Current Report Filing (8-k)

December 29 2020 - 5:00PM

Edgar (US Regulatory)

0000725363

false

0000725363

2020-12-23

2020-12-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date of

Report (date of earliest event reported): December 23,

2020

CEL SCI

CORP

(Exact

name of Registrant as specified in its charter)

|

Colorado

|

001-11889

|

84-0916344

|

|

(State

or other jurisdiction of incorporation)

|

(Commission

File No.)

|

(IRS

Employer Identification No.)

|

8229 Boone Blvd., #802

Vienna,

Virginia

22182

(Address

of principal executive offices, including Zip Code)

Registrant’s

telephone number, including area code: (703)

506-9460

N/A

(Former

name or former address if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligations of the registrant

under any of the following provisions:

☐ Written

communications pursuant to Rule 425 under the Securities Act (17CFR

230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17

CFR 240.14d-2(b)

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17

CFR 240.13e-14c))

Securities registered pursuant to Section 12(b) of the

Act:

|

Title of Each Class

|

Trading Symbol(s)

|

Name of Each Exchange on Which Registered

|

|

Common Stock

|

CVM

|

NYSE American

|

Indicate

by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§203.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of

1934 (§204.12b-2 of this chapter.

Emerging

growth company ☐

If an

emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act. ☐

Item

4.02

Non-Reliance

on Previously Issued Financial Statements or a Related Audit Report

or Completed Interim Review.

On

December 23, 2020, the board of directors (the “Board”)

of CEL-SCI Corporation (the “Company”), in consultation

with management, concluded that the Company’s previously

issued unaudited condensed financial statements contained within

the Quarterly Reports on Form 10-Q for the quarterly periods ended

December 31, 2019, March 31, 2020, and June 30, 2020 should no

longer be relied upon. Accordingly, the Company intends to restate

the aforementioned financial statements by amending its quarterly

reports on Form 10-Q for the quarters ended December 31, 2019,

March 31, 2020, and June 30, 2020. The Company expects to file

amended quarterly reports as soon as possible.

On

October 1, 2019, the Company adopted Accounting Standards

Codification (ASC) 842, Leases, and applied the

standard’s transition provisions to account for the

build-to-suit lease for the Company’s Multikine manufacturing

facility. The lease for the manufacturing facility was signed in

August 2007. When calculating the right of use (ROU) asset for this

lease under ASC 842 during the preparation of the year-end

financial statements, the Company determined that the opening

Finance ROU asset and total stockholders’ equity balances

were understated by approximately $2.04 million as of October 1,

2019, the date of adoption.

●

The unamortized

value of approximately $0.6 million relating to the issuance of

warrants to the landlord should have been capitalized and included

as part of the Finance ROU asset as of October 1,

2019.

●

The unamortized

value of approximately $1.4 million relating to a payment made to

the landlord at lease inception, which the Company is recovering in

the form of reduced rent, should have been capitalized and included

as part of the Finance ROU asset as of October 1,

2019.

The

changes do not impact any prior year’s financial statements

but are an adjustment to the opening Finance ROU asset and

accumulated deficit balances effective October 1, 2019. As a result

of the changes to the opening Finance ROU asset and accumulated

deficit balances, the financial statements filed for the three

quarterly reporting periods during 2020 will be adjusted as

follows:

|

|

As of December 31, 2019

|

|

|

|

|

|

BALANCE

SHEET

|

As Reported

|

Adjustment

|

Corrected

|

% Impact

|

|

|

|

|

|

Finance and Operating ROU

Assets

|

$14,066,247

|

$1,985,751

|

$16,051,998

|

14%

|

|

|

|

|

|

Property and equipment,

net

|

2,712,577

|

-

|

2,712,577

|

0%

|

|

|

|

|

|

Other Assets

|

12,729,009

|

-

|

12,729,009

|

0%

|

|

|

|

|

|

Total

Assets

|

$29,507,833

|

$1,985,751

|

$31,493,584

|

7%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Finance and

Operating Lease Liability

|

$14,252,491

|

-

|

14,252,491

|

0%

|

|

|

|

|

|

Other

Liabilities

|

8,287,028

|

-

|

8,287,028

|

0%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

stockholders' equity

|

6,968,314

|

1,985,751

|

8,954,065

|

28%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders'

equity

|

$29,507,833

|

$1,985,751

|

$31,493,584

|

7%

|

|

|

|

|

In

addition, the cumulative effect adjustment to the opening

accumulated deficit balance in the statement of stockholders'

equity as of October 1, 2019 increased approximately $2.0 million

from approximately $0.1 million (as reported) to approximately $2.1

million (corrected).

