EZCORP, Inc. (NASDAQ:EZPW) today announced results for its fourth

quarter and fiscal year ended September 30, 2017.

All amounts in this release are from EZCORP continuing

operations and conform with U.S. generally accepted accounting

principles (GAAP) unless otherwise noted. Comparisons are made to

the same period in the prior year unless otherwise noted.

FOURTH QUARTER HIGHLIGHTS

- Seventh consecutive quarter of year-over-year (YOY) earnings

and profit growth. Earnings per share improved $0.52 to $0.21 in

the fourth quarter and grew $0.77 to $0.62 in the full fiscal

year.

- Net income from continuing operations improved $27.6 million to

$10.1 million in the fourth quarter, and grew $41.0 million to

$32.0 million in the full fiscal year. Adjusted EBITDA1 improved

$19.1 million to $22.1 million in the fourth quarter, and grew 39%,

or $24.6 million, to $88.5 million in the full fiscal year.

- Continue to lead the U.S. market in same store pawn loans

outstanding (PLO) YOY growth. PLO increased 19% in Mexico (11% on a

constant currency basis2).

- Operating contribution from the Mexico Pawn segment improved

significantly — up 153% to $5.8 million. Highest growth segment now

20% of company’s total pawn profit contribution.

- Cash balance at September 30 up 150% to $164.4 million.

- Successfully completed $143.8 million offering of convertible

notes, improving liquidity with an attractive coupon rate of 2.875%

and seven-year term.

- Favorable restructuring of the notes receivable repayment

arrangement with AlphaCredit improved the return and risk profile

and increases future cash flow and profit.

In October 2017, the company significantly expanded its

footprint in the emerging Latin American pawn market by acquiring

112 pawn stores in Guatemala, El Salvador, Honduras and Peru for

$60 million cash, with an additional $2.25 million earn-out

possible based on post-acquisition performance. This acquisition

will be accretive to earnings starting the first quarter of fiscal

2018 and provides a platform for further growth and expansion in

the high growth rate region.

CEO COMMENTARY AND OUTLOOK

Chief Executive Officer Stuart Grimshaw said, “Even though our

results were somewhat impacted by the hurricane activity in Texas

and Florida, we are proud of our operating performance during the

fourth quarter, which capped off a fiscal year that showed a

dramatic turnaround on the bottom line. We delivered significant

earnings growth in both the U.S and Mexico pawn segments during the

quarter and the year, driven by continued execution on our

strategic initiatives to create long-term profitable growth.

“First, we continue the diversification of our revenue base and

operations, increasing our mix of business from Latin America. Our

Mexico Pawn segment is our fastest growing business and is now

providing 20% of our total pawn operating contribution. We added 10

new stores in Mexico during the year and see plenty of opportunity

to open and acquire more. And we are increasing our presence in

Latin America beyond Mexico. The recent acquisition of 112 pawn

stores in four new countries expands our Latin American store base,

which now comprises 41% of our total pawn stores. It provides

compelling opportunities for further growth through the expansion

of general merchandise pawn loan and retail activities, the opening

of new stores in attractive and under-penetrated markets, and the

pursuit of complementary acquisitions in the region.

“Second, we are improving the experience customers have in our

stores,” Grimshaw continued. “Our customers represent a large,

underserved market. We are updating our technology, better training

our field staff and refreshing our stores to meet their needs and

exceed their expectations.

“Third, we’re strengthening our balance sheet and liquidity,

reducing our corporate expenses, better analyzing and acting on

customer data and process improvements, and optimizing loan values

and merchandise pricing. These actions are expected to further

increase our market share and profitability and provide us with the

ability to continue to capitalize on attractive growth

opportunities.”

1EBITDA is earnings before interest, taxes, depreciation and

amortization. “Adjusted EBITDA” includes EBITDA attributable to

continuing operations, further adjusted to exclude the estimated

impact of the hurricanes that affected the Texas Gulf Coast and

Florida in the fourth quarter, as well as certain other discrete

items. See "Non-GAAP Financial Information" at the end of this

release.

2In addition to the financial information prepared in conformity

with U.S. generally accepted accounting principles (GAAP), we

provide financial information on a “constant currency” and

"adjusted EBITDA" basis, which excludes the impact of foreign

currency exchange rate fluctuations, and provides a different way

to view the operational results of our business, respectively. For

additional information about the constant currency calculations, as

well as a reconciliation of the constant currency financial

measures to the comparable GAAP financial measures and calculation

of our adjusted EBITDA, see “Non-GAAP Financial Information” at the

end of this release.

CONSOLIDATED RESULTS

Temporary Impact of U.S. Hurricanes

During the fourth quarter, the U.S. Pawn segment was affected by

Hurricanes Harvey and Irma resulting in the temporary closure of

stores in the affected areas, all of which have since reopened. In

addition to the loss of inventory and loan collateral and the

damage to physical facilities, all totaling $1.0 million, the

company estimates that the effects of the hurricanes include a

reduction in U.S. pawn loan balances of $5.0 million as of

September 30, 2017, with a resulting reduction in pawn service

charge (PSC) revenues and merchandise sales gross profit. The

company expects pawn loan demand to return to normal levels after

the annual tax refund season in the U.S.

Three Months Ended September 30, 2017

Results

- Despite the impacts of the hurricanes, net revenue improved 1%

to $108.1 million (flat at $107.4 million on a constant currency

basis), due largely to a 4% increase in PSC revenue (up 3% on a

constant currency basis). Same store PLO was down 1% in the U.S.

(up 3% in stores unaffected by the hurricanes). Same store PLO rose

19% in Mexico (up 11% in Mexico on a constant currency basis).

Merchandise sales gross margins held at 35%, within the 35-38%

target range.

- Continued discipline in cost control reduced operations

expenses 2% to $78.3 million (down 3% to $77.8 million on a

constant currency basis) and reduced corporate expenses 34% to

$11.9 million.

- The company restructured the repayment of the remaining $60.9

million of principal from AlphaCredit, improving its risk and

return profile, as well as significantly increasing future cash

flow and profit. Under the restructured arrangement, the company

expects to collect $32.6 million of principal in fiscal 2018 and

$28.3 million in fiscal 2019. The restructured arrangement includes

a higher interest rate and an incremental deferred compensation fee

of up to $14.0 million to be received in 2019 and 2020.

- Interest expense includes a $5.3 million debt extinguishment

charge offset by a $3.0 million pre-tax benefit from the

restructuring of the AlphaCredit notes. The AlphaCredit note

restructuring drove an additional one-time income tax benefit of

$3.0 million in the quarter.

