Force Protection, Inc (NASDAQ: FRPT) today announced results for

the third quarter, ended September 30, 2008. Net sales for the

period were $343.3 million, an increase of 66% versus the prior

year�s level of $206.8 million. Net income for the third quarter

was also strong, increasing to $19.9 million, or $0.29 per fully

diluted share versus the year-ago net loss of ($0.8) million, or

($0.01) per diluted share. Michael Moody, Chairman and Chief

Executive Officer of Force Protection, Inc., said, �We are very

pleased with our third quarter financial results. Our improved

performance was primarily due to growth in spare parts and services

revenues and improved efficiencies in our vehicle manufacturing

operations.� The Company noted that the third quarter represented

strong levels of MRAP production. Force Protection and its

subcontractor, General Dynamics Land Systems (GDLS), delivered 422

Cougar vehicles during the third quarter. The Company noted that

revenues derived from Cougar vehicles delivered represented total

sales of $255.5 million during the quarter. This compares with 353

Cougar vehicles delivered in the third quarter of the prior year,

which generated $176.9 million. Included in Cougar revenues are

revenues from vehicles produced by GDLS under the GDLS Subcontract

during the third quarter of 2008 totaling $106.9 million versus

$33.3 million in the prior year�s quarter. Spare parts and services

revenues during the third quarter of 2008 were $72.2 million versus

$14.3 million during the year-ago third quarter. This growth

reflected significant shipments of spare parts as well as field

services and training. The Company also recorded $15.6 million of

revenues in the third quarter from sales of the Company�s Buffalo

vehicle. Gross margin in the third quarter was 18.6% of net sales

versus 10.9% in the prior year�s third quarter. This improvement

was impacted by significant growth in spare parts and services

revenues, which carry somewhat higher margins. Additionally, the

Company noted that it has achieved substantial improvements in

operating efficiency, particularly in the more efficient use of

labor in manufacturing activities. These gains were partially

offset by the increased revenues in the third quarter associated

with the vehicles produced by GDLS under the GDLS Subcontract,

although the Company noted that unlike the prior year�s period it

was able to record some gross profit on these revenues. Mr. Moody

continued, �We continue to focus intently on optimizing our

manufacturing capacity for our expected levels of production. While

we made excellent strides in this respect during the third quarter,

we must continue to adjust our business as deliveries under the

MRAP vehicle acquisition program come to a close during the

upcoming fourth quarter.� General and administrative expenses

during the third quarter were $27.8 million, or 8.1% of sales,

versus $21.7 million, or 10.5% of sales in the year-ago period. The

increased expense level was driven primarily by higher levels of

legal, accounting, auditing, and consulting fees associated with

the completion of the Company�s restatement and audit work.

Expenses were also driven by costs associated with employee

severance and higher depreciation expense. Research and development

expenses during the quarter were $4.3 million versus $2.3 million

in the year-ago quarter. These expenses were associated with the

development of new products. During the quarter, the Company

completed development of its Cougar Restricted Terrain (RT)

vehicle. It expects to deliver these vehicles, which contain

upgraded features including enhanced mobility and an improved power

to weight ratio, and which address the operational requirements for

restricted terrain environments such as Afghanistan, during the

fourth quarter. The Company also completed development of

ForceArmorTM, a proprietary add-on armor package which is tested

and certified to address the threat of explosively formed

projectiles. The Company also began rapid development work for a

cargo variant of the Cougar. Mr. Moody continued, "We are

exceptionally pleased with the recent work from our research and

development team. As a result of their efforts, we are pursuing

several significant new business opportunities. While we have yet

to receive the orders which would fully validate their innovation,

we are very excited at the prospect of diversifying our business

and demonstrating to our customers that we are a true technology

leader in the safety and survivability market." The Company�s

funded vehicle backlog, as of September 30, 2008, represented

orders for a total of 335 vehicles, including 116 Cougar MRAPs

(which includes 44 vehicles to be delivered by GDLS), 212 other

Cougar variants, and 7 Buffalos. The Company noted that a recent

contract award for 27 Buffalo vehicles has been received from U.S.

Army Tank-Automotive and Armaments Command (TACOM) since the close

of the third quarter. In addition, the Company continues to have an

expectation of significant levels of service and support work

related to its fielded fleet of vehicles. The Company noted that at

September 30, 2008, it continued to maintain a strong capital

position, with no long-term debt and $79.4 million of cash.

