Ameristar Casinos Shares Rise as Penn National Gaming Announces Creation of New Casino REIT

November 20 2012 - 8:20AM

Marketwired

Gaming stocks received a boost last Friday after Penn National

Gaming Inc. announced breakup plans to create the first

casino-focused REIT. Analysts have suggested that other gaming

companies may follow suit as it would help free up capital. "This

could be a trend within the gaming sector to distribute profits on

a more tax efficient basis," said Joseph Greff, a JPMorgan Chase

& Co. analyst. The Paragon Report examines investing

opportunities in the Resorts & Casinos Industry and provides

equity research on Penn National Gaming, Inc. (NASDAQ: PENN) and

Ameristar Casinos, Inc. (NASDAQ: ASCA).

Access to the full company reports can be found at:

www.ParagonReport.com/PENN

www.ParagonReport.com/ASCA

Penn National will break up into two public companies and place

a majority of their properties, at least 17, into a new real estate

investment trust. Shareholders of Penn will a dividend of $5.35 a

share in addition to stock in the newly established REIT. The

breakup is expected to occur, pending regulatory approval, during

the second half of 2013.

"This process will unlock the tremendous value of our real

estate portfolio," Chairman and CEO Peter Carlino said on a

conference call. "This is just strictly our view of how we can best

take the assets we have and make the most of them."

Paragon Report releases regular market updates on the Resorts

& Casinos Industry so investors can stay ahead of the crowd and

make the best investment decisions to maximize their returns. Take

a few minutes to register with us free at www.ParagonReport.com and

get exclusive access to our numerous stock reports and industry

newsletters.

Penn National Gaming owns, operates or has ownership interests

in gaming and racing facilities with a focus on slot machine

entertainment. The company presently operates twenty-nine

facilities in nineteen jurisdictions. The new REIT would own 17

casino facilities encompassing over 3,200 acres of land, 6.9

million square feet of building space and 20,000 structured parking

spaces.

Ameristar Casinos is an innovative casino gaming company

featuring the newest and most popular slot machines. The company

generates more than $1 billion in net revenues annually. The

company currently offers an annual dividend of $0.50 per share for

a yield of approximately 2.56%.

The Paragon Report has not been compensated by any of the

above-mentioned publicly traded companies. Paragon Report is

compensated by other third party organizations for advertising

services. We act as an independent research portal and are aware

that all investment entails inherent risks. Please view the full

disclaimer at:

http://www.paragonreport.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

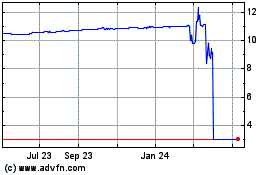

A SPAC I Acquisition (NASDAQ:ASCA)

Historical Stock Chart

From Jun 2024 to Jul 2024

A SPAC I Acquisition (NASDAQ:ASCA)

Historical Stock Chart

From Jul 2023 to Jul 2024