COLORADO SPRINGS, Colo., Nov. 8, 2011 /CNW/ -- Century Casinos,

Inc. today announced its financial results for the three and nine

months ended September 30, 2011. Third Quarter 2011 Highlights --

Net operating revenue was $18.1 million, a 14% increase compared to

the three months ended September 30, 2010. -- Adjusted EBITDA* was

$3.1 million, a 27% increase from the three months ended September

30, 2010. -- Net earnings per share was $0.06 compared to $0.01 for

the three months ended September 30, 2010. For the Three Months For

the Nine Months -------------------- ------------------- Amounts in

thousands, except share and per share data Ended September 30,

Ended September 30, ------------------ -------------------

------------------- Consolidated Results: 2011 2010% 2011 2010%

------------ ---- ---- Change ---- ---- Change ------ ------ Net

operating revenue $18,146 $15,984 14% $53,263 $45,061 18%

------------- ------- ------- --- ------- ------- --- Earnings from

operations 1,548 744 108% 3,281 1,433 129% ------------- ----- ---

--- ----- ----- --- Net earnings 1,423 321 343% 2,431 191 1173%

------------ ----- --- --- ----- --- ---- Adjusted EBITDA* $3,081

$2,424 27% $8,364 $6,528 28% ---------------- ------ ------ ---

------ ------ --- Earnings per share: ------------------- Basic

$0.06 $0.01 500% $0.10 $0.01 900% ----- ----- ----- --- ----- -----

--- Diluted $0.06 $0.01 500% $0.10 $0.01 900% ------- ----- -----

--- ----- ----- --- Weighted-average common shares:

---------------- Basic 23,877,362 23,678,795 23,715,224 23,584,079

----- ---------- ---------- ---------- ---------- Dilutive

24,191,252 23,851,110 24,015,139 23,771,930 -------- ----------

---------- ---------- ---------- "We are very pleased to report

another quarter with growth in revenue, adjusted EBITDA and net

earnings. Our strategies to continuously elevate the guest

experience at our properties and to improve operating efficiencies

are generating positive results. By leveraging management expertise

across multiple properties in Colorado, USA and Alberta, Canada, we

are starting to create synergies that should drive even higher

levels of operational performance," said Erwin Haitzmann and Peter

Hoetzinger, Co Chief Executive Officers of Century Casinos. "We

remain focused on operational improvements and the pursuit of

potential new opportunities to create additional value for

shareholders," they continued. Three and Nine Months Ended

September 30, 2011 Results Net operating revenue increased by $2.2

million, or 13.5%, and $8.2 million, or 18.2%, for the three and

nine months ended September 30, 2011 compared to the three and nine

months ended September 30, 2010, respectively. Net operating

revenue increased at all properties except Central City for the

three months ended September 30, 2011 compared to the three months

ended September 30, 2010. Net operating revenue increased at all

properties for the nine months ended September 30, 2011 compared to

the nine months ended September 30, 2010. Following is a summary of

net operating revenue increases and decreases by property for the

three and nine months ended September 30, 2011 compared to the

three and nine months ended September 30, 2010, respectively: Net

Operating Revenue For the three For the nine months months ended

September ended September 30, 30, Amounts in millions Change %

Change Change % Change Century Casino & Hotel, Edmonton $0.6

10.6% $1.6 10.2% ----------------------- ---- ---- ---- ----

Century Casino, Calgary 0.5 24.5% 1.7 29.3% -----------------------

--- ---- --- ---- Century Casino & Hotel, Central City (0.1)

