0001501796false00015017962023-08-092023-08-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 09, 2023 |

Aura Biosciences, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-40971 |

32-0271970 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

80 Guest Street |

|

Boston, Massachusetts |

|

02135 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 617 500-8864 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.00001 par value per share |

|

AURA |

|

The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On August 9, 2023, Aura Biosciences, Inc. (the “Company”) issued a press release announcing its financial results for the quarter ended June 30, 2023. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Form 8-K, including Exhibit 99.1 hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 8.01. Other Events

On August 9, 2023, the Company updated its corporate presentation for use in meetings with investors, analysts and others. A copy of the corporate presentation is filed as Exhibit 99.2 for purposes of Section 18 of the Exchange Act.

Forward Looking Statements

Statements contained under this Item 8.01 regarding matters that are not historical facts are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. Such statements include, but are not limited to, statements about the initiation, timing, progress, results, and cost of our research and development programs and our current and future preclinical studies and clinical trials, including statements regarding the timing of initiation and completion of studies or trials and related preparatory work, the period during which the results of the trials will become available, and our research and development programs; our ability to successfully manufacture our drug substances and product candidates for preclinical use, for clinical trials and on a larger scale for commercial use, if approved; the ability and willingness of our third-party strategic collaborators to continue research and development activities relating to our development candidates and product candidates; our ability to obtain funding for our operations necessary to complete further development and commercialization of our product candidates; our ability to obtain and maintain regulatory approval of our product candidates; the size and growth potential of the markets for our product candidates, and our ability to serve those markets; our financial performance; our ability to commercialize our products, if approved; and the implementation of our business model, and strategic plans for our business and product candidates.

Any forward-looking statements are neither promises nor guarantees, and investors should not place undue reliance on these forward-looking statements because they involve known and unknown risks, uncertainties, and other factors, many of which are beyond the Company’s control and which could cause actual results to differ materially from those expressed or implied by these forward-looking statements, including, without limitation, uncertainties inherent in clinical trials and in the availability and timing of data from ongoing clinical trials; the expected timing for submissions for regulatory approval or review by governmental authorities; the risk that the results of the Company’s clinical trials may not be predictive of future results in connection with future clinical trials; the risk that interim data from ongoing clinical trials may not be predictive of final data from completed clinical trials; the risk that governmental authorities may disagree with the Company’s clinical trial designs; whether the Company will receive regulatory approvals to conduct trials or to market products; whether the Company’s cash resources will be sufficient to fund its foreseeable and unforeseeable operating expenses and capital expenditure requirements; the Company’s ongoing and planned pre-clinical activities; and the Company’s ability to initiate, enroll, conduct or complete ongoing and planned clinical trials. These risks, uncertainties, and other factors include those risks and uncertainties described under the heading “Risk Factors” in the Company’s most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q filed with the U.S. Securities and Exchange Commission (“SEC”) and in subsequent filings made by the Company with the SEC, which are available on the SEC’s website at www.sec.gov. Except as required by law, the Company disclaims any intention or responsibility for updating or revising any forward-looking statements contained in this press release in the event of new information, future developments or otherwise. These forward-looking statements are based on the Company’s current expectations and speak only as of the date hereof and no representations or warranties (express or implied) are made about the accuracy of any such forward-looking statements.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

Aura Biosciences, Inc. |

|

|

|

|

Date: |

August 9, 2023 |

By: |

/s/ Julie Feder |

|

|

|

Julie Feder

Chief Financial Officer |

Exhibit 99.1

Aura Biosciences Reports Second Quarter 2023 Financial Results and Provides Clinical Development and Operational Highlights

Strengthened Clinical and Regulatory Leadership Team with Key Appointments

Start-up Activities for the Global Phase 3 Trial Ongoing with Release of Drug Product Manufactured with Commercial Process and First Patient Expected to be Dosed in 2H 2023

BOSTON, MA – August 9, 2023 – Aura Biosciences Inc. (NASDAQ: AURA), a clinical-stage biotechnology company developing a novel class of virus-like drug conjugate (VDC) therapies for multiple oncology indications, today reported financial results for the second quarter ended June 30, 2023, and provided clinical development and operational highlights.

“As we build momentum across our portfolio, we are happy to welcome Drs. Bruce Brown and Anthony Daniels as our Therapeutic Area Heads in Urologic Oncology and Ocular Oncology, respectively, as well as Dr. Richard Mountfield as our new Senior Vice President of Regulatory Affairs and Quality. These key appointments are critical in supporting our corporate growth and expansion of our clinical programs in two important oncology therapeutic areas with high unmet medical needs for patients,” said Elisabet de los Pinos, Ph.D., Chief Executive Officer of Aura.

Dr. de los Pinos added, “We are excited to announce that we have released our drug product manufactured using the commercial process to be used in the global Phase 3 trial and remain encouraged by the progress we have made with the start-up activities, with multiple sites ready to enroll patients in the United States. We remain focused on the execution of our clinical studies and plan to share 12-month data from the Phase 2 trial in choroidal melanoma in the second half of 2023.”

Recent Pipeline Developments

•Global Start up Activities for the Phase 3 trial ongoing.

•The Phase 3 trial is designed as a superiority trial comparing belzupacap sarotalocan (bel-sar) versus sham. The trial is a global Phase 3, randomized, multi-center, masked study, and it is intended to enroll approximately 100 patients randomized 2:1:2 to receive high dose regimen of bel-sar, low dose regimen of bel-sar with suprachoroidal (SC) administration, or a sham control.

•The primary endpoint is time to tumor progression and the first key secondary endpoint is a composite time to event analysis that will compare the tumor control and visual acuity of the bel-sar high dose regimen to sham when the last patient completes their 12 months of follow up.

•Aura released the commercial process material for the global Phase 3 trial. The majority of sites are qualified globally, and multiple sites are ready to enroll patients in the United States.

•The first patient is expected to be dosed in the second half of 2023.

