0001589526false00015895262023-12-072023-12-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): December 7, 2023

BLUE BIRD CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-36267 | | 46-3891989 |

(State or Other Jurisdiction of

Incorporation) | | (Commission File Number) | | (IRS Employer

Identification No.) |

3920 Arkwright Road

2nd Floor

Macon, Georgia 31210

(Address of principal executive offices and zip code)

(478) 822-2801

(Registrant's telephone number including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, $0.0001 par value | | BLBD | | NASDAQ Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Agreement.

On December 7, 2023, Blue Bird Corporation (the “Company”) announced that the Company, through its wholly owned subsidiary, Blue Bird Body Company, and GC Mobility Investments I, LLC, a wholly owned subsidiary of Generate Capital, PBC (“Generate Capital”), a sustainable investment company focusing on clean energy, transportation, water, waste, agriculture, smart cities and industrial decarbonization, have executed a definitive agreement (the “Joint Venture Agreement”) establishing a joint venture named Clean Bus Solutions, LLC to provide a fleet electrification-as-a-service offering using electric school buses (the “Joint Venture”). The service will be offered to qualified customers of the Company. Through the Joint Venture, Blue Bird will provide its end customers with turnkey electrification solutions, including a wide product range of electric school buses, financing of electric vehicles and supporting charging infrastructure, project planning and management, and fleet optimization.

The Company and Generate Capital will initially have an equal common ownership interest in the Joint Venture, and will initially jointly share management responsibility and control, with each party having certain customary consent and approval rights and control triggers. The parties have each agreed to contribute up to $10 million to the Joint Venture as agreed from time to time for common interests to fund administrative expenses, and up to an additional $100 million of capital in the form of preferred interests to fund the purchase, delivery, installation, operation and maintenance of fleet-as-a-service projects, inclusive of Blue Bird electric school buses and associated charging infrastructure. Of this amount, the Company has committed to provide up to $20 million and Generate Capital has committed to provide up to $80 million, with the Company’s aggregate commitment in any one year not to exceed $10 million without its consent.

Pursuant to the Joint Venture Agreement, the Company will promote the Joint Venture as the Company’s preferred fleet-as-service offering for electric school buses and has agreed not to participate as a joint venture partner in any other similar fleet as a service offering for electric school buses, except as an OEM of buses. The Company’s obligations do not prevent or limit any activities of its dealers.

The Joint Venture has a perpetual duration subject to the right of either party to terminate early upon the occurrence of certain events of default or the failure to achieve certain milestones under the Joint Venture Agreement.

In connection with the execution of the Joint Venture Agreement, the Company granted Generate Capital warrants to purchase an aggregate of 1,000,000 shares of Company common stock at an exercise price of $25.00 per share (the “Warrants”), during a five-year exercise period. Two-thirds of the Warrants are immediately exercisable; the remaining Warrants will become exercisable upon certain funding conditions being satisfied. The exercise price and the number of shares issuable upon exercise of the Warrants are subject to adjustment in the event of a recapitalization, stock dividend or similar event. The Company relied on the exemption provided by Rule 506 of Regulation D and Section 4(a)(2) of the Securities Act of 1933, as amended, in connection with the issuance of the Warrants.

The foregoing description of the Joint Venture Agreement and the Warrants is qualified in its entirety by reference to the full text of the Joint Venture Agreement and the form of Warrant, which will be filed as exhibits to the Company’s quarterly report on Form 10-Q for the quarter ended December 30, 2023.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information included in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 2.03.

Item 3.02 Unregistered Sales of Equity Securities.

The information included in Item 1.01 of this Current Report on Form 8-K regarding the Warrants is incorporated by reference into this Item 3.02.

Item 7.01 Regulation FD Disclosure.

On December 7, 2023, the Company issued a press release announcing entry into the Joint Venture Agreement. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

In accordance with General Instruction B.2. to Form 8-K, the information in this Item 7.01 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed

incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statement and Exhibits.

(d) Exhibits.

104 Cover Page Interactive Data File (embedded within the Inline XBRL document).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| BLUE BIRD CORPORATION |

| | |

| By: | | /s/ Ted Scartz |

| Name: | | Ted Scartz |

| Title: | | Senior Vice President and General Counsel |

Dated: December 7, 2023

PRESS RELEASE

Blue Bird and Generate Capital Establish Clean Bus Solutions, a Fleet Electrification-as-a-Service Joint Venture

Vertically-Integrated Joint Venture to Accelerate Adoption of Electric School Buses

MACON, Ga. (December 7, 2023) – Blue Bird Corporation (Nasdaq: BLBD), the leader in electric and low-emission school buses, and Generate Capital, a leading sustainable investment and operating company, have formed a joint venture (JV) named Clean Bus Solutions, LLC to meet the increasing demand for electric school buses and accelerate the adoption of clean transportation of students in North America.

The joint venture’s fleet electrification-as-a-service offering will make it simpler for school districts to upgrade to advanced electric vehicles (EVs) by offering electric school buses and associated charging infrastructure at an affordable monthly fee. This turnkey electrification solution will include Blue Bird’s best-selling and widest range of electric school buses in the industry, financing of both electric vehicles and charging infrastructure, project planning and management as well as fleet and charging optimization.

