UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

PROXY

STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES

EXCHANGE ACT OF 1934

Filed by the Registrant ☒

Filed by a Party other than

the Registrant ☐

Check the appropriate box:

| ☐ |

|

Preliminary Proxy Statement |

| |

|

| ☐ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

| ☐ |

|

Definitive Proxy Statement |

| |

|

| ☐ |

|

Definitive Additional Materials |

| |

|

| ☒ |

|

Soliciting Material Pursuant to Section 240.14a-12 |

AVANTAX,

INC.

(Name of Registrant

as Specified In Its Charter)

(Name of Person(s)

Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check

all boxes that apply):

| |

|

| ☒ |

|

No fee required |

| |

|

| ☐ |

|

Fee paid previously with preliminary materials |

| |

|

|

| ☐ |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

On September 13, 2023, the following email was sent to end-clients

of Avantax Planning Partners:

To our valued clients,

We have some exciting news to share. Avantax, Inc., the ultimate

parent of Avantax Planning Partners, has entered into an agreement to be acquired by Cetera Holdings (Cetera).

Like Avantax Planning Partners, Cetera understands the value of

tax-intelligent advice and the importance of a strategic financial planning partnership with your CPA.

We are committed to ensuring this transition is as seamless as possible.

The transaction is expected to close by the end of the year, subject to stockholder approval, regulatory approvals and other customary

closing conditions. Upon the closing, we do not expect there to be any changes in the custodian of your accounts, Financial Planning Consultant

or the relationship between Avantax and your CPA. We will continue to partner with your CPA to provide comprehensive financial planning

through a tax-focused lens.

We’re excited about additional resources and scale that the

transaction will afford following the closing, which we believe will allow us to serve you well in the coming years. Please reach out

to your Financial Planning Consultant with any questions.

Sincerely,

Louie Rosalez

Senior Vice President, Avantax Planning Partners

Cautionary Statement Regarding Forward-Looking Statements

This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended, including, without limitation, statements regarding the anticipated timing

of the consummation of the proposed merger transaction (the “proposed transaction”) involving Avantax, Inc. (the “Company”),

Aretec Group, Inc. (“Parent”) and C2023 Sub Corp., whereby the Company would become a wholly-owned subsidiary of Parent,

plans for the Company following the closing of the proposed transaction and the anticipated effects of the proposed transaction. Forward-looking

statements provide current expectations of future events based on certain assumptions and include any statement that does not directly

relate to any historical or current fact. Forward-looking statements can also be identified by words such as “anticipates,”

“believes,” “plans,” “expects,” “future,” “intends,” “may,” “will,”

“would,” “could,” “should,” “estimates,” “predicts,” “potential,”

“continues,” “target,” “outlook” and similar terms and expressions, but the absence of these words

does not mean that the statement is not forward-looking. Actual results may differ significantly from management’s expectations

due to various risks and uncertainties including, without limitation: (i) the risk that the proposed transaction may not be completed

in a timely manner, or at all; (ii) the failure to satisfy the conditions to the consummation of the proposed transaction, including,

without limitation, the receipt of stockholder and regulatory approvals; (iii) unanticipated difficulties or expenditures relating to

the proposed transaction; (iv) the effect of the announcement or pendency of the proposed transaction on the plans, business relationships,

operating results and operations; (v) potential difficulties retaining employees, financial professionals and clients as a result of

the announcement and pendency of the proposed transaction; (vi) the response of employees, financial professionals and suppliers to the

announcement of the proposed transaction; (vii) risks related to diverting management’s attention from the Company’s ongoing

business operations; (viii) legal proceedings, including those that may be instituted against the Company, its board of directors, its

executive officers or others following the announcement of the proposed transaction; and (ix) risks regarding the failure to obtain the

necessary financing to complete the proposed transaction. In addition, a description of certain other factors that could affect the Company’s

business, financial condition or results of operations is included in the Company’s most recent Annual Report on Form 10-K and

most recent Quarterly Report on Form 10-Q filed with the U.S. Securities and Exchange Commission (the “SEC”). Forward-looking

statements reflect the Company’s good faith beliefs, assumptions and expectations but are not guarantees of future performance

or events. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of

this communication. The Company undertakes no obligation to update any forward-looking statements to reflect events or circumstances

after the date hereof, except as may be required by law.

Additional Information Regarding the Merger and Where to Find

It This communication is being issued in connection with the proposed transaction. This communication does not constitute an offer

to sell or the solicitation of an offer to buy any securities or the solicitation of any vote or approval. The proposed transaction will

be submitted to the stockholders of the Company for their consideration at a special meeting of the stockholders. In connection therewith,

the Company intends to file a proxy statement and other relevant materials with the SEC, including a definitive proxy statement on Schedule

14A, which will be mailed or otherwise disseminated to the stockholders of the Company as of the record date established for voting on

the proposed transaction. The Company may also file other relevant documents with the SEC regarding the proposed transaction. BEFORE MAKING

ANY VOTING OR INVESTMENT DECISION WITH RESPECT TO THE PROPOSED TRANSACTION, INVESTORS AND SECURITY HOLDERS OF THE COMPANY ARE URGED TO

READ THE DEFINITIVE PROXY STATEMENT REGARDING THE PROPOSED TRANSACTION (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND OTHER RELEVANT

DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders may obtain free copies of the definitive proxy statement, any

amendments or supplements thereto and other documents containing important information about the Company, once such documents are filed

with the SEC, through the website maintained by the SEC at www.sec.gov. In addition, stockholders of

the Company may obtain free copies of the documents filed with the SEC by directing a request through the Investor Relations portion of

the Company’s website at https://investors.avantax.com or by mail to Avantax, Inc., 3200 Olympus Boulevard, Suite 100, Dallas, Texas

75019, Attention: Dee Littrell, Investor Relations.

