AS

FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON JULY 7, 2017

REGISTRATION

NO. 333-__________

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-3

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

POLARITYTE,

INC.

(Exact

name of registrant as specified in its charter)

Delaware

(State

or other jurisdiction of

incorporation

or organization)

06-1529524

I.R.S.

Employer Identification Number

4041-T

Hadley Road

S.

Plainfield, New Jersey 07080

Telephone:

(732) 225-8910

(Address,

including zip code, and telephone number, including area code of registrant’s principal executive offices)

Denver

Lough

Chief

Executive Officer

PolarityTE,

Inc.

4041-T

Hadley Road

S.

Plainfield, New Jersey 07080

Telephone:

(732) 225-8910

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

Harvey

Kesner, Esq.

Sichenzia

Ross Ference Kesner LLP

61

Broadway, 32

nd

Floor

New

York, NY 10006

(212)

930-9700

Approximate

date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please

check the following box: [ ]

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plants, check

the following box:[X]

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please

check the following and list the Securities Act registration statement number of the earlier effective registration statement

for the same offering.[ ]

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become

effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. [ ]

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register

additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following

box. [ ]

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

[ ]

Large accelerated filer

[ ]

Accelerated filer

[ ]

Non-accelerated filer (Do not check is a smaller reporting company)

[X]

Smaller reporting company

[ ]

Emerging growth company

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. [ ]

CALCULATION

OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

Proposed

|

|

|

|

|

|

|

|

|

|

|

Proposed

|

|

|

maximum

|

|

|

|

|

|

|

|

Amount

|

|

|

maximum

|

|

|

aggregate

|

|

|

Amount of

|

|

|

Title of each class of

|

|

to be

|

|

|

offering price

|

|

|

offering

|

|

|

registration

|

|

|

Securities to be registered

|

|

registered

(1)

|

|

|

per unit

|

|

|

price

(2)

|

|

|

fee

(3)

|

|

|

Common stock, par value $0.001 per share

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Preferred stock, par value $0.001 per share

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Warrants(4)

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Units(5)

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Total

|

|

|

|

|

|

|

|

|

|

$

|

100,000,000

|

|

|

$

|

11,590

|

|

|

(1)

|

There

are being registered hereunder such indeterminate number of shares of common stock, preferred stock, and warrants to purchase

common stock or preferred stock, as shall have an aggregate initial offering price not to exceed $100,000,000. The securities

registered also include such indeterminate amounts and numbers of common stock and preferred stock as may be issued upon conversion

of or exchange for preferred stock that provide for conversion or exchange, upon exercise of warrants, or pursuant to the

antidilution provisions of any such securities.

|

|

|

|

|

(2)

|

In

no event will the aggregate offering price of all securities issued from time to time pursuant to this registration statement

exceed $100,000,000.

|

|

|

|

|

(3)

|

Calculated

pursuant to Rule 457(o) under the Securities Act. The total amount is being paid herewith.

|

|

|

|

|

(4)

|

Includes

warrants to purchase common stock and warrants to purchase preferred stock.

|

|

|

|

|

(5)

|

Any

of the securities registered hereunder may be sold separately, or as units with other securities registered hereby. We will

determine the proposed maximum offering price per unit when we issue the above listed securities. The proposed maximum per

unit and aggregate offering prices per class of securities will be determined from time to time by the registrant in connection

with the issuance by the registrant of the securities registered under this registration statement and is not specified as

to each class of security pursuant to General Instruction II.D of Form S-3 under the Securities Act.

|

The

registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until

the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become

effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective

on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement

relating to these securities that has been filed with the Securities and Exchange Commission is effective. This prospectus is

not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or

sale is not permitted.

(Subject

to Completion, Dated July 7, 2017)

PROSPECTUS

$100,000,000

PolarityTE,

Inc.

Common

Stock

Preferred

Stock

Warrants

Units

We

may from time to time, in one or more offerings at prices and on terms that we will determine at the time of each offering, sell

common stock, preferred stock, warrants, or a combination of these securities, or units, for an aggregate initial offering price

of up to $100,000,000. This prospectus describes the general manner in which our securities may be offered using this prospectus.

Each time we offer and sell securities, we will provide you with a prospectus supplement that will contain specific information

about the terms of that offering. Any prospectus supplement may also add, update, or change information contained in this prospectus.

You should carefully read this prospectus and the applicable prospectus supplement as well as the documents incorporated or deemed

to be incorporated by reference in this prospectus before you purchase any of the securities offered hereby.

This

prospectus may not be used to offer and sell securities unless accompanied by a prospectus supplement.

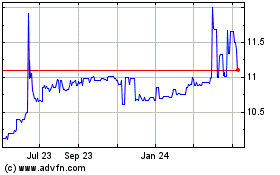

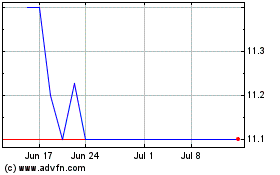

Our common

stock is currently traded on the NASDAQ Capital Market under the symbol “COOL.” On July 6, 2017, the last reported

sales price for our common stock was $22.99 per share. We will apply to list any shares of common stock sold by us under

this prospectus and any prospectus supplement on the NASDAQ Capital Market. The prospectus supplement will contain information,

where applicable, as to any other listing of the securities on the NASDAQ Capital Market or any other securities market or exchange

covered by the prospectus supplement.

The

securities offered by this prospectus involve a high degree of risk. See “Risk Factors” beginning on page 5,

in addition to Risk Factors contained in the applicable prospectus supplement.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

We

may offer the securities directly or through agents or to or through underwriters or dealers. If any agents or underwriters are

involved in the sale of the securities their names, and any applicable purchase price, fee, commission or discount arrangement

between or among them, will be set forth, or will be calculable from the information set forth, in an accompanying prospectus

supplement. We can sell the securities through agents, underwriters or dealers only with delivery of a prospectus supplement describing

the method and terms of the offering of such securities. See “Plan of Distribution.”

