Registration No. 333-272986

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________

Amendment No. 1 to

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

__________________

COMSTOCK INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Nevada | | 65-0955118 |

(State or Other Jurisdiction of Incorporation) | | (I.R.S. Employer Identification No.) |

117 American Flat Road

Virginia City, NV 89440

(775) 847-5272

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

___________________________________

Corrado De Gasperis

Executive Chairman & Chief Executive Officer

117 American Flat Road

Virginia City, NV 89440

(775) 847-4755

(Name, address, including zip code, and telephone number, including area code, of agent for service)

__________________________________

With a copy to:

Clyde W. Tinnen, Jr., Esq.

Foley & Lardner LLP

777 East Wisconsin Avenue

Milwaukee, WI 53202

(414) 271-2400

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

__________________________________

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

1,805,620 Shares of Common Stock

This prospectus relates to the offer and resale by GHF, Inc. and Alvin Fund LLC, the selling stockholders, and each of their respect subsequent transferees, pledgees, donees and successors (the “seller”) of up to 1,805,620 shares of our Common Stock, par value $0.000666 per share (the “Common Stock”), 1,200,000 of which may be issued upon the exercise of warrants held by GHF, Inc. and 605,620 of which are presently issued and outstanding and held by Alvin Fund LLC.

The shares offered hereby may be sold from time to time by the seller. The seller is not required to offer or sell any shares, pursuant to this prospectus or otherwise. The seller anticipates that, if and when offered and sold, the shares will be offered and sold in transactions effected on NYSE AMERICAN LLC, or NYSE AMERICAN, at then prevailing market prices. The seller has the right, however, to offer and sell the shares on any other national securities exchange on which the Common Stock may become listed or in the over-the-counter market, in each case at then prevailing market prices, or in privately negotiated transactions at a price then to be negotiated.

All proceeds from sales of shares by seller will be retained by the seller. We will not receive any proceeds from the sale of shares by the seller. We will bear all of the expenses in connection with the registration of the shares offered hereby, including legal and accounting fees.

You should read this prospectus and any applicable prospectus supplement, as well as the documents incorporated by reference or deemed incorporated by reference into this prospectus and any prospectus supplement, carefully before you invest in our shares.

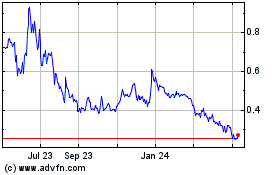

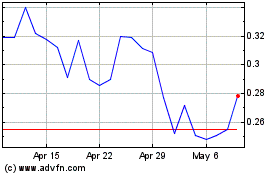

Our Common Stock is listed on the NYSE AMERICAN under the symbol “LODE.” On June 27, 2023, the closing price of one share of our Common Stock on NYSE AMERICAN was $0.81 per share.

Investing in our securities involves risks that are referenced in the “Risk Factors” section, at page 10, of this prospectus and are set forth in our periodic reports filed with the Securities and Exchange Commission. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

____________________

The date of this prospectus is July 11, 2023.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or the Commission, utilizing a “shelf” registration process. Under this shelf registration process, the seller may, from time to time, offer and sell shares of our Common Stock pursuant to this prospectus. This prospectus provides you with a general description of the securities the seller may offer.

You should read carefully both this prospectus and any prospectus supplement, together with additional information described below under “Where You Can Find More Information” before you invest in our securities. If there is any inconsistency between the information in this prospectus and any prospectus supplement, you must rely on the information in the prospectus supplement.

You should rely only on the information contained or incorporated by reference in this prospectus. We have not authorized any other person to provide you with additional or different information. If anyone provides you with additional, different or inconsistent information, you should not rely on it. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus is accurate on any date subsequent to the date set forth on the front of the document or that any information that we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference. Our business, financial condition, results of operation and prospects may have changed since those dates.

This prospectus does not contain all the information provided in the registration statement we filed with the Commission. For further information about us or the securities offered hereby, you should refer to that registration statement, which you can obtain from the Commission as described below under “Where You Can Find More Information.”

In this prospectus, unless otherwise specified or the context otherwise requires, “Comstock,” “we,” “us” and “our,” “our Company” or the “Company” refer to Comstock Inc. and its consolidated subsidiaries. In addition, unless the context requires otherwise, reference to the “Board” refers to the Board of Directors of Comstock Inc.

WHERE YOU CAN FIND MORE INFORMATION

We are required to file periodic reports, proxy statements and other information relating to our business, financial and other matters with the Commission under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Our filings are available to the public over the Internet at the Commission’s web site at http://www.sec.gov. You may also read and copy any document we file with the Commission at, and obtain a copy of any such document by mail from, the Commission’s public reference room located at 100 F Street, N.E., Washington, D.C. 20549, at prescribed charges. Please call the Commission at 1-800-SEC-0330 for further information on the public reference room and its charges.

We have filed with the Commission a registration statement on Form S-3 under the Securities Act with respect to our securities described in this prospectus. References to the “registration statement” or the “registration statement of which this prospectus is a part” mean the original registration statement and all amendments, including all schedules and exhibits. This prospectus does, and any prospectus supplement will, not contain all of the information in the registration statement because we have omitted parts of the registration statement in accordance with the rules of the Commission. Please refer to the registration statement for any information in the registration statement that is not contained in this prospectus or a prospectus supplement. The registration statement is available to the public over the Internet at the Commission’s web site described above and can be read and copied at the locations described above.

Each statement made in this prospectus or any prospectus supplement concerning a document filed as an exhibit to the registration statement is qualified in its entirety by reference to that exhibit for a complete description of its provisions.

We make available, free of charge, on or through our web site, copies of our proxy statements, our annual reports on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after we electronically file them with or furnish them to the Commission. We maintain a web site at http://www.comstock.inc. The information contained on our web site is not part of this prospectus, any prospectus supplement or the registration statement.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

We have filed the following documents with the Commission pursuant to the Exchange Act and hereby incorporate them by reference in the registration statement:

We incorporate by reference the documents listed below and any future documents that we file with the Commission under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this prospectus supplement:

(a)Our annual report on Form 10-K for the fiscal year ended December 31, 2022, filed with the Commission on March 16, 2023 (the “Form 10-K”); and (b)Our quarterly reports on Form 10-Q for the quarter ended March 31, 2023, filed with the Commission on May 3, 2023 (the “Form 10-Q”); (c)Our proxy statement on Schedule 14A, filed with the Commission on April 14, 2023; and (d)The description of our Common Stock contained in our Form 8-A (File No. 001-35200), filed with the Commission under Section 12 of the Exchange Act on June 8, 2011 (the “Form 8-A”). (e)Our current reports on Form 8-K filed with the Commission on January 5, 2023, March 7, 2023, April 6, 2023, April 11, 2023, April 26, 2023, May 15, 2023, May 30, 2023, June 29, 2023, July 6, 2023 and July 6, 2023 All documents subsequently filed by us with the Commission pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, prior to the filing of a post-effective amendment which indicates that all securities offered have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference in the registration statement and to be a part hereof from the date of filing of such documents.

