false0001171155DEF 14A0001171155rlgt:GrantDateFairValueOfEquityAwardsGrantedDuringFiscalYearMemberecd:NonPeoNeoMember2022-07-012023-06-300001171155ecd:PeoMemberrlgt:ChangeInFairValueFromPriorFiscalYearToVestingDateForEquityAwardsVestedMember2020-07-012021-06-300001171155rlgt:ChangeInFairValueFromPriorFiscalYearToVestingDateForEquityAwardsVestedMemberecd:NonPeoNeoMember2021-07-012022-06-300001171155ecd:PeoMemberrlgt:GrantDateFairValueOfEquityAwardsGrantedDuringFiscalYearMember2020-07-012021-06-300001171155ecd:PeoMemberrlgt:YearEndFairValueOfEquityAwardsGrantedDuringFiscalYearMember2021-07-012022-06-300001171155ecd:PeoMemberrlgt:ChangeInFairValueFromPriorFiscalYearToVestingDateForEquityAwardsVestedMember2021-07-012022-06-3000011711552021-07-012022-06-300001171155ecd:PeoMemberrlgt:YearEndFairValueOfEquityAwardsGrantedDuringFiscalYearMember2020-07-012021-06-300001171155rlgt:YearEndFairValueOfEquityAwardsGrantedDuringFiscalYearMemberecd:NonPeoNeoMember2020-07-012021-06-300001171155rlgt:YearEndFairValueOfEquityAwardsGrantedDuringFiscalYearMemberecd:NonPeoNeoMember2021-07-012022-06-300001171155ecd:PeoMemberrlgt:OneYearChangeInFairValueOfUnvestedEquityAwardsGrantedInPriorFiscalYearMember2022-07-012023-06-300001171155rlgt:OneYearChangeInFairValueOfUnvestedEquityAwardsGrantedInPriorFiscalYearMemberecd:NonPeoNeoMember2022-07-012023-06-3000011711552020-07-012021-06-300001171155rlgt:YearEndFairValueOfEquityAwardsGrantedDuringFiscalYearMemberecd:NonPeoNeoMember2022-07-012023-06-300001171155ecd:PeoMemberrlgt:GrantDateFairValueOfEquityAwardsGrantedDuringFiscalYearMember2021-07-012022-06-300001171155rlgt:ChangeInFairValueFromPriorFiscalYearToVestingDateForEquityAwardsVestedMemberecd:NonPeoNeoMember2022-07-012023-06-300001171155ecd:PeoMemberrlgt:OneYearChangeInFairValueOfUnvestedEquityAwardsGrantedInPriorFiscalYearMember2020-07-012021-06-3000011711552022-07-012023-06-300001171155rlgt:ChangeInFairValueFromPriorFiscalYearToVestingDateForEquityAwardsVestedMemberecd:NonPeoNeoMember2020-07-012021-06-300001171155rlgt:OneYearChangeInFairValueOfUnvestedEquityAwardsGrantedInPriorFiscalYearMemberecd:NonPeoNeoMember2021-07-012022-06-300001171155ecd:PeoMemberrlgt:OneYearChangeInFairValueOfUnvestedEquityAwardsGrantedInPriorFiscalYearMember2021-07-012022-06-300001171155ecd:PeoMemberrlgt:ChangeInFairValueFromPriorFiscalYearToVestingDateForEquityAwardsVestedMember2022-07-012023-06-300001171155ecd:PeoMemberrlgt:GrantDateFairValueOfEquityAwardsGrantedDuringFiscalYearMember2022-07-012023-06-300001171155rlgt:OneYearChangeInFairValueOfUnvestedEquityAwardsGrantedInPriorFiscalYearMemberecd:NonPeoNeoMember2020-07-012021-06-300001171155ecd:PeoMemberrlgt:YearEndFairValueOfEquityAwardsGrantedDuringFiscalYearMember2022-07-012023-06-300001171155rlgt:GrantDateFairValueOfEquityAwardsGrantedDuringFiscalYearMemberecd:NonPeoNeoMember2020-07-012021-06-300001171155rlgt:GrantDateFairValueOfEquityAwardsGrantedDuringFiscalYearMemberecd:NonPeoNeoMember2021-07-012022-06-30iso4217:USD

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant Filed by a Party other than the Registrant

Check the appropriate box:

|

|

|

|

|

Preliminary Proxy Statement |

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

Definitive Proxy Statement |

|

|

Definitive Additional Materials |

|

|

Soliciting Material under §240.14a-12 |

RADIANT LOGISTICS, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

|

|

|

|

|

No fee required. |

|

|

Fee paid previously with preliminary materials. |

|

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

2023

Notice of Annual

Meeting of Stockholders

and Proxy Statement

Wednesday, November 15, 2023

9:00 a.m., Local Time

Triton Towers Two

700 S. Renton Village Place, Seventh Floor

Renton, Washington 98057

(This page left blank intentionally)

Triton Towers Two

700 S. Renton Village Place, Seventh Floor

Renton, Washington 98057

FROM OUR CHAIRMAN OF THE BOARD

Dear Stockholder:

The 2023 Annual Meeting of Stockholders will be held at our principal executive offices located at Triton Towers Two, 700 S. Renton Village Place, Seventh Floor, Renton, Washington 98057, at 9:00 a.m., Local Time, on Wednesday, November 15, 2023.

In connection with the Annual Meeting, stockholders will be asked to consider and vote upon the following proposals: (1) to elect four directors to serve for the ensuing year as members of the Board of Directors of Radiant Logistics, Inc.; (2) to ratify the appointment of Moss Adams LLP, as our independent registered public accounting firm for the fiscal year ending June 30, 2024; (3) to approve, on an advisory basis, our executive compensation; and (4) to transact such other business as may properly come before the Annual Meeting or at any continuation, postponement, or adjournment thereof. The accompanying Notice of 2023 Annual Meeting of Stockholders and proxy statement describe these matters in more detail. We urge you to read this information carefully.

The Board of Directors recommends a vote: FOR each of the four nominees for director named in the proxy statement and FOR the approval of the other proposals being submitted to a vote of stockholders.

Voting your shares of Radiant Logistics common stock is easily achieved without the need to attend the Annual Meeting in person. Regardless of the number of shares of Radiant Logistics common stock that you own, it is important that your shares be represented and voted at the Annual Meeting. Therefore, I urge you to vote your shares of Radiant Logistics common stock via the Internet, by telephone, or by promptly marking, dating, signing, and returning the proxy card. Voting over the Internet, by telephone, or by written proxy will ensure that your shares are represented at the Annual Meeting.

On behalf of the Board of Directors and management of Radiant Logistics, we thank you for your participation and continued support.

Sincerely,

Bohn H. Crain

Chairman of the Board and Chief Executive Officer

October 6, 2023

|

You can help us make a difference by eliminating paper proxy materials. With your consent, we will provide all future proxy materials electronically. Instructions for consenting to electronic delivery can be found on your proxy card or at www.proxyvote.com. Your consent to receive stockholder materials electronically will remain in effect until canceled. |

Radiant Logistics, Inc. – 2023 Proxy Statement 1

NOTICE OF 2023 ANNUAL MEETING OF STOCKHOLDERS

The 2023 Annual Meeting of Stockholders of Radiant Logistics, Inc., a Delaware corporation, will be held on November 15, 2023, at 9:00 a.m., Local Time at our principal executive offices located at Triton Towers Two, 700 S. Renton Village Place, Seventh Floor, Renton, Washington 98057, for the following purposes:

1.To elect four directors to serve as members of the Board of Directors of Radiant Logistics, Inc. until the next annual meeting of stockholders and until their successors are duly elected and qualified. The director nominees named in the proxy statement for election to the Board of Directors are Bohn H. Crain, Michael Gould, Kristin E. Toth and Richard P. Palmieri;

2.To ratify the appointment of Moss Adams, LLP as our independent registered public accounting firm for the year ending June 30, 2024;

3.To approve, on an advisory basis, our executive compensation;

4.To transact such other business as may properly come before the Annual Meeting or at any continuation, postponement, or adjournment thereof.

The proxy statement accompanying this Notice describes each of these items of business in detail. Only holders of record of our common stock at the close of business on September 22, 2023 are entitled to notice of, to attend, and to vote at the Annual Meeting or any continuation, postponement, or adjournment thereof. A list of such stockholders will be available for inspection, for any purpose germane to the Annual Meeting, at our principal executive offices during regular business hours for a period of no less than 10 days prior to the Annual Meeting.

To ensure your representation at the Annual Meeting, you are urged to vote your shares of Radiant Logistics common stock via the Internet, by telephone, or by promptly marking, dating, signing, and returning the proxy card. If your shares of Radiant Logistics common stock are held by a bank, broker, or other agent, please follow the instructions from your bank, broker, or other agent to have your shares voted.

