BENTONVILLE, Ark., June 28 /PRNewswire-FirstCall/ -- America's

Car-Mart, Inc. (NASDAQ:CRMT) today announced its operating results

for the fourth fiscal quarter and year ended April 30, 2007.

Highlights of fourth quarter operating results: -- Revenue decline

of 5.1% -- Interest income growth of 8.1% -- Net income of $2.1

million ($.17 per diluted share). Net income for the quarter was

aided by an effective income tax rate of 8.3%. -- Retail unit sales

decrease of 16.6% -- Accounts over 30 days past due down to 3.4% at

April 30, 2007 compared to 3.7% at April 30, 2006 (down from 5.6%,

5.4% and 3.8% at the end of the three prior fiscal 2007 quarter

ends) -- Finance receivables, net, of $139 million as of April 30,

2007, as compared to $149 million as of April 30, 2006.Total

provision for loan losses of $14.2 million or 26.6% of sales, for

the three months ended April 30, 2007, as compared to total

provision for loan losses of $11.2 million, or 19.6% of sales, for

the three months ended April 30, 2006 For the three months ended

April 30, 2007, revenues decreased 5.1% to $59.3 million compared

with $62.5 million in the same period of the prior year. The $2.1

million net income for the current quarter compares to $4.6 million

net income ($.38 per diluted share) for the same period in the

prior year. Retail unit sales decreased 16.6% to 5,917 vehicles in

the current quarter, compared to 7,096 in the same period last

year. Accounts over 30 days past due decreased to 3.4% compared to

3.7% at April 30, 2006 and compared to 3.8% at January 31, 2007

(the end of the Company's third fiscal quarter). On May 8, 2007,

the Company received notification from the Internal Revenue Service

that the Company would not be assessed any additional taxes,

penalties or interest related to the on-going audits of the

Company's two primary operating subsidiaries. Based upon the

favorable notification, the Company recognized $500,000 of net

income in the fourth quarter for the elimination of associated tax

reserves ($.04 per share). Additionally, a favorable state tax law

change had the effect of decreasing the Company's effective income

taxes by approximately $150,000 in the fourth quarter ($.01 per

share). Highlights of twelve month operating results: -- Revenue

growth of 2.6% -- Interest income growth of 18.8% -- Earnings of

$.35 per diluted share including a $.28 per diluted share charge to

increase the allowance for loan losses at October 31, 2006 and

including a $.05 per diluted share benefit related to an overall

26% effective income tax rate for the year -- Retail unit sales

decrease of 8.1% -- Same store revenue decrease of 3.2% -- Total

provision for loan losses of $63.1 million, or 29.1%, for the

twelve months ended April 30, 2007, as compared to total provision

for loan losses of $45.8 million, or 21.4%, for the twelvemonths

ended April 30, 2006 For the twelve months ended April 30, 2007,

revenues increased 2.6% to $240 million, compared with $234 million

for fiscal 2006. Income for fiscal 2007 was $4.2 million ($.35 per

diluted share) compared to $16.7 million ($1.39 per diluted share)

for fiscal 2006. Excluding the effects of the non- cash increase in

the allowance for loan losses in the second quarter and excluding

the effects of the favorable income tax results recognized during

the fourth quarter, the Company earned profits of $6.96 million

($.58 per diluted share) for fiscal 2007. The Company's Allowance

for Loan Losses is 22% of Finance Receivables at April 30, 2007,

compared to 19.2% at April 30, 2006. The increased percentage

equates to approximately $5.0 million in net non-cash additions to

the allowance to cover future credit losses (with $10 million less

in finance receivables, net compared to the prior year-end). Retail

unit sales decreased 8.1% to 25,199 vehicles for fiscal 2007,

compared to 27,415 vehicles for fiscal 2006. "As we discussed in

our second and third quarter comments, we have put in place

numerous initiatives to enhance the quality of our accounts

receivable portfolio," said T. J. ("Skip") Falgout, III, Chairman

and Chief Executive Officer of America's Car Mart. "We have been

focused on improving credit quality and, by slowing our new store

growth, we can all allocate more resources to improving all aspects

of credit quality and collections, with the result being increased

profitability of our existing store base prior to accelerating new

store growth. Also, our balance sheet remains strong with debt to

equity of 33% and debt to finance receivables of 23% at April 30,

2007. Cash flows from operations in the fourth quarter were very

strong allowing us to pay down an additional $2.5 million in debt."