Notwithstanding the foregoing, documents or portions thereof containing information furnished under Items 2.02 and 7.01 of any Current Report on Form 8-K, including the related exhibits under Item 9.01, are not incorporated by reference in this prospectus.

We make available copies of the documents incorporated by reference in this prospectus to each person, including any beneficial owner, to whom a prospectus is delivered, without charge, upon written or oral request. Such requests should be directed to:

| | |

| Comstock Inc. |

| P.O. Box 1118 |

| Virginia City, Nevada 89440 |

| Attention: Investor Relations |

| Telephone: (775) 847-5272 |

SUMMARY

This summary highlights information contained elsewhere or incorporated by reference in this prospectus and does not contain all of the information you should consider in making your investment decision. You should read this summary together with the more detailed information included elsewhere or incorporated by reference in this prospectus, including financial statements and the related notes. You should carefully consider, among other things, the matters discussed under “Risks Factors” in the Form 10-K and in other documents that we subsequently file with the Commission that are incorporated by reference herein.

The Company

Comstock innovates and commercializes technologies that enable systemic decarbonization, primarily by enabling the extraction and conversion of under-utilized natural resources into renewable energy products. Our strategic plan is based on innovating, enabling and commercializing material science solutions that use our technologies to reduce reliance on long cycle fossil fuels, to shift to and maximize throughput of short cycle fuels, and to lead and support the adoption and growth of a profitable, balanced short cycle ecosystem that continuously offsets, recycles, and/or neutralizes carbon emissions.

We achieve our goal by accelerating the commercialization of our technology portfolios and investments, primarily in renewable fuels, electrification metals, and artificial intelligence enabled mineral discovery and materials development.

Comstock Fuels – Most renewable fuels draw from the same feedstock pool, but the total supply can only meet a small fraction of the demand. Our technologies unblock that constraint by converting abundant but underutilized lignocellulosic biomass into biointermediates for refining into renewable fuels. Our team recently demonstrated commercial readiness with unprecedented yields approaching 100 gallons of fuel per dry ton of feedstock on a gasoline gallon equivalent basis. Execution of one or more license agreements with operationally experienced, technologically sophisticated, and well capitalized customers is a top 2023 objective. Each license could create more than 20 years of recurring royalty revenue with material upfront engineering fees.

Comstock Metals – The world is focused on the production of energy generation and storage technologies to reduce reliance on fossil fuels, including lithium-ion batteries (“LIBs”), photovoltaics, and fuel cells. Each of those technologies relies on scarce critical metals, increasing global demand for primary metal mining and recycling. During 2022, we deployed a pilot system to validate technologies for use in efficiently crushing, conditioning, extracting, and recycling high purity metal concentrates from LIBs and other electronic devices. We also expanded our leadership team in metals recycling, permitted a universal waste storage facility and opportunistically entered into an agreement to sell an existing facility for net cash proceeds of over $14 million. Securing revenue generating supply commitments in our expanded metals recycling business is a key objective for 2023.

Comstock Mining – We own or control twelve square miles of patented mining claims, unpatented mining claims, and surface parcels, covering six and a half miles of continuous mineral strike length. We enhanced the value of a small portion of our properties in the past year with two SK-1300 technical reports confirming Measured and Indicated resources of 605,000 ounces of gold and 5,880,000 ounces of silver, plus Inferred resources of 297,000 ounces of gold and 2,572,000 ounces of silver. We believe that our mining properties collectively contain billions of dollars of recoverable metals. Our plan to demonstrate that value combines our amassed historical and current data repository with hyperspectral orbital imaging and generative artificial intelligence (“AI”) solutions to provide prospecting analytics and enable mineral discovery for fraction of the cost of conventional exploration. Our 2023 efforts should enhance our resources and advance us toward full economic feasibility.

Artificial Intelligence – Quantum Generative Materials LLC ("GenMat"), our 48% owned subsidiary, has developed and launched a new generative AI to simulate critical properties of known materials during calibration testing late last year. Remarkably, GenMat also used its AI to simulate new material characteristics. GenMat’s generative AI models can be employed today for commercial use on GenMat’s existing high-performance computing platform, well before quantum computers become mainstream. In 2023, GenMat will, among other things, elevate new material simulation to commercial readiness by synthesizing and directly testing new AI

simulated materials in high value applications. Our investment in GenMat is also a crucial component of our ongoing innovation strategy.

The Company’s strategic investment in the further demonstrate our commitment to sustainable innovation. SSOF and its subsidiaries support responsible, sustainable economic growth in Silver Springs, NV and our northern Nevada communities.

Recent Developments

Comstock historically focused on natural resource exploration, development, and production, with an emphasis on mining gold and silver resources from its extensive contiguous property holdings in the historic Comstock and Silver City mining districts in Nevada (collectively, the “Comstock Mineral Estate”). Between 2012 and 2016, we mined and processed about 2.6 million tons of mineralized material from the Comstock Mineral Estate, producing 59,515 ounces of gold and 735,252 ounces of silver.

We subsequently focused on diversification and during 2021 and 2022, we completed a series of transactions that were designed to build on our competencies and reposition us to capitalize on the global transition to clean energy. Those transactions primarily included our acquisitions of 100% of Comstock Innovations, 100% of Comstock Engineering Corporation, 88.21% of LINICO Corporation, our acquisition of 48.19% of Quantum Generative Materials LLC, and our acquisition of the intellectual property portfolio from FLUX Photon Corporation. These transactions added the management, employees, facilities, intellectual properties, and other assets needed to transform our company and business into an emerging leader in the innovation and sustainable production of renewable energy, primarily by commercializing two new lines of business, cellulosic fuels and electrification metals.

Outlook

The primary focus for 2023 is commercialization. The Company’s biorefining technologies are commercially ready and offer unprecedented performance for the Company’s prospective customers. The Company is actively pursuing revenue producing licensing opportunities with globally recognized renewable fuel producers. The Company’s metals and GenMat’s generative AI solutions have made significant technological advancements in the past two years with the 2023 goal of commercial readiness first followed by commercialization with early adopting customers.

