0001666071false00016660712024-01-252024-01-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 25, 2024

CARDLYTICS, INC.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | |

| Delaware | 001-38386 | 26-3039436 |

(State or other jurisdiction of

incorporation or organization) | (Commission

File Number) | (I.R.S. Employer

Identification No.) |

| 675 Ponce de Leon Avenue NE, Suite 4100 | Atlanta | Georgia | 30308 |

| (Address of principal executive offices, including zip code) |

| (888) | 798-5802 | |

| (Registrant's telephone, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

| | | | | | | | |

| Title of each class | Trading symbol | Name of each exchange on which registered |

| Common Stock | CDLX | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| | | | | |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

On January 25, 2024, Cardlytics, Inc. (the “Company”) and Shareholder Representative Services LLC (“SRS”) entered into a settlement agreement (the “Settlement Agreement”) resolving all disputes between the parties related to the Agreement and Plan of Merger dated as of April 12, 2021, as amended, by and among the Company, Bridg, Inc., Mr. T Merger Sub, Inc, and SRS (the “Merger Agreement”), including all disputes related to the First Anniversary Payment Amount and the Second Anniversary Payment Amount, which are the two earnout payments contemplated by the Merger Agreement.

Pursuant to the Settlement Agreement, the Company agreed to pay $25.0 million in cash and issue 3.6 million shares of Company common stock, par value $0.0001, to SRS. For the cash payment, the Company has agreed to pay SRS $20.0 million by January 30, 2024, $3.0 million by January 31, 2025, and $2.0 million by June 30, 2025. For the equity issuance, the Company has agreed to issue 3.6 million shares of the Company’s common stock by February 4, 2024.

The Settlement Agreement contains broad releases of the parties and their affiliates and representatives, including releases of all claims related to the Merger Agreement, the First Anniversary Payment Amount, and the Second Anniversary Payment Amount, as well as a customary covenant not to sue. The Settlement Agreement further requires the Company to dismiss its lawsuit against SRS in the Delaware Court of Chancery, captioned Cardlytics, Inc. v. Shareholder Representative Services LLC, C.A. No. 2023-0531-MAA, with prejudice.

The foregoing description of the Settlement Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Settlement Agreement, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K, which is incorporated herein by reference.

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION

On January 29, 2024, the Company issued a press release announcing the Company’s entry into the Settlement Agreement described above, as well as the Company’s preliminary and unaudited financial results for the fourth quarter of 2023. The Company’s press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information included in this Item 2.02 and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

| | | | | | | | |

| Exhibit | | Exhibit Description |

| 10.1 | | |

| 99.1 | | |

* Pursuant to Item 601(a)(5) of Regulation S-K promulgated by the SEC, certain exhibits and schedules to the Settlement Agreement have been omitted. The Company hereby agrees to furnish supplementally to the SEC, upon its request, any or all of such omitted exhibits or schedules.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | |

| | Cardlytics, Inc. |

| | | |

| Date: | January 29, 2024 | By: | /s/ Alexis DeSieno |

| | | Alexis DeSieno |

| | | Chief Financial Officer (Principal Financial and Accounting Officer) |

Settlement Agreement

WHEREAS, as of April 12, 2021, Cardlytics, Inc. (“Cardlytics”), Mr. T Merger Sub, Inc., and Bridg, Inc. (“Bridg”) entered into an Agreement and Plan of Merger (the “Merger Agreement”) pursuant to which Cardlytics acquired Bridg;

WHEREAS, Shareholder Representative Services LLC (the “Stockholder Representative”) is a party to the Merger Agreement solely in its capacity as a representative, agent, and attorney-in-fact of the “Company Security Holders” of Bridg, as that term is defined in the Merger Agreement;

WHEREAS, Section 1.15 of the Merger Agreement provides for certain earnout payments to be made to the Company Security Holders contingent on the satisfaction of certain terms, namely the “First Anniversary Payment Amount” and the “Second Anniversary Payment Amount,” as those terms are defined in the Merger Agreement (together, the “Earnout Payment Amounts”);

WHEREAS, disputes have arisen between Cardlytics, on the one hand, and the Stockholder Representative, on the other hand, (collectively, the “Parties”) concerning whether and to what extent the Earnout Payment Amounts are owed to the Company Security Holders;

