer agent will send a transmittal

letter to each stockholder advising such holder of the procedure for surrendering Old Certificate(s) in exchange for new shares held

in book-entry. Your Old Certificate(s) representing pre-split shares cannot be used for either transfers or deliveries. Accordingly,

you must exchange your Old Certificate(s) in order to effect transfers or deliveries of your shares. Any stockholder whose Old Certificate(s)

have been lost, destroyed or stolen will be entitled to new shares in book-entry only after complying with the requirements that we and

our transfer agent customarily apply in connection with lost, stolen or destroyed certificates.

STOCKHOLDERS

SHOULD NOT DESTROY ANY PRE-SPLIT STOCK CERTIFICATE AND SHOULD NOT SUBMIT ANY CERTIFICATES UNTIL THEY ARE REQUESTED TO DO

SO.

Accounting

Consequences

The

par value per share of common stock would remain unchanged at $0.0001 per share after the Reverse Split. As a result, on the effective

date of the Reverse Split, the stated capital on our balance sheet attributable to the common stock will be reduced proportionally, based

on the Approved Split Ratio selected by the Board, from its present amount, and the additional paid-in capital account shall be credited

with the amount by which the stated capital is reduced. The per share common stock net income or loss and net book value will be increased

because there will be fewer shares of common stock outstanding. The shares of common stock held in treasury, if any, will also be reduced

proportionately based on the Approved Split Ratio selected by the Board. Retroactive restatement will be given to all share numbers in

our financial statements, and accordingly all amounts including per share amounts will be shown on a post-split basis. We do not anticipate

that any other accounting consequences would arise as a result of the Reverse Split.

No

Appraisal Rights

Our

stockholders are not entitled to dissenters’ or appraisal rights under the Delaware General Corporation Law with respect to this

Proposal 1 and we will not independently provide our stockholders with any such right if the Reverse Split is implemented.

Material

Federal U.S. Income Tax Consequences of the Reverse Split

The

following is a summary of material U.S. federal income tax consequences of a Reverse Split to our U.S. Holders (as defined below). The

summary is based on the Internal Revenue Code of 1986, as amended (the “Code”), applicable Treasury Regulations promulgated

thereunder, judicial authority and current administrative rulings and practices as in effect on the date of this Proxy Statement. Changes

to the laws could alter the tax consequences described below, possibly with retroactive effect. We have not sought and will not seek

an opinion of counsel or a ruling from the Internal Revenue Service regarding the federal income tax consequences of a Reverse Split.

This discussion only addresses U.S. Holders who hold common stock as capital assets. It does not purport to be complete and does not

address U.S. Holders subject to special tax treatment under the Code, including, without limitation, financial institutions, tax-exempt

organizations, insurance companies, dealers in securities, foreign stockholders, stockholders who hold their pre-reverse stock split

shares as part of a straddle, hedge or conversion transaction, and stockholders who acquired their pre-reverse stock split shares pursuant

to the exercise of employee stock options or otherwise as compensation. If a partnership (or other entity treated as a partnership for

U.S. federal income tax purposes) is the beneficial owner of our common stock, the U.S. federal income tax treatment of a partner in

the partnership will generally depend on the status of the partner and the activities of the partnership. Accordingly, partnerships (and

other entities treated as partnerships for U.S. federal income tax purpose) holding our common stock and the partners in such entities

should consult their own tax advisors regarding the U.S. federal income tax consequences of the proposed Reverse Split to them. In addition,

the following discussion does not address the tax consequences of the Reverse Split under state, local and foreign tax laws. Furthermore,

the following discussion does not address any tax consequences of transactions effectuated before, after or at the same time as the Reverse

Split, whether or not they are in connection with the Reverse Split.

For

purposes of the discussion below, a “U.S. Holder” is a beneficial owner of shares of the Company’s common stock that

for U.S. federal income tax purposes is: (i) an individual citizen or resident of the United States; (ii) a corporation (or other entity

taxable as a corporation for U.S. federal income tax purposes) created or organized in or under the laws of the United States, any state

therein or the District of Columbia; (iii) an estate, the income of which is subject to U.S. federal income taxation regardless of its

source; or (iv) a trust with respect to which a U.S. court is able to exercise primary supervision over its administration and one or

more U.S. persons have the authority to control all of its substantial decisions of the trust, or that has a valid election in effect

to be treated as a U.S. person under applicable U.S. Treasury Regulations.