This

prospectus is dated ___________, 2017

Table

of Contents

You

should rely only on the information contained or incorporated by reference in this prospectus or any prospectus supplement. We

have not authorized anyone to provide you with information different from that contained or incorporated by reference into this

prospectus. If any person does provide you with information that differs from what is contained or incorporated by reference in

this prospectus, you should not rely on it. No dealer, salesperson or other person is authorized to give any information or to

represent anything not contained in this prospectus. You should assume that the information contained in this prospectus or any

prospectus supplement is accurate only as of the date on the front of the document and that any information contained in any document

we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the

time of delivery of this prospectus or any prospectus supplement or any sale of a security. These documents are not an offer to

sell or a solicitation of an offer to buy these securities in any circumstances under which the offer or solicitation is unlawful.

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or SEC, using a “shelf”

registration process. Under this shelf registration process, we may sell any combination of the securities described in this prospectus

in one of more offerings up to a total dollar amount of proceeds of $100,000,000. This prospectus describes the general manner

in which our securities may be offered by this prospectus. Each time we sell securities, we will provide a prospectus supplement

that will contain specific information about the terms of that offering. The prospectus supplement may also add, update or change

information contained in this prospectus or in documents incorporated by reference in this prospectus. The prospectus supplement

that contains specific information about the terms of the securities being offered may also include a discussion of certain U.S.

Federal income tax consequences and any risk factors or other special considerations applicable to those securities. To the extent

that any statement that we make in a prospectus supplement is inconsistent with statements made in this prospectus or in documents

incorporated by reference in this prospectus, you should rely on the information in the prospectus supplement. You should carefully

read both this prospectus and any prospectus supplement together with the additional information described under “Where

You Can Find More Information” before buying any securities in this offering.

Unless

the context otherwise requires, references to “we,” “our,” “us,” “Polarity” or

the “Company” in this prospectus mean PolarityTE, Inc., f/k/a Majesco Entertainment Company, a Delaware corporation,

on a consolidated basis with its wholly-owned subsidiaries, as applicable.

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus and the documents and information incorporated by reference in this prospectus include forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities

Exchange Act of 1934, as amended, or the Exchange Act. These statements are based on our management’s beliefs and assumptions

and on information currently available to our management. Such forward-looking statements include those that express plans, anticipation,

intent, contingency, goals, targets or future development and/or otherwise are not statements of historical fact.

All

statements in this prospectus and the documents and information incorporated by reference in this prospectus that are not historical

facts are forward-looking statements. We may, in some cases, use terms such as “anticipates,” “believes,”

“could,” “estimates,” “expects,” “intends,” “may,” “plans,”

“potential,” “predicts,” “projects,” “should,” “will,” “would”

or similar expressions or the negative of such items that convey uncertainty of future events or outcomes to identify forward-looking

statements.

Forward-looking

statements are made based on management’s beliefs, estimates and opinions on the date the statements are made and we undertake

no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change,

except as may be required by applicable law. Although we believe that the expectations reflected in the forward-looking statements

are reasonable, we cannot guarantee future results, levels of activity, performance or achievements.

ABOUT

POLARITYTE, INC.

Corporate

Background

The

Company was incorporated in 2004 in the state of Delaware. Effective January 11, 2017, the Company changed its name to PolarityTE,

Inc. from “Majesco Entertainment Company.”

Our

principal executive offices are located at 4041-T Hadley Road, South Plainfield, NJ 07080 and our telephone number is (732) 225-8910.

Our web site address is www.Polarityte.com.

Overview

We

are a technology company which has developed, marketed, published and distributed software through online platforms. We develop

applications for gaming on computers, handheld devices and game consoles. We have had commercial successes (Zumba Fitness) which

have not been replicated and in furtherance of seeking to diversify, on December 1, 2016 we entered into an Agreement and Plan

of Reorganization to acquire the patents, know-how and trade secrets of PolarityTE, Inc. (“PolarityTE NV”). PolarityTE

NV is the owner of patent applications and know-how related to regenerative medicine and tissue engineering, as well as software

applications used in diagnosis and treatment related to regenerative medicine developed by our Chief Executive Officer, Chief

Technology Officer and Chairman of our Board of Directors, Dr. Denver Lough. PolarityTE NV seeks to develop and obtain regulatory

approval for technology that will utilize a patient’s own tissue substrates for the regeneration of skin, bone, muscle,

cartilage, fat, blood vessels and nerves.

With

the foregoing goals and operational strategy in mind, we have directed resources towards building the operational base of the

regenerative medicine business following the execution of the Agreement. The Company leased office and research and development

space in Salt Lake City, Utah and acquired equipment necessary to perform high end tissue engineering development research, including

single and multiphoton microscopes and tissue culture and base equipment together with obtaining certification for the use of

all laboratory equipment. The Company is also building a research and development team suitable for pursuing its regenerative

medicine and tissue engineering goals.

RISK

FACTORS

Investing

in our securities involves a high degree of risk. Before making an investment decision, you should consider carefully the risks,

uncertainties and other factors described in our most recent Annual Report on Form 10-K, as supplemented and updated by subsequent

quarterly reports on Form 10-Q and current reports on Form 8-K that we have filed or will file with the SEC, which are incorporated

by reference into this prospectus.

Our

business, affairs, prospects, assets, financial condition, results of operations and cash flows could be materially and adversely

affected by these risks. For more information about our SEC filings, please see “Where You Can Find More Information.”

