Ameristar Casinos Reports Record First Quarter Financial Results

and Continued Growth in All Key Performance Measures LAS VEGAS, May

4 /PRNewswire-FirstCall/ -- Ameristar Casinos, Inc. (NASDAQ:ASCA)

today announced 2005 first quarter financial results, which set

all-time records for consolidated net revenues, operating income,

EBITDA, net income and earnings per share. Financial Highlights *

First quarter consolidated net revenues of $240.1 million,

representing an increase of $25.7 million, or 12.0%, over the first

quarter of 2004. * First quarter consolidated operating income of

$46.3 million, an increase of $4.1 million, or 9.8%, from the

prior-year first quarter. * First quarter consolidated EBITDA (a

non-GAAP financial measure that is defined and reconciled with

operating income below) of $67.1 million, representing an increase

of $7.6 million, or 12.8%, over the first quarter of 2004. * First

quarter consolidated net income of $19.2 million, up $3.3 million,

or 20.9%, from the first quarter of 2004. * First quarter diluted

earnings per share of $0.68, compared to $0.58 for the first

quarter of 2004. Analysts' latest consensus estimate for the first

quarter, as reported by Thomson First Call, was $0.62. Our

previously issued earnings guidance for the first quarter of 2005

indicated a range of $0.58 to $0.63 per share. * On February 8,

2005, our Board of Directors increased the amount of our quarterly

cash dividend by 25.0%, to $0.15625 per share. We paid the first

quarter's dividend on March 15, 2005 to shareholders of record as

of March 1, 2005. * On April 29, 2005, our Board of Directors

declared a 2-for-1 split of our common stock, effective at the

close of business on June 6, 2005. The share and per-share

information in this press release does not give effect to the stock

split. * We improved our total debt leverage ratio (as defined in

our senior credit agreement) from 3.27:1 at March 31, 2004 to

3.18:1 at March 31, 2005, notwithstanding a $63.3 million increase

in total debt from March 31, 2004 to March 31, 2005. * During the

first quarter of 2005, Standard & Poor's upgraded the Company's

credit rating to "BB," citing our reduced leverage and increased

free cash flow. * We were the leader in market share (based on

gross gaming revenues) in our St. Charles, Kansas City, Council

Bluffs, Vicksburg and Jackpot markets during the first quarter of

2005, while reducing our consolidated promotional allowances as a

percentage of casino revenues by 1.4 percentage points from the

first quarter of 2004 to the same period in 2005. Craig H. Neilsen,

Chairman and CEO, stated: "Our record first quarter financial

results are a testament to the strength of Ameristar's brand. We

continued to improve upon the financial successes of prior years by

setting new records for net revenues, operating income, EBITDA, net

income and earnings per share. Our St. Charles property broke the

all-time monthly Missouri gaming revenue record in March 2005,

further evidencing the success of the Company's operating

strategies. Additionally, with the continued improvement in our

operating results, our Board declared a 25% increase in our cash

dividend that reflects our commitment to increasing our return to

shareholders. We are pleased to report the Mountain High

acquisition is already providing a positive contribution to our

financial results and we expect to see further growth as we

complete our planned major capital improvement projects at the

property." Financial Results Net Revenues Consolidated net revenues

for the first quarter of 2005 were $240.1 million, an increase of

12.0% compared to the first quarter of 2004. All of our properties

improved in net revenues, with increases of 9.5% at Ameristar

Council Bluffs, 8.5% at Ameristar Kansas City, 3.4% at the Jackpot

Properties, 3.1% at Ameristar Vicksburg and 1.7% at Ameristar St.