The

Reverse Split is expected to constitute a “recapitalization” for U.S. federal income tax purposes pursuant to Section 368(a)(1)(E)

of the Code. A U.S. Holder generally will not recognize gain or loss on the deemed exchange of shares pursuant to the Reverse Split,

except potentially with respect to any additional fractions of a share of our common stock received as a result of the rounding up of

any fractional shares that otherwise would be issued, as discussed below. Subject to the following discussion regarding a U.S. Holder’s

receipt of a whole share of the Company’s common stock in lieu of a fractional share, a U.S. Holder’s aggregate tax basis

in the shares of common stock received in the Reverse Split will equal the U.S. Holder’s basis in its old shares of common stock

and such U.S. Holder’s holding period in the shares received will include the holding period in its old shares exchanged. The Treasury

Regulations provide detailed rules for allocating the tax basis and holding period of shares of common stock surrendered in a recapitalization

to shares received in the recapitalization. U.S. Holders of our common stock acquired on different dates and at different prices should

consult their tax advisors regarding the allocation of the tax basis and holding period of such shares.

As

described above under “Treatment of Fractional Shares,” no fractional shares of the Company’s common stock will be

issued as a result of the Reverse Split. Instead, record holders of our common stock who otherwise would be entitled to receive a fractional

share because they hold a number of shares not evenly divisible by the Approved Split Ratio will automatically be entitled to receive

an additional fraction of a share of common stock to round up to the next whole share. A U.S. Holder who receives one whole share of

the Company’s common stock in lieu of a fractional share may recognize income or gain in an amount not to exceed the excess of

the fair market value of such share over the fair market value of the fractional share to which such U.S. Holder was otherwise entitled.

The Company is not making any representation as to whether the receipt of one whole share in lieu of a fractional share will result in

income or gain to any stockholder, and stockholders are urged to consult their own tax advisors as to the possible tax consequences of

receiving a whole share in lieu of a fractional share in the Reverse Split.

We

will not recognize any gain or loss as a result of the proposed Reverse Split.

THE

PRECEDING DISCUSSION IS INTENDED ONLY AS A SUMMARY OF CERTAIN FEDERAL U.S. INCOME TAX CONSEQUENCES OF THE REVERSE SPLIT AND DOES NOT

PURPORT TO BE A COMPLETE ANALYSIS OR DISCUSSION OF ALL POTENTIAL TAX EFFECTS RELEVANT THERETO. YOU SHOULD CONSULT YOUR OWN TAX ADVISORS

AS TO THE PARTICULAR FEDERAL, STATE, LOCAL, FOREIGN AND OTHER TAX CONSEQUENCES OF THE REVERSE SPLIT IN LIGHT OF YOUR SPECIFIC CIRCUMSTANCES.

Required

Vote and Recommendation

In

accordance with our Charter and Delaware law, approval and adoption of this Proposal 1 requires the affirmative vote of a majority of

the votes cast at the Special Meeting. Abstentions and broker non-votes, if any, with respect to this proposal are not counted as votes

cast and will not affect the outcome of this proposal.

THE

BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE APPROVAL OF AN AMENDMENT TO THE CHARTER TO EFFECT THE REVERSE SPLIT.

PROPOSAL

2: APPROVAL, FOR THE PURPOSE OF COMPLYING WITH THE APPLICABLE PROVISIONS OF NASDAQ LISTING RULE 5635(D), OF THE ISSUANCE OF UP TO 10,387,812

SHARES OF COMMON STOCK ISSUABLE UPON THE EXERCISE OF WARRANTS

Overview

We

are seeking stockholder approval, for the purpose of complying with the applicable provisions of Nasdaq Listing Rule 5635(d), for the

issuance of up to 10,387,812 shares of our common stock issuable upon the exercise of the Series A warrants and Series B warrants that

were issued in and in connection with our offering that closed on September 13, 2023 (the “Offering”).

On

September 11, 2023, we entered into a securities purchase agreement (the “Purchase Agreement”) with an institutional investor

(the “Investor”), pursuant to which we sold (i) 1,720,000 shares of common stock, (ii) pre-funded warrants to purchase up

to an aggregate of 5,205,208 shares of common stock (the “Pre-Funded Warrants”), (iii) Series A warrants to purchase up to

an aggregate of 6,925,208 shares of common stock (“Series A warrants”), and (iv) Series B warrants to purchase up to 3,462,604

shares of common stock (“Series B warrants” and, together with the Series A warrants, the “Common Warrants”).

The Offering closed on September 13, 2023.