USE

OF PROCEEDS

Unless

otherwise indicated in a prospectus supplement, we intend to use the net proceeds from the sale of the securities under this prospectus

for general corporate purposes, including and for general working capital purposes. We may also use a portion of the net proceeds

to acquire or invest in businesses and products that are complementary to our own, although we have no current plans, commitments

or agreements with respect to any acquisitions as of the date of this prospectus.

DESCRIPTION

OF COMMON STOCK

General

We

are authorized to issue 250,000,000 shares of common stock, $0.001 par value per share.

Holders

of our common stock are entitled to one vote per share. Our Restated Certificate of Incorporation does not provide for cumulative

voting. Holders of our common stock are entitled to receive ratably such dividends, if any, as may be declared by our Board out

of legally available funds. However, the current policy of our Board is to retain earnings, if any, for the operation and expansion

of our Company. Upon liquidation, dissolution or winding-up, the holders of our common stock are entitled to share ratably in

all of our assets which are legally available for distribution, after payment of or provision for all liabilities. The holders

of our common stock have no preemptive, subscription, redemption or conversion rights.

DESCRIPTION

OF PREFERRED STOCK

We

are authorized to issue up to 10,000,000 shares of preferred stock, par value $0.001 per share, from time to time in one or more

series.

Series

A Preferred Stock

As

of July 7, 2017, there were 3,801,458 shares of Series A Preferred Stock outstanding. The Series A Preferred Stock are

convertible into shares of common stock based on a conversion calculation equal to the stated value of such Series A Preferred

Stock, plus all accrued and unpaid dividends, if any, on such Series A Preferred Stock, as of such date of determination, divided

by the conversion price. The stated value of each Series A Preferred Stock is $0.68 and the initial conversion price was

$4.08 (the current conversion price is $3.00) per share, each subject to adjustment for stock splits, stock dividends,

recapitalizations, combinations, subdivisions or other similar events. In addition, in the event the Company issues or sells,

or is deemed to issue or sell, shares of common stock at a per share price that is less than the conversion price then in effect,

the conversion price shall be reduced to such lower price, subject to certain exceptions. The Company is prohibited from effecting

a conversion of the Series A Preferred Stock to the extent that, as a result of such conversion, such investor would beneficially

own more than 4.99% of the number of shares of common stock outstanding immediately after giving effect to the issuance of shares

of common stock upon conversion of the Series A Preferred Stock, which beneficial ownership limitation may be increased by the

holder up to, but not exceeding, 9.99% (the “Series A Limit”).

Each

holder of Series A Preferred Stock is entitled to vote on all matters submitted to stockholders of the Company, and shall have

the number of votes equal to the number of shares of common stock issuable upon conversion of such holder’s Series A Preferred

Stock,

provided

that a holder is only entitled to vote shares of common stock underlying the Preferred A Shares to the

extent such shares do not result in the holder exceeding the Series A Limit and

provided further

that in no event shall

the holders be entitled to cast votes in excess of the number of votes that holders would be entitled to cast if the Series A

Preferred Stock were converted at $3.54 per share (equal to the market price as determined by NASDAQ on the trading date immediately

prior to closing) (the “Voting Floor”). The Voting Floor shall only be removed in accordance with applicable Nasdaq

Listing Rules. Pursuant to the Certificate of Designations, Preferences and Rights of the 0% Series A Convertible Preferred Stock

of the Company, the Company is prohibited from incurring debt or liens, or entering into new financing transactions without the

consent of the Lead Investor (as defined in the Subscription Agreements dated December 17, 2014). The Preferred A Shares bear

no interest or dividends.

Series

B Preferred Stock

As

of July 7, 2017, there were 48,109.25 shares of Series B Preferred Stock outstanding. The Series B Preferred Stock are

convertible into shares of common stock based on a conversion calculation equal to the stated value of such Series B Preferred

Stock, plus all accrued and unpaid dividends, if any, on such Series B Preferred Stock, as of such date of determination, divided

by the conversion price. The stated value of each Series B Preferred Stock is $140 and the initial conversion price is $8.40 per

share, each subject to adjustment for stock splits, stock dividends, recapitalizations, combinations, subdivisions or other similar

events. The Company is prohibited from effecting a conversion of the Series B Preferred Stock to the extent that, as a result

of such conversion, such investor would beneficially own more than 4.99% of the number of shares of common stock outstanding immediately

after giving effect to the issuance of shares of common stock upon conversion of the Series B Preferred Stock, which beneficial

ownership limitation may be increased by the holder up to, but not exceeding, 9.99% (the “Series B Limit”).

Each

holder of Series B Preferred Stock is entitled to vote on all matters submitted to stockholders of the Company, and shall have

the number of votes equal to the number of shares of common stock issuable upon conversion of such holder’s Series B Preferred

Stock based on a conversion price of $8.40 per share,

provided

that a holder is only entitled to vote shares of common

stock underlying the Series B Preferred Stock to the extent such shares do not result in the holder exceeding the Series B Limit.

The Series B Preferred Stock bear no interest or dividends.

Series

C Preferred Stock

As

of July 7, 2017, there were 20,114.84 shares of Series C Preferred Stock outstanding. The Series C Preferred Stock are

convertible into shares of common stock based on a conversion calculation equal to the stated value of such Series C Preferred

Stock, plus all accrued and unpaid dividends, if any, on such Series C Preferred Stock, as of such date of determination, divided

by the conversion price. The stated value of each Series C Preferred Stock is $120 per share, and the initial conversion price

was $7.20 (the current conversion price is $5.16) per share, each subject to adjustment for stock splits, stock

dividends, recapitalizations, combinations, subdivisions or other similar events. The Company is prohibited from effecting a conversion

of the Series C Preferred Stock to the extent that, as a result of such conversion, such holder would beneficially own more than

4.99% of the number of shares of common stock outstanding immediately after giving effect to the issuance of shares of common

stock upon conversion of the Series C Preferred Stock, which beneficial ownership limitation may be increased by the holder up

to, but not exceeding, 9.99% (the “Series C Limit”).

