Ameristar Reports Financial Results for the Third Quarter of 2003

LAS VEGAS, Oct. 28 /PRNewswire-FirstCall/ -- Ameristar Casinos,

Inc. today announced results for the third quarter of 2003. Third

quarter 2003 highlights: * Record net revenues of $201.5 million,

an increase of $14.3 million, or 7.6%, from the third quarter of

2002. * Operating income of $34.2 million and EBITDA (a non-GAAP

financial measure which is defined and reconciled with operating

income below) of $50.1 million, representing increases of 34.8% and

28.5%, respectively, from the third quarter of 2002. Operating

income and EBITDA included charges of $1.3 million related to the

introduction of the "All New Ameristar Kansas City" and $0.9

million associated with the unsuccessful pursuit of a corporate

acquisition. * Net income of $11.9 million, a 60.4% increase from

$7.4 million for the third quarter of 2002. * Diluted earnings per

share of $0.44 for the third quarter of 2003, compared to $0.28 for

the third quarter of 2002. Our previously issued estimate for

diluted earnings per share for the third quarter of 2003 was $0.47

to $0.52. Analysts' latest consensus estimate for the third quarter

of 2003, as reported by Thomson First Call, was $0.54. Diluted

earnings per share in 2003 was reduced by $0.06 per share as a

result of costs related to the introduction of the "All New

Ameristar Kansas City," the unsuccessful pursuit of the corporate

acquisition and the early retirement of long-term debt. Diluted

earnings per share benefited by $0.03 per share due to an

adjustment to the interest accrual on our senior subordinated

notes. * On September 12-14, 2003, we introduced the "All New

Ameristar Kansas City," which features a completely renovated

casino with the widespread implementation of ticket-in, ticket-out

slot machines and seven new restaurant and entertainment venues,

including the 330-seat Amerisports Brew Pub with state-of-the-art

audio and video technology. * We continued to be the leader in our

markets in the implementation of "coinless" slot technology. We

remain on target to implement "coinless" technology in 75% of the

slot machines at our riverboat properties by the end of 2003 and

approximately 100% by the end of 2004. The record revenues in the

third quarter of 2003 were driven primarily by a 20.1% increase in

revenues at Ameristar St. Charles. The new St. Charles facility,

which opened in August 2002, continued to generate strong results.

Revenues were also positively impacted by a 9.1% increase in

revenues at Council Bluffs as the property continued to extend its

market share lead. Net income and diluted earnings per share for

the third quarter of 2003 improved despite increases in net

interest expense and depreciation expense. For the three months

ended September 30, 2003, consolidated net interest expense

increased to $15.1 million from $13.9 million for the same period

in 2002 as a result of a significant reduction in capitalized

interest following the opening of the new St. Charles facility,

partially offset by a $1.4 million adjustment to our interest

accrual recorded in the third quarter of 2003. Depreciation and

amortization expense increased from $13.6 million in the third

quarter of 2002 to $15.9 million in the third quarter of 2003,

primarily due to the opening of the new St. Charles facility and

the Kansas City enhancements. Net income and diluted earnings per

share were also reduced by charges of $1.3 million related to the

introduction of the "All New Ameristar Kansas City," $0.9 million

associated with the unsuccessful pursuit of the corporate

acquisition and $0.4 million related to the early retirement of

debt. Craig H. Neilsen, Chairman and CEO, stated, "We are very

pleased with our performance in the third quarter. We continue to

benefit from the implementation of our business model and operating

strategies, including maintaining the highest quality facilities in

each of our markets and successfully executing targeted marketing

and cost management strategies. Our St. Charles, Council Bluffs,

Vicksburg and Jackpot properties continue to be market share

leaders, which contributed to our record net revenues for the

quarter. We believe Ameristar Kansas City's future financial

results will improve as occurred following the completion of the

renovation and improvement projects at Ameristar Council Bluffs and

Ameristar Vicksburg and the new facility at Ameristar St. Charles."