The

combined purchase price for each share of common stock and accompanying Common Warrants was $0.5776, and the combined purchase price

for each Pre-Funded Warrant and accompanying Common Warrants was $0.5775. The Nasdaq Official Closing Price of our common stock on Nasdaq

on September 8, 2023, the trading date immediately preceding the signing of the Purchase Agreement, was $0.5776 per share.

Description

of Common Warrants

Duration

and Exercise Price

Pursuant

to Nasdaq Listing Rule 5635(d), the Common Warrants are not exercisable until our stockholders approve the issuance of shares of common

stock issuable upon exercise of the Common Warrants (the “Warrant Stockholder Approval”). We have agreed with the Investor

that if we do not obtain the Warrant Approval at the first stockholder meeting at which such stockholder approval is sought, we will

a call additional stockholder meeting every 60 days.

The

Series A warrants have an exercise price of $0.5776 per share and will be exercisable beginning on the effective date of the Warrant

Stockholder Approval (the “Initial Exercise Date”). The Series A warrants will expire on the five-year anniversary of the

Initial Exercise Date. The Series B warrants have exercise price of $0.5776 per share and will be exercisable beginning on the Initial

Exercise Date. The Series B warrants will expire on the two-year anniversary of the Initial Exercise Date.

The

exercise price and number of shares of common stock issuable upon exercise of the Common Warrants is subject to appropriate adjustment

in the event of stock dividends, stock splits, reorganizations or similar events affecting our common stock and the exercise price.

Exercisability

Subject

to receipt of the Warrant Stockholder Approval, the Common Warrants will be exercisable, at the option of each holder, in whole or in

part, by delivering to us a duly executed exercise notice accompanied by payment in full for the number of shares of our common stock

purchased upon such exercise (except in the case of a cashless exercise as discussed below). A holder (together with its affiliates)

may not exercise any portion of such holder’s Common Warrants to the extent that the holder would own more than 4.99% of the outstanding

common stock immediately after exercise, except that upon at least 61 days’ prior notice from the holder to us, the holder may

increase the amount of ownership of outstanding stock after exercising the holder’s Common Warrants up to 9.99% of the number of

shares of our common stock outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in

accordance with the terms of the Common Warrants.

Cashless

Exercise

If,

at the time a holder exercises its Common Warrants, a registration statement registering the issuance or resale of the shares of common

stock underlying the Common Warrants under the Securities Act is not then effective or available for the issuance of such shares, then

in lieu of making the cash payment otherwise contemplated to be made to us upon such exercise in payment of the aggregate exercise price,

the holder may elect instead to receive upon such exercise (either in whole or in part) the net number of shares of common stock determined

according to a formula set forth in the Common Warrant.

Fundamental

Transactions

In

the event of a fundamental transaction, as described in the Common Warrants and generally including any reorganization, recapitalization

or reclassification of our shares of common stock, the sale, transfer or other disposition of all or substantially all of our properties

or assets, our consolidation or merger with or into another person, the acquisition of more than 50% of the voting power represented

by our outstanding shares of capital stock, any person or group becoming the beneficial owner of more than 50% of the voting power represented

by our outstanding shares of capital stock, any merger with or into another entity or a tender offer or exchange offer approved by more

than 50% of the voting power represented by our outstanding shares of capital, then upon any subsequent exercise of a Common Warrant,

the holder will have the right to receive as alternative consideration, for each share of our common stock that would have been issuable

upon such exercise immediately prior to the occurrence of such fundamental transaction, the number of shares of common stock of the successor

or acquiring corporation or of our company, if it is the surviving corporation, and any additional consideration receivable upon or as

a result of such transaction by a holder of the number of shares of our common stock for which the Common Warrant is exercisable immediately

prior to such event. Notwithstanding the foregoing, in the event of a fundamental transaction, the holders of the Common Warrants have

the right to require us or a successor entity to redeem the Common Warrants for cash in the amount of the Black-Scholes Value (as defined

in each Common Warrant) of the unexercised portion of the Common Warrants concurrently with or within 30 days following the consummation

of a fundamental transaction.

However,

in the event of a fundamental transaction which is not in our control, including a fundamental transaction not approved by our board

of directors, the holders of the Common Warrants will only be entitled to receive from us or our successor entity, as of the date of

consummation of such fundamental transaction the same type or form of consideration (and in the same proportion), at the Black Scholes

Value of the unexercised portion of the Common Warrant that is being offered and paid to the holders of our common stock in connection

with the fundamental transaction, whether that consideration is in the form of cash, stock or any combination of cash and stock, or whether

the holders of our common stock are given the choice to receive alternative forms of consideration in connection with the fundamental

transaction.