BY ORDER OF THE BOARD OF DIRECTORS

Bohn H. Crain

Chairman of the Board and

Chief Executive Officer

Renton, Washington

October 6, 2023

Radiant Logistics, Inc. – 2023 Proxy Statement 2

CONTENTS

Page

_____________________

References in this proxy statement to:

•“Radiant Logistics,” “we,” “us,” “our,” or the “Company” refer to Radiant Logistics, Inc.;

•“Board” refer to the Board of Directors of Radiant Logistics;

•“Annual Meeting” refer to our 2023 Annual Meeting of Stockholders; and

•“2023 Annual Report” or “2023 Annual Report to Stockholders” refer to our Annual Report on Form 10-K for the year ended June 30, 2023, being made available together with this proxy statement.

Information on our website and any other website referenced herein is not incorporated by reference into, and does not constitute a part of, this proxy statement.

™ and ® denote trademarks and registered trademarks of Radiant Logistics, Inc. or our affiliates, registered as indicated in the United States. All other trademarks and trade names referred to in this release are the property of their respective owners.

We intend to make this proxy statement and our 2023 Annual Report available online and to commence mailing of the notice to all stockholders entitled to vote at the Annual Meeting beginning on or about October 6, 2023. We will mail paper copies of these materials, together with a proxy card, within three business days of a request properly made by a stockholder entitled to vote at the 2023 Annual Meeting of Stockholders.

Radiant Logistics, Inc. – 2023 Proxy Statement 3

PROXY STATEMENT SUMMARY

|

This executive summary provides an overview of the information included in this proxy statement. We recommend that you review the entire proxy statement and our 2023 Annual Report to Stockholders before voting. |

2023 ANNUAL MEETING OF STOCKHOLDERS

|

|

|

|

DATE AND TIME Wednesday, November 15, 2023 9:00 a.m., Local Time LOCATION Radiant Logistics, Inc. Principal Executive Offices Triton Towers Two 700 S. Renton Village Place, Seventh Floor Renton, Washington 98057 RECORD DATE Holders of record of our common stock at the close of business on September 22, 2023, are entitled to notice of, to attend, and to vote at the 2023 Annual Meeting of Stockholders or any continuation, postponement, or adjournment thereof. |

VOTING ITEMS |

|

|

Proposal |

Board’s Vote Recommendation |

Page |

Proposal No. 1: Election of directors |

FOR |

25 |

Proposal No. 2: Ratification of appointment of independent registered public accounting firm |

FOR |

28 |

Proposal No. 3: Advisory vote on executive compensation |

FOR |

31 |

|

|

|

|

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on Wednesday, November 15, 2023 This proxy statement and our 2023 Annual Report of Stockholders are available online, free of charge, at www.proxyvote.com. On this website, you will be able to access this proxy statement, our 2023 Annual Report, and any amendments or supplements to these materials that are required to be furnished to stockholders. We encourage you to access and review all of the important information contained in the proxy materials before voting. |

Radiant Logistics, Inc. – 2023 Proxy Statement 4

Fiscal year 2023 BUSINESS HIGHLIGHTS

FINANCIAL

|

|

$1,085.5 million |

Revenues Achieved $1,085.5 million in total revenues, a 25.6%↓ year-over-year |

$283.8 million |

Non-GAAP Adjusted Gross Profit Achieved $283.8 million in non-GAAP adjusted gross profit, a 7.3%↓ year-over-year |

$20.6 million |

Net Income Achieved net income of $20.6 million, a 53.7%↓ year-over-year, or $0.43 per basic and $0.42 per fully diluted share |

$39.3 million |

Non-GAAP Adjusted Net Income Achieved non-GAAP adjusted net income of $39.3 million, a 32.5%↓ year-over-year, or $0.82 per basic and $0.79 per fully diluted share |

$55.6 million |

Non-GAAP Adjusted EBITDA and Adjusted EBITDA Margin Achieved non-GAAP adjusted EBITDA of $55.6 million, a 31.3%↓ year-over-year, and non-GAAP adjusted EBITDA Margin of 19.6%, ↓680 basis points year-over-year |

OPERATIONAL

|

|

|

Strong Network of Company-Owned Locations and Strategic Operating Partners Maintains a strong network of over 25 company-owned locations and over 100 strategic operating partners (independent agents) in the United States and Canada as well as additional global partners to facilitate international shipments |

|

Compelling Multi-Modal Service Offering Continues to build out a strong compelling multi-modal service offering, leveraging our technology and bundling value-added logistics solutions with our core transportation service offerings |

|

Highly Diversified Customer Base Cultivates significant long-standing customer relationships across the platform, with no one customer representing more than 5% of our revenues |

STRATEGIC

|

|

$2.2 million |

2023 Investment in Robust and Advanced Technology Offerings and Platform Provides robust and advanced technology offerings to our customers, our company-owned locations, strategic operating partners, and to support corporate and finance operations. During fiscal year 2023, we invested over $2.2 million on technology enhancements and software systems to increase our operating efficiency and improve technology offerings. |

21 acquisitions |

Proven Growth Platform Continues to deliver profitable growth with a track record of executing and integrating 21 acquisitions since our inception in 2006. |

|

|

|

Annex I provides reconciliations of non-GAAP financial measures to most comparable U.S. GAAP measures. |

Radiant Logistics, Inc. – 2023 Proxy Statement 5

CORPORATE GOVERNANCE

HIGHLIGHTS

|

|

|

|

|

Three-quarters of directors are independent |

|

Annual say-on-pay vote |

|

Annual election of all directors |

|

Officer and director stock ownership and retention requirements |

|

Majority vote standard for uncontested director elections, with a director resignation policy |

|

Prohibitions on hedging, pledging, and stock option repricing |

|

Emphasis on diversity in Board refreshment efforts |

|

Double trigger change of control arrangements |

|

Independent lead director |

|

Robust clawback policy |

|

Board oversight of ESG policies |

|

No poison pill |

|

Robust Board and committee evaluations |

|

Single class of stock |

STOCKHOLDER ENGAGEMENT

We are committed to a robust and proactive stockholder engagement program. The Board of Directors values the perspectives of our stockholders, and feedback from stockholders on our business, corporate governance, executive compensation, and sustainability practices are important considerations for Board discussions throughout the year.

During fiscal year 2023, our Board reached out to 23 of our largest institutional investors. Stockholder feedback is thoughtfully considered and has led to modifications in our executive compensation program, governance practices and disclosures. Some of the actions we have taken in response to feedback over the last several years are described below.

|

|

What We Heard |

What We Did |

Align the interest of executive officers with those of stockholders |

We adopted stock ownership and retention guidelines applicable to our NEOs to ensure that their interests would be closely aligned with those of our stockholders. All of our NEOs are in compliance with our guidelines. We also have adopted an anti-hedging/pledging policy. Our founder and CEO owns approximately 21.3% of our outstanding common stock. |

Emphasize long-term performance-based incentives |

Beginning in fiscal year 2022, we revised our Long-Term Incentive Program (LTIP) to provide for new performance unit awards which will vest based upon achievement of a combination of company and individual performance goals as measured over a three-year period. The performance unit awards are in addition to our restricted stock unit awards which are granted on an annual basis and are determined based, in large part, on the achievement of annual company and individual performance goals, and once granted do not vest until the three-year anniversary of the grant date. The performance unit awards constitute at least 70% our CEO’s target LTIP opportunity for fiscal year 2023. |

Radiant Logistics, Inc. – 2023 Proxy Statement 6

|

|

Increase disclosure on executive compensation |

As a smaller reporting company, we were not required to include a Compensation Discussion and Analysis section in our proxy statement nor the more extensive executive compensation tables. Starting in 2021, in response to stockholder feedback, we substantially increased and improved our executive compensation disclosure in this proxy statement, with an eye towards transparency despite the fact that we are not required to provide these disclosures. |

Ensure the recovery of incentive compensation based on incorrect calculations that resulted in a financial restatement |

In September 2021, we adopted a separate and more robust clawback policy covering cash and equity incentive compensation applicable to current and former executives. |

Perform a compensation risk assessment |

As a smaller reporting company, we were not required to perform a compensation risk assessment. Starting in 2021, in response to stockholder feedback, we performed a compensation risk assessment which concluded that our compensation policies, practices and programs, along with our governance structure, work together in a manner so as to encourage our executives (and employees) to pursue growth strategies that emphasize stockholder value creation, but not to take unnecessary or excessive risks that could threaten the value of our Company. |

