Filed Pursuant to Rule 424(b)(3)

Registration No. 333-275441

PROSPECTUS SUPPLEMENT NO. 2

(To Prospectus Dated February 2, 2024)

AUDDIA INC.

2,105,263 Post Split Shares of Common Stock

This prospectus supplement No. 1 updates, amends

and supplements the prospectus dated February 2, 2024 (the “Prospectus”), relating to the offering and resale by White Lion

Capital LLC (“White Lion” or the “Selling Securityholder”) of up to 2,105,263 shares (after the reverse stock

split effective on February 26, 2024) of our common stock, par value $0.001 per share.

The shares of common stock being offered by the

Selling Securityholder have been or may be issued and sold to the Selling Securityholder pursuant to the purchase agreement (the “Purchase

Agreement”) effective as of November 6, 2024, that we entered into with White Lion. See “The White Lion Transaction”

in the Prospectus for a description of the Purchase Agreement and “Selling Securityholder” for additional information regarding

White Lion.

This prospectus supplement incorporates into our

prospectus the information contained in our Press Release dated March 7, 2024, which is attached.

As described in the attached Press Release, the Company has terminated

its previously announced purchase agreement for the proposed acquisition by the Company of Radio FM, a leading AM/FM radio streaming app.

As a result, the Company will not pursue its pending public offering

which sought to obtain the financing needed to purchase Radio FM. The Company will withdraw its pending registration statement on Form

S-1 (File No. 333-276723) which registration statement related to the financing for the proposed Radio FM acquisition.

You should read this prospectus supplement in

conjunction with the Prospectus, including any supplements and amendments thereto. This prospectus supplement is qualified by reference

to the Prospectus except to the extent that the information in the prospectus supplement supersedes the information contained in the Prospectus.

This prospectus supplement is not complete without,

and may not be delivered or utilized except in connection with, the Prospectus, including any supplements and amendments thereto.

You should carefully consider matters discussed under the caption

“Risk Factors” beginning on page 18 of the Prospectus.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of the Prospectus

or this prospectus supplement. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is March

7, 2024.

Auddia Announces Withdrawal of S-1 to Finance

Acquisition of Radio FM

Continuing to pursue the two AM/FM streaming

radio targets under LOI that are more favorably priced

Expects to reengage with Radio FM after other

targets are acquired and conditions improve for a larger transaction

BOULDER, CO / March 7, 2024 / Auddia

Inc. (NASDAQ:AUUD) (NASDAQ:AUUDW) (“Auddia” or the “Company”), a proprietary AI platform for audio identification,

classification and related technologies, reinventing how consumers engage with AM/FM radio, podcasts, and other audio content, today announced

the withdrawal of the S-1 on file to secure the financing to acquire Radio FM, a leading AM/FM radio streaming app.

“We have been pursuing an aggressive AM/FM streaming app acquisition

strategy by negotiating with three targets simultaneously,” said Jeff Thramann, Executive Chairman of Auddia. “It is now clear

that market conditions are unfavorable for securing the largest acquisition as our first target. As such, to optimize shareholder value

we are withdrawing the current S-1 on file that contemplates the Radio FM acquisition.”

The Company expects to continue to advance discussions with the remaining

two targets under LOI and reiterates that a purchase agreement for target #2 is expected to be signed in Q2.

John Mahoney, CFO of Auddia, added, “As we executed the purchase

agreement for Radio FM and began to explore financing options in the current market, it became clear that a far more capital efficient

process would be to proceed with acquiring target #2 followed by target #3, both of which require substantially less cash at closing.

Once these targets are successfully integrated and synergies are demonstrated, we will be in a stronger position to pursue larger opportunities

in our space.”

The current purchase agreement has been terminated and the Company

plans to reengage with Radio FM in the future should the opportunity arise.

About Auddia Inc.

Auddia, through its proprietary AI platform for audio identification

and classification and related technologies, is reinventing how consumers engage with AM/FM radio, podcasts, and other audio content.

Auddia’s flagship audio superapp, called faidr, brings two industry firsts to the audio-streaming landscape: subscription-based,

ad-free listening on any AM/FM radio station and podcasts with interactive digital feeds that support deeper stories and open untapped

revenue streams to podcasters. faidr also delivers exclusive content and playlists, and showcases exciting new artists, hand-picked by

curators and DJs. Both differentiated offerings address large and rapidly growing audiences with strong purchase intent. For more information,

visit: www.auddia.com

Forward-Looking Statements

This press release contains forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange

Act of 1934 about the Company's current expectations about future results, performance, prospects and opportunities. Statements that are

not historical facts, such as "anticipates," "believes" and "expects" or similar expressions, are forward-looking

statements. These forward-looking statements are based on the current plans and expectations of management and are subject to a number

of uncertainties and risks that could significantly affect the Company's current plans and expectations, as well as future results of

operations and financial condition. These and other risks and uncertainties are discussed more fully in our filings with the Securities

and Exchange Commission. Readers are encouraged to review the section titled "Risk Factors" in the Company's Annual Report on

Form 10-K for the year ended December 31, 2022, as well as other disclosures contained in the Annual Report and subsequent filings made

with the Securities and Exchange Commission. Forward-looking statements contained in this announcement are made as of this date and the

Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information,

future events or otherwise.

Investor Relations:

Kirin Smith, President

PCG Advisory, Inc.

ksmith@pcgadvisory.com

www.pcgadvisory.com

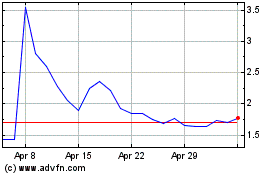

Auddia (NASDAQ:AUUD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Auddia (NASDAQ:AUUD)

Historical Stock Chart

From Apr 2023 to Apr 2024