false

0001277250

0001277250

2024-01-08

2024-01-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 8, 2024

| |

CHARGE ENTERPRISES, INC.

|

|

| |

(Exact name of registrant as specified in its charter)

|

|

|

Delaware

|

|

001-41354

|

|

90-0471969

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

file number)

|

|

(I.R.S. Employer

Identification No.)

|

| |

|

|

125 Park Avenue, 25th Floor

New York, NY

|

|

10017

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(212)921-2100

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common stock, par value $0.0001

|

|

CRGE

|

|

Nasdaq Global Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter):

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

1.01. Entry into a Material Definitive Agreement

On January 8, 2024, Charge Enterprises, Inc. (sometimes referred to herein as “Company”, “we,” “us,” “our”, “Charge” or similar terms) entered into an amendment (the “Amendment”) to that certain Unit Purchase Agreement by and between the Company, Nextridge, Inc., Paul M. Williams, and Greenspeed Energy Solutions, L.L.C. (“Greenspeed”), dated as of August 1, 2023 (the “Greenspeed UPA”).

The Greenspeed UPA contained certain earnout consideration based on certain EBITDA targets of Greenspeed. In recognition of the enhanced integration of Greenspeed with Charge Infrastructure (a business unit within the Company’s subsidiary ANS Advanced Network Services, LLC) and increased focus of such integration efforts, the Amendment modifies the definition of “EBITDA” to include the EBITDA performance of Charge Infrastructure in addition to Greenspeed. The accounting methodology and EBITDA targets remain unchanged.

The foregoing summary of the Amendment is qualified in its entirety by reference to the full text of the Amendment, a copy of which is filed with this Current Report on Form 8-K as Exhibit 2.1 and is incorporated herein by reference.

8.01. Other Information

Charge is providing the information under this Item 8.01 of this Form 8-K to provide updates to prior disclosures and disclose related developments.

As disclosed in our Current Report on Form 8-K filed on November 21, 2023 (the “November 21st 8-K”), while preparing to access funds in its investment accounts and liquidate marketable securities for the repayment of notes payable dated May 19, 2021 and December 17, 2021 (collectively, the “Notes”), the Company learned that certain Company funds managed by Mr. Kenneth Orr through KORR Acquisitions Group, Inc. (“KORR”) pursuant to an oral agreement, later memorialized in the Special Advisor Agreement with KORR, dated June 7, 2022 (the “Special Advisor Agreement”), were unexpectedly unavailable, rendering the Company unable to repay the Notes. At the time of the November 21st 8-K, the Company was informed by KORR that approximately $9.9 million of funds were invested in limited partnership interests of KORR Value, L.P., a limited partnership controlled by KORR rather than in cash, cash equivalents, marketable securities or similar readily liquid assets, as would have been consistent with the Special Advisor Agreement, past practice, prior accessibility of funds under management with KORR and the Company’s investment directives. As noted in the November 21st 8-K, the Company was investigating these matters. The Special Committee of the Board of Directors initiated and is directing the investigation.

After further investigation into these matters, led by outside counsel engaged for these purposes, and information from accounting firms, brokerage firms and related banking information, the Company believes that these assets were never held, documented or accounted for as limited partnership interests. Rather, the Company believes, based on information available to date, that the limited partnership agreement produced by KORR may have been forged and the assertion that the Company was invested in an illiquid limited partnership interest was a misleading and after-the-fact justification for why the Company’s monies were not returned as previously directed and as consistent with prior course of conduct and the Special Advisor Agreement. Moreover, the investigation indicates that the Company’s funds, which were in custodial accounts at KORR’s broker, had been improperly shifted to accounts for the benefit of other companies affiliated with Mr. Orr and invested in a manner that encumbered such monies and/or used them to cross-collateralize personal investments or loans of Mr. Orr or KORR, all in violation of the Special Advisor Agreement.

In connection with the foregoing, the Company filed a complaint against Mr. Orr, KORR, Korr Value, L.P. and certain other parties in the Supreme Court of New York, New York County on January 8, 2024, Index No. 650109/2024 (the “Complaint”). In the Complaint, the Company claims that the defendants breached their fiduciary duties to the Company as registered investment advisors, and the Complaint includes claims of unjust enrichment, constructive trust, conversion, fraud in the inducement, among other claims. Pursuant to the Complaint, the Company is seeking equitable relief, including a temporary restraining order and injunction against any further dispersal or movement of the Company’s assets, in addition to damages in excess of $15,000,000.

Notice Regarding Forward-Looking Information

This report contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements reflect current expectations or beliefs regarding future events or Charge's future performance. Often, but not always, forward-looking statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", “potential”, "continues", "forecasts", "projects", "predicts", "intends", "anticipates", "targets" or "believes", or variations of, or the negatives of, such words and phrases or state that certain actions, events or results "may", "could", "would", "should", "might" or "will" be taken, occur or be achieved. All forward-looking statements, including those herein, are qualified by this cautionary statement. Although Charge believes that the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements involve risks and uncertainties, and actual results may differ materially from any future results expressed or implied by such forward-looking statements. Such risks and uncertainties include statements regarding litigation efforts, the recoverability of certain Company assets, the Company’s ability to maintain internal capital sufficient to pursue the above litigation at all times necessary going forward and other risks discussed in Charge's filings with the U.S. Securities and Exchange Commission ("SEC"). Readers are cautioned that the foregoing list of risks and uncertainties is not exhaustive of the factors that may affect forward-looking statements. Accordingly, readers should not place undue reliance on forward-looking statements. The forward-looking statements in this report speak only as of the date of this press release or as of the date or dates specified in such statements. For more information on us, investors are encouraged to review our public filings with the SEC, including the factors described in the section captioned “Risk Factors” of Charge’s Annual Report on Form 10-K filed with the SEC on March 15, 2023, and subsequent reports we file from time to time with the SEC, including Charge’s Quarterly Report on Form 10-Q filed with the SEC on November 8, 2023, which are available on the SEC's website at www.sec.gov. Charge disclaims any intention or obligation to update or revise any forward- looking information, whether as a result of new information, future events or otherwise, other than as required by law.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this Form 8-K to be signed on its behalf by the undersigned duly authorized.

