Statement of Ownership (sc 13g)

February 16 2021 - 2:52PM

Edgar (US Regulatory)

United States

Securities and Exchange Commission

Washington, D.C. 20549

Schedule 13G

(Rule 13d-102)

Information to be Included in Statements Filed Pursuant

to § 240.13d-1(b), (c) and (d) and Amendments Thereto Filed

Pursuant to § 240.13d-2

UNDER THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )*

Airbnb, Inc.

(Name of Issuer)

Class A Common Stock, $0.0001 par value per share

(Title of Class of Securities)

009066101

(CUSIP Number)

December 31, 2020

(Date of Event Which Requires Filing of this Statement)

Check the appropriate box to

designate the rule pursuant to which this Schedule is filed:

☐ Rule 13d-1(b)

☐ Rule 13d-1(c)

☒

Rule 13d-1(d)

|

*

|

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form

with respect to the subject class of securities, and for any subsequent amendment containing information which would alter the disclosures provided in a prior cover page.

|

The information required in the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

|

|

CUSIP No. 009066101

|

|

Schedule 13G

|

|

Page

2

of 6

|

|

|

|

|

|

|

|

|

|

1

|

|

Names of

Reporting Persons

Joseph Gebbia

|

|

2

|

|

Check the Appropriate Box if a Member

of a Group

(a) ☒ (b) ☐

|

|

3

|

|

SEC Use Only

|

|

4

|

|

Citizenship or Place of

Organization

United

States

|

|

|

|

|

|

|

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With

|

|

5

|

|

Sole Voting Power

69,562,193

|

|

|

6

|

|

Shared Voting Power

0

|

|

|

7

|

|

Sole Dispositive Power

69,562,193

|

|

|

8

|

|

Shared Dispositive Power

0

|

|

|

|

|

|

|

|

|

|

9

|

|

Aggregate Amount Beneficially Owned by Each Reporting Person

69,562,193

|

|

10

|

|

Check if the Aggregate Amount in Row

(9) Excludes Certain Shares

Not Applicable

|

|

11

|

|

Percent of Class Represented by

Amount in Row 9

37.6%

|

|

12

|

|

Type of Reporting Person

IN

|

|

|

|

|

|

|

|

CUSIP No. 009066101

|

|

Schedule 13G

|

|

Page

3

of 6

|

|

|

|

|

|

ITEM 1. (a)

|

|

Name of Issuer:

|

|

|

|

Airbnb, Inc. (the

“Issuer”).

|

|

|

|

|

(b)

|

|

Address of Issuer’s Principal Executive Offices:

|

|

|

|

|

|

|

888 Brannan Street, San Francisco, California 94103

|

|

|

|

|

ITEM 2. (a)

|

|

Name of Person Filing:

|

|

|

|

|

|

|

This statement is filed on behalf of Joseph Gebbia (the “Reporting Person”).

|

|

|

|

|

(b)

|

|

Address or Principal Business Office:

|

|

|

|

|

|

|

The business address of the Reporting Person is 888 Brannan Street, San Francisco, California 94103.

|

|

|

|

|

(c)

|

|

Citizenship of each Reporting Person is:

|

|

|

|

|

|

|

The Reporting Person is a citizen of the United States.

|

|

|

|

|

(d)

|

|

Title of Class of Securities:

|

|

|

|

|

|

|

Class A Common Stock, par value $0.0001 per share (“Class A Common Stock”).

|

|

|

|

|

(e)

|

|

CUSIP Number:

|

|

|

|

|

|

|

009066101

|

Not applicable.

The ownership information below represents beneficial ownership of Class A Common Stock of the Issuer as of December 31, 2020, based

upon 115,499,875 shares of Class A Common Stock outstanding as of December 31, 2020, as provided by the Issuer. The information below assumes the conversion of the Class B common stock, par value $0.0001 per share (“Class B

Common Stock”) of the Issuer held by the Reporting Person into shares of Class A Common Stock of the Issuer on a one-to-one basis.

|

|

|

|

|

|

|

CUSIP No. 009066101

|

|

Schedule 13G

|

|

Page

4

of 6

|

|

|

|

|

|

(a)

|

|

Amount beneficially owned:

|

|

|

|

The Reporting Person is deemed to be the

beneficial owner of 69,562,193 shares of Class A Common Stock, which includes: (i) 6,628 shares of Class A Common Stock held of record by the Reporting Person, (ii) 18,629 shares of Class A Common Stock issuable to the Reporting

Person upon vesting of Restricted Stock Units that will vest on or before March 1, 2021, (iii) 61,064,821 shares of Class A Common Stock issuable upon conversion of 61,064,821 shares of Class B Common Stock held in trusts over which

the Reporting Person has investment discretion; (iv) 6,092,400 shares of Class A Common Stock issuable upon conversion of 6,092,400 shares of Class B Common Stock held by limited liability companies over which the Reporting Person has

investment discretion; (v) 2,298,144 shares of Class A Common Stock issuable upon conversion of 2,298,144 shares of Class B Common Stock subject to a stock option currently exercisable by the Reporting Person; and (vi) 81,571 shares

of Class A Common Stock subject to stock options held by the Reporting Person exercisable on or before March 1, 2021.

|

|

|

|

|

(b)

|

|

Percent of class: 37.6%

|

|

|

|

|

(c)

|

|

Number of shares as to which the person has:

|

|

|

|

|

|

|

(i) Sole power to vote or to direct the vote: 69,562,193

(ii) Shared power to vote or direct the vote: 0

(iii) Sole power to dispose or to direct the disposition of: 69,562,193

(iv) Shared power to dispose or to direct the disposition of: 0

|

|

ITEM 5.

|

Ownership of Five Percent or Less of a Class.

|

Not applicable.

|

ITEM 6.

|

Ownership of More than Five Percent on Behalf of Another Person.

|

Not applicable.

|

ITEM 7.

|

Identification and Classification of the Subsidiary Which Acquired the Security Being Reported on By the

Parent Holding Company.

|

Not applicable.

|

ITEM 8.

|

Identification and Classification of Members of the Group.

|

Pursuant to the Voting Agreement, dated as of December 4, 2020, by and among the Reporting Person, Brian Chesky, Nathan Blecharczyk, and

certain affiliated trusts and entities described therein (the “Voting Agreement”), the parties to the Voting Agreement may be deemed to constitute a group for purposes of Rule 13d-3 under the

Securities and Exchange Act of 1934, as amended. The Reporting Person disclaims beneficial ownership of the securities beneficially owned by the other parties to the Voting Agreement.

|

|

|

|

|

|

|

CUSIP No. 009066101

|

|

Schedule 13G

|

|

Page

5

of 6

|

|

ITEM 9.

|

Notice of Dissolution of Group.

|

Not applicable.

Not applicable.

|

|

|

|

|

|

|

CUSIP No. 009066101

|

|

Schedule 13G

|

|

Page

6

of 6

|

SIGNATURE

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: February 12, 2021

|

|

|

Joseph Gebbia

|

|

|

|

/s/ Joseph Gebbia

|

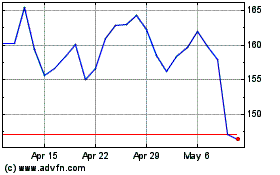

Airbnb (NASDAQ:ABNB)

Historical Stock Chart

From Mar 2024 to Apr 2024

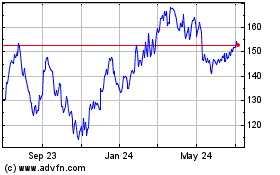

Airbnb (NASDAQ:ABNB)

Historical Stock Chart

From Apr 2023 to Apr 2024