"The decrease in retail unit sales is largely the result of our

efforts to improve the quality of our sales. In addition, the

operational initiatives which we have instituted over the recent

quarters are beginning to show some initial positive results," said

Hank Henderson, President of America's Car Mart. "For example, we

have continued to see significantly higher down payments than a

year ago, and our over-30-day delinquency numbers have remained

steady in an acceptable range. We know we have more work to do, and

more time needs to elapse to fully evaluate our initiatives, but we

remain encouraged by the results so far." As previously announced,

the Company will not provide earnings guidance as our primary goal

is to maximize long-term per share results, and management has

determined that issuing guidance is inconsistent with this goal.

Conference Call Management will be holding a conference call on

Thursday June 28, 2007 at 11:00 a.m. Eastern time to discuss fourth

quarter results. To participate, please dial (800) 309-9490.

International callers dial (706) 634-0104. Callers should dial in

approximately 10 minutes before the call begins. A conference call

replay will be available one hour following the call for seven days

and can be accessed by calling: (800) 642-1687 (U.S. Callers) or

(706) 645-9291 (International Callers), conference ID 9927407.

About America's Car-Mart America's Car-Mart operates 92 automotive

dealerships in nine states and is the largest publicly held

automotive retailer in the United States focused exclusively on the

"Buy Here/Pay Here" segment of the used car market. The Company

operates its dealerships primarily in small cities throughout the

South-Central United States selling quality used vehicles and

providing financing for substantially all of its customers. For

more information on America's Car-Mart, please visit our website at

http://www.car-mart.com/ . Included herein are forward-looking

statements, including statements with respect to projected revenues

and earnings per share amounts. Such forward- looking statements

are based upon management's current knowledge and assumptions.

There are many factors that affect management's view about future

revenues and earnings. These factors involve risks and

uncertainties that could cause actual results to differ materially

from management's present view. These factors include, without

limitation, assumptions relating to unit sales, average selling

prices, credit losses, gross margins, operating expenses,

collection results, operational initiatives underway and economic

conditions, and other risk factors described under "Forward-Looking

Statements" of Item 1A of Part I of the Company's Annual Report on

Form 10-K for the fiscal year ended April 30, 2006 and its current

and quarterly reports filed with or furnished to the Securities and

Exchange Commission. All forward-looking statements are made

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. The Company does not undertake any

obligation to update forward-looking statements. America's

Car-Mart, Inc. Consolidated Balance Sheet and Other Data (Dollars

in Thousands) April 30, April 30, 2007 2006 Cash and cash

equivalents $257 $255 Finance receivables, net $139,194 $149,379

Total assets $173,598 $177,613 Total debt $40,829 $43,588

Stockholders' equity $123,728 $119,251 Shares outstanding

11,874,708 11,848,024 Finance receivables: Principal balance

$178,519 $185,243 Allowance for credit losses (39,325)(a)

(35,864)(a) Finance receivables, net $139,194 $149,379 Allowance as

% of principal balance 22.03% 19.36% (a) Represents the weighted

average for Finance Receivables generated by the Company (at 22.0%

and 19.2%) and purchased Finance Receivables. Changes in allowance

for credit losses: Twelve Months Ended April 30, 2007 2006 Balance

at beginning of year $35,864 $29,251 Provision for credit losses

63,077 45,810 Net charge-offs (59,250) (39,724) Change in allowance

related to purchased accounts (366) 527 Balance at end of period

$39,325 $35,864 America's Car-Mart, Inc. Consolidated Results of

Operations (Operating Statement Dollars in Thousands) % Change As a

% of Sales Three Months Ended 2007 Three Months Ended April 30, vs.

