- First AML patient treated with

UCART123, our allogeneic CAR T product candidate in the Phase I

dose-escalation study arm; enrollment ongoing

- IND clearance granted by the FDA to

Servier and Pfizer related to the Phase I clinical trials of

UCART19 in ALL patients

- Closing of the Calyxt’s Nasdaq IPO with

$64.4 million in gross proceeds to Calyxt on July 25, 2017

- Strong cash position of $272 million1

(€238 million) as of June 30, 2017

Regulatory News:

Cellectis S.A. (Paris:ALCLS) (NASDAQ:CLLS), a clinical-stage

biopharmaceutical company focused on developing immunotherapies

based on gene-edited CAR T-cells (UCART), today announced its

results for the three-month period ended June 30, 2017 and for the

six-month period ended June 30, 2017.

____________________________

1 Translated only for convenience into U.S. dollars at an

exchange rate of €1.00=$1.1412, the daily reference rate reported

by the European Central Bank (“ECB”) as of June 30, 2017.

Second Quarter 2017 and Recent

Highlights

Cellectis - Therapeutics

UCART123: Cellectis’ most advanced, wholly controlled TALEN®

gene-edited, allogeneic CAR T product candidate

- First patient administration of

UCART123 product candidate - in Acute Myeloid Leukemia (AML),

marking the start of the Phase I dose escalation study.

- For AML patients, the Phase I clinical

trial is being conducted at Weill Cornell Medicine New York -

Presbyterian Hospital, and led by Gail J. Roboz, MD, Director of

the Clinical and Translational Leukemia Programs and Professor of

Medicine.

- For Blastic Plasmacytoid Dendritic Cell

Neoplasm (BPDCN) patients, the Phase I clinical trial is being

conducted at MD Anderson Cancer Center, and is led by Naveen

Pemmaraju, MD, Assistant Professor, and Hagop Kantarjian, MD,

Professor and Department Chair, Department of Leukemia, Division of

Cancer Medicine.

UCART19: exclusively licensed to Servier

- IND clearance obtained for Servier, in

collaboration with Pfizer, to proceed with UCART19 Phase I clinical

trials in the U.S. in patients with relapsed /refractory acute

lymphoblastic leukemia (ALL).

- UCART19 Phase I clinical trials in

pediatric and adult ALL patients are ongoing at University College

London (UCL) and Kings College London (KCL), in the UK, sponsored

by Servier.

Manufacturing

- On-going manufacturing of UCART CS1, an

allogeneic CAR T-cell product candidate for Multiple Myeloma.

- Signed a Development and Manufacturing

Agreement on July 27, 2017 with MolMed S.p.A for the development

and manufacturing of UCAR T-cell product candidates

IP/ Patent portfolio

- U.S. patent 8,921,332, which claims the

use of chimeric restriction endonucleases for directing chromosomal

gene editing in cells by homologous recombination (HR), initially

issued on Dec. 30, 2014, was upheld by the United States Patent and

Trademark Office (USPTO) after a reexamination initiated in October

2015.

- Grant by the European Patent Office of

patent No. EP3004337, covering a method of using RNA-guided

endonucleases, such as Cas9 or Cpf1 for the genetic engineering of

T-cells

Conferences

- Presentation of data on Cellectis’

UCART product candidates at the ASGCT 20th Annual Meeting in

Washington, D.C., USA.

- Presentations on Cellectis-controlled

programs and Pfizer/Cellectis collaboration programs at the 2017

American Association for Cancer Research (AACR) Annual Meeting:

- Wholly-controlled Program UCART22: An

Allogeneic Adoptive Immunotherapy for Leukemia Targeting CD22 with

CAR T-cells;

- Collaboration Programs:

- Allogeneic EGFRvIII Chimeric Antigen

Receptor T-cells for Treatment of Glioblastoma and

- Differential Modulation of the PD-1

Pathway Impacts the Anti-Tumor Activity of CAR T- cells.

- Company’s founder, Chairman and CEO,

Dr. André Choulika participated at the 2017 Milken Institute Global

Conference as a panelist for a session titled, “Humankind vs.

