UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14D-9

SOLICITATION/RECOMMENDATION STATEMENT

UNDER SECTION 14(d)(4) OF THE SECURITIES EXCHANGE ACT OF 1934

BSQUARE CORPORATION

(Name of Subject Company)

BSQUARE CORPORATION

(Name of Person(s) Filing Statement)

Common Stock, no par value per share

(Title of Class of Securities)

11776U300

(CUSIP Number of Class of Securities)

Ralph C. Derrickson

President and Chief Executive Officer

PO Box 59478

Renton, WA, 98058

(425) 519-5900

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications

on Behalf of the Person(s) Filing Statement)

With a copy to:

Andrew Ledbetter

DLA Piper LLP (US)

701 5th Ave Ste 7000

Seattle, WA 98104

(206) 839-4845

|

☒

|

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

|

This Schedule 14D-9C consists of the following documents related to the proposed acquisition of Bsquare Corporation, a Washington corporation (the “Company” or “BSQR”), pursuant to the terms of an Agreement and Plan of Merger, dated as of October 11, 2023, among the Company, Kontron America, Incorporated, a Delaware corporation (“Kontron”), and Kontron Merger Sub., Inc., a Delaware corporation and a wholly-owned subsidiary of Kontron (“Merger Sub”):

|

1.

|

Joint Press release issued by the Company and Kontron on October 11, 2023, incorporated herein by reference to Exhibit 99.1 of the Current Report on Form 8-K filed by the Company on October 11, 2023.

|

|

2.

|

Email from Ralph Derrickson, the President & Chief Executive Officer of the Company, to all employees, first used on October 11, 2023.

|

|

3.

|

Internal Communication / Employee FAQs, first used on October 11, 2023.

|

|

4.

|

Business Partners Communication, dated October 11, 2023.

|

Items #1-4 above were first used or made available on October 11, 2023. In addition, the information set forth under Item 1.01 and Item 8.01 of the Current Report on Form 8-K filed by the Company on October 11, 2023 (including all exhibits attached thereto) are incorporated herein by reference.

IMPORTANT INFORMATION

The tender offer for all of the outstanding common stock of BSQR referred to in this communication has not yet commenced. The description contained in this communication is neither an offer to purchase nor a solicitation of an offer to sell any securities, nor is it a substitute for the tender offer materials that BSQR or Kontron will file with the U.S. Securities and Exchange Commission (the “SEC”). The solicitation and offer to buy the common stock of BSQR will only be made pursuant to an offer to purchase and related tender offer materials. At the time the tender offer is commenced, Kontron will file a tender offer statement on Schedule TO and thereafter BSQR will file a solicitation/recommendation statement on Schedule 14D-9 with the SEC. THE TENDER OFFER MATERIALS (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT ON SCHEDULE 14D-9 WILL CONTAIN IMPORTANT INFORMATION. ANY HOLDERS OF SHARES ARE URGED TO READ THESE DOCUMENTS CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT HOLDERS SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR SHARES. The offer to purchase, the related letter of transmittal and the solicitation/recommendation statement will be made available for free at the SEC’s website at www.sec.gov. Free copies of the offer to purchase, the related letter of transmittal and certain other offering documents will be made available by Kontron and when available may be obtained by directing a request to the information agent for the tender offer that will be named in the Schedule TO and related offer documents. Copies of the documents filed with the SEC by BSQR will be available free of charge on BSQR’s internet website at www.bsquare.com or by contacting BSQR’s Investor Relations Department at 425-519-5900.

In addition to the offer to purchase, the related letter of transmittal and certain other tender offer documents filed by Kontron, as well as the solicitation/recommendation statement filed by BSQR, BSQR will also file periodic and current reports with the SEC. You may read and copy any reports or other information filed by Kontron or BSQR at the SEC public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room. BSQR’s filings with the SEC are also available to the public from commercial document-retrieval services and at the website maintained by the SEC at http://www.sec.gov.

FORWARD-LOOKING STATEMENTS

This communication contains statements that constitute “forward looking statements,” including statements that express the opinions, expectations, beliefs, plans, objectives, assumptions or projections regarding future events or future results, including statements regarding the proposed acquisition of BSQR by Kontron (the “Proposed Acquisition”), in contrast with statements that reflect historical facts. In some cases, you can identify such forward-looking statements by terminology such as “anticipate,” “intend,” “believe,” “estimate,” “plan,” “seek,” “project,” or “expect,” “may,” “will,” “would,” “could,” “potential,” “intend,” or “should,” the negative of these terms or similar expressions. Forward-looking statements are based on management’s current beliefs and assumptions and on information currently available to Kontron and BSQR. However, these forward-looking statements are not a guarantee of performance, and you should not place undue reliance on such statements.