- Improvements in net revenues and cost discipline have increased

operating leverage and the resulting bottom line. Earnings per

share increased YOY for the seventh-consecutive quarter. EPS from

continuing operations is $0.21, up from a loss of $0.31 a year

ago.

Fiscal Year Ended September 30, 2017

- The continued focus on investment in customer experience

increased net revenue 2% to $435.5 million (up 3% to $439.3 million

on a constant currency basis), driven primarily by a 4% rise in PSC

revenue (up 5% on a constant currency basis). Merchandise sales

gross margins were down slightly to 36%, but within the 35-38%

target range.

- Corporate expenses were down 22% to $53.3 million. The

company remains on track to reduce corporate expenses to no more

than $50 million in FY18.

- During the year and prior to the note restructuring, EZCORP

collected a total of $34 million from AlphaCredit ($29.5 million in

principal and $4.5 million in interest).

- Earnings per share from continuing operations reached $0.62, a

significant turnaround from the loss of ($0.15) in the prior year.

The strategic transformation initiatives achieved during fiscal

2017 set the stage for further success in fiscal 2018 and

beyond.

PAWN RESULTS

U.S. Pawn Segment

Three Months Ended September 30, 2017

- PLO was down 1% in total and on a same store basis, to $148.1

million (up 3% in stores unaffected by the hurricanes). Changes in

PLO resulted in PSC increasing 1% in total and 2% on a same-store

basis to $61.0 million.

- The merchandise sales gross margin of 36% was consistent with

the prior-year quarter and within the target range of 35-38%.

Inventory aged over one year improved to 10% from 11%.

- Operations expenses decreased 3% to $65.5 million driven by

cost control initiatives and lower variable compensation.

- Segment contribution increased 7% to $22.8 million. Initiatives

are underway to continue improving long-term net revenue and

profitability. These include investing in upgrading the POS system,

enhancing product and customer data analytics, and enhancing the

customer experience by refreshing stores.

Fiscal Year Ended September 30, 2017

- Driven by the impact of PLO outlined above, PSC rose 4% in

total and on a same store basis to $238.4 million.

- Merchandise sales increased 1% in total and on a same store

basis. The merchandise sales gross margin of 36% is within the

35-38% U.S. target.

- Operations expenses grew 2% to $260.0 million as a result of

investment in customer facing labor and higher benefit claims.

- Segment contribution was up 3% to $103.5 million.

Mexico Pawn Segment

Three Months Ended September 30, 2017

- The company continues to experience significant growth in the

Mexico Pawn segment, taking advantage of market opportunities

primarily from its existing store footprint. PLO expanded 20%

to $21.1 million (up 13% to $19.8 million on a constant currency

basis), which drove a 22% increase in PSC to $10.1 million

(up 16% to $9.7 million on a constant currency

basis).

- Merchandise sales increased 10% in total and 7% on a same store

basis (up 4% in total and 1% in same stores on a constant currency

basis). The 30% merchandise sales gross margin was slightly above

the prior-year quarter, while aged inventory balances decreased to

2% from 6% in the fiscal 2017 third quarter.

- Segment contribution increased 153% to $5.8 million (up 140% to

$5.5 million on a constant currency basis) driven by an 18%

improvement in net revenue, with only a 3% increase in operations

expense due to continued discipline in cost control.

- The company opened four new stores in the fourth quarter, for a

total of 10 in fiscal 2017. There is a significant runway for

continued store openings and acquisitions, in addition to the

growth potential of the existing store base.

Fiscal Year Ended September 30, 2017

- The PLO changes described above drove a 9% increase in PSC

to $34.6 million (up 15% to $36.8 million on a

constant currency basis).

- Merchandise sales grew 4% in total and 3% on a same store basis

(up 12% in total and 10% in same stores on a constant currency

basis). Merchandise margin was 32%, consistent with the prior

year.

- Segment contribution yielded a 119% increase to $18.7

million (up 130% to $19.6 million on a constant currency

basis) as a result of a 7% net revenue expansion while operations

expenses dropped 6%.

CONFERENCE CALL

EZCORP will host a conference call on Thursday, November 16,

2017, at 7:30 a.m. Central Time to discuss fourth quarter and

fiscal year-end results. Analysts and institutional investors may

participate by dialing (877) 201-0168, Conference ID: 8074459,

international dialing (647) 788-4901. The call will be webcast

simultaneously to the public through this link:

http://investors.ezcorp.com/. A replay will be available online at

http://investors.ezcorp.com/ shortly after the call.

ABOUT EZCORP

EZCORP is a leading provider of pawn loans in the United States

and Latin America. It also sells merchandise, primarily collateral

forfeited from pawn lending operations, and used merchandise

purchased from customers. EZCORP is a member of the Russell

2000 Index, S&P SmallCap 600 Index, S&P 1000 Index and

Nasdaq Composite Index.

FORWARD LOOKING STATEMENTS

This news release contains forward-looking statements on the

company’s strategy, initiatives and expected performance. These

statements are based on management’s current expectations on the

outcome and timing of future events. All statements other than

historical facts-including those on the company's strategy,

initiatives and future performance, which address activities or

results that the company plans, expects, believes, projects,

estimates or anticipates, will, should or may occur in the future,

including future financial or operating results-are forward-looking

statements. Actual results for future periods may differ materially

from those expressed or implied here, due to a number of

uncertainties and other factors. These include operating risks,

liquidity risks, legislative or regulatory developments, market

factors, or current or future litigation. For a discussion of these

and other factors affecting the company’s business and prospects,

see EZCORP’s annual, quarterly and other reports filed with the

Securities and Exchange Commission. The company undertakes no

obligation to update or revise forward-looking statements to

reflect changed assumptions, the occurrence of unanticipated events

or changes to future operating results over time.

Contact:Jeff ChristensenVice President,

Investor RelationsEmail: jeff_christensen@ezcorp.comPhone: (512)