Participants in the Solicitation The Company and its directors,

its executive officers and certain other members of Company management and Company employees may, under the rules of the SEC, be deemed

to be participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive

officers of the Company is set forth in the Company’s definitive proxy statement on Schedule 14A for the 2023 annual meeting of

the stockholders of the Company, filed with the SEC on April 3, 2023 and in subsequent documents filed with the SEC, each of which is

(or, when filed will be) available free of charge from the sources indicated above. Other information regarding the participants in the

solicitation of proxies from the stockholders of the Company and a description of their direct and indirect interests, by security holdings

or otherwise, will be contained in the preliminary and definitive proxy statements and other relevant materials to be filed with the

SEC regarding the proposed transaction when they become available.

On September 13, 2023, the following email was sent to end-clients

of Avantax Planning Partners:

To our valued clients,

We have some exciting news to share. Avantax, Inc., the ultimate

parent of Avantax Planning Partners, has entered into an agreement to be acquired by Cetera Holdings (Cetera).

Like Avantax Planning Partners, Cetera understands the value of

tax-intelligent advice and the importance of a strategic financial planning partnership with your CPA.

We are committed to ensuring this transition is as seamless as possible.

The transaction is expected to close by the end of the year, subject to stockholder approval, regulatory approvals and other customary

closing conditions. Upon the closing, we do not expect there to be any changes in the custodian of your accounts, retirement services

team or the relationship between Avantax and your CPA. We will continue to partner with your CPA to provide comprehensive financial planning

through a tax-focused lens.

We’re excited about additional resources and scale that the

transaction will afford following the closing, which we believe will allow us to serve you well in the coming years. Please reach out

to your RPS Relationship Manager with any questions.

Sincerely,

Louie Rosalez

Senior Vice President, Avantax Planning Partners

Cautionary Statement Regarding Forward-Looking Statements

This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended, including, without limitation, statements regarding the anticipated timing

of the consummation of the proposed merger transaction (the “proposed transaction”) involving Avantax, Inc. (the “Company”),

Aretec Group, Inc. (“Parent”) and C2023 Sub Corp., whereby the Company would become a wholly-owned subsidiary of Parent,

plans for the Company following the closing of the proposed transaction and the anticipated effects of the proposed transaction. Forward-looking

statements provide current expectations of future events based on certain assumptions and include any statement that does not directly

relate to any historical or current fact. Forward-looking statements can also be identified by words such as “anticipates,”

“believes,” “plans,” “expects,” “future,” “intends,” “may,” “will,”

“would,” “could,” “should,” “estimates,” “predicts,” “potential,”

“continues,” “target,” “outlook” and similar terms and expressions, but the absence of these words

does not mean that the statement is not forward-looking. Actual results may differ significantly from management’s expectations

due to various risks and uncertainties including, without limitation: (i) the risk that the proposed transaction may not be completed

in a timely manner, or at all; (ii) the failure to satisfy the conditions to the consummation of the proposed transaction, including,

without limitation, the receipt of stockholder and regulatory approvals; (iii) unanticipated difficulties or expenditures relating to

the proposed transaction; (iv) the effect of the announcement or pendency of the proposed transaction on the plans, business relationships,

operating results and operations; (v) potential difficulties retaining employees, financial professionals and clients as a result of

the announcement and pendency of the proposed transaction; (vi) the response of employees, financial professionals and suppliers to the

announcement of the proposed transaction; (vii) risks related to diverting management’s attention from the Company’s ongoing

business operations; (viii) legal proceedings, including those that may be instituted against the Company, its board of directors, its

executive officers or others following the announcement of the proposed transaction; and (ix) risks regarding the failure to obtain the

necessary financing to complete the proposed transaction. In addition, a description of certain other factors that could affect the Company’s

business, financial condition or results of operations is included in the Company’s most recent Annual Report on Form 10-K and

most recent Quarterly Report on Form 10-Q filed with the U.S. Securities and Exchange Commission (the “SEC”). Forward-looking

statements reflect the Company’s good faith beliefs, assumptions and expectations but are not guarantees of future performance

or events. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of

this communication. The Company undertakes no obligation to update any forward-looking statements to reflect events or circumstances

after the date hereof, except as may be required by law.

Additional Information Regarding the Merger and Where to Find

It This communication is being issued in connection with the proposed transaction. This communication does not constitute an offer

to sell or the solicitation of an offer to buy any securities or the solicitation of any vote or approval. The proposed transaction will

be submitted to the stockholders of the Company for their consideration at a special meeting of the stockholders. In connection therewith,

the Company intends to file a proxy statement and other relevant materials with the SEC, including a definitive proxy statement on Schedule

14A, which will be mailed or otherwise disseminated to the stockholders of the Company as of the record date established for voting on

the proposed transaction. The Company may also file other relevant documents with the SEC regarding the proposed transaction. BEFORE MAKING

ANY VOTING OR INVESTMENT DECISION WITH RESPECT TO THE PROPOSED TRANSACTION, INVESTORS AND SECURITY HOLDERS OF THE COMPANY ARE URGED TO

READ THE DEFINITIVE PROXY STATEMENT REGARDING THE PROPOSED TRANSACTION (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND OTHER RELEVANT

DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders may obtain free copies of the definitive proxy statement, any

amendments or supplements thereto and other documents containing important information about the Company, once such documents are filed

with the SEC, through the website maintained by the SEC at www.sec.gov. In addition, stockholders of

the Company may obtain free copies of the documents filed with the SEC by directing a request through the Investor Relations portion of

the Company’s website at https://investors.avantax.com or by mail to Avantax, Inc., 3200 Olympus Boulevard, Suite 100, Dallas, Texas

75019, Attention: Dee Littrell, Investor Relations.

Participants in the Solicitation The Company and its directors,

its executive officers and certain other members of Company management and Company employees may, under the rules of the SEC, be deemed

to be participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive

officers of the Company is set forth in the Company’s definitive proxy statement on Schedule 14A for the 2023 annual meeting of

the stockholders of the Company, filed with the SEC on April 3, 2023 and in subsequent documents filed with the SEC, each of which is

(or, when filed will be) available free of charge from the sources indicated above. Other information regarding the participants in the

solicitation of proxies from the stockholders of the Company and a description of their direct and indirect interests, by security holdings

or otherwise, will be contained in the preliminary and definitive proxy statements and other relevant materials to be filed with the

SEC regarding the proposed transaction when they become available.