Subject

to the Series C Limit, each holder is entitled to vote on all matters submitted to stockholders of the Company, and shall have

the number of votes equal to the number of shares of common stock issuable upon conversion of such holder’s Series C Preferred

Shares, based on a conversion price of $7.20 per share. Pursuant to the Certificate of Designations, Preferences and Rights of

the 0% Series C Convertible Preferred Stock of the Company, the Series C Preferred Shares bear no dividends and shall rank junior

to the Company’s Series A Preferred Stock but senior to the Company’s Series B Preferred Stock.

Series

D Preferred Stock

As

of July 7, 2017, there are 26,667 shares of Series D Preferred Stock outstanding. The Series D Preferred Stock are convertible

into shares of common stock based on a conversion calculation equal to the stated value of such Series D Preferred Stock, plus

all accrued and unpaid dividends, if any, on such Series D Preferred Stock, as of such date of determination, divided by the conversion

price. The stated value of each Series D Preferred Stock is $1,000.00 and the initial conversion price is $600 per share, each

subject to adjustment for stock splits, stock dividends, recapitalizations, combinations, subdivisions or other similar events.

The Company is prohibited from effecting a conversion of the Preferred D Shares to the extent that, as a result of such conversion,

such investor would beneficially own more than 4.99% of the number of shares of common stock outstanding immediately after giving

effect to the issuance of shares of common stock upon conversion of the Series D Preferred Stock. Upon 61 days written notice,

the beneficial ownership limitation may be increased by the holder up to, but not exceeding, 9.99%. Except as otherwise required

by law, holders of Series D Preferred Stock shall not have any voting rights. Pursuant to the Certificate of Designations, Preferences

and Rights of the 0% Series D Convertible Preferred Stock, the Preferred D Shares bear no interest or dividends and shall rank

senior to the Company’s other classes of capital stock.

Series

E Preferred Stock

As

of July 7, 2017, there are 7,050 shares of Series E Preferred Stock outstanding. The Series E Preferred Stock are convertible

into shares of common stock based on a conversion calculation equal to the stated value of such preferred stock, plus all accrued

and unpaid dividends, if any, on such preferred stock, as of such date of determination, divided by the conversion price. The

stated value of each Series E Preferred Stock is $1,000 and the initial conversion price is $1.00 per share, each subject to adjustment

for stock splits, stock dividends, recapitalizations, combinations, subdivisions or other similar events.

The

Series E Preferred Stock, with respect to dividend rights and rights on liquidation, winding-up and dissolution, in each case

will rank senior to the Company’s

common stock

and all other securities of

the Company that do not expressly provide that such securities rank on parity with or senior to the Series E Preferred Stock.

Until converted, each share of Series E Preferred Stock is entitled to two votes for every share of

common

stock

into which it is convertible on any matter submitted for a vote of stockholders.

Subject

to the foregoing, our Restated Certificate of Incorporation authorizes our board of directors to issue preferred stock from time

to time with such designations, preferences, conversion or other rights, voting powers, restrictions, dividends or limitations

as to dividends or other distributions, qualifications or terms or conditions of redemption as shall be determined by the Board

of Directors for each class or series of stock. Preferred stock is available for possible future financings or acquisitions and

for general corporate purposes without further authorization of stockholders unless such authorization is required by applicable

law, the rules of the NASDAQ Capital Market or other securities exchange or market on which our stock is then listed or admitted

to trading.

Our

board of directors may authorize the issuance of preferred stock with voting or conversion rights that could adversely affect

the voting power or other rights of the holders of common stock. The issuance of preferred stock, while providing flexibility

in connection with possible acquisitions and other corporate purposes could, under some circumstances, have the effect of delaying,

deferring or preventing a change in control of the Company.

A

prospectus supplement relating to any series of preferred stock being offered will include specific terms relating to the offering.

Such prospectus supplement will include:

|

●

|

the

title and stated or par value of the preferred stock;

|

|

|

|

|

●

|

the

number of shares of the preferred stock offered, the liquidation preference per share and the offering price of the preferred

stock;

|

|

|

|

|

●

|

the

dividend rate(s), period(s) and/or payment date(s) or method(s) of calculation thereof applicable to the preferred stock;

|

|

|

|

|

●

|

whether

dividends shall be cumulative or non-cumulative and, if cumulative, the date from which dividends on the preferred stock shall

accumulate;

|

|

|

|

|

●

|

the

provisions for a sinking fund, if any, for the preferred stock;

|

|

|

|

|

●

|

any

voting rights of the preferred stock;

|

|

|

|

|

●

|

the

provisions for redemption, if applicable, of the preferred stock;

|

|

|

|

|

●

|

any

listing of the preferred stock on any securities exchange;

|

|

|

|

|

●

|

the

terms and conditions, if applicable, upon which the preferred stock will be convertible into our common stock, including the

conversion price or the manner of calculating the conversion price and conversion period;

|

|

|

|

|

●

|

if

appropriate, a discussion of Federal income tax consequences applicable to the preferred stock;

|

|

●

|

any

other specific terms, preferences, rights, limitations or restrictions of the preferred stock.

|

The

terms, if any, on which the preferred stock may be convertible into or exchangeable for our common stock will also be stated in

the preferred stock prospectus supplement. The terms will include provisions as to whether conversion or exchange is mandatory,

at the option of the holder or at our option, and may include provisions pursuant to which the number of shares of our common

stock to be received by the holders of preferred stock would be subject to adjustment.