Forward-looking statements are subject to many risks, uncertainties and other variable circumstances, including, but not limited to, the ability of the parties to satisfy the closing conditions for the Proposed Acquisition on a timely basis or at all, including statements about the expected timetable for completing the Proposed Acquisition; uncertainties as to how many of BSQR’s shareholders will tender their shares in the offer; the possibility that competing offers will be made; the occurrence of events that may give rise to a right of one or both of Kontron and BSQR to terminate the merger agreement; negative effects of the announcement of the Proposed Acquisition on the market price of BSQR’s common stock and/or on its business, financial condition, results of operations and financial performance; the effects of the Proposed Acquisition (or the announcement thereof) on BSQR’s ability to retain and hire qualified professional staff and talent, including technical, sales and management personnel; BSQR’s ability to execute its development initiatives and sales and marketing strategies; the extent to which BSQR is successful in gaining new long-term customers and retaining existing ones; whether BSQR is able to maintain its favorable relationship with Microsoft as a systems integrator and distributor; BSQR’s success in leveraging strategic partnering initiatives with companies such as Microsoft, AWS and Intel; the ongoing impact of COVID-19 and recovery related challenges on its business and on its customers and vendors; the possibility that a governmental entity may prohibit, delay or refuse to grant approval for the consummation of the Proposed Acquisition; and competition for clients and the increased bargaining power of BSQR’s clients. Such risks and uncertainties may cause the statements to be inaccurate and readers are cautioned not to place undue reliance on such statements. Many of these risks are outside of the control of Kontron and BSQR and could cause actual results to differ materially. The forward-looking statements included in this filing are made only as of the date hereof. Kontron and BSQR do not undertake, and specifically decline, any obligation to update any such statements or to publicly announce the results of any revisions to any such statements to reflect future events or developments, except as required by law.

A further description of risks and uncertainties relating to BSQR can be found in BSQR’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as filed with the SEC, and in other documents filed from time to time with the SEC by BSQR and available at www.sec.gov and www.bsquare.com.

|

Exhibit

No.

|

|

Description

|

| |

|

|

|

99.1

|

|

Joint Press release issued by the Company and Kontron on October 11, 2023, incorporated herein by reference to Exhibit 99.1 of the Current Report on Form 8-K filed by the Company on October 11, 2023.

|

| |

|

|

|

99.2

|

|

Email from Ralph Derrickson, the President & Chief Executive Officer of the Company, to all employees, first used on October 11, 2023.

|

| |

|

|

|

99.3

|

|

Internal Communication / Employee FAQs, first used on October 11, 2023.

|

| |

|

|

|

99.4

|

|

Business Partners Communication, dated October 11, 2023.

|

Exhibit 99.2

Dear Colleagues:

Today I am excited to share that Bsquare Corporation (“Bsquare”) is embarking on a new chapter. Moments ago, we announced that we entered into an agreement for Bsquare to be acquired by a subsidiary of Kontron America, Incorporated (“Kontron”), a leading IoT solutions company. A copy of the press release, which includes more details about the transaction, including the processes and closing conditions, is attached to this message.

Kontron (www.kontron.com), is a leading IoT technology company. For more than 20 years, Kontron has been supporting companies from a wide range of industries to achieve their business goals with intelligent solutions. From automated industrial operations, smarter and safer transport to advanced communications, medical and energy solutions, the company delivers technologies that add value for its customers. Kontron is listed on the SDAX® and TecDAX® of the German Stock Exchange and has around 4,500 employees with subsidiaries in more than 20 countries around the world.

Complementary Expertise

Bsquare is known for our system software expertise. Our strengths as a leading provider of embedded software solutions, Microsoft licensing expertise, and IoT systems and operations are a natural complement to Kontron’s strengths as a leading hardware developer. Combining our expertise will create a unified team with a range of breadth and experience that will set us apart in the industry.

Complementary Products

Kontron and Bsquare leadership believe that Bsquare’s software products and services will combine naturally with Kontron’s IoT hardware products and services to create a more complete solution for our customers and allow us to compete more effectively in all our markets.

Global Reach and Scale

The combination of Bsquare and Kontron will increase our combined reach and give us the scale to operate more efficiently and serve our customers more completely.

Next Steps—Business as Usual and All Company Meeting

Today is just the first step. This transaction, which will take us from a public to private company, will take time. We expect to close the transaction, subject to customary closing conditions and Bsquare shareholder and regulatory approvals, in late 2023. Until then, we will remain separate companies.

While the transaction is pending nothing will change for you or our customers. We will continue selling Microsoft licenses providing industry leading technical support and business services. We will continue to provide operations and software development services for our Edge-to-Cloud customers. And we will continue to develop SquareOne and support our customers.