Dated: January 9, 2024

| |

CHARGE ENTERPRISES, INC.

|

|

| |

|

|

|

| |

By:

|

/s/ Leah Schweller

|

|

| |

|

Leah Schweller

Chief Financial Officer

|

|

FIRST AMENDMENT (“FIRST AMENDMENT”) TO THE UNIT PURCHASE AGREEMENT by and between CHARGE ENTERPRISES, INC., NEXTRIDGE, INC., PAUL M. WILLIAMS, and GREENSPEED ENERGY SOLUTIONS, L.L.C., DATED AS OF AUGUST 1, 2023 (“AUGUST UPA”)

This First Amendment, dated as of January 8, 2024, is entered into by and among NEXTRIDGE, INC., a New York corporation (“Buyer”), CHARGE ENTERPRISES, INC., a Delaware corporation and the ultimate parent of Buyer (“Charge”), PAUL M. WILLIAMS, an individual with an address at 7315 Chattahoochee Bluff Drive, Atlanta, GA 30350 (the “Member”), and GREENSPEED ENERGY SOLUTIONS, L.L.C., a Georgia limited liability company (the “Company”). Terms used herein shall have the meanings set forth in the August UPA unless otherwise defined herein.

WHEREAS, on August 1, 2023, the parties closed the transactions contemplated by the August UPA, including the purchase by Buyer of all of the outstanding membership interests of the Company;

WHEREAS, Section 1.6 of the August UPA provides for additional consideration for the membership interests based on the achievement of certain milestones that are based on EBITDA of the Company over the two years following the Closing;

WHEREAS, the Parties recognize a change in the focus and agreed upon responsibility of the Member since the date of Closing, including the integration of the Company with Charge Infrastructure, a business unit of ANS Advanced Network Services, LLC, a subsidiary of Buyer (“Charge Infrastructure”);

WHEREAS, the integration of the Company with Charge Infrastructure resulted in a significant amount of time by the Member to evaluate, manage, and make appropriate changes within the operations of Charge Infrastructure;

WHEREAS, in recognition of the foregoing significant change in responsibilities of the Member, the Parties wish to amend the definition of EBITDA within Section 1.6, Earnout, of the August UPA.

NOW, THEREFORE, in consideration of the mutual agreements herein contained, the parties hereto agree as follows:

The definition of EBITDA within Section 1.6 (b) of the August UPA is amended and restated in its entirety as follows:

“(iv) “EBITDA” means, for each Earnout Measurement Period, combined earnings generated by both (1) the Company and (2) Charge Infrastructure, as determined in accordance with the Accounting Principles during each Earnout Measurement Period, calculated before allocation of interest, tax, depreciation or amortization. For the sake of clarity, all references to “Company” in Section 1.6, regarding the calculation of EBITDA shall be deemed to include Charge Infrastructure.”

Except as otherwise provided in this First Amendment, all other terms and provisions set forth in the August UPA shall remain in full force and effect.

IN WITNESS WHEREOF, each party has duly executed and delivered this First Amendment as of the date first above written.

| |

“BUYER”

NEXTRIDGE, INC.

By: /s/ Craig Denson

Name: Craig Denson

Title: Treasurer & Chairman

|

| |

CHARGE ENTERPRISES, INC.

By: /s/ Craig Denson

Name: Craig Denson

Title: Interim CEO & COO

“COMPANY”

GREENSPEED ENERGY SOLUTIONS, L.L.C.

By: /s/ Paul M. Williams

Name: Paul Williams

Title: President & CEO

|

| |

“MEMBER”

/s/ Paul M. Williams

Paul M. Williams

|

v3.23.4

Document And Entity Information

|

Jan. 08, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

CHARGE ENTERPRISES, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Jan. 08, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-41354

|

| Entity, Tax Identification Number |

90-0471969

|

| Entity, Address, Address Line One |

125 Park Avenue, 25th Floor

|

| Entity, Address, City or Town |

New York

|

| Entity, Address, State or Province |

NY

|

| Entity, Address, Postal Zip Code |

10017

|

| City Area Code |

212

|

| Local Phone Number |

921-2100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.0001

|

| Trading Symbol |

CRGE

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

true

|

| Entity, Ex Transition Period |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001277250

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

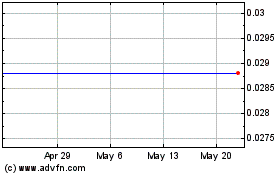

Charge Enterprises (NASDAQ:CRGE)

Historical Stock Chart

From Apr 2024 to May 2024

Charge Enterprises (NASDAQ:CRGE)

Historical Stock Chart

From May 2023 to May 2024