Commercialization

Comstock’s team has decades of diverse technology development and commercialization experience. The Company uses a disciplined approach to devising, qualifying, and elevating innovations from conception through increasing degrees of commercial readiness. The Company has adopted a widely used Technology Readiness Level (“TRL”) measurement system for objectively assessing Comstock’s progress, risks, investment qualifications, and commercial maturity.

There are nine readiness levels on the TRL scale, starting with TRL 1. Progression up the scale requires achievement of “SMART” milestones that are Specific, Measurable, Achievable, Relevant, and Timely. Proof of concept occurs at TRL 3. TRL 4 and 5 involve increasing degrees of process validation. TRL 6 is the first true demonstration of commercial readiness. TRL 7 and 8 involve various functional prototypes and pilots with increasing fidelity and sophistication. A TRL 9 technology is commercially mature and fully deployed. Depending on the technology and other applicable factors, revenue can commence at TRL 6 for early adopting and generally sophisticated commercial clients with continued development to TRL 7, 8, and 9.

The following chart summarizes the change in TRL status over the past year, and the objectives for 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Line of Business | | Technology | | 12/2021 | | 12/2022 | | 12/2023

Goal |

| Cellulosic Fuels | | Conversion of under-utilized woody biomass into renewable fuels at high yield | | TRL 4 | | TRL 6 | | TRL 7 |

| Artificial Intelligence | | Generative AI that simulates new materials at exponentially increased speed | | TRL 3 | | TRL 4 | | TRL 6 |

| Metals | | Scalable extraction of purified black mass concentrate from lithium-ion batteries | | TRL 2 | | TRL 5 | | TRL 6 |

| Mining Technology | | Dramatically reduced exploration costs with hyperspectral imaging and AI-based analytics | | TRL 0 | | TRL 2 | | TRL 3 |

Comstock’s SMART milestones and commercialization process involve meticulous planning that is informed by many factors, including the total addressable markets, growth rates and the speed that we can initiate and increase revenue.

Cellulosic Fuels

Most current forms of renewable fuel draw from the same pool of conventional feedstocks, including corn and vegetable oils in the U.S., but the entire available supply of those feedstocks could only meet a small fraction of the demand for renewable fuels. Comstock's patented and patent-pending biorefining technologies unblock that constraint by converting abundant but underutilized lignocellulosic or "woody" biomass into biointermediates for refining drop-in and other renewable fuels.

Comstock Fuels objectives for 2023 include:

Executing one or more early adopter license agreements and commencing development on commercial scale projects for operationally experienced, technologically sophisticated and well capitalized customers.

Completion of full technical documentation and engineering submittal packages.

Completion of an independent lifecycle carbon analysis to prove the carbon emissions reduction benefits of the fuels produced with Comstock’s known processes.

Continuous operation of the integrated bio-intermediate production process at the Company’s demonstration plant for sufficient time to achieve and broadly demonstrate TRL 7.

Each license agreement for a commercial production facility will create 15 to 20 years of recurring royalty revenue for the Company in addition to upfront fees for design and engineering.

Artificial Intelligence

Investment in artificial intelligence (“AI”) is a crucial component of Comstock’s technology innovation strategy. Quantum Generative Materials LLC ("GenMat"), develops and commercializes cutting-edge generative artificial intelligence models for the discovery and manipulation of matter. GenMat is a company in which Comstock has a 48.19% investment interest. This includes generative AI models that can be employed today, for commercial use on GenMat’s existing, high-performance computing platforms, well before quantum computers become mainstream.

GenMat's AI operates similarly to the large language models widely discussed in the media today, but instead of words and language, it uses atoms and molecules to generate physical systems and harness math and science to discover new materials in an exponentially shorter time than traditional methods allow. To put this into perspective, new material discovery typically takes many years and many millions of dollars. GenMat's AI will simulate thousands of unique new materials in seconds.

GenMat’s objectives for 2023 include:

Elevate new material simulation to TRL 6 by synthesizing and directly testing the AI’s simulated materials to confirm the precision and accuracy of those simulations.

Commercialize an enterprise-oriented API and other generative AI solutions to early adopter enterprise clients for advanced materials simulation and synthesis.

Launch and make operational a space-based hyperspectral imaging sensor for mineral discovery applications.

While the Company can’t be precise about exactly when GenMat will initiate revenue, GenMat’s technologies are maturing much faster than anticipated when the Company invested in GenMat in 2021.

Mining and Minerals

The Company has amassed the single largest known repository of historical and current geological data on the Comstock mineral district, including extensive geophysical surveys, geological mapping, sampling and drilling data and published updated SK-1300 technical reports on the Lucerne and Dayton resource areas.

Mining and Minerals objectives for 2023 include:

Publish preliminary economic assessments for both the Lucerne and Dayton resource areas.

Develop, in collaboration with GenMat, a next-generation geostatistical digital twin model of the Dayton resource area using the Company’s existing geologic and geophysical data.

Our 2023 efforts will enhance Comstock’s gold and silver resources progressing toward full economic feasibility.

Metal Recycling

Resource scarcity and supply are generally the main drivers presented when discussing battery recycling. From a market perspective what is often missed is that electric vehicle batteries are only one of many metals-based products that can cause a massive amount of pollution if simply landfilled at the end of life with no recovery of the underlying metal values.

Comstock Metals objectives for 2023 include:

Physically reposition and broaden the addressable market for commercialization of our metals recycling.

Advancing the technology readiness for broader material recycling, including photovoltaics and more.

The Company will provide additional, specific objectives for Comstock Metals during the second quarter of 2023.

The Company has also made meaningful progress and expects to complete the monetization of up to $30 million in sales of our non-strategic assets during 2023, while funding our business developments and limiting our focus to the objectives above.

Corporate Information

The Company’s executive offices are located at 117 American Flat Road, Virginia City, Nevada 89440 and its telephone number is (775) 847-5272. The Company’s mailing address is P.O. Box 1118, Virginia City, Nevada 89440. The Company’s web site address is www.comstock.inc. The Company’s web site and the information contained on, or that can be accessed through, the web site are not part of this prospectus.