(2.0%) 0.4 3.3% ----------------------- ---- ------ --- --- Century

Casino & Hotel, Cripple Creek 0.5 16.5% 1.7 21.0%

----------------------- --- ---- --- ---- Cruise Ships & Other

0.7 82.5% 2.8 138.8% -------------------- --- ---- --- ----- Total

operating costs and expenses increased by $1.6 million, or 10.8%,

and $6.8 million, or 15.4%, for the three and nine months ended

September 30, 2011 compared to the three and nine months ended

September 30, 2010, respectively. Total operating costs increased

at all of our properties for both the three and nine months ended

September 30, 2011 compared to the three and nine months ended

September 30, 2010. Following is a summary of total operating costs

and expenses increases by property for the three and nine months

ended September 30, 2011 compared to the three and nine months

ended September 30, 2010, respectively: Total Operating Costs For

the three For the nine months months ended September ended

September 30, 30, Amounts in millions Change % Change Change %

Change Century Casino & Hotel, Edmonton $0.3 8.4% $0.9 7.2%

----------------------- ---- --- ---- --- Century Casino, Calgary

0.4 19.4% 1.8 31.0% ----------------------- --- ---- --- ----

Century Casino & Hotel, Central City 0.1 0.8% 0.5 4.3%

----------------------- --- --- --- --- Century Casino & Hotel,

Cripple Creek 0.3 11.2% 0.9 11.5% ----------------------- --- ----

--- ---- Cruise Ships & Other 0.6 75.8% 2.5 130.2%

-------------------- --- ---- --- ----- Corporate (0.1) (5.8%) 0.2

4.9% --------- ---- ------ --- --- Net earnings increased by $1.1

million, or 343%, and $2.2 million, or 1173%, for the three and

nine months ended September 30, 2011 compared to the three and nine

months ended September 30, 2010, respectively. Net earnings

increased at all of our properties except Central City for the

three months ended September 30, 2011 compared to the three months

ended September 30, 2010. Net earnings increased at all of our

properties except for Central City and Calgary for the nine months

ended September 30, 2011 compared to the nine months ended

September 30, 2010. Following is a summary of net earnings

increases and decreases by property for the three and nine months

ended September 30, 2011 compared to the three and nine months

ended September 30, 2010, respectively: Net Earnings For the three

For the nine months months ended September ended September 30, 30,

Amounts in millions Change % Change Change % Change Century Casino

& Hotel, Edmonton $0.4 49.4% $0.9 38.5% -----------------------

---- ---- ---- ---- Century Casino, Calgary 0.2 162.2% (0.1)

(74.7%) ----------------------- --- ----- ---- ------- Century

Casino & Hotel, Central City (0.1) (19.9%) (0.0) (6.0%)

----------------------- ---- ------- ---- ------ Century Casino

& Hotel, Cripple Creek 0.1 57.1% 0.5 178.5%

----------------------- --- ---- --- ----- Cruise Ships & Other

0.1 275.9% 0.3 311.7% -------------------- --- ----- --- -----

Property Results (in thousands) -------------- Adjusted Adjusted

Net Operating EBITDA* Net Operating EBITDA* Revenue ---------

Revenue --------- ------- ------- For the Three For the Three For

the Nine For the Nine Months Months Months Months Ended Ended Ended

Ended September September September September 30, 30, 30, 30, -- --

-- -- 2011 2010 2011 2010 2011 2010 2011 2010 ---- ---- ---- ----

---- ---- ---- ---- Century Casino & Hotel, Edmonton 5,852

5,291 1,936 1,693 17,791 16,147 5,939 5,107 Century Casino, Calgary

2,446 1,964 96 (90) 7,503 5,804 318 62 Century Casino & Hotel,

Central City 4,754 4,849 1,010 1,283 13,674 13,231 2,919 3,152

Century Casino & Hotel, Cripple Creek 3,506 3,010 804 639 9,554

7,893 2,019 1,322 Cruise Ships & Other 1,588 870 223 113 4,741

1,986 768 350 Corporate - - (988) (1,214) - - (3,599) (3,465)

Consolidated 18,146 15,984 3,081 2,424 53,263 45,061 8,364 6,528

====== ====== ===== ===== ====== ====== ===== ===== Balance Sheet

and Liquidity As of September 30, 2011, the Company had $21.3

million in cash and cash equivalents and $9.4 million in debt

obligations on its balance sheet compared to $21.5 million in cash

and cash equivalents and $13.5 million in debt obligations at

December 31, 2010. Conference Call Information Today the Company

will post a copy of the Form 10-Q filed with the SEC for the third

quarter of 2011 on its website at

http://corporate.cnty.com/investor-relations/sec-filings/ Century

Casinos will host its third quarter 2011 earnings conference call

today at 10:00 am MST; 6:00 pm CET, respectively. U.S. domestic

participants should dial 1-800-862-9098. For all other

international participants please use +1-785-424-1051 to dial in.