Cancer: The Scorecard” on Wednesday, May 3, 2017.

Corporate Governance

- Cellectis Shareholders’ General Meeting

was held at the Company’s head office in Paris on June 26, 2017. At

the meeting, more than 73% of voting rights were exercised, and all

resolutions recommended by the board of directors, were adopted,

including:

- the appointment of two new directors to

the board of directors, Mr. Rainer Boehm and Mr. Hervé Hoppenot;

and

- the renewal of the term of office of

director of Mr. Laurent Arthaud, Mr. Pierre Bastid and Mrs. Annick

Schwebig.

Calyxt Inc. – Cellectis’ plant science

subsidiary

- Calyxt closed its IPO with $64.4

million in gross proceeds to Calyxt from the sale of approximately

8 million shares at $8 per share, including the full exercise of

the underwritter’s overallotment option and Cellectis’ purchase of

$20.0 million of shares in the IPO. Calyxt’s shares of common stock

are traded on NASDAQ under the symbol “CLXT”. Cellectis owns

approximately 79.9% of Calyxt’s outstanding shares of common

stock.

- Calyxt launched, under a services

agreement with University of Minnesota U.S. field trials for

powdery mildew-resistant spring wheat variety, representing its

fourth gene-edited crop to undergo trials

- Joseph B. Saluri was named as General

Counsel and Executive Vice President, Corporate Development. Mr.

Saluri brings to Calyxt over 24 years of legal, business

development, strategic planning and project management experience

in the global agri-business space.

- Calyxt signed an agreement with a

third-party for the sale and leaseback of its Roseville, MN,

greenhouse and warehouse facility and construction of the remaining

facility. The completion of the sale is conditioned on Calyxt and

the buyer entering into a new facility construction agreement and a

lease in respect of the property in the forms contemplated by the

sale agreement.

Financial Results

Cellectis’ consolidated financial statements have been prepared

in accordance with International Financial Reporting Standards, or

IFRS, as issued by the International Accounting Standards Board

(“GAAP”).

Second Quarter 2017 Financial Results

Cash: As of June 30, 2017, Cellectis had €237.6 million

in total cash, cash equivalents and current financial assets

compared to €258.5 million as of March 31, 2017. This decrease of

€20.9 million reflects (i) net cash flows used by operating

activities of €10.0 million, (ii) capital expenditures of €0.7

million and (iii) the unrealized negative translation effect of

exchange rate fluctuations on our U.S. dollar cash, cash

equivalents and current financial assets of €11.0 million;

partially offset by (iv) the increase in equity mainly attributable

to the exercise of share warrants for €0.8 million.

Revenues and Other Income: During the quarters ended June

30 2016 and 2017, we recorded €18.1 million and €8.2 million,

respectively, in revenues and other income. This decrease is mainly

due to a €10.0 million decrease in collaboration revenues of which

€7.7 million represented milestone, revenues received during the

second quarter of 2016 with the first patient dosed in Phase I

clinical trial for UCART19, and a decrease of €2.0 million in

recognition of upfront already paid to Cellectis.

Total Operating Expenses: Total operating expenses for

the second quarter of 2017 were €26.2 million, compared to €28.2

million for the second quarter of 2016. The non-cash stock-based

compensation expenses included in these amounts were €11.3 million

and €14.4 million, respectively.

R&D Expenses: For the quarters ended June 30, 2016

and 2017, research and development expenses decreased by €2.6

million from €19.5 million in 2016 to €16.9 million in 2017.

Personnel expenses decreased by €3.2 million from €11.6 million in

2016 to €8.4 million in 2017, primarily due to a €3.1 million

decrease in non-cash stock based compensation expense, partly

offset by a €0.1 million increase in wages and salaries. Purchases

and external expenses and other expenses increased by €0.5 million

from €7.5 million in 2016 to €8.0 million in 2017, mainly due to

increased expenses related to payments to third parties

participating in product development, purchases of biological raw

materials and expenses associated with the use of laboratories and

other facilities.