FORWARD LOOKING STATEMENTS

Certain statements contained in this prospectus or incorporated by reference in this prospectus are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical facts, are forward-looking statements. The words “believe,” “expect,” “anticipate,” “estimate,” “project,” “plan,” “should,” “intend,” “may,” “will,” “would,” “potential” and similar expressions identify forward-looking statements, but are not the exclusive means of doing so. Forward-looking statements include statements about matters such as: future industry market conditions; future explorations or acquisitions; future changes in our exploration activities; future prices and sales of, and demand for, our products; land entitlements and uses; permits; production capacity and operations; operating and overhead costs; future capital expenditures and their impact on us; operational and management changes (including changes in the Board of Directors); changes in business strategies, planning and tactics; future employment and contributions of personnel, including consultants; future land sales; investments, acquisitions, joint ventures, strategic alliances, business combinations, operational, tax, financial and restructuring initiatives, including the nature, timing and accounting for restructuring charges, derivative assets and liabilities and the impact thereof; contingencies; litigation, administrative or arbitration proceedings; environmental compliance and changes in the regulatory environment; offerings, limitations on sales or offering of equity or debt securities, including asset sales and associated costs; and future working capital, costs, revenues, business opportunities, debt levels, cash flows, margins, taxes, earnings and growth.

These statements are based on assumptions and assessments made by our management in light of their experience and their perception of historical and current trends, current conditions, possible future developments and other factors they believe to be appropriate. Forward-looking statements are not guarantees, representations or warranties and are subject to risks and uncertainties, many of which are unforeseeable and beyond our control and could cause actual results, developments and business decisions to differ materially from those contemplated by such forward-looking statements. Some of those risks and uncertainties include the risk factors set forth in this prospectus or incorporated by reference in this prospectus and our Annual Report on Form 10-K, and the following: adverse effects of climate changes or natural disasters; adverse effects of global or regional pandemic disease spread or other crises; global economic and capital market uncertainties; the speculative nature of gold or mineral exploration, mercury remediation and lithium, nickel and cobalt recycling, including risks of diminishing quantities or grades of qualified resources; operational or technical difficulties in connection with exploration or mercury remediation, metal recycling, processing or mining activities; costs, hazards and uncertainties associated with precious metal based activities, including environmentally friendly and economically enhancing clean mining and processing technologies, precious metal exploration, resource development, economic feasibility assessment and cash generating mineral production; costs, hazards and uncertainties associated with mercury remediation, metal recycling, processing or mining activities; contests over our title to properties; potential dilution to our stockholders from our stock issuances, recapitalization and balance sheet restructuring activities; potential inability to comply with applicable government regulations or law; adoption of or changes in legislation or regulations adversely affecting our businesses; permitting constraints or delays; ability to achieve the benefits of business opportunities that may be presented to, or pursued by, us, including those involving battery technology, mercury remediation technology and efficacy, quantum computing and advanced materials development, and development of cellulosic technology in bio-fuels and related carbon-based material production; ability to successfully identify, finance, complete and integrate acquisitions, joint ventures, strategic alliances, business combinations, asset sales, and investments that we may be party to in the future; changes in the United States or other monetary or fiscal policies or regulations; interruptions in our production capabilities due to capital constraints; equipment failures; fluctuation of prices for gold or certain other commodities (such as silver, zinc, lithium, nickel, cobalt, cyanide, water, diesel, gasoline and alternative fuels and electricity); changes in generally accepted accounting principles; adverse effects of war, mass shooting, terrorism and geopolitical events; potential inability to implement our business strategies; potential inability to grow revenues; potential inability to attract and retain key personnel; interruptions in delivery of critical supplies, equipment and raw materials due to credit or other limitations imposed by vendors; assertion of claims, lawsuits and proceedings against us; potential inability to satisfy debt and lease obligations; potential inability to maintain an effective system of internal controls over financial reporting; potential inability or failure to timely file periodic reports with the Securities and Exchange Commission; potential inability to list our securities on any securities exchange or market or maintain the listing of our securities; and work stoppages or other labor

difficulties. Occurrence of such events or circumstances could have a material adverse effect on our business, financial condition, results of operations or cash flows, or the market price of our securities. All subsequent written and oral forward-looking statements by or attributable to us or persons acting on our behalf are expressly qualified in their entirety by these factors. Except as may be required by securities or other law, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

RISK FACTORS

An investment in shares of our Common Stock involves a high degree of risk. You should carefully consider the risks set forth under the caption “Risk Factors” in the Form 10-K and Form 10-Q, which are incorporated in this prospectus by reference, as updated by any future filing we make under the Exchange Act. These risk are not the only ones faced by us. Additional risks not known, or that are deemed immaterial could also materially and adversely affect our financial condition, results of operations, business and prospects. Any of these risks might cause you to lose all or part of your investment.

USE OF PROCEEDS

We will not receive any proceeds from the sale of any shares offered hereby by the seller.

SELLING STOCKHOLDER

Information about the selling stockholder (excluding its subsequent transferees, pledgees, donees and successors) is identified below. The seller may from time to time offer and sell shares of our Common Stock pursuant to this prospectus or any applicable prospectus supplement.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Before Offering | | After Offering |

| Name | | Total Number of Shares Beneficially Owned | | Number of Shares Offered (1) | | Shares Beneficially Owned After Offering (1) | | Percentage of Shares Beneficially Owned After Offering (1) |

GHF, Inc.(2) | | 1,200,000 | | | 1,200,000(3) | | — | | | — | % |

| Alvin Fund LLC | | 1,154,891 | | | 605,620(3) | | 549,271 | | | 0.53 | % |

______________

(1)Assumes all shares registered hereby are sold and the exercise price is paid in cash. (Cashless exercise would result in the issuance of less shares based upon the market price of the stock on the date of exercise.)

(2)GHF, Inc. owns warrants to purchase 500,000 shares of Common Stock with an exercise price of $2.5217 per share, 500,000 shares of Common Stock with an exercise price of $0.4555 per share, and 200,000 shares of Common Stock with an exercise price of $1.00 per share.

(3)Please see Item 1. Business–Financing Events–Debt Financing Agreements in the Company’s annual report on Form 10-K for the fiscal year ended December 31, 2022, filed with the Commission on March 16, 2023, which is hereby incorporated herein by reference.

DESCRIPTION OF COMMON STOCK

The information appearing under “Item 1. Description of Registrant’s Securities to be Registered” in the Form 8-A, is hereby incorporated by reference. The Company currently has 102,707,603 shares of Common Stock issued and outstanding.