Ameristar St. Charles Ameristar St. Charles again posted record

results. Net revenues increased 20.1% to $66.0 million, from $55.0

million in the prior-year quarter, due to a full quarter of

operations from the new gaming, restaurant and entertainment

facilities. For the third quarter of 2003, Ameristar St. Charles'

market share increased to 31.8%, 5.0% more than in the third

quarter of 2002.(1) Ameristar St. Charles has been the market share

leader in the greater St. Louis market in each of the four quarters

since the new facility opened. Operating income increased to $15.6

million from $3.9 million, and EBITDA increased to $21.4 million

from $8.2 million, in the third quarter of 2003 compared to the

third quarter of 2002. In the third quarter of 2002, we incurred

impairment charges and pre-opening expenses totaling $4.9 million

related to the opening of the new facility. Excluding these

charges, operating income increased 78.3% and EBITDA increased

63.9% in the third quarter of 2003 compared to the prior-year

quarter. Ameristar St. Charles' operating margin improved to 23.7%

and its EBITDA margin improved to 32.5% for the third quarter of

2003. Ameristar Kansas City On September 12-14, 2003, we introduced

the "All New Ameristar Kansas City" with a free public concert by

Martina McBride, two-time Academy of Country Music top Female

Vocalist, a world-class fireworks display and other festivities.

The enhanced facility includes a completely renovated casino with

the widespread implementation of ticket-in, ticket-out slot machine

technology and a casino cabaret featuring live Las Vegas-style

entertainment. The property also features new food and

entertainment venues, including the Great Plains Cattle Co., Falcon

Diner, Depot No. 9 Stage and Bar, Pearl's Oyster Bar, the

Amerisports Brew Pub with state-of-the-art audio and video

technology and a food court with three popular national chain

outlets. Net revenues at Ameristar Kansas City remained stable at

$55.5 million in the third quarter of 2003 compared to the third

quarter of 2002 despite the significant construction disruption

from the renovation of the facility. Operating income was $9.4

million and EBITDA was $13.0 million in the third quarter of 2003,

compared to $10.1 million and $13.4 million, respectively, in the

third quarter of 2002. In the 2003 quarter, operating income and

EBITDA were impacted by $1.3 million of costs incurred to open the

new venues and to advertise, market and promote the introduction of

the "All New Ameristar Kansas City." Ameristar Council Bluffs Net

revenues at Ameristar Council Bluffs increased 9.1% to $40.3

million in the third quarter of 2003, compared to $36.9 million for

the third quarter of 2002. Ameristar Council Bluffs' market share

increased to 39.4%, compared to 38.0% in the prior-year period. The

property has now been the market share leader for 25 consecutive

months. Operating income and operating margins at Ameristar Council

Bluffs increased to $12.3 million and 30.6%, respectively, in the

third quarter of 2003 from $10.3 million and 28.0%, respectively,

in the third quarter of 2002. EBITDA grew to $14.9 million for the

third quarter of 2003, an 18.3% increase from $12.6 million for the

same period in the prior year. EBITDA margin reached a record level

of 37.0% during the third quarter of 2003. Ameristar Vicksburg

Despite continuing softness in the Vicksburg gaming market,

Ameristar Vicksburg reported an increase in net revenues of 1.4%,

to $23.6 million for the third quarter of 2003 from $23.3 million

for the third quarter of 2002. Food and beverage revenues were

negatively impacted by the renovation of the Veranda Buffet, which

is expected to be completed in December 2003. Ameristar Vicksburg

continued to maintain its long-time market leadership position,

with a 40.1% share in the third quarter of 2003. Operating income

decreased to $5.1 million for the third quarter of 2003 from $5.5

million for the third quarter of 2002. EBITDA also decreased, from

$7.8 million for the third quarter of 2002 to $7.5 million for the

third quarter of 2003. The decline in operating income and EBITDA

was primarily due to higher self-funded health insurance costs due

to a significant increase in the number of large claims. Jackpot

Properties Net revenues at the Jackpot Properties decreased $0.4

million, or 2.5%, in the third quarter of 2003 compared to the

third quarter of 2002. The Jackpot Properties' financial results

continue to be impacted by the sluggish Southern Idaho economy. The

Jackpot Properties reported operating income of $2.5 million and

EBITDA of $3.4 million for the third quarter of 2003, down 8.2% and

4.0%, respectively, from the third quarter of 2002. In addition to

lower revenues, the decreases in operating income and EBITDA are

attributable to higher general and administrative expenses. Income

tax rates Our effective income tax rate for the quarter ended

September 30, 2003 was 37.0%, compared to 33.5% for the prior-year

quarter. The federal income tax statutory rate was 35.0% in both

years. The differences from the statutory rate are due to the

effects of state income tax expense and certain expenses we

incurred that are not deductible for federal income tax purposes.