On September 13, 2023, the following letter was sent to end-clients

of Avantax Planning Partners:

Date

Client

Street Address

City, State

Dear <<Client’s Name>>

To our valued clients,

We have some exciting news to share. Avantax, Inc., the ultimate

parent of Avantax Planning Partners, has entered into an agreement to be acquired by Cetera Holdings (Cetera).

Like Avantax Planning Partners, Cetera understands the value of

tax-intelligent advice and the importance of a strategic financial planning partnership with your CPA.

We are committed to ensuring this transition is as seamless as possible.

The transaction is expected to close by the end of the year, subject to stockholder approval, regulatory approvals and other customary

closing conditions. Upon the closing, we do not expect there to be any changes in the custodian of your accounts, Financial Planning Consultant

or the relationship between Avantax and your CPA. We will continue to partner with your CPA to provide comprehensive financial planning

through a tax-focused lens.

We’re excited about additional resources and scale that the

transaction will afford following the closing, which we believe will allow us to serve you well in the coming years. Please reach out

to your Financial Planning Consultant with any questions.

Sincerely,

Louie Rosalez

Senior Vice President, Avantax Planning Partners

Cautionary Statement Regarding Forward-Looking Statements

This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended, including, without limitation, statements regarding the anticipated timing

of the consummation of the proposed merger transaction (the “proposed transaction”) involving Avantax, Inc. (the “Company”),

Aretec Group, Inc. (“Parent”) and C2023 Sub Corp., whereby the Company would become a wholly-owned subsidiary of Parent,

plans for the Company following the closing of the proposed transaction and the anticipated effects of the proposed transaction. Forward-looking

statements provide current expectations of future events based on certain assumptions and include any statement that does not directly

relate to any historical or current fact. Forward-looking statements can also be identified by words such as “anticipates,”

“believes,” “plans,” “expects,” “future,” “intends,” “may,” “will,”

“would,” “could,” “should,” “estimates,” “predicts,” “potential,”

“continues,” “target,” “outlook” and similar terms and expressions, but the absence of these words

does not mean that the statement is not forward-looking. Actual results may differ significantly from management’s expectations

due to various risks and uncertainties including, without limitation: (i) the risk that the proposed transaction may not be completed

in a timely manner, or at all; (ii) the failure to satisfy the conditions to the consummation of the proposed transaction, including,

without limitation, the receipt of stockholder and regulatory approvals; (iii) unanticipated difficulties or expenditures relating to

the proposed transaction; (iv) the effect of the announcement or pendency of the proposed transaction on the plans, business relationships,

operating results and operations; (v) potential difficulties retaining employees, financial professionals and clients as a result of

the announcement and pendency of the proposed transaction; (vi) the response of employees, financial professionals and suppliers to the

announcement of the proposed transaction; (vii) risks related to diverting management’s attention from the Company’s ongoing

business operations; (viii) legal proceedings, including those that may be instituted against the Company, its board of directors, its

executive officers or others following the announcement of the proposed transaction; and (ix) risks regarding the failure to obtain the

necessary financing to complete the proposed transaction. In addition, a description of certain other factors that could affect the Company’s

business, financial condition or results of operations is included in the Company’s most recent Annual Report on Form 10-K and

most recent Quarterly Report on Form 10-Q filed with the U.S. Securities and Exchange Commission (the “SEC”). Forward-looking

statements reflect the Company’s good faith beliefs, assumptions and expectations but are not guarantees of future performance

or events. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of

this communication. The Company undertakes no obligation to update any forward-looking statements to reflect events or circumstances

after the date hereof, except as may be required by law.

Additional Information Regarding the Merger and Where to Find

It This communication is being issued in connection with the proposed transaction. This communication does not constitute an offer

to sell or the solicitation of an offer to buy any securities or the solicitation of any vote or approval. The proposed transaction will

be submitted to the stockholders of the Company for their consideration at a special meeting of the stockholders. In connection therewith,

the Company intends to file a proxy statement and other relevant materials with the SEC, including a definitive proxy statement on Schedule

14A, which will be mailed or otherwise disseminated to the stockholders of the Company as of the record date established for voting on

the proposed transaction. The Company may also file other relevant documents with the SEC regarding the proposed transaction. BEFORE

MAKING ANY VOTING OR INVESTMENT DECISION WITH RESPECT TO THE PROPOSED TRANSACTION, INVESTORS AND SECURITY HOLDERS OF THE COMPANY ARE

URGED TO READ THE DEFINITIVE PROXY STATEMENT REGARDING THE PROPOSED TRANSACTION (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND

OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders may obtain free copies of the definitive

proxy statement, any amendments or supplements thereto and other documents containing important information about the Company, once such

documents are filed with the SEC, through the website maintained by the SEC at www.sec.gov. In addition,

stockholders of the Company may obtain free copies of the documents filed with the SEC by directing a request through the Investor Relations

portion of the Company’s website at https://investors.avantax.com or by mail to Avantax, Inc., 3200 Olympus Boulevard, Suite 100,

Dallas, Texas 75019, Attention: Dee Littrell, Investor Relations.

Participants in the Solicitation The Company and its directors,

its executive officers and certain other members of Company management and Company employees may, under the rules of the SEC, be deemed

to be participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive

officers of the Company is set forth in the Company’s definitive proxy statement on Schedule 14A for the 2023 annual meeting of

the stockholders of the Company, filed with the SEC on April 3, 2023 and in subsequent documents filed with the SEC, each of which is

(or, when filed will be) available free of charge from the sources indicated above. Other information regarding the participants in the

solicitation of proxies from the stockholders of the Company and a description of their direct and indirect interests, by security holdings

or otherwise, will be contained in the preliminary and definitive proxy statements and other relevant materials to be filed with the SEC

regarding the proposed transaction when they become available.

The following email was sent to Avantax, Inc.’s affiliates

on September 13, 2023:

We hope you were able to join our webinar this morning with Avantax

leaders regarding the Avantax/Cetera acquisition agreement.