The JV will help school districts accelerate the electrification of their fleets while delivering new revenue and profit streams to Blue Bird and its dealers. In addition to the traditional up-front vehicle sale, Blue Bird’s ownership in the JV will generate additional recurring revenue from the financing and charging infrastructure services that are paid over the vehicle lifetime and from the maintenance and repair services delivered through Blue Bird’s dealer network.

Generate’s flexible capital solutions, expertise in Infrastructure-as-a-Service solutions, established project developer network and existing

decarbonization contracts with school districts complement Blue Bird’s mobility solutions and can help reduce the eight million metric tons of emission generated each year by diesel-powered school buses in the U.S.

“We are excited to partner with Generate Capital to provide a market-leading fleet electrification-as-a-service offering. Blue Bird’s customers are poised to benefit greatly from Generate’s sustainable investment expertise and flexible financial resources,” said Phil Horlock, CEO of Blue Bird Corporation. “Through the JV, school districts will continue to be supported by Blue Bird and the dealers they have known and trusted for many years. School districts will also avoid the significant upfront costs and complexity of electrifying their school bus fleets while improving air quality for their students and communities.”

“Parents are rightly pressuring their community leaders to clean up the air their children are forced to breathe, and there's no more obvious imperative than the school bus fleet. Electric, pollution-free transportation is here, and it's the most compelling economic and environmental choice – so it's time we take care of our most precious community members,” said Scott Jacobs, CEO and Co-Founder of Generate Capital. “Combining our decade of expertise and experience in these communities with Blue Bird and its market-leading electric school buses is a perfect way to accelerate the transition to clean air and transportation that all of our families, communities, and school districts are demanding.”

Blue Bird continues to expand its electric vehicle production capacity to meet increasing demand. The company recently opened its Electric Vehicle (EV) Build-up Center, a dedicated 40,000 sq.ft. facility which will enable Blue Bird to significantly increase its production of electric school buses, with capacity of up to 5,000 EVs annually in the years to come.

About Blue Bird Corporation

Blue Bird (NASDAQ: BLBD) is recognized as a technology leader and innovator of school buses since its founding in 1927. Our dedicated team members design, engineer and manufacture school buses with a singular focus on safety, reliability, and durability. Blue Bird buses carry the most precious cargo in the world – the majority of 25 million children twice a day – making us the most trusted brand in the industry. The company is the proven leader in low- and zero-emission school buses with more than 20,000 propane, natural gas, and electric powered buses in operation today. Blue Bird is transforming the student transportation industry through cleaner energy solutions. For more information on Blue Bird's complete product and service portfolio, visit www.blue-bird.com.

About Generate Capital

Generate Capital, PBC is a leading sustainable investment and operating company driving the infrastructure transition. Generate builds, owns, operates and finances clean energy, transportation, water, waste, agriculture, smart cities and industrial decarbonization. Co-founded by Jigar Shah, Scott Jacobs and Matan Friedman in 2014, Generate has partnered with over 50 technology and project developers and owns and operates more than 2,000 assets globally. Generate is a one-stop-shop offering pioneers of the infrastructure revolution tailored funding and support needed to get projects built. The company’s Infrastructure-as-a-Service model is designed to deliver affordable, reliable and sustainable resources to thousands of customers, companies, communities, school districts and universities. Together, we are rebuilding the world. For more information, please visit www.generatecapital.com.

Forward Looking Statements

This press release includes forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements relate to expectations for future financial performance, business strategies or expectations for our business and the joint venture described in this press release. Specifically, forward-looking statements include statements in this press release regarding earnings growth and Blue Bird’s future positioning and may include other statements preceded by, followed by or that include the words “estimate,” “plan,” “project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “seek,” “target” or similar expressions

These forward-looking statements are based on information available as of the date of this press release, and current expectations, forecasts and assumptions, and involve a number of judgments, risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. The factors described above, as well as risk factors described in reports filed with the SEC by us (available at www.sec.gov), could cause our actual results to differ materially from estimates or expectations reflected in such forward-looking statements.

Blue Bird Investor Contact

Mark Benfield

Investor Relations

M: +1.478.822.2315

Mark.Benfield@blue-bird.com

Blue Bird Media Contact

Julianne Barclay

TSN Communications

M: +1.267.934.5340

E: julianne@tsncommunications.com

Generate Capital Media Contact

Elise Benoit

Vice President, Marketing and Communications

Elise.benoit@generatecapital.com

E: press@generatecapital.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

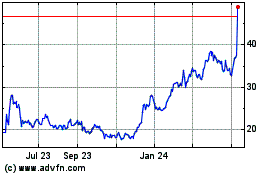

Blue Bird (NASDAQ:BLBD)

Historical Stock Chart

From Mar 2024 to Apr 2024

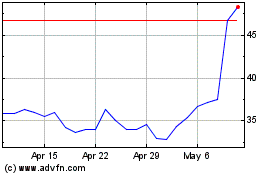

Blue Bird (NASDAQ:BLBD)

Historical Stock Chart

From Apr 2023 to Apr 2024