Securities Registration: Employee Benefit Plan (s-8)

December 29 2017 - 6:14AM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on December 29, 2017

Registration

No. 333-

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

S-8

REGISTRATION STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

NOAH HOLDINGS LIMITED

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

|

|

Cayman Islands

|

|

No. 1687 Changyang Road, Changyang Valley Building 2, Shanghai 200090

People’s Republic of China

(86-21)

3860-2301

|

|

Not Applicable

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(Address, including Zip Code, of Registrant’s Principal Executive Offices)

|

|

(I.R.S. Employer

Identification No.)

|

2017 SHARE INCENTIVE PLAN

(Full Title of the Plan)

Law Debenture

Corporate Services Inc.

400 Madison Avenue, 4th Floor

New York, New York 10017

(212)

750-6474

(Name, address, zip code and telephone number, including area code, of agent for service)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a

non-accelerated

filer, a smaller reporting company or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule

12b-2

of the Exchange Act.

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

|

☑

|

|

Accelerated filer

|

|

☐

|

|

|

|

|

|

|

Non-accelerated

filer

|

|

☐ (Do not check if a smaller reporting company)

|

|

Smaller reporting company

|

|

☐

|

|

|

|

|

|

|

Emerging growth company

|

|

☐

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has

elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

|

|

|

|

|

|

|

|

|

Copies to:

|

|

|

|

|

Shang Yan Chuang, Chief Financial Officer

Noah Holdings Limited

No. 1687 Changyang Road, Changyang Valley, Building 2

Shanghai 200090, People’s Republic of China

Phone: (86) 21 8035 9221

Facsimile: (86) 21 8035 9641

|

|

Paul W. Boltz, Jr., Esq.

Gibson, Dunn & Crutcher

32/F Gloucester Tower, The Landmark

15 Queen’s Road Central, Hong Kong

(852) 2214-3700

|

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Securities

to be Registered(1)

|

|

Amount

to be

Registered(2)

|

|

Proposed

Maximum

Offering

Price

Per Share

|

|

Proposed

Maximum

Aggregate

Offering Price

|

|

Amount of

Registration Fee

|

|

Class A Ordinary Shares, par value US$0.0005 per

share:

|

|

2,792,000(3)

|

|

$89.64(3)

|

|

$250,274,880

|

|

$31,159.22

|

|

Class A Ordinary Shares, par value US$0.0005 per

share:

|

|

8,000(4)

|

|

$89.64(4)

|

|

$717,120

|

|

$89.28

|

|

TOTAL

|

|

2,800,000

|

|

|

|

$250,992,000

|

|

$31,248.50

|

|

|

|

|

|

(1)

|

These shares may be represented by the Registrant’s ADSs, two of which represent one Class A ordinary share. The Registrant’s ADSs issuable upon deposit of the Class A ordinary shares registered

hereby have been registered under a separate registration statement on Form

F-6

(333-170167).

|

|

(2)

|

Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement also covers an indeterminate number of additional shares which may be offered and issued

to prevent dilution from share splits, share dividends or similar transactions as provided in the 2017 Share Incentive Plan (the “2017 Plan”). Any Class A ordinary share covered by an award granted under the 2017 Plan (or portion of

an award) that terminates, expires, lapses or is repurchased for any reason will be deemed not to have been issued for purposes of determining the maximum aggregate number of Class A ordinary shares that may be issued under the 2017 Plan.

|

|

(3)

|

These Class A ordinary shares are reserved for future award grants under the 2017 Plan. The proposed maximum offering price per Class A ordinary share, which is estimated solely for the purposes of calculating

the registration fee under Rule 457(h) and Rule 457(c) under the Securities Act, is based on $44.82 per ADS, the average of the high and low prices for the Registrant’s ADSs as quoted on the New York Stock Exchange on December 26, 2017.

|

|

(4)

|

These shares represent Class A ordinary shares issuable upon the vesting of outstanding restricted shares granted under the 2017 Plan, and the corresponding proposed maximum offering price per share, which is

estimated solely for the purposes of calculating the registration fee under Rule 457(h) and Rule 457(c) under the Securities Act, is based on $44.82 per ADS, the average of the high and low prices for the Registrant’s ADSs as quoted on the New

York Stock Exchange on December 26, 2017.

|

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

|

Item 1.

|

Plan Information*

|

|

Item 2.

|

Registrant Information and Employee Plan Annual Information*

|

|

|

*

|

Information required by Part I to be contained in the Section 10(a) prospectus is omitted from this Registration Statement in accordance with Rule 428 under the Securities Act and the Note to Part I of Form

S-8.