PLAN OF DISTRIBUTION

The seller may, from time to time, sell any or all of its shares of Common Stock on the NYSE AMERICAN or any other stock exchange, market or trading facility on which the shares are traded or in private transactions. If the shares of Common Stock are sold through underwriters or broker-dealers, the seller will be responsible for underwriting discounts or commissions or agent’s commissions. These sales may be at fixed prices, at prevailing market prices at the time of the sale, at varying prices determined at the time of the sale or at negotiated prices. The seller may use any one or more of the following methods when selling shares:

•on any national securities exchange or quotation service on which the securities may be listed or quoted at the time of sale;

•in the over-the-counter market;

•in transactions otherwise than on these exchanges or systems or in the over-the-counter market;

•ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

•block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction;

•purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

•an exchange distribution in accordance with the rules of the applicable exchange;

•privately negotiated transactions;

•settlement of short sales entered into after the effective date of the registration statement of which this prospectus is a part;

•broker-dealers may agree with the seller to sell a specified number of such shares at a stipulated price per share;

•a combination of any such methods of sale;

•through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; or

•any other method permitted pursuant to applicable law.

The seller may also sell shares under Rule 144 under the Securities Act of 1933, as amended (the “Securities Act”), if available, rather than under this prospectus.

Broker-dealers engaged by the seller may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the seller (or, if any broker-dealer acts as agent for the purchaser of shares, from the purchaser) in amounts to be negotiated, but, except as set forth in a supplement to this Prospectus, in the case of an agency transaction not in excess of a customary brokerage commission in compliance with the rules of the NYSE AMERICAN or other stock exchange on which the Common Stock is traded.

In connection with the sale of the Common Stock or interests therein, the seller may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the Common Stock in the course of hedging the positions they assume. The seller may also sell shares of the Common Stock short and deliver these securities to close out short positions, or loan or pledge the Common Stock to broker-dealers that in turn may sell these securities. The seller may also loan or pledge shares of Common Stock to broker-dealers that in turn may sell such shares. The seller may also enter into option or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to such broker-dealer or other financial institution of shares offered by this prospectus, which shares such broker-

dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The seller and any broker-dealers or agents that are involved in selling the shares may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act.

The resale shares will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in certain states, the resale shares may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

Under applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the resale shares may not simultaneously engage in market making activities with respect to the Common Stock for a period of two business days prior to the commencement of the distribution. In addition, the seller will be subject to applicable provisions of the Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of shares of the Common Stock by the seller or any other person. At the time a particular offering of the shares of Common Stock is made, a prospectus supplement, if required as determined by the Company in its sole discretion, will be distributed which will set forth the aggregate amount of shares of Common Stock being offered and the terms of the offering, including the name or names of any broker-dealers or agents, any discounts, commissions and other terms constituting compensation from the seller and any discounts, commissions or concessions allowed or reallowed or paid to broker-dealers. We will make copies of this prospectus available to the seller and have informed the seller of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale unless exempted from the prospectus delivery requirement.

The seller may pledge or grant a security interest in some or all of the shares of Common Stock owned by it and, if it defaults in the performance of secured obligations, the pledgees or secured parties may offer and sell the shares of Common Stock from time to time pursuant to this prospectus or any amendment or supplement to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act, amending, if necessary, the list of seller to include the pledgee, transferee or other successors in interest as seller under this prospectus. The seller also may transfer and donate the shares of Common Stock in other circumstances in which case the transferees, donees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

There can be no assurance that any seller will sell any or all of the shares of Common Stock registered pursuant to the registration statement, of which this prospectus forms a part.

Once sold under the registration statement, of which this prospectus forms a part, the shares of Common Stock will be freely tradable in the hands of persons other than our affiliates.

We will not receive any of the proceeds from the sale by the seller of the shares of Common Stock. We will pay all expenses of the registration of the shares of Common Stock pursuant to the registration rights agreement, including, without limitation, Securities and Exchange Commission filing fees and expenses of compliance with state securities or “blue sky” laws; provided, however, that the seller will pay all underwriting discounts and selling commissions, if any.

VALIDITY OF THE SECURITIES

The validity of the securities offered and to be offered hereby and certain other legal matters will be passed upon for us by McDonald Carano LLP. Counsel for any underwriter or agent will be named in the applicable prospectus supplement.

EXPERTS

The consolidated financial statements incorporated in this Prospectus by reference from the Company’s Annual Report on Form 10-K for the years ended December 31, 2022 and December 31, 2021 have been audited by Assure CPA, LLC, an independent registered public accounting firm, as stated in their report, which is incorporated herein by reference. Such consolidated financial statements have been so incorporated in reliance upon the report of such firm given upon their authority as experts in accounting and auditing.

No expert or counsel named in this prospectus as having prepared or certified any part thereof or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of our Common Stock was employed on a contingency basis or had or is to receive, in connection with the offering, a substantial interest, directly or indirectly, in us. Additionally, no such expert or counsel was connected with us as a promoter, managing or principal underwriter, voting trustee, director, officer or employee.

1,805,620 Shares of Common Stock

July 11, 2023

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution.

The following table sets forth all fees and expenses payable by the registrant in connection with the issuance and distribution of the securities being registered hereby (other than underwriting discounts and commissions). All of such expenses, except the Commission registration fee, are estimated.

| | | | | | | | |

| Commission registration fee | | $ | 161.17 | |

| Accounting fees and expenses | | $ | 10,000.00 | |

| Legal fees and expenses | | $ | 12,500.00 | |

| Miscellaneous expenses | | $ | 750.00 | |

| Total | | $ | 23,411.17 | |

Item 15. Indemnification of Directors and Officers.

Our Articles of Incorporation and Bylaws provide for the indemnification of a present or former director or officer. We indemnify any director, officer, employee or agent who is successful on the merits or otherwise in defense on any action or suit. Such indemnification shall include, but not necessarily be limited to, expenses, including attorney’s fees actually or reasonably incurred by him. Nevada law also provides for discretionary indemnification for each person who serves as or at our request as an officer or director. We may indemnify such individual against all costs, expenses and liabilities incurred in a threatened, pending or completed action, suit or proceeding brought because such individual is a director or officer. Such individual must have conducted himself in good faith and reasonably believed that his conduct was in, or not opposed to, our best interests. In a criminal action, he must not have had a reasonable cause to believe his conduct was unlawful.