Liquidity and Capital Resources At September 30, 2003, our total

debt was $737.3 million, a decrease of $61.7 million since December

31, 2002. During the third quarter of 2003, we repaid approximately

$29.4 million of long-term debt, including a $20.0 million

prepayment of our senior credit facilities and a $1.9 million

prepayment of other long-term debt. During the fourth quarter of

2003, we will make approximately $6.0 million of mandatory

principal payments. Additionally, we intend to prepay up to $20.0

million of other long-term debt during the fourth quarter. Our cash

and cash equivalents decreased from $90.6 million at December 31,

2002 to $81.5 million at September 30, 2003. At September 30, 2003,

we had $68.5 million of available revolving borrowing capacity

under our senior credit facilities. Interest expense (net of

capitalized interest associated with our ongoing construction

projects) for the third quarter of 2003 was $15.1 million, up 8.5%

from $13.9 million for the third quarter of 2002. Total interest

cost before capitalizing interest was $15.5 million for the quarter

ended September 30, 2003, compared to $17.4 million for the quarter

ended September 30, 2002. Interest cost decreased due to a lower

weighted-average debt balance in the third quarter of 2003 compared

to the prior-year quarter as a result of mandatory and accelerated

reductions in long-term debt during 2003. Interest expense also

declined due to lower average interest rates associated with our

senior credit facilities in the third quarter 2003 compared to the

third quarter 2002 and the $1.4 million adjustment to the interest

accrual on our senior subordinated notes recorded in the

current-year quarter. Capital expenditures for 2003 will exceed the

amount currently permitted under our senior credit facilities

(approximately $73 million) due to the acceleration of our

implementation of "coinless" slots at our properties and the

renovation and improvement projects recently completed at Ameristar

Kansas City. Accordingly, we expect to seek from our lenders a

waiver of the capital expenditure limitation under our senior

credit facilities prior to the end of the year. While we do not

currently anticipate any difficulties in obtaining the waiver, no

assurances can be given that we will be able to do so. For the year

ending December 31, 2003, we expect to generate free cash flow of

$55 million to $57 million. Free cash flow is a non-GAAP financial

measure, which we define as cash flows from operations, as defined

in accordance with GAAP, less capital expenditures. The

reconciliation of estimated GAAP cash flows from operations to

estimated free cash flow is shown below. Earnings guidance for the

fourth quarter of 2003 and year ending December 31, 2003 Based on

our preliminary results of operations to date and our outlook for

the remainder of the quarter, we currently estimate consolidated

operating income of $29 million to $31 million, EBITDA of $45

million to $47 million (given anticipated depreciation expense of

$16 million) and diluted earnings per share of $0.30 to $0.34 for

the fourth quarter of 2003. For the year ending December 31, 2003,

we are revising our previously issued guidance and currently

estimate operating income of $137 million to $139 million, EBITDA

of $200 million to $202 million (given anticipated depreciation

expense of $63 million) and diluted earnings per share of $1.71 to

$1.75. Conference call We will hold a conference call to discuss

our third quarter results and guidance for the fourth quarter at

3:00 p.m. Eastern Time on October 29, 2003. The call can be

accessed live by calling (800) 361-0912. It can be replayed until

November 7, 2003 at 8 p.m. Eastern Time by calling (888) 203-1112

and using the access code number 337800. Forward-looking

information This press release contains certain forward-looking

information that generally can be identified by the context of the

statement or the use of forward-looking terminology, such as

"believes," "estimates," "anticipates," "intends," "expects,"

"plans," "is confident that" or words of similar meaning, with

reference to Ameristar or our management. Similarly, statements

that describe our future plans, objectives, strategies, financial

position, operational expectations or goals are forward-looking

statements. It is possible that our expectations may not be met due

to various factors, many of which are beyond our control, and we

therefore cannot give any assurance that such expectations will

prove to be correct. For a discussion of relevant factors, risks

and uncertainties that could materially affect our future results,

attention is directed to "Item 1. Business -- Risk Factors" and

"Item 7. Management's Discussion and Analysis of Financial

Condition and Results of Operations" in our Annual Report on Form

10-K for the year ended December 31, 2002 and "Item 2. Management's

Discussion and Analysis of Financial Condition and Results of

Operations" in our Quarterly Report on Form 10-Q for the quarter

ended June 30, 2003. About Ameristar Ameristar Casinos, Inc. is an

innovative, Las Vegas-based gaming and entertainment company known

for its distinctive, quality conscious hotel- casinos and value

orientation. Led by President and Chief Executive Officer Craig H.