Participants may also listen to the call live or obtain a recording

of the call on the Company's website at

http://corporate.cnty.com/investor-relations/financial-results/

*See discussion and reconciliation of Non-GAAP financial measures

in Supplemental Information below. CENTURY CASINOS, INC. AND

SUBSIDIARIES FINANCIAL INFORMATION - US GAAP BASIS

------------------------------------- For the three months For the

nine months ended September 30, ended September 30, Amounts in

thousands, except for per share information 2011 2010 2011 2010

---- ---- ---- ---- Operating revenue: Gaming $16,236 $14,348

$46,989 $40,169 Hotel, bowling, food and beverage 3,152 2,789 9,536

8,311 Other 956 773 2,895 2,122 --- --- ----- ----- Gross revenue

20,344 17,910 59,420 50,602 Less: Promotional allowances (2,198)

(1,926) (6,157) (5,541) Net operating revenue 18,146 15,984 53,263

45,061 ------ ------ ------ ------ Operating costs and expenses:

Gaming 7,543 6,289 21,815 17,578 Hotel, bowling, food and beverage

2,565 2,404 7,629 6,742 General and administrative 5,213 4,986

16,429 15,082 Depreciation 1,526 1,529 4,832 4,542 ----- -----

----- ----- Total operating costs and expenses 16,847 15,208 50,705

43,944 ------ ------ ------ ------ Earnings from equity investment

249 (32) 723 316 Earnings from operations 1,548 744 3,281 1,433

----- --- ----- ----- Non-operating income (expense): Interest

income 6 17 13 39 Interest expense (186) (280) (629) (861) (Losses)

gains on foreign currency transactions & other (27) 14 162 26

Non-operating income (expense), net (207) (249) (454) (796) ----

---- ---- ---- Earnings before income taxes 1,341 495 2,827 637

Income tax provision (82) 174 396 446 Net earnings $1,423 $321

$2,431 $191 ====== ==== ====== ==== Earnings per share: Basic $0.06

$0.01 $0.10 $0.01 ----- ----- ----- ----- Diluted $0.06 $0.01 $0.10

$0.01 ===== ===== ===== ===== CENTURY CASINOS, INC. AND

SUBSIDIARIES FINANCIAL INFORMATION - US GAAP BASIS

------------------------------------- Century Casinos, Inc.

Condensed Consolidated Balance Sheets (Amounts in thousands)

September December 30, 31, 2011 2010 ---- ---- Assets Current

Assets $23,804 $23,467 Property and equipment, net 99,357 103,956

Other Assets 9,339 9,303 Total Assets $132,500 $136,726 ========

======== Liabilities and Shareholders' Equity Current Liabilities

$11,325 $14,057 Non-Current Liabilities 9,394 11,171 Shareholders'