•Enrollment is complete in the Phase 2 trial evaluating SC administration of bel-sar for the first-line treatment of adult patients with early-stage choroidal melanoma (CM). Updated efficacy data with 12 months median follow up of patients treated with the therapeutic regimen intended to be used in the global Phase 3 trial is on track to be presented in the second half of 2023.

•The Phase 1 trial of bel-sar for the treatment of non-muscle invasive bladder cancer (NMIBC) is currently ongoing, and Aura expects to report data in 2024. This represents an area of high unmet need with approximately 60,000 patients diagnosed in the United States every year. Aura received Fast Track Designation from the Oncology Division of the FDA for this indication in June 2022.

•The Phase 1 multi-center, open-label clinical trial is expected to enroll approximately 19 adult patients. The trial is designed to assess the safety and tolerability of bel-sar as a single agent. The primary endpoint of the Phase 1 trial is the incidence and severity of treatment-related adverse events, serious adverse events and/or the incidence of dose-limiting toxicities. The trial will provide histopathological evaluation after the local treatment to support bel-sar’s biological activity.

•Beyond early-stage CM, Aura continues to build its ocular oncology franchise. Aura’s goal is to initiate clinical development in choroidal metastasis, an indication with a high unmet medical need and no approved therapies, as the second ocular oncology indication. Aura is on track to initiate the Phase 2 trial in 2024.

Recent Corporate Events

Strengthened the clinical leadership team with the following key appointments:

•Dr. Bruce Brown joined Aura as Therapeutic Area Head Urologic Oncology. Dr. Brown is responsible for leading the bladder cancer program, including the current ongoing trial, as well as driving future strategy and development plans. Dr. Brown was previously VP, Clinical Development at Myovant Sciences. Dr. Brown is a board-certified urologist and joined the pharmaceutical industry after practicing urology for 17 years.

•Dr. Anthony Daniels is joining Aura as the Therapeutic Area Head Ocular Oncology. Dr. Daniels will be responsible for leading the ocular oncology program and driving future strategy. Dr. Daniels is a board-certified ophthalmologist who has treated ocular oncology patients for 15 years, and most recently was Chief of the Division of Ocular Oncology at Vanderbilt University Medical Center.

•Dr. Richard Mountfield joined Aura as SVP, Regulatory Affairs & Quality. Dr. Mountfield is responsible for overseeing regulatory affairs and quality activities for all programs. Dr. Mountfield was previously the SVP of Regulatory Affairs & Quality at Zenas BioPharma.

Second Quarter 2023 Financial Results

•As of June 30, 2023, Aura had cash and cash equivalents and marketable securities totaling $162.0 million. Aura believes its current cash and cash equivalents and marketable securities are sufficient to fund its operations into the second half of 2025.

•Research and development expenses increased to $15.1 million for the three months ended June 30, 2023 from $9.5 million for the three months ended June 30, 2022, primarily due to ongoing clinical costs associated with the progression of our Phase 2 study and CRO costs associated with the start of our Phase 3 global trial, manufacturing and development costs for bel-sar, and higher personnel expenses from growing headcount.

•General and administrative expenses increased to $5.2 million for the three months ended June 30, 2023 from $4.3 million for the three months ended June 30, 2022. General and administrative expenses include $1.2 million and $0.8 million of stock-based compensation for the three months ended June 30, 2023 and 2022, respectively. The increase was primarily driven by personnel expenses, as well as increases in general corporate expenses related to growth of the Company.

•Net loss for the three months ended June 30, 2023 was $18.3 million compared to $13.5 million for the three months ended June 30, 2022.

About Aura Biosciences

Aura Biosciences, Inc. is a clinical-stage biotechnology company developing virus-like drug conjugates (VDCs), a novel class of therapies, for the treatment of multiple oncology indications. Aura’s lead VDC candidate, belzupacap sarotalocan (bel-sar; AU-011), consists of a virus-like particle conjugated with an anti-cancer agent. Bel-sar is designed to selectively target and destroy cancer cells and activate the immune system with the potential to create long-lasting, anti-tumor immunity. Bel-sar is currently in development for ocular cancers, and Aura has initiated activities for the global Phase 3 trial evaluating first-line treatment of early-stage choroidal melanoma, a vision- and life-threatening form of eye cancer where standard of care with radiotherapy leaves patients with severe comorbidities, including major vision loss. Aura plans to pursue development of bel-sar across its ocular oncology franchise including for the treatment of patients with choroidal metastasis. In addition, leveraging Aura’s technology platform, Aura is developing bel-sar more broadly across multiple cancers, including in patients with non-muscle invasive bladder cancer. Aura is headquartered in Boston, MA.

For more information, visit aurabiosciences.com, or follow us on Twitter and LinkedIn.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, and other federal securities laws. Any statements that are not statements of historical fact may be deemed to be forward looking statements. Words such as “may,” “will,” “could”, “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “projects,” “seeks,” “endeavor,” “potential,” “continue” or the negative of such words or other similar expressions that can be used to identify forward-looking statements. These forward looking statements include express or implied statements regarding Aura’s future expectations, plans and prospects, including, without limitation, statements regarding the therapeutic potential of bel-sar for the treatment of cancers including choroidal melanoma, non-muscle invasive bladder cancer and choroidal metastasis; any express or implied statements regarding the Company’s expectations for the Phase 2 and Phase 3 clinical trials of bel-sar for early-stage choroidal melanoma and the Phase 1 trial of bel-sar for non-muscle invasive bladder cancer; the potential approvability of bel-sar; the Phase 2 trial of bel-sar for choroidal metastasis; Aura’s expectations regarding the estimated patient populations and related market opportunities for bel-sar; and Aura’s expectations regarding cash runway.