Neilsen, the organization's roots go back nearly five decades to a

tiny roadside casino in the high plateau country that borders Idaho

and Nevada. Publicly held since November 1993, the Company owns and

operates six properties in Missouri, Iowa, Mississippi and Nevada,

two of which carry the prestigious American Automobile

Association's Four Diamond designation. Ameristar's Common Stock is

traded on the Nasdaq National Market under the symbol: ASCA. Visit

Ameristar Casinos' Web site at http://www.ameristarcasinos.com/

(which shall not be deemed to be incorporated in or a part of this

news release). (1) All market share information in this press

release is based on gross gaming revenues. AMERISTAR CASINOS, INC.

AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(Amounts in Thousands, Except Per Share Data) (Unaudited) Three

Months Nine Months Ended September 30, Ended September 30, 2002

2003 2002 2003 REVENUES: Casino $181,631 $194,865 $500,302 $566,752

Food and beverage 23,039 26,034 60,722 74,109 Rooms 6,492 6,602

18,629 18,123 Other 5,703 5,833 14,343 16,271 216,865 233,334

593,996 675,255 Less: Promotional allowances 29,607 31,806 77,652

90,381 Net revenues 187,258 201,528 516,344 584,874 OPERATING

EXPENSES: Casino 80,867 89,382 217,093 260,043 Food and beverage

15,477 15,730 38,512 43,760 Rooms 2,010 1,651 5,683 4,712 Other

4,488 3,307 10,403 9,216 Selling, general and administrative 39,443

41,227 108,953 111,216 Depreciation and amortization 13,602 15,888

34,024 46,666 Impairment loss 1,077 147 5,213 687 Preopening

expenses 4,925 -- 6,401 -- Total operating expenses 161,889 167,332

426,282 476,300 Income from operations 25,369 34,196 90,062 108,574

OTHER INCOME (EXPENSE): Interest income 23 71 108 282 Interest

expense (13,935) (15,115) (33,931) (48,344) Loss on early

retirement of debt -- (415) -- (415) Other (318) 126 (415) 160

INCOME BEFORE INCOME TAX PROVISION 11,139 18,863 55,824 60,257

Income tax provision 3,731 6,979 20,337 22,186 NET INCOME $7,408

$11,884 $35,487 $38,071 AMERISTAR CASINOS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME-CONTINUED (Amounts in

Thousands, Except Per Share Data) (Unaudited) Three Months Nine

Months Ended September 30, Ended September 30, 2002 2003 2002 2003

EARNINGS PER SHARE: Net income: Basic $0.28 $0.45 $1.36 $1.44

Diluted $0.28 $0.44 $1.34 $1.41 WEIGHTED AVERAGE SHARES

OUTSTANDING: Basic 26,159 26,489 26,067 26,376 Diluted 26,367

27,297 26,424 27,025 AMERISTAR CASINOS, INC. AND SUBSIDIARIES

SUMMARY CONSOLIDATED FINANCIAL DATA (Dollars in Thousands)

(Unaudited) Three Months Nine Months Ended September 30, Ended

September 30, 2002 2003 2002 2003 Consolidated cash flow

information Cash flows provided by operations $5,986 $26,110

$82,232 $112,126 Cash flows used in investing $(45,002) $(17,711)

$(198,407) $(60,732) Cash flows provided by (used in) financing

$40,414 $(29,180) $122,251 $(60,507) Net revenues Ameristar St.