The documents containing information specified in this Part I will be separately provided to the participants covered by the Plan, as specified by Rule 428(b)(1) under the Securities Act.

|

PART II

INFORMATION

REQUIRED IN THE REGISTRATION STATEMENT

|

Item 3.

|

Incorporation of Documents by Reference.

|

The following documents, which have previously

been filed by the Registrant with the Securities and Exchange Commission (the “Commission”), are incorporated by reference herein and shall be deemed to be a part hereof:

1. the Registrant’s latest Annual Report on Form

20-F

filed pursuant to Sections

13(a) or 15(d) of the Securities Exchange Act of 1934 (the “Exchange Act”) or latest prospectus filed pursuant to Rule 424(b) under the Securities Act that contains audited financial statements for the Registrant’s latest fiscal year

for which such statements have been filed;

2. all other reports filed or furnished by the Registrant pursuant to

Section 13(a) or 15(d) of the Exchange Act since the end of the fiscal year covered by the Registrant’s latest Annual Report or prospectus referred to in 1 above; and

3. the description of the Registrant’s ordinary shares contained in the registration statement filed with the Commission

on October 28, 2010 on Form

8-A

(Commission File

No. 001-34936)

pursuant to Section 12 of the Exchange Act, including any amendment or report filed for

the purpose of updating such description.

In addition, all documents subsequently filed with or furnished to the Commission by the

Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, prior to the filing of a post-effective amendment to this Registration Statement which deregisters any securities remaining unsold, shall be deemed to be incorporated by

reference herein and to be a part hereof from the date of filing or furnishing of such documents; provided, however, that the documents listed above or subsequently filed or furnished by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d)

of the Exchange Act in each year during which the offering made by this Registration Statement is in effect prior to the filing with the Commission of the Registrant’s Annual Report on Form

20-F

covering

such year shall cease to be incorporated by reference in this Registration Statement from and after the filing of such Annual Reports.

Any statement, including financial statements, contained in a document incorporated or deemed to be incorporated by reference herein shall be

deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein or therein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein

modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

|

Item 4.

|

Description of Securities.

|

Not applicable.

|

Item 5.

|

Interests of Named Experts and Counsel.

|

Not applicable.

2

|

Item 6.

|

Indemnification of Directors and Officers.

|

Cayman Islands law does not limit the extent

to which a company’s articles of association may provide for indemnification of directors and officers, except to the extent any such provision may be held by the Cayman Islands courts to be contrary to public policy, such as to provide

indemnification against civil fraud or the consequences of committing a crime. The Registrant’s amended and restated articles of association, adopted by its shareholders on January 28, 2016, provides that the Registrant shall indemnify its

directors and officers against actions, proceedings, costs, charges, expenses, losses, damages or liabilities incurred by such persons in their capacity as such, except through their own willful neglect or default.

Pursuant to the indemnification agreements, the form of which was filed as Exhibit 10.3 to the Registrant’s registration statement on

Form

F-1

(File

No. 333-170055),

the Registrant has agreed to indemnify its directors and officers against certain liabilities and expenses incurred by such persons

in connection with claims made by reason of their being such a director or officer.

The Underwriting Agreement, the form of which was

filed as Exhibit 1.1 to the Registrant’s registration statement on Form

F-1,

as amended (File

No. 333-170055),

also provides for indemnification of the

Registrant and its directors and officers for certain liabilities, including liabilities arising under the Securities Act, but only to the extent that such liabilities are caused by information relating to the underwriters furnished to the

Registrant in writing expressly for use in such registration statement and certain other disclosure documents.

Insofar as indemnification

for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling the Registrant pursuant to the foregoing provisions, the Registrant has been informed that in the opinion of the Commission such

indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

The Registrant also maintains

a directors and officers liability insurance policy for its directors and officers.

|

Item 7.

|

Exemption from Registration Claimed.

|

Not applicable.

See exhibits listed under the Exhibit Index below which are hereby

incorporated by reference.

|

|

1.

|

The undersigned Registrant hereby undertakes:

|

(a) To file, during any period in which offers

or sales are being made, a post-effective amendment to this Registration Statement:

(i) To include any prospectus required by

Section 10(a)(3) of the Securities Act;

(ii) To reflect in the prospectus any facts or events arising after the effective date of

this registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the Registration Statement. Notwithstanding the foregoing, any

increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in

the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation

of Registration Fee” table in the effective registration statement; and

(iii) To include any material information with respect to

the plan of distribution not previously disclosed in this Registration Statement or any material change to such information in this Registration Statement;

provided, however, that paragraphs (1)(a)(i) and (1)(a)(ii) do not apply if the information required to be included in a

post-effective amendment by those paragraphs is contained in periodic reports filed by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in this registration statement;

3

(b) That, for the purpose of determining any liability under the Securities Act,

each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof; and

(c) To remove from registration by means of a post-effective amendment any of the securities being registered which remain

unsold at the termination of the offering.

