European Luxury, Airline Stocks Suffer Blow Amid Chinese Outbreak -- 2nd Update

January 21 2020 - 5:43PM

Dow Jones News

By Anna Isaac

Luxury retailers, airlines and casino stocks fell Tuesday after

a potentially deadly virus spread between humans in China, spurring

concerns that an outbreak may crimp tourism and shopping during the

crucial Lunar New Year holiday period.

Christian Dior SE slipped 2.3% in Paris while Kering SA, owner

of the Gucci and Yves Saint Laurent brands, dropped 2.1%.

International Consolidated Airlines Group SA, the parent of British

Airways, retreated 3% in London, part of a broad decline in global

airline stocks.

The number of confirmed cases of coronavirus, which is

pneumonialike, tripled Monday, reprising memories of the 2002-03

outbreak of severe acute respiratory syndrome, or SARS. That

outbreak led to more than 700 people dying and crimped economic

growth in the region.

The latest outbreak has spread to neighboring countries,

prompting speculation that measures aimed at preventing further

proliferation might affect businesses at a critical time in China's

leisure and tourism calendar.

Chinese consumers have become more important for the global

economy and luxury sector in the last two decades as economic

growth has bolstered wealth in the country, analysts said. They

accounted for 33% of global spending on luxury goods in 2018,

according to a study published by consulting firm Bain & Co. in

2019.

"Wealthier Chinese people often go overseas to shop for luxury

brands or to Macau for gambling during the Lunar New Year break,"

said Jasper Lawler, head of research at London & Capital Group

Ltd. "Luxury brands are now very sensitive to Chinese demand."

The SARS outbreak curbed both travel and luxury spending, said

Paola Carboni, an analyst at Equita Group. While the authorities

have learned some lessons in containment since then, the timing of

the coronavirus -- ahead of the Lunar New Year holiday -- has made

investors especially nervous.

Shares in Wynn Resorts Ltd., which operates hotels globally

including in Macau, dropped 6.1% in New York. Bigger rival Las

Vegas Sands shed 5.4%, while stock in the company's Hong

Kong-listed division also suffered declines. Casino operator MGM

China Holdings dropped over 6.2% in Hong Kong.

Meanwhile, some Chinese drugmakers and face mask manufacturers

benefited from investors' expectations that there may be an

increased need for medication and containment in response to the

outbreak, Mr. Lawler said. Among them: Shandong Lukang

Pharmaceutical Co. Ltd. and face mask manufacturer Shanghai Dragon

Corp., both of which rose roughly 10%.

Such stocks could see their gains erased rapidly if the virus

was quickly contained, Mr. Lawler said.

Over in Europe, LVMH Moët Hennessy Louis Vuitton SE fell 1.1% in

Paris and Switzerland's Cie. Financière Richemont SA declined 1.9%.

Burberry Group PLC pared back earlier declines and traded down 0.6%

in London.

Among airline operators, Air France-KLM SA shed 2.6%, United

Airlines Holdings dropped 4.4% and American Airlines Group dropped

4.2%.

"The fear of getting infected might affect the propensity of

Chinese buyers to travel and spend," said Ms. Carboni. "You never

know how long it will last."

Write to Anna Isaac at anna.isaac@wsj.com

(END) Dow Jones Newswires

January 21, 2020 17:28 ET (22:28 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

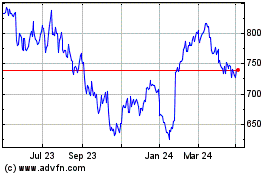

Christian Dior (EU:CDI)

Historical Stock Chart

From Mar 2024 to Apr 2024

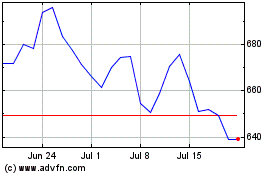

Christian Dior (EU:CDI)

Historical Stock Chart

From Apr 2023 to Apr 2024