Charles $54,966 $66,005 $131,903 $191,842 Ameristar Kansas City

55,536 55,480 159,732 159,832 Ameristar Council Bluffs 36,920

40,285 109,647 116,753 Ameristar Vicksburg 23,315 23,643 69,161

70,924 Jackpot Properties 16,521 16,115 45,726 45,523 Corporate and

other -- -- 175 -- Consolidated net revenues $187,258 $201,528

$516,344 $584,874 Operating income (loss) (1) Ameristar St. Charles

$3,900 $15,644 $20,845 $46,301 Ameristar Kansas City 10,080 9,365

32,776 31,230 Ameristar Council Bluffs 10,324 12,339 30,225 33,718

Ameristar Vicksburg 5,469 5,109 18,503 16,301 Jackpot Properties

2,682 2,462 8,424 7,516 Corporate and other (7,086) (10,723)

(20,711) (26,492) Consolidated operating income $25,369 $34,196

$90,062 $108,574 EBITDA (1) (2) Ameristar St. Charles $8,194

$21,423 $27,592 $63,696 Ameristar Kansas City 13,423 12,977 42,069

41,158 Ameristar Council Bluffs 12,603 14,903 37,142 41,271

Ameristar Vicksburg 7,791 7,471 25,479 23,436 Jackpot Properties

3,557 3,414 11,153 10,436 Corporate and other (6,597) (10,104)

(19,349) (24,757) Consolidated EBITDA $38,971 $50,084 $124,086

$155,240 Operating income margins (1) Ameristar St. Charles 7.1%

23.7% 15.8% 24.1% Ameristar Kansas City 18.2% 16.9% 20.5% 19.5%

Ameristar Council Bluffs 28.0% 30.6% 27.6% 28.9% Ameristar

Vicksburg 23.5% 21.6% 26.8% 23.0% Jackpot Properties 16.2% 15.3%

18.4% 16.5% Consolidated operating income margin 13.5% 17.0% 17.4%

18.6% AMERISTAR CASINOS, INC. AND SUBSIDIARIES SUMMARY CONSOLIDATED

FINANCIAL DATA-CONTINUED (Unaudited) Three Months Nine Months Ended

September 30, Ended September 30, 2002 2003 2002 2003 EBITDA

margins (1) (2) Ameristar St. Charles 14.9% 32.5% 20.9% 33.2%

Ameristar Kansas City 24.2% 23.4% 26.3% 25.8% Ameristar Council

Bluffs 34.1% 37.0% 33.9% 35.3% Ameristar Vicksburg 33.4% 31.6%

36.8% 33.0% Jackpot Properties 21.5% 21.2% 24.4% 22.9% Consolidated

EBITDA margin 20.8% 24.9% 24.0% 26.5% (1) For the three and nine

months ended September 30, 2002, operating income and EBITDA

include impairment charges of $1.1 million and $5.2 million,

respectively, related to assets held for sale at St. Charles and

pre-opening expenses of $4.9 million and $6.4 million,

respectively, related to the opening of the new St. Charles

facility.For the three and nine months ended September 30, 2003,

operating income and EBITDA include impairment charges of $0.1

million and $0.7 million, respectively, related to slot machines

held for sale at all properties and expenses of $1.3 million

associated with introducing the "All New Ameristar Kansas City.

"Operating income and EBITDA for the three and nine months ended

September 30, 2003 also include corporate costs of $0.9 million

related to the unsuccessful pursuit of a corporate

acquisition.Operating income margin is operating income as a

percentage of net revenues. (2) EBITDA is earnings before interest,

taxes, depreciation and amortization. EBITDA is presented solely as

a supplemental disclosure because management believes that it is a

widely used measure of operating performance in the gaming industry

and a principal basis for the valuation of gaming companies. Our

credit agreement also requires the use of EBITDA as a measure of

compliance with our principal debt covenants. In addition,

management uses property-level EBITDA (EBITDA before corporate

expense) as the primary measure of our operating properties'

performance, including the evaluation of operating personnel.

EBITDA margin is EBITDA as a percentage of net revenues.EBITDA

should not be construed as an alternative to income from operations

(as determined in accordance with GAAP) as an indicator of our

operating performance, or as an alternative to cash flows from

operating activities (as determined in accordance with GAAP) as a

measure of liquidity, or as an alternative to any other measure

determined in accordance with GAAP.We have significant uses of cash

flows, including capital expenditures, interest payments, taxes and

debt principal repayments, which are not reflected in EBITDA.It

should also be noted that not all gaming companies that report

EBITDA information calculate EBITDA in the same manner as we do.