2. The undersigned Registrant hereby undertakes that, for purposes of

determining any liability under the Securities Act, each filing of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act that is incorporated by reference in the Registration Statement shall be

deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

3. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and

controlling persons of the Company pursuant to the foregoing provisions, or otherwise, the Company has been advised that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act and is,

therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Company of expenses incurred or paid by a director, officer or controlling person of the Company in the successful

defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Company will, unless in the opinion of its counsel the matter has been settled by

controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

4

EXHIBIT INDEX

5

SIGNATURES

Pursuant to the requirements of the Securities Act, the Registrant certifies that it has reasonable grounds to believe that it meets all of

the requirements for filing on Form

S-8

and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Shanghai, China, on this 29th day of

December 2017.

|

|

|

|

|

NOAH HOLDINGS LIMITED

|

|

|

|

|

By:

|

|

/s/ Jingbo Wang

|

|

|

|

|

|

Name:

|

|

Jingbo Wang

|

|

Title:

|

|

Chairwoman of the Board of Directors and Chief Executive Officer

|

P

OWER OF ATTORNEY

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the

capacities indicated below. Each of the directors and/or officers of the Registrant whose signature appears below hereby appoints Jingbo Wang and Shang Yan Chuang, and each of them severally as his or her

attorney-in-fact

to date and file with the Securities and Exchange Commission this Registration Statement on

Form S-8,

and to sign, date and file any and all

amendments and post-effective amendments to this Registration Statement, in each case on his or her behalf, in any and all capacities stated below, as appropriate, in such forms as they or any one of them may approve, granting unto said

attorneys-in-fact

and agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done to the end that such

Registration Statement or Registration Statements shall comply with the Securities Act of 1933, as amended, and the applicable Rules and Regulations adopted or issued pursuant thereto, as fully and to all intents and purposes as he or she might or

could do in person, and generally to do all such things on their behalf in their capacities as officers and directors to enable the Registrant to comply with the provisions of the Securities Act of 1933, and all requirements of the Securities and

Exchange Commission.

|

|

|

|

|

|

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

/s/ Jingbo Wang

|

|

Chairwoman of the Board of Directors and Chief Executive officer (Principal Executive Officer)

|

|

December 29, 2017

|

|

Jingbo Wang

|

|

|

|

|

|

|

|

/s/ Shang Yan Chuang

|

|

Chief Financial Officer (Principal Financial Officer and Accounting Officer)

|

|

December 29, 2017

|

|

Shang Yan Chuang

|

|

|

|

|

|

|

|

/s/ Zhe Yin

|

|

Director

|

|

December 29, 2017

|

|

Zhe Yin

|

|

|

|

|

|

|

|

/s/ Boquan He

|

|

Director

|

|

December 29, 2017

|

|

Boquan He

|

|

|

|

|

|

|

|

/s/ Chia-Yue Chang

|

|

Director

|

|

December 29, 2017

|

|

Chia-Yue Chang

|

|

|

|

|

|

|

|

/s/ Neil Nanpeng Shen

|

|

Director

|

|

December 29, 2017

|

|

Neil Nanpeng Shen

|

|

|

|

|

|

|

|

/s/ May Yihong Wu

|

|

Director

|

|

December 29, 2017

|

|

May Yihong Wu

|

|

|

|

|

|

|

|

/s/

Tze-Kaing

Yang

|

|

Director

|

|

December 29, 2017

|

|

Tze-Kaing

Yang

|

|

|

|

|

6

|

|

|

|

|

|

|

|

|

|

|

/s/ Jinbo Yao

|

|

Director

|

|

December 29, 2017

|

|

Jinbo Yao

|

|

|

|

|

|

|

|

/s/ Zhiwu Chen

|

|

Director

|

|

December 29, 2017

|

|

Zhiwu Chen

|

|

|

|

|

|

|

|

|

|

/s/ Giselle Manon

|

|

Authorized U.S. Representative

|

|

December 29, 2017

|

|

Giselle Manon

Service of Process Officer, Law Debenture

Corporate Services Inc.

|

|

|

|

7

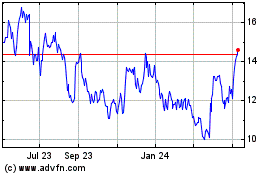

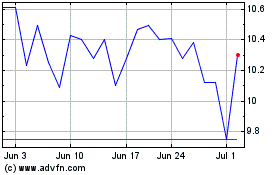

Noah (NYSE:NOAH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Noah (NYSE:NOAH)

Historical Stock Chart

From Apr 2023 to Apr 2024