Charles. Mountain High contributed $14.2 million in net revenues

during its first full quarter since being acquired in December

2004. For the quarter, Ameristar Kansas City and Ameristar Council

Bluffs improved their market leadership positions to 35.8% and

42.6%, respectively, with increases of 1.7 and 0.8 percentage

points, respectively, over the prior-year first quarter. Ameristar

Vicksburg's long-time market leadership position was relatively

unchanged at 45.9%. Ameristar St. Charles recaptured the market

share leadership position with 31.6% of the market, despite a 1.5

percentage point decrease from the first quarter of 2004 and a

major facility expansion at the property's primary competitor that

was completed in the third quarter of 2004. Ameristar St. Charles

has led the St. Louis market for 8 of the last 10 quarters. Led by

a $26.7 million (14.4%) increase in slot revenues, consolidated

casino revenues for the first quarter of 2005 increased $27.1

million, or 12.6%, from the first quarter of 2004. We believe that

the growth in slot revenues has been driven by our complete

implementation of coinless slot technology at our Ameristar-branded

properties and our successful slot mix strategy, which includes the

continued installation of popular new-generation,

lower-denomination slot machines. Additionally, Mountain High

contributed $13.9 million to slot revenues during the first quarter

of 2005. We further believe casino revenues increased in part as a

result of our continued successful implementation of our targeted

marketing programs, as evidenced by a 7.1% increase in rated play

at our Ameristar-branded properties from the first quarter of 2004.

Room revenues decreased 9.2%, from $6.3 million in the first

quarter of 2004 to $5.7 million in 2005. The $0.6 million decrease

was primarily due to reduced room capacity as a result of the

continuing renovation of the hotel rooms at Ameristar Council

Bluffs and Ameristar Kansas City, which are expected to be

completed in the second quarter and third quarter of 2005,

respectively. Operating Income and EBITDA In the first quarter of

2005, consolidated operating income increased $4.1 million, or

9.8%, to $46.3 million. Consolidated operating income margin

decreased 0.4 percentage point from the prior-year first quarter,

to 19.3%. The decrease was driven in part by a 3.0 percentage point

decline at Ameristar St. Charles, which was partially offset by

operating income margin increases at Ameristar Kansas City,

Ameristar Vicksburg and the Jackpot Properties of 4.7, 1.0, and 6.4

percentage points, respectively. Consolidated EBITDA increased

12.8% to $67.1 million compared to the first quarter of 2004.

Additionally, consolidated EBITDA margin in the first quarter of

2005 increased from 27.7% to 27.9%, driven by improvements at

Ameristar Kansas City, Ameristar Vicksburg and the Jackpot

Properties of 4.9, 1.3 and 8.0 percentage points, respectively,

from the prior-year first quarter. The growth in EBITDA margins at

these properties was partially offset by a 2.0 percentage point

decline year-over-year at Ameristar St. Charles. The growth in

operating income, EBITDA and the related margins at Ameristar

Kansas City, Ameristar Vicksburg and the Jackpot Properties was

principally driven by the increase in revenues noted above and the

continued concentration on cost-containment initiatives. Operating

income, EBITDA and the related margins at Ameristar St. Charles

were negatively impacted by higher employee benefit costs and a

more competitive market environment that has resulted in increased

promotional expenses. Additionally, operating income and the

associated margin were negatively affected by an increase in

depreciation expense resulting mostly from our recent slot product

acquisitions. Ameristar Council Bluffs increased first quarter

operating income by $1.1 million, or 9.4%, and first quarter EBITDA

by $1.4 million, or 9.6%, compared to the prior-year period. This

property's operating income and EBITDA benefited from construction

disruption and a reduced number of available slot machines at the

competing racetrack casino. The improvements in operating income

and EBITDA occurred despite a 2.0% increase in the Iowa tax rate on

gaming revenues of riverboat casinos, which became effective July

1, 2004. Mountain High provided $2.3 million of operating income in

the first quarter of 2005. Additionally, Mountain High favorably

impacted first quarter 2005 EBITDA by $3.6 million. Operating

income, EBITDA and the related margins were negatively affected by

a $2.8 million increase in corporate expense in the first quarter

of 2005, compared to the same quarter of 2004. The increase was

primarily the result of higher employee compensation, employee

benefits and professional fees and related costs associated with

our expanded development activities. Development-related costs

totaled $2.0 million for the quarter ended March 31, 2005, a $1.4

million increase over the same period in 2004. The increase was

mostly attributable to costs incurred in connection with the

pursuit of development opportunities in the United Kingdom and

costs associated with acquiring a potential gaming site in

Philadelphia and performing due diligence on a potential

acquisition that management elected not to pursue. Depreciation and

amortization expense increased to $20.8 million in the first

quarter of 2005 from $17.3 million in the first quarter of 2004,

primarily due to the increase in our depreciable assets resulting

from the continued purchase of new-generation, lower-denomination

slot product and $1.4 million in additional depreciation expense

relating to Mountain High. Net Income and Diluted Earnings Per

Share For the first quarter of 2005, net income increased 20.9% to

$19.2 million, from $15.9 million for the first quarter of 2004.