DESCRIPTION

OF WARRANTS

We

may issue warrants for the purchase of preferred stock or common stock. Warrants may be issued independently or together with

any preferred stock or common stock, and may be attached to or separate from any offered securities. Each series of warrants will

be issued under a separate warrant agreement to be entered into between a warrant agent specified in the agreement and us. The

warrant agent will act solely as our agent in connection with the warrants of that series and will not assume any obligation or

relationship of agency or trust for or with any holders or beneficial owners of warrants. This summary of some provisions of the

securities warrants is not complete. You should refer to the securities warrant agreement, including the forms of securities warrant

certificate representing the securities warrants, relating to the specific securities warrants being offered for the complete

terms of the securities warrant agreement and the securities warrants. The securities warrant agreement, together with the terms

of the securities warrant certificate and securities warrants, will be filed with the SEC in connection with the offering of the

specific warrants.

The

applicable prospectus supplement will describe the following terms, where applicable, of the warrants in respect of which this

prospectus is being delivered:

|

●

|

the

title of the warrants;

|

|

|

|

|

●

|

the

aggregate number of the warrants;

|

|

|

|

|

●

|

the

price or prices at which the warrants will be issued;

|

|

|

|

|

●

|

the

designation, amount and terms of the offered securities purchasable upon exercise of the warrants;

|

|

|

|

|

●

|

if

applicable, the date on and after which the warrants and the offered securities purchasable upon exercise of the warrants

will be separately transferable;

|

|

|

|

|

●

|

the

terms of the securities purchasable upon exercise of such warrants and the procedures and conditions relating to the exercise

of such warrants;

|

|

|

|

|

●

|

any

provisions for adjustment of the number or amount of securities receivable upon exercise of the warrants or the exercise price

of the warrants;

|

|

|

|

|

●

|

the

price or prices at which and currency or currencies in which the offered securities purchasable upon exercise of the warrants

may be purchased;

|

|

|

|

|

●

|

the

date on which the right to exercise the warrants shall commence and the date on which the right shall expire;

|

|

|

|

|

●

|

the

minimum or maximum amount of the warrants that may be exercised at any one time;

|

|

|

|

|

●

|

information

with respect to book-entry procedures, if any;

|

|

|

|

|

●

|

if

appropriate, a discussion of Federal income tax consequences; and

|

|

|

|

|

●

|

any

other material terms of the warrants, including terms, procedures and limitations relating to the exchange and exercise of

the warrants.

|

Warrants

for the purchase of common stock or preferred stock will be offered and exercisable for U.S. dollars only. Warrants will be issued

in registered form only.

Upon

receipt of payment and the warrant certificate properly completed and duly executed at the corporate trust office of the warrant

agent or any other office indicated in the applicable prospectus supplement, we will, as soon as practicable, forward the purchased

securities. If less than all of the warrants represented by the warrant certificate are exercised, a new warrant certificate will

be issued for the remaining warrants.

Prior

to the exercise of any securities warrants to purchase preferred stock or common stock, holders of the warrants will not have

any of the rights of holders of the common stock or preferred stock purchasable upon exercise, including in the case of securities

warrants for the purchase of common stock or preferred stock, the right to vote or to receive any payments of dividends on the

preferred stock or common stock purchasable upon exercise.

DESCRIPTION

OF UNITS

As

specified in the applicable prospectus supplement, we may issue units consisting of shares of common stock, shares of preferred

stock or warrants or any combination of such securities.

The

applicable prospectus supplement will specify the following terms of any units in respect of which this prospectus is being delivered:

|

●

|

the

terms of the units and of any of the common stock, preferred stock and warrants comprising the units, including whether and

under what circumstances the securities comprising the units may be traded separately;

|

|

|

|

|

●

|

a

description of the terms of any unit agreement governing the units; and

|

|

|

|

|

●

|

a

description of the provisions for the payment, settlement, transfer or exchange of the units.

|

PLAN

OF DISTRIBUTION

We

may sell the securities offered through this prospectus (i) to or through underwriters or dealers, (ii) directly to purchasers,

including our affiliates, (iii) through agents, or (iv) through a combination of any these methods. The securities may be distributed

at a fixed price or prices, which may be changed, market prices prevailing at the time of sale, prices related to the prevailing

market prices, or negotiated prices. The prospectus supplement will include the following information:

|

●

|

the

terms of the offering;

|

|

|

|

|

●

|

the

names of any underwriters or agents;

|

|

|

|

|

●

|

the

name or names of any managing underwriter or underwriters;

|

|

|

|

|

●

|

the

purchase price of the securities;

|

|

|

|

|

●

|

any

over-allotment options under which underwriters may purchase additional securities from us;

|

|

|

|

|

●

|

the

net proceeds from the sale of the securities

|

|

|

|

|

●

|

any

delayed delivery arrangements

|

|

|

|

|

●

|

any

underwriting discounts, commissions and other items constituting underwriters’ compensation;

|

|

|

|

|

●

|

any

initial public offering price;

|

|

|

|

|

●

|

any

discounts or concessions allowed or reallowed or paid to dealers;

|

|

|

|

|

●

|

any

commissions paid to agents; and

|

|

|

|

|

●

|

any

securities exchange or market on which the securities may be listed.

|

Sale

Through Underwriters or Dealers

Only

underwriters named in the prospectus supplement are underwriters of the securities offered by the prospectus supplement.

If

underwriters are used in the sale, the underwriters will acquire the securities for their own account, including through underwriting,

purchase, security lending or repurchase agreements with us. The underwriters may resell the securities from time to time in one

or more transactions, including negotiated transactions. Underwriters may sell the securities in order to facilitate transactions

in any of our other securities (described in this prospectus or otherwise), including other public or private transactions and

short sales. Underwriters may offer securities to the public either through underwriting syndicates represented by one or more

managing underwriters or directly by one or more firms acting as underwriters. Unless otherwise indicated in the prospectus supplement,

the obligations of the underwriters to purchase the securities will be subject to certain conditions, and the underwriters will

be obligated to purchase all the offered securities if they purchase any of them. The underwriters may change from time to time

any initial public offering price and any discounts or concessions allowed or reallowed or paid to dealers.