437-3545

| EZCORP, Inc.CONSOLIDATED

STATEMENTS OF OPERATIONS |

| |

| |

Three Months Ended September 30, |

|

Fiscal Year Ended September 30, |

|

|

2017 |

|

2016 |

|

2017 |

|

2016 |

|

|

|

|

|

|

|

|

|

| |

(Unaudited) |

|

|

|

|

| |

(in thousands, except per share amounts) |

| Revenues: |

|

Merchandise sales |

$ |

95,166 |

|

|

$ |

97,166 |

|

|

$ |

414,838 |

|

|

$ |

409,107 |

|

| Jewelry

scrapping sales |

13,531 |

|

|

16,482 |

|

|

51,189 |

|

|

50,113 |

|

| Pawn

service charges |

71,097 |

|

|

68,603 |

|

|

273,080 |

|

|

261,800 |

|

| Other

revenues |

2,275 |

|

|

2,334 |

|

|

8,847 |

|

|

9,485 |

|

| Total

revenues |

182,069 |

|

|

184,585 |

|

|

747,954 |

|

|

730,505 |

|

| Merchandise cost of

goods sold |

61,685 |

|

|

63,540 |

|

|

266,525 |

|

|

258,271 |

|

| Jewelry scrapping cost

of goods sold |

11,736 |

|

|

13,768 |

|

|

43,931 |

|

|

42,039 |

|

| Other cost of

revenues |

555 |

|

|

416 |

|

|

1,988 |

|

|

1,965 |

|

| Net

revenues |

108,093 |

|

|

106,861 |

|

|

435,510 |

|

|

428,230 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

Operations |

78,284 |

|

|

79,941 |

|

|

304,636 |

|

|

301,387 |

|

|

Administrative |

11,949 |

|

|

18,016 |

|

|

53,254 |

|

|

68,101 |

|

|

Depreciation and amortization |

5,415 |

|

|

6,120 |

|

|

23,661 |

|

|

26,542 |

|

| Loss on

sale or disposal of assets |

348 |

|

|

465 |

|

|

359 |

|

|

1,106 |

|

|

Restructuring |

— |

|

|

11 |

|

|

— |

|

|

1,921 |

|

| Total

operating expenses |

95,996 |

|

|

104,553 |

|

|

381,910 |

|

|

399,057 |

|

| Operating

income |

12,097 |

|

|

2,308 |

|

|

53,600 |

|

|

29,173 |

|

| Interest expense |

10,956 |

|

|

4,463 |

|

|

27,803 |

|

|

16,477 |

|

| Interest income |

(5,194 |

) |

|

(15 |

) |

|

(12,103 |

) |

|

(81 |

) |

| Equity in net (income)

loss of unconsolidated affiliate |

(1,148 |

) |

|

5,881 |

|

|

(4,916 |

) |

|

255 |

|

| Impairment of

investments |

— |

|

|

10,957 |

|

|

— |

|

|

10,957 |

|

| Other (income)

expense |

(129 |

) |

|

387 |

|

|

(423 |

) |

|

1,202 |

|

| Income (loss) from

continuing operations before income taxes |

7,612 |

|

|

(19,365 |

) |

|

43,239 |

|

|

363 |

|

| Income tax (benefit)

expense |

(2,457 |

) |

|

(1,863 |

) |

|

11,206 |

|

|

9,361 |

|

| Income (loss) from

continuing operations, net of tax |

10,069 |

|

|

(17,502 |

) |

|

32,033 |

|

|

(8,998 |

) |

| Income (loss) from

discontinued operations, net of tax |

43 |

|

|

19,636 |

|

|

(1,825 |

) |

|

(79,432 |

) |

| Net income (loss) |

10,112 |

|

|

2,134 |

|

|

30,208 |

|

|

(88,430 |

) |

| Net loss attributable

to noncontrolling interest |

(1,298 |

) |

|

(1,097 |

) |

|

(1,650 |

) |

|

(7,686 |

) |

| Net income (loss)

attributable to EZCORP, Inc. |

$ |

11,410 |

|

|

$ |

3,231 |

|

|

$ |

31,858 |

|

|

$ |

(80,744 |

) |

| |

|

|

|

|

|

|

|

| Basic earnings per

share attributable to EZCORP, Inc. — continuing operations |

$ |

0.21 |

|

|

$ |

(0.31 |

) |

|

$ |

0.62 |

|

|

$ |

(0.15 |

) |

| Diluted earnings per

share attributable to EZCORP, Inc. — continuing operations |

$ |

0.21 |

|

|

$ |

(0.31 |

) |

|

$ |

0.62 |

|

|

$ |

(0.15 |

) |

| |

|

|

|

|

|

|

|

| Weighted-average basic

shares outstanding |

54,298 |

|

|

53,991 |

|

|

54,260 |

|

|

54,427 |

|

| Weighted-average

diluted shares outstanding |

54,428 |

|

|

53,991 |

|

|

54,368 |

|

|

54,427 |

|

| EZCORP, Inc.CONSOLIDATED

BALANCE SHEETS(in thousands, except share and per share

amounts) |

| |

September 30, 2017 |

|

September 30, 2016 |

| |

| |

|

|

|

Assets: |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

164,393 |

|

|

$ |

65,737 |

|

| Pawn loans |

169,242 |

|

|

167,329 |

|

| Pawn service charges receivable, net |

31,548 |

|

|

31,062 |

|

| Inventory, net |

154,411 |

|

|

140,224 |

|

| Notes receivable, net |

32,598 |

|

|

41,946 |

|

| Prepaid expenses and other current assets |

28,765 |

|

|

35,845 |

|

| Total current assets |

580,957 |

|

|

482,143 |

|

| Investment in unconsolidated affiliate |

43,319 |

|

|

37,128 |

|

| Property and equipment, net |

57,959 |

|

|

58,455 |

|

| Goodwill |

254,760 |

|

|

253,976 |

|

| Intangible assets, net |

32,420 |

|

|

30,681 |

|

| Notes receivable, net |

28,377 |

|

|

41,119 |

|

| Deferred tax asset, net |

16,856 |

|

|

35,303 |

|

| Other assets, net |

9,715 |

|

|

44,439 |

|

| Total

assets |

$ |

1,024,363 |

|

|

$ |

983,244 |

|

| |

|

|

|

| Liabilities

and equity: |

|

|

|

| Current liabilities: |

|

|

|

| Accounts payable, accrued expenses and other current

liabilities |

$ |

61,543 |

|

|

$ |

84,285 |

|

| Customer layaway deposits |

11,032 |

|

|

10,693 |

|

| Total current liabilities |

72,575 |

|

|

94,978 |

|

| Long-term debt, net |

284,807 |

|

|

283,611 |

|

| Other long-term liabilities |

7,055 |

|

|

10,450 |

|

| Total liabilities |

364,437 |

|

|

389,039 |

|

| Stockholders’ equity: |

|

|

|

| Class A Non-Voting Common Stock, par value $.01 per share;

shares authorized: 100 million; issuedand outstanding:

51,427,832 as of September 30, 2017 and 51,129,144 as of September

30, 2016 |

514 |

|

|

511 |

|

| Class B Voting Common Stock, convertible, par value $.01

per share; shares authorized: 3 million;issued and

outstanding: 2,970,171 |

30 |

|

|

30 |

|

| Additional paid-in capital |

348,532 |

|

|

318,723 |

|

| Retained earnings |

351,666 |

|

|

319,808 |

|

| Accumulated other comprehensive loss |

(38,367 |

) |

|

(44,089 |

) |

| EZCORP, Inc. stockholders’ equity |

662,375 |

|

|

594,983 |

|

| Noncontrolling interest |

(2,449 |

) |

|

(778 |

) |

| Total equity |

659,926 |

|

|

594,205 |

|

| Total

liabilities and equity |

$ |

1,024,363 |

|

|

$ |

983,244 |

|

| EZCORP, Inc.CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS |

| |

Fiscal Year Ended September 30, |

| |

2017 |

|

|

2016 |

| |

|

|

|

|

|

|

|

| |

(in thousands) |

| |

|

|

|

|

|

|

|

| Operating

activities: |

|

|

|

|

|

|

|

| Net income (loss) |

$ |

30,208 |

|

|

$ |

(88,430 |

) |

| Adjustments to reconcile net income (loss) to net cash flows

from operating activities: |

|

|

|

|

|

|

|

| Depreciation and amortization |

23,661 |

|

|

28,651 |

|

| Amortization of debt discount and deferred financing costs |

12,303 |

|

|

12,375 |

|

| Amortization of prepaid commissions |

— |

|

|

13,083 |

|

| Accretion of notes receivable discount |

(3,788 |

) |

|

— |

|

| Consumer loan loss provision |

1,988 |

|

|

27,917 |

|

| Deferred income taxes |

6,046 |

|

|

2,674 |

|

| Impairment of goodwill |

— |

|

|

73,244 |

|

| Other adjustments |

17 |

|

|

7,289 |

|

| Gain on restructured notes receivable |

(3,048 |

) |

|

— |

|

| Gain on disposition of Grupo Finmart, net of loss on

extinguishment |

— |

|

|

(32,172 |

) |

| Loss on extinguishment of debt and other |

5,250 |

|

|

— |

|

| Loss on sale or disposal of assets |

359 |

|

|

1,106 |

|

| Stock compensation expense |

5,866 |

|

|

5,346 |

|

| Income from investment in unconsolidated affiliate |

(4,916 |

) |

|

255 |

|

| Impairment of investments in unconsolidated affiliate |

— |

|

|

10,957 |

|

| Changes in operating assets and liabilities: |

|

|

|

| Service charges and fees receivable |

(224 |

) |

|

7,677 |

|

| Inventory |

721 |

|

|

(3,735 |

) |

| Prepaid expenses, other current assets and other assets |

5,166 |

|

|

(15,397 |

) |

| Accounts payable, accrued expenses and other liabilities |

(31,041 |

) |

|

(26,297 |

) |

| Customer layaway deposits |

241 |

|

|

329 |

|

| Income taxes, net of excess tax benefit from stock

compensation |

3,027 |

|

|

37,334 |

|

| Dividends from unconsolidated affiliate |

— |

|

|

2,197 |

|

| Net cash provided by operating activities |

51,836 |

|

|

64,403 |

|

| Investing

activities: |

|

|

|

| Loans made |

(646,625 |

) |

|

(676,375 |

) |

| Loans repaid |

386,383 |

|

|

428,196 |

|

| Recovery of pawn loan principal through sale of forfeited

collateral |

244,632 |

|

|

235,168 |

|

| Additions to property and equipment |

(18,853 |

) |

|

(9,550 |

) |

| Acquisitions, net of cash acquired |

(2,250 |

) |

|

(6,000 |

) |

| Proceeds from disposition of Grupo Finmart, net of cash

disposed |

— |

|

|

35,277 |

|

| Principal collections on notes receivable |

29,458 |

|

|

— |

|

| Net cash (used in) provided by investing activities |

(7,255 |

) |

|

6,716 |

|

| Financing

activities: |

|

|

|

| Taxes paid related to net share settlement of equity

awards |

(767 |

) |

|

(172 |

) |

| Payout of deferred consideration |

— |

|

|

(15,000 |

) |

| Proceeds from settlement of forward currency contracts |

— |

|

|

3,557 |

|

| Change in restricted cash |

— |

|

|

8,199 |

|

| Proceeds from borrowings, net of issuance costs |

139,506 |

|

|

64,133 |

|

| Payments on borrowings |

(85,388 |

) |

|

(112,123 |

) |

| Repurchase of common stock |

— |

|

|

(11,750 |

) |

| Net cash provided by (used in) financing activities |

53,351 |

|

|

(63,156 |

) |

| Effect of

exchange rate changes on cash and cash equivalents |

724 |

|

|

(1,350 |

) |

| Net

increase in cash and cash equivalents |

98,656 |

|

|

6,613 |

|

| Cash and

cash equivalents at beginning of period |

65,737 |

|

|

59,124 |

|

| Cash and

cash equivalents at end of period |

$ |

164,393 |

|

|

$ |

65,737 |

|

| Non-cash

investing and financing activities: |

|

|

|

| Pawn loans forfeited and transferred to inventory |

$ |

257,388 |

|

|

$ |

249,316 |

|

| Dividend reinvestment acquisition of additional ownership in

unconsolidated affiliate |

1,153 |

|

|

— |

|

| EZCORP, Inc. |

| OPERATING SEGMENT RESULTS

(UNAUDITED) |

| |

|

|

Three Months Ended September 30,

2017 |

|

|

U.S. Pawn |

|

MexicoPawn |

|

OtherInternational |

|

TotalSegments |

|

CorporateItems |

|

Consolidated |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in thousands) |