Diluted earnings per share were $0.68 in the quarter ended March

31, 2005, compared to $0.58 in the corresponding prior-year

quarter. Average diluted shares outstanding increased by 0.9

million over the prior-year quarter, in large part due to the

substantial increase in our stock price that resulted in increased

dilution from in-the-money stock options, adversely affecting

diluted earnings per share by $0.02. Interest expense for the 2005

first quarter was $15.3 million, down $0.2 million from the first

quarter of 2004. An increase in our average long-term debt level

resulting from the $115.0 million borrowed in December 2004 to

acquire Mountain High was more than offset by the termination of

our interest rate swap agreement on March 31, 2004 and an increase

in capitalized interest. Other non-operating expenses included a

$0.7 million loss on disposal of assets at our Kansas City property

during the first quarter of 2005. For the quarter ended March 31,

2004, we incurred a $0.2 million loss on early retirement of debt.

Our effective income tax rate for the quarter ended March 31, 2005

decreased to 36.9% from 40.0% for the quarter ended March 31, 2004,

due primarily to a decrease in our effective state income tax rate.

Liquidity and Capital Resources Our financial position remains

strong, with approximately $100.9 million of cash and cash

equivalents and $69.3 million of available borrowing capacity under

our senior credit facilities as of March 31, 2005. During the first

quarter of 2005, we decreased our long-term debt by approximately

$2.2 million from December 31, 2004, due primarily to a $1.0

million prepayment of debt related to the Jackpot Properties and

$1.0 million in scheduled debt service payments under our senior

credit facilities. At March 31, 2005, our total debt was $764.3

million, representing an increase of $63.3 million from March 31,

2004. Capital expenditures for the 2005 first quarter totaled $33.7

million, which included the continued acquisition of

new-generation, lower-denomination slot machines, the ongoing hotel

room renovations at our Council Bluffs and Kansas City properties,

the capital improvement projects underway at Mountain High and the

implementation of information technology solutions to enhance our

operating capabilities. We are currently seeking local government

approvals to expand the scope of the Mountain High hotel

construction project by increasing the number of rooms to be built

from 300 to 400. We believe that the additional rooms will further

improve the property's competitive position upon the completion of

our planned improvements. After giving effect to the anticipated

increase in the scope of the hotel project, we now expect to incur

approximately $160.0 million in total capital improvements at our

Mountain High property. Outlook Based on our preliminary results of

operations in April 2005 and our outlook for the remainder of the

quarter, we currently estimate operating income of $41 million to

$43 million, EBITDA of $62 million to $64 million (given

anticipated depreciation expense of $21 million), interest expense

of $16 million and diluted earnings per share of $0.55 to $0.59 for

the second quarter of 2005. Gaming regulatory authorities in

Colorado, Iowa, Mississippi and Missouri currently publish, on a

monthly basis, gross gaming revenue, market share and other

financial information with respect to the gaming facilities,

including Ameristar's, that operate within their respective

jurisdictions. Because various factors in addition to our gross

gaming revenue (including changes in operating costs, promotional

allowances and other expenses) influence our operating income,

EBITDA and diluted earnings per share, such reported information,

as it relates to Ameristar, may not be indicative of the results of

our operations for such periods or for future periods. Conference

Call We will hold a conference call to discuss our first quarter

results and guidance for the second quarter at 5:00 p.m. Eastern

Time on May 4, 2005. The call can be accessed live by calling (800)

967-7135. It can be replayed until May 10, 2005 at 12:00 a.m.

Eastern Time by calling (888) 203-1112 and using the access code

number 6846148. Interested parties wanting to listen to the live

conference call on the Internet may do so on our web site --

http://www.ameristar.com/ -- in About Ameristar/Investor Relations

under the Quarterly Results Conference Calls section.

Forward-Looking Information This press release contains certain

forward-looking information that generally can be identified by the

context of the statement or the use of forward-looking terminology,

such as "believes," "estimates," "anticipates," "intends,"

"expects," "plans," "is confident that" or words of similar

meaning, with reference to Ameristar or our management. Similarly,

statements that describe our future plans, objectives, strategies,

financial results or position, operational expectations or goals

are forward-looking statements. It is possible that our

expectations may not be met due to various factors, many of which

are beyond our control, and we therefore cannot give any assurance

that such expectations will prove to be correct. For a discussion

of relevant factors, risks and uncertainties that could materially

affect our future results, attention is directed to "Item 1.