Transferability

Subject

to applicable laws, a Common Warrant may be transferred at the option of the holder upon surrender of the Common Warrant to us together

with the appropriate instruments of transfer.

Fractional

Shares

No

fractional shares of common stock will be issued upon the exercise of the Common Warrants. Rather, the number of shares of common stock

to be issued will, at our election, either be rounded up to the next whole share or we will pay a cash adjustment in respect of such

final fraction in an amount equal to such fraction multiplied by the exercise price.

Trading

Market

There

is no established trading market for the Common Warrants, and we do not expect such a market to develop. We do not intend to apply to

list the Common Warrants on any securities exchange or other nationally recognized trading system. Without an active trading market,

the liquidity of the Common Warrants will be extremely limited.

Right

as a Stockholder

Except

as otherwise provided in the Common Warrants or by virtue of the holder’s ownership of shares of our common stock, such holder

of Common Warrants does not have the rights or privileges of a holder of our common stock, including any voting rights, until such holder

exercises such holder’s Common Warrants. The Common Warrants will provide that the holders of the Common Warrants have the right

to participate in distributions or dividends paid on our shares of common stock.

Waivers

and Amendments

The

Common Warrants may be modified or amended or the provisions of such Common Warrants waived with our consent and the consent of each

holder.

The

foregoing description of the Common Warrants is not complete and is qualified in its entirety by reference to the full text of the forms

of the Series A warrant and Series B warrant, copies of which are attached as Exhibits 4.6 and 4.7, respectively, to the Company’s

registration statement on form S-1 (No. 333-273405) that was declared effective by the SEC on September 11, 2023.

Reasons

for the Warrant Exercise Proposal

Our

common stock is listed on Nasdaq and trades under the ticker symbol “CING.” Nasdaq Listing Rule 5635(d) requires stockholder

approval for certain transactions, other than public offerings, involving the issuance of 20% or more of the total pre-transaction shares

outstanding at less than the applicable Minimum Price. Under Rule 5635(d), the “Minimum Price” means a price that is the

lower of: (i) the Nasdaq Official Closing Price immediately preceding the signing of the binding agreement; or (ii) the average Nasdaq

Official Closing Price of the common stock for the five trading days immediately preceding the signing of the binding agreement. The

Nasdaq Official Closing Price of our common stock on Nasdaq on September 8, 2023, the trading date immediately preceding the signing

of the Purchase Agreement, was $0.5776 per share. Additionally, for an offering to satisfy the “Minimum Price,” Nasdaq generally

attributes a value of $0.125 for each warrant to purchase one share of common stock when determining whether a transaction is effected

at a discount and when an equal number of warrants are issued with the common stock (100% coverage) and in the Offering a value of $0.19

since the Offering had 150% warrant coverage. In order to ensure that such value was not attributed to the Common Warrants, the Common

Warrants provide that they may not be exercised, and therefore have no value, until stockholder approval of their exercise is

obtained.

Potential

Consequences if Proposal 2 is Not Approved

The

Board is not seeking the approval of our stockholders to authorize our entry into or consummation of the transactions contemplated by

the Purchase Agreement, as the Offering has already been completed and the Common Warrants have already been issued. We are only asking

for approval to issue the shares of common stock underlying the Common Warrants upon exercise thereof.

The

failure of our stockholders to approve this Proposal 2 will mean that: (i) we cannot permit the exercise of the Common Warrants and (ii)

may incur substantial additional costs and expenses, including the costs and expense of seeking stockholder approval every 60 days until

our stockholders approve the issuance of the shares underlying the Common Warrants.

Each

Common Warrant has an initial exercise price of $0.5776 per share. Accordingly, we would realize an aggregate of up to approximately

$6.0 million in gross proceeds if all the Common Warrants were exercised for cash. If the Common Warrants cannot be exercised, we will

not receive any such proceeds, which could adversely impact our ability to fund our operations.

In

addition, in connection with the Offering and the issuance of Common Warrants, we agreed to seek stockholder approval every 60 days until

our stockholders approve the issuance of the shares underlying the Common Warrants. The costs and expenses associated with seeking such

approval could materially adversely impact our ability to fund our operations.