WHEREAS, on May 16, 2023, Cardlytics filed an action against the Stockholder Representative (solely in its capacity as representative, agent, and attorney-in-fact of the Company Security Holders) in the Delaware Court of Chancery concerning certain disputes between them, captioned Cardlytics, Inc. v. Shareholder Representative Services, LLC, C.A. No. 2023-0531-MAA (the “Action”);

WHEREAS, the Parties engaged a mediator to facilitate a settlement of their disputes;

WHEREAS, effective as of January 11, 2024, the Parties executed a binding term sheet for purposes of settling all disputes between them (the “Binding Term Sheet”), subject to satisfying the conditions set forth in Paragraph 1 thereof;

WHEREAS, all conditions set forth in Paragraph 1 of the Binding Term Sheet have since been satisfied;

NOW, THEREFORE, the Parties herein enter into this settlement agreement (the “Settlement Agreement”) containing the following terms:

1.Settlement Consideration. In consideration of the other terms of this Settlement Agreement, Cardlytics shall:

(a) pay cash in the amount of twenty million dollars ($20,000,000) within five (5) days of executing the Settlement Agreement to the Paying Agent, as that term is defined in the Merger Agreement, for distribution to the Company Security Holders, except for the portion of which is owed to employee optionholders (as identified in Exhibit A), which shall be paid via Cardlytics payroll in accordance with the Merger Agreement section 1.7, or via other employee payroll service, with all fees for such payroll service and all employer payroll taxes to be paid by Cardlytics;

(b) issue three million six-hundred thousand (3,600,000) unrestricted shares of Cardlytics common stock to the Company Security Holders within ten (10) days of executing the Settlement Agreement;

(c) pay cash in the amount of three million dollars ($3,000,000) by January 31, 2025, with payment to be made in accordance with the language of subsection 1(a) above;

(d) pay cash in the amount of two million dollars ($2,000,000) by June 30, 2025, with payment to be made in accordance with the language of subsection 1(a) above; and,

(e) with respect to each of the items described in subsections (a)-(d) above, Cardlytics shall make such payments and issue such shares in amounts as set forth in the allocation schedule attached to this Settlement Agreement as Exhibit A.

2.Mutual General Releases.

(a) Releases by the Stockholder Representative. Upon Cardlytics paying all of the cash and issuing all of the shares in full compliance with subsections 1(a) and 1(b) of this Settlement Agreement in accordance with subsection 1(e), the Stockholder Representative, on behalf of itself, its affiliates and representatives, every Company Security Holder, and any person claiming by, through, or for the benefit of any of them, and each of their respective successors and assigns, hereby fully irrevocably, unconditionally, and completely releases, relinquishes, forgives, waives, remises, extinguishes, acquits, and forever discharges Cardlytics and its past and present affiliates, predecessors, successors, assigns, parent companies, subsidiaries, and their respective representatives, and all of their past, present, and future officers, trustees, shareholders, directors, agents, attorneys, financial representatives (including without limitation Ankura and Deloitte), and employees, and their respective successors, assigns, executors, and administrators from any and all claims, counterclaims, demands, reckonings, suits, actions, causes of action, debts, judgments, damages, and liabilities of any kind or nature whatsoever (including attorney’s fees), whether accrued or fixed, known or unknown, absolute or contingent, matured or unmatured, or determined or determinable, that any of the above-described releasors have now or ever had against anyone arising out of or related to the Merger Agreement or the Earnout Payment Amounts, regardless of whether styled in tort, breach of the Merger Agreement, or presented in any other way; provided, however, that claims for breach of the Settlement Agreement shall not be released, including without limitation Cardlytics’s agreement to make the cash payments as described above in subsection 1(c) and 1(d) in accordance with subsection 1(e).

(b) Releases by Cardlytics. Upon Cardlytics paying all of the cash and issuing all of the shares in full compliance with subsections 1(a) and 1(b) of this Settlement Agreement in accordance with subsection 1(e), Cardlytics, on behalf of itself, its affiliates and representatives, and any person claiming by, through, or for the benefit of any of them, and each of their respective successors and assigns, hereby fully irrevocably, unconditionally, and completely releases, relinquishes, forgives, waives, remises, extinguishes, acquits, and forever discharges the Stockholder Representative and its past and present affiliates, predecessors, successors, assigns, parent companies, subsidiaries, and their respective representatives, and all of their past, present, and future officers, trustees, shareholders, directors, employees, and agents, and all Company Security Holders, advisory committee members (Amit Jain, Joseph Miller, and James Armstrong), attorneys, and financial representatives (including without limitation Alvarez & Marsal), and their respective successors, assigns, executors, and administrators from any and all claims, counterclaims, demands, reckonings, suits, actions, causes of action, debts, judgments, damages, and liabilities of any kind or nature whatsoever (including attorney’s fees), whether accrued or fixed, known or unknown, absolute or contingent, matured or unmatured, or determined or determinable that any of the above-described releasors have now or ever had against anyone arising out of or related to the Merger Agreement or the Earnout Payment Amounts, regardless of whether styled in tort, breach of the Merger Agreement, or presented in any other way; provided, however, that claims for breach of the Settlement Agreement shall not be released.

