Mattel Resolves Accounting Probe, Easing Debt Squeeze

October 29 2019 - 6:50PM

Dow Jones News

By Paul Ziobro

Mattel Inc.'s chief financial officer is leaving, and the

company is restating some past earnings after completing an

investigation into accounting issues raised in a whistleblower

letter.

The investigation found shortcomings in the toy maker's

accounting and reporting procedures but concluded that the actions

didn't amount to fraud.

Shares of the maker of Barbie dolls and Hot Wheels cars rose

more than 20% in post-market trading as the resolution, coupled

with strong third-quarter earnings, removes a roadblock to the

company's plans to refinance debt due next year. The whistleblower

letter, disclosed in August, abruptly nixed plans to raise debt at

the last minute.

The investigation found that Mattel understated its net loss by

$109 million in the third quarter of 2017 due to an error

calculating its tax valuation allowance, and then understated

fourth-quarter results that year by a similar amount. The error

wasn't reported to the CEO at the time or the audit committee.

The letter also questioned the independence of the lead auditor,

PricewaterhouseCoopers LLP. The investigation found that the lead

partner at the accounting firm violated some independence rules by

recommending candidates for Mattel's senior finance positions.

Mattel said that PwC replaced its lead partner and other members of

its audit team that deals with the toy maker but will continue as

auditor.

Mattel has launched a search for a new CFO to succeed Joe

Euteneuer, who joined the company in late 2017. He will leave the

company after a six-month transition period.

PwC said in a statement that both the accounting firm and Mattel

had concluded PwC is "objective and impartial." The firm "takes

independence very seriously and has robust policies and procedures

in place to identify and address potential threats to

independence," the statement said.

Mattel otherwise reported a sharp jump in profit, as ongoing

cost cuts benefited the bottom line while overall sales rose for

the second straight quarter.

In an interview, Mattel Chief Executive Ynon Kreiz said tariffs

had minimal impact on the El Segundo, Calif.-based company in the

latest quarter.

Mr. Kreiz said more retailers agreed to buy Mattel's products in

China rather than ask the toy maker to import products to the U.S.

and store them in warehouses. "It says a lot about the retailers'

confidence and the inventory they're committing to," Mr. Kreiz

said.

Rival Hasbro Inc. dealt with the opposite trend. The maker of

Play-Doh and Nerf blasters said that the threat of tariffs widely

disrupted ordering patterns in the third quarter.

Retailers canceled direct import orders, where the sale is made

in China, and instead required Hasbro to import the products

themselves, adding to shipping and warehousing costs. The switch

caused Hasbro to miss out on some orders that they couldn't fulfill

in time, which hurt the company's profit and sales in the

period.

Hasbro executives said the delay was caused by uncertainty about

when a tariff on toys from China would go into effect. Currently, a

10% tariff is set to take effect on Dec. 15.

Mr. Kreiz said that tariffs wouldn't be an issue for Mattel this

year. "We saw a de minimis impact on our results, and we don't

expect to see any impact from tariffs this year," he said.

Mattel, which is undergoing a revamp under Mr. Kreiz that

includes cutting costs and putting out more movies and television

shows based on Mattel brands, posted sharply higher profit in the

third quarter. The company benefited from ongoing cost cuts, while

sales rose for the second straight quarter.

Mr. Kreiz said the toy maker is confident as the company enters

the all-important holiday season, even as it faces a truncated

shopping season due to Thanksgiving falling later.

"We need to work harder in fewer days," Mr. Kreiz said. "We know

the challenges, we know the opportunities, and our team is focused

on executing and delivering."

Mattel posted earnings of $70.6 million, or 20 cents a share, in

the third quarter, compared with $6.3 million, or 2 cents a share,

in the same period a year ago. Analysts polled by FactSet were

expecting per-share earnings of 16 cents.

Sales rose 3% to $1.48 billion, primarily from a 10% increase in

the international segment as sales in the U.S. stalled. Analysts

expected revenue of $1.43 billion.

The fastest-growing brands include some of Mattel's largest.

Barbie sales rose 10%, while Hot Wheels sales rose 25%.

Fisher-Price sales fell 3%, while American Girl, a high-end doll

line and retail chain, posted a 15% sales decline.

Gross margin widened to 46.3% from 42.6% last year.

Jean Eaglesham contributed to this article.

Write to Paul Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

October 29, 2019 18:35 ET (22:35 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

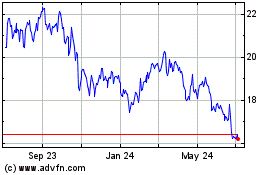

Mattel (NASDAQ:MAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

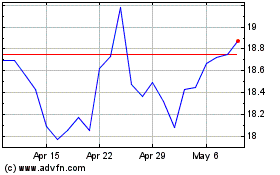

Mattel (NASDAQ:MAT)

Historical Stock Chart

From Apr 2023 to Apr 2024