For those who weren't able to attend, please find a quick recap

below:

| ¨ | We believe Avantax and Cetera will be stronger together with a more robust and even more meaningful footprint in the tax and accounting

sector. |

| ¨ | Like Avantax, Cetera understands the value of tax-intelligent advice and works specifically with tax professionals to integrate wealth

management services into their practices. Upon the closing, we expect our affiliate support will be stronger and have a more robust footprint

in the tax and accounting sector. |

| ¨ | The acquisition of Avantax is expected to close by the end of the year, subject to Avantax stockholder approval, regulatory approvals

and other customary closing conditions. |

| ¨ | We will not be required to change clearing and custody platforms upon the closing, so there’s no new paperwork to sign. |

| ¨ | There will be no changes to your Financial Planning Consultant or the Avantax support team prior to closing. |

Several of our affiliates asked to preview the letter to your clients

prior to sending. You can view the preview here.

We are committed to ensuring this transition is as seamless as possible.

In the months ahead, we plan to share regular updates, as appropriate. Please reach out to your Relationship Manager or Financial Planning

Consultant with any additional questions.

Cautionary Statement Regarding Forward-Looking Statements

This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended, including, without limitation, statements regarding the anticipated timing

of the consummation of the proposed merger transaction (the “proposed transaction”) involving Avantax, Inc. (the “Company”),

Aretec Group, Inc. (“Parent”) and C2023 Sub Corp., whereby the Company would become a wholly-owned subsidiary of Parent,

plans for the Company following the closing of the proposed transaction and the anticipated effects of the proposed transaction. Forward-looking

statements provide current expectations of future events based on certain assumptions and include any statement that does not directly

relate to any historical or current fact. Forward-looking statements can also be identified by words such as “anticipates,”

“believes,” “plans,” “expects,” “future,” “intends,” “may,” “will,”

“would,” “could,” “should,” “estimates,” “predicts,” “potential,”

“continues,” “target,” “outlook” and similar terms and expressions, but the absence of these words

does not mean that the statement is not forward-looking. Actual results may differ significantly from management’s expectations

due to various risks and uncertainties including, without limitation: (i) the risk that the proposed transaction may not be completed

in a timely manner, or at all; (ii) the failure to satisfy the conditions to the consummation of the proposed transaction, including,

without limitation, the receipt of stockholder and regulatory approvals; (iii) unanticipated difficulties or expenditures relating to

the proposed transaction; (iv) the effect of the announcement or pendency of the proposed transaction on the plans, business relationships,

operating results and operations; (v) potential difficulties retaining employees, financial professionals and clients as a result of

the announcement and pendency of the proposed transaction; (vi) the response of employees, financial professionals and suppliers to the

announcement of the proposed transaction; (vii) risks related to diverting management’s attention from the Company’s ongoing

business operations; (viii) legal proceedings, including those that may be instituted against the Company, its board of directors, its

executive officers or others following the announcement of the proposed transaction; and (ix) risks regarding the failure to obtain the

necessary financing to complete the proposed transaction. In addition, a description of certain other factors that could affect the Company’s

business, financial condition or results of operations is included in the Company’s most recent Annual Report on Form 10-K and

most recent Quarterly Report on Form 10-Q filed with the U.S. Securities and Exchange Commission (the “SEC”). Forward-looking

statements reflect the Company’s good faith beliefs, assumptions and expectations but are not guarantees of future performance

or events. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of

this communication. The Company undertakes no obligation to update any forward-looking statements to reflect events or circumstances

after the date hereof, except as may be required by law.

Additional Information Regarding the Merger and Where to Find

It This communication is being issued in connection with the proposed transaction. This communication does not constitute an offer

to sell or the solicitation of an offer to buy any securities or the solicitation of any vote or approval. The proposed transaction will

be submitted to the stockholders of the Company for their consideration at a special meeting of the stockholders. In connection therewith,

the Company intends to file a proxy statement and other relevant materials with the SEC, including a definitive proxy statement on Schedule

14A, which will be mailed or otherwise disseminated to the stockholders of the Company as of the record date established for voting on

the proposed transaction. The Company may also file other relevant documents with the SEC regarding the proposed transaction. BEFORE

MAKING ANY VOTING OR INVESTMENT DECISION WITH RESPECT TO THE PROPOSED TRANSACTION, INVESTORS AND SECURITY HOLDERS OF THE COMPANY ARE

URGED TO READ THE DEFINITIVE PROXY STATEMENT REGARDING THE PROPOSED TRANSACTION (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND

OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders may obtain free copies of the definitive

proxy statement, any amendments or supplements thereto and other documents containing important information about the Company, once such

documents are filed with the SEC, through the website maintained by the SEC at www.sec.gov. In addition,

stockholders of the Company may obtain free copies of the documents filed with the SEC by directing a request through the Investor Relations

portion of the Company’s website at https://investors.avantax.com or by mail to Avantax, Inc., 3200 Olympus Boulevard, Suite 100,

Dallas, Texas 75019, Attention: Dee Littrell, Investor Relations.

Participants in the Solicitation The Company and its directors,

its executive officers and certain other members of Company management and Company employees may, under the rules of the SEC, be deemed

to be participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive

officers of the Company is set forth in the Company’s definitive proxy statement on Schedule 14A for the 2023 annual meeting of

the stockholders of the Company, filed with the SEC on April 3, 2023 and in subsequent documents filed with the SEC, each of which is

(or, when filed will be) available free of charge from the sources indicated above. Other information regarding the participants in the

solicitation of proxies from the stockholders of the Company and a description of their direct and indirect interests, by security holdings

or otherwise, will be contained in the preliminary and definitive proxy statements and other relevant materials to be filed with the SEC

regarding the proposed transaction when they become available.

The following communication was posted to Avantax, Inc.’s

intranet for independent financial professionals on September 13, 2023:

Title: Clients Resources on Avantax Agreement

with Cetera Holdings

With Monday’s

announcement about Avantax, Inc. entering into an agreement to be acquired by Cetera Holdings (Cetera), we want to provide you

with resources if clients have questions and to provide a Compliance-approved email if you want to reach out to your clients.