Business - Risk Factors" and "Item 7. Management's Discussion and

Analysis of Financial Condition and Results of Operations" in our

Annual Report on Form 10-K for the year ended December 31, 2004.

About Ameristar Ameristar Casinos, Inc. is a leading Las

Vegas-based gaming and entertainment company known for its premier

properties characterized by innovative architecture,

state-of-the-art casino floors and superior dining, lodging and

entertainment offerings. Ameristar's focus on the total

entertainment experience and the highest quality guest service has

earned it a leading market share position in each of the markets in

which it operates. Founded in 1954 in Jackpot, Nevada, Ameristar

has been a public company since November 1993. The company has a

portfolio of seven casinos in six markets: Ameristar St. Charles

(greater St. Louis); Ameristar Kansas City; Ameristar Council

Bluffs (Omaha, Nebraska and southwestern Iowa); Ameristar Vicksburg

(Jackson, Mississippi and Monroe, Louisiana); Mountain High in

Black Hawk, Colorado (Denver metropolitan area); and Cactus Petes

and the Horseshu in Jackpot, Nevada (Idaho and the Pacific

Northwest). Visit Ameristar Casinos' web site at

http://www.ameristar.com/ (which shall not be deemed to be

incorporated in or a part of this news release). AMERISTAR CASINOS,

INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS (Amounts in Thousands, Except Per Share Data)

(Unaudited) Three Months Ended March 31, 2005 2004 REVENUES: Casino

$242,368 $215,310 Food and beverage 30,287 29,048 Rooms 5,733 6,314

Other 5,590 5,659 283,978 256,331 Less: Promotional allowances

43,869 41,968 Net revenues 240,109 214,363 OPERATING EXPENSES:

Casino 105,523 96,118 Food and beverage 15,757 15,336 Rooms 1,499

1,625 Other 3,792 3,174 Selling, general and administrative 46,244

38,532 Depreciation and amortization 20,818 17,332 Impairment loss

on assets held for sale 193 112 Total operating expenses 193,826

172,229 Income from operations 46,283 42,134 OTHER INCOME

(EXPENSE): Interest income 119 10 Interest expense, net (15,261)

(15,435) Loss on early retirement of debt -- (246) Other (687) 43

INCOME BEFORE INCOME TAX PROVISION 30,454 26,506 Income tax

provision 11,224 10,605 NET INCOME $19,230 $15,901 EARNINGS PER

SHARE: Basic $0.70 $0.59 Diluted $0.68 $0.58 WEIGHTED AVERAGE

SHARES OUTSTANDING: Basic 27,617 26,805 Diluted 28,452 27,581

AMERISTAR CASINOS, INC. AND SUBSIDIARIES SUMMARY CONSOLIDATED

FINANCIAL DATA (Dollars in Thousands) (Unaudited) Three Months

Ended March 31, 2005 2004 Consolidated cash flow information Net

cash provided by operating activities $49,922 $35,079 Net cash used

in investing activities (33,566) (21,032) Net cash used in

financing activities (1,944) (13,317) Net revenues Ameristar St.

Charles $72,644 $71,439 Ameristar Kansas City 62,523 57,603

Ameristar Council Bluffs 46,363 42,354 Ameristar Vicksburg 29,797

28,915 Jackpot Properties 14,533 14,052 Mountain High (1) 14,249 --

Corporate and other -- -- Consolidated net revenues $240,109

$214,363 Operating income (loss) Ameristar St. Charles $17,592

$19,422 Ameristar Kansas City 14,414 10,582 Ameristar Council

Bluffs 13,366 12,217 Ameristar Vicksburg 9,278 8,710 Jackpot

Properties 2,332 1,345 Mountain High (1) 2,274 -- Corporate and

other (12,973) (10,142) Consolidated operating income $46,283

$42,134 EBITDA (2) Ameristar St. Charles $24,060 $25,043 Ameristar

Kansas City 19,594 15,231 Ameristar Council Bluffs 16,292 14,871

Ameristar Vicksburg 12,202 11,456 Jackpot Properties 3,488 2,251

Mountain High (1) 3,645 -- Corporate and other (12,180) (9,386)

