L.B. Foster Company (NASDAQ:FSTR), a leading manufacturer and

distributor of products and services for transportation and energy

infrastructure, today reported third quarter 2017 net income of

$3.2 million, or $0.31 per diluted share, which includes:

- Sales increased by 14.7% from the prior year quarter to $131.5

million.

- Gross profit margin of 20.1% compared to 17.3% in the prior

year.

- New orders increased by 31.3% from the prior year

quarter.

- An increase in backlog of 31.8% from the prior year to $189.6

million.

- Net cash used by operating activities for the quarter totaled

$2.4 million compared to $5.3 million provided in the prior year

quarter. The $7.7 million decline is the result of an increase in

working capital levels related to inventory increases in the third

quarter 2017 in anticipation of a stronger revenue outlook for the

fourth quarter 2017.

Third Quarter Results

- Third quarter net sales of $131.5 million increased by $16.8

million, or 14.7%, compared to the prior year quarter due to

increases in each of the three segments: Tubular and Energy

Services (Tubular) sales increased 32.3%, Construction Products

(Construction) sales increased 12.2%, and Rail Products and

Services (Rail) sales increased 9.1%.

- Gross profit margin was 20.1%, 280 basis points higher than the

prior year quarter. Each of the three segments saw increased gross

profit margins compared to the prior year. The Tubular segment saw

the greatest increase of 1,830 basis points, which was supported by

all divisions within the segment. The Construction segment saw a

290 basis point increase, primarily from its Precast Concrete

Products division. The Rail segment's gross profit margin increased

80 basis points compared to the prior year, primarily from our

North American divisions.

- Net income for the third quarter 2017 was $3.2 million, or

$0.31 per diluted share, compared to a net loss of $6.0 million, or

$0.58 per diluted share, last year. Our prior year quarter earnings

included impairment charges totaling $6.9 million ($5.9 million net

of tax). Excluding the prior year impairment charge of $5.9 million

net of tax1, the 2016 net loss would have totaled less than $0.1

million or less than $0.01 per diluted share.

- Third quarter Adjusted EBITDA1 (earnings before interest,

taxes, depreciation, amortization, and asset impairments) was $9.9

million compared to $4.1 million in the third quarter of

2016.

- Selling and administrative expenses in the third quarter

increased by $0.4 million, or 2.1%. The increase was primarily

comprised of personnel-related costs of $0.8 million and was offset

by a $0.5 million reduction in litigation costs for the Union

Pacific Rail Road (UPRR) matter.

- Interest expense was $2.0 million in the third quarter of 2017,

compared to $1.5 million in the prior year quarter. The increase

was attributable to an increase in interest rates.

- Net cash used by operating activities for the quarter totaled

$2.4 million compared to $5.3 million provided in the prior year

quarter. The $7.7 million decline is the result of an increase in

working capital levels related to inventory increases in the third

quarter 2017 in anticipation of a stronger revenue outlook for the

fourth quarter 2017 compared to the fourth quarter 2016.

- Third quarter new orders were $145.5 million, a 31.3% increase

from the prior year quarter, due to a 97.1% increase in Tubular and

a 44.5% increase in Rail. This was partially offset by an 11.1%

reduction in Construction.

- The Company’s income tax benefit for the third quarter was $0.2

million, primarily related to changes in the estimated annual

effective tax rate resulting from the realization of a portion of

U.S. deferred tax assets previously offset by a valuation

allowance.

- Other income included $1.0 million gain from the sale of

certain Tubular and Rail assets.

- Total debt increased by $0.3 million, or 0.2%, in the third

quarter to $138.3 million as compared to June 30, 2017.

Increased fourth quarter working capital requirements contributed

to the current quarter increase.

1 See "Non-GAAP Disclosures" at the end of this press release

for information regarding the following non-GAAP measures used in

this release: EBITDA, Adjusted EBITDA, and net loss excluding the

prior year impairment charge.