The resources:

| • | Client

Talking Points <<link to talking points>> – To address questions you receive if clients reach out to you. The key points are no new paperwork or change in platforms, such as eMoney,

Envestnet and Wealthscape, for the client. |

| • | Compliance-approved

Email <<link to email template>> – You are able to add your Compliance-approved logo and signature to this email template to send to clients. |

If you have any questions

about the resources, please reach out to Avantax Communications at communications@avantax.com.

Cautionary Statement Regarding Forward-Looking Statements

This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended, including, without limitation, statements regarding the anticipated timing

of the consummation of the proposed merger transaction (the “proposed transaction”) involving Avantax, Inc. (the “Company”),

Aretec Group, Inc. (“Parent”) and C2023 Sub Corp., whereby the Company would become a wholly-owned subsidiary of Parent,

plans for the Company following the closing of the proposed transaction and the anticipated effects of the proposed transaction. Forward-looking

statements provide current expectations of future events based on certain assumptions and include any statement that does not directly

relate to any historical or current fact. Forward-looking statements can also be identified by words such as “anticipates,”

“believes,” “plans,” “expects,” “future,” “intends,” “may,” “will,”

“would,” “could,” “should,” “estimates,” “predicts,” “potential,”

“continues,” “target,” “outlook” and similar terms and expressions, but the absence of these words

does not mean that the statement is not forward-looking. Actual results may differ significantly from management’s expectations

due to various risks and uncertainties including, without limitation: (i) the risk that the proposed transaction may not be completed

in a timely manner, or at all; (ii) the failure to satisfy the conditions to the consummation of the proposed transaction, including,

without limitation, the receipt of stockholder and regulatory approvals; (iii) unanticipated difficulties or expenditures relating to

the proposed transaction; (iv) the effect of the announcement or pendency of the proposed transaction on the plans, business relationships,

operating results and operations; (v) potential difficulties retaining employees, financial professionals and clients as a result of

the announcement and pendency of the proposed transaction; (vi) the response of employees, financial professionals and suppliers to the

announcement of the proposed transaction; (vii) risks related to diverting management’s attention from the Company’s ongoing

business operations; (viii) legal proceedings, including those that may be instituted against the Company, its board of directors, its

executive officers or others following the announcement of the proposed transaction; and (ix) risks regarding the failure to obtain the

necessary financing to complete the proposed transaction. In addition, a description of certain other factors that could affect the Company’s

business, financial condition or results of operations is included in the Company’s most recent Annual Report on Form 10-K and

most recent Quarterly Report on Form 10-Q filed with the U.S. Securities and Exchange Commission (the “SEC”). Forward-looking

statements reflect the Company’s good faith beliefs, assumptions and expectations but are not guarantees of future performance

or events. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of

this communication. The Company undertakes no obligation to update any forward-looking statements to reflect events or circumstances

after the date hereof, except as may be required by law.

Additional Information Regarding the Merger and Where to Find

It This communication is being issued in connection with the proposed transaction. This communication does not constitute an offer

to sell or the solicitation of an offer to buy any securities or the solicitation of any vote or approval. The proposed transaction will

be submitted to the stockholders of the Company for their consideration at a special meeting of the stockholders. In connection therewith,

the Company intends to file a proxy statement and other relevant materials with the SEC, including a definitive proxy statement on Schedule

14A, which will be mailed or otherwise disseminated to the stockholders of the Company as of the record date established for voting on

the proposed transaction. The Company may also file other relevant documents with the SEC regarding the proposed transaction. BEFORE MAKING

ANY VOTING OR INVESTMENT DECISION WITH RESPECT TO THE PROPOSED TRANSACTION, INVESTORS AND SECURITY HOLDERS OF THE COMPANY ARE URGED TO

READ THE DEFINITIVE PROXY STATEMENT REGARDING THE PROPOSED TRANSACTION (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND OTHER RELEVANT

DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders may obtain free copies of the definitive proxy statement, any

amendments or supplements thereto and other documents containing important information about the Company, once such documents are filed

with the SEC, through the website maintained by the SEC at www.sec.gov. In addition, stockholders of

the Company may obtain free copies of the documents filed with the SEC by directing a request through the Investor Relations portion of

the Company’s website at https://investors.avantax.com or by mail to Avantax, Inc., 3200 Olympus Boulevard, Suite 100, Dallas, Texas

75019, Attention: Dee Littrell, Investor Relations.

Participants in the Solicitation The Company and its directors,

its executive officers and certain other members of Company management and Company employees may, under the rules of the SEC, be deemed

to be participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive

officers of the Company is set forth in the Company’s definitive proxy statement on Schedule 14A for the 2023 annual meeting of

the stockholders of the Company, filed with the SEC on April 3, 2023 and in subsequent documents filed with the SEC, each of which is

(or, when filed will be) available free of charge from the sources indicated above. Other information regarding the participants in the

solicitation of proxies from the stockholders of the Company and a description of their direct and indirect interests, by security holdings

or otherwise, will be contained in the preliminary and definitive proxy statements and other relevant materials to be filed with the

SEC regarding the proposed transaction when they become available.

On September 13, 2023, the following

email was posted to Avantax, Inc.'s intranet for independent financial professionals for potential distribution to end-clients:

<Space for Advisor Logo>

Dear Valued Client,

You might have seen the news this week about Avantax, Inc.,

the ultimate parent of our broker-dealer and registered investment adviser, entering into a definitive agreement to be acquired by Cetera

Holdings.

Avantax and Cetera support firms such as ours by providing technology,

service and products to help us deliver comprehensive, tax-inclusive financial services to you. Both Avantax and Cetera offer tools and

flexibility to help firms like us run our independent businesses.

The acquisition of Avantax should have very little impact on

you – no new paperwork to sign and no immediate change to technology, investment products or the way we service your accounts. In

the long-term following the closing, we expect to have enhanced resources that improve your client experience.