SG&A Expenses: During the quarters ended June 30,

2016 and 2017, we recorded €8.6 million and €9.1 million,

respectively, of selling, general and administrative expenses. The

increase of €0.5 million primarily reflects an increase of €0.6

million in personnel expenses from €6.5 million to €7.1 million,

attributable, among other things, to an increase of €0.6 in wages

and salaries and an increase of €0.1 million in non-cash

stock-based compensation expense, partially offset by a decrease of

€0.2 million in purchases and external expenses.

Financial Gain (Loss): The financial gain was €3.8

million for the second quarter of 2016 compared with a financial

loss of €6.0 million for the second quarter of 2017. The change in

financial result was primarily attributable to a decrease in net

foreign exchange loss of €11.5 million due to the effect of

exchange rate fluctuations on our U.S. dollar cash and cash

equivalent accounts and an increase of €1.9 million in fair value

adjustment income on our foreign exchange derivatives and current

financial assets.

Net Income (Loss) Attributable to Shareholders of

Cellectis: During the three months ended June 30, 2016 and

2017, we recorded a net loss attributable to shareholders of

Cellectis of €6.3 million (€0.18 per share on both a basic and a

diluted basis) and net loss attributable to shareholders of

Cellectis of €24.1 million (€0.68 per share on both a basic and a

diluted basis), respectively. Adjusted loss attributable to

shareholders of Cellectis for the second quarter of 2017 was €12.8

million (€0.36 per share on both a basic and a diluted basis)

compared to adjusted income attributable to shareholders of

Cellectis of €8.1 million (€0.23 per share on both a basic and a

diluted basis), for the second quarter of 2016. Adjusted income

(loss) attributable to shareholders of Cellectis for the second

quarter of 2017 and 2016 excludes non-cash stock-based compensation

expense of €11.3 million and €14.4 million, respectively. Please

see "Note Regarding Use of Non-GAAP Financial Measures" for

reconciliation of GAAP net income (loss) attributable to

shareholders of Cellectis to adjusted income (loss) attributable to

shareholders of Cellectis.

First Six Months 2017 Financial Results

Cash: As of June 30, 2017, Cellectis had €237.6 million

in total cash, cash equivalents and current financial assets

compared to € 276.2 million as of December 31, 2016. This decrease

of €38.6 million primarily reflects (i) net cash flows used by

operating activities of €25.2 million, (ii) capital expenditures of

€1.4 million and (iii) the unrealized negative translation effect

of exchange rate fluctuations on our U.S. dollar cash, cash

equivalents and current financial assets of €13.0 million;

partially offset by an increase in equity mainly attributable to

the exercise of share warrants for €1.0 million.

Cellectis expects that its cash, cash equivalents and current

financial assets of €237.6 million as of June 30, 2017 will be

sufficient to fund its current operations to 2019.

Revenues and Other Income: During the six-month periods

ended June 30, 2016 and 2017, we recorded €27.6 million and €17.8

million, respectively, in revenues and other income. This decrease

is mainly due to (i) a €10.4 million decrease in collaboration

revenues of which €7.7 million represented milestones revenues

received during the second quarter of 2016 with the first patient

dosed in the Phase I clinical trial for UCART 19, a decrease of

€3.5 million in recognition of upfront fees already paid to

Cellectis and a decrease of €0.8 million in research and

development cost reimbursements; partially offset by an increase of

€1.5 million in revenue related to supply to Servier, partly offset

by (ii) an increase of €0.7 million in research tax credits.

Total Operating Expenses: Total operating expenses for

the six-month period ended June 30, 2017 were €54.4 million,

compared to €58.1 million for the six months ended June 30, 2016.

The non-cash stock-based compensation expenses included in these

amounts were €24.1 million and €27.8 million, respectively.

R&D Expenses: For the six-month periods ended June

30, 2016 and 2017, research and development expenses decreased by

€3.1 million from €38.4 million in 2016 to €35.3 million in 2017.