CEO Comments

Bob Bauer, President and Chief Executive

Officer, commented, “The Company's third quarter results reflect

the actions we have taken to improve profitability along with

improving market conditions. Net sales of $131.5 million and an

ending backlog of $189.6 million for the third quarter are the

result of strong new orders driven by recovering rail and

energy markets as well as significant wins across a number of

product divisions. The U.S. energy markets continued to improve,

and our actions to restore profitability in the Tubular and Energy

Services segment led to a substantial improvement in segment gross

profit in the third quarter. Selling and administrative expenses as

a percent of sales were well below prior year levels, helping drive

a $5.8 million improvement in third quarter Adjusted EBITDA."

Mr. Bauer added, "We have made significant

improvements in strengthening our balance sheet as operating cash

flow improved $15.6 million for the first nine months of 2017

compared to the prior period. We reduced our debt by $21.3 million

during the last nine months. Operating cash flow of $27.5 million

for the first nine months of the year is a substantial improvement

over the prior year."

Nine Month Results

- Net sales for the first nine months of 2017 of $395.1 million

increased by $18.1 million, or 4.8%, compared to the prior year

period due to a 13.8% increase in Construction sales and a 5.0%

increase in Tubular sales, partially offset by a 0.4% decline in

Rail sales.

- Gross profit margin was 19.1%, 10 basis points higher than the

prior year period. The increase was from the Tubular segment,

partially offset by reductions in the Rail and Construction

segments. Year to date Tubular gross profit margins were favorable

in each division within the segment.

- Net income for the first nine months of 2017 was $3.8 million,

or $0.37 per diluted share, compared to a net loss of $100.8

million, or $9.82 per diluted share, last year. Excluding the prior

year impairment charge of $96.8 million net of tax, the net loss

would have been $4.0 million or $0.39 per diluted share.

- Adjusted EBITDA for the first nine months of 2017 was $25.6

million compared to $15.6 million in the first nine months of

2016.

- Selling and administrative expense decreased by $5.9 million,

or 9.0%. The decrease was primarily comprised of personnel-related

costs of $4.1 million and $1.4 million in lower litigation costs

for the UPRR matter.

- Amortization expense was $5.2 million for the first nine months

ended September 30, 2017, compared to $7.8 million in the prior

year period. The reduction was primarily due to the 2016 impairment

of definite-lived intangible assets.

- Interest expense was $6.3 million in the first nine months of

2017, compared to $4.3 million in the prior year period. The

increase was attributable to an increase in interest

rates.

- Net cash provided by operating activities for the nine months

ended September 30, 2017 totaled $27.5 million compared to $11.9

million in the prior year period, a $15.6 million

improvement.

- New orders were $436.7 million for the first nine months of

2017, an 18.4% increase from the prior year period, due to a 47.6%

increase in Tubular and a 28.9% increase in Rail which were

partially offset by an 8.7% reduction in Construction

orders.

- The Company’s income tax expense for the first nine months of

2017 was $0.7 million. The Company's estimated annual

effective tax rate was primarily related to income taxes in foreign

jurisdictions, but partially offset by a benefit from the

realization of a portion of U.S. deferred tax assets previously

offset by a valuation allowance.

- Total debt was reduced by $21.3 million, or 13.3%, to $138.3

million as of September 30, 2017, as compared to total debt as

of December 31, 2016.

2017 Fourth Quarter OutlookOverall market

conditions are expected to remain favorable across our business

segments in the fourth quarter, particularly within the energy

markets we serve. Additionally, the strength of our new orders and

backlog within our Rail and Tubular segments continue to indicate

recovery in these markets. Based on our current backlog levels, the

Company expects fourth quarter 2017 revenues to range between

$135.0 million and $142.0 million. Further, with expenses remaining

at current levels, we anticipate that fourth quarter EBITDA will be

in a range between $9.5 million and $11.5 million. Full year

revenues are expected to range between $530.0 million and $537.0

million, with full year EBITDA estimated to be between $35.0

million and $37.0 million.