Like Avantax, Cetera understands the value of tax-intelligent

advice and works specifically with tax professionals to integrate wealth management services into their practices. Upon the closing, we

expect our broker-dealer support will be stronger and have a more robust footprint in the tax and accounting sector. Cetera also shares

Avantax’s commitment to a strong advisor community that fosters peer learning and collaboration. We’re encouraged that Cetera

has indicated that many Avantax programs supporting our growth will continue so we can keep evolving to meet your needs.

The acquisition is expected to close by the end of the year,

subject to stockholder approval, regulatory approvals and other customary closing conditions. Overall, we’re excited about the additional

resources and scale this deal will afford following the closing, which we believe will allow us to serve you well in the coming years.

If you have any questions, please feel free to contact our team.

Sincerely,

<Approved

Advisor signature>

Cautionary Statement Regarding Forward-Looking Statements

This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended, including, without limitation, statements regarding the anticipated timing

of the consummation of the proposed merger transaction (the “proposed transaction”) involving Avantax, Inc. (the “Company”),

Aretec Group, Inc. (“Parent”) and C2023 Sub Corp., whereby the Company would become a wholly-owned subsidiary of Parent,

plans for the Company following the closing of the proposed transaction and the anticipated effects of the proposed transaction. Forward-looking

statements provide current expectations of future events based on certain assumptions and include any statement that does not directly

relate to any historical or current fact. Forward-looking statements can also be identified by words such as “anticipates,”

“believes,” “plans,” “expects,” “future,” “intends,” “may,” “will,”

“would,” “could,” “should,” “estimates,” “predicts,” “potential,”

“continues,” “target,” “outlook” and similar terms and expressions, but the absence of these words

does not mean that the statement is not forward-looking. Actual results may differ significantly from management’s expectations

due to various risks and uncertainties including, without limitation: (i) the risk that the proposed transaction may not be completed

in a timely manner, or at all; (ii) the failure to satisfy the conditions to the consummation of the proposed transaction, including,

without limitation, the receipt of stockholder and regulatory approvals; (iii) unanticipated difficulties or expenditures relating to

the proposed transaction; (iv) the effect of the announcement or pendency of the proposed transaction on the plans, business relationships,

operating results and operations; (v) potential difficulties retaining employees, financial professionals and clients as a result of

the announcement and pendency of the proposed transaction; (vi) the response of employees, financial professionals and suppliers to the

announcement of the proposed transaction; (vii) risks related to diverting management’s attention from the Company’s ongoing

business operations; (viii) legal proceedings, including those that may be instituted against the Company, its board of directors, its

executive officers or others following the announcement of the proposed transaction; and (ix) risks regarding the failure to obtain the

necessary financing to complete the proposed transaction. In addition, a description of certain other factors that could affect the Company’s

business, financial condition or results of operations is included in the Company’s most recent Annual Report on Form 10-K and

most recent Quarterly Report on Form 10-Q filed with the U.S. Securities and Exchange Commission (the “SEC”). Forward-looking

statements reflect the Company’s good faith beliefs, assumptions and expectations but are not guarantees of future performance

or events. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of

this communication. The Company undertakes no obligation to update any forward-looking statements to reflect events or circumstances

after the date hereof, except as may be required by law.

Additional Information Regarding the Merger and Where to Find

It This communication is being issued in connection with the proposed transaction. This communication does not constitute an offer

to sell or the solicitation of an offer to buy any securities or the solicitation of any vote or approval. The proposed transaction will

be submitted to the stockholders of the Company for their consideration at a special meeting of the stockholders. In connection therewith,

the Company intends to file a proxy statement and other relevant materials with the SEC, including a definitive proxy statement on Schedule

14A, which will be mailed or otherwise disseminated to the stockholders of the Company as of the record date established for voting on

the proposed transaction. The Company may also file other relevant documents with the SEC regarding the proposed transaction. BEFORE

MAKING ANY VOTING OR INVESTMENT DECISION WITH RESPECT TO THE PROPOSED TRANSACTION, INVESTORS AND SECURITY HOLDERS OF THE COMPANY ARE

URGED TO READ THE DEFINITIVE PROXY STATEMENT REGARDING THE PROPOSED TRANSACTION (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND

OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders may obtain free copies of the definitive

proxy statement, any amendments or supplements thereto and other documents containing important information about the Company, once such

documents are filed with the SEC, through the website maintained by the SEC at www.sec.gov.

In addition, stockholders of the Company may obtain free copies

of the documents filed with the SEC by directing a request through the Investor Relations portion of the Company’s website at https://investors.avantax.com

or by mail to Avantax, Inc., 3200 Olympus Boulevard, Suite 100, Dallas, Texas 75019, Attention: Dee Littrell, Investor Relations.

Participants in the Solicitation The Company and its directors,

its executive officers and certain other members of Company management and Company employees may, under the rules of the SEC, be deemed

to be participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive

officers of the Company is set forth in the Company’s definitive proxy statement on Schedule 14A for the 2023 annual meeting of

the stockholders of the Company, filed with the SEC on April 3, 2023 and in subsequent documents filed with the SEC, each of which is

(or, when filed will be) available free of charge from the sources indicated above. Other information regarding the participants in the

solicitation of proxies from the stockholders of the Company and a description of their direct and indirect interests, by security holdings

or otherwise, will be contained in the preliminary and definitive proxy statements and other relevant materials to be filed with the SEC

regarding the proposed transaction when they become available.