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Merchandise sales |

$ |

78,753 |

|

|

$ |

16,410 |

|

|

$ |

3 |

|

|

$ |

95,166 |

|

|

$ |

— |

|

|

$ |

95,166 |

|

| Jewelry

scrapping sales |

13,045 |

|

|

486 |

|

|

— |

|

|

13,531 |

|

|

— |

|

|

13,531 |

|

| Pawn

service charges |

60,957 |

|

|

10,140 |

|

|

— |

|

|

71,097 |

|

|

— |

|

|

71,097 |

|

| Other

revenues |

62 |

|

|

188 |

|

|

2,025 |

|

|

2,275 |

|

|

— |

|

|

2,275 |

|

| Total

revenues |

152,817 |

|

|

27,224 |

|

|

2,028 |

|

|

182,069 |

|

|

— |

|

|

182,069 |

|

| Merchandise cost of

goods sold |

50,240 |

|

|

11,445 |

|

|

— |

|

|

61,685 |

|

|

— |

|

|

61,685 |

|

| Jewelry scrapping cost

of goods sold |

11,320 |

|

|

416 |

|

|

— |

|

|

11,736 |

|

|

— |

|

|

11,736 |

|

| Other cost of

revenues |

— |

|

|

— |

|

|

555 |

|

|

555 |

|

|

— |

|

|

555 |

|

| Net

revenues |

91,257 |

|

|

15,363 |

|

|

1,473 |

|

|

108,093 |

|

|

— |

|

|

108,093 |

|

| Segment and corporate

expenses (income): |

|

|

|

|

|

|

|

|

|

|

|

|

Operations |

65,478 |

|

|

9,772 |

|

|

3,034 |

|

|

78,284 |

|

|

— |

|

|

78,284 |

|

|

Administrative |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

11,949 |

|

|

11,949 |

|

|

Depreciation and amortization |

2,684 |

|

|

765 |

|

|

47 |

|

|

3,496 |

|

|

1,919 |

|

|

5,415 |

|

| Loss on

sale or disposal of assets |

252 |

|

|

69 |

|

|

— |

|

|

321 |

|

|

27 |

|

|

348 |

|

| Interest

expense |

— |

|

|

2 |

|

|

— |

|

|

2 |

|

|

10,954 |

|

|

10,956 |

|

| Interest

income |

— |

|

|

(1,041 |

) |

|

— |

|

|

(1,041 |

) |

|

(4,153 |

) |

|

(5,194 |

) |

| Equity in

net income of unconsolidated affiliate |

— |

|

|

— |

|

|

(1,148 |

) |

|

(1,148 |

) |

|

— |

|

|

(1,148 |

) |

| Other

income |

(5 |

) |

|

(8 |

) |

|

(68 |

) |

|

(81 |

) |

|

(48 |

) |

|

(129 |

) |

| Segment contribution

(loss) |

$ |

22,848 |

|

|

$ |

5,804 |

|

|

$ |

(392 |

) |

|

$ |

28,260 |

|

|

|

|

|

| Income from continuing

operations before income taxes |

|

|

|

|

|

|

$ |

28,260 |

|

|

$ |

(20,648 |

) |

|

$ |

7,612 |

|

| EZCORP, Inc. |

| OPERATING SEGMENT RESULTS |

|

|

|

|

|

Twelve Months Ended September 30,

2017 |

|

|

U.S. Pawn |

|

MexicoPawn |

|

OtherInternational |

|

TotalSegments |

|

CorporateItems |

|

Consolidated |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in thousands) |

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Merchandise sales |

$ |

351,878 |

|

|

$ |

62,957 |

|

|

$ |

3 |

|

|

$ |

414,838 |

|

|

$ |

— |

|

|

$ |

414,838 |

|

| Jewelry

scrapping sales |

48,203 |

|

|

2,986 |

|

|

— |

|

|

51,189 |

|

|

— |

|

|

51,189 |

|

| Pawn

service charges |

238,437 |

|

|

34,643 |

|

|

— |

|

|

273,080 |

|

|

— |

|

|

273,080 |

|

| Other

revenues |

219 |

|

|

645 |

|

|

7,983 |

|

|

8,847 |

|

|

— |

|

|

8,847 |

|

| Total

revenues |

638,737 |

|

|

101,231 |

|

|

7,986 |

|

|

747,954 |

|

|

— |

|

|

747,954 |

|

| Merchandise cost of

goods sold |

223,475 |

|

|

43,050 |

|

|

— |

|

|

266,525 |

|

|

— |

|

|

266,525 |

|

| Jewelry scrapping cost

of goods sold |

41,434 |

|

|

2,497 |

|

|

— |

|

|

43,931 |

|

|

— |

|

|

43,931 |

|

| Other cost of

revenues |

— |

|

|

— |

|

|

1,988 |

|

|

1,988 |

|

|

— |

|

|

1,988 |

|

| Net

revenues |

373,828 |

|

|

55,684 |

|

|

5,998 |

|

|

435,510 |

|

|

— |

|

|

435,510 |

|

| Segment and corporate

expenses (income): |

|

|

|

|

|

|

|

|

|

|

|

|

Operations |

259,977 |

|

|

36,211 |

|

|

8,448 |

|

|

304,636 |

|

|

— |

|

|

304,636 |

|

|

Administrative |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

53,254 |

|

|

53,254 |

|

|

Depreciation and amortization |

10,171 |

|

|

2,675 |

|

|

191 |

|

|

13,037 |

|

|

10,624 |

|

|

23,661 |

|

| Loss on

sale or disposal of assets |

198 |

|

|

134 |

|

|

— |

|

|

332 |

|

|

27 |

|

|

359 |

|

| Interest

expense |

— |

|

|

9 |

|

|

— |

|

|

9 |

|

|

27,794 |

|

|

27,803 |

|

| Interest

income |

— |

|

|

(1,930 |

) |

|

— |

|

|

(1,930 |

) |

|

(10,173 |

) |

|

(12,103 |

) |

| Equity in

net income of unconsolidated affiliate |

— |

|

|

— |

|

|

(4,916 |

) |

|

(4,916 |

) |

|

— |

|

|

(4,916 |

) |

| Other

income |

(19 |

) |

|

(69 |

) |

|

(96 |

) |

|

(184 |

) |

|

(239 |

) |

|

(423 |

) |

| Segment

contribution |

$ |

103,501 |

|

|

$ |

18,654 |

|

|

$ |

2,371 |

|

|

$ |

124,526 |

|

|

|

|

|

| Income from continuing

operations before income taxes |

|

|

|

|

|

|

$ |

124,526 |

|

|

$ |

(81,287 |

) |

|

$ |

43,239 |

|

| EZCORP, Inc. |

| OPERATING SEGMENT RESULTS

(UNAUDITED) |

|

|

|

|

|

Three Months Ended September 30,

2016 |

|

|

U.S. Pawn |

|

MexicoPawn |

|

OtherInternational |

|

TotalSegments |

|

CorporateItems |

|

Consolidated |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in thousands) |

