Notification That Form 20-f Will Be Submitted Late (nt 20-f)

April 30 2021 - 4:15PM

Edgar (US Regulatory)

|

|

|

SEC FILE NUMBER

001-38737

|

|

|

|

CUSIP NUMBER

89856T104

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 12b-25

NOTIFICATION OF LATE FILING

|

(Check one):

|

|

o Form 10-K

|

x Form 20-F

|

o Form 11-K

|

o Form 10-Q

|

o Form 10-D

|

|

|

|

o Form N-CEN

|

o Form N-CSR

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For Period Ended:

|

December 31, 2020

|

|

|

|

o Transition Report on Form 10-K

|

|

|

|

|

|

o Transition Report on Form 20-F

|

|

|

|

|

|

o Transition Report on Form 11-K

|

|

|

|

|

|

o Transition Report on Form 10-Q

|

|

|

|

|

|

For the Transition Period Ended:

|

|

|

|

|

|

|

|

|

|

|

|

Nothing in this form shall be construed to imply that the Commission has verified any information contained herein.

|

|

If the notification relates to a portion of the filing

checked above, identify the Item(s) to which the notification relates:

|

|

|

|

|

|

PART I — REGISTRANT INFORMATION

|

|

TuanChe Limited

|

|

Full Name of Registrant

|

|

|

|

Former Name if Applicable

|

|

9F, Ruihai Building, No. 21 Yangfangdian Road

|

|

Address of Principal Executive Office (Street and Number)

|

|

Haidian District Beijing, The People’s Republic of China 100038

|

|

City, State and Zip Code

|

PART II — RULES 12b-25(b) AND (c)

If the subject report could not be filed without

unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b-25(b), the following should be completed. (Check

box if appropriate)

|

|

(a)

|

The reason described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense;

|

|

|

|

|

|

x

|

(b)

|

The subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, Form 11-K, Form N-CEN or Form N-CSR, or portion thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report or transition report on Form 10-Q or subject distribution report on Form 10-D, or portion thereof, will be filed on or before the fifth calendar day following the prescribed due date; and

|

|

|

|

|

|

|

(c)

|

The accountant’s statement or other exhibit required by Rule 12b-25(c) has been attached if applicable.

|

PART III — NARRATIVE

State below in reasonable detail why Forms 10-K,

20-F, 11-K, 10-Q, 10-D, N-CEN, N-CSR, or the transition report or portion thereof, could not be filed within the prescribed time period.

|

TuanChe Limited (the “Company”) has experienced a delay in compiling all the information necessary to complete its annual financial statements in connection with the filing of the Form 20-F for the year ended December 31, 2020 (the “2020 Form 20-F”), and therefore, the Company needs additional time to complete the 2020 Form 20-F for the year ended December 31, 2020. The Company currently expects to file the 2020 Annual Report within the 15-day extension period prescribed by Rule 12b-25(b)(2)(ii) under the Securities Exchange Act of 1934.

|

PART IV — OTHER INFORMATION

|

(1)

|

Name and telephone number of person to contact in regard to this notification

|

|

|

Chenxi Yu

|

|

(86) 10

|

|

6398-2942

|

|

|

(Name)

|

|

(Area Code)

|

|

(Telephone Number)

|

|

(2)

|

Have all other periodic reports required under Section 13 or 15(d) of the Securities Exchange Act of 1934

or Section 30 of the Investment Company Act of 1940 during the preceding 12 months or for such shorter period that the registrant was

required to file such report(s) been filed? If answer is no, identify report(s).

|

|

Yes

|

x

|

No

|

¨

|

|

|

(3)

|

Is it anticipated that any significant change in results of operations from the corresponding period for

the last year will be reflected by the earnings statements to be included in the subject report or portion thereof?

|

|

Yes

|

x

|

No

|

¨

|

|

|

|

If so, attach an explanation of the anticipated change, both narratively and quantitatively, and, if appropriate,

state the reasons why a reasonable estimate of the results cannot be made.