Disclose CEO pay ratio |

As a smaller reporting company, we were not required to disclose a CEO pay ratio. Starting in 2021, in response to stockholder feedback, we calculated and disclosed a CEO pay ratio in accordance with SEC rules and regulations under “—CEO Pay Ratio”. |

Adopt or disclose an anti-hedging/pledging policy |

We have increased substantially our disclosure of our anti-hedging/pledging policy in this proxy statement. |

Adopt a no tax gross-up policy |

In September 2021, we adopted a new tax gross-up policy that prohibits tax gross-ups, other than the grandfathered provision in the employment agreement of our founder and CEO. |

Increase board diversity |

We added Ms. Kristin E. Toth to the Board of Directors effective June 3, 2021. |

Formalized a Lead Independent Director role to the board |

Our Board designated the Chairman of the Company’s Audit Executive and Oversight Committee as the Company’s Lead Independent Director to formalize the position and to further enhance the Company’s corporate governance practices, which already include a majority of independent directors. |

Provide more robust disclosure regarding ESG efforts |

We have increased our disclosure regarding our ESG efforts in this proxy statement and our Annual Report on Form 10-K. |

Radiant Logistics, Inc. – 2023 Proxy Statement 7

BOARD NOMINEES

Below are the directors nominated for election by stockholders at the Annual Meeting for a one-year term. The Board recommends a vote “FOR” each of these nominees.

|

|

|

|

|

|

Director |

Age |

Serving Since |

Independent |

Committees |

Other Public Boards |

Bohn H. Crain |

59 |

2005 |

No(1) |

— |

— |

Richard P. Palmieri |

70 |

2014 |

Yes |

Audit and Executive Oversight Committee |

— |

Michael Gould |

59 |

2016 |

Yes |

Audit and Executive Oversight Committee |

— |

Kristin E. Toth |

48 |

2021 |

Yes |

Audit and Executive Oversight Committee |

— |

(1)Bohn H. Crain is not independent because he also serves as our Chief Executive Officer.

KEY QUALIFICATIONS

The following are some of the key qualifications, skills, and experiences of our Board nominees.

|

|

|

|

|

|

Director |

CEO/Senior Officer Experience |

Financial/Finance Experience |

Industry Experience |

Technology and

E-Commerce |

Corporate Governance |

Bohn H. Crain |

● |

● |

● |

|

|

Richard P. Palmieri |

● |

● |

|

|

● |

Michael Gould |

● |

|

● |

● |

|

Kristin E. Toth |

● |

|

● |

● |

|

The lack of a mark for a particular item does not mean that the director does not possess that qualification, characteristic, skill, or experience. We look to each director to be knowledgeable in these areas; however, the mark indicates that the item is a particularly prominent qualification, characteristic, skill, or experience that the director brings to the Board.

EXECUTIVE COMPENSATION BEST PRACTICES

Our compensation practices include many best pay practices that support our executive compensation objectives and principles and benefit our stockholders.

|

|

|

|

|

What We Do |

|

What We Don’t Do |

|

Maintain a competitive compensation package |

|

No guaranteed salary increases or bonuses |

|

Structure our executive officer compensation so that a significant portion of pay is at risk |

|

No excessive perquisites |

|

Emphasize long-term performance in our equity-based incentive awards |

|

No repricing of stock options unless approved by stockholders |

|

Maintain a robust clawback policy |

|

No pledging of Radiant securities |

|

Require a double-trigger for equity acceleration upon a change of control |

|

No short sales or derivative transactions in Radiant stock, including hedges |

|

Have robust stock ownership and retention guidelines |

|

No current payment of dividends on unvested awards |

|

Hold an annual say-on-pay vote |

|

No excise or other tax gross-ups (other than the grandfathered arrangement with our founder and CEO) |

Radiant Logistics, Inc. – 2023 Proxy Statement 8

2024 ANNUAL MEETING OF STOCKHOLDERS

Date of 2024 Annual Meeting of Stockholders

We anticipate that our 2024 Annual Meeting of Stockholders will be held on or about Wednesday, November 13, 2024.

Important Dates for Stockholder Submissions

The following are important dates in connection with our 2024 Annual Meeting of Stockholders.

|

|

Stockholder Action |

Submission Deadline |

Proposal Pursuant to Rule 14a-8 of the Securities Exchange Act of 1934 |

No later than June 8, 2024 |

Nomination of a Candidate Pursuant to our Bylaws and Rule 14a-19 of the Securities Exchange Act of 1934 |

Between August 15, 2024 and September 14, 2024 |

Proposal of Other Business for Consideration Pursuant to our Bylaws |

Between August 30, 2024 and September 24, 2024 |

OUR COMMITMENT TO ENVIRONMENTAL, SOCIAL, AND GOVERNANCE PRINCIPLES

OUR esg STORY

The Board continues to deepen its commitment to Environmental, Social, and Governance (ESG) values. In fiscal year 2023, Radiant further enhanced and consolidated our efforts to accelerate programs related to Climate Change and Greenhouse Gas Emissions; Inclusion (DEI); as well as community action and good corporate citizenship.

We continue to take great pride in our work that supports humanitarian and relief related projects around the globe for both humanitarian and governmental agencies. This work has included the transportation of medical equipment, MREs and construction supplies; we have transported search and rescue equipment, generators, hygiene supplies, and bottled water across the world for those areas affected by natural disasters including to Guam, Turkey, and Hawaii. Concurrently, we have also expanded our social responsibility initiatives to include the launching of a long-term partnership with the American Heart Association. In addition, we have continued to seek partnerships with organizations who are actively committed to the goal of lifting up local communities.

We have progressed our internal environmental initiatives, including our technology recycling program; paper recycling program at corporate headquarters; public transport incentive program for corporate employees; remote hybrid working options to reduce emissions from commuting and power-saving initiatives to reduce electricity consumption and single-use containers. Radiant remains a long-term member of the SmartWay® Transport Partnership and is also exploring other member and partnerships that are focused on the reduction of our collective environmental footprint.

In fiscal year 2023, Radiant further expanded our ESG & Sustainability team. Our ESG Steering Committee continues to meet at least biweekly and we have launched a Radiant ESG Task Force: a working group that includes both operational and administrative representatives from across our business. These groups together will lead the charge for the future success in our environmental, social, and overall governance related endeavors. Radiant has likewise continued to work with an external ESG consultant as we further explore our alignment with the Task Force on Climate-related Financial Disclosures (TCFD) as well as the Sustainability Accounting Standards Board (SASB) and in the areas of climate and greenhouse gas emissions, similar alignment with the Science Based Target initiative (SBTi).

Radiant Logistics, Inc. – 2023 Proxy Statement 9

As part of our work with both our Steering Committee and external ESG consultant, and as a result of our initial risk assessment in 2022, we have developed a preliminary blueprint from which to expand and build programs that prioritize ways to mitigate ESG-related risks and support ESG-related opportunities. These programs focus on:

•Helping customers to manage increased complexity from carbon taxes and emissions reporting requirements; meeting demand for decarbonized logistics services including intermodal and other eco-friendly transportation and logistics solutions;

•Supporting government agencies, non-governmental organizations (NGOs) and other partners in humanitarian and disaster relief work;

•Expanding and nurturing relationships with third party vendors and community partners dedicated to social equity in the community; and

•Fostering a positive and engaging organizational culture of diversity, equity, and inclusion, with the goal to both create and maintain a high-performance environment where all people throughout our workforce can thrive.

A Note on ESG and Climate Change Effects

At Radiant, we recognize the importance of addressing climate-related risks and opportunities to ensure our business is resilient and sustainable for the future. In 2023 we have continued in our efforts to further align with the TCFD framework and their four pillars of Governance Framework, Risk Management, Strategic Planning and Metrics and Targets. We have already begun to collect data to inform future strategy as well as our disclosures. While as a function of Radiant’s asset-light based business model and strategy, we do not anticipate that the risks associated will climate change will have a material financial impact on our business, we recognize that we must work to reduce our emissions across the organization.