Personnel expenses decreased by €5.3 million from €23.5 million in

2016 to €18.2 million in 2017, primarily due to a €3.7 million

decrease in non-cash stock based compensation expense, and a

€1.7 million decrease in social charges on stock options;

grants partly offset by a €0.1 million increase in wages and

salaries. Purchases and external expenses increased by €2.0 million

from €14.2 million in 2016 to €16.2 million in 2017, mainly due to

increased expenses related to payments to third parties

participating in product development, purchases of biological raw

materials and expenses associated with the use of laboratories and

other facilities.

SG&A Expenses: During the six-month periods ended

June 30, 2016 and 2017, we recorded €19.1 million and €18.2

million, respectively, of selling, general and administrative

expenses. The decrease of €0.9 million primarily reflects

(i) a decrease of €0.4 million in personnel expenses from

€14.8 million to €14.3 million, attributable, among other

things, to a decrease of €1.5 million of social charges on

stock options grants, partly offset by a €1.1 million increase

in wages and salaries, and (ii) a decrease of

€0.6 million in purchases and external expenses.

Financial Gain (Loss): The financial loss was €5.3

million for the six-month period ended June 30, 2016 compared with

financial loss of €6.1 million for the six-month period ended June

30, 2017. The change in financial result was primarily attributable

to the effect of exchange rate fluctuations on our U.S. dollar cash

and cash equivalent accounts for €3.9 million partially offset by

the fair value adjustment on our derivative instrument and

financial current asset for €3.0 million.

Net Income (Loss) Attributable to Shareholders of

Cellectis: During the six-months periods ended June 30, 2016

and 2017, we recorded a net loss attributable to shareholders of

Cellectis of €35.7 million (€ 1.01 per share on both a basic and a

diluted basis) and a net loss attributable to shareholders of

Cellectis of €42.7 million (€1.20 per share on both a basic and

diluted basis), respectively. Adjusted loss attributable to

shareholders of Cellectis for the six-month period ended June 30,

2017 was €18.6 million (€0.52 per share on both a basic and a

diluted basis) compared to adjusted loss attributable to

shareholders of Cellectis of €7.9 million (€0.22 per share on both

a basic and a diluted basis), for the six-month period ended June

30, 2016. Adjusted loss attributable to shareholders of Cellectis

for the six-month periods ended June 30, 2017 and 2016 excludes a

non-cash stock-based compensation expense of €24.1 million and

€27.8 million, respectively. Please see "Note Regarding Use of

Non-GAAP Financial Measures" for a reconciliation of GAAP net

income (loss) attributable to shareholders of Cellectis to Adjusted

income (loss) attributable to shareholders of Cellectis.

CELLECTIS S.A.

INTERIM STATEMENT OF CONSOLIDATED

FINANCIAL POSITION

(€ in thousands, except per share

data)

As of December 31, 2016

Audited

June 30, 2017

Unaudited

ASSETS Non-current assets Intangible assets

1,274 1,213 Property, plant, and equipment 16,033 15,466 Other

non-current financial assets 656 835

Total non-current

assets 17,963 17,515 Current assets

Inventories 112 114 Trade receivables 3,441 4,346 Subsidies

receivables 8,276 13,500 Other current assets 8,414 14,196 Cash and

cash equivalent and Current financial assets 276,216 237, 614

Total current assets 296,459 269,771 TOTAL

ASSETS 314,422 287,286 LIABILITIES

Shareholders’ equity Share capital 1,767 1,793 Premiums

related to the share capital 473,306 496,752 Treasury share reserve

(307) (199) Currency translation adjustment 2,501 (3,030) Retained

earnings (157,695) (218,496) Net income (loss) (60,776) (42,653)

Total shareholders’ equity - Group Share 258,795

234,168 Non-controlling interests 1,779 3,118

Total

shareholders’ equity 260,574 237,285

Non-current liabilities Non-current financial liabilities 28

18 Non-current provisions 532 571

Total non-current

liabilities 560 589 Current

liabilities Current financial liabilities 1,641 61 Trade

payables 9,223 15,040 Deferred revenues and deferred income 36,931

28,605 Current provisions 563 382 Other current liabilities 4,930

5,323

Total current liabilities 53,288 49,412

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY 314,422

287,286

CELLECTIS S.A.