The following talking points were

posted to Avantax, Inc.’s intranet for independent financial professionals on September 13, 2023:

| ¨ | Avantax, Inc., the ultimate parent of our broker-dealer and registered investment adviser, entered into a definitive agreement to

be acquired by Cetera Holdings. |

| ¨ | Avantax and Cetera support firms such as ours by providing technology, service and products to help us deliver comprehensive, tax-inclusive

financial services to our clients. Both Avantax and Cetera offer tools and flexibility to help firms like us run our independent businesses. |

| o | If the client has questions about your relationship with Avantax or the role of a broker-dealer: A broker-dealer helps us maintain

and monitor your accounts and comply with regulatory requirements and gives us product and technology support in executing your financial

plan. You might have noticed the Avantax name on your account statements or other paperwork, but my team at [firm name] will remain your

points of contact regardless of the change in ownership of Avantax, Inc. |

| ¨ | The acquisition of Avantax should have very little impact on you. We will not be required to change clearing and custody platforms

upon the closing, so there’s no new paperwork to sign. Also, Cetera has indicated that, following the closing, there will be no

immediate change to technology, investment products or the way we’ve serviced your accounts. In the long-term following the closing,

we expect to have enhanced resources that improve your client experience. |

| ¨ | Like Avantax, Cetera understands the value of tax-intelligent advice and works specifically with tax professionals to integrate wealth

management services into their practices. Upon the closing, we expect our broker-dealer support will be stronger and have a more robust

footprint in the tax and accounting sector. |

| ¨ | Cetera also shares Avantax’s commitment to a strong advisor community that fosters peer learning and collaboration. We’re

encouraged that Cetera has indicated that many Avantax programs supporting our growth will continue so we can keep evolving to meet your

needs. |

| ¨ | The acquisition of Avantax is expected to close by the end of the year, subject to Avantax stockholder approval, regulatory approvals

and other customary closing conditions. |

| ¨ | Overall, we’re excited about additional resources and scale this deal will afford following the closing, which we believe will

allow us to serve you well in the coming years. |

Cautionary Statement Regarding Forward-Looking Statements

This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended, including, without limitation, statements regarding the anticipated timing

of the consummation of the proposed merger transaction (the “proposed transaction”) involving Avantax, Inc. (the “Company”),

Aretec Group, Inc. (“Parent”) and C2023 Sub Corp., whereby the Company would become a wholly-owned subsidiary of Parent,

plans for the Company following the closing of the proposed transaction and the anticipated effects of the proposed transaction. Forward-looking

statements provide current expectations of future events based on certain assumptions and include any statement that does not directly

relate to any historical or current fact. Forward-looking statements can also be identified by words such as “anticipates,”

“believes,” “plans,” “expects,” “future,” “intends,” “may,” “will,”

“would,” “could,” “should,” “estimates,” “predicts,” “potential,”

“continues,” “target,” “outlook” and similar terms and expressions, but the absence of these words

does not mean that the statement is not forward-looking. Actual results may differ significantly from management’s expectations

due to various risks and uncertainties including, without limitation: (i) the risk that the proposed transaction may not be completed

in a timely manner, or at all; (ii) the failure to satisfy the conditions to the consummation of the proposed transaction, including,

without limitation, the receipt of stockholder and regulatory approvals; (iii) unanticipated difficulties or expenditures relating to

the proposed transaction; (iv) the effect of the announcement or pendency of the proposed transaction on the plans, business relationships,

operating results and operations; (v) potential difficulties retaining employees, financial professionals and clients as a result of

the announcement and pendency of the proposed transaction; (vi) the response of employees, financial professionals and suppliers to the

announcement of the proposed transaction; (vii) risks related to diverting management’s attention from the Company’s ongoing

business operations; (viii) legal proceedings, including those that may be instituted against the Company, its board of directors, its

executive officers or others following the announcement of the proposed transaction; and (ix) risks regarding the failure to obtain the

necessary financing to complete the proposed transaction. In addition, a description of certain other factors that could affect the Company’s

business, financial condition or results of operations is included in the Company’s most recent Annual Report on Form 10-K and

most recent Quarterly Report on Form 10-Q filed with the U.S. Securities and Exchange Commission (the “SEC”). Forward-looking

statements reflect the Company’s good faith beliefs, assumptions and expectations but are not guarantees of future performance

or events. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of

this communication. The Company undertakes no obligation to update any forward-looking statements to reflect events or circumstances

after the date hereof, except as may be required by law.

Additional Information Regarding the Merger and Where to Find

It This communication is being issued in connection with the proposed transaction. This communication does not constitute an offer

to sell or the solicitation of an offer to buy any securities or the solicitation of any vote or approval. The proposed transaction will

be submitted to the stockholders of the Company for their consideration at a special meeting of the stockholders. In connection therewith,

the Company intends to file a proxy statement and other relevant materials with the SEC, including a definitive proxy statement on Schedule

14A, which will be mailed or otherwise disseminated to the stockholders of the Company as of the record date established for voting on

the proposed transaction. The Company may also file other relevant documents with the SEC regarding the proposed transaction. BEFORE

MAKING ANY VOTING OR INVESTMENT DECISION WITH RESPECT TO THE PROPOSED TRANSACTION, INVESTORS AND SECURITY HOLDERS OF THE COMPANY ARE

URGED TO READ THE DEFINITIVE PROXY STATEMENT REGARDING THE PROPOSED TRANSACTION (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND

OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders may obtain free copies of the definitive

proxy statement, any amendments or supplements thereto and other documents containing important information about the Company, once such

documents are filed with the SEC, through the website maintained by the SEC at www.sec.gov.

In addition, stockholders of the Company may obtain free copies

of the documents filed with the SEC by directing a request through the Investor Relations portion of the Company’s website at https://investors.avantax.com

or by mail to Avantax, Inc., 3200 Olympus Boulevard, Suite 100, Dallas, Texas 75019, Attention: Dee Littrell, Investor Relations.

Participants in the Solicitation The Company and its directors,

its executive officers and certain other members of Company management and Company employees may, under the rules of the SEC, be deemed

to be participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive

officers of the Company is set forth in the Company’s definitive proxy statement on Schedule 14A for the 2023 annual meeting of

the stockholders of the Company, filed with the SEC on April 3, 2023 and in subsequent documents filed with the SEC, each of which is

(or, when filed will be) available free of charge from the sources indicated above. Other information regarding the participants in the

solicitation of proxies from the stockholders of the Company and a description of their direct and indirect interests, by security holdings

or otherwise, will be contained in the preliminary and definitive proxy statements and other relevant materials to be filed with the SEC

regarding the proposed transaction when they become available.