Equity 111,781 111,498 Total Liabilities and Shareholders' Equity

$132,500 $136,726 ======== ======== CENTURY CASINOS, INC. AND

SUBSIDIARIES SUPPLEMENTAL INFORMATION ------------------------

Century Casinos, Inc. Adjusted EBITDA Margins ** by Property

(Unaudited) For the Three For the Nine Months Months Ended

September Ended September 30, 30, ---------------- ----------------

2011 2010 2011 2010 ---- ---- ---- ---- Century Casino & Hotel,

Edmonton 33% 32% 33% 32% Century Casino, Calgary 4% -5% 4% 1%

Century Casino & Hotel, Central City 21% 26% 21% 24% Century

Casino & Hotel, Cripple Creek 23% 21% 21% 17% Cruise Ships

& Other 14% 13% 16% 18% Consolidated Adjusted EBITDA Margin 17%

15% 16% 14% Century Casinos, Inc. Reconciliation of Adjusted EBITDA

* to Earnings (Loss) by Property (Unaudited) For the Three and Nine

Months Ended September 30, 2011 and 2010 Amounts In thousands Three

Months Ended September 30, 2011

------------------------------------- Edmonton Calgary Central

Cripple Cruise Corporate Total -------- ------- City Creek Ships

& --------- ----- ---- Other ----- Earnings (loss) 1,149 74 302

341 109 (552) 1,423 Interest income (6) - - - - - (6) Interest

expense 185 - - - - 1 186 Income taxes (benefit) 234 (170) 173 208

2 (529) (82) Depreciation 373 194 535 255 112 57 1,526 Non- cash

stock based compensation - - - - - 4 4 Foreign currency losses

(gains) 1 (2) - - - 29 28 Loss on disposition of fixed assets - - -

- - 2 2 Adjusted EBITDA* 1,936 96 1,010 804 223 (988) 3,081 =====

=== ===== === === ==== ===== CENTURY CASINOS, INC. AND SUBSIDIARIES

-------------------------------------- SUPPLEMENTAL INFORMATION

------------------------ Century Casinos, Inc. Reconciliation of

Adjusted EBITDA * to Earnings (Loss) by Property (Unaudited) For

the Three and Nine Months Ended September 30, 2011 and 2010 Three

Months Ended September 30, 2010

------------------------------------- Edmonton Calgary Central

Cripple Cruise Corporate Total -------- ------- City Creek Ships

& --------- ----- ---- Other ----- Earnings (loss) 769 (119)

377 217 29 (952) 321 Interest income (4) - - - - (13) (17) Interest

expense 280 - - - - - 280 Income taxes (benefit) 296 (45) 219 134 1

(431) 174 Depreciation 350 77 677 288 83 54 1,529 Non-cash stock

based compensation - - - - - 98 98 Foreign currency (gains) (4) (3)

- - - (15) (22) Property write-down and other write offs - - 10 - -

(10) - Loss on disposition of fixed assets 6 - - - - 55 61 Adjusted

EBITDA* 1,693 (90) 1,283 639 113 (1,214) 2,424 ===== === ===== ===

=== ====== ===== Nine Months Ended September 30, 2011

------------------------------------ Edmonton Calgary Central

Cripple Cruise Corporate Total -------- ------- City Creek Ships

& --------- ----- ---- Other ----- Earnings (loss) 3,242 (152)

673 777 387 (2,496) 2,431 Interest income (13) - - - - - (13)

Interest expense 626 1 - - - 1 628 Income taxes (benefit) 975 (144)

377 476 7 (1,295) 396 Depreciation 1,114 577 1,854 771 331 185

4,832 Non-cash stock based compensation - - - - - 196 196 Foreign

currency (gains) losses (5) 36 - - - (192) (161) Loss (Gain) on

disposition of fixed assets - - 15 (5) 43 2 55 Adjusted EBITDA*

5,939 318 2,919 2,019 768 (3,599) 8,364 ===== === ===== ===== ===

====== ===== CENTURY CASINOS, INC. AND SUBSIDIARIES SUPPLEMENTAL

INFORMATION ------------------------ Century Casinos, Inc.

Reconciliation of Adjusted EBITDA * to Earnings (Loss) by Property

(Unaudited) For the Three and Nine Months Ended September 30, 2011

and 2010 Nine Months Ended September 30, 2010

------------------------------------ Edmonton Calgary Central

Cripple Cruise Corporate Total -------- ------- City Creek Ships

& --------- ----- ---- Other ----- Earnings (loss) 2,340 (87)

723 279 94 (3,158) 191 Interest income (20) (1) - - - (18) (39)

Interest expense 857 - - - - 4 861 Income taxes (benefit) 856 (33)

405 171 3 (956) 446 Depreciation 1,047 185 2,023 871 253 163 4,542

Non- cash stock based compensation - - - - - 386 386 Foreign

currency losses (gains) 18 (2) - - - 57 73 Loss on disposition of

fixed assets 9 - 1 1 - 57 68 Adjusted EBITDA* 5,107 62 3,152 1,322

350 (3,465) 6,528 ===== === ===== ===== === ====== ===== * The

Company defines Adjusted EBITDA as earnings (loss) before interest,

income taxes, depreciation, amortization, pre-opening expenses,

non-cash stock based compensation charges, asset impairment costs,

gains (losses) on disposition of fixed assets, discontinued

operations, realized foreign currency gains (losses) and certain

other one-time items. Intercompany transactions consisting

primarily of management and royalty fees and interest, along with

their related tax effects, are excluded from the presentation of

net earnings and Adjusted EBITDA reported for each property. Not

all of the aforementioned items occur in each reporting period, but

have been included in the definition based on historical activity.

