Office Depot CEO's Answer to Retail Woes? Becoming an IT Help Desk

October 04 2017 - 4:27PM

Dow Jones News

By Michelle Ma

Office Depot Inc.'s $1 billion purchase of CompuCon Systems Inc.

plunges it into new territory, an effort to reposition itself as a

tech-support provider that isn't as dependent on selling printer

paper, toner and other office supplies.

Investors reacted harshly Wednesday, sending the stock down 15%.

Office Depot also warned of weak profits and lower sales in its

latest quarter, a reminder of its struggles to compete with

Amazon.com Inc. and others in its traditional business.

The CompuCon acquisition is the first big move by Office Depot's

Chief Executive Gerry Smith, who joined in February from computer

maker Lenovo Group Ltd. In an interview with The Wall Street

Journal on Wednesday, he discussed the strategy shift and the

future of the big-box chain.

Edited excerpts:

WSJ: This seems to be a reversal in strategy -- from doubling

down with a Staples merger to what seems like a push to minimize

your retail presence. Why the reversal?

Smith: I don't think I'm minimizing retail presence at all. I

think the last mile footprint is very valuable. Having 1,400

locations across the country is ripe for selling tech services.

We're going to lead with the services based approach when you walk

into the store...

Doing services is important because it's sticky and you don't

get into a bidding war from a transactional relationships

perspective. I think this is reinventing retail, not abandoning

retail.

WSJ: IT services is a highly competitive industry. How do you

foresee Office Depot making a dent in a crowded market?

Smith: CompuCon has 6,000 technicians that are salaried,

trained. A lot of competitors are outsourced. Do you want to

outsource to someone with no security clearance? No...They're going

to continue to serve their enterprise customers but we're also

going to [go after the small and medium business] space as

well...

In the space where CompuCon competes, they're No. 2 in market

share. There are a lot of people like CompuCon and 75% of the

market is completely fragmented.... 75% of people are below 1%

market share. They're tiny. As we build up this national footprint,

we think there's opportunity to consolidate the marketplace.

WSJ: Investors have reacted harshly to the news, your stock is

down like 15% today. What are you hearing from them today and what

are you telling them?

Smith: I'm not concerned about the short-term. We had an

earnings adjustment because we've had tremendous impact from the

hurricanes. Our biggest market is Florida... people don't buy

anything when they're worried about flooding...

We saw a dramatic drop off...in September. A big chunk was a

triple whammy [of the recent storms] from the earnings

perspective...It did have an impact but I'm also not shying away

from fact that we didn't execute back-to-school well.

WSJ: Long term, how much of your revenue do you foresee coming

from retail versus services? Is this the first of several such

deals?

Smith: It's the first major step. That means we're not done.

Internally we're doing cool things. We're also looking

inorganically at our core where can we build and grow this

business. Our goal is to grow the services piece faster. This is a

necessary pivot for us to be a highly valued company in the

future.

WSJ: How is this going to change your physical stores?

Smith: We will have a dramatic change in appearance of our

stores going forward. The first one in Austin in December. Another

one in California early in Q1...You're going to see a physically

different experience. You want customers who go into Office Depot

who say I want business services, tech services, potentially shared

office space, potentially supply chain services. We're going to

feature that in the front of the store.

(END) Dow Jones Newswires

October 04, 2017 16:12 ET (20:12 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

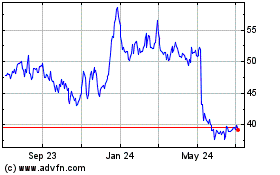

ODP (NASDAQ:ODP)

Historical Stock Chart

From Apr 2024 to May 2024

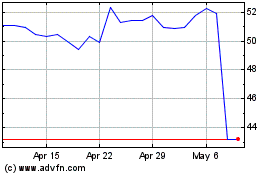

ODP (NASDAQ:ODP)

Historical Stock Chart

From May 2023 to May 2024