Nevada Law

Pursuant to the provisions of Nevada Revised Statutes 78.751, we shall indemnify any director, officer and employee as follows: every director, officer, or employee of ours shall be indemnified by us against all expenses and liabilities, including counsel fees, reasonably incurred by or imposed upon him/her in connection with any proceeding to which he/she may be made a party, or in which he/she may become involved, by reason of being or having been a director, officer, employee or agent of us or is or was serving at our request as a director, officer, employee or agent of us, partnership, joint venture, trust or enterprise, or any settlement thereof, whether or not he/she is a director, officer, employee or agent at the time such expenses are incurred, except in such cases wherein the director, officer, employee or agent is adjudged guilty of willful misfeasance or malfeasance in the performance of his/her duties; provided that in the event of a settlement the indemnification herein shall apply only when the Board approves such settlement and reimbursement as being for our best interests. We shall provide to any person who is or was a director, officer, employee or agent of us or is or was serving at our request as a director, officer, employee or agent of the corporation, partnership, joint venture, trust or enterprise, the indemnity against expenses of a suit, litigation or other proceedings which is specifically permissible under applicable law.

Item 16. Exhibits

(a) The exhibits listed in the following table have been filed as part of this registration statement.

| | | | | | | | |

Exhibit Number | | Description of Exhibit |

| 4.1 | | |

| 4.2 | | |

| 4.3 | | |

| 10.1 | | |

| 10.2 | | |

| 10.3 | | |

5.1 | | |

23.1 | | |

23.2 | | |

| 24.1 | | |

| 107 | | |

Item 17. Undertakings

The undersigned registrant hereby undertakes:

(1)To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i) to include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) to reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement;

(iii) to include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however, that paragraphs (i), (ii) and (iii) above do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Securities and Exchange Commission by the registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2)That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3)To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4)That, for the purpose of determining liability under the Securities Act to any purchaser:

(i) If the registrant is relying on Rule 430B:

(A) Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(B) Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date; or

(ii) If the registrant is subject to Rule 430C, each prospectus filed pursuant to Rule 424(b) as part of a registration statement relating to an offering, other than registration statements relying on Rule 430B or other than prospectuses filed in reliance on Rule 430A, shall be deemed to be part of and included in the registration statement as of the date it is first used after effectiveness. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such first use, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such date of first use.

(5)That, for the purpose of determining liability of the registrant under the Securities Act to any purchaser in the initial distribution of the securities:

The undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this Registration Statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i) Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

(iii) The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

(iv) Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Virginia City, Nevada, on July 11, 2023.

| | | | | |

| COMSTOCK INC. |

| |

| By: | /s/ Corrado De Gasperis |

| Corrado De Gasperis |

| Executive Chairman & Chief Executive Officer |

| (Principal Executive, Financial Officer and Accounting Officer) |

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

| | | | | | | | | | | | | | |

| Name | | Title | | Date |

| | | | |

| /s/ Corrado De Gasperis | | Executive Chairman & Chief Executive Officer and Director | | July 11, 2023 |

| Corrado De Gasperis | | |

| | (Principal Executive Officer, Principal Financial Officer and Principal Accounting Officer) | | |

| | | | |

| * | | Director and Chief Technology Officer

| | July 11, 2023 |

| Kevin Kreisler | | |

| | | | |

| * | | Director | | July 11, 2023 |

| Leo Drozdoff | | |

| | | | |

| * | | Director | | July 11, 2023 |

| William Nance | | |

| | | | |

| * | | Director | | July 11, 2023 |

| Walter Marting | | |

| | | | |

| * | | Director | | July 11, 2023 |

| Guez Salinas | | |

| | | | |

| * | | Director | | July 11, 2023 |

| Kristin Slanina | | |

| | | | |

| *By: /s/ Corrado DeGasperis | | | | |

| Corrado DeGasperis | | | | |

| Attorney-in-Fact | | | | |

CALCULATION OF REGISTRATION FEE

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Title of each class of securities to be registered | | Amount to be registered (1) | | Proposed maximum offering price per unit | | Proposed maximum aggregate offering price (2) | | Amount of registration fee (3) |

| Common stock - Warrants, $0.000666 per share | | 1,200,000 | | (2) | | 972,000 | | 107.11 |

| Common stock, $0.000666 per share | | 605,620 | | (2) | | 490,552 | | $ | 54.06 |

| Total | | 1,805,620 | | (2) | | 1,462,552 | | $ | 161.17 |

_____________

(1)We are registering under this registration statement such indeterminate number of shares of common stock as may be sold by the registrant from time to time, which together shall have an aggregate initial offering price not to exceed $1,462,552. We may sell any securities we are registering under this registration statement separately or as units with the other securities we are registering under this registration statement. We will determine, from time to time, the proposed maximum offering price per unit in connection with our issuance of the securities we are registering under this registration statement. The securities we are registering under this registration statement also include such indeterminate number of shares of common stock. In addition, pursuant to Rule 416 under the Securities Act of 1933, as amended (the "Securities Act"), the shares we are registering under this registration statement include such indeterminate number of shares of common stock and preferred stock as may be issuable with respect to the shares we are registering as a result of stock splits, stock dividends or similar transactions.

(2)We will determine the proposed maximum aggregate offering price per class of security from time to time in connection with our issuance of the securities we are registering under this registration statement and we are not specifying such price as to each class of security pursuant to General Instruction II.D. of Form S-3 under the Securities Act.

(3)Registration fee calculated pursuant to Rule 457(c) under the Securities Act, based on aggregated number of securities to be sold by the registrant.

COMMON STOCK PURCHASE WARRANT

COMSTOCK INC.

THE SECURITIES REPRESENTED HEREBY HAVE BEEN ACQUIRED FOR INVESTMENT AND HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”). SUCH SHARES MAY NOT BE SOLD, PLEDGED, OR TRANSFERRED PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT OR PURSUANT TO AN AVAILABLE EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND IN ACCORDANCE WITH APPLICABLE STATE SECURITIES LAWS AS EVIDENCED BY A LEGAL OPINION OF COUNSEL TO THE TRANSFEROR TO SUCH EFFECT, THE SUBSTANCE OF WHICH SHALL BE REASONABLY ACCEPTABLE TO THE COMSTOCK INC. (THE “COMPANY”).

| | | | | |

| Warrant Shares: 500,000 | Issue Date: December 15, 2022 |

This is to certify that, FOR VALUE RECEIVED, GHF, Inc. (the “Holder”) is entitled to purchase, subject to the provisions of this warrant (this “Warrant”), from the Company, 500,000 shares of common stock of the Company, par value $0.000666 per share (the “Stock”), at a price of per share of $0.4555 (the “Exercise Price”). The number of shares of Stock to be received and the Exercise Price to be paid therefor upon the exercise of this Warrant are subject to adjustment as set forth in Section 5 below. The shares of Stock deliverable upon such exercise at any time are hereinafter sometimes referred to as “Warrant Shares.”