After closing, we will follow a collaborative, deliberate, and thoughtful integration process to define how best to unite our organizations.

Because Bsquare is a publicly traded company we must exercise discretion in sharing specific details at this stage. We are rigorously complying with all legal procedures and requirements. I commit that we will share relevant developments as soon as possible.

We expect today’s announcement to generate interest in Bsquare from people outside our organization. If you receive inquiries from the media, investors, analysts, or other outside parties, please do not comment or respond. Instead, please notify me or Cheryl and we will ensure the inquiry is handled appropriately. Please note that we have a plan for reaching out to key customers and business partners that is being coordinated and executed by the Senior Leadership Team.

I look forward to sharing more with you and answering questions at an All Company meeting that will take place via Zoom on Thursday, October 12 at 8:00 am PDT/ 4:00 pm BST. You will receive an invitation shortly.

Warm regards,

Ralph

Important Information for Investors and Security Holders

The tender offer for all of the outstanding common stock of Bsquare referred to in this document has not yet commenced. The description contained in this document is neither an offer to purchase nor a solicitation of an offer to sell any securities, nor is it a substitute for the tender offer materials that Bsquare or Kontron will file with the U.S. Securities and Exchange Commission (the “SEC”). The solicitation and offer to buy the common stock of Bsquare will only be made pursuant to an offer to purchase and related tender offer materials. At the time the tender offer is commenced, Kontron will file a tender offer statement on Schedule TO and thereafter Bsquare will file a solicitation/recommendation statement on Schedule 14D-9 with the SEC. THE TENDER OFFER MATERIALS (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT ON SCHEDULE 14D-9 WILL CONTAIN IMPORTANT INFORMATION. ANY HOLDERS OF SHARES ARE URGED TO READ THESE DOCUMENTS CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT HOLDERS SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR SHARES. The offer to purchase, the related letter of transmittal and the solicitation/recommendation statement will be made available for free at the SEC’s website at www.sec.gov. Free copies of the offer to purchase, the related letter of transmittal and certain other offering documents will be made available by Kontron and when available may be obtained by directing a request to the information agent for the tender offer that will be named in the Schedule TO and related offer documents. Copies of the documents filed with the SEC by Bsquare will be available free of charge on Bsquare internet website at www.Bsquare.com or by contacting Bsquare Investor Relations at InvestorRelations@Bsquare.com or by calling 425-519-5900.

In addition to the offer to purchase, the related letter of transmittal and certain other tender offer documents filed by Kontron, as well as the solicitation/recommendation statement filed by Bsquare, Bsquare will also file periodic and current reports with the SEC. You may read and copy any reports or other information filed by Kontron or Bsquare at the SEC public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room. Bsquare’s filings with the SEC are also available to the public from commercial document-retrieval services and at the website maintained by the SEC at http://www.sec.gov.

Forward Looking Statements

This document contains statements that constitute “forward looking statements,” including statements that express the opinions, expectations, beliefs, plans, objectives, assumptions or projections regarding future events or future results, including statements regarding the proposed acquisition of Bsquare by Kontron (the “Proposed Acquisition”), in contrast with statements that reflect historical facts. In some cases, you can identify such forward-looking statements by terminology such as “anticipate,” “intend,” “believe,” “estimate,” “plan,” “seek,” “project,” or “expect,” “may,” “will,” “would,” “could,” “potential,” “intend,” or “should,” the negative of these terms or similar expressions. Forward-looking statements are based on management’s current beliefs and assumptions and on information currently available to Kontron and Bsquare. However, these forward-looking statements are not a guarantee of performance, and you should not place undue reliance on such statements.

Forward-looking statements are subject to many risks, uncertainties and other variable circumstances, including, but not limited to, the ability of the parties to satisfy the closing conditions for the Proposed Acquisition on a timely basis or at all, including statements about the expected timetable for completing the Proposed Acquisition; uncertainties as to how many of Bsquare’s shareholders will tender their shares in the offer; the possibility that competing offers will be made; the occurrence of events that may give rise to a right of one or both of Kontron and Bsquare to terminate the merger agreement; negative effects of the announcement of the Proposed Acquisition on the market price of Bsquare’s common stock and/or on its business, financial condition, results of operations and financial performance; the effects of the Proposed Acquisition (or the announcement thereof) on Bsquare’s ability to retain and hire qualified professional staff and talent, including technical, sales and management personnel; BSQR’s ability to execute its development initiatives and sales and marketing strategies; the extent to which BSQR is successful in gaining new long-term customers and retaining existing ones; whether BSQR is able to maintain its favorable relationship with Microsoft as a systems integrator and distributor; BSQR’s success in leveraging strategic partnering initiatives with companies such as Microsoft, AWS and Intel; the ongoing impact of COVID-19 and recovery related challenges on its business and on its customers and vendors; the possibility that a governmental entity may prohibit, delay or refuse to grant approval for the consummation of the Proposed Acquisition; and competition for clients and the increased bargaining power of Bsquare’s clients. Such risks and uncertainties may cause the statements to be inaccurate and readers are cautioned not to place undue reliance on such statements. Many of these risks are outside of the control of Kontron and Bsquare and could cause actual results to differ materially. The forward-looking statements included in this document are made only as of the date hereof. Kontron and Bsquare do not undertake, and specifically decline, any obligation to update any such statements or to publicly announce the results of any revisions to any such statements to reflect future events or developments, except as required by law.