Additionally, the Company noted that, in order to create additional

financial flexibility, in October 2008 it modified its credit

agreement with Wachovia Bank to increase the principal amount to a

maximum of $40 million and to extend the maturity date to April 30,

2010. Mr. Moody concluded, "We are very pleased to continue to make

progress in our operational and financial results. Our results in

the third quarter reinforce our belief that we are a fundamentally

strong company with an important, ongoing role to play in the

survivability solutions market. We believe that there is an

excellent opportunity to further develop our business, to continue

to provide new technology and products to our customer and the

war-fighter and, importantly, to create significant value for our

shareholders." About Force Protection, Inc. Force Protection, Inc.

is a leading American designer, developer and manufacturer of life

saving survivability equipment, predominantly ballistic- and

blast-protected wheeled vehicles currently deployed by the U.S.

military and its allies to support armed forces and security

personnel in conflict zones. The Company�s specialty vehicles, the

Cougar, Buffalo, and the Cheetah, are designed specifically for

reconnaissance, forward command and control, and urban operations

and to protect their occupants from landmines, hostile fire, and

improvised explosive devices (IEDs, commonly referred to as

roadside bombs). The Company is one of the original developers and

primary providers of vehicles for the U.S. military�s Mine

Resistant Ambush Protected, or MRAP, vehicle program. For more

information on Force Protection and its vehicles, visit

www.forceprotection.net. Safe Harbor Language This press release

contains forward looking statements that are not historical facts,

including statements about our beliefs and expectations. These

statements are based on beliefs and assumptions by Force

Protection�s management, and on information currently available to

management. These forward looking statements, include, among other

things: the growth and demand for Force Protection�s vehicles; the

rate at which the Company will be able to produce those vehicles,

including the deliveries of the Cougar Restricted Terrain vehicle;

the Company�s ability to develop new technologies and products and

the effectiveness of these technologies and products; and the

Company�s expected financial and operating results, including its

cash flow, for future periods. Forward-looking statements speak

only as of the date they are made, and the Company undertakes no

obligation to update any of them publicly in light of new

information or future events. A number of important factors could

cause actual results to differ materially from those contained in

any forward-looking statements. Examples of these factors include,

but are not limited to, the Company�s ability to fulfill the above

described orders on a timely basis, the ability to effectively

manage the risks in the Company�s business, the ability to develop

new technologies and products and the acceptance of these

technologies and products; and other risk factors and cautionary

statements listed in the Company�s periodic reports filed with the

Securities and Exchange Commission, including the risks set forth

in the Company�s Annual Report on Form 10-K for the year ended

December 31, 2007. Force Protection,�Inc. and Subsidiaries

Condensed Consolidated Balance Sheets (Unaudited) � � As of

September 30, 2008 As of December 31, 2007 (In Thousands) Assets

Current assets: Cash and cash equivalents $ 79,398 $ 90,997

Accounts receivable, net 196,129 118,794 Inventories 105,799

140,639 Advances to subcontractor 6,150 25,106 Deferred income tax

assets 12,780 14,530 Income taxes receivable � 6,565 Other current

assets 4,178 8,481 Total current assets 404,434 405,112 Property

and equipment, net 62,897 66,707 Intangible assets, net 827 1,355

Deferred income tax assets 1,390 1,496 Total assets $ 469,548 $

474,670 � Liabilities and Shareholders� Equity Current liabilities:

Accounts payable $ 125,158 $ 146,515 Due to United States

government 19,315 18,969 Other current liabilities 31,948 20,710

Advance payments on contracts 26,051 56,552 Total current

liabilities 202,472 242,746 � Other long-term liabilities 139 295

202,611 243,041 � Commitments and contingencies � Shareholders�

equity: � Common stock 68 68 Additional paid-in capital 257,257

257,160 Retained earnings (accumulated deficit) 9,612 (25,599 )

Total shareholders� equity 266,937 231,629 Total liabilities and

shareholders� equity $ 469,548 $ 474,670 Force Protection,�Inc. and

Subsidiaries Condensed Consolidated Statements of Operations

(Unaudited) � � For the three months ended September 30, For the

nine months ended September 30, 2008 � 2007 2008 � 2007 (In

Thousands, Except Per Share Data) Net sales $ 343,309 $ 206,794 $

1,087,273 $ 450,278 Cost of sales 279,532 184,260 947,814 387,475

Gross profit 63,777 22,534 139,459 62,803 � General and

administrative expenses 27,817 21,708 73,967 56,113 Research and

development expenses 4,306 2,344 10,205 10,848 Operating income

(loss) 31,654 (1,518 ) 55,287 (4,158 ) � Other income, net 440 594

1,411 3,488 Interest expense (2 ) (55 ) (225 ) (86 ) Income (loss)

before income tax (expense) benefit 32,092 (979 ) 56,473 (756 ) �

Income tax (expense) benefit (12,185 ) 180 (21,262 ) 140 Net income

(loss) $ 19,907 $ (799 ) $ 35,211 $ (616 ) Earnings (loss) per

common share: Basic $ 0.29 $ (0.01 ) $ 0.52 $ (0.01 ) Diluted $

0.29 $ (0.01 ) $ 0.51 $ (0.01 ) Weighted average common shares

outstanding: Basic 68,318 68,208 68,309 67,990 Diluted 68,381

68,208 68,372 67,990

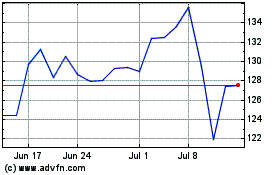

Freshpet (NASDAQ:FRPT)

Historical Stock Chart

From Aug 2024 to Sep 2024

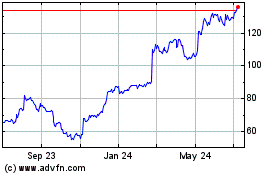

Freshpet (NASDAQ:FRPT)

Historical Stock Chart

From Sep 2023 to Sep 2024