1. EXERCISE OF WARRANT.

a. Procedural Requirements. This Warrant may be exercised in whole or in part at any time from the Issue Date until 5:00 p.m., Eastern Standard Time on December 15, 2024. In order to exercise this Warrant, the Holder shall deliver to the Company (A) the Purchase Form attached hereto as Exhibit A, duly completed and executed; (B) payment of the Exercise Price for the Warrant Shares; and (C) this Warrant upon receipt of the foregoing items, the Company shall execute or cause to be executed and deliver or cause to be delivered to the Holder, a certificate or certificates representing the aggregate number of full Warrant Shares issuable upon such exercise, together with cash in lieu of any fraction of a share, as hereinafter provided. The stock certificate or certificates so delivered shall be in such denomination or denominations as the Holder shall request and shall be registered in the name of the Holder or, subject to the restrictions on transfer set forth herein, such other name as shall be designated in the notice. This Warrant shall he deemed to have been exercised and such certificate or certificates shall be deemed to have been issued, and the Holder or any other person so designated shall be deemed to have become a holder of record of such shares for all purposes, as of the date the notice, together with the Exercise Price and this Warrant, are received by the Company as described above. If this Warrant shall have been exercised in part, the Company shall, at the time of delivery of the certificate or certificates representing Warrant Shares, deliver to the Holder a new Warrant evidencing the right of the Holder to purchase the unpurchased Warrant Shares called for by this Warrant, which new

Warrant shall in all other respects be identical with this Warrant, or, at the request of the Holder, appropriate notation may be made on this Warrant and the same returned to the Holder.

b. Cashless Exercise. This Holder may at its option elect to provide a notice of cashless exercise, in which event the Company shall issue to the Holder the number of Warrant Shares determined as follows: X = Y * (A-B)/A where: X = the number of Warrant Shares to be issued to the Holder. Y = the number of shares of common stock with respect to which the warrant is being exercised. A = the closing sale prices of the Company’s common stock for the trading day immediately prior to the date of exercise. B = $0.4555.

.

2. RESERVATION OF SHARES. The Company shall at all times reserve for issuance and delivery upon exercise of this Warrant such number of shares of Stock as shall be required for such issuance and delivery upon exercise hereof. All such shares of Stock shall, when issued in accordance with the terms hereof, be validly issued, fully paid and non-assessable.

3. FRACTIONAL SHARES. Notwithstanding any provision contained in this Warrant to the contrary, the Company shall not issue fractional shares upon exercise of Warrants. If, by reason of any adjustment made pursuant to this Warrant, the holder of any Warrant would be entitled, upon the exercise of such Warrant, to receive a fractional interest in a share, the Company shall, upon such exercise, round to the nearest whole number the number of the shares of Stock to be issued to the Holder.

4. RIGHTS OF HOLDER, The Holder shall not, solely by virtue hereof, be entitled to any rights of a shareholder in. the Company, either at law or equity, and the rights of the Holder are limited to those expressed in this Warrant and are not enforceable against the Company except to the extent set forth herein.

5. ADJUSTMENT OF NUMBER OF SHARES AND EXERCISE PRICE. In case the Company shall at any time subdivide or combine its outstanding shares of capital stack of the Company into a greater or lesser number of shares by stock split, stock dividend, reverse stock split or otherwise, the number of Warrant Shares and the Exercise Price shall be proportionately adjusted to take into account the effect of such subdivision; or combination. In the case of any reclassification or change of the Stock issuable upon exercise of this Warrant, the Company shall execute a new Warrant providing that the Holder of this Warrant shall have the right to exercise such new Warrant and upon such exercise to receive, in lieu of each share of Stock theretofore issuable upon exercise of this Warrant, the number and kind of shares of stock, other securities, money or property receivable upon such reclassification or change in respect of one share of the Stock. Such new Warrant shall provide for further adjustments which shall be as nearly equivalent as may be practicable to the adjustments provided for in this Section 5.

6. LOSS OR MUTILATION. Upon receipt by the Company from the Holder of evidence reasonably satisfactory to it of the ownership and the loss, theft, destruction or mutilation of this Warrant and indemnity reasonably satisfactory to it, and in case of mutilation upon surrender and cancellation hereof, the Company will execute and deliver in lien hereof a

new Warrant of like tenor to the Holder; provided, in the case of mutilation, that no indemnity shall be required if this Warrant in identifiable form is surrendered to the Company for cancellation.

7. GOVERNING LAW. This Warrant shall be governed by, and construed and enforced in accordance with, the substantive laws of the State of Nevada without regard to conflicts of law principles.

8. HOLDER’S ACKNOWLEDGMENTS. By the Holder’s acceptance hereof, the Holder acknowledges, represents and warrants to the Company that:

a. the Holder is an “accredited investor” as defined under Rule 501 of Regulation D promulgated under the Securities Act;

b. the Holder has had the opportunity, to the Holder’s satisfaction, to make a due diligence investigation of the Company, to request additional information regarding the Company and the Company’s business, and to discuss the Company’s affairs with the Company’s principals. The Holder, either alone or with the Holder’s professional purchaser representative, has sufficient knowledge and experience in business and financial matters to evaluate the merits and risks of the Holder’s investment in this Warrant and the Stock;

c. the Holder (i) understands that an investment in this Warrant and the Stock is speculative due to factors including (but not limited to) the risk of economic loss from the operations of the Company, but believes that such an investment is suitable for the Holder based upon the Holder’s financial needs, (ii) can withstand a complete loss of the Holder’s investment; and (iii) has the net worth to undertake these risks;

d. the Holder is acquiring tills Warrant and will acquire the Stock for the Holder’s own account and not with a view to or for sale in connection with, any distribution thereof, the Holder has no present intention of distributing, selling or otherwise disposing of this Warrant or any of the Stock, except for transfers any affiliates of Holder approved by the Company in advance writing; and the Holder will not sell, transfer or otherwise dispose of this Warrant or the Stock except in compliance with the registration requirements of applicable federal and state securities laws (or in reliance on an applicable exemption therefrom); and

e. this Warrant is, and the Stock will be, offered under one or more exemptions provided in the Securities Act and applicable state securities laws. As such, transfer of this Warrant and the Stock will be severely restricted, and the Holder may be required to bear the economic risk of investment for an indefinite period of time. The Holder has no need of liquidity with respect to the Holder’s investment in the Company.