A further description of risks and uncertainties relating to Bsquare can be found in Bsquare’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as filed with the SEC, and in other documents filed from time to time with the SEC by Bsquare and available at www.sec.gov and www.Bsquare.com.

Exhibit 99.3

| Internal Communication / Employee FAQs |

Purpose: The following frequently asked questions and related answers have been developed as a communication guide for Bsquare’s Senior Leadership Team to support conversations resulting from the news issued by Bsquare on October 11, 2023.

News and Deal Facts

What is the news?

Bsquare, a leading provider of connected solutions, announced that Kontron America, Incorporated has entered into a definitive agreement to acquire Bsquare Corporation.

Bsquare and Kontron both issued press releases today announcing the agreement.

The release is available on Bsquare’s website at: www.bsquare.com.

What are the terms of the deal?

Kontron will acquire Bsquare for $1.90 per share in a cash transaction valued at $38 million.

After closing, Bsquare will become a privately held company, and shares of Bsquare common stock will no longer be listed on any public market.

When is the deal closing?

The transaction’s closing is subject to customary conditions, including certain regulatory approvals and the tender of shares representing at least two-thirds of Bsquare’s outstanding common stock.

The transaction is expected to close in late 2023.

Until closing, Bsquare and Kontron will each continue to operate in the ordinary course of business as separate companies.

Why did Bsquare agree to this acquisition?

To remain successful in today’s increasingly competitive IoT services and solutions market, we must constantly seek to evolve, innovate, and explore every opportunity to build toward, and invest in, the future. Agreements like this one are the fuel that can, and often do, catapult organizations like Bsquare and Kontron to new and exciting growth trajectories.

The combination of Kontron and Bsquare is expected to create a global IoT solutions organization with a robust portfolio of solutions supported by an expanded Global Delivery Network and innovative technologies and digital accelerators. Joining together will accelerate both organizations’ achievement of our global growth ambitions.

A shared commitment to quality, innovation, growth, and, above all, customer success and employees makes this acquisition an attractive fit for both organizations.

Joining Kontron also removes some of the financial and market pressures inherent to running a publicly traded company.

Will the current Bsquare management/executive team be retained? Will we keep our existing management structure?

Kontron values the skills and expertise of Bsquare’s executives, management, and employees and believes that continuity is critical to our joint success moving forward.

A joint integration team will determine how best to work together, where synergies can be leveraged, and how best to align executive and senior leadership, management, and our teams moving forward.

Will Bsquare’s current Board of Directors have a role with Kontron?

The current Bsquare Board of Directors will be dissolved and will not have a role with Kontron.

Why weren’t we told about the deal before now?

As Bsquare is a public company, by law, news that is considered material must be treated as highly confidential until the company makes a public announcement.

Material news is any news that relates to the company’s business and, depending on the news, has the potential to move the company’s share price up or down.

Why is Kontron acquiring Bsquare? Why was Kontron interested in Bsquare, specifically?

Kontron believes Bsquare’s reputation as a leading provider of embedded software solutions, Microsoft licensing expertise, and IoT systems and operations are a natural complement to Kontron’s strengths as a leading hardware developer. Combining our expertise will create a unified team with a range of breadth of experience that will set us apart in the industry.

Kontron and Bsquare leadership believe that Bsquare’s software products and services will combine naturally with Kontron’s IoT hardware products and services to create a more complete solution for our customers and allow us to compete more effectively in all our markets.

The acquisition of Bsquare aligns with Kontron's strategic vision for global growth and expansion in the U.S. and European markets.

What does Kontron bring to Bsquare?

Kontron and Bsquare leadership believe that Bsquare’s software products and services will combine naturally with Kontron’s IoT hardware products and services to create a more complete solution for our customers and allow us to compete more effectively in all our markets.

New growth and engagement opportunities for our team members.

The ability to operate at scale and invest in growth and development.

What will Bsquare’s name be after the deal closes? Will our branding or logo change?