|

|

|

|

|

|

|

|

|

|

|

|

The Company has disclosed the following unaudited results of operations

prepared internally by the management for the year ended December 31, 2020 in a press release dated April 12, 2021, which was furnished

with the Commission on Form 6-K on April 12, 2021:

Net revenues decreased by 48.8% to RMB330.2 million (US$50.6 million)

in 2020 from RMB644.8 million in 2019. Gross profit decreased by 47.3% to RMB241.4 million (US$37.0 million) in 2020 from RMB458.2 million

in 2019. Loss from continuing operations decreased by 34.4% to RMB171.3 million (US$26.3 million) in 2020 from RMB261.0 million in 2019.

Comprehensive loss attributable to the Company’s equity shareholders in 2020 was RMB169.9 million (US$26.0 million), as compared

to RMB240.9 million in 2019. Fully diluted net loss attributable to ordinary shareholder per share in 2020 was RMB0.54 (US$0.08), as compared

to RMB0.85 in 2019.

As of December 31, 2020, the Company had RMB109.9 million (US$16.8

million) cash and cash equivalents, RMB45.7 million (US$7.0 million) time deposits, collectively RMB155.6 million (US$23.8 million). Net

cash used in operating activities in the fourth quarter of 2020 was RMB1.0 million (US$0.2 million) compared with net cash used in operating

activities of RMB27.1 million in the prior year period.

The unaudited financial information

set out above is preliminary and subject to potential adjustments, which could result in significant differences from this preliminary

unaudited financial information.

Historically, the Company has

relied principally on both operational sources of cash and non-operational sources of financing from investors to fund its operations

and business development. The Company's ability to continue as a going concern is dependent on management's ability to successfully execute

its business plan and responding to the development of the COVID-19 pandemic. The Company believes the cash and cash equivalents

and time deposits currently on hand are sufficient to meet the cash requirements to fund planned operations and other commitments for

at least the next twelve months from the date of the issuance of the consolidated financial statements.

Based on currently available

information, the Company expects that operating losses and negative cash flows from operations are likely to continue for the foreseeable

future. The Company plans to continue to raise additional capital, including among others, obtaining debt financing, to support

its future operating activities. There can be no assurance, however, that the Company will be able to obtain additional financing on terms

acceptable to the Company, on a timely basis or at all.

The Company anticipates that

its independent registered public accounting firm will include an emphasis of matter paragraph in its audit opinion with respect to the

liquidity matter as discussed above in its report on the consolidated financial statements for the year ended December 31, 2020.

Forward-Looking Statements

This notification includes forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. The word “expects,”

“anticipates” and similar terms and phrases are used in this notification to identify forward-looking statements. Risks, uncertainties

and assumptions that could affect the Company’s forward-looking statements include, among other things, any changes to our anticipated

financial results as a result of our independent registered public accounting firm completing its audit of the Company’s financial

statements, the ability of us and our auditors to confirm information or data identified in the review, our ability to complete and file

future periodic filings with the SEC on a timely basis and other risks and uncertainties discussed more fully in the Company’s filings

with the SEC. Unless required by law, the Company expressly disclaims any obligation to update publicly any forward-looking statements,

whether as a result of new information, future events or otherwise.

|

|

TuanChe Limited

|

|

|

(Name of Registrant as Specified in Charter)

|

|

|

has caused this notification to be signed on its

behalf by the undersigned hereunto duly authorized.

|

Date: April 30, 2021

|

By:

|

/s/ Chenxi Yu

|

|

|

|

|

Name: Chenxi Yu

|

|

|

|

|

Title: Deputy Chief Financial Officer

|

|

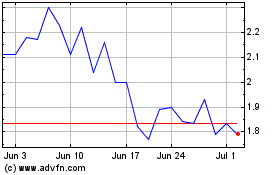

TuanChe (NASDAQ:TC)

Historical Stock Chart

From Mar 2024 to Apr 2024

TuanChe (NASDAQ:TC)

Historical Stock Chart

From Apr 2023 to Apr 2024