9. NOTICES. Any notice, demand, request, consent, approval, declaration, delivery or other communication hereunder to be made pursuant to the provisions of this Warrant shall be sufficiently given or made if either delivered in person with receipt acknowledged or sent by registered or certified mail, return receipt requested, postage prepaid, or by a

nationally recognized overnight courier or by telecopy with confirmation of receipt, addressed as follows:

| | | | | |

| If to the Company: | |

| |

| Comstock Inc. |

| PO Box 1118 |

| 117 American Flat Road Virginia City, Nevada 89440 |

| Attn: Corrado De Gasperis, CEO |

| Email: DeGasperis@comstockinc.com Phone: (775) 848 5310 |

| |

| |

| |

| |

with a copy | |

| to: | |

| Foley & Lardner LLP |

| 777 East Wisconsin Avenue Milwaukee, Wisconsin 53202 |

| Attention: Clyde Tinnen |

| Email: ctinnen@foley.com Phone: 414-297-5026 |

If to Holder, to its residence address (or mailing address, if different) and facsimile number set forth at the end of this Warrant, or to such other address and/or facsimile number and/or to the attention of such other person as specified by written notice given to the Company five calendar days prior to the effectiveness of such change.

[Signature pages follow]

HOLDER SIGNATURE PAGE TO COMMON STOCK PURCHASE WARRANT

IN WITNESS WHEREOF, and intending to be legally bound hereby, Holder has caused this Warrant to be duly executed and, by executing this signature page, hereby executes, adopts and agrees to all terms, conditions, and representations contained in the foregoing Warrant.

| | | | | |

GHF, INC. | |

| |

| /s/ Theo Melas-Kyriazi | |

| Signature | |

| |

Theo Melas-Kyriazi | |

| Print Name | |

| |

| |

| |

| |

| Address: | |

| |

| 190 Elgin Avenue | |

| George Town, Grand Cayman KY1-9005 | |

| Cayman Islands | |

| |

COMPANY SIGNATURE PAGE TO COMMON STOCK PURCHASE WARRANT

–PLEASE DO NOT WRITE BELOW THIS LINE–

COMPANY USE ONLY

| | | | | |

| Accepted and Agreed: |

| |

| COMSTOCK INC. |

| |

| By: | /s/ Corrado De Gasperis |

| Name: | Corrado De Gasperis |

| Title: | Executive Chairman & CEO |

| |

As of: December 15, 2022 |

Exhibit A

PURCHASE FORM

1. The undersigned hereby elects to purchase ______________ Shares (as such term is defined in the attached Warrant (the “Warrant”)) of Comstock Inc. pursuant to the terms of the Warrant, and tenders herewith payment of the purchase price of such shares in full.

2. The undersigned hereby elects to convert the Warrant into shares as specified in the Warrant. This conversion is exercised with respect to ______________ of the shares covered by the Warrant.

3. Please issue a certificate or certificates representing said shares in the name of the undersigned or in such other name as is specified below:

| | |

|

|

| (Holder’s Signature) |

|

|

|

| (Holder’s Name and title (if not an individual)) |

|

|

|

|

|

| (Address) |

4. The undersigned represents it is acquiring the shares solely for its own account and not as a nominee for any other party and not with a view toward the resale or distribution thereof except in compliance with the Warrant and applicable securities laws.

| | |

| GHF, Inc. |

|

|

|

| (Signature) |

|

|

|

| (Name and Title) |

|

|

| (Date) |

COMMON STOCK PURCHASE WARRANT

COMSTOCK INC.

THE SECURITIES REPRESENTED HEREBY HAVE BEEN ACQUIRED FOR INVESTMENT AND HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”). SUCH SHARES MAY NOT BE SOLD, PLEDGED, OR TRANSFERRED PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT OR PURSUANT TO AN AVAILABLE EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND IN ACCORDANCE WITH APPLICABLE STATE SECURITIES LAWS AS EVIDENCED BY A LEGAL OPINION OF COUNSEL TO THE TRANSFEROR TO SUCH EFFECT, THE SUBSTANCE OF WHICH SHALL BE REASONABLY ACCEPTABLE TO THE COMSTOCK INC. (THE “COMPANY”).

| | | | | |

| Warrant Shares: 500,000 | Issue Date: December 15, 2022 |

This is to certify that, FOR VALUE RECEIVED, GHF, Inc. (the “Holder”) is entitled to purchase, subject to the provisions of this warrant (this “Warrant”), from the Company, 500,000 shares of common stock of the Company, par value $0.000666 per share (the “Stock”), at a price of per share of $2.5217 (the “Exercise Price”). The number of shares of Stock to be received and the Exercise Price to be paid therefor upon the exercise of this Warrant are subject to adjustment as set forth in Section 5 below. The shares of Stock deliverable upon such exercise at any time are hereinafter sometimes referred to as “Warrant Shares.”

1. EXERCISE OF WARRANT.

a. Procedural Requirements. This Warrant may be exercised in whole or in part at any time from the Issue Date until 5:00 p.m., Eastern Standard Time on December 15, 2024. In order to exercise this Warrant, the Holder shall deliver to the Company (A) the Purchase Form attached hereto as Exhibit A, duly completed and executed; (B) payment of the Exercise Price for the Warrant Shares; and (C) this Warrant upon receipt of the foregoing items, the Company shall execute or cause to be executed and deliver or cause to be delivered to the Holder, a certificate or certificates representing the aggregate number of full Warrant Shares issuable upon such exercise, together with cash in lieu of any fraction of a share, as hereinafter provided. The stock certificate or certificates so delivered shall be in such denomination or denominations as the Holder shall request and shall be registered in the name of the Holder or, subject to the restrictions on transfer set forth herein, such other name as shall be designated in the notice. This Warrant shall he deemed to have been exercised and such certificate or certificates shall be deemed to have been issued, and the Holder or any other person so designated shall be deemed to have become a holder of record of such shares for all purposes, as of the date the notice, together with the Exercise Price and this Warrant, are received by the Company as described above. If this Warrant shall have been exercised in part, the Company shall, at the time of delivery of the certificate or certificates representing Warrant Shares, deliver to the Holder a new Warrant evidencing the right of the Holder to purchase the unpurchased Warrant Shares called for by this Warrant, which new

Warrant shall in all other respects be identical with this Warrant, or, at the request of the Holder, appropriate notation may be made on this Warrant and the same returned to the Holder.