(c) The Parties intend that the execution and performance of this Agreement shall be effective as a full and final settlement of, and as a bar to, all claims released pursuant to subsections 2(a) and 2(b) of this Settlement Agreement (together, the “Released Claims”). The Parties covenant and agree that if they hereafter discover facts different from or in addition to the facts that they now know or believe to be true with respect to the subject matter of this Settlement Agreement, it is nevertheless their intention hereby to settle and release fully and finally the Released Claims. The foregoing releases shall be and will remain in effect as releases notwithstanding the discovery of any such different or additional facts. It is expressly understood and agreed by the Parties that the claims released above may and shall be deemed to encompass claims or matters, the nature of which has not yet been discovered. The Parties understand and acknowledge that it is possible that unknown claims exist or that known claims may have been underestimated in amount or severity. The Parties expressly waive all rights under California Civil Code section 1542 and any similar laws. California Civil Code section 1542 provides as follows: “A general release does not extend to claims which the creditor does not know or suspect to exist in his or her favor at the time of executing the release, which if known by him or her must have materially affected his or her settlement with the debtor.” The Parties understand, acknowledge, and agree that this Settlement Agreement may be pled as a full and complete defense to, and used as a basis for an injunction against, any action, suit, or other proceeding that may be instituted, prosecuted, or attempted in breach of this Settlement Agreement.

3.Termination of Merger Agreement. Upon Cardlytics paying all of the cash and issuing all of the shares in full compliance with subsections 1(a) and 1(b) of this Settlement Agreement in accordance with subsection 1(e), the Merger Agreement shall be terminated, except for section 4.5, section 7.2, and Article 9 of the Merger Agreement, which shall survive and shall not terminate due to this Settlement Agreement.

4.Covenant Not to Sue. The Parties agree not to initiate or pursue, either directly or indirectly, any proceeding, including any proceeding before a court, expert, or arbitrator, in connection with any of the matters released pursuant to section 2 of this Settlement Agreement.

5.No Admission of Liability. Neither this Settlement Agreement nor any of its terms, provisions, or conditions shall be construed as an admission of the presence or absence of liability or wrongdoing.

6.Non-Disparagement. The Parties shall not publicly make any statements regarding the disputes settled herein that malign the opposing party or the positions they asserted with respect to the Earnout Payment Amounts or determination thereof.

7.Choice of Law, Exclusive Jurisdiction, and Waiver of Jury Trial. This Agreement shall be governed by and construed in accordance with the internal laws of the State of Delaware without giving effect to any choice or conflict of law provision or rule (whether of the State of Delaware or any other jurisdiction). The Parties agree that any dispute relating hereto shall be resolved exclusively in and by the Delaware Court of Chancery, except to the extent that the Delaware Court of Chancery determines that it lacks subject matter jurisdiction, in which case any such dispute shall be resolved in Delaware state or federal court. In all circumstances, the Parties waive trial by jury with respect to any dispute relating to this Settlement Agreement.

8.Dismissal of Action. Within five (5) days following compliance by Cardlytics with subsection 1(b) of this Settlement Agreement, Cardlytics will dismiss the Action with prejudice.

9.Amit Jain Indemnification. Cardlytics acknowledges and will continue to honor its indemnification obligations to Amit Jain, including but not limited to section 4.5 of the Merger Agreement and any other relevant indemnification provisions. For the avoidance of doubt, Cardlytics will continue to indemnify Amit Jain with respect to any legal fees, costs, or loss required to be paid by Cardlytics pursuant to any such indemnification provisions in connection with the defense of the litigation captioned DailyGobble, Inc. v. Amit Jain, et al., Case No. 22STCV15317 in the Superior Court of the State of California, County of Los Angeles, or any related litigation or claims, and will not change counsel for Amit Jain from his current counsel without Amit Jain’s written consent.

