Rio Tinto Shares Rise After Buyback; Likely to Boost PICK ETF

September 20 2018 - 10:31AM

Dow Jones News

Shares in Rio Tinto PLC (RIO.LN) rose 2.3% in London on Thursday

after the Anglo-Australian mining company launched a $3.2 billion

share buyback, a market move that helped boost exchange-traded fund

PICK.

--According to fund issuer BlackRock, Rio Tinto accounts for

7.37% of the total PICK ETF, behind rival BHP Billiton Ltd.

(BHP.AU), which represents 9.46%.

--The ETF, iShares MSCI Global Metals & Mining Producers

(PICK), has net assets of $384.2 million. Its shares rose 2.3% in

early trade at $32.55.

--Rio Tinto's share buyback is part of a move to return proceeds

from the sale of coal assets to its shareholders. Its London-traded

shares at 1351 GMT rose 84.50 pence to 3,807 pence.

--Investment bank Jefferies said it also expects proceeds from

the $3.5 billion sale of its Grasberg mine in Indonesia to be

returned to shareholders.

Write to Oliver Griffin at oliver.griffin@dowjones.com;

@OliGGriffin

(END) Dow Jones Newswires

September 20, 2018 10:16 ET (14:16 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

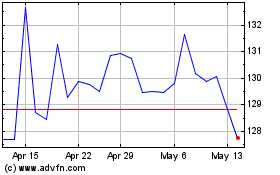

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

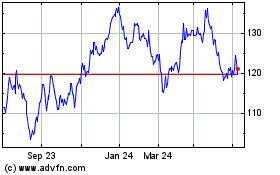

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Apr 2023 to Apr 2024