The forward-looking statements in this press release are neither promises nor guarantees, and investors should not place undue reliance on these forward-looking statements because they involve known and unknown risks, uncertainties, and other factors, many of which are beyond Aura’s control and which could cause actual results to differ materially from those expressed or implied by these forward-looking statements, including, without limitation, uncertainties inherent in clinical trials and in the availability and timing of data from ongoing clinical trials; the expected timing for submissions for regulatory approval or review by governmental authorities; the risk that the results of Aura’s clinical trials may not be predictive of future results in connection with future clinical trials; the risk that interim data from ongoing clinical trials may not be predictive of final data from completed clinical trials; the risk that governmental authorities may disagree with Aura’s clinical trial designs; whether Aura will receive regulatory approvals to conduct trials or to market products; whether Aura’s cash resources will be sufficient to fund its foreseeable and unforeseeable operating expenses and capital expenditure requirements; Aura’s ongoing and planned pre-clinical activities; and Aura’s ability to initiate, enroll, conduct or complete ongoing and planned clinical trials. These risks, uncertainties, and other factors include those risks and uncertainties described under the heading “Risk Factors” in Aura’s most recent Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission (SEC) and in subsequent filings made by Aura with the SEC, which are available on the SEC’s website at www.sec.gov. Except as required by law, Aura disclaims any intention or responsibility for updating or revising any forward-looking statements contained in this press release in the event of new information, future developments or otherwise. These forward-looking statements are based on Aura’s current expectations and speak only as of the date hereof and no representations or warranties (express or implied) are made about the accuracy of any such forward-looking statements.

Investor and Media Contact:

Alex Dasalla

Head of Investor Relations and Corporate Communications

adasalla@aurabiosciences.com

Aura Biosciences, Inc.

Consolidated Statement of Operations and Comprehensive Loss

(in thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, |

|

|

Six Months Ended

June 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Operating Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

$ |

15,120 |

|

|

$ |

9,510 |

|

|

$ |

29,524 |

|

|

$ |

17,786 |

|

General and administrative |

|

|

5,156 |

|

|

$ |

4,306 |

|

|

|

10,196 |

|

|

|

8,841 |

|

Total operating expenses |

|

|

20,276 |

|

|

|

13,816 |

|

|

|

39,720 |

|

|

|

26,627 |

|

Total operating loss |

|

|

(20,276 |

) |

|

|

(13,816 |

) |

|

|

(39,720 |

) |

|

|

(26,627 |

) |

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income, including amortization and accretion income |

|

|

2,009 |

|

|

|

292 |

|

|

|

4,000 |

|

|

|

319 |

|

Other income (expense) |

|

|

(32 |

) |

|

|

56 |

|

|

|

(45 |

) |

|

|

5 |

|

Total other income |

|

|

1,977 |

|

|

|

348 |

|

|

|

3,955 |

|

|

|

324 |

|

Net loss |

|

|

(18,299 |

) |

|

|

(13,468 |

) |

|

|

(35,765 |

) |

|

|

(26,303 |

) |

Net loss per common share—basic and diluted |

|

|

(0.48 |

) |

|

|

(0.46 |

) |

|

|

(0.95 |

) |

|

|

(0.90 |

) |

Weighted average common stock outstanding—basic and diluted |

|

|

37,855,533 |

|

|

|

29,251,480 |

|

|

|

37,820,104 |

|

|

|

29,232,661 |

|

Comprehensive loss: |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(18,299 |

) |

|

$ |

(13,468 |

) |

|

$ |

(35,765 |

) |

|

$ |

(26,303 |

) |

Other comprehensive items: |

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized loss on marketable securities |

|

$ |

(178 |

) |

|

|

(123 |

) |

|

|

(151 |

) |

|

|

(128 |

) |

Total other comprehensive loss |

|

|

(178 |

) |

|

|

(123 |

) |

|

|

(151 |

) |

|

|

(128 |

) |

Total comprehensive loss |

|

$ |

(18,477 |

) |

|

$ |

(13,591 |

) |

|

$ |

(35,916 |

) |

|

$ |

(26,431 |

) |

Aura Biosciences, Inc.

Consolidated Balance Sheets

(in thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

June 30, 2023 |

|

|

December 31, 2022 |

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

47,732 |

|

|

$ |

121,582 |

|

Marketable securities |

|

|

114,281 |

|

|

|

67,229 |

|

Restricted cash and deposits |

|

|

20 |

|

|

|

20 |

|

Prepaid expenses and other current assets |

|

|

4,178 |

|

|

|

7,871 |

|

Total current assets |

|

|

166,211 |

|

|

|

196,702 |

|

Restricted cash and deposits, net of current portion |

|

|

768 |

|

|

|

768 |

|

Right of use assets - operating lease |

|

|

20,003 |

|

|

|

20,671 |

|

Other long-term assets |

|

|

700 |

|

|

|

423 |

|

Property and equipment, net |

|

|

5,057 |

|

|

|

5,371 |

|

Total Assets |

|

$ |

192,739 |

|

|

$ |

223,935 |

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

|

553 |

|

|

|

2,921 |

|

Short-term operating lease liability |

|

|

3,008 |

|

|

|

2,963 |

|

Accrued expenses and other current liabilities |

|

|

5,334 |

|

|

|

4,573 |

|

Total current liabilities |

|

|

8,895 |

|

|

|

10,457 |

|

Long-term operating lease liability |

|

|

17,407 |

|

|

|

17,895 |

|

Total Liabilities |

|

|

26,302 |

|

|

|

28,352 |

|

Commitments and Contingencies |

|

|

|

|

|

|

Stockholders’ Equity: |

|

|

|

|

|

|

Common stock, $0.00001 par value, 150,000,000 authorized at June 30, 2023 and December 31, 2022, and 38,086,606 and 37,771,918 shares issued and outstanding at June 30, 2023 and December 31, 2022, respectively |