AMERISTAR CASINOS, INC. AND SUBSIDIARIES RECONCILIATION OF

OPERATING INCOME (LOSS) TO EBITDA (Dollars in Thousands)

(Unaudited) The following table sets forth a reconciliation of

operating income (loss), a GAAP financialmeasure, to EBITDA, a

non-GAAP financial measure. Three Months Nine Months Ended

September 30, Ended September 30, 2002 2003 2002 2003 Ameristar St.

Charles: Operating income $3,900 $15,644 $20,845 $46,301

Depreciation and amortization 4,294 5,779 6,747 17,395 EBITDA

$8,194 $21,423 $27,592 $63,696 Ameristar Kansas City: Operating

income $10,080 $9,365 $32,776 $31,230 Depreciation and amortization

3,343 3,612 9,293 9,928 EBITDA $13,423 $12,977 $42,069 $41,158

Ameristar Council Bluffs: Operating income $10,324 $12,339 $30,225

$33,718 Depreciation and amortization 2,279 2,564 6,917 7,553

EBITDA $12,603 $14,903 $37,142 $41,271 Ameristar Vicksburg:

Operating income $5,469 $5,109 $18,503 $16,301 Depreciation and

amortization 2,322 2,362 6,976 7,135 EBITDA $7,791 $7,471 $25,479

$23,436 Jackpot Properties: Operating income $2,682 $2,462 $8,424

$7,516 Depreciation and amortization 875 952 2,729 2,920 EBITDA

$3,557 $3,414 $11,153 $10,436 Corporate and other: Operating income

$(7,086) $(10,723) $(20,711) $(26,492) Depreciation and

amortization 489 619 1,362 1,735 EBITDA $(6,597) $(10,104)

$(19,349) $(24,757) Consolidated: Operating income $25,369 $34,196

$90,062 $108,574 Depreciation and amortization 13,602 15,888 34,024

46,666 EBITDA $38,971 $50,084 $124,086 $155,240 AMERISTAR CASINOS,

INC. AND SUBSIDIARIES RECONCILIATION OF ESTIMATED CASH FLOWS FROM

OPERATIONS TO ESTIMATED FREE CASH FLOW (Dollars in Thousands)

(Unaudited) The following table sets forth a reconciliation of

estimated cash flows from operations, a GAAP financial measure, to

estimated free cash flow, a non-GAAP financial measure. Year ending

December 31, 2003 Estimated Cash Flows from Operations $145,000 --

147,000 Less: Estimated Capital Expenditures 90,000 Estimated Free

Cash Flow (1) $55,000 -- 57,000 (1)Free cash flow is a non-GAAP

financial measure, which we define as cash flows from operations,

as determined in accordance with GAAP, less capital expenditures.

Free cash flow represents the cash generated by our business

operations that is available to be used to repurchase stock, repay

debt obligations and invest in future growth through new business

development activities or acquisitions. Management uses this

measure to evaluate our ability to execute these initiatives and

believes it is useful to investors for the same purpose. Free cash

flow should not be construed as an alternative to cash flows from

operations or any other measure determined in accordance with GAAP.

We have other uses of cash flows, including mandatory principal

payments of long-term debt, which are not included in the

calculation of free cash flow. In addition, capital expenditures

for maintenance purposes should not be considered as discretionary.

It should also be noted that not all companies that report free

cash flow calculate free cash flow in the same manner as we do.

http://www.newscom.com/cgi-bin/prnh/20010501/AMERISTARLOGO

http://photoarchive.ap.org/ DATASOURCE: Ameristar Casinos, Inc.

CONTACT: Tom Steinbauer, Senior Vice President of Finance, Chief

Financial Officer of Ameristar Casinos, Inc., +1-702-567-7000 Web

site: http://www.ameristarcasinos.com/

Copyright

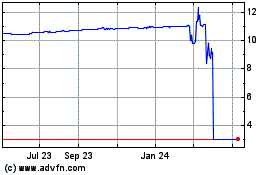

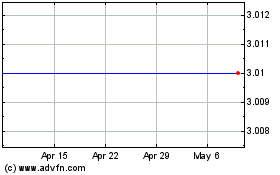

A SPAC I Acquisition (NASDAQ:ASCA)

Historical Stock Chart

From May 2024 to Jun 2024

A SPAC I Acquisition (NASDAQ:ASCA)

Historical Stock Chart

From Jun 2023 to Jun 2024