Did Someone Forget The BONK? Trading Volume Plunges Over 70%

April 12 2024 - 2:47AM

NEWSBTC

Bucking the trend within the highly volatile memecoin sector, Bonk

(BONK), a Solana-native meme token, has exhibited a bearish bias

despite prevailing bullish sentiment across the broader memecoin

market. Related Reading: Shiba Inu Surpasses 4 Million Addresses,

Ignites Frenzy Recent data from CoinMarketCap reveals a staggering

25% price decline for Bonk over the past month, a stark contrast to

the general upward trajectory witnessed across the meme coin

landscape during the same period. At the time of writing, BONK was

trading at $0.00002166, down 1.93% and 1.40% in the daily and

weekly timeframes, data from CMC shows. Traders Grapple With

Uncertainty In Bonk’s Derivatives Market In the derivatives market,

where traders speculate on the future price movements of assets,

Bonk’s futures open interest has witnessed a dramatic decline,

plummeting by a staggering 60% since early March, as reported by

data from Coinglass. This sharp downturn in open interest reflects

a significant reduction in the number of contracts or positions

held by traders, indicative of diminishing interest and confidence

in Bonk’s prospects among derivative traders. Despite the

pronounced downturn in futures open interest, the funding rate

across various cryptocurrency exchanges has managed to maintain a

positive stance. This funding rate, which reflects the cost of

holding long positions relative to short positions, suggests that

some traders are still maintaining optimism and are unwilling to

entirely abandon the possibility of an impending uptrend in Bonk’s

price. BONKUSD trading at $0.000021on the daily chart:

TradingView.com However, the conflicting signals between technical

indicators and market sentiment leave traders grappling with

uncertainty, unsure whether to hold onto their positions or cut

their losses. The 30-day period under review has seen a significant

fall in Bonk’s daily trading volume, with Santiment’s data

indicating a 75% decrease. This decline in trading activity adds

further weight to the bearish sentiment surrounding the coin,

signaling waning investor interest and confidence in its potential.

Source: Santiment Technical Indicators Signal Trouble For Bonk

Further exacerbating Bonk’s woes are its momentum indicators, which

reveal a troubling discrepancy between distribution and

accumulation. The Money Flow Index (MFI) points to increased

selling activity, outweighing any attempts at buying and adding

further downward pressure on the coin’s value. Related Reading: CEO

Throws Cold Water On May Ethereum ETF Approval – Impact On Price As

the market grapples with these conflicting signals, the spotlight

remains firmly fixed on Bonk and its ability to weather the storm.

With its MACD line sinking below the signal and zero lines,

signaling a weakening short-term trend compared to its longer-term

outlook, traders are faced with a critical decision point. A

Glimmer Of Hope Amidst The Storm As traders continue to monitor the

situation closely, there is potential for a shift in sentiment that

could breathe new life into Bonk’s ailing price. For now, the road

ahead for Bonk remains uncertain, with technical indicators

pointing towards further declines while traders cling to hopes of a

reversal. Featured image from Pixabay, chart from TradingView

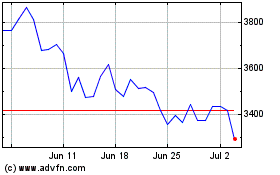

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024