|

|

— |

|

|

|

— |

|

Additional paid-in capital |

|

|

413,325 |

|

|

|

406,555 |

|

Accumulated deficit |

|

|

(246,665 |

) |

|

|

(210,900 |

) |

Accumulated other comprehensive loss |

|

|

(223 |

) |

|

|

(72 |

) |

Total Stockholders’ Equity |

|

|

166,437 |

|

|

|

195,583 |

|

Total Liabilities and Stockholders’ Equity |

|

$ |

192,739 |

|

|

$ |

223,935 |

|

Corporate Presentation�August 2023 Exhibit 99.2

Legal Disclosure This presentation contains forward-looking statements, all of which are qualified in their entirety by this cautionary statement. Many of the forward-looking statements contained herein can be identified by the use of forward-looking words such as "may", "anticipate", "believe", "could', "expect", "should", "plan", "intend", "estimate", "will", "potential" and "ongoing", among others, although not all forward-looking statements contain these identifying words. These forward-looking statements include statements about the initiation, timing, progress, results, and cost of our research and development programs and our current and future preclinical studies and clinical trials, including statements regarding the timing of initiation and completion of studies or trials and related preparatory work, the period during which the results of the trials will become available, and our research and development programs; our ability to successfully manufacture our drug substances and product candidates for preclinical use, for clinical trials and on a larger scale for commercial use, if approved; the ability and willingness of our third-party strategic collaborators to continue research and development activities relating to our development candidates and product candidates; our ability to obtain funding for our operations necessary to complete further development and commercialization of our product candidates; our ability to obtain and maintain regulatory approval of our product candidates; the size and growth potential of the markets for our product candidates, and our ability to serve those markets; our financial performance; and the implementation of our business model, and strategic plans for our business and product candidates. Except as otherwise noted, these forward-looking statements speak only as of the date of this presentation, and we undertake no obligation to update or revise any of such statements to reflect events or circumstances occurring after this presentation. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified and some of which are beyond our control, you should not rely on these forward-looking statements as predictions of future events. For a discussion of these and other risks and uncertainties, and other important factors, any of which could cause our actual results to differ from those contained in the forward-looking statements, see the section entitled "Risk Factors" in our most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission, as well as discussions of potential risks, uncertainties, and other important factors in our other subsequent filings with the Securities and Exchange Commission. The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. We caution you not to place undue reliance on the forward-looking statements contained in this presentation. This presentation discusses product candidates that are under preclinical or clinical evaluation and that have not yet been approved for marketing by the U.S. Food and Drug Administration or any other regulatory authority. Until finalized in a clinical study report, clinical trial data presented herein remain subject to adjustment as a result of clinical site audits and other review processes. No representation is made as to the safety or effectiveness of these product candidates for the use for which such product candidates are being studied. This presentation shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or other jurisdiction.

Aura Biosciences Highlights Novel Platform to Treat Multiple Solid Tumors Developing virus-like drug conjugates (VDCs) that bind to tumor specific HSPGs* to deliver a therapeutic payload Targeting multiple solid tumor indications including ocular and bladder cancers Ocular Oncology Franchise Multi-billion-dollar addressable market opportunity Invasive standard of care that may lead to blindness and loss of eye Clinical proof of concept with two routes of administration Choroidal Melanoma: Startup activities ongoing for the global Phase 3 trial Choroidal Metastasis: Open IND and plan to initiate Phase 2 trial in 2024 Urologic Oncology Franchise Durable complete responses and improved survival in in vivo bladder cancer models Synergy with checkpoint inhibitors (durable immunologic memory) Ongoing enrollment of Phase 1 trial Strong Cash Position Cash runway to fund operations into 2H 2025 *VDCs bind to a subset of modified tumor associated glycosaminoglycans (GAGs) that are part of the heparan sulphate chain of HSPGs. Schiller et al. Viruses 2022, 14(8), 1656

Pipeline Targeting Life-Threatening Cancers with High Unmet Needs Program OTHER SOLID TUMORS OCULAR ONCOLOGY Preclinical Phase 1 Phase 2 Phase 3 Planned Milestones Choroidal Metastasis (Multiple primary cancers with metastasis in the eye e.g. Breast and Lung) Primary Choroidal Melanoma (Suprachoroidal administration) Cancers of the Ocular Surface Non-Muscle Invasive Bladder Cancer Other HSPG* Expressing Tumors (e.g., Cutaneous melanoma, HNSCC) 2H 2023 – FPI Phase 3 trial 2H 2023 – ~12 mos. Phase 2 data 2024 – Phase 2 data 2024 – Phase 1 data Global Commercial Rights for All Product Candidate Indications *VDCs bind to a subset of modified tumor associated glycosaminoglycans (GAGs) that are part of the heparan sulphate chain of HSPGs. Schiller et al. Viruses 2022, 14(8), 1656

Targeted Oncology Platform: Virus-Like Drug Conjugates (VDCs) Virus-Like Particle Conjugated to a Cytotoxic Payload Selective Binding to Tumor Associated HSPGs* Virus-Like Particle (VLP) Virus-Like Drug Conjugate (VDC) Cx Cytotoxic Drug Kines et al; International Journal of Cancer, 138;901–911, February 2016; Kines et al; Molecular Cancer Therapeutics, 17(2) February 2018; Kines et al; Cancer Immunology Research, May 2021 Potential Key Differentiation: Potency, Multivalent Binding and Selectivity Potential Treatment of Multiple Solid Tumors *VDCs bind to a subset of modified tumor associated glycosaminoglycans (GAGs) that are part of the heparan sulphate chain of HSPGs. Schiller et al. Viruses 2022, 14(8), 1656

Bel-sar is a VDC with a Novel Dual Mechanism of Action Light Activatable Drug Bel-sar Bel-sar is a novel VDC that consists of VLP conjugated to ~200 molecules of light activatable drug Potential Key Differentiation: Agnostic to Genetic Mutations, Less Susceptible to Resistance Mechanisms, Long Term Anti-tumor Immunity Kines et al; Cancer Immunology Research, May 2021 VDCs bind to a subset of modified tumor associated glycosaminoglycans (GAG) that are part of the heparan sulphate chain of HSPGs. Schiller et al. Viruses 2022, 14(8), 1656 Bel-sar – Belzupacap Sarotalocan Reactive oxygen species disrupts cell membrane and organelles

