Report of Foreign Issuer (6-k)

July 19 2017 - 6:03AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of July, 2017

(Commission File No. 001-33356),

Gafisa S.A.

(Translation of Registrant's name into English)

Av. Nações Unidas No. 8501, 19th floor

São Paulo, SP, 05425-070

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)

Yes ______ No ___X___

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ______ No ___X___

Indicate by check mark whether by furnishing the information contained in this Form,

the Registrant is also thereby furnishing the information to the Commission pursuant

to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes ______ No ___X___

If “Yes” is marked, indicate below the file number assigned

to the registrant in connection with Rule 12g3-2(b):

N/A

PREVIEW OF OPERATIONAL RESULTS

2Q17

FOR IMMEDIATE RELEASE

- São Paulo, July 18, 2017 – Gafisa S.A. (Bovespa: GFSA3; NYSE: GFA), one of Brazil’s leading diversified homebuilders focused on the upper-middle and high income segments, today announced preliminary operational results for the second quarter ended June 30, 2017. The operating results are unaudited and remain subject to audit review.

"We achieved improved operating performance in the second quarter despite continued challenging political and economic dynamics. During the period, key operating metrics - namely gross sales, speed of sales and delivered PSV – all increased quarter-over-quarter, maintaining the momentum evident since the end of 2016. SoS was higher both year-over-year and quarter-over-quarter, while dissolutions decreased on the same basis, continuing the trend observed since the end of 2016. In addition, we made further headway on several of our strategic priorities, including reducing inventory levels and balancing the placement of new projects in the market, with new launches expected in the second half of 2017. By prioritizing projects with strong liquidity characteristics that reflect the current market environment, we remain committed to improving sales and profitability. While the industry and macroeconomic environment remain uncertain, we have a streamlined business model, solid operating platform and strong brand recognition. These competitive differentiatiors position us well to capture growth as market conditions improve,” said Sandro Gamba, Gafisa’s CEO.

|

Table 1. Gafisa Launches and Sales (R$ thousand and %)

|

|

|

2Q17

|

1Q17

|

Q/Q (%)

|

2Q16

|

Y/Y (%)

|

|

Launches

|

-

|

-

|

-

|

130,360

|

-

|

|

Gross Sales

|

240,795

|

235,611

|

2.2%

|

261,982

|

-8.1%

|

|

Dissolutions

|

(113,648)

|

(118,214)

|

-3.9%

|

(132,463)

|

-14.2%

|

|

Net Sales

|

127,146

|

117,398

|

8.3%

|

129,519

|

-1.8%

|

|

Speed of Sales (SoS)

|

7.9%

|

6.7%

|

123 bps

|

6.3%

|

159bps

|

|

Delivered PSV

|

479,869

|

265,058

|

81.0%

|

687,726

|

-30.2%

|

|

Table 2. Inventory at Market Value 2Q17 x 1Q17 (R$ thousand)

|

|

|

1Q17

|

Launches

|

Dissolutions

|

Gross Sales

|

Adjustments

|

2Q17

|

Q/Q(%)

|

|

Gafisa Inventory

|

1,635,267

|

-

|

113,648

|

(240,795)

|

(31,840)

|

1,476,281

|

-9.7%

|

This release contains forward-looking statements relating to the prospects of the business, estimates for operating and financial results, and those related to growth prospects of Gafisa. These are merely projections and, as such, are based exclusively on the expectations of management concerning the future of the business and its continued access to capital to fund the Company’s business plan. Such forward-looking statements depend, substantially, on changes in market conditions, government regulations, competitive pressures, the performance of the Brazilian economy and the industry, among other factors; therefore, they are subject to change without prior notice

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: July 18, 2017

|

Gafisa S.A.

|

|

|

|

|

|

By:

|

|

|

|

Name: Sandro Gamba

Title: Chief Executive Officer

|

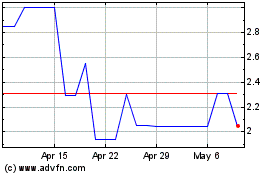

Gafisa (PK) (USOTC:GFASY)

Historical Stock Chart

From Apr 2024 to May 2024

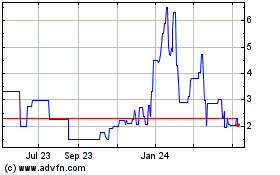

Gafisa (PK) (USOTC:GFASY)

Historical Stock Chart

From May 2023 to May 2024