These adjustments have no effect on the consolidated results as

reported under GAAP. Adjusted EBITDA is not considered a measure of

performance recognized under accounting principles generally

accepted in the United States of America. Management believes that

Adjusted EBITDA is a valuable measure of the relative performance

of its properties and the Company. The gaming industry commonly

uses Adjusted EBITDA as a method of arriving at the economic value

of a casino operation. Management uses Adjusted EBITDA to compare

the relative operating performance of separate operating units by

eliminating the above mentioned items associated with the varying

levels of capital expenditures for infrastructure required to

generate revenue, and the often high cost of acquiring existing

operations. EBITDA (Earnings before interest, taxes, depreciation

and amortization) is used by the Company's lending institution to

gauge operating performance. The Company's computation of Adjusted

EBITDA may be different from, and therefore may not be comparable

to, similar measures used by other companies. Please see the

reconciliation of Adjusted EBITDA to earnings (loss) above. ** The

Company defines Adjusted EBITDA margin as Adjusted EBITDA divided

by net operating revenue. Management uses this margin as one of

several measures to evaluate the efficiency of the Company's casino

operations. About Century Casinos, Inc.: Century Casinos, Inc. is

an international casino entertainment company that owns and

operates Century Casino & Hotels in Cripple Creek and Central

City, Colorado, and in Edmonton, Alberta, Canada and the Century

Casino in Calgary, Alberta, Canada. The Company also operates

casinos aboard twelve luxury cruise vessels (Regatta, Insignia,

Nautica, Marina, Mein Schiff 1, Mein Schiff 2, Wind Surf, Wind

Star, Wind Spirit, Seven Seas Voyager, Seven Seas Mariner and Seven

Seas Navigator) and signed a contract for an additional casino on

board Oceania Cruises' Riviera that is expected to start operations

in 2012. Through its Austrian subsidiary, Century Casinos Europe

GmbH, the Company holds a 33.3% ownership interest in Casinos

Poland Ltd., the owner and operator of seven casinos in Poland. The

Company also manages the casino at the Radisson Aruba Resort,

Casino & Spa in Aruba, Caribbean. Century Casinos, Inc.

continues to pursue other international projects in various stages

of development. For more information about Century Casinos, visit

our website at www.centurycasinos.com. Century Casinos' common

stock trades on The NASDAQ Capital Market® and the Vienna Stock

Exchange under the symbol CNTY. This release may contain

"forward-looking statements" within the meaning of Section 27A of

the Security Act of 1933, as amended, Section 21E of the Securities

Exchange Act of 1934, as amended, and the Private Securities

Litigation Reform Act of 1995. These statements are based on the

beliefs and assumptions of the management of Century Casinos based

on information currently available to management. Such

forward-looking statements include, but are not limited to,

statements regarding future results of operations, operational

efficiencies, synergies and operational performance, expected

competition, the impact of new gaming laws and plans for our

casinos. Such forward-looking statements are subject to risks,

uncertainties and other factors that could cause actual results to

differ materially from future results expressed or implied by such

forward-looking statements. Important factors that could cause

actual results to differ materially from the forward-looking

statements include, among others, the risks described in the

section entitled "Risk Factors" under Item 1A in our Annual Report

on Form 10-K for the year ended December 31, 2010. Century Casinos

disclaims any obligation to revise or update any forward-looking

statement that may be made from time to time by it or on its

behalf. Century Casinos, Inc. CONTACT: Peter Hoetzinger, Co CEO

& President of Century Casinos, Inc.,+1-719-689-5813,

+43-664-355-3935, peter.hoetzinger@cnty.com Web

Site:http://www.centurycasinos.com

Copyright

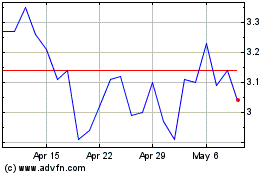

Century Casinos (NASDAQ:CNTY)

Historical Stock Chart

From Apr 2024 to May 2024

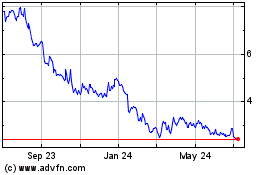

Century Casinos (NASDAQ:CNTY)

Historical Stock Chart

From May 2023 to May 2024