There are no immediate planned changes to the Bsquare brand.

Between now and closing, Bsquare and Kontron will each separately follow business-as-usual conduct in our respective business and client engagements and brand standards.

After the transaction’s closing, a joint integration team, including members of the respective marketing organizations, will thoughtfully consider the best brand standards for the organization.

About Kontron

Who is Kontron?

Kontron (www.kontron.com), is a leading IoT technology company. For more than 20 years, Kontron has been supporting companies from a wide range of industries to achieve their business goals with intelligent solutions. From automated industrial operations, smarter and safer transport to advanced communications, medical and energy solutions, the company delivers technologies that add value for its customers. Kontron is listed on the SDAX® and TecDAX® of the German Stock Exchange and has around 4,500 employees with subsidiaries in more than 20 countries around the world.

Is Kontron profitable?

Kontron is a rapidly growing and profitable business with strong gross margins.

Kontron's revenue in 2022 was 1.5 billion EUR with a net profit of 233 million EUR.

What is Kontron’s core business?

A comprehensive, integrated range of IoT hardware products, services and solutions.

Who are Kontron’s clients? Is there overlap with Bsquare’s client list?

Kontron and Bsquare share many clients and industry verticals.

What is the culture at Kontron? What is the Company’s mission, vision, and values?

Kontron’s vision is to be the #1 trusted advisor of IoT and leader of embedded computing technology.

Their mission is to offer their customers a complete and integrated portfolio of hardware, software and services that unleash the full possibilities of their applications.

Kontron’s values are:

Trust: Kontron gives customers peace of mind that with Kontron as their trusted partner and advisor, their experience and outcome will be intelligently designed to achieve their business goals.

Commitment: Embedded in each of us is a steadfast dedication to ensuring the success of our colleagues, customers and shareholders by valuing their investment.

Creativity: Kontron harnesses its creativity, scaling individual ingenuity into a global collective intelligence, to develop innovative solutions that make the most of its customers’ application.

Leadership: Kontron's focus Is on forward-thinking ideas and products, enhancing the capabilities of its customers and the industry, leading an ecosystem that makes our world smarter and better.

Agility: Kontron drives its business forward by embracing change and following through with speed and precision.

What does this mean for Bsquare employees? Will anyone lose their job because of the deal? Will my reporting structure change? Will my title or job description change?

Bsquare and Kontron will conduct business-as-usual with respect to client engagements between now and closing.

After the close of the transaction, a joint integration team will thoughtfully consider the best structure for the global organization considering how we best work together, where synergies can be leveraged, and how best to align teams moving forward.

Kontron is committed to the following:

Doing their utmost to ensure that all employees’ interests and welfare are well-considered.

Leveraging the best of what Bsquare brings to the deal while at the same time enhancing the growth trajectory of both organizations.

Communicating any developments that may affect employees transparently and as proactively as possible.

Will my compensation or benefits change?

We do not anticipate making immediate changes to existing compensation or benefit plans.

Assuming the merger concludes successfully, Kontron will buy-out all "in-the-money" stock options. Option holders will receive in cash an amount equal to the number of vested and unvested “in-the-money” options times $1.90 less the option strike price. This will be a taxable event for option holders. A stock option buyout will occur at the conclusion of a successful tender process. If you already own shares as a result of exercising options or open market purchases, you will have the opportunity to “tender” or sell those to Kontron for $1.90 per share like any other shareholder.

What happens to Bsquare’s existing offices?

Kontron will assume Bsquare’s Trowbridge office lease as part of the acquisition. There are no immediate plans to make changes to physical locations or operations and people will not be asked to move.

I am a Bsquare shareholder. What happens to my shares if we are no longer publicly traded?

As a shareholder, you will have the opportunity to tender your shares as part of Kontron's tender offer process. Upon successful completion of the tender offer process, Kontron will acquire any untendered shares of Bsquare’s common stock through a second-step merger effected for the same per common share consideration ($1.90 per share).

After the transaction successfully closes, Bsquare will no longer be a public company and there will be no outstanding shares of Bsquare common stock.

Bsquare Operations and Organizational Structure

Does Kontron have an integration plan/strategy?

Will Bsquare’s organizational structure remain the same? Who will lead the Bsquare’s organization going forward? Will Bsquare keep our back office and support functions such as financial and administration, human resources, sales and marketing, and administration? Will Bsquare salespeople keep their existing territories and client bases?

We want to take our time with the integration process, and we are focused on ensuring that it does not become a distraction to the tremendous work you do each day and to our ability to continue to provide the same high levels of service our clients have come to expect from Bsquare.

Kontron is committed to leveraging the best of what Bsquare brings to the deal while at the same time enhancing the growth trajectory of both organizations.