10.Non-Disclosure. SRS agrees not to disclose the Settlement Agreement or its terms until such are publicly disclosed by Cardlytics. Additionally, SRS agrees not to issue any press release or make any public statement to third parties regarding this Settlement Agreement or the matters contemplated herein, except that SRS may disclose to the Company Security Holders (as that term is defined in the Merger Agreement) the fact of this settlement and the dollar and share amounts under this Settlement Agreement.

11.Authority. The undersigned individuals executing this Settlement Agreement on behalf of their respective Parties are authorized to do so and thereby bind the Parties on whose behalf they are executing this Agreement.

12.Entire Agreement. This Settlement Agreement contains the entire agreement between the Parties with respect to the subject matter herein and supersedes all prior understandings, negotiations, and agreements in connection therewith, including but not limited to the Binding Term Sheet. The Parties acknowledge that in entering into this Settlement Agreement they have not relied on any representation, information, statement, communication, or anything else not specifically set forth in this Settlement Agreement. This Settlement Agreement shall not be altered or amended in any manner, except in writing and signed by each of the Parties.

13.Waiver. No breach of any provision hereof can be waived unless done in writing. Waiver of any one breach of this Settlement Agreement shall not be deemed a waiver of any other breach of the same or other provisions hereof. This Settlement Agreement may be amended only by written agreement executed by each of the Parties.

14.Interpretation. The Parties hereto acknowledge and agree that this Settlement Agreement is the jointly drafted product of arm’s length negotiations between them and that each has been given the opportunity to independently review this Settlement Agreement with legal counsel and agree to the language of the provisions hereof. In the event of an ambiguity in or dispute regarding the interpretation of same, interpretation of this Settlement Agreement shall not be resolved by any rule of interpretation providing for interpretation against the Party who causes the uncertainty or against the draftsman, and all Parties hereto expressly agree that in the event of an ambiguity or dispute regarding the interpretation of this Settlement Agreement, the Settlement Agreement will be interpreted as if each Party hereto participated in the drafting.

15.Counterpart Signatures. This Settlement Agreement may be executed in one or more counterparts, and the Parties may provide each other with facsimile or .pdf copies of all signature pages of this Agreement, together which shall be considered one instrument and shall be considered duplicate originals.

16.Successor and Assigns. This Settlement Agreement shall be binding upon, enforceable against, and inure to the benefit of the Parties hereto and their respective heirs, agents, executors, administrators, liquidators, successors, and assigns.

January 25, 2024

| | | | | | | | |

SHAREHOLDER REPRESENTATIVE SERVICES LLC, solely in its capacity as representative, agent, and attorney-in-fact of the Company Security Holders | | CARDLYTICS, INC. |

By: _/s/ Casey McTigue_____ Casey McTigue | |

By: _/s/ Nick Lynton_________ Nick Lynton |

| Title: Managing Director | | Title: Chief Legal & Privacy Officer |

Cardlytics Announces Successful Resolution of SRS Dispute and Preliminary Fourth Quarter 2023 Results

Expects Preliminary Results to Allow Extension of Credit Facility Maturity Date to April 2025

ATLANTA, Jan. 29, 2024 (GLOBE NEWSWIRE) -- Cardlytics, Inc. (NASDAQ: CDLX), an advertising platform in banks’ digital channels, today announced that it entered into a settlement agreement with Shareholder Representative Services LLC, or SRS, successfully resolving all disputes between the parties related to the Bridg merger agreement and the earnout payments, and further reported preliminary financial results for the fourth quarter ended December 31, 2023. With the preliminary financial results, Cardlytics expects to achieve positive adjusted EBITDA for full year 2023, which would allow it to extend the maturity date of its credit facility until April 2025 pursuant to the terms of its credit facility agreement.

SRS Settlement

On January 25, 2024, Cardlytics entered into a settlement agreement with SRS, the entity representing the former shareholders of Bridg. The settlement agreement resolved all disputes between the parties related to the Bridg merger agreement, including the disputes related to the first anniversary earnout payment and the second anniversary earnout payment.