Ocular Oncology�Franchise Bel-sar INN: belzupacap sarotalocan Target Indications: Early-Stage Choroidal Melanoma Choroidal Metastasis Other Ocular Cancers

Primary Choroidal Melanoma – High Unmet Medical Need with No Drugs Approved Choroidal Melanoma is a Rare and Life-Threatening Ocular Cancer Kaliki et al; Eye (Lond) 2017 Feb; 31(2): 241–257; Clearview & Putnam & Assoc. Market Research; Source: Peddada. J Contemp Brachytherapy. August 2019 Most common primary intraocular cancer in adults Impacts 11,000 patients in US/Europe per year ~80% patients diagnosed with early-stage disease Melanoma cells Melanocytic Lesion Benign nevus cells Standard of Care is Radiotherapy or Enucleation Blindness, Eye Loss, and Disfiguration The choroid is the part of the uvea that is behind the retina

Bel-sar has the Potential to be the First Approved Therapy in Primary Choroidal Melanoma No radioactive co-morbidities Preservation of vision Local tumor control Opportunity to treat early �and reduce risk of metastases Improvement in safety �and quality of life intravitreal suprachoroidal Bel-sar is Delivered by Simple Intravitreal or Suprachoroidal Injection Goals of Treatment Light Activation with Standard Ophthalmic Laser Bel-sar – Belzupacap Sarotalocan

Ocular Oncology Franchise Represents a Multi-Billion Dollar Addressable Market Opportunity Ocular Oncology Franchise total addressable market ~80% of patients are diagnosed at the early stage (indeterminate lesions (ILs) and small tumors) Current radiotherapy treatment Leaves ~70% of patients with major irreversible vision loss within 5-10 years ~100 Ocular Oncologists in US/EU — focused call point <20 Field Based Team Intend to add small sales force�to launch globally 33,500 ClearView & Putnam & Assoc. Epidemiology Analysis Choroidal Melanoma and Choroidal Metastasis American Cancer Society- Retinoblastoma statistics Batsi et al Cornea 2003 Ocular Surface squamous neoplasia: a review Multibillion $ addressable market opportunity Cancers of the Ocular Surface Retinoblastoma Choroidal Melanoma Choroidal Metastasis 11,000 patients/year 20,000 patients/year 500 patients/year 2,000 patients/year 11,000 Choroidal Melanoma patients diagnosed each year (US/EU) Initial Indication Follow-on Indication

No Drugs Approved and No Known Competition in Early-Stage Disease Plaque Brachytherapy Proton Beam Plaque Brachytherapy Proton Beam Watch & Wait Chemotherapy Enucleation 80% ~ 9000 patients Diagnosed with Early-Stage Disease: Indeterminate Lesions and Small Melanomas CM – Choroidal Melanoma Initial Path to Market Aura’s Bel-Sar in Phase 3 development as the potential to be the first approved first line treatment in Primary Choroidal Melanoma Ideaya’s Darovasertib Phase 2 development for Metastatic and (Neo)/adjuvant Uveal Melanoma Immunocore’s Kimmtrack approved to treat patients with Metastatic Uveal Melanoma Aura’s Bel-Sar has the potential to expand into medium 11,000 patients with Choroidal Melanoma diagnosed each year in US/EU Medium Large Metastatic

Goal for Bel-sar: Eliminate Malignant Cells in the Choroid and �Preserve Vision Endpoint Endpoint Definitions Tumor Progression Growth in Tumor Height ≥0.5mm or ≥1.5 mm in Largest Basal Diameter (LBD) Visual Acuity Failure Decrease from baseline: ≥15 letters Tumor Thickness Growth Rate Change in tumor height over time Bel-sar – Belzupacap Sarotalocan Key Endpoints Aligned with Clinical Practice and FDA Objective of Treatment is to Obtain a Local Cure with Visual Acuity Preservation Similar to Current Clinical Practice with Radiotherapy - Local Tumor Control is Equivalent to a Local Cure

Ph 2 Trial - Evaluating Suprachoroidal Administration to Determine Optimal Administration Route Ph2 SC Trial Design – Enrollment Complete *2 subjects were planned; third subject was additionally enrolled due to dose error in 1 subject ClinicalTrials.gov Identifier: NCT04417530 ; AU-011-202 Interim Data- January 10, 2023; Last two subjects enrolled after data cut not included in dataset SC – Suprachoroidal; LBD – Largest Basal Diameter Goal: To Determine Safety, Optimal Dose and Therapeutic Regimen with Suprachoroidal Administration One Cycle = Doses on days 1, 8, and 15 1 dose- 20 μg x 1 Laser 1 dose- 40 μg x 1 Laser 1 dose- 40 μg x 2 Lasers 2 doses- 40 μg �x 2 Lasers QWx2 Cohort 1 (n=1) Cohort 2 (n=3*) Cohort 3 (n=2) Cohort 4 (n=3) Cohort 5 9 doses- 80 μg �x 2 Lasers QWx3 3 cycles Cohort 6 (n=up to 10) 2 Cycles (n=1) 3 Cycles (n=2) 1- 2 Doses (n=9) (Sub-Therapeutic Regimen) 6 Doses 2 Cycles (n=1) 9 Doses 3 Cycles (Therapeutic Regimen) n=9 Enrollment Criteria Representative of Early-Stage Disease: Indeterminate lesions and small choroidal melanomas Enrichment Strategy with active growth: Tumor thickness ≥0.5 mm and ≤2.5 mm LBD ≤10 mm Active tumor growth (≥0.3mm) within 2 years of screening Same criteria as the planned Phase 3 6-9 doses- 40 μg �x 2 Lasers QWx3 Up to 3 cycles