Bsquare Sales, Solutions, and Delivery

Will Kontron sell and market Bsquare’s services and solutions? How will Bsquare clients benefit from this acquisition?

Yes. After closing the transaction, we will look to create a go-to-market strategy that leverages all the combined organization’s offerings and expanded delivery capabilities to provide the highest-value solutions to all clients.

Are there specific Bsquare’s services and solutions that Kontron wanted to add or strengthen its portfolio because of this deal?

Kontron was interested in Bsquare software sales and development expertise.

Bsquare and Kontron’s product and service offerings are complementary and will result in a more complete solution for our customers.

Will Kontron acquire the intellectual property owned and developed by Bsquare?

Yes. All intellectual property owned by Bsquare is included in the acquisition, including management and domain expertise, business process capabilities, proprietary methodologies, tools, and software assets.

Should I contact my client contacts to inform them of this news? How and when will our clients be informed?

Brandee Smith will coordinate the outreach to our Partner Solutions customers.

Eric French and Matthew Inglis will coordinate the outreach to our Edge to Cloud/SquareOne customers.

No Bsquare team members should communicate with any outside parties. All customer inquiries should be directed to Brandee Smith, Eric French, or Matthew Inglis.

Other inquiries should be directed to Ralph Derrickson, CEO or Cheryl Wynne, CFO.

All parties must adhere to the approved communication plans.

If a customer expresses concern or has questions about this transaction, contact the appropriate member (see above) responsible for the customer and tell the customer that someone will be in contact ASAP.

Will Bsquare client contracts, pricing, services, or solutions change? Will proposals and quotes that have been submitted by Bsquare still be honored? Will there be staffing changes for Bsquare customer accounts?

No immediate contract, pricing, staffing, or service changes are expected.

As part of the integration process and after closing, Bsquare will work closely with Kontron to review and assess Bsquare’s contracting terms and processes.

Bsquare and Kontron are equally committed to providing high-quality services to Bsquare clients.

Bsquare Partners (Business and Technology)

How and when will our key partners (business and technology) be notified?

Brandee Smith will coordinate the outreach to our Partner Solutions customers.

Eric French and Matthew Inglis will coordinate the outreach to our Edge-to-Cloud/SquareOne customers.

Ralph and Brandee will be communicating with Microsoft.

All parties must adhere to the approved communication plans.

Are the contracts Bsquare has in place with business partners still valid? If so, for how long?

No immediate changes are expected.

As part of the integration process and after closing, Bsquare will work closely with Kontron to review and assess Bsquare’s contracting terms and processes.

More Information

Who do I contact about employee, client, or partner questions not addressed in this document?

Please direct the question and as much detail as possible to Ralph Derrickson (ralph.derrickson@bsquare.com) or Cheryl Wynne (CherylW@bsquare.com). They will coordinate answers and responses as quickly as possible.

What do I do if an investor, analyst, or media member contacts me?

Please direct the inquiry and as much detail as possible to Ralph Derrickson (ralph.derrickson@bsquare.com) or Cheryl Wynne (CherylW@bsquare.com). They will coordinate answers and responses as quickly as possible.

Important Information for Investors and Security Holders

The tender offer for all of the outstanding common stock of Bsquare referred to in this document has not yet commenced. The description contained in this document is neither an offer to purchase nor a solicitation of an offer to sell any securities, nor is it a substitute for the tender offer materials that Bsquare or Kontron will file with the U.S. Securities and Exchange Commission (the “SEC”). The solicitation and offer to buy the common stock of Bsquare will only be made pursuant to an offer to purchase and related tender offer materials. At the time the tender offer is commenced, Kontron will file a tender offer statement on Schedule TO and thereafter Bsquare will file a solicitation/recommendation statement on Schedule 14D-9 with the SEC. THE TENDER OFFER MATERIALS (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT ON SCHEDULE 14D-9 WILL CONTAIN IMPORTANT INFORMATION. ANY HOLDERS OF SHARES ARE URGED TO READ THESE DOCUMENTS CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT HOLDERS SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR SHARES. The offer to purchase, the related letter of transmittal and the solicitation/recommendation statement will be made available for free at the SEC’s website at www.sec.gov. Free copies of the offer to purchase, the related letter of transmittal and certain other offering documents will be made available by Kontron and when available may be obtained by directing a request to the information agent for the tender offer that will be named in the Schedule TO and related offer documents. Copies of the documents filed with the SEC by Bsquare will be available free of charge on Bsquare internet website at www.Bsquare.com or by contacting Bsquare Investor Relations at InvestorRelations@Bsquare.com or by calling 425-519-5900.