If

dealers are used in the sale of securities offered through this prospectus, we will sell the securities to them as principals.

They may then resell those securities to the public at varying prices determined by the dealers at the time of resale. The prospectus

supplement will include the names of the dealers and the terms of the transaction.

Direct

Sales and Sales Through Agents

We

may sell the securities offered through this prospectus directly. In this case, no underwriters or agents would be involved. Such

securities may also be sold through agents designated from time to time. The prospectus supplement will name any agent involved

in the offer or sale of the offered securities and will describe any commissions payable to the agent. Unless otherwise indicated

in the prospectus supplement, any agent will agree to use its reasonable best efforts to solicit purchases for the period of its

appointment.

We

may sell the securities directly to institutional investors or others who may be deemed to be underwriters within the meaning

of the Securities Act with respect to any sale of those securities. The terms of any such sales will be described in the prospectus

supplement.

Delayed

Delivery Contracts

If

the prospectus supplement indicates, we may authorize agents, underwriters or dealers to solicit offers from certain types of

institutions to purchase securities at the public offering price under delayed delivery contracts. These contracts would provide

for payment and delivery on a specified date in the future. The contracts would be subject only to those conditions described

in the prospectus supplement. The applicable prospectus supplement will describe the commission payable for solicitation of those

contracts.

Continuous

Offering Program

Without

limiting the generality of the foregoing, we may enter into a continuous offering program equity distribution agreement with a

broker-dealer, under which we may offer and sell shares of our common stock from time to time through a broker-dealer as our sales

agent. If we enter into such a program, sales of the shares of common stock, if any, will be made by means of ordinary brokers’

transactions on the NASDAQ Capital Market at market prices, block transactions and such other transactions as agreed upon by us

and the broker-dealer. Under the terms of such a program, we also may sell shares of common stock to the broker-dealer, as principal

for its own account at a price agreed upon at the time of sale. If we sell shares of common stock to such broker-dealer as principal,

we will enter into a separate terms agreement with such broker-dealer, and we will describe this agreement in a separate prospectus

supplement or pricing supplement.

Market

Making, Stabilization and Other Transactions

Unless

the applicable prospectus supplement states otherwise, other than our common stock all securities we offer under this prospectus

will be a new issue and will have no established trading market. We may elect to list offered securities on an exchange or in

the over-the-counter market. Any underwriters that we use in the sale of offered securities may make a market in such securities,

but may discontinue such market making at any time without notice. Therefore, we cannot assure you that the securities will have

a liquid trading market.

Any

underwriter may also engage in stabilizing transactions, syndicate covering transactions and penalty bids in accordance with Rule

104 under the Securities Exchange Act. Stabilizing transactions involve bids to purchase the underlying security in the open market

for the purpose of pegging, fixing or maintaining the price of the securities. Syndicate covering transactions involve purchases

of the securities in the open market after the distribution has been completed in order to cover syndicate short positions.

Penalty

bids permit the underwriters to reclaim a selling concession from a syndicate member when the securities originally sold by the

syndicate member are purchased in a syndicate covering transaction to cover syndicate short positions. Stabilizing transactions,

syndicate covering transactions and penalty bids may cause the price of the securities to be higher than it would be in the absence

of the transactions. The underwriters may, if they commence these transactions, discontinue them at any time.

General

Information

Agents,

underwriters, and dealers may be entitled, under agreements entered into with us, to indemnification by us against certain liabilities,

including liabilities under the Securities Act. Our agents, underwriters, and dealers, or their affiliates, may be customers of,

engage in transactions with or perform services for us, in the ordinary course of business.

LEGAL

MATTERS

The

validity of the issuance of the securities offered by this prospectus will be passed upon for us by Sichenzia Ross Ference Kesner

LLP, New York, New York.

EXPERTS

The consolidated balance

sheets of PolarityTE, Inc., formerly Majesco Entertainment Company and Subsidiary as of October 31, 2016 and 2015, and the related

consolidated statements of operations, stockholders’ equity, and cash flows for each of the years then ended, have been

audited by EisnerAmper LLP, independent registered public accounting firm, as stated in their report which is incorporated herein

by reference. Such financial statements have been incorporated herein by reference in reliance on the report of such firm given

upon their authority as experts in accounting and auditing.

WHERE

YOU CAN FIND MORE INFORMATION

We

file annual, quarterly and special reports, along with other information with the SEC. Our SEC filings are available to the public

over the Internet at the SEC’s website at http://www.sec.gov. You may also read and copy any document we file at the SEC’s

Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information

on the Public Reference Room.

This

prospectus is part of a registration statement on Form S-3 that we filed with the SEC to register the securities offered hereby

under the Securities Act of 1933, as amended. This prospectus does not contain all of the information included in the registration

statement, including certain exhibits and schedules. You may obtain the registration statement and exhibits to the registration

statement from the SEC at the address listed above or from the SEC’s internet site.