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Merchandise sales |

$ |

82,211 |

|

|

$ |

14,955 |

|

|

$ |

— |

|

|

$ |

97,166 |

|

|

$ |

— |

|

|

$ |

97,166 |

|

| Jewelry

scrapping sales |

15,693 |

|

|

789 |

|

|

— |

|

|

16,482 |

|

|

— |

|

|

16,482 |

|

| Pawn

service charges |

60,263 |

|

|

8,340 |

|

|

— |

|

|

68,603 |

|

|

— |

|

|

68,603 |

|

| Other

revenues |

50 |

|

|

154 |

|

|

2,130 |

|

|

2,334 |

|

|

— |

|

|

2,334 |

|

| Total

revenues |

158,217 |

|

|

24,238 |

|

|

2,130 |

|

|

184,585 |

|

|

— |

|

|

184,585 |

|

| Merchandise cost of

goods sold |

52,980 |

|

|

10,560 |

|

|

— |

|

|

63,540 |

|

|

— |

|

|

63,540 |

|

| Jewelry scrapping cost

of goods sold |

13,105 |

|

|

663 |

|

|

— |

|

|

13,768 |

|

|

— |

|

|

13,768 |

|

| Other cost of

revenues |

— |

|

|

— |

|

|

416 |

|

|

416 |

|

|

— |

|

|

416 |

|

| Net

revenues |

92,132 |

|

|

13,015 |

|

|

1,714 |

|

|

106,861 |

|

|

— |

|

|

106,861 |

|

| Segment and corporate

expenses (income): |

|

|

|

|

|

|

|

|

|

|

|

|

Operations |

67,803 |

|

|

9,520 |

|

|

2,618 |

|

|

79,941 |

|

|

— |

|

|

79,941 |

|

|

Administrative |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

18,016 |

|

|

18,016 |

|

|

Depreciation and amortization |

2,753 |

|

|

680 |

|

|

55 |

|

|

3,488 |

|

|

2,632 |

|

|

6,120 |

|

| Loss on

sale or disposal of assets |

162 |

|

|

53 |

|

|

4 |

|

|

219 |

|

|

246 |

|

|

465 |

|

|

Restructuring |

11 |

|

|

— |

|

|

— |

|

|

11 |

|

|

— |

|

|

11 |

|

| Interest

expense |

— |

|

|

6 |

|

|

— |

|

|

6 |

|

|

4,457 |

|

|

4,463 |

|

| Interest

income |

— |

|

|

(7 |

) |

|

— |

|

|

(7 |

) |

|

(8 |

) |

|

(15 |

) |

| Equity in

net loss of unconsolidated affiliate |

— |

|

|

— |

|

|

5,881 |

|

|

5,881 |

|

|

— |

|

|

5,881 |

|

|

Impairment of investments |

— |

|

|

— |

|

|

10,957 |

|

|

10,957 |

|

|

— |

|

|

10,957 |

|

| Other

expense (income) |

— |

|

|

465 |

|

|

(1 |

) |

|

464 |

|

|

(77 |

) |

|

387 |

|

| Segment contribution

(loss) |

$ |

21,403 |

|

|

$ |

2,298 |

|

|

$ |

(17,800 |

) |

|

$ |

5,901 |

|

|

|

|

|

| Loss from continuing

operations before income taxes |

|

|

|

|

|

|

$ |

5,901 |

|

|

$ |

(25,266 |

) |

|

$ |

(19,365 |

) |

| EZCORP, Inc. |

| OPERATING SEGMENT RESULTS |

|

|

|

|

|

Twelve Months Ended September 30,

2016 |

|

|

U.S. Pawn |

|

MexicoPawn |

|

OtherInternational |

|

TotalSegments |

|

CorporateItems |

|

Consolidated |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in thousands) |