|

|

Three Months Ending December 31, 2019

|

|

|

|

|

|

|

As Reported

|

Adjustment

|

Corrected

|

% Impact

|

|

|

|

|

|

STATEMENT

OF

OPERATIONS

|

|

|

|

|

|

|

|

|

|

Grant Income

|

$35,506

|

$-

|

$35,506

|

0%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating

Expenses

|

|

|

|

|

|

|

|

|

|

Research and

Development

|

4,196,613

|

56,200

|

4,252,813

|

1%

|

|

|

|

|

|

General and

administrative

|

2,638,896

|

-

|

2,638,896

|

0%

|

|

|

|

|

|

Total Operating

Expenses

|

6,835,509

|

56,200

|

6,891,709

|

1%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating

loss

|

(6,800,003)

|

(56,200)

|

(6,856,203)

|

1%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest

expense, net

|

(250,783)

|

-

|

(250,783)

|

0%

|

|

|

|

|

|

Other profit

and loss items

|

1,575,626

|

-

|

1,575,626

|

0%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

$(5,475,160)

|

$(56,200)

|

$(5,531,360)

|

1%

|

|

|

|

|

|

|

As of March 31, 2020

|

|

|

|

|

|

BALANCE

SHEET

|

As Reported

|

Adjustment

|

Corrected

|

% Impact

|

|

|

|

|

|

Finance and Operating ROU

Assets

|

$13,640,703

|

$1,929,551

|

$15,570,254

|

14%

|

|

|

|

|

|

Prpoperty and equipment,

net

|

3,286,273

|

-

|

3,286,273

|

0%

|

|

|

|

|

|

Other Assets

|

17,790,250

|

-

|

17,790,250

|

0%

|

|

|

|

|

|

Total

Assets

|

$34,717,226

|

$1,929,551

|

$36,646,777

|

6%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Finance and Operating Lease

Liability

|

$14,022,236

|

-

|

14,022,236

|

0%

|

|

|

|

|

|

Other

Liabilities

|

8,486,481

|

-

|

8,486,481

|

0%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

stockholders' equity

|

12,208,509

|

1,929,551

|

14,138,060

|

16%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders' equity

|

$34,717,226

|

$1,929,551

|

$36,646,777

|

6%

|

|

|

|

|

|

|

Three Months Ending March 31, 2020

|

Six Months Ending March 31, 2020

|

|

|

As Reported

|

Adjustment

|

Corrected

|

% Impact

|

As Reported

|

Adjustment

|

Corrected

|

% Impact

|

|

STATEMENT

OF

OPERATIONS

|

|

|

|

|

|

|

|

|

|

Grant

Income

|

$298,726

|

$-

|

$298,726

|

0%

|

$334,232

|

$-

|

$334,232

|

0%

|

|

|

|

|

|

|

|

|

|

|

|

Operating

Expenses

|

|

|

|

|

|

|

|

|

|

Research and

Development

|

4,402,347

|

56,200

|

4,458,547

|

1%

|

8,598,960

|

112,400

|

8,711,360

|

1%

|

|

General and

administrative

|

2,558,522

|

-

|

2,558,522

|

0%

|

5,197,418

|

-

|

5,197,418

|

0%

|

|

Total

Operating Expenses

|

6,960,869

|

56,200

|

7,017,069

|

1%

|

13,796,378

|

112,400

|

13,908,778

|

1%

|

|

|

|

|

|

|

|

|

|

|

|

Operating

loss

|

(6,662,143)

|

(56,200)

|

(6,718,343)

|

1%

|

(13,462,146)

|

(112,400)

|

(13,574,546)

|

1%

|

|

|

|

|

|

|

|

|

|

|

|

Interest

expense, net

|

(253,407)

|

-

|

(253,407)

|

0%

|

(504,190)

|

-

|

(504,190)

|

0%

|

|

Other profi

and loss items

|

(2,117,802)

|

-

|

(2,117,802)

|

0%

|

(542,176)

|

-

|

(542,176)

|

0%

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

$(9,033,352)

|

$(56,200)

|

$(9,089,552)

|

1%

|

$(14,508,512)

|

$(112,400)