INCORPORATION

OF CERTAIN DOCUMENTS BY REFERENCE

This

prospectus is part of a registration statement filed with the SEC. The SEC allows us to “incorporate by reference”

into this prospectus the information that we file with them, which means that we can disclose important information to you by

referring you to those documents. The information incorporated by reference is considered to be part of this prospectus, and information

that we file later with the SEC will automatically update and supersede this information. The following documents are incorporated

by reference and made a part of this prospectus:

|

|

●

|

our

Annual Report on Form 10-K for the year ended October 31, 2016 filed with the SEC on December 30, 2016, as amended by Amendment

No. 1 thereto filed with the SEC on January 30, 2017;

|

|

|

|

|

|

|

●

|

our

Quarterly Report on Form 10-Q for the period ended April 30, 2017, filed with the SEC on June 9, 2017;

|

|

|

|

|

|

|

●

|

our

Quarterly Report on Form 10-Q for the period ended January 31, 2017, filed with the SEC on March 16, 2017;

|

|

|

|

|

|

|

●

|

our

Current Reports on Form 8-K filed with the SEC on December 7, 2016, December 16, 2016, January 9, 2017, January 10, 2017,

January 19, 2017, February 14, 2017, February 22, 2017, March 7, 2017, March 13, 2017, and April 7, 2017;

|

|

|

|

|

|

|

●

|

our

Definitive Proxy Statement on Schedule 14A filed with the SEC on February 24, 2017

|

|

|

|

|

|

|

●

|

our

Definitive Additional Materials on Schedule 14A filed with the SEC on March 3, 2017;

|

|

|

|

|

|

|

●

|

the

description of our common stock contained in the our Registration Statement on Form 8-A filed with the SEC on January 21,

2015 (File No. 001-51128), including any amendment or report filed for the purpose of updating such description; and

|

|

|

|

|

|

|

●

|

all

reports and other documents subsequently filed by us pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act after

the date of this prospectus and prior to the termination of this offering.

|

Notwithstanding

the foregoing, information furnished under Items 2.02 and 7.01 of any Current Report on Form 8-K, including the related exhibits,

is not incorporated by reference in this prospectus.

The

information about us contained in this prospectus should be read together with the information in the documents incorporated by

reference. You may request a copy of any or all of these filings, at no cost, by writing or telephoning us at: 404I-T Hadley Road,

S. Plainfield, New Jersey 07080, phone number 732-225-8910.

$100,000,000

Common

Stock

Preferred

Stock

Warrants

Units

PolarityTE,

Inc.

Prospectus

, 2017

PART

II

INFORMATION

NOT REQUIRED IN PROSPECTUS

Item

14. Other Expenses of Issuance and Distribution.

The

following table sets forth the costs and expenses payable by the Registrant in connection with this offering, other than underwriting

commissions and discounts, all of which are estimated except for the SEC registration fee.

|

Item

|

|

Amount

|

|

|

SEC

registration fee

|

|

$

|

11,590

|

|

|

Printing

and engraving expenses

|

|

|

10,000

|

|

|

Legal

fees and expenses

|

|

|

50,000

|

|

|

Accounting

fees and expenses

|

|

|

10,000

|

|

|

Transfer

agent and registrar’s fees and expenses

|

|

|

10,000

|

|

|

Miscellaneous

expenses

|

|

|

15,000

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

106,590

|

|

Item

15. Indemnification of Directors and Officers.

Subsection

(a) of Section 145 of the DGCL empowers a corporation to indemnify any person who was or is a party or is threatened to be made

a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative

(other than an action by or in the right of the corporation) by reason of the fact that he is or was a director, employee or agent

of the corporation or is or was serving at the request of the corporation as a director, officer, employee or agent of another

corporation, partnership, joint venture, trust or other enterprise, against expenses (including attorneys’ fees), judgments,

fines and amounts paid in settlement actually and reasonably incurred by him in connection with such action, suit or proceeding

if he acted in good faith and in a manner he reasonably believed to be in or not opposed to the best interests of the corporation

and, with respect to any criminal action or proceeding, had no reasonable cause to believe his conduct was unlawful.

Subsection

(b) of Section 145 of the DGCL empowers a corporation to indemnify any person who was or is a party or is threatened to be made

a party to any threatened, pending or completed action or suit by or in the right of the corporation to procure a judgment in

its favor by reason of the fact that such person acted in any of the capacities set forth above, against expenses (including attorneys’

fees) actually and reasonably incurred by him in connection with the defense or settlement of such action or suit if he acted

in good faith and in a manner he reasonably believed to be in or not opposed to the best interests of the corporation and except

that no indemnification may be made with respect to any claim, issue or matter as to which such person shall have been adjudged

to be liable to the corporation unless and only to the extent that the Court of Chancery or the court in which such action or

suit was brought shall determine upon application that, despite the adjudication of liability but in view of all of the circumstances

of the case, such person is fairly and reasonably entitled to indemnity for such expenses which the Court of Chancery or such

other court shall deem proper.

Section

145 of the DGCL further provides that to the extent a director, officer, employee or agent of a corporation has been successful

on the merits or otherwise in the defense of any action, suit or proceeding referred to in subsections (a) and (b) or in the defense

of any claim, issue or matter therein, he shall be indemnified against expenses (including attorneys’ fees) actually and

reasonably incurred by him in connection therewith; that indemnification or advancement of expenses provided for by Section 145

shall not be deemed exclusive of any other rights to which the indemnified party may be entitled; and empowers the corporation

to purchase and maintain insurance on behalf of a director, officer, employee or agent of the corporation against any liability

asserted against him or incurred by him in any such capacity or arising out of his status as such whether or not the corporation

would have the power to indemnify him against such liabilities under Section 145.