April 30, 2007 2006 2006 2007 2006 Operating Data: Retail units

sold 5,917 7,096 (16.6)% Average number of stores in operation 91.7

84.7 8.3 Average retail units sold per store per month 21.5 27.9

(23.0) Average retail sales price $8,384 $7,701 8.9 Same store

revenue growth -9.5% 8.3% Period End Data: Stores open 92 85 8.2%

Accounts over 30 days past due 3.4% 3.7% Finance Receivables, gross

$178,519 $185,243 (3.6)% Operating Statement: Revenues: Sales

$53,515 $57,105 (6.3)% 100.0% 100.0% Interest income 5,781 5,346

8.1 10.8 9.4 Total 59,296 62,451 (5.1) 110.8 109.4 Costs and

expenses: Cost of sales 31,308 32,422 (3.4) 58.5 56.8 Selling,

general and administrative 10,373 10,567 (1.8) 19.4 18.5 Provision

for credit losses 14,231 11,214 26.9 26.6 19.6 Interest expense 873

723 20.7 1.6 1.3 Depreciation and amortization 269 279 (3.6) 0.5

0.5 Total 57,054 55,205 3.3 106.6 96.7 Income before taxes 2,242

7,246 4.2 12.7 Provision for income taxes 187 2,693 0.3 4.7 Net

income $2,055 $4,553 3.8 8.0 Earnings per share: Basic $0.17 $0.38

Diluted $0.17 $0.38 Weighted average number of shares outstanding:

Basic 11,853,317 11,846,063 Diluted 11,940,202 11,991,375 America's

Car-Mart, Inc. Consolidated Results of Operations (Operating

Statement Dollars in Thousands) % Change As a % of Sales Twelve

Months Ended 2007 Twelve Months Ended April 30, vs. April 30, 2007

2006 2006 2007 2006 Operating Data: Retail units sold 25,199 27,415

(8.1)% Average number of stores in operation 89.7 81.5 10.1 Average

retail units sold per store per month 23.4 28.0 (16.5) Average

retail sales price $8,125 $7,494 8.4 Same store revenue growth

-3.2% 9.8% Period End Data: Stores open 92 85 8.2% Accounts over 30

days past due 3.4% 3.7% Finance Receivables, gross $178,519

$185,243 (3.6)% Operating Statement: Revenues: Sales $216,898

$214,482 1.1% 100.0% 100.0% Interest income 23,436 19,725 18.8 10.8

9.2 Total 240,334 234,207 2.6 110.8 109.2 Costs and expenses: Cost

of sales 125,073 119,433 4.7 57.7 55.7 Selling, general and

administrative 41,778 39,261 6.4 19.3 18.3 Provision for credit

losses 63,077 45,810 37.7 29.1 21.4 Interest expense 3,728 2,458

51.7 1.7 1.1 Depreciation and amortization 994 724 37.3 0.5 0.3

Total 234,650 207,686 13.0 108.2 96.8 Income before taxes 5,684

26,521 2.6 12.4 Provision for income taxes 1,452 9,816 0.7 4.6 Net

income $4,232 $16,705 2.0 7.8 Earnings per share: Basic $0.36 $1.41

Diluted $0.35 $1.39 Weighted average number of shares outstanding:

Basic 11,850,247 11,852,804 Diluted 11,953,987 12,018,541

DATASOURCE: America's Car-Mart, Inc. CONTACT: T.J. ("Skip")

Falgout, III, CEO, +1-972-717-3423, or Jeffrey A. Williams, CFO,

+1-479-418-8021, both of America's Car-Mart Web site:

http://www.car-mart.com/

Copyright

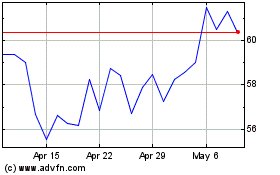

Americas Car Mart (NASDAQ:CRMT)

Historical Stock Chart

From Jun 2024 to Jul 2024

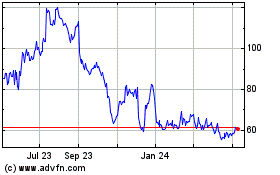

Americas Car Mart (NASDAQ:CRMT)

Historical Stock Chart

From Jul 2023 to Jul 2024