In connection with the settlement agreement, Cardlytics agreed to pay SRS $25 million in cash and issue SRS 3.6 million shares of Cardlytics common stock. For the cash payment, Cardlytics has agreed to pay $20 million in January 2024, $3 million in January 2025, and $2 million in June 2025. All shares of Cardlytics stock will be issued in February 2024. Per the terms of the settlement agreement, Cardlytics does not have to make any additional payments in connection with its previous withholding from the first anniversary earnout payment that was the subject of a court proceeding in Delaware.

"I am delighted to resolve this significant issue that has greatly impacted Cardlytics for the last year and a half,” said Cardlytics CEO Karim Temsamani. “All matters with SRS, including our withholding from the first anniversary earnout payment as well as the second anniversary earnout dispute, were settled for less than $46 million in total value based on our stock price at market close on Friday. This is a very positive result for the Company and our shareholders, and we are looking forward to focusing solely on the business moving forward.”

Fourth Quarter 2023 Preliminary Results

Additionally, Cardlytics today announced preliminary and unaudited financial results for the fourth quarter ended December 31, 2023. Cardlytics anticipates billings, revenue, adjusted contribution and adjusted EBITDA to be in the following ranges (in millions):

| | | | | | | | | | | | | |

| Q4 2023 Previously Reported Guidance | | Q4 2023 Preliminary Results(1) | | |

| Billings | $122.0 - $133.0 | | $131.0 - $133.0 | | |

| Revenue | $82.0 - $90.0 | | $89.0 - $90.0 | | |

| Adjusted contribution | $44.0 - $50.0 | | $47.0 - $48.0 | | |

| Adjusted EBITDA | $4.0 - $8.0 | | $9.5 - $10.5 | | |

(1) Q4 2023 preliminary results include approximately $2 million in one-time revenue-related benefits.

“I am pleased that we expect to meet or exceed our previous guidance,” said Cardlytics CFO Alexis DeSieno. “Our focus on cost discipline and efficiency is paying off, and our fourth-quarter performance continues to prove that we can achieve sustained profitability. Our preliminary Q4 2023 results also imply positive adjusted EBITDA for 2023. Once finalized, this positive adjusted EBITDA result for 2023 will allow us to extend the maturity date of our credit facility to April 2025 pursuant to the terms of the credit facility agreement, giving us additional flexibility.”

Financial Disclosure Advisory

The foregoing expected results are preliminary, unaudited and subject to change based on the completion of Cardlytics’ quarter-end review process and the completion of the audit for the year ended December 31, 2023. These preliminary results include calculations or figures that have been prepared internally by management and have not been reviewed or audited by Cardlytics’ auditors.

A reconciliation of billings to GAAP revenue on a forward-looking basis is presented below under the heading "Reconciliation of Preliminary GAAP Revenue to Billings." A reconciliation of adjusted contribution to GAAP gross profit and a reconciliation of adjusted EBITDA to GAAP net loss on a forward-looking basis is not available without unreasonable efforts due to the high variability, complexity, and low visibility with respect to the items excluded from this non-GAAP measure.

Reconciliation of Forecasted GAAP Revenue to Billings

| | | | | | | | |

| Q4 2023 Preliminary Results (amounts in millions) |

| Revenue | $89.0 - $90.0 |

| Plus: | |

| Consumer Incentives | $42.0 - $43.0 |

| Billings | $131.0 - $133.0 |

About Cardlytics

Cardlytics (NASDAQ: CDLX) is a digital advertising platform. We partner with financial institutions to run their banking rewards programs that promote customer loyalty and deepen banking relationships. In turn, we have a secure view into where and when consumers are spending their money. We use these insights to help marketers identify, reach, and influence likely buyers at scale, as well as measure the true sales impact of marketing campaigns. Headquartered in Atlanta, Cardlytics has offices in Menlo Park, New York, Los Angeles, and London. Learn more at www.cardlytics.com.

Cautionary Language Concerning Forward-Looking Statements:

This press release contains "forward-looking statements" within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to forward-looking statements related to our payments in connection with the settlement agreement with SRS, our preliminary results for the quarter ended December 31, 2023, our expected adjusted EBITDA results for full year 2023, and the extension of the maturity date of our credit facility. These forward-looking statements are made as of the date they were first issued and were based on current expectations, estimates, forecasts and projections as well as the beliefs and assumptions of management. Words such as "expect," "anticipate," "should," "believe," "hope," "target," "project," "goals," "estimate," "potential," "predict," "may," "will," "might," "could," "intend," or variations of these terms or the negative of these terms and similar expressions are intended to identify these forward-looking statements. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond our control.