INTERIM STATEMENT OF CONSOLIDATED

OPERATIONS – Second quarter

(unaudited)

(€ in thousands, except per share

data)

For the three-month period

ended June 30,

2016 2017 Revenues and other

income Revenues 15,823 5,902 Other income 2,317 2,248

Total

revenues and other income 18,140 8,150

Operating expenses Royalty expenses (291) (512) Research and

development expenses (19,526) (16,910) Selling, general and

administrative expenses (8,600) (9,105) Other operating income and

expenses 259 337

Total operating expenses (28,158)

(26,190) Operating income (loss)

(10,018) (18,040) Financial gain

(loss) 3,763 (6,045) Net income

(loss) (6,255) (24,085) Attributable to

shareholders of Cellectis (6,255) (24,085) Attributable to

non-controlling interests

-

-

Basic net income (loss) attributable to

shareholders of Cellectis per share (€/share) (0.18)

(0.68) Diluted net income (loss)

attributable to shareholders of Cellectis per share (€/share)

(0.18) (0.68)

CELLECTIS S.A.

INTERIM STATEMENT OF CONSOLIDATED

OPERATIONS – FIRST SIX MONTHS

(unaudited)

(€ in thousands, except per share

data)

For the six-month period

ended June 30,

2016 2017 Revenues and other

income Revenues 22,801 12,230 Other income 4,838 5,582

Total

revenues and other income 27,639 17, 812

Operating expenses Royalty expenses (723) (1,086) Research

and development expenses (38,396) (35,303) Selling, general and

administrative expenses (19,127) (18,248) Other operating income

and expenses 180 238

Total operating expenses

(58,066) (54,398) Operating income

(loss) (30,427) (36,586)

Financial gain (loss) (5,292) (6,067)

Net income (loss) (35,719) (42,653)

Attributable to shareholders of Cellectis (35,719) (42,653)

Attributable to non-controlling interests

-

-

Basic net income (loss) attributable to

shareholders of Cellectis per share (€/share) (1.01)

(1.20) Diluted net income (loss)

attributable to shareholders of Cellectis per share (€/share)

(1.01) (1.20)

Note Regarding Use of Non-GAAP Financial Measures

Cellectis S.A. presents Adjusted income (loss) attributable to

shareholders of Cellectis in this press release. Adjusted income

(loss) attributable to shareholders of Cellectis is not a measure

calculated in accordance with IFRS. We have included in this press

release a reconciliation of this figure to Net income (loss)

attributable to shareholders of Cellectis, which is the most

directly comparable financial measure calculated in accordance with

IFRS. Because Adjusted income (loss) attributable to shareholders

of Cellectis excludes Non-cash stock-based compensation expense—a

non-cash expense, we believe that this financial measure, when

considered together with our IFRS financial statements, can enhance

an overall understanding of Cellectis’ financial performance.

Moreover, our management views the Company’s operations, and

manages its business, based, in part, on this financial measure. In

particular, we believe that the elimination of Non-cash stock-based

expenses from Net income (loss) attributable to shareholders of

Cellectis can provide a useful measure for period-to-period

comparisons of our core businesses. Our use of Adjusted income

(loss) attributable to shareholders of Cellectis has limitations as

an analytical tool, and you should not consider it in isolation or

as a substitute for analysis of our financial results as reported

under IFRS. Some of these limitations are: (a) other companies,

including companies in our industry which use similar stock-based

compensation, may address the impact of Non-cash stock-based

compensation expense differently; and (b) other companies may

report Adjusted income (loss) attributable to shareholders or

similarly titled measures but calculate them differently, which

reduces their usefulness as a comparative measure. Because of these

and other limitations, you should consider Adjusted income (loss)

attributable to shareholders of Cellectis alongside our IFRS

financial results, including Net Income (loss) attributable to

shareholders of Cellectis.