In fiscal year 2023, we have begun an initial carbon inventory to better inform our greenhouse gasses (GHG) initiatives, which we expect to complete in the coming months. As we continue to work through and develop best practices in minimizing the negative effects of our industry on the environment, we intend to (1) report on our data in relation to greenhouse gas emissions, (2) execute on both an Environmental Management Policy and a Sustainable Procurement Policy, and (3) establish targets for reduction of GHG emissions and our carbon footprint, with consideration to SBTi alignment. Following the completion of our carbon inventory, we also intend to subsequently publish a full TCFD-aligned report, which will be available online at www.radiantdelivers.com. Highlights of our progress are included below.

|

|

|

|

|

Complete |

In Progress |

For 2024 & Beyond |

Governance |

•Radiant has undertaken to integrate sustainability & climate related matters into our corporate governance, making ESG risks & opportunities a regular agenda item in quarterly meetings. •An independent board member has been responsible for sustainability/ESG in tandem with an internal management liaison since 2022 •We continue to evaluate areas of opportunity to improve the integration of ESG into our governance and decision making process. |

•The Radiant ESG Steering Committee continues to establish learning pathways for the organization as a whole, data collection processes and metrics, as well as a cadence of risk and opportunity assessment that engages with all leaders of senior management. •Radiant has further engaged the expertise of key members within the organization with the preliminary development of an Radiant ESG Task Force. |

•The ESG Task Force will meet monthly to ensure our climate-related initiatives continue to align seamlessly with our business strategy and overarching corporate goals. •Radiant will continue to further integrate ESG into company policies and extended working groups. |

Risk Management |

•Climate-related risks are being identified and assessed by our ESG Steering Committee with oversight |

•Climate-related risks are reviewed and discussed initially via our ESG Steering Committee and moving |

•While discussed at the committee level, these risks will still be considered within the TCFD framework and in conjunction |

Radiant Logistics, Inc. – 2023 Proxy Statement 10

|

|

|

|

|

for data acquisition, measurement and evaluation. •The ESG Steering Committee continues to report on at least a quarterly basis to both the CEO & Board of Directors in these areas. |

forward in conjunction with our ESG Taskforce. |

with our ERM Framework at the Board level and with our overall Business Continuity Plan in mind. |

Strategic Planning |

•Radiant began its initial assessment of climate related risks and opportunities in 2022 •Throughout 2023 we have further developed relationships with vendors and partners who share the core value that we are all responsible for climate-related challenges. |

•We have continued to identify & evaluate and formalize those short, medium and long term risks & opportunities, with the understanding that this is a changing model that must account for a dynamic market. •We have continued to engage with customers and vendors to ensure we are aware of developments in climate related risks and opportunities and other sustainability measures. |

As a climate-related opportunity, we see our core commitment to our customers as an emerging opportunity on multiple fronts: 1.helping customers to manage increased complexity from carbon taxes and emissions reporting requirements 2.meeting the shifting demand for decarbonized logistics services including intermodal and other eco-friendly transportation and logistics solutions 3.Supporting government agencies, NGOs and other partners |

Metrics & Targets |

We have explored Scope 1, 2 and 3 emissions and how to best align with the TCFD as well as science based emissions targets. |

We are currently focusing on the data collection to establish our Scope 1 & 2 greenhouse gas emissions |

•We will continue to evaluate programs that will help to reduce our overall impact as a company on the environment •Once we have concluded our baseline measurements, we intend to establish formal targets to measure our performance against. |

Ultimately, we believe progress on our ESG initiatives will have a positive impact on our stockholders, consumers, customers, our talented worldwide associates and the communities in which we are proud to live and work.

CORPORATE GOVERNANCE

best PRACTICES

We have adopted several corporate governance best practices, which are designed to promote actions that benefit our stockholders and create a framework for our decision-making.

|

|

Annual election of all directors |

All directors are elected annually for a one-year term. |

Majority vote standard for uncontested director elections, with a director resignation policy |

We have a majority voting standard for uncontested director elections, and directors who do not receive more votes “for” than “against” their election must offer to resign from the Board. |

Three-quarters of our directors are independent |

Three of the four directors on our Board are independent. |

Robust Board and committee evaluations |

Our Board and committees conduct annual performance self-evaluations. |

No poison pill |

We believe that not having a poison pill benefits our stockholders by not discouraging takeover attempts that may increase value for our stockholders. |

Radiant Logistics, Inc. – 2023 Proxy Statement 11

|

|

Board oversight of ESG initiatives |

The Audit and Executive Oversight Committee has been delegated oversight authority of our ESG initiatives. |

Emphasis on gender and racial/ethnic diversity in Board |

Effective June 3, 2021, the Board added a female director to the Board. In addition, our Chairman and CEO is a Native American Indian. As a result, half of our Board is diverse based on gender and racial/ethnic diversity. |

Robust stockholder outreach program |

Our executives hold numerous meetings primarily with institutional investors to seek stockholder input and strive to take actions that reflect the input received. |

Officer and director stock ownership and retention requirements |

We have robust stock ownership and retention guidelines for our directors and officers that require maintenance of a specified level of ownership based on compensation. |

Hedging, pledging, and stock option repricing prohibitions |

We prohibit certain employees, including our NEOs, from engaging in any hedging transactions, short sales, transactions in publicly traded options, such as puts, calls and other derivatives, or short-term trading. |

Require a double trigger for cash severance and accelerated vesting of equity upon a change of control |

The double trigger feature incentivizes executives to accept or continue employment with Radiant Logistics in the event of a change of control event. |

Robust clawback policy |

We maintain a robust clawback policy pursuant to which we may recover cash and equity incentive compensation from current or former officers in the event of a restatement. |

Single class of stock |

We have a single class of stock, so our stockholders all have equal voting rights. |

GUIDELINES

The Board has adopted Corporate Governance Principles covering, among other things, the duties and responsibilities of, and independence standards applicable to, our directors and Board committee structures and responsibilities. Among the topics addressed in our Corporate Governance Guidelines are:

|

|

2.Selection of the Chairman of the Board 3.Selection of new directors 4.Director qualifications 7.Directors who change their present job responsibility 8.Retirement and resignation policy 10.Separate sessions of independent directors 11.Board and Board committee self-evaluations 12.Strategic direction of the Company 13.Board access to management 15.Management development |

17.Board interaction with institutional investors, analysts, press, and customers 18.Board orientation and continuing education 19.Director attendance at annual meetings of stockholders 21.Selection of agenda items for Board meetings 22.Number and names of Board committees 23.Independence of Board committees 24.Assignment and rotation of committee members 25.Evaluation of Board committee charters 26.Evaluation of executive officers 29.Communications with directors |

From time to time, the Board, upon recommendation of the Audit and Executive Oversight Committee, reviews and updates the Corporate Governance Guidelines as it deems necessary and appropriate. The Corporate Governance Guidelines are available in the “Investors—Corporate Governance—Governance Documents” section of the Company’s website located at About – Radiant Global Logistics (radiantdelivers.com).

Radiant Logistics, Inc. – 2023 Proxy Statement 12

MAJORITY VOTE STANDARD AND RESIGNATION POLICY

Our Bylaws provide for a majority vote standard for uncontested director elections. Director nominees will be elected by a majority of the votes cast. A “majority of the votes cast” means that the number of votes cast “for” a director nominee exceeds the number of votes cast “against” such director nominee, with “abstentions” and “broker non-votes” not counted as a vote cast either “for” or “against” that nominee’s election. However, director nominees will be elected by a plurality of the votes cast in connection with a contested election, as defined in our Bylaws.

Pursuant to our Corporate Governance Guidelines, any incumbent director who is not elected to the Board in accordance with the Bylaws shall promptly tender a written offer of resignation as a director. The Nominating and Corporate Governance Committee will recommend to the Board whether to accept or reject the director’s resignation offer or take other action, and the Board will take action with respect to the offer no later than 90 days following certification of the election results and will publicly disclose its decision regarding the director’s resignation offer, if applicable, promptly thereafter. Any director whose resignation offer is under consideration will abstain from participating in any decision regarding that resignation offer.

Director Independence

Under the NYSE American continued listing standards, independent directors must comprise a majority of a listed company’s board of directors. In addition, the NYSE American continued listing standards require that, subject to specified exceptions, each member of a listed company’s audit, compensation, and nominating and corporate governance committees be independent. Audit committee members must also satisfy heightened independence criteria set forth in Rule 10A-3 under the Securities Exchange Act of 1934 (Exchange Act), and compensation committee members must satisfy heightened independence criteria set forth in the NYSE American rules. Under the NYSE American rules, a director will only qualify as an “independent director” if the company’s board of directors affirmatively determines that the director has no material relationship with the company, either directly or indirectly, that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

The Board has undertaken a review of its composition, the composition of its Board committees, and the independence of each director. Based upon information requested from and provided by each of our directors concerning his or her background, employment, and affiliations, including family relationships with us, our senior management, and our independent registered public accounting firm, the Board has determined that all but one of our directors, Bohn H. Crain, are independent directors under the standards established by the Securities and Exchange Commission (SEC) and the NYSE American. In making this determination, the Board considered the current and prior relationships that each non-employee director has with Radiant Logistics and all other facts and circumstances the Board deemed relevant in determining their independence.

Board Leadership Structure

The Board does not have a policy regarding the separation of the roles of Chief Executive Officer and Chairman of the Board as the Board believes it is in the best interests of the Company to make that determination based on the position and direction of the Company and the membership of the Board. The Board has determined that having our founder and Chief Executive Officer serve as Chairman is in the best interest of our stockholders at this time. We believe this structure makes the best use of the Chief Executive Officer’s extensive knowledge of the Company and its industry, as well as fostering greater communication between our management and the Board.