Our actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors, including but not limited to the risks detailed in the “Risk Factors” section of our Form 10-Q filed with the Securities and Exchange Commission on November 8, 2023 and in subsequent periodic reports that we file with the Securities and Exchange Commission. Past performance is not necessarily indicative of future results.

The forward-looking statements included in this press release represent our views as of the date of this press release. We anticipate that subsequent events and developments will cause our views to change. We undertake no intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date of this press release.

Non-GAAP Measures

To supplement the financial measures presented in our press release and related conference call or webcast in accordance with generally accepted accounting principles in the United States (“GAAP”), we also present the following non-GAAP measures of financial performance in this press release: billings, adjusted contribution, and adjusted EBITDA.

A “non-GAAP financial measure” refers to a numerical measure of our historical or future financial performance or financial position that is included in (or excluded from) the most directly comparable measure calculated and presented in accordance with GAAP in our financial statements. We provide certain non-GAAP measures as additional information relating to our operating results as a complement to results provided in accordance with GAAP. The non-GAAP financial information presented herein should be considered in conjunction with, and not as a substitute for or superior to, the financial information presented in accordance with GAAP and should not be considered a measure of liquidity. There are significant limitations associated with the use of non-GAAP financial measures. Further, these measures may differ from the non-GAAP information, even where similarly titled, used by other companies and therefore should not be used to compare our performance to that of other companies.

We have presented billings, adjusted contribution, and adjusted EBITDA as non-GAAP financial measures in this press release. Billings represents the gross amount billed to customers and marketers for advertising campaigns in order to generate revenue. Cardlytics platform billings is recognized gross of both Consumer Incentives and Partner Share. Cardlytics platform GAAP revenue is recognized net of Consumer Incentives and gross of Partner Share. Bridg platform billings is the same as Bridg platform GAAP revenue. We define adjusted contribution as a measure by which revenue generated from our marketers exceeds the cost to obtain the purchase data and the digital advertising space from our partners. Adjusted contribution demonstrates how incremental marketing spend on our platforms generates incremental amounts to support our sales and marketing, research and development, delivery costs, general and administration, and other investments. Adjusted contribution is calculated by taking our total revenue less our Partner Share and other third-party costs. Adjusted contribution does not take into account all costs associated with generating revenue from advertising campaigns, including sales and marketing expenses, research and development expenses, delivery costs, general and administrative expenses and other expenses, which we do not take into consideration when making decisions on how to manage our advertising campaigns. We define adjusted EBITDA as our net loss before income taxes; interest expense, net; depreciation and amortization expense; stock-based compensation expense; foreign currency gain (loss); acquisition and integration cost (benefit); loss (gain) in fair value of contingent consideration; goodwill impairment and restructuring and reduction of force. Notably, any impacts related to minimum Partner Share commitments in connection with agreements with certain partners are not added back to net income in order to calculate adjusted EBITDA and adjusted contribution.

We believe the use of non-GAAP financial measures, as a supplement to GAAP measures, is useful to investors in that they eliminate items that are either not part of our core operations or do not require a cash outlay, such as stock-based compensation expense. Management uses these non-GAAP financial measures when evaluating operating performance and for internal planning and forecasting purposes. We believe that these non-GAAP financial measures help indicate underlying trends in the business, are important in comparing current results with prior period results, and are useful to investors and financial analysts in assessing operating performance.

Contacts:

Public Relations:

Robert Robinson

pr@cardlytics.com

Investor Relations:

Robert Robinson

ir@cardlytics.com

v3.24.0.1

| X |

- Definition

+ References

+ Details

| Name: |

cdlx_Titleof12bSecurity |

| Namespace Prefix: |

cdlx_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

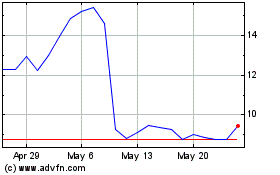

Cardlytics (NASDAQ:CDLX)

Historical Stock Chart

From Apr 2024 to May 2024

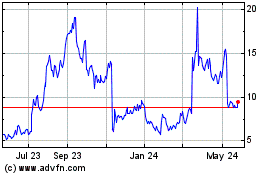

Cardlytics (NASDAQ:CDLX)

Historical Stock Chart

From May 2023 to May 2024