The Company also expects net debt at December 31, 2017 to

be in the range of $90.0 million to $100.0 million which will

result in a net debt to EBITDA ratio below 3.0x.

L.B. Foster Company will conduct a conference call and webcast

to discuss its third quarter 2017 operating results on Tuesday,

November 7, 2017 at 5:00 pm ET. The call will be hosted by Mr.

Robert Bauer, President, and Chief Executive Officer. Listen via

audio and access the slide presentation on the L.B. Foster web

site: www.lbfoster.com, under the Investor Relations page. The

conference call can also be accessed by dialing 877-407-0784 (U.S.

& Canada) or 201-689-8560 (International) and providing access

code 13672428.

About L.B. Foster CompanyL.B. Foster is a

leading manufacturer and distributor of products and services for

transportation and energy infrastructure with locations in North

America and Europe. For more information, please visit

www.lbfoster.com.

This release may contain forward-looking statements that involve

risks and uncertainties. Forward-looking statements provide current

expectations of future events based on certain assumptions and

include any statement that does not directly relate to any

historical or current fact. Sentences containing words such as

“believe,” “intend,” “plan,” “may,” “expect,” “should,” “could,”

“anticipate,” “estimate,” “predict,” “project,” or their negatives,

or other similar expressions of a future or forward-looking nature

generally should be considered forward-looking statements.

Forward-looking statements in this release may concern, among other

things, L.B. Foster Company’s (the “Company”) expectations relating

to our strategy, goals, projections, and plans regarding our

financial position, liquidity, capital resources and results of

operations; the outcome of litigation and product warranty claims;

decisions regarding our strategic growth initiatives, market

position, and product development; all of which are based on

current estimates that involve inherent risks and uncertainties.

The Company has based these forward-looking statements on current

expectations and assumptions about future events. While the Company

considers these expectations and assumptions to be reasonable, they

are inherently subject to significant business, economic,

competitive, regulatory, and other risks and uncertainties, most of

which are difficult to predict and many of which are beyond the

Company’s control. The Company cautions readers that various

factors could cause the actual results of the Company to differ

materially from those indicated by forward-looking statements.

Accordingly, investors should not place undue reliance on

forward-looking statements as a prediction of actual results. Among

the factors that could cause the actual results to differ

materially from those indicated in the forward-looking statements

are risks and uncertainties related to: environmental matters,

including any costs associated with any remediation and monitoring;

a resumption of the economic slowdown we have experienced in the

previous two years in the markets we serve; the risk of doing

business in international markets; our ability to effectuate our

strategy, including cost reduction initiatives, and our ability to

effectively integrate acquired businesses and realize anticipated

benefits; costs of and impacts associated with shareholder

activism; a decrease in freight or passenger rail traffic; the

timeliness and availability of materials from our major suppliers

as well as the impact on our access to supplies of customer

preferences as to the origin of such supplies, such as customers'

concerns about conflict minerals; labor disputes; the continuing

effective implementation of an enterprise resource planning system;

changes in current accounting estimates and their ultimate

outcomes; the adequacy of internal and external sources of funds to

meet financing needs, including our ability to negotiate any

additional necessary amendments to our credit agreement; the

Company’s ability to manage its working capital requirements and

indebtedness; domestic and international taxes, including estimates

that may impact these amounts; foreign currency fluctuations;

inflation; domestic and foreign government regulations; economic

conditions and regulatory changes caused by the United Kingdom’s

pending exit from the European Union; sustained declines in energy

prices; a lack of state or federal funding for new infrastructure

projects; an increase in manufacturing or material costs; the

ultimate number of concrete ties that will have to be replaced

pursuant to the previously disclosed product warranty claim of the

Union Pacific Railroad (“UPRR”) and an overall resolution of the

related contract claims as well as the possible costs associated

with the outcome of the lawsuit filed by the UPRR; the loss of

future revenues from current customers; and risks inherent in

litigation. Should one or more of these risks or uncertainties

materialize, or should the assumptions underlying the

forward-looking statements prove incorrect, actual outcomes could

vary materially from those indicated. Significant risks and

uncertainties that may affect the operations, performance, and

results of the Company’s business and forward-looking statements

include, but are not limited to, those set forth under Item 1A,

“Risk Factors,” and elsewhere in our Annual Report on Form 10-K and

our other periodic filings with the Securities and Exchange

Commission.