Radiant Logistics, Inc. – 2023 Proxy Statement 13

We have adopted a counterbalancing governance structure to protect the interests of our stockholders by preventing the Board from being unduly influenced by the combination of these positions. Effective as of our 2021 Annual Meeting, the Board designated Richard P. Palmieri, the Chairman of the Company’s Audit Executive and Oversight Committee, as the Company’s Lead Independent Director to formalize the position and to further enhance the Company’s corporate governance practices. The Lead Independent Director’s primary responsibility is to ensure that the Board functions independent of management and acts as principal liaison between the independent directors and the non-independent directors and the Chief Executive Officer. The lead independent director presides at executive sessions of our independent directors, as well as performs other duties applicable to that position including, among other things, providing guidance to the Chairman regarding agendas for Board and committee meetings, advising the Chair as to the information to be provided the Board for its meetings, chairing meetings of the Board in the event the Chairman cannot be in attendance, and acting as principal liaison between the independent directors and the Chair. The lead independent director is expected to foster a cohesive board that cooperates with the Chairman towards the ultimate goal of creating stockholder value and leads our stockholder engagement efforts.

The Board believes that the most effective board structure is one that emphasizes board independence and ensures that the board’s deliberations are not dominated by management. Three out of the four directors on the Board are independent, and our Audit and Executive Oversight Committee is composed entirely of independent directors. In support of the independent oversight of management, the independent directors meet and hold discussions without management present.

Management is responsible for the Company’s day-to-day risk management and the Board’s responsibility is to engage in informed oversight of and provide overall direction with respect to such risk management. Our Board administers its risk oversight function directly and through our Audit and Executive Oversight Committee, which includes regular meetings with management to discuss, identify and mitigate potential areas of risk. Our Board’s approach to risk management is to focus on understanding the nature of our enterprise risks, to support the achievement of organizational objectives, including strategic objectives, to improve long-term organizational performance and enhance stockholder value, while at the same time overseeing an appropriate level of risk for the Company. We believe our current board leadership structure helps ensure proper risk oversight, based on the allocation of duties among committees and the role of our independent directors in risk oversight.

Executive Sessions

Our non-management independent directors meet in executive sessions without management to consider such matters as they deem appropriate, such as reviewing the performance of management. Executive sessions of our independent directors are typically held in conjunction with regularly scheduled Board meetings.

Committees of the Board of Directors

We currently have one standing committee of the Board, the Audit and Executive Oversight Committee, which was formed in 2012. The Board may establish other Board committees as it deems necessary or appropriate from time to time.

Below are our directors, their committee memberships and their fiscal year 2023 attendance rates for Board meetings.

|

|

|

|

Director |

Board |

Audit and Executive Oversight Governance |

Board Meeting Attendance Rate |

Bohn H. Crain |

● |

|

100% |

Richard P. Palmieri |

● |

Chair |

100% |

Michael Gould |

● |

● |

100% |

Kristin E. Toth |

● |

● |

100% |

Audit and executive oversight committee

The standing committee of the Board of Directors is the Audit and Executive Oversight Committee, which was formed in 2012. The Audit and Executive Oversight Committee fulfills the consolidated oversight functions typically associated with audit, compensation and nominating and governance committee.

Radiant Logistics, Inc. – 2023 Proxy Statement 14

The Audit and Executive Oversight Committee operates under a written charter that is reviewed annually. In September 2021, the Board of Directors amended and restated the Company’s Audit and Executive Oversight Committee Charter to reflect the restructuring of the roles of authority granted to each member of the Audit and Executive Oversight Committee and to include the oversight of the development and implementation of corporate governance policies for the Company. The amended and restated Charter is available on our website at www.radiantdelivers.com.

The Audit and Executive Oversight Committee held five formal meetings during fiscal year 2023. The members of the Audit and Executive Oversight Committee are Messrs. Gould, Palmieri (Chair), and Ms. Toth.

Audit committee Function:

The Audit and Executive Oversight Committee, pursuant to its written charter, among other matters, performs traditional Audit Committee functions and oversees (i) our financial reporting, auditing, and internal control activities; (ii) the integrity and audits of our financial statements; (iii) our compliance with legal and regulatory requirements; (iv) the qualifications and independence of our independent auditors; (v) the performance of our internal audit function and independent auditors; and (vi) our overall risk exposure and management. Richard P. Palmieri is responsible for oversight of the Audit Committee functions of the Audit and Executive Oversight Committee.

Additionally, the Committee:

•is responsible for the appointment, retention, and termination of our independent auditors, and determines the compensation of our independent auditors;

•reviews with the independent auditors the plans and results of the audit engagement;

•evaluates the qualifications, performance, and independence of our independent auditors;

•has sole authority to approve in advance all audit and non-audit services by our independent auditors, the scope and terms thereof, and the fees therefor;

•reviews the adequacy of our internal accounting controls; and

•meets at least quarterly with our executive officers, internal audit staff, and our independent auditors in separate executive sessions.

The Audit and Executive Oversight Committee charter authorizes the Audit and Executive Oversight Committee to retain independent legal, accounting, and other advisors as it deems necessary to carry out its responsibilities. The Audit and Executive Oversight Committee reviews and evaluates, at least annually, the performance of the Audit and Executive Oversight Committee, including compliance with its charter.

Financial Literacy and Financial Experts

The Board has determined that each member of the Audit and Executive Oversight Committee is “financially literate” under the continued listing requirements of the NYSE American and satisfies the heightened independence criteria for audit committee members set forth in Rule 10A-3 under the Exchange Act. As of December 28, 2020, Mr. Palmieri has been designated by the Board as our “audit committee financial expert,” as that term is defined in the rules of the SEC.

Material Weaknesses and Remediation Efforts

As previously reported in our Annual Report on Form 10-K for the year ended June 30, 2023, we concluded that a material weakness existed in our internal control over financial reporting as of June 30, 2021 related to the recording and processing of revenue transactions, including the timing of the Company’s estimated accrual of in-transit revenues and related costs.

Radiant Logistics, Inc. – 2023 Proxy Statement 15

In response to this material weakness, the Company has continued making progress with corrective action during fiscal year 2023 to address the material weakness and provide reasonable assurance that future errors in revenue transactions would be prevented and/or detected in a timely manner. The Company’s corrective actions include, but are not limited to:

a)Implementing new controls;

b)Working with strategic operating partners and Company-owned locations to understand their reporting processes and strengthen the Company’s monitoring controls over their operations;

c)Identifying and formalizing the critical data elements in our revenue accrual process;

d)Further refining our accrual process to be more granular and operate to the desired level of precision to detect material misstatements; and

e)Performing additional review procedures and analysis including testing of unposted shipments and subsequently analyzing posted shipments in an effort to improve the overall accuracy of the revenue accrual.

As of June 30, 2023, remediation is ongoing. While existing controls have been enhanced, and new controls have been implemented, there is a need for additional enhancements around the design of those controls, including, but not limited to, the formalization of the documentation retained to evidence the performance of these controls. Further testing procedures are also needed to verify their effectiveness over multiple periods of operation.

Separately, as previously reported in our Annual Report on Form 10-K for the year ended June 30, 2023, we concluded that material weaknesses exist surrounding our Information Technology General Controls (“ITGCs”) as of June 30, 2023, specifically relating to change management and user access rights. The material weaknesses related to the ineffective design and operation of ITGCs over the information technology (“IT”) systems supporting the Company’s Transportation Management (“TM”) systems as well as its Enterprise Resource Planning (“ERP”) system.

In response to the material weaknesses, the Company removed certain elevated logical access privileges from user accounts and is actively enhancing existing controls that may include the addition of new controls to further strengthen our technology environment. The Company will need the refined and new controls to operate effectively for a specific period of time before concluding that the material weaknesses have been resolved.

The Audit and Executive Oversight Committee takes its review of the adequacy of our internal accounting controls seriously. In addition to the foregoing remediation efforts, the Audit and Executive Oversight Committee has retained directly, Armanino LLP to provide consulting services to facilitate the remediation efforts of management related to the material weaknesses and has elected to withhold the payment of a portion of bonuses to senior management until there is a resolution of the material weaknesses.

