Current Report Filing (8-k)

February 16 2018 - 4:33PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 13, 2018

DOCUMENT

SECURITY SYSTEMS, INC.

(Exact

name of registrant as specified in its charter)

|

New

York

|

|

001-32146

|

|

16-1229730

|

|

(State

or other jurisdiction

of incorporation)

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification No.)

|

|

200

Canal View Boulevard

Suite 300

Rochester, NY

|

|

14623

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code:

(585) 325-3610

Not

Applicable

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item

2.04 Triggering Events That Accelerate or Increase a Direct Financial Obligation under an Off-Balance Sheet Arrangement

Document

Security Systems, Inc. (“DSS”) and its wholly-owned subsidiary, DSS Technology Management, Inc. (the “Company”),

are parties to an Investment Agreement (the “Agreement”) dated February 13, 2014 (the “Effective Date”)

along with Fortress Credit Co LLC, as collateral agent (the “Collateral Agent”), and certain investors (the “Investors”),

pursuant to which the Company contracted to receive a series of advances totaling $4,500,000 (the “Advances”). Entry

into this Agreement was reported in a Current Report on Form 8-K filed on February 18, 2014, to which a copy of the Agreement

was attached as an exhibit. Undefined capitalized terms contained in this report shall have the meanings assigned to them in the

Agreement, or in the Amendment described below.

The

Agreement defines certain Events of Default. As previously reported in a Current Report on Form 8-K filed on February 16, 2016,

the Company had previously defaulted under the Agreement by failing to make payments to the Investors in an amount equal to the

outstanding Advances, on or before the second anniversary date of the Effective Date of the Agreement, which was February 13,

2016.

On

December 2, 2016, the Company, DSS, the Collateral Agent and the Investors entered into a First Amendment to Investment Agreement

And Certain Other Documents (the “Amendment”). as reported in a Current Report on Form 8-K filed on December 8, 2016.

The purposes of the Amendment were to vacate the Company’s February 13, 2016 non-payment default under the Agreement, to

extend the Maturity Date of all obligations under the Agreement to February 13, 2018, and to amend certain other provisions of

the Agreement, as more particularly described in the aforementioned Form 8-K filed on December 8, 2016.

On

February 13, 2018, the Maturity Date of the Agreement, the Company failed to pay the Investors an amount equal to (x) two times

the aggregate amount of all Advances made by the Investors as of such date plus (y) the Capitalized Expenses, which was an Event

of Default under the Agreement. The sole recourse available to the Investors under the Agreement for a non-payment default is

the establishment of a special purpose entity controlled by the Investors which would take ownership of the Collateral securing

the Company’s obligations under the Agreement which consists of the Patents covered under the Agreement. Each of

the Investors and the Collateral Agent have contractually agreed that they will not, individually or collectively, seek to enforce

any monetary judgement with respect to or against any assets of the Company other than the Patents, the Monetization Payments,

and any remaining Deposit amount (which net accrued Deposit balance, pursuant to the terms of the Amendment, is approximately

$410,000). In keeping with the above-described limited contractual remedy for this non-payment default, the Company expects to

record a net gain on extinguishment of liabilities of approximately $3.2 million sometime during 2018, in connection with this

transaction.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

DOCUMENT

SECURITY SYSTEMS, INC.

|

|

|

|

|

|

Dated:

February 16, 2018

|

By:

|

/s/

Jeffrey Ronaldi

|

|

|

|

Jeffrey

Ronaldi

|

|

|

|

Chief

Executive Officer

|

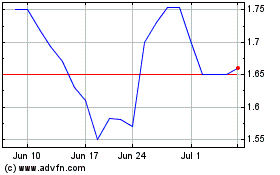

DSS (AMEX:DSS)

Historical Stock Chart

From Mar 2024 to Apr 2024

DSS (AMEX:DSS)

Historical Stock Chart

From Apr 2023 to Apr 2024