Ph 2 Interim Tumor Control Rates Demonstrated a Dose Response Tumor Progression: change from baseline in thickness ≥0.5mm; or in LBD ≥1.5mm confirmed by at least one repeat assessment Interim Data- January 10, 2023; Last two subjects enrolled after data cut not included in dataset Populations Total Patients (n) Tumor Control Rate Average Follow-up (months) All Doses/Regimens All Treated Patients 20 55% (11/20) 9 Lower Doses/Regimens Up to 2 Cycles (20µg-40µg) 10 20% (2/10) 10 Highest Doses/Regimens*+ 3 Cycles (n=9) 40µg (n=2)/80µg (n=7) 9 89% (8/9) 8 Average 8-10 Months of Follow Up *One subject in C6 who discontinued after 1 cycle due to unrelated SAEs is not included +Assigned regimen of 3 cycles (Cohort 6) and Cohort 5 subjects who received 3 cycles, each cycle comprised of 3 once/week treatments of 40µg x 2 Laser or 80µg x 2 Laser Lower dose regimens (n=10) include cohorts 1-4 and 1 patient in Cohort 5 that received 2 cycles Dose Response Observed with Interim Tumor Control Rates Demonstrated Meaningful Clinical Benefit Dose Response: Lower Regimens vs. 3 Cycle Regimens LBD – Largest Basal Diameter Up to 2 cycles regimens (n=10) 3 cycle regimens (n=9) 89% 20%

Ph 2 Interim Analysis Demonstrated Tumor Control Rate 89%-100% Ph 2 Interim Analysis Demonstrated Tumor Control Rate of 100% in Planned Ph 3 Population^ Tumor Progression: change from baseline in thickness ≥0.5mm; or in LBD ≥1.5mm confirmed by at least one repeat assessment; Interim Data- January 10, 2023; Last two subjects enrolled after data cut not included in dataset ; post-SOC data not included Progression Definition based on Tumor Thickness (Increase ≥0.5mm) Subject 015-2029 had circumpapillary tumor – similar subjects will be excluded from Phase 3 trial 89%-100% Tumor Control Rate: Active Growth and Therapeutic Regimen (3 cycles) Change from Baseline in Tumor Thickness Over 12 Months Treatment Timeframe Follow-up Timeframe Change from Baseline in Tumor Thickness (mm) Bel-sar – Belzupacap Sarotalocan Bel-sar treatment cycles Populations Total Patients (n) Tumor Control Rate Average Follow-up (months) Highest Doses/Regimens 3 Cycles (n=9) 40µg (n=2)/80µg (n=7) 9 89% (8/9) 8 Highest Doses/Regimens - Planned Phase 3^ 3 Cycles (n=8) 40µg (n=2)/80µg (n=6) 8 100% (8/8) 9 Average 8-9 Months of Follow Up One subject in C6 who discontinued after 1 cycle due to unrelated SAEs is not included Assigned regimen of 3 cycles (Cohort 6) and Cohort 5 subjects who received 3 cycles, each cycle comprised of 3 once/week treatments of 40µg x 2 Laser or 80µg x 2 Laser ^ One subject in C6 with circumpapillary tumor not included (similar subjects not planned in Phase 3 trial)

Ph 2 Interim Analysis Demonstrated Visual Acuity Preservation ~90% Interim Data Demonstrated High Vision Preservation Rates Across All Groups Including Patients at High Risk for Vision Loss SC – Suprachoroidal Populations Total Patients (n) Vision Failures (n) Vision Preservation Rate Mean Change from Baseline at Last Visit (letters) Average Follow-up (months) All Dose Cohorts All Treated Patients 20 2 90% -3.7 9 Lower Doses/Regimens Up to 2 cycles (20µg-40µg) 10 1 90% -3.2 10 Highest Doses/Regimens*+ 3 Cycles (40µg-80µg) 40µg (n=2)/80µg (n=7) 9 1 89% -4.8 8 Highest Doses/Regimens - Planned Phase 3*+ 3 Cycles (40µg-80µg)^ 40µg (n=2)/80µg (n=6) 8 1 88% -5.3 9 Vision Preservation Rates *One subject in C6 who discontinued after 1 cycle due to unrelated SAEs is not included +Assigned regimen of 3 cycles (Cohort 6) and Cohort 5 subjects who received 3 cycles, each cycle comprised of 3 once/week treatments of 40µg x 2 Laser or 80µg x 2 Laser Vision Failure confirmed loss ≥15 letters at ≥Week 39; post-SOC data not included ^7 out of 8 subjects in this subgroup were high-risk for vision loss (tumor edge ≤ 3 mm from the foveola or optic disc) Interim Data- January 10, 2023 ; Last two subjects enrolled after data cut not included in dataset

Ph 2 Interim Data Demonstrated Statistically Significant Tumor Growth �Rate Reduction Interim Data Showed Growth Arrest in Planned Phase 3 Population with a p-value of <0.0001 p=0.0001 p= <0.0001 Statistically Significant Change in Tumor Growth Rate (mm/yr): Therapeutic Regimen (3 cycles) Bel-sar – Belzupacap Sarotalocan Planned Phase 3 Historical Growth Rate (mm/yr) Excludes subject with circumpapillary tumor Bel-sar Growth Rate (mm/yr) n Historical Growth Rate (mm/yr) AU-011 Growth Rate (mm/yr) Growth Rate Reduction�(mm/yr) p-value Average Follow up (months) Highest Doses/Regimens 3 Cycles (40µg-80µg) 40µg (n=2)/80µg (n=7) 9 0.454 0.169 -0.285 0.0001 8 Highest Doses/Regimens - Planned Phase 3^ 3 Cycles (40µg-80µg) 40µg (n=2)/80µg (n=6) 8 0.382 0.093 -0.289 <0.0001 9 Tumor thickness growth rates/ slopes estimated using MMRM (random intercept and slope model for Hx and Study periods) Change in Tumor Growth After Treatment with Bel-sar One subject in C6 who discontinued after 1 cycle due to unrelated SAEs is not included Assigned regimen of 3 cycles (Cohort 6) and Cohort 5 subjects who received 3 cycles, each cycle comprised of 3 once/week treatments of 40µg x 2 Laser or 80µg x 2 Laser ^One subject in C6 with circumpapillary tumor not included (similar subjects not planned in Phase 3 trial) Interim Data- January 10, 2023; ; Last two subjects enrolled after data cut not included in dataset