Compensation Committee Function:

We do not have a standing Compensation Committee. The Audit and Executive Oversight Committee fulfills the compensation committee functions. The Audit and Executive Oversight Committee reviews the compensation philosophy, strategy of the Company and consults with the Chief Executive Officer, as needed, regarding the role of our compensation strategy in achieving our objectives and performance goals and the long-term interests of our stockholders. The Audit and Executive Oversight Committee has direct responsibility for approving the compensation of our Chief Executive Officer, and makes recommendations to the Board with respect to our other executive officers. The term “executive officer” has the same meaning specified for the term “officer” in Rule 16a-1(f) under the Securities Exchange Act. Michael Gould is responsible for oversight of the Compensation Committee functions of the Audit and Executive Oversight Committee.

Our Chief Executive Officer sets the compensation for anyone whose compensation is not set by the Board.

The Committee, pursuant to its written charter, among other matters:

•assists the Board in developing and evaluating potential candidates for executive officer positions and overseeing the development of executive succession plans;

Radiant Logistics, Inc. – 2023 Proxy Statement 16

•administers, reviews, and makes recommendations to the Board regarding our compensation plans, including the Radiant Logistics, Inc. 2012 Stock Option and Performance Award Plan, 2021 Omnibus Incentive Plan, and Management Incentive Compensation Plan (MICP), and administers or oversees all such plans and discharges any responsibilities imposed on the Committee by such plans, including, without limitation, the grant of equity-based awards to officers and employees;

•reviews and approves on an annual basis our corporate goals and objectives with respect to compensation for executive officers and, at least annually, evaluates each executive officer’s performance in light of such goals and objectives to set his or her annual compensation, including salary, bonus, and equity and non-equity incentive compensation, subject to approval by the Board;

•reviews and approves any employment, severance, change of control, retention, retirement, deferred compensation, perquisite, or similar compensatory agreements, plans, programs, or arrangements with executive officers;

•provides oversight of management’s decisions regarding the performance, evaluation, and compensation of other officers;

•reviews our incentive compensation arrangements to confirm that incentive pay does not encourage unnecessary risk-taking, and reviews and discusses, at least annually, the relationship between risk management policies and practices, business strategy, and our executive officers’ compensation; and

•reviews the results of advisory stockholder votes on executive compensation and considers whether to recommend adjustments to our executive compensation policies and practices as a result of such votes and other stockholder input on executive compensation matters.

The Audit and Executive Oversight Committee may retain compensation consultants, outside counsel and other advisors as the Board deems appropriate to assist it in discharging its duties.

During fiscal year 2021, the Committee engaged Meridian Compensation Partners to perform an updated executive compensation study, develop an updated a peer group and provide it with guidance regarding the Company’s executive compensation program. Meridian completed the development of a Peer Group listing for Radiant Logistics and then conducted an analysis of our NEO positions compared to similar positions at Peer Group companies. Meridian also conducted an analysis of our Board of Directors compensation compared to the Peer Group companies. This information was used to develop our current compensation programs for Executives and Directors. As well, these trends and this information is being used by the Audit and Executive Oversight Committee to determine whether to make any additional changes to the Company’s overall compensation policies during fiscal year 2023.

During fiscal year 2023, Meridian Compensation Partners did not provide any services to the Company.

The Committee reviews and evaluates, at least annually, the performance of the Committee, including compliance with its charter.

The Board has determined that each of the Committee members satisfies the heightened independence criteria for compensation committee members under the continued listing requirements of the NYSE American. In addition, each of the Committee members is a “non-employee director” within the meaning of Rule 16b-3 under the Exchange Act.

nominating and governance committee Function:

We do not have a standing Nominating and Governance Committee. The Audit and Executive Oversight Committee fulfills the nominating and governance committee functions. The Audit and Executive Oversight Committee identifies and recommends to the Board individuals qualified to be nominated for election to the Board and recommends to the Board the members and Chairperson for each Board committee. Kristin E. Toth is responsible for oversight of the Nominating and Governance Committee functions of the Audit and Executive Oversight Committee.

The Committee, pursuant to its written charter, among other matters:

•identifies individuals qualified to become members of the Board and reviews with the Board the Board’s composition as a whole to ensure that it has the requisite and desired expertise, experience, qualifications, attributes and skills and that its membership consists of persons with sufficiently diverse and independent backgrounds;

Radiant Logistics, Inc. – 2023 Proxy Statement 17

•develops and recommends to the Board for its approval qualifications for director candidates and periodically reviews these qualifications with the Board;

•makes recommendations to the Board regarding director retirement age, tenure and refreshment policies;

•reviews the committee structure of the Board and recommends directors to serve as members or chairs of each Board committee;

•reviews and recommends Board committee slates annually and recommends additional Board committee members to fill vacancies as needed;

•develops and recommends to the Board a set of corporate governance guidelines and, at least annually, reviews such guidelines and recommends changes to the Board for approval as necessary;

•considers and oversees corporate governance issues as they arise from time to time and develops appropriate recommendations for the Board;

•reviews and approves the Company’s policies and practices pertaining to ESG issues and monitors the Company’s performance relative to such policies and practices; and

•oversees the annual self-evaluations of the Board, each Board committee, and management.

The Committee charter authorizes the Committee to retain a search firm or other advisors to assist in the identification and evaluation of director candidates, including the sole authority to approve the search firm’s or other advisors’ fees and other retention terms.

The Committee reviews and evaluates, at least annually, the performance of the Committee, including compliance with its charter.

Board and Board Committee Meetings; Attendance

The Board held eleven formal meetings during fiscal year 2023. All directors attended at least 75% of the combined total of (i) all Board meetings and (ii) all meetings of committees of the Board of which the director was a member during fiscal year 2023. Although the Board does not have a formal policy governing director attendance at its annual meeting of stockholders, we expect all of our directors to attend our annual meeting of stockholders, and we customarily schedule a regular Board meeting on the same day as our annual meeting. All directors serving at the time of our 2022 Annual Meeting of Stockholders held on May 23, 2023 attended the meeting either in person or by telephone.

Director QUALIFICATIONS and Nominations Process

The Board seeks to ensure that the Board is composed of members whose particular expertise, experience, qualifications, attributes, and skills, when taken together, will allow the Board to satisfy its oversight responsibilities effectively. We do not have a standing Nominating Committee. The Audit and Executive Oversight Committee fulfills the nominating committee functions. New directors are approved by the Board after recommendation by the Audit and Executive Oversight Committee.

In selecting nominees for director, without regard to the source of the recommendation, the Audit and Executive Oversight Committee believes that each director nominee should be evaluated based on his or her individual merits, taking into account the needs of the Company and the composition of the Board. Members of the Board should have the highest professional and personal ethics, consistent with our values and standards and Code of Ethics. At a minimum, a nominee must possess integrity, skill, leadership ability, financial sophistication, and capacity to help guide us. Nominees should be committed to enhancing stockholder value and should have sufficient time to carry out their duties and to provide insight and practical wisdom based on their experiences. Their service on other boards of public companies should be limited to a number that permits them, given their individual circumstances, to responsibly perform all director duties. In addition, the Audit and Executive Oversight Committee considers all applicable statutory and regulatory requirements and the requirements of any exchange upon which our common stock is listed or to which it may apply in the foreseeable future.

Radiant Logistics, Inc. – 2023 Proxy Statement 18

The Audit and Executive Oversight Committee will typically employ a variety of methods for identifying and evaluating nominees for director. The Audit and Executive Oversight Committee regularly assesses the appropriate size of the Board and whether any vacancies on the Board are expected due to retirement or otherwise. In the event that vacancies are anticipated, or otherwise arise, the Audit and Executive Oversight Committee will consider various potential candidates for director. Candidates may come to the attention of the Audit and Executive Oversight Committee through current directors, stockholders, or other companies or persons. The Audit and Executive Oversight Committee does not evaluate director candidates recommended by stockholders differently than director candidates recommended by other sources. Director candidates may be evaluated at regular or special meetings of the Audit and Executive Oversight Committee and may be considered at any point during the year.

We do not have a formal policy with regard to the consideration of diversity in identifying director nominees, but the Audit and Executive Oversight Committee strives to nominate directors with a variety of complementary skills so that, as a group, the Board will possess the appropriate talent, skills, and expertise to oversee our businesses. In evaluating director nominations, the Audit and Executive Oversight Committee seeks to achieve a balance of knowledge, experience, and capability on the Board. In connection with this evaluation, the Audit and Executive Oversight Committee will make a determination of whether to interview a prospective nominee based upon the Board’s level of interest. If warranted, one or more members of the Audit and Executive Oversight Committee, and others as appropriate, will interview prospective nominees in person or by telephone. After completing this evaluation and any appropriate interviews, the Audit and Executive Oversight Committee will recommend the director nominees after consideration of all its directors’ input. The director nominees are then selected by a majority of the independent directors on the Board, meeting in executive session and considering the Audit and Executive Oversight Committee’s recommendations.