The following invitation was sent

to the Avantax, Inc. community on September 13, 2023:

GTC Leader Q&A with Avantax Leadership on Thursday,

Sept. 14, at Noon Central

GTC Leaders,

As a follow up to the all-field Avantax Q&A call on Monday

addressing the Avantax/Cetera announcement, many of you have requested more time with leadership in a smaller group.

Please join us Thursday, Sept.

14, at noon Central for a GTC Leader call with Todd Mackay, president of Avantax, and other Avantax leaders.

We look forward to speaking with you and continuing to work

with you in leading Avantax into this new chapter on our journey to provide opportunities to you, the full Avantax Community, and your

clients.

Again, click here to

join the call at noon Central on Thursday, Sept. 14, at noon Central.

Thanks,

Nate Biddick

Vice President, Community & Advisor Engagement

Emily Fox

Director, Program & Education

Dani Schoolcraft

Education & Program Planner

Cautionary Statement Regarding Forward-Looking

Statements This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933,

as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including, without limitation, statements regarding the

anticipated timing of the consummation of the proposed merger transaction (the “proposed transaction”) involving

Avantax, Inc. (the “Company”), Aretec Group, Inc. (“Parent”) and C2023 Sub Corp.,

whereby the Company would become a wholly-owned subsidiary of Parent, plans for the Company following the closing of the proposed transaction

and the anticipated effects of the proposed transaction. Forward-looking statements provide current expectations of future events based

on ertain assumptions and include any statement that does not directly relate to any historical or current fact. Forward-looking statements

can also be identified by words such as “anticipates,” “believes,” “plans,” “expects,”

“future,” “intends,” “may,” “will,” “would,” “could,” “should,”

“estimates,” “predicts,” “potential,” “continues,” “target,” “outlook”

and similar terms and expressions, but the absence of these words does not mean that the statement is not forward-looking. Actual results

may differ significantly from management’s expectations due to various risks and uncertainties including, without limitation: (i)

the risk that the proposed transaction may not be completed in a timely manner, or at all; (ii) the failure to satisfy the conditions

to the consummation of the proposed transaction, including, without limitation, the receipt of stockholder and regulatory approvals;

(iii) unanticipated difficulties or expenditures relating to the proposed transaction; (iv) the effect of the announcement or pendency

of the proposed transaction on the plans, business relationships, operating results and operations; (v) potential difficulties retaining

employees, financial professionals and clients as a result of the announcement and pendency of the proposed transaction; (vi) the response

of employees, financial professionals and suppliers to the announcement of the proposed transaction; (vii) risks related to diverting

management’s attention from the Company’s ongoing business operations; (viii) legal proceedings, including those that may

be instituted against the Company, its board of directors, its executive officers or others following the announcement of the proposed

transaction; and (ix) risks regarding the failure to obtain the necessary financing to complete the proposed transaction. In addition,

a description of certain other factors that could affect the Company’s business, financial condition or results of operations is

included in the Company’s most recent Annual Report on Form 10-K and most recent Quarterly Report on Form 10-Q filed with the U.S.

Securities and Exchange Commission (the “SEC”). Forward-looking statements reflect the Company’s good

faith beliefs, assumptions and expectations but are not guarantees of future performance or events. Readers are cautioned not to place

undue reliance on these forward-looking statements, which speak only as of the date of this communication. The Company undertakes no

obligation to update any forward-looking statements to reflect events or circumstances after the date hereof, except as may be required

by law.

Additional Information Regarding the Merger and Where to

Find It This communication is being issued in connection with the proposed transaction. This communication does not constitute an

offer to sell or the solicitation of an offer to buy any securities or the solicitation of any vote or approval. The proposed transaction

will be submitted to the stockholders of the Company for their consideration at a special meeting of the stockholders. In connection

therewith, the Company intends to file a proxy statement and other relevant materials with the SEC, including a definitive proxy statement

on Schedule 14A, which will be mailed or otherwise disseminated to the stockholders of the Company as of the record date established

for voting on the proposed transaction. The Company may also file other relevant documents with the SEC regarding the proposed transaction.

BEFORE MAKING ANY VOTING OR INVESTMENT DECISION WITH RESPECT TO THE PROPOSED TRANSACTION, INVESTORS AND SECURITY HOLDERS OF THE COMPANY

ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT REGARDING THE PROPOSED TRANSACTION (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO)

AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY

WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders may obtain free copies of the definitive

proxy statement, any amendments or supplements thereto and other documents containing important information about the Company, once such

documents are filed with the SEC, through the website maintained by the SEC at www.sec.gov. In addition, stockholders of the Company

may obtain free copies of the documents filed with the SEC by directing a request through the Investor Relations portion of the Company’s

website at https://investors.avantax.com or by mail to Avantax, Inc., 3200 Olympus Boulevard, Suite 100, Dallas, Texas 75019,

Attention: Dee Littrell, Investor Relations.

Participants in the Solicitation The

Company and its directors, its executive officers and certain other members of Company management and Company employees may, under the

rules of the SEC, be deemed to be participants in the solicitation of proxies in connection with the proposed transaction. Information

about the directors and executive officers of the Company is set forth in the Company’s definitive proxy statement on Schedule

14A for the 2023 annual meeting of the stockholders of the Company, filed with the SEC on April 3, 2023 and in subsequent documents filed

with the SEC, each of which is (or, when filed will be) available free of charge from the sources indicated above. Other information

regarding the participants in the solicitation of proxies from the stockholders of the Company and a description of their direct and

indirect interests, by security holdings or otherwise, will be contained in the preliminary and definitive proxy statements and other

relevant materials to be filed with the SEC regarding the proposed transaction when they become available.

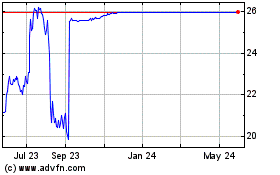

Avantax (NASDAQ:AVTA)

Historical Stock Chart

From Apr 2024 to May 2024

Avantax (NASDAQ:AVTA)

Historical Stock Chart

From May 2023 to May 2024