Investor Relations:Judith Balog(412)

928-3417investors@lbfoster.com

L.B. Foster Company415 Holiday DrivePittsburgh, PA

15220

| |

| L.B. FOSTER COMPANY AND SUBSIDIARIESCONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS(In thousands, except per

share data) |

| |

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

|

2017 |

|

2016 |

|

2017 |

|

2016 |

| |

|

(Unaudited) |

|

(Unaudited) |

| Sales of goods |

|

$ |

103,058 |

|

|

$ |

100,293 |

|

|

$ |

318,414 |

|

|

$ |

326,278 |

|

| Sales of services |

|

28,434 |

|

|

14,351 |

|

|

76,640 |

|

|

50,670 |

|

| Total net sales |

|

131,492 |

|

|

114,644 |

|

|

395,054 |

|

|

376,948 |

|

| Cost of goods sold |

|

82,460 |

|

|

81,674 |

|

|

256,152 |

|

|

260,705 |

|

| Cost of services

sold |

|

22,667 |

|

|

13,167 |

|

|

63,549 |

|

|

44,667 |

|

| Total cost of

sales |

|

105,127 |

|

|

94,841 |

|

|

319,701 |

|

|

305,372 |

|

| Gross profit |

|

26,365 |

|

|

19,803 |

|

|

75,353 |

|

|

71,576 |

|

| Selling and

administrative expenses |

|

20,218 |

|

|

19,807 |

|

|

60,023 |

|

|

65,941 |

|

| Amortization

expense |

|

1,764 |

|

|

1,763 |

|

|

5,218 |

|

|

7,818 |

|

| Asset impairments |

|

— |

|

|

6,946 |

|

|

— |

|

|

135,884 |

|

| Interest expense |

|

2,026 |

|

|

1,520 |

|

|

6,315 |

|

|

4,342 |

|

| Interest income |

|

(56 |

) |

|

(50 |

) |

|

(166 |

) |

|

(157 |

) |

| Equity in (income) loss

of nonconsolidated investments |

|

(50 |

) |

|

263 |

|

|

5 |

|

|

946 |

|

| Other income |

|

(551 |

) |

|

(1,085 |

) |

|

(564 |

) |

|

(263 |

) |

| |

|

23,351 |

|

|

29,164 |

|

|

70,831 |

|

|

214,511 |

|

| Income (loss) before

income taxes |

|

3,014 |

|

|

(9,361 |

) |

|

4,522 |

|

|

(142,935 |

) |

| Income tax (benefit)

expense |

|

(208 |

) |

|

(3,379 |

) |

|

698 |

|

|

(42,125 |

) |

| Net income (loss) |

|

$ |

3,222 |

|

|

$ |

(5,982 |

) |

|

$ |

3,824 |

|

|

$ |

(100,810 |

) |

| Basic earnings (loss)

per common share |

|

$ |

0.31 |

|

|

$ |

(0.58 |

) |

|

$ |

0.37 |

|

|

$ |

(9.82 |

) |

| Diluted earnings (loss)

