Form 8-K - Current report

June 29 2023 - 8:30AM

Edgar (US Regulatory)

0001436229

false

0001436229

2023-06-29

2023-06-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): June 29, 2023

BTCS

INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-40792 |

|

90-1096644 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

9466

Georgia Avenue #124, Silver Spring, MD 20910

(Address

of Principal Executive Offices, and Zip Code)

(202)

430-6576

Registrant’s

Telephone Number, Including Area Code

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.001 par value |

|

BTCS |

|

The

Nasdaq Stock Market

|

| |

|

|

|

(The

Nasdaq Capital Market) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item

7.01. |

Regulation

FD Disclosure. |

On

June 29, 2023, BTCS Inc. (“BTCS” or the “Company”) listed its Series V Preferred Stock (“Preferred Stock”

or “Preferred Shares”) on the Upstream stock exchange (“Upstream”). Investors who elect to transfer their Preferred

Shares to Upstream may withdraw their Preferred Shares from Upstream back to our transfer agent Equity Stock Transfer (“EST”)

and further transfer back to their broker at any time.

Deposit

Preferred Stock on Upstream

Details

on the Company’s Preferred Stock distribution and the steps needed to deposit the Preferred Stock on Upstream are summarized

below and can be found at https://www.btcs.com/seriesv/.

| |

1. |

Investors

must move their Preferred Stock to the Company’s transfer agent Equity

Stock Transfer (“EST”). Preferred Stock may be moved to EST by contacting their

broker-dealer (or other custodian) and initiating a Direct Registration System (“DRS”) transfer request of the Series

V to EST. Broker-dealers may have different processes so investors should contact them directly for their process. The Preferred

Stock may be transferred using free delivery at DTC via a DRS transfer to EST. BTCS, however, will not cover the cost of a DWAC or

other transfer methods. |

| |

2. |

Preferred

Stock holders can open an account with Upstream by downloading their preferred app from Upstream’s website (https://upstream.exchange)

and creating an Upstream account. Detailed information on the process of how to deposit and trade shares on Upstream is available

by following the link: https://upstream.exchange/SupportCenter |

| |

3. |

U.S.

based Preferred Stock holders must also create an account with Boustead Securities (https://www.boustead1828.com/upstream)

to deposit and trade their shares with Upstream. |

| |

4. |

Lastly,

Preferred Stock holders should request the deposit of their Preferred Stock into their Upstream account using the Upstream app. |

Withdrawing

Preferred Stock from Upstream

Investors

interested in withdrawing shares of Preferred Stock from Upstream may submit a withdrawal of securities request for the Preferred Stock

via the Upstream app. Directions can be found on Upstream’s website https://upstream.exchange/SupportCenter. After the submission

is processed the Company’s transfer agent EST will receive the Preferred Stock and hold the shares in book entry.

Investors

interested in moving Preferred Stock to a brokerage account should contact their broker, to ascertain what paperwork the broker will

need to initiate a DRS deposit of the Preferred Stock.

Risk

Factors

Because

currently, outstanding shares of our common stock trade on Nasdaq and the Preferred Shares are to be listed for trading on Upstream,

recipients of Preferred Shares are expected to face potential illiquidity, trading volatility and/or pricing discrepancies when compared

to shares of common stock which trade on Nasdaq and will also not have the protections afforded by the Securities Exchange Act of 1934

and Nasdaq.

If

your Preferred Shares are moved to Upstream, the trading volumes and market prices for those Preferred Shares may be lower than comparable

metrics of our common stock listed on Nasdaq, in general or in specific instances, and you may therefore face challenges in liquidating

your Preferred Shares both as compared to our Nasdaq-listed common stock and in general. If the Preferred Shares are not moved to Upstream,

your Preferred Shares will be relatively illiquid, and you will need to privately locate a willing purchaser in order to sell your Preferred

Shares, which you may be unable to do in a reasonable timeframe, without undue costs, at desired prices or at all.

Additionally

Upstream is not subject to SEC regulation under the Securities Act of 1933 or the Securities Exchange Act of 1934 (the “Exchange

Act”). These federal statutes and regulations are designed to protect investors and enhance transparency and capital formation

in the capital markets, and the lack of this or similar regulatory oversight will subject holders of Preferred Shares who move their

shares to Upstream to risks inherent in a trading market that operates in the absence of those considerations or where their influence

is limited or inadequately enforced. While the SEC or other regulatory involvement never guarantees investor protection, the lack thereof

exacerbates the risk of loss.

Digital

asset-focused exchanges are often the target of fraud and malicious actors, and holders of investments in digital securities in the custody

of such exchanges may be afforded limited or no protection from adverse developments such as theft and bankruptcy impacting the exchange

on which their digital securities are held. As a result, unless new regulation or oversight is adopted and applies to Upstream, holders

of Preferred Shares may be subject to certain of these contingencies. Additionally, since Upstream is based on blockchain technology

it may also involve several technical risks. For instance, the blockchain on which the exchange operates may face difficulties in scaling

to handle a large number of users and transactions including Upstream, as well as ensuring adequate performance and security. Additionally,

Upstream may also face risks related to the underlying blockchain protocol, such as forks or other network changes that could negatively

impact Upstream’s operations. Furthermore, Upstream may also face risks related to smart contract security, as any bugs or vulnerabilities

in the smart contracts used on Upstream could result in loss of Preferred Shares or funds as well as other security breaches.

Other

potential risks and uncertainties, include:

| |

● |

The

possibility that a viable trading market never develops or is sustained on Upstream; |

| |

● |

Adverse

attention or action from regulatory authorities; |

| |

● |

The

possibility that the technology on which Upstream depends fails to function properly; |

| |

● |

The

security systems of Upstream may be inadequate or ineffective, or subject to breach or

damage,

endangering the Preferred Shares stored thereon; |

| |

● |

Uncertainty

as to the potential application laws and regulations including those regarding digital securities; |

| |

● |

Upstream’s

exposure to of digital assets and digital securities may subject it to

bankruptcy

or liquidation events given the volatile nature of digital assets; and |

| |

● |

Trading

on Upstream is not subject to the enhanced investor protections provided by the Exchange

Act

and Nasdaq. |

Any

of the above or other uncertainties relating to Upstream could adversely impact our Preferred Shareholders and more specifically Preferred

Shareholders who move their shares to Upstream.

The

information in Item 7.01 of this report, is furnished pursuant to Item 7.01 of Form 8-K and shall not be deemed “filed” for

the purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section. Furthermore,

the information in Item 7.01 of this report, shall not be deemed to be incorporated by reference in the filings of the registrant under

the Securities Act of 1933.

| Item

9.01 |

Financial

Statements and Exhibits |

(d)

Exhibits.

| Exhibit

No. |

|

Exhibit |

| |

|

|

| 104 |

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

BTCS

INC. |

| |

|

|

| Date:

June 29, 2023 |

By: |

/s/

Charles W. Allen |

| |

Name: |

Charles

W. Allen |

| |

Title: |

Chief

Executive Officer |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

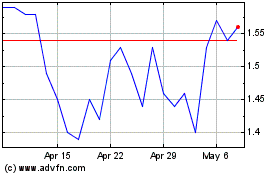

BTCS (NASDAQ:BTCS)

Historical Stock Chart

From Mar 2024 to Apr 2024

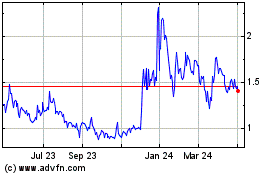

BTCS (NASDAQ:BTCS)

Historical Stock Chart

From Apr 2023 to Apr 2024