The Company’s Corporate Governance Principles contain a retirement policy that requires no person shall be nominated to the Board to serve as a director after such person’s 74th birthday. The principles are intended to serve as a flexible framework within which the Board may conduct its business.

Ms. Toth was appointed to the Board effective June 3, 2021, upon the recommendation of the Audit and Executive Oversight Committee. Mr. Gould led our search for a new director. The Nominating and Governance Committee functions, including our commitment to environmental, social and governance principles, will be led by Ms. Toth.

In addition to stockholders’ general nominating rights provided in our Bylaws, stockholders may recommend director candidates for consideration by the Board. The Audit and Executive Oversight Committee will consider director candidates recommended by stockholders if the recommendations are sent to the Board in accordance with the procedures for other stockholder proposals described below in this proxy statement under the heading “Stockholder Proposals.” All director nominations submitted by stockholders to the Board for its consideration must include all of the required information set forth in our Bylaws, as summarized under the heading “Stockholder Proposals,” and the following additional information:

•any information relevant to a determination of whether the nominee meets the criteria described above;

•any information regarding the nominee relevant to a determination of whether the nominee would be considered independent under SEC rules or, alternatively, a statement that the nominee would not be considered independent;

•a statement, signed by the nominee, verifying the accuracy of the biographical and other information about the nominee that is submitted with the recommendation and consenting to serve as a director if so elected; and

•if the recommending stockholder, or group of stockholders, has beneficially owned more than five percent (5%) of our voting stock for at least one year as of the date the recommendation is made, evidence of such beneficial ownership.

During fiscal year 2023, we made no material changes to the procedures by which stockholders may recommend nominees to the Board as described in last year’s proxy statement.

BOARD REFRESHMENT AND BOARD DIVERSITY

The Board of Directors, with support and recommendations from the Audit and Executive Oversight, oversees the succession of its members. To this end, at least once a year, in connection with the annual director nomination and

Radiant Logistics, Inc. – 2023 Proxy Statement 19

re-nomination process, the Audit and Executive Oversight Committee evaluates each director’s performance, relative strengths and weaknesses, and future plans, including any personal retirement objectives and the potential applicability of the Company’s retirement policy for directors, which is set forth in the Company’s Corporate Governance Principles and provides that no person shall be nominated to the Board to serve as a director after such person’s 74th birthday. As part of that evaluation, the Nominating and Corporate Governance Committee also identifies areas of overall strength and weakness with respect to its composition and considers whether the Board of Directors as a whole possesses core competencies in the areas of accounting and finance, industry knowledge, management experience, sales and marketing, strategic vision, executive compensation, and corporate governance, among others.

We value boardroom diversity as integral to effective corporate governance. We believe that board diversity – gender, race, age, insight, background, and professional experience – is a necessity that improves the quality of decision-making and strategic vision, and represents the kind of company we aspire to be. Our Board is representative of a diverse group of backgrounds, viewpoints and ages. The Audit and Executive Oversight Committee, which oversees the function of the Audit, Compensation, and Nominating and Governance Committees, seeks to find director candidates who have demonstrated executive leadership ability and who are representative of the broad scope of stockholder interests.

As a smaller reporting company, we face challenges with recruiting director candidates. In the current climate, candidates who identify as diverse in terms gender or race/ethnicity are highly sought after by public company boards looking to increase their diversity. Larger publicly-traded companies provide these diverse candidates with opportunities for greater visibility and higher compensation. Additionally, many stockholders have policies on the number of publicly-traded boards a director can serve on, further limiting the pool of diverse candidates. Our board is aware of the continued emphasis placed upon board diversity by stockholders and regulatory bodies, and we will continue to monitor and consider trends in the market with respect to our board size and composition.

Below is a summary of our board diversity in terms of age, tenure, race/ethnicity, and gender.

|

|

|

|

|

|

Director |

Title |

Age |

Tenure |

Racial/Ethnic Diversity |

Gender Diversity |

Bohn H. Crain |

Chairman and CEO |

59 |

18 |

Native American |

M |

Richard P. Palmieri |

Independent Director |

70 |

9 |

White/Caucasian |

M |

Michael Gould |

Independent Director |

59 |

7 |

White/Caucasian |

M |

Kristin E. Toth |

Independent Director |

48 |

2 |

White/Caucasian |

F |

Summary |

Independence: 3/4 (75%) |

59 |

8 |

Racial/Ethnic Diversity: 1/4 (25%) |

Gender Diversity: 1/4 (25%) |

MANAGEMENT SUCCESSION Planning and development

The Board of Directors recognizes that one of its most important responsibilities is to ensure excellence and continuity in our senior leadership by overseeing the development of executive talent and planning for the effective succession of our Chief Executive Officer and the other members of our management team. This responsibility is reflected in the Company’s Corporate Governance Principles, which provide for a review of CEO succession planning and management development, and the charter of the Audit and Executive Oversight Committee, which requires the Audit and Executive Oversight Committee to recommend potential candidates for executive officer positions and oversee the development of executive succession plans.

BOARD AND COMMITTEE SELF-EVALUATIONS

The Board recognizes that a thorough evaluation process is an important element of corporate governance and enhances the effectiveness of the full Board and each committee. Therefore, each year, the Audit and Executive Oversight Committee oversees the evaluation process to ensure that the full Board and each committee conduct an assessment of their performance and solicit feedback for areas of improvement.

board Oversight OF BUSINESS STRATEGY

The Board of Directors oversees our strategic direction and business activities. Throughout the year, the Board and management discuss our short and long-term business strategy.

With respect to our short-term strategy, at the beginning of each year, our management presents to the Board a proposed annual business plan for the year and receives input from the Board and a final annual business plan is

Radiant Logistics, Inc. – 2023 Proxy Statement 20

approved by the Board. At each subsequent regular board meeting, the Board reviews our operating and financial performance relative to the annual business plan.

board role in Risk Oversight

Risk is inherent with every business. We face a number of risks, including financial (accounting, credit, interest rate, liquidity, and tax), operational, political, strategic, regulatory, compliance, legal, competitive, and reputational risks.

Management is responsible for the Company’s day-to-day risk management and the Board’s responsibility is to engage in informed oversight of and provide overall direction with respect to such risk management. Our Board administers its risk oversight function directly and through our Audit and Executive Oversight Committee, which includes regular meetings with management to discuss, identify and mitigate potential areas of risk. Our Board’s approach to risk management is to focus on understanding the nature of our enterprise risks, to support the achievement of organizational objectives, including strategic objectives, to improve long-term organizational performance and enhance stockholder value, while at the same time oversee an appropriate level of risk for the Company. We believe our current board leadership structure helps ensure proper risk oversight, based on the allocation of duties among committees and the role of our independent directors in risk oversight.

Code of Ethics

The Board has adopted a Code of Ethics that applies to our officers, directors, and employees. Among other matters, our Code of Ethics is designed to deter wrongdoing and to promote the following:

•honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships;

•full, fair, accurate, timely and understandable disclosure in reports and documents that we file with, or submit to, the SEC and in our other public communications;

•compliance with applicable governmental laws, rules, and regulations;

•prompt internal reporting of violations of the code to appropriate persons identified in the code; and

•accountability for adherence to our Code of Ethics.

Any waiver of our Code of Ethics for our employees may be made only by our CEO and, with respect to or director or executive officers, our Board of Directors. Any waiver will be promptly disclosed as required by law and continued listing requirements of the NYSE American. We intend to satisfy the disclosure requirements of Item 5.05 of Form 8-K and applicable continued listing requirements of the NYSE American regarding amendments to or waivers from any provision of our Code of Ethics by posting such information in the “About—Governance” section of our website located at www.radiantdelivers.com. Our Code of Ethics is available on our website at www.radiantdelivers.com, and may be obtained without charge upon written request directed to Attn: Human Resources, Radiant Logistics, Inc., Triton Towers Two, 700 S. Renton Village Place, Seventh Floor, Renton, Washington 98057.

WHISTLEBLOWER Procedures

We maintain procedures to receive, retain, and treat complaints regarding accounting, internal accounting controls, or auditing matters and to allow for the confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters. A 24-hour, toll-free, confidential ethics hotline and a confidential web-based reporting tool are available for the submission of concerns regarding these and other matters by any employee. Concerns and questions received through these methods relating to accounting, internal accounting controls, or auditing matters are promptly brought to the attention of our General Counsel and the Chair of the Audit and Executive Oversight Committee and are handled in accordance with procedures established by the Audit and Executive Oversight Committee. Complete information regarding our complaint procedures is contained within our Code of Ethics, which is described above and may be accessed on our website as noted above.

Radiant Logistics, Inc. – 2023 Proxy Statement 21

STOCKHOLDER ENGAGEMENT

We are committed to a robust and proactive stockholder engagement program. The Board values the perspectives of our stockholders, and feedback from stockholders on our business, corporate governance, executive compensation, and sustainability practices are important considerations for Board discussions throughout the year.