per common share |

|

$ |

0.31 |

|

|

$ |

(0.58 |

) |

|

$ |

0.37 |

|

|

$ |

(9.82 |

) |

| Dividends paid per

common share |

|

$ |

— |

|

|

$ |

0.04 |

|

|

$ |

— |

|

|

$ |

0.12 |

|

| Average number of

common shares outstanding — Basic |

|

10,341 |

|

|

10,296 |

|

|

10,332 |

|

|

10,264 |

|

| Average number of

common shares outstanding — Diluted |

|

10,479 |

|

|

10,296 |

|

|

10,435 |

|

|

10,264 |

|

| L.B. FOSTER COMPANY AND SUBSIDIARIESCONDENSED

CONSOLIDATED BALANCE SHEETS(In thousands) |

| |

| |

|

September 30, 2017 |

|

December 31, 2016 |

| |

|

(Unaudited) |

|

|

|

ASSETS |

|

|

|

|

| Current assets: |

|

|

|

|

| Cash and

cash equivalents |

|

$ |

35,008 |

|

|

$ |

30,363 |

|

| Accounts

receivable - net |

|

79,324 |

|

|

66,632 |

|

|

Inventories - net |

|

104,035 |

|

|

83,243 |

|

| Prepaid

income tax |

|

1,048 |

|

|

14,166 |

|

| Other

current assets |

|

9,986 |

|

|

5,200 |

|

|

Total current assets |

|

229,401 |

|

|

199,604 |

|

| Property,

plant, and equipment - net |

|

98,536 |

|

|

103,973 |

|

| Other assets: |

|

|

|

|

|

Goodwill |

|

19,699 |

|

|

18,932 |

|

| Other

intangibles - net |

|

59,135 |

|

|

63,519 |

|

|

Investments |

|

151 |

|

|

4,031 |

|

| Other

assets |

|

2,242 |

|

|

2,964 |

|

|

Total assets |

|

$ |

409,164 |

|

|

$ |

393,023 |

|

| LIABILITIES AND

STOCKHOLDERS' EQUITY |

|

|

|

|

| Current

liabilities: |

|

|

|

|

| Accounts

payable |

|

$ |

59,825 |

|

|

$ |

37,744 |

|

| Deferred

revenue |

|

11,038 |

|

|

7,597 |

|

| Accrued

payroll and employee benefits |

|

10,353 |

|

|

7,497 |

|

| Accrued

warranty |

|

9,614 |

|

|

10,154 |

|

| Current

maturities of long-term debt |

|

9,887 |

|

|

10,386 |

|

| Other

accrued liabilities |

|

8,452 |

|

|

8,953 |

|

|

Total current liabilities |

|

109,169 |

|

|

82,331 |

|

| Long-term

debt |

|

128,398 |

|

|

149,179 |

|

| Deferred

tax liabilities |

|

11,044 |

|

|

11,371 |

|

| Other

long-term liabilities |

|

16,734 |

|

|

16,891 |

|

| Stockholders'

equity: |

|

|

|

|

| Class A

Common Stock |

|

111 |

|

|

111 |

|

| Paid-in

capital |

|

44,423 |

|

|

44,098 |

|

| Retained

earnings |

|

137,492 |

|

|

133,667 |

|

| Treasury

stock |

|

(18,662 |

) |

|

(19,336 |

) |

|

Accumulated other comprehensive loss |

|

(19,545 |

) |

|

(25,289 |

) |

|

Total stockholders' equity |

|

143,819 |

|

|

133,251 |

|

| TOTAL

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

$ |

409,164 |

|

|

$ |

393,023 |

|

| |

|

|

|

|

|

|

|

|

Non-GAAP Disclosures

This earnings release discloses earnings before interest, taxes,

depreciation, and amortization (“EBITDA”) and EBITDA that is

adjusted for asset impairments ("Adjusted EBITDA") which

are non-GAAP financial measures. The Company believes

that EBITDA is useful to investors in order to provide a more

complete understanding of the ongoing operations of the Company’s

business. Similarly, Adjusted EBITDA displays the performance of

the Company without the impact of asset impairments in order to

enhance investors' understanding of our day to day operations. In

addition, management believes that

these non-GAAP financial measures are useful to investors

in the assessment of the use of our assets without regard to

financing methods, capital structure, or historical cost basis.