Consolidated EBITDA $67,101 $59,466 AMERISTAR CASINOS, INC. AND

SUBSIDIARIES SUMMARY CONSOLIDATED FINANCIAL DATA - CONTINUED

(Dollars in Thousands) (Unaudited) Three Months Ended March 31,

2005 2004 Operating income margins (3) Ameristar St. Charles 24.2%

27.2% Ameristar Kansas City 23.1% 18.4% Ameristar Council Bluffs

28.8% 28.8% Ameristar Vicksburg 31.1% 30.1% Jackpot Properties

16.0% 9.6% Mountain High (1) 16.0% -- Consolidated operating income

margin 19.3% 19.7% EBITDA margins (2) Ameristar St. Charles 33.1%

35.1% Ameristar Kansas City 31.3% 26.4% Ameristar Council Bluffs

35.1% 35.1% Ameristar Vicksburg 40.9% 39.6% Jackpot Properties

24.0% 16.0% Mountain High (1) 25.6% -- Consolidated EBITDA margin

27.9% 27.7% (1) We acquired Mountain High on December 21, 2004, and

operating results are only included since the acquisition date. (2)

EBITDA is earnings before interest, taxes, depreciation and

amortization. EBITDA is presented solely as a supplemental

disclosure because management believes that it is a widely used

measure of operating performance in the gaming industry and a

principal basis for the valuation of gaming companies. Our credit

agreement also requires the use of EBITDA as a measure of

compliance with our principal debt covenants. In addition,

management uses property-level EBITDA (EBITDA before corporate

expense) as the primary measure of our operating properties'

performance, including the evaluation of operating personnel.

EBITDA margin is EBITDA as a percentage of net revenues. EBITDA

should not be construed as an alternative to income from operations

(as determined in accordance with GAAP) as an indicator of our

operating performance, or as an alternative to cash flows from

operating activities (as determined in accordance with GAAP) as a

measure of liquidity, or as an alternative to any other measure

determined in accordance with GAAP. We have significant uses of

cash flows, including capital expenditures, interest payments,

taxes and debt principal repayments, which are not reflected in

EBITDA. It should also be noted that not all gaming companies that

report EBITDA calculate EBITDA in the same manner as we do. (3)

Operating income margin is operating income as a percentage of net

revenues. RECONCILIATION OF OPERATING INCOME (LOSS) TO EBITDA

(Dollars in Thousands) (Unaudited) The following table sets forth a

reconciliation of operating income (loss), a GAAP financial

measure, to EBITDA, a non-GAAP financial measure. Three Months

Ended March 31, 2005 2004 Ameristar St. Charles: Operating income

$17,592 $19,422 Depreciation and amortization 6,468 5,621 EBITDA

$24,060 $25,043 Ameristar Kansas City: Operating income $14,414

$10,582 Depreciation and amortization 5,180 4,649 EBITDA $19,594

$15,231 Ameristar Council Bluffs: Operating income $13,366 $12,217

Depreciation and amortization 2,926 2,654 EBITDA $16,292 $14,871

Ameristar Vicksburg: Operating income $9,278 $8,710 Depreciation

and amortization 2,924 2,746 EBITDA $12,202 $11,456 Jackpot

Properties: Operating income $2,332 $1,345 Depreciation and

amortization 1,156 906 EBITDA $3,488 $2,251 Mountain High:

Operating income $2,274 $-- Depreciation and amortization 1,371 --

EBITDA $3,645 $-- Corporate and other: Operating loss $(12,973)

$(10,142) Depreciation and amortization 793 756 EBITDA $(12,180)

$(9,386) Consolidated: Operating income $46,283 $42,134

Depreciation and amortization 20,818 17,332 EBITDA $67,101 $59,466

http://www.newscom.com/cgi-bin/prnh/20040930/LATH017LOGO

http://photoarchive.ap.org/ DATASOURCE: Ameristar Casinos, Inc.

CONTACT: Tom Steinbauer, Senior Vice President of Finance, Chief

Financial Officer of Ameristar Casinos, Inc., +1-702-567-7000 Web

site: http://www.ameristar.com/

Copyright

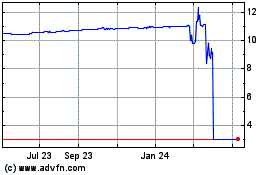

A SPAC I Acquisition (NASDAQ:ASCA)

Historical Stock Chart

From May 2024 to Jun 2024

A SPAC I Acquisition (NASDAQ:ASCA)

Historical Stock Chart

From Jun 2023 to Jun 2024