During fiscal year 2023, we reached out to our institutional investors to request meetings to discuss any issues or concerns they may have. We reached out to our top 23 institutional investors as of March 31, 2023, representing 45.4% of our outstanding common stock. This outreach did not include our founder and CEO, who owns 21.3% of our outstanding common stock. Five institutional investors representing 9.7% of our outstanding common stock agreed to engage with us. Stockholder feedback is thoughtfully considered and has led to modifications in our executive compensation program, governance practices and disclosures. Some of the actions we have taken in response to feedback over the last several years are described below.

|

|

What We Heard |

What We Did |

Increase stockholder influence over director elections |

In October 2019, we adopted a majority vote standard for uncontested director elections, with a director resignation policy, instead of a plurality vote standard. |

Increase Board diversity |

We added Ms. Kristin E. Toth to the Board of Directors effective June 3, 2021. |

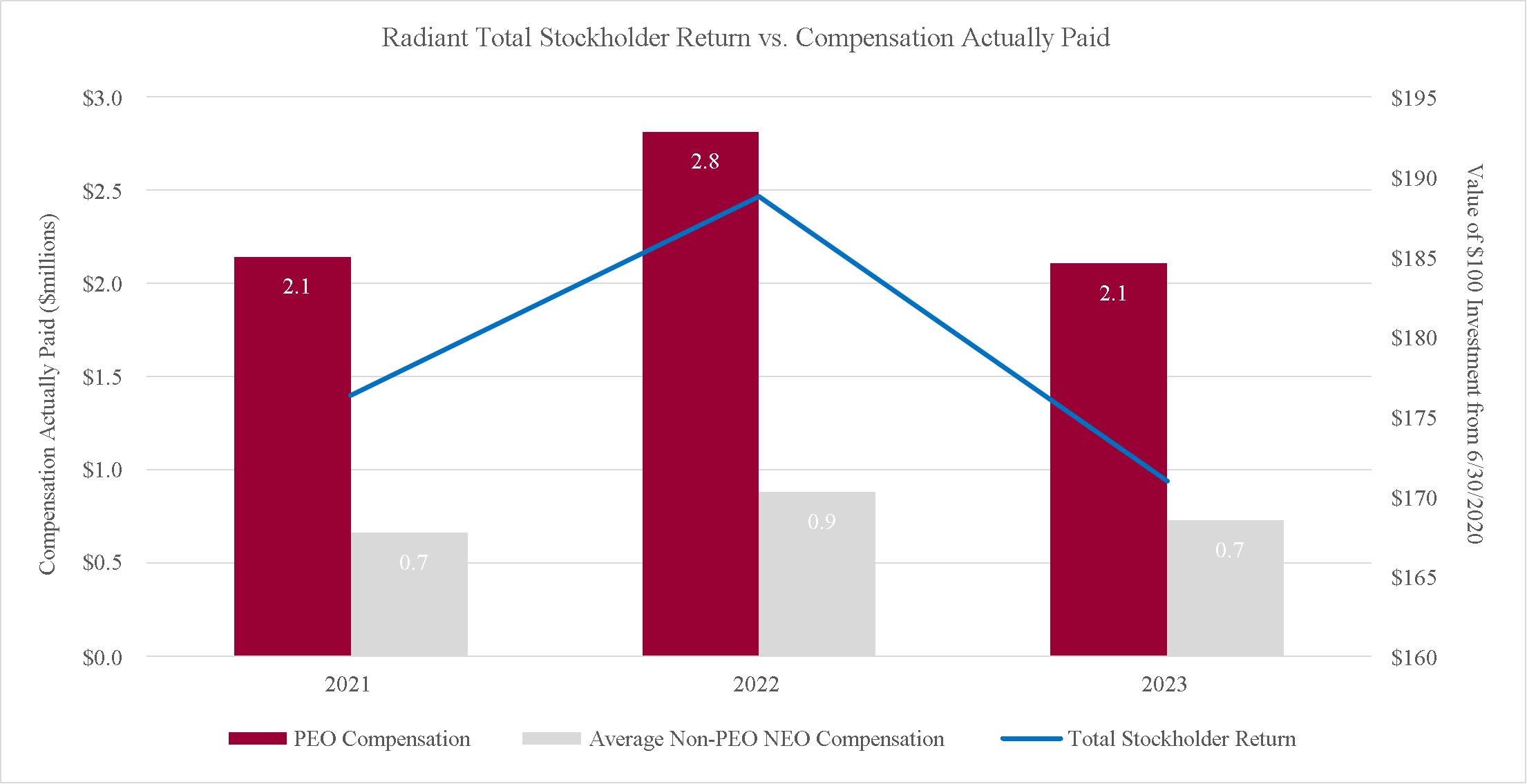

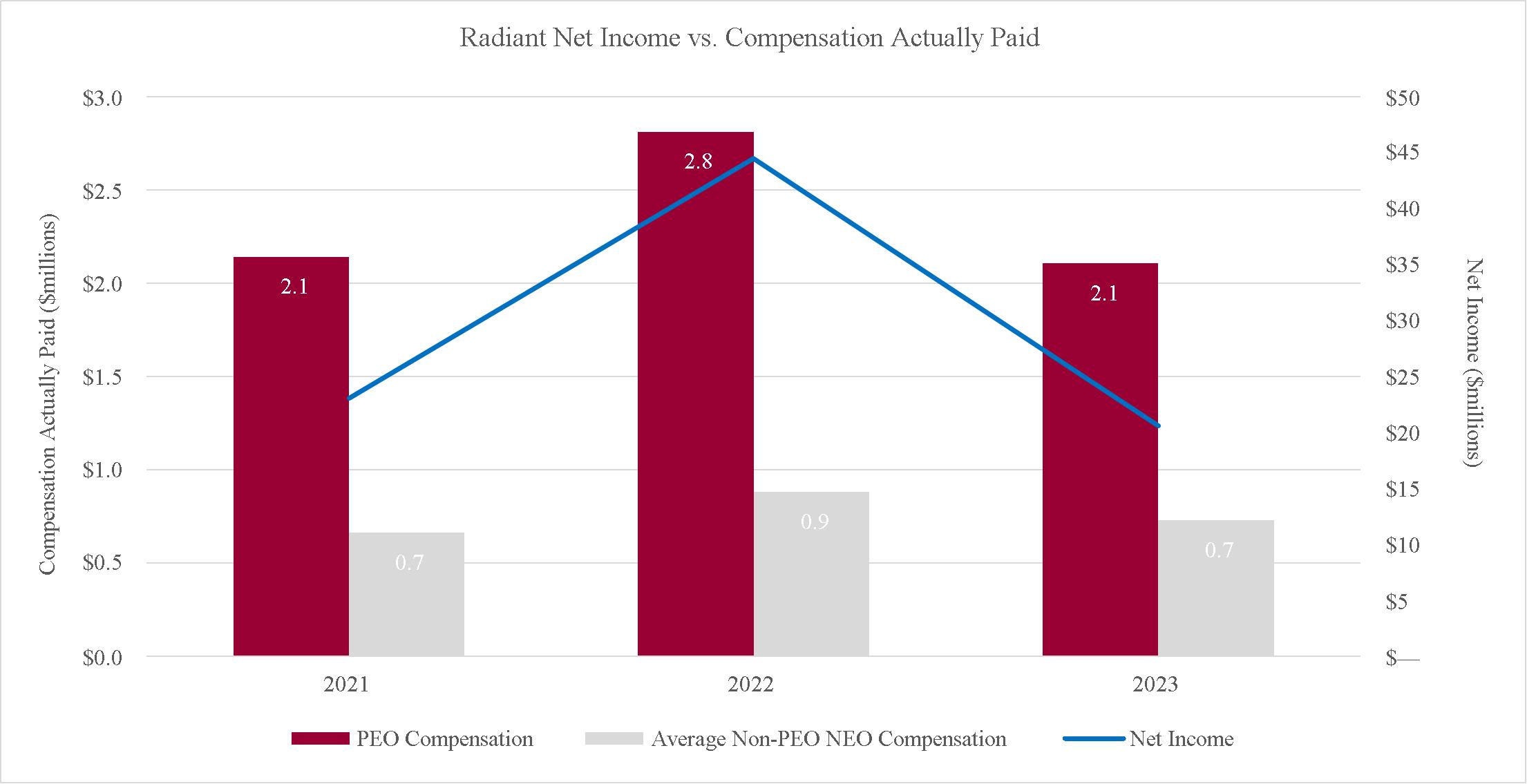

Align the interest of directors and executive officers with those of stockholders |