Additionally, EBITDA is a financial measurement that management and

the Board of Directors use in the determination of certain

compensation programs. Adjusted diluted earnings (loss) per share

amounts in this earnings release exclude asset impairment charges

and are non-GAAP measures used for management reporting purposes.

Management believes that these measures provide useful information

to investors because they will assist investors in evaluating

earnings performance on a comparable year-over-year

basis.

Non-GAAP financial measures are not a substitute for GAAP

financial results and should only be considered in conjunction with

the Company’s financial information that is presented in accordance

with GAAP. Quantitative reconciliations of EBITDA, adjusted EBITDA,

and adjusted earnings (loss) per share are presented below (in

thousands, except per share data):

| |

|

|

|

|

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

|

2017 |

|

2016 |

|

2017 |

|

2016 |

| |

|

(Unaudited) |

|

(Unaudited) |

| Adjusted EBITDA

Reconciliation |

|

|

|

|

|

|

|

|

| Net income (loss), as

reported |

|

$ |

3,222 |

|

|

$ |

(5,982 |

) |

|

$ |

3,824 |

|

|

$ |

(100,810 |

) |

| Interest expense,

net |

|

1,970 |

|

|

1,470 |

|

|

6,149 |

|

|

4,185 |

|

| Income tax (benefit)

expense |

|

(208 |

) |

|

(3,379 |

) |

|

698 |

|

|

(42,125 |

) |

| Depreciation

expense |

|

3,178 |

|

|

3,295 |

|

|

9,705 |

|

|

10,620 |

|

| Amortization

expense |

|

1,764 |

|

|

1,763 |

|

|

5,218 |

|

|

7,818 |

|

| Total

EBITDA |

|

$ |

9,926 |

|

|

$ |

(2,833 |

) |

|

$ |

25,594 |

|

|

$ |

(120,312 |

) |

| Asset impairments |

|

— |

|

|

6,946 |

|

|

— |

|

|

135,884 |

|

| Adjusted

EBITDA |

|

$ |

9,926 |

|

|

$ |

4,113 |

|

|

$ |

25,594 |

|

|

$ |

15,572 |

|

| |

|

|

|

|

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

|

2017 |

|

2016 |

|

2017 |

|

2016 |

| |

|

(Unaudited) |

|

(Unaudited) |

| Adjusted

Diluted Earnings (Loss) Per Share Reconciliation |

|

|

|

|

|

|

|

|

| Net income (loss), as

reported |

|

$ |

3,222 |

|

|

$ |

(5,982 |

) |

|

$ |

3,824 |

|

|

$ |

(100,810 |

) |

| Asset impairments, net

of tax benefits of $1,000 and $39,038 |

|

— |

|

|

5,946 |

|

|

— |

|

|

96,846 |

|

| Adjusted net income

(loss) |

|

$ |

3,222 |

|

|

$ |

(36 |

) |

|

$ |

3,824 |

|

|

$ |

(3,964 |

) |

| Average number of

common shares outstanding - Diluted |

|

10,479 |

|

|

10,296 |

|

|

10,435 |

|

|

10,264 |

|

| Diluted earnings (loss)

per common share, as reported |

|

$ |

0.31 |

|

|

$ |

(0.58 |

) |

|

$ |

0.37 |

|

|

$ |

(9.82 |

) |

| Diluted earnings (loss)

per common share, as adjusted |

|

$ |

0.31 |

|

|

$ |

(0.00 |

) |

|

$ |

0.37 |

|

|

$ |

(0.39 |

) |

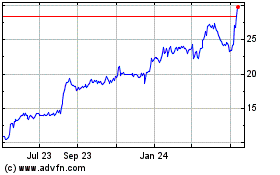

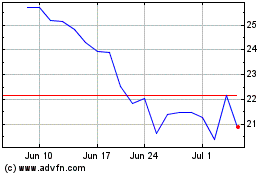

L B Foster (NASDAQ:FSTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

L B Foster (NASDAQ:FSTR)

Historical Stock Chart

From Apr 2023 to Apr 2024