In addition to the offer to purchase, the related letter of transmittal and certain other tender offer documents filed by Kontron, as well as the solicitation/recommendation statement filed by Bsquare, Bsquare will also file periodic and current reports with the SEC. You may read and copy any reports or other information filed by Kontron or Bsquare at the SEC public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room. Bsquare’s filings with the SEC are also available to the public from commercial document-retrieval services and at the website maintained by the SEC at http://www.sec.gov.

Forward Looking Statements

This document contains statements that constitute “forward looking statements,” including statements that express the opinions, expectations, beliefs, plans, objectives, assumptions or projections regarding future events or future results, including statements regarding the proposed acquisition of Bsquare by Kontron (the “Proposed Acquisition”), in contrast with statements that reflect historical facts. In some cases, you can identify such forward-looking statements by terminology such as “anticipate,” “intend,” “believe,” “estimate,” “plan,” “seek,” “project,” or “expect,” “may,” “will,” “would,” “could,” “potential,” “intend,” or “should,” the negative of these terms or similar expressions. Forward-looking statements are based on management’s current beliefs and assumptions and on information currently available to Kontron and Bsquare. However, these forward-looking statements are not a guarantee of performance, and you should not place undue reliance on such statements.

Forward-looking statements are subject to many risks, uncertainties and other variable circumstances, including, but not limited to, the ability of the parties to satisfy the closing conditions for the Proposed Acquisition on a timely basis or at all, including statements about the expected timetable for completing the Proposed Acquisition; uncertainties as to how many of Bsquare’s shareholders will tender their shares in the offer; the possibility that competing offers will be made; the occurrence of events that may give rise to a right of one or both of Kontron and Bsquare to terminate the merger agreement; negative effects of the announcement of the Proposed Acquisition on the market price of Bsquare’s common stock and/or on its business, financial condition, results of operations and financial performance; the effects of the Proposed Acquisition (or the announcement thereof) on Bsquare’s ability to retain and hire qualified professional staff and talent, including technical, sales and management personnel; BSQR’s ability to execute its development initiatives and sales and marketing strategies; the extent to which BSQR is successful in gaining new long-term customers and retaining existing ones; whether BSQR is able to maintain its favorable relationship with Microsoft as a systems integrator and distributor; BSQR’s success in leveraging strategic partnering initiatives with companies such as Microsoft, AWS and Intel; the ongoing impact of COVID-19 and recovery related challenges on its business and on its customers and vendors; the possibility that a governmental entity may prohibit, delay or refuse to grant approval for the consummation of the Proposed Acquisition; and competition for clients and the increased bargaining power of Bsquare’s clients. Such risks and uncertainties may cause the statements to be inaccurate and readers are cautioned not to place undue reliance on such statements. Many of these risks are outside of the control of Kontron and Bsquare and could cause actual results to differ materially. The forward-looking statements included in this document are made only as of the date hereof. Kontron and Bsquare do not undertake, and specifically decline, any obligation to update any such statements or to publicly announce the results of any revisions to any such statements to reflect future events or developments, except as required by law.

A further description of risks and uncertainties relating to Bsquare can be found in Bsquare’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as filed with the SEC, and in other documents filed from time to time with the SEC by Bsquare and available at www.sec.gov and www.Bsquare.com.

Exhibit 99.4

| Business Partners Communication |

Upon announcement of the proposed acquisition of Bsquare Corporation (“Bsquare”) by Kontron America, Incorporated (“Kontron”), Bsquare and Kontron are providing the following information to customers:

|

●

|

Kontron and Bsquare have executed a merger agreement whereby Kontron will commence a tender offer for the outstanding shares of Bsquare. Under the agreement, a successful tender will be followed by a merger to acquire any untendered shares and Bsquare will merge into Kontron’s US subsidiary, Kontron Merger Sub., Inc., based in San Diego, CA.

|

|

●

|

The tender offer and the merger are subject to certain customary and other closing conditions.

|

|

●

|

While the tender and merger are in progress nothing will change for Bsquare customers. Microsoft licensing customers should expect to continue purchasing as they have in the past and we will continue to provide industry-leading technical support and business services. We will continue to provide operations and software development services for our Edge-to-Cloud and SquareOne customers.

|

|

●

|

We believe that Bsquare’s software products and services will combine naturally with Kontron’s IoT hardware products and services to create a more complete solution for our customers.