Ph 2 Ongoing Tolerability Evaluation Continues to Be Favorable No Grade 3 AEs and Majority of AEs Were Transient and Resolved Without Clinical Sequelae Tolerability Profile Supports Indication as a First Line Treatment in Early-Stage Disease *J. Contemp Brachytherapy. J. 2019 Aug; 11(4): 392–397.; Arch Ophthalmol. 2000;118(9):1219-1228; Curr. Opin. Ophthalmol. 2019 May;30(3):206-214; Eye 2017 Feb;31(2):241-257�**High-Risk Subjects are those with tumors <3mm to fovea or optic nerve Adverse Event Radiotherapy* Bel-Sar+ Surgeries secondary to AEs+ (e.g., Cataracts) 40%+ 0% Radiation Retinopathy 40%+ 0% Neovascular Glaucoma 10% 0% Dry Eye Syndrome 20% 0% Strabismus 2%+ 0% Retinal Detachment 1-2% 0% Vision Loss (≥15 letters) ~70% ~10% Serious Adverse Event Radiotherapy* Bel-Sar+ Scleral Necrosis 0-5% 0% Enucleation/Eye Loss 10-15% 0% Vision Loss in High-Risk Subjects** (≥30 letters) ~90% 0%++ *Cross-trial comparison of Radiotherapy and AU-011-202 with suprachoroidal administration +Related to bel-sar or laser **75% (15/20) of patients in Ph2 SC trial were at high risk for vision loss Bel-Sar – Belzupacap Sarotalocan Table presents percentage of subjects with AEs related to bel-sar or laser by severity and overall; subjects with more than 1 AE are counted in the highest severity group Interim Data- January 10, 2023; Last two subjects enrolled after data cut not included in dataset Ongoing Phase 2 Safety Outcomes with SC Administration All Treated Subjects (n=20) Drug/Laser Related Adverse Events ≥10% Subjects Grade I Grade II Grade III Total Anterior Chamber Cell/ Inflammation 25% 0 0 25% Conjunctival Hyperemia 15% 0 0 15% Eye Pain 10% 5% 0 15% Punctate Keratitis 10% 0 0 10%

Cohort 5 Subject with Documented Tumor Growth Tumor location: Superotemporal Photograph and ultrasound at baseline TT: 1.50 mm, LBD: 8.92 mm (IRC reads) Photograph and ultrasound at 12 months TT: 1.47 mm, LBD: 8.55 mm (IRC reads) Baseline Week 4 Week 8 Week 12 Week 26 Week 39 Week 52 BCVA (letter score) 91 92 92 89 89 90 89 Durable Response to Treatment with Tumor Control & Vision Preservation at 1 Year, with 3 Cycles BCVA: best corrected visual acuity; IRC: independent reading center; LBD: largest basal diameter; TT: tumor thickness; AU-011= Bel-sar Historical and projected growth based on MMRM

Randomized Controlled Global Phase 3 Trial

Global Phase 3 Trial Design Using Suprachoroidal Administration�Fast Track and Orphan Designations Composite Time to Event Analysis - Tumor progression or visual acuity failure Tumor Growth Rate Time to Tumor Progression Primary Endpoint Key Secondary Endpoints 21 Bel-Sar – Belzupacap Sarotalocan 12 Mos Primary Efficacy Analysis Enrollment (N=~100) Randomize (2:1:2) 80 µg bel-sar treatment arm (n=40) 40 µg bel-sar treatment arm (n=20) Sham control arm (n=40) Endpoint analysis is based on the comparison between high dose arm and sham arm

Clinical Endpoints to Support Potential Approval in Alignment with Regulatory Agencies Note: Tumor Height (TH) is synonymous with Tumor Thickness; VA – Visual Acuity; Bel-sar – Belzupacap Sarotalocan Conservative Assumptions Provide >90% Power to Support Potential for a Single Global Phase 3 Trial 50% 13% Tumor Progression Assumptions Visual Acuity Failure Assumptions

Choroidal Metastasis

Ocular Oncology Franchise Represents a Multi-Billion Dollar Addressable Market Opportunity Ocular Oncology Franchise total addressable market Same Call Point as CM ~100 Ocular Oncologists in US/EU — focused call point Same Field Force as CM <20 Field Based Team Intend to add small sales force�to launch globally 33,500 ClearView & Putnam & Assoc. Epidemiology Analysis Choroidal Melanoma and Choroidal Metastasis American Cancer Society- Retinoblastoma statistics Batsi et al Cornea 2003 Ocular Surface squamous neoplasia: a review CM – Choroidal Melanoma Multibillion $ addressable market opportunity Cancers of the Ocular Surface Retinoblastoma Choroidal Melanoma Choroidal Metastasis 11,000 patients/year 20,000 patients/year 500 patients/year 2,000 patients/year 20,000 Choroidal Metastasis patients diagnosed each year (US/EU) 2x Doubles the market opportunity Initial Indication Follow-on Indication

Choroidal Metastasis is a High Unmet Medical Need Choroidal Metastasis Cause Decreased Vision and Decreased Quality of Life in Patients Fighting Metastatic Cancer Originate from Multiple Primary Cancers (e.g. Breast and Lung) 20,000/year eyes diagnosed in US 88% with choroidal location 72% unilateral and solitary Standard of Care is Radiotherapy Blindness, Eye Loss, and Disfiguration Breast 40-53% Lung 20-29% GI 4% Kidney 2% Prostate 2% Skin 2% Mathis et al. New concepts in choroidal metastasis, Progress in retinal and eye research (2019), Cohen, Ocular metastasis, Eye (2014), Shields et al. Survey of 520 eyes with uveal metastases. Ophthalmology (1997), Namad et al. Bilateral choroidal metastasis from non-small lung cancer, Case reports in oncological medicine (2014).