Potential

Adverse Effects of the Approval of Proposal 2

If

this Proposal 2 is approved, existing stockholders will suffer dilution in their ownership interests in the future upon the issuance

of shares of common stock upon exercise of the Common Warrants. Assuming the full exercise of the Common Warrants, an aggregate of 10,387,812

additional shares of common stock will be outstanding, and the ownership interest of our existing stockholders would be correspondingly

reduced. In addition, the sale into the public market of these shares also could materially and adversely affect the market price of

our common stock.

No

Appraisal Rights

No

appraisal rights are available under the General Corporation Law of the State of Delaware or under our Charter or Bylaws with respect

to Proposal 2.

Required

Vote and Recommendation

In

accordance with our Charter and Delaware law, approval and adoption of this Proposal 2 requires the affirmative vote of a majority of

the votes cast at the Special Meeting. Abstentions and broker non-votes, if any, with respect to this proposal are not counted as votes

cast and will not affect the outcome of this proposal.

THE

BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE APPROVAL, FOR THE PURPOSE OF COMPLYING WITH THE APPLICABLE PROVISIONS OF NASDAQ

LISTING RULE 5636(D), OF THE ISSUANCE OF UP TO 10,387,812 SHARES OF COMMON STOCK ISSUABLE UPON THE EXERCISE OF WARRANTS

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

following table sets forth information about the beneficial ownership of our common stock as of September 12, 2023 (unless otherwise

noted) by:

| |

● |

each person or group known

to us who beneficially owns more than 5% of our common stock; |

| |

|

|

| |

● |

each of our directors; |

| |

|

|

| |

● |

each of our Named Executive

Officers; and |

| |

|

|

| |

● |

all of our directors and

executive officers as a group. |

We

have determined beneficial ownership in accordance with the rules of the SEC. Under these rules, beneficial ownership includes any shares

of common stock as to which the individual or entity has sole or shared voting power or investment power. In computing the number of

shares beneficially owned by an individual or entity and the percentage ownership of that person, shares of common stock subject to options

or warrants held by such person that are currently exercisable or will become exercisable within 60 days of September 12, 2023 are considered

outstanding, although these shares are not considered outstanding for purposes of computing the percentage ownership of any other person.

| Name of Beneficial Owner (1) | |

Number of Shares

Beneficially Owned | | |

Percent of Class (2) | |

| | |

| | |

| |

| Named Executive Officers and Directors | |

| | | |

| | |

| Shane J. Schaffer, Pharm.D. | |

| 993,114 | (3) | |

| 6.28 | % |

| Laurie A. Myers | |

| 77,609 | (4) | |

| * | |

| Louis G. Van Horn, MBA | |

| 185,952 | (5) | |

| 1.19 | % |

| Craig S. Gilgallon, Esq. | |

| 229,208 | (6) | |

| 1.46 | % |

| Scott Applebaum | |

| 12,000 | (7) | |

| * | |

| Patrick Gallagher, MBA | |

| 79,604 | (8) | |

| * | |

| Gregg Givens | |

| 212,064 | (9) | |

| 1.35 | % |

| Curt Medeiros | |

| 11,246 | (10) | |

| * | |

| Peter J. Werth | |

| 3,206,715 | (11) | |

| 19.99 | % |

| All Directors and Executive Officers as a group (11 persons) | |

| 6,197,078 | (12) | |

| 38.43 | % |

| (1) |

Unless noted otherwise,

the address of all listed stockholder is 1901 W. 47th Place, Kansas City, KS 66205. Each of the stockholders listed has

sole voting and investment power with respect to the shares beneficially owned by the stockholder unless noted otherwise, subject

to community property laws where applicable. |

| |

|

| (2) |

We have determined beneficial

ownership in accordance with Rule 13d-3 under the Securities Exchange Act of 1934, as amended, which is generally determined by voting

power and/or dispositive power with respect to securities. Percentage ownership is based on 15,658,798 shares of common stock issued

and outstanding as of September 12, 2023, plus any shares issuable upon exercise of options or warrants that are exercisable with

60 days of September 12, 2023 held by such person. |

| |

|

| (3) |

Includes (i) 70,738 shares

of our common stock issuable upon exercise of warrants that are currently exercisable, (ii) 73,048 shares of our common stock issuable

upon the exercise of stock options that are exercisable within 60 days of September 12, 2023, and (iii) 807,828 shares of common

stock held by Fountainhead Shrugged, LLC. Dr. Schaffer is the manager of Fountainhead Shrugged, LLC and has voting and investment

power over the securities held by Fountainhead Shrugged, LLC. Does not include 264,120 shares of our common stock issuable upon the

exercise of stock options that are not exercisable within 60 days of September 12, 2023. |

| (4) |

Includes 29,346 shares

of our common stock issuable upon the exercise of stock options that are exercisable within 60 days of September 12, 2023. Does not

include 108,030 shares of our common stock issuable upon the exercise of stock options that are not exercisable within 60 days of

