Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

September 18 2020 - 5:16PM

Edgar (US Regulatory)

Issuer Free Writing Prospectus

Filed Pursuant to Rule 433

Registration Statement No. 333-236571

To Preliminary Prospectus Supplement to

be dated September 21, 2020

(To Prospectus dated March 3, 2020)

TERM SHEET

Uranium Energy Corp.

Public Offering of Units

September 18, 2020

A final base shelf prospectus dated

March 3, 2020 containing important information relating to the securities described in this document has been filed with the securities

regulatory authorities in each of the provinces of Canada (other than Quebec). A copy of the final base shelf prospectus, any amendment

to the final base shelf prospectus and any applicable shelf prospectus supplement that has been filed, is required to be delivered

with this document.

This document does not provide full

disclosure of all material facts relating to the securities offered. Investors should read the final base shelf prospectus, any

amendment and any applicable shelf prospectus supplement for disclosure of those facts, especially risk factors relating to the

securities offered, before making an investment decision.

A

prospectus supplement to the base prospectus dated March 3, 2020 will also be filed with the Securities and Exchange Commission

(SEC) in the United States and will contain important information relating to the securities described in this term sheet.

The issuer has filed a registration statement (including the base prospectus) with the SEC for the offering to which this communication

relates. Before you invest, you should read the prospectus, as supplemented by the prospectus supplement to be filed with the SEC,

in that registration statement and other documents the issuer has and will file with the SEC for more complete information about

the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov.

Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus,

as supplemented, if you request it, from, H.C. Wainwright & Co., via email at placements@hcwco.com, and in Canada by from Haywood

Securities Inc. at ecm@haywood.com.

|

Issuer:

|

Uranium Energy Corp. (the “Company”).

|

|

|

|

|

Issued Securities:

|

6,666,667 units of the Company (the “Units” and the offering of such Units, the “Offering”). Each Unit is comprised of one (1) share of common stock in the capital of the Company (each, a “Share”) and one-half (1/2) of one common stock purchase warrant (each whole warrant, a “Warrant”).

|

|

Size of Issue:

|

US$8,000,000.

|

|

|

|

|

Issue Price:

|

US$1.20 per Unit (the “Issue Price”).

|

|

|

|

|

Warrants:

|

Each Warrant shall entitle the holder to purchase one (1) Share (each, a “Warrant Share”) at US$1.80, and is exercisable starting upon the date of issuance until any time prior to 5:00 pm (Vancouver time) on the date that is 24 months from the date of issuance.

|

|

|

|

|

Underwriters:

|

H.C. Wainwright & Co. and

Haywood Securities Inc. (collectively, the “Joint Bookrunners”) on behalf of a syndicate of underwriters to

be agreed upon by the Joint Bookrunners and the Company.

|

|

|

|

|

Jurisdictions:

|

The United States and all provinces of Canada (except Quebec). The Units may also be offered in those jurisdictions outside of Canada and the United States as agreed to by the Company and the Underwriters, provided that no prospectus filing or comparable obligation arises and the Company does not thereafter become subject to continuous disclosure obligations in such jurisdictions.

|

|

|

|

|

Underwriters’ Fees:

|

The Company shall pay the Underwriters a cash commission equal to 6% of the gross proceeds of the Offering. A reduced cash commission of 2% will be payable on the gross proceeds of up to US$5,000,000 of the Offering sold to purchasers included on the Company’s president’s list (the “President’s List”). In addition, the Company shall issue to the Underwriters warrants (the “Compensation Warrants”) on the same terms as the Warrants to purchase up to that number of shares of common stock equal to 6% of the Units issued under the Offering, other than with respect to Units sold to purchasers on the President’s List orders for which 2% Compensation Warrants will be issuable.

|

|

|

|

|

Selling Concession:

|

3%.

|

|

|

|

|

Use of Proceeds:

|

The net proceeds of the Offering will be used to fund exploration and development expenditures at the Company’s projects and for general corporate and working capital purposes.

|

|

|

|

|

Listing:

|

Prior to the Closing Date, the Company will obtain all necessary regulatory approvals for the Offering, including NYSE American approval of the listing of the Common Shares comprising the Units and the Warrant Shares issuable upon exercise of the Warrants. Warrants will settle in physical form and will not be listed.

|

|

|

|

|

Eligibility for Investment:

|

Eligible under the usual Canadian statutes as well as for RRSPs, RESPs, RRIFs, TFSAs and DPSPs.

|

|

|

|

|

Closing Date:

|

On or about September 23, 2020 or such other date as the Company and the Underwriters mutually agree (the “Closing Date”).

|

__________

____

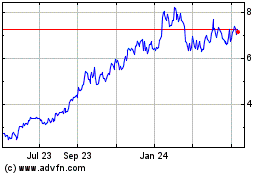

Uranium Energy (AMEX:UEC)

Historical Stock Chart

From Jun 2024 to Jul 2024

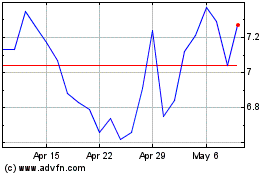

Uranium Energy (AMEX:UEC)

Historical Stock Chart

From Jul 2023 to Jul 2024