|

Important Information for Investors and Security Holders

The tender offer for all of the outstanding common stock of Bsquare referred to in this document has not yet commenced. The description contained in this document is neither an offer to purchase nor a solicitation of an offer to sell any securities, nor is it a substitute for the tender offer materials that Bsquare or Kontron will file with the U.S. Securities and Exchange Commission (the “SEC”). The solicitation and offer to buy the common stock of Bsquare will only be made pursuant to an offer to purchase and related tender offer materials. At the time the tender offer is commenced, Kontron will file a tender offer statement on Schedule TO and thereafter Bsquare will file a solicitation/recommendation statement on Schedule 14D-9 with the SEC. THE TENDER OFFER MATERIALS (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT ON SCHEDULE 14D-9 WILL CONTAIN IMPORTANT INFORMATION. ANY HOLDERS OF SHARES ARE URGED TO READ THESE DOCUMENTS CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT HOLDERS SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR SHARES. The offer to purchase, the related letter of transmittal and the solicitation/recommendation statement will be made available for free at the SEC’s website at www.sec.gov. Free copies of the offer to purchase, the related letter of transmittal and certain other offering documents will be made available by Kontron and when available may be obtained by directing a request to the information agent for the tender offer that will be named in the Schedule TO and related offer documents. Copies of the documents filed with the SEC by Bsquare will be available free of charge on Bsquare internet website at www.Bsquare.com or by contacting Bsquare Investor Relations at InvestorRelations@Bsquare.com or by calling 425-519-5900.

In addition to the offer to purchase, the related letter of transmittal and certain other tender offer documents filed by Kontron, as well as the solicitation/recommendation statement filed by Bsquare, Bsquare will also file periodic and current reports with the SEC. You may read and copy any reports or other information filed by Kontron or Bsquare at the SEC public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room. Bsquare’s filings with the SEC are also available to the public from commercial document-retrieval services and at the website maintained by the SEC at http://www.sec.gov.

Forward Looking Statements

This document contains statements that constitute “forward looking statements,” including statements that express the opinions, expectations, beliefs, plans, objectives, assumptions or projections regarding future events or future results, including statements regarding the proposed acquisition of Bsquare by Kontron (the “Proposed Acquisition”), in contrast with statements that reflect historical facts. In some cases, you can identify such forward-looking statements by terminology such as “anticipate,” “intend,” “believe,” “estimate,” “plan,” “seek,” “project,” or “expect,” “may,” “will,” “would,” “could,” “potential,” “intend,” or “should,” the negative of these terms or similar expressions. Forward-looking statements are based on management’s current beliefs and assumptions and on information currently available to Kontron and Bsquare. However, these forward-looking statements are not a guarantee of performance, and you should not place undue reliance on such statements.

Forward-looking statements are subject to many risks, uncertainties and other variable circumstances, including, but not limited to, the ability of the parties to satisfy the closing conditions for the Proposed Acquisition on a timely basis or at all, including statements about the expected timetable for completing the Proposed Acquisition; uncertainties as to how many of Bsquare’s shareholders will tender their shares in the offer; the possibility that competing offers will be made; the occurrence of events that may give rise to a right of one or both of Kontron and Bsquare to terminate the merger agreement; negative effects of the announcement of the Proposed Acquisition on the market price of Bsquare’s common stock and/or on its business, financial condition, results of operations and financial performance; the effects of the Proposed Acquisition (or the announcement thereof) on Bsquare’s ability to retain and hire qualified professional staff and talent, including technical, sales and management personnel; BSQR’s ability to execute its development initiatives and sales and marketing strategies; the extent to which BSQR is successful in gaining new long-term customers and retaining existing ones; whether BSQR is able to maintain its favorable relationship with Microsoft as a systems integrator and distributor; BSQR’s success in leveraging strategic partnering initiatives with companies such as Microsoft, AWS and Intel; the ongoing impact of COVID-19 and recovery related challenges on its business and on its customers and vendors; the possibility that a governmental entity may prohibit, delay or refuse to grant approval for the consummation of the Proposed Acquisition; and competition for clients and the increased bargaining power of Bsquare’s clients. Such risks and uncertainties may cause the statements to be inaccurate and readers are cautioned not to place undue reliance on such statements. Many of these risks are outside of the control of Kontron and Bsquare and could cause actual results to differ materially. The forward-looking statements included in this document are made only as of the date hereof. Kontron and Bsquare do not undertake, and specifically decline, any obligation to update any such statements or to publicly announce the results of any revisions to any such statements to reflect future events or developments, except as required by law.

A further description of risks and uncertainties relating to Bsquare can be found in Bsquare’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as filed with the SEC, and in other documents filed from time to time with the SEC by Bsquare and available at www.sec.gov and www.Bsquare.com.

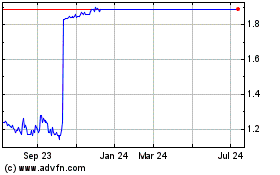

BSQUARE (NASDAQ:BSQR)

Historical Stock Chart

From Apr 2024 to May 2024

BSQUARE (NASDAQ:BSQR)

Historical Stock Chart

From May 2023 to May 2024