September 12, 2023. |

| |

|

| (5) |

Includes (i) 141,606 shares

of common stock held by Louis G. Van Horn Trust, 12/23/19. Mr. Van Horn is the Trustee of Louis G. Van Horn Trust, 12/23/19 and has

voting and investment power over the securities held by Louis G. Van Horn Trust, 12/23/19 and (ii) 29,346 shares of our common stock

issuable upon the exercise of stock options that are exercisable within 60 days of September 12, 2023. Does not include 118,030 shares

of our common stock issuable upon the exercise of stock options that are not exercisable within 60 days of September 12, 2023. |

| |

|

| (6) |

Includes (i) 5,016 shares

of our common stock issuable upon exercise of warrants that are currently exercisable, (ii) 29,346 shares of our common stock issuable

upon the exercise of stock options that are exercisable within 60 days of September 12, 2023, and (iii) 185,296 shares of common

stock held by The Limerick Group, LLC . Mr. Gilgallon is the sole member of The Limerick Group, LLC and has voting and investment

power over the securities held by Limerick Group, LLC. Does not include 108,030 shares of our common stock issuable upon the exercise

of stock options that are not exercisable within 60 days of September 12, 2023. |

| |

|

| (7) |

Does not include 15,000

shares of our common stock issuable upon the exercise of stock options that are not exercisable within 60 days of September 12, 2023. |

| |

|

| (8) |

Includes 11,246 shares

of our common stock issuable upon the exercise of stock options that are exercisable within 60 days of September 12, 2023. Does not

include 21,737 shares of our common stock issuable upon the exercise of stock options that are not exercisable within 60 days of

September 12, 2023. |

| |

|

| (9) |

Includes

(i) 16,500 shares of our common stock issuable upon exercise of warrants that are currently exercisable, (ii) 11,246 shares of our

common stock issuable upon the exercise of stock options that are exercisable within 60 days of September 12, 2023, and (iii) 30,000

shares of common stock held by Mr. Givens’ children. Does not include 21,737 shares of our common stock issuable upon the exercise

of stock options that are not exercisable within 60 days of September 12, 2023.

|

| (10) |

Includes 11,246 shares

of our common stock issuable upon the exercise of stock options that are exercisable within 60 days of September 12, 2023. Does not

include 21,737 shares of our common stock issuable upon the exercise of stock options that are not exercisable within 60 days of

September 12, 2023. |

| |

|

| (11) |

Includes (i) 375,300 shares

of our common stock issuable upon exercise of warrants that are currently exercisable, (ii) 11,246 shares of our common stock issuable

upon the exercise of stock options that are exercisable within 60 days of September 12, 2023, and (iii) 2,798,320 shares of common

stock held by Werth Family Investment Associates LLC. Mr. Werth is the manager of Werth Family Investment Associates LLC and has

voting and investment power over the securities held by Werth Family Investment Associates LLC. Does not include (i) 6,471,235 shares

of common stock issuable upon the exercise of pre-funded warrants which are subject to a 19.99% beneficial ownership limitation blocker

or (ii) 21,737 shares of our common stock issuable upon the exercise of stock options that are not exercisable within 60 days of

September 12, 2023. |

| |

|

| (12) |

Does not include 732,681

shares of our common stock issuable upon the exercise of stock options that are not exercisable within 60 days of September 12, 2023. |

STOCKHOLDER

PROPOSALS

Stockholder

Proposals to be Considered for Inclusion in the Company’s Proxy Materials

In

order for a stockholder proposal to be eligible to be included in the Company’s proxy statement and proxy card for the 2024 Annual

Meeting of Stockholders, the proposal must (1) be received by the Company at its principal executive offices, 1901 W. 47th

Place, 3rd Floor, Kansas City, Kansas 66205, Attn: Craig S. Gilgallon, Secretary, on or before December 30, 2023, and (2)

concern a matter that may be properly considered and acted upon at the annual meeting in accordance with applicable laws, regulations

and the Company’s Bylaws and policies, and must otherwise comply with Rule 14a-8 of the Exchange Act.

Director

Nominations and Other Business to be Brought Before the 2024 Annual Meeting of Stockholders

Notice