Tumor Regression Prolonged Survival Breast Cancer In-Vivo (Syngeneic Mouse Model, EMT-6) Tumor cells were implanted subcutaneously. AU-011 treatment was initiated when tumors reached approximately 50 mm3. Treatment consisted of a single intravenous administration of AU-011 followed 12 hours later by light activation (400 mW/cm2, 58 J/cm2). Tumor volumes were measured over time (N=8-12) Bel-sar has Demonstrated Dose-Dependent Activity for Cancer Types Known to Metastasize to the Choroid Single Administration of Bel-sar Showed Tumor Regression and Prolonged Survival in a Dose-Dependent Fashion Data Supportive of Moving into Phase 2 Trial in 2024 Savinainen et al., ARVO 2022 Abstract # 3709397; AU-011 – Bel-sar – Belzupacap Sarotalocan

Urologic Oncology Bel-sar INN: belzupacap sarotalocan Target Indications: Non-Muscle Invasive Bladder Cancer

NMIBC is a High Unmet Need with High Recurrence Rate Mechanism of Action Supports Bel-sar Opportunity as Potential Front-Line Treatment Following Initial Diagnosis and/or BCG Refractory Disease Source: Putnam Associates Primary Research & Literature Review, July 2021; NMIBC – Non-Muscle Invasive Bladder Cancer; TURBT - trans urethral resection of bladder tumor; BCG - Bacillus Calmette–Guérin; Bel-sar – Belzupacap Sarotalocan NMIBC Cross section of the bladder wall and staging of bladder cancer 422,000 New cases NMIBC/year globally 61,000 New cases/year in the US Problem Treatment Guidelines Risk Stratification Progression with no alternative option but Cystectomy Mix of Chemo / BCG High Risk (30%) Mix of TURBT + Chemo / BCG Failure of �BCG/Chemo ~40% Intermediate Risk (30%) Surveillance or TURBT + Chemo Recurrence after TURBT Low Risk (40%)

Durable CRs with Single Administration of Bel-sar in Bladder Cancer Model Data Demonstrate Robust Nonclinical Activity Supporting Development of Bel-sar as Single Agent and in Combination with Checkpoint Inhibitors Syngeneic Mouse Tumor Bladder Model (MB49 Model in C57BL/6 Mice) (N=8 -10/group) Tumor Regression Survival Survival After Re-challenge AU-011 Single Dose Treatment of Tumor Caused Anti-Tumor Immune Response and Prevented Tumor Growth After Re-Challenge Bel-sar: Belzupacap Sarotalocan; CR: Complete Responses Kines et al. Can Immunol Res 9(6):693-706, 2021

Novel Approach using Local Administration Ongoing Phase 1 Trial Designed to Establish Safety and Optimize Administration Local Administration and Light Activation into the Bladder with Standard Cystoscope Bel-sar, AU-011 – Belzupacap Sarotalocan 30 Bel-sar will be administered locally and activated with light using standard cystoscope Study Design and Objectives Bel-sar alone Part 1 Part 2 Safety Feasibility Distribution Safety Feasibility Distribution Biological Activity Bel-sar + Focal Light activation

Bel-Sar is a Clinical Asset with a Multibillion Dollar Market Opportunity in Non-Muscle Invasive Bladder Cancer NMIBC is High Unmet Need High Incidence globally >400,000 patients/year Rate of recurrence is high Bel-Sar’s MoA Well Suited to NMIBC Strong precedent for immune-activators in NMIBC (BCG) Bladder tumors physically accessible via cystoscope (injection, laser) Robust Nonclinical Data Package Durable CRs and improved survival in in vivo bladder cancer models Synergy with checkpoint inhibitors (durable immunologic memory) Read Through from Ocular Clinical Proof of Concept Two clinical trials demonstrate robust efficacy in Ocular Oncology Initiating global Ph 3 trial in choroidal melanoma Phase 1 Study Ongoing Initial data available in 2024 CR – complete responses; BCG - Bacillus Calmette–Guérin

Strategy & Key Milestones

Aura Biosciences Investment Highlights Technology Platform Clinical Data Highlights 2023 Milestones Key Highlights Virus-like Drug Conjugates Novel class of cancer therapies - tumor specific cytotoxicity combined with immune activation Targeting multiple solid tumor indications initially focusing on ocular and urologic cancers Ocular Oncology Franchise: Positive data in completed Phase 2 trial (IVT) Positive interim data in ongoing Phase 2 trial (SC) Startup activities ongoing for the global Phase 3 trial Urologic Oncology Franchise: Enrolling patients in Phase 1 trial in NMIBC Primary Choroidal Melanoma: 2H 2023: Dose first patient in global Phase 3 trial 2H 2023: Phase 2 SC Data Choroidal Metastasis: 2024: Phase 2 data Non-Muscle Invasive Bladder Cancer: 2024: Phase 1 data Strong Phase 2 Clinical Proof of Concept in CM Startup Activities Ongoing -Phase 3 Trial to Support Registration in CM Multi-Billion Dollar Market Opportunity Strong Cash Position CM – Choroidal Melanoma

v3.23.2

Document And Entity Information

|

Aug. 09, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 09, 2023

|

| Entity Registrant Name |

Aura Biosciences, Inc.

|

| Entity Central Index Key |

0001501796

|

| Entity Emerging Growth Company |

true

|

| Securities Act File Number |

001-40971

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

32-0271970

|

| Entity Address, Address Line One |

80 Guest Street

|

| Entity Address, City or Town |

Boston

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02135

|

| City Area Code |

617

|

| Local Phone Number |

500-8864

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Ex Transition Period |

false

|

| Title of 12(b) Security |

Common Stock, $0.00001 par value per share

|

| Trading Symbol |

AURA

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

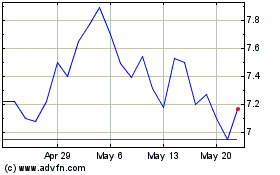

Aura Biosciences (NASDAQ:AURA)

Historical Stock Chart

From Apr 2024 to May 2024

Aura Biosciences (NASDAQ:AURA)

Historical Stock Chart

From May 2023 to May 2024