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Merchandise sales |

$ |

348,771 |

|

|

$ |

60,331 |

|

|

$ |

5 |

|

|

$ |

409,107 |

|

|

$ |

— |

|

|

$ |

409,107 |

|

| Jewelry

scrapping sales |

47,810 |

|

|

2,282 |

|

|

21 |

|

|

50,113 |

|

|

— |

|

|

50,113 |

|

| Pawn

service charges |

229,893 |

|

|

31,907 |

|

|

— |

|

|

261,800 |

|

|

— |

|

|

261,800 |

|

| Other

revenues |

331 |

|

|

385 |

|

|

8,769 |

|

|

9,485 |

|

|

— |

|

|

9,485 |

|

| Total

revenues |

626,805 |

|

|

94,905 |

|

|

8,795 |

|

|

730,505 |

|

|

— |

|

|

730,505 |

|

| Merchandise cost of

goods sold |

217,268 |

|

|

41,002 |

|

|

1 |

|

|

258,271 |

|

|

— |

|

|

258,271 |

|

| Jewelry scrapping cost

of goods sold |

40,138 |

|

|

1,885 |

|

|

16 |

|

|

42,039 |

|

|

— |

|

|

42,039 |

|

| Other cost of

revenues |

— |

|

|

— |

|

|

1,965 |

|

|

1,965 |

|

|

— |

|

|

1,965 |

|

| Net

revenues |

369,399 |

|

|

52,018 |

|

|

6,813 |

|

|

428,230 |

|

|

— |

|

|

428,230 |

|

| Segment and corporate

expenses (income): |

|

|

|

|

|

|

|

|

|

|

|

|

Operations |

255,321 |

|

|

38,481 |

|

|

7,585 |

|

|

301,387 |

|

|

— |

|

|

301,387 |

|

|

Administrative |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

68,101 |

|

|

68,101 |

|

|

Depreciation and amortization |

12,242 |

|

|

2,965 |

|

|

218 |

|

|

15,425 |

|

|

11,117 |

|

|

26,542 |

|

| Loss on

sale or disposal of assets |

664 |

|

|

169 |

|

|

4 |

|

|

837 |

|

|

269 |

|

|

1,106 |

|

|

Restructuring |

993 |

|

|

543 |

|

|

202 |

|

|

1,738 |

|

|

183 |

|

|

1,921 |

|

| Interest

expense |

125 |

|

|

109 |

|

|

— |

|

|

234 |

|

|

16,243 |

|

|

16,477 |

|

| Interest

income |

(2 |

) |

|

(30 |

) |

|

— |

|

|

(32 |

) |

|

(49 |

) |

|

(81 |

) |

| Equity in

net income of unconsolidated affiliate |

— |

|

|

— |

|

|

255 |

|

|

255 |

|

|

— |

|

|

255 |

|

|

Impairment of investments |

— |

|

|

— |

|

|

10,957 |

|

|

10,957 |

|

|

— |

|

|

10,957 |

|

| Other

expense (income) |

— |

|

|

1,273 |

|

|

2 |

|

|

1,275 |

|

|

(73 |

) |

|

1,202 |

|

| Segment contribution

(loss) |

$ |

100,056 |

|

|

$ |

8,508 |

|

|

$ |

(12,410 |

) |

|

$ |

96,154 |

|

|

|

|

|

| Income from continuing

operations before income taxes |

|

|

|

|

|

|

$ |

96,154 |

|

|

$ |

(95,791 |

) |

|

$ |

363 |

|

| EZCORP, Inc. |

| STORE COUNT ACTIVITY (UNAUDITED) |

|

|

| |

Three Months Ended September 30,

2017 |

| |

U.S. Pawn |

|

Mexico Pawn |

|

OtherInternational |

|

Consolidated |

| |

|

|

|

|

|

|

|

| As of June 30,

2017 |

515 |

|

|

244 |

|

|

27 |

|

|

786 |

|

| New

locations opened |

— |

|

|

4 |

|

|

— |

|

|

4 |

|

| Locations

acquired |

2 |

|

|

— |

|

|

— |

|

|

2 |

|

| Locations

sold, combined or closed |

(4 |

) |

|

(2 |

) |

|

— |

|

|

(6 |

) |

| As of September 30,

2017 |

513 |

|

|

246 |

|

|

27 |

|

|

786 |

|

| |

Three Months Ended September 30,

2016 |

| |

U.S. Pawn |

|

Mexico Pawn |

|

OtherInternational |

|

Consolidated |

| |

|

|

|

|

|

|

|

| As of June 30,

2016 |

522 |

|

|

238 |

|

|

27 |

|

|

787 |

|

| New

locations opened |

— |

|

|

2 |

|

|

— |

|

|

2 |

|

| Locations

acquired |

— |

|

|

— |

|

|

— |

|

|

— |

|

| Locations

sold, combined or closed |

(2 |

) |

|

(1 |

) |

|

— |

|

|

(3 |

) |

| As of September 30,

2016 |

520 |

|

|

239 |

|

|

27 |

|

|

786 |

|

| |

Twelve Months Ended September 30,

2017 |

| |

U.S. Pawn |

|

Mexico Pawn |

|

OtherInternational |

|

Consolidated |

| |

|

|

|

|

|

|

|

| As of September 30,

2016 |

520 |

|

|

239 |

|

|

27 |

|

|

786 |

|

| New

locations opened |

— |

|

|

10 |

|

|

— |

|

|

10 |

|

| Locations

acquired |

2 |

|

|

— |

|

|

— |

|

|

2 |

|

| Locations

sold, combined or closed |

(9 |

) |

|

(3 |

) |

|

— |

|

|

(12 |

) |

| As of September 30,

2017 |

513 |

|

|

246 |

|

|

27 |

|

|

786 |

|

| |

Twelve Months Ended September 30,

2016 |

| |

U.S. Pawn |

|

Mexico Pawn |

|

OtherInternational |

|

Consolidated |

| |

|

|

|

|

|

|

|

| As of September 30,

2015 |

522 |

|

|

237 |

|

|

27 |

|

|

786 |

|

| New

locations opened |

— |

|

|

3 |

|

|

— |

|

|

3 |

|

| Locations

sold, combined or closed |

(8 |

) |

|

(1 |

) |

|

— |

|

|

(9 |

) |

| As of September 30,

2016 |

520 |

|

|

239 |

|

|

27 |

|

|

786 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Financial Information (Unaudited)

In addition to the financial information prepared in conformity

with generally accepted accounting principles in the United States

of America (GAAP), we provide certain other non-GAAP financial

information, including adjusted EBITDA and “constant currency”

results solely for our Mexico Pawn operations. We use adjusted

EBITDA to evaluate the operating and financial performance of the

company and period-over-period growth. We derive the financial

calculations of adjusted EBITDA, primarily by excluding from a

comparable GAAP measure certain items we do not consider to be

representative of our actual operating performance. We use constant

currency and ongoing segment contribution results to evaluate

results of our Mexico Pawn operations, which are denominated in

Mexican pesos. We believe presenting constant currency results is

meaningful and useful in understanding our Mexico Pawn operations,

activities and business metrics. We provide non-GAAP financial data

for informational purposes and to enhance understanding of our GAAP

consolidated financial statements. We use non-GAAP information to

evaluate and compare operating results across accounting

periods. Readers should consider the information in addition

to-not instead of or superior to-our GAAP financial statements.

This non-GAAP financial information may be determined or calculated

differently by other companies, limiting the usefulness of those

measures for comparative purposes.

Constant currency results reported here are calculated by

translating consolidated balance sheet and consolidated statement

of operations items denominated in Mexican pesos to U.S. dollars.

We use the exchange rate from the prior-year comparable period, as

opposed to the current period, to exclude the effects of foreign

currency rate fluctuations. We use the end-of-period rate for

balance sheet items, and the average closing daily exchange rate on

a monthly basis, during the appropriate period for statement of

operations items. The end-of-period exchange rate

for September 30, 2017 and 2016 was 18.2 to 1 and 19.4 to

1, respectively. The approximate average exchange rate for the

years ended September 30, 2017, 2016 and 2015 was 19.1 to 1,

17.9 to 1, and 15.1, respectively. However, our statement of

operations constant currency results reflect the impact of monthly

effects of exchange rates, so can’t be directly calculated from the

above rates. Constant currency results also exclude the foreign

currency gain or loss, and the related foreign currency derivative

gain or loss impact. There has been a prolonged weakening of the

Mexican peso to the U.S. dollar. We may continue to experience

further weakening in future reporting periods, which may adversely

affect our operating results when stated on a GAAP basis.

The following information reconciles certain non-GAAP financial

measures presented in this news release to the most directly

comparable financial measures calculated and presented in

accordance with GAAP, for the three and 12 months ended

September 30, 2017.

| Adjusted EBITDA (Unaudited) |

|

|

|

|

|

|

|

Three Months EndedSeptember 30, |

|

Fiscal Year EndedSeptember

30, |

|

|

2017 |

|

2016 |

|

2017 |

|

2016 |

|

|

|

|

|

|

|

|

|

|

|

(in millions) |

| Income (loss) from

continuing operations, net of tax |

$ |

10.1 |

|

|

$ |

(17.5 |

) |

|

$ |

32.0 |

|

|

$ |

(9.0 |

) |

| Interest

expense |

11.0 |

|

|

4.5 |

|

|

27.8 |

|

|

16.5 |

|

| Interest

income |

(5.2 |

) |

|

— |

|

|

(12.1 |

) |

|

(0.1 |

) |

| Income

taxes |

(2.5 |

) |

|

(1.9 |

) |

|

11.2 |

|

|

9.4 |

|

|

Depreciation and amortization |

5.4 |

|

|

6.1 |

|

|

23.7 |

|

|

26.5 |

|

| Estimated

impact of natural disasters |

2.9 |

|

|

— |

|

|

2.9 |

|

|

— |

|

|

Acquisition costs |

0.8 |

|

|

— |

|

|

1.2 |

|

|

— |

|

|

Impairment of investments |

— |

|

|

11.0 |

|

|

— |

|

|

11.0 |

|

|

Restatement related costs |

— |

|

|

— |

|

|

— |

|

|

6.2 |

|

| Mexico

buy/sell stores |

— |

|

|

0.9 |

|

|

— |

|

|

4.2 |

|

|

Other* |

(0.4 |

) |

|

(0.1 |

) |

|

1.8 |

|

|

(0.8 |

) |

| Adjusted EBITDA |

$ |

22.1 |

|

|

$ |

3.0 |

|

|

$ |

88.5 |

|

|

$ |

63.9 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Other items include foreign currency impacts and strategic

plan costs as well as a one-time legal credit in fiscal 2016.

