Prudential PLC Says Demerger on Track, Reports Rising New-Business Profit

November 14 2018 - 2:57AM

Dow Jones News

By Adam Clark

Prudential PLC (PRU.LN) said Wednesday that the ongoing demerger

of its U.K. and European business unit is on track and reported

sales growth across its units.

The FTSE 100 insurance and asset-management business said it is

continuing to make good progress on demerging M&G Prudential

but gave no details of a timeline for the split. The demerger was

originally announced in March.

Prudential said over the first nine months of 2018 its

life-insurance new-business profit rose 17%, or 12% on an actual

exchange-rate basis.

In Asia, Prudential said its new-business profit increased by

15% to 1.76 billion pounds ($2.28 billion) compared with the same

period in 2017, driven by its health-and-protection business. In

its Eastspring asset-management business in the region, total funds

under management rose to GBP149.2 billion as of Sept. 30 from

GBP138.9 billion at the end of 2017.

In the U.S., Prudential said new-business profit for its Jackson

business rose 22% to GBP716 million over the nine-month period. In

the U.K. and Europe, M&G Prudential increased its new-business

profit by 18% to GBP277 million. Funds under management fell to

GBP334.4 billion from GBP350.7 billion at the start of the year,

including the redemption of a single large institutional

mandate.

The company's Solvency II surplus, a key measure of balance

sheet strength, stood at GBP14.1 billion as of Sept. 30, equivalent

to a cover ratio of 205%. The company said it remains well-placed

for long-term growth.

Write to Adam Clark at adam.clark@dowjones.com;

@AdamDowJones

(END) Dow Jones Newswires

November 14, 2018 02:42 ET (07:42 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

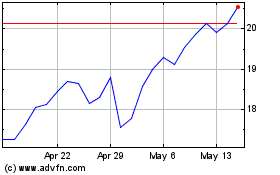

Prudential (NYSE:PUK)

Historical Stock Chart

From Mar 2024 to Apr 2024

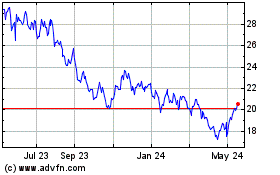

Prudential (NYSE:PUK)

Historical Stock Chart

From Apr 2023 to Apr 2024