RECONCILIATION OF GAAP TO NON-GAAP NET

INCOME – Second quarter

(unaudited)

(€ in thousands, except per share

data)

For the three-month period

ended June 30,

2016 2017 Net income (loss)

attributable to shareholders of Cellectis (6,255)

(24,085) Adjustment: Non-cash stock-based compensation

expense 14,383 11,288

Adjusted net income (loss) attributable to

shareholders of Cellectis 8,128 (12,797)

Basic Adjusted net income (loss) attributable to

shareholders of Cellectis (€/share) 0.23 (0.36)

Weighted average number of outstanding shares,

basic (units) 35,295,817 35,560,088

Diluted Adjusted net income (loss) attributable to shareholders

of Cellectis (€/share) 0.23 (0.36)

Weighted average number of outstanding shares, diluted

(units) 35,472,312 35,580,391

RECONCILIATION OF GAAP TO NON-GAAP NET

INCOME – First six months

(unaudited)

(€ in thousands, except per share

data)

For the six-month period

ended June 30,

2016 2017 Net income (loss)

attributable to shareholders of Cellectis (35,719)

(42,653) Adjustment: Non-cash stock-based compensation

expense 27,797 24,076

Adjusted net income (loss) attributable to

shareholders of Cellectis (7,922) (18,577)

Basic Adjusted net income (loss) attributable to

shareholders of Cellectis (€/share) (0.22) (0.52)

Weighted average number of outstanding shares,

basic (units) 35,245,549 35,447,574

Diluted Adjusted net income (loss) attributable to shareholders

of Cellectis (€/share) (0.22) (0.52)

Weighted average number of outstanding shares, diluted

(units) 35,622,858 35,490,639

About Cellectis

Cellectis is a clinical-stage biopharmaceutical company focused

on developing a new generation of cancer immunotherapies based on

gene-edited T-cells (UCART). By capitalizing on its 17 years of

expertise in gene editing – built on its flagship TALEN® technology

and pioneering electroporation system PulseAgile – Cellectis uses

the power of the immune system to target and eradicate cancer

cells. Using its life-science-focused, pioneering genome

engineering technologies, Cellectis’ goal is to create innovative

products in multiple fields and with various target markets.

Cellectis is listed on the Nasdaq market (ticker: CLLS) and on the

NYSE Alternext market (ticker: ALCLS). To find out more about us,

visit our website: www.cellectis.com

Talking about gene editing? We do it. TALEN® is a registered

trademark owned by Cellectis

Cautionary Statement Regarding Forward-Looking

Statements

This press release contains certain “forward - looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements may be identified by

words such as “anticipate,” “believe,” “can,” “could,” “estimate,”

“expect,” “intend,” “is designed to,” “may,” “might,” “plan,”

“potential,” “predict,” “objective,” “should,” or the negative of

these and similar expressions and include, but are not limited to,

statements regarding the outlook for Cellectis’ future business and

financial performance. Forward-looking statements are based on

management’s current expectations and assumptions, which are

subject to inherent uncertainties, risks and changes in

circumstances, many of which are beyond Cellectis’ control. Actual

outcomes and results may differ materially due to global political,

economic, business, competitive, market, regulatory and other

factors and risks. Cellectis expressly disclaims any obligation to

update or revise any of these forward-looking statements, whether

because of future events, new information, a change in its views or

expectations, or otherwise.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170802006265/en/

Media:Jennifer Moore, VP of Communications,

917-580-1088media@cellectis.comorCaitlin Kasunich, KCSA Strategic

Communications, 212-896-1241ckasunich@kcsa.comorIR:Simon

Harnest, VP of Corporate Strategy and Finance,

646-385-9008simon.harnest@cellectis.com

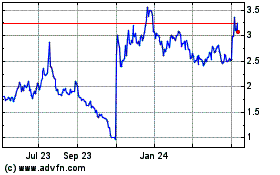

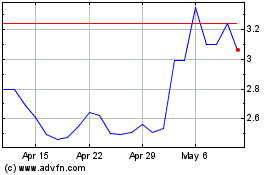

Cellectis (NASDAQ:CLLS)

Historical Stock Chart

From Aug 2024 to Sep 2024

Cellectis (NASDAQ:CLLS)

Historical Stock Chart

From Sep 2023 to Sep 2024