|

Other Miscellaneous Non-GAAP Financial Measures

(Unaudited) |

|

|

| |

U.S. DollarAmount |

|

PercentageChange YOY |

| |

|

|

|

| |

(in millions) |

|

|

| Mexico Pawn same store

PLO |

$ |

20.7 |

|

|

19 |

% |

| Currency exchange rate

fluctuations |

(1.3 |

) |

|

|

| Constant

currency Mexico Pawn same store PLO |

$ |

19.4 |

|

|

11 |

% |

| |

|

|

|

| Mexico Pawn segment

profit before tax (three months ended September 30, 2017) |

$ |

5.8 |

|

|

153 |

% |

| Currency exchange rate

fluctuations (three months ended September 30, 2017) |

(0.3 |

) |

|

|

| Constant

currency Mexico Pawn segment profit before tax (three months ended

September 30, 2017) |

$ |

5.5 |

|

|

140 |

% |

| |

|

|

|

| Consolidated net

revenue (three months ended September 30, 2017) |

$ |

108.1 |

|

|

1 |

% |

| Currency exchange rate

fluctuations |

(0.7 |

) |

|

|

| Constant

currency consolidated net revenue (three months ended September 30,

2017) |

$ |

107.4 |

|

|

— |

% |

| |

|

|

|

| Consolidated PSC

revenue (three months ended September 30, 2017) |

$ |

71.1 |

|

|

4 |

% |

| Currency exchange rate

fluctuations |

(0.5 |

) |

|

|

| Constant

currency consolidated PSC revenue (three months ended September 30,

2017) |

$ |

70.6 |

|

|

3 |

% |

| |

|

|

|

| Consolidated operations

expenses (three months ended September 30, 2017) |

$ |

78.3 |

|

|

(2 |

)% |

| Currency exchange rate

fluctuations (three months ended September 30, 2017) |

(0.5 |

) |

|

|

| Constant

currency consolidated operations expenses (three months ended

September 30, 2017) |

$ |

77.8 |

|

|

3 |

% |

| |

|

|

|

| Consolidated net

revenue (twelve months ended September 30, 2017) |

$ |

435.5 |

|

|

2 |

% |

| Currency exchange rate

fluctuations |

3.8 |

|

|

|

| Constant

currency consolidated net revenue (twelve months ended September

30, 2017) |

$ |

439.3 |

|

|

3 |

% |

| |

|

|

|

| Consolidated PSC

revenue (twelve months ended September 30, 2017) |

$ |

273.1 |

|

|

4 |

% |

| Currency exchange rate

fluctuations |

2.2 |

|

|

|

| Constant

currency consolidated PSC revenue (twelve months ended September

30, 2017) |

$ |

275.3 |

|

|

5 |

% |

| |

|

|

|

| Mexico Pawn PLO |

$ |

21.1 |

|

|

20 |

% |

| Currency exchange rate

fluctuations |

(1.3 |

) |

|

|

| Constant

currency Mexico Pawn PLO |

$ |

19.8 |

|

|

13 |

% |

| |

|

|

|

| Mexico Pawn PSC revenue

(three months ended September 30, 2017) |

$ |

10.1 |

|

|

22 |

% |

| Currency exchange rate

fluctuations (three months ended September 30, 2017) |

(0.4 |

) |

|

|

| Constant

currency Mexico Pawn PSC revenue (three months ended September 30,

2017) |

$ |

9.7 |

|

|

16 |

% |

|

|

|

|

|

| Mexico Pawn merchandise

sales (three months ended September 30, 2017) |

$ |

16.4 |

|

|

10 |

% |

| Currency exchange rate

fluctuations (three months ended September 30, 2017) |

(0.8 |

) |

|

|

| Constant

currency Mexico Pawn merchandise sales (three months ended

September 30, 2017) |

$ |

15.6 |

|

|

4 |

% |

|

|

|

|

|

| Mexico Pawn same store

merchandise sales (three months ended September 30, 2017) |

$ |

15.9 |

|

|

7 |

% |

| Currency exchange rate

fluctuations (three months ended September 30, 2017) |

(0.8 |

) |

|

|

| Constant

currency Mexico Pawn same store merchandise sales (three months

ended September 30, 2017) |

$ |

15.1 |

|

|

1 |

% |

|

|

|

|

|

| Mexico Pawn PSC revenue

(twelve months ended September 30, 2017) |

$ |

34.6 |

|

|

9 |

% |

| Currency exchange rate

fluctuations (twelve months ended September 30, 2017) |

2.2 |

|

|

|

| Constant

currency Mexico Pawn PSC revenue (twelve months ended September 30,

2017) |

$ |

36.8 |

|

|

15 |

% |

| |

|

|

|

| Mexico Pawn merchandise

sales (twelve months ended September 30, 2017) |

$ |

63.0 |

|

|

4 |

% |

| Currency exchange rate

fluctuations (twelve months ended September 30, 2017) |

4.6 |

|

|

|

| Constant

currency Mexico Pawn merchandise sales (twelve months ended

September 30, 2017) |

$ |

67.6 |

|

|

12 |

% |

| |

|

|

|

| Mexico Pawn same store

merchandise sales (twelve months ended September 30, 2017) |

$ |

61.0 |

|

|

3 |

% |

| Currency exchange rate

fluctuations (twelve months ended September 30, 2017) |

4.6 |

|

|

|

| Constant

currency Mexico Pawn same store merchandise sales (twelve months

ended September 30, 2017) |

$ |

65.6 |

|

|

10 |

% |

| |

|

|

|

| Mexico Pawn segment

profit before tax (twelve months ended September 30, 2017) |

$ |

18.7 |

|

|

119 |

% |

| Currency exchange rate

fluctuations (twelve months ended September 30, 2017) |

0.9 |

|

|

|

| Constant

currency Mexico Pawn segment profit before tax (twelve months ended

September 30, 2017) |

$ |

19.6 |

|

|

130 |

% |

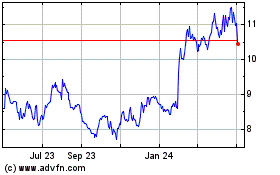

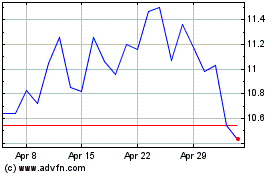

EZCORP (NASDAQ:EZPW)

Historical Stock Chart

From Apr 2024 to May 2024

EZCORP (NASDAQ:EZPW)

Historical Stock Chart

From May 2023 to May 2024