|

$(14,620,912)

|

1%

|

|

|

As of June 30, 2020

|

|

|

|

|

|

BALANCE

SHEET

|

As Reported

|

Adjustment

|

Corrected

|

% Impact

|

|

|

|

|

|

Finance and

Operating ROU Assets

|

$13,605,286

|

$1,873,351

|

$15,478,637

|

14%

|

|

|

|

|

|

Property and

equipment, net

|

3,762,633

|

-

|

3,762,633

|

0%

|

|

|

|

|

|

Other

Assets

|

24,666,948

|

-

|

24,666,948

|

0%

|

|

|

|

|

|

Total Assets

|

$42,034,867

|

$1,873,351

|

$43,908,218

|

4%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Finance and

Operating Lease Liability

|

$14,157,390

|

-

|

14,157,390

|

0%

|

|

|

|

|

|

Other

Liabilities

|

8,862,537

|

-

|

8,862,537

|

0%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

stockholders' equity

|

19,014,940

|

1,873,351

|

20,888,291

|

10%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders' equity

|

$42,034,867

|

$1,873,351

|

$43,908,218

|

4%

|

|

|

|

|

|

|

Three Months Ending June 30, 2020

|

Nine Months Ending June 30, 2020

|

|

|

As Reported

|

Adjustment

|

Corrected

|

% Impact

|

As Reported

|

Adjustment

|

Corrected

|

% Impact

|

|

STATEMENT

OF

OPERATIONS

|

|

|

|

|

|

|

|

|

|

Grant

Income

|

$195,874

|

$-

|

$195,874

|

0%

|

$530,106

|

$-

|

$530,106

|

0%

|

|

|

|

|

|

|

|

|

|

|

|

Operating

Expenses

|

|

|

|

|

|

|

|

|

|

Research and

Development

|

3,912,870

|

56,200

|

3,969,070

|

1%

|

12,511,830

|

168,600

|

12,680,430

|

1%

|

|

General and

administrative

|

3,192,403

|

-

|

3,192,403

|

0%

|

8,389,821

|

-

|

8,389,821

|

0%

|

|

Total

Operating Expenses

|

7,105,273

|

56,200

|

7,161,473

|

1%

|

20,901,651

|

168,600

|

21,070,251

|

1%

|

|

|

|

|

|

|

|

|

|

|

|

Operating

loss

|

(6,909,399)

|

(56,200)

|

(6,965,599)

|

1%

|

(20,371,545)

|

(168,600)

|

(20,540,145)

|

1%

|

|

|

|

|

|

|

|

|

|

|

|

Interest

expense, net

|

(273,708)

|

-

|

(273,708)

|

0%

|

(777,898)

|

-

|

(777,898)

|

0%

|

|

Other profit

and loss items

|

(3,037,672)

|

-

|

(3,037,672)

|

0%

|

(3,579,848)

|

-

|

(3,579,848)

|

0%

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

$(10,220,779)

|

$(56,200)

|

$(10,276,979)

|

1%

|

$(24,729,291)

|

$(168,600)

|

$(24,897,891)

|

1%

|

Management has

determined that, as a result of the errors described above,

management's previous conclusions regarding the effectiveness of

the Company's disclosure controls and procedures as of December 31,

2019, March 31, 2020, and June 30, 2020 need to be modified. The

Company will provide management's modified conclusions in the

restated interim financial statements.

The

Company's Audit Committee has discussed with BDO USA LLP, the

Company’s independent registered public accounting firm, the

matters disclosed in this 8-K report.

SIGNATURES

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused

this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

|

CEL-SCI CORPORATION

|

|

|

|

|

|

|

|

Date:

December 29, 2020

|

By:

|

/s/ Geert

Kersten

|

|

|

|

|

Geert

Kersten

|

|

|

|

|

Chief

Executive Officer

|

|

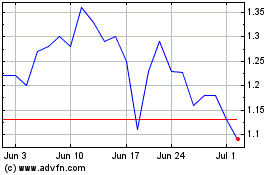

Cel Sci (AMEX:CVM)

Historical Stock Chart

From Mar 2024 to Apr 2024

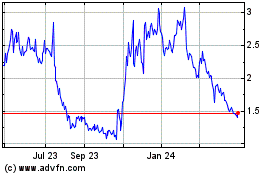

Cel Sci (AMEX:CVM)

Historical Stock Chart

From Apr 2023 to Apr 2024