Reference

is also made to Section 102(b)(7) of the DGCL, which enables a corporation in its certificate of incorporation to eliminate or

limit the personal liability of a director for monetary damages for violations of a director’s fiduciary duty, except for

liability (i) for any breach of the director’s duty of loyalty to the corporation or its stockholders, (ii) for acts or

omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii) under Section 174 of

the DGCL (providing for liability of directors for unlawful payment of dividends or unlawful stock purchases or redemptions) or

(iv) for any transaction from which the director derived an improper personal benefit. Pursuant to Delaware law, this includes

elimination of liability for monetary damages for breach of the directors’ fiduciary duty of care to the Company and its

stockholders. However, our directors may be personally liable for liability:

|

|

●

|

for any breach of duty of loyalty

to us or to our stockholders;

|

|

|

|

|

|

|

●

|

for acts or omissions not in good

faith or that involve intentional misconduct or a knowing violation of law;

|

|

|

|

|

|

|

●

|

for unlawful payment of dividends

or unlawful stock repurchases or redemptions; or

|

|

|

|

|

|

|

●

|

for any transaction from which the

director derived an improper personal benefit.

|

|

|

|

|

|

In addition, our amended

and restated bylaws provide that:

|

|

|

|

|

|

|

●

|

we are required to indemnify our

directors and executive officers to the fullest extent not prohibited by Delaware law or any other applicable law, subject

to limited exceptions;

|

|

|

|

|

|

|

●

|

we may indemnify our other officers,

employees and other agents as set forth in Delaware law or any other applicable law;

|

|

|

|

|

|

|

●

|

we are required to advance expenses

to our directors and executive officers as incurred in connection with legal proceedings against them for which they may be

indemnified; and

|

|

|

|

|

|

|

●

|

the rights conferred in the amended

and restated bylaws are not exclusive.

|

Our

Restated Certificate of Incorporation and Restated Bylaws include provisions that indemnify, to the fullest extent allowable under

the DGCL, the personal liability of directors or officers for monetary damages for actions taken as a director or officer of us,

or for serving at our request as a director or officer or another position at another corporation or enterprise, as the case may

be. Our Restated Certificate of Incorporation and Restated Bylaws also provide that we must indemnify and advance reasonable expenses

to our directors and officers, subject to our receipt of an undertaking from the indemnified party as may be required under the

DGCL. Our Restated Certificate of Incorporation expressly authorize us to carry directors’ and officers’ insurance

to protect us, our directors, officers and certain employees for some liabilities. The limitation of liability and indemnification

provisions in our Restated Certificate of Incorporation and Restated Bylaws may discourage stockholders from bringing a lawsuit

against directors for breach of their fiduciary duty. These provisions may also have the effect of reducing the likelihood of

derivative litigation against our directors and officers, even though such an action, if successful, might otherwise benefit us

and our stockholders. However, these provisions do not limit or eliminate our rights, or those of any stockholder, to seek non-monetary

relief such as injunction or rescission in the event of a breach of a director’s duty of care. The provisions will not alter

the liability of directors under the federal securities laws. In addition, your investment may be adversely affected to the extent

that, in a class action or direct suit, we pay the costs of settlement and damage awards against directors and officers pursuant

to these indemnification provisions. There is currently no pending material litigation or proceeding against any of our directors,

officers or employees for which indemnification is sought.

Item

16. Exhibits.

|

Exhibit

|

|

|

|

Number

|

|

Description

of Document

|

|

|

|

|

|

1.1

|

|

Form

of Underwriting Agreement.*

|

|

|

|

|

|

4.1

|

|

Restated

Certificate of Incorporation (incorporated by reference to Exhibit 3.1 to our Quarterly Report on Form 10-Q filed on September

15, 2014).

|

|

|

|

|

|

4.2

|

|

Restated

Bylaws (incorporated by reference to Exhibit 3.1 to our Current Report on Form 8-K filed on June 17, 2005).

|

|

|

|

|

|

4.3

|

|

Certificate

of Designations, Preferences and Rights of the 0% Series A Convertible Preferred Stock of Majesco Entertainment Company (incorporated

by reference to Exhibit 4.1 to our Current Report on Form 8-K filed on December 18, 2014)

|

|

|

|

|

|

4.4

|

|

Certificate

of Designations, Preferences and Rights of the 0% Series B Convertible Preferred Stock of Majesco Entertainment Company (incorporated

by reference to Exhibit 4.1 to our Current Report on Form 8-K filed on April 30, 2015)

|

|

|

|

|

|

4.5

|

|

Certificate

of Designations, Preferences and Rights of the 0% Series C Convertible Preferred Stock of Majesco Entertainment Company (incorporated

by reference to Exhibit 4.4 to our Current Report on Form 8-K filed on June 9, 2015)

|

|

|

|

|

|

4.6

|

|

Certificate

of Designations, Preferences and Rights for 0% Series D Convertible Preferred Stock (incorporated by reference to Exhibit

4.1 to our Current Report on Form 8-K filed on October 20, 2015)

|

|

|

|

|

|

4.7

|

|

Certificate

of Amendment to Restated Certificate of Incorporation (incorporated by reference to Exhibit 3.1 to our Form 8-K filed with

the Commission on July 29, 2016)

|

|

|

|

|

|

4.8

|

|

Form

of Certificate of Designation of Series E Convertible Preferred Stock (incorporated by reference to Exhibit 3.1 to our Form

8-K filed with the Commission on December 7, 2016)

|

|

|

|

|

|

4.9

|

|

Certificate

of Amendment to Restated Certificate of Incorporation (incorporated by reference to Exhibit 3.1 to our Form 8-K filed with

the Commission on January 10, 2017

|

|

|

|

|

|

4.10

|

|

Form

of Certificate of Designation.*

|

|

|

|

|

|

4.11

|

|

Form

of Preferred Stock Certificate.*

|

|

|

|

|

|

4.12

|

|

Form

of Warrant Agreement.*

|

|

|

|

|

|

4.13

|

|

Form

of Warrant Certificate.*

|

|

|

|

|

|

4.14

|

|

Form

of Stock Purchase Agreement.*

|

|

|

|

|

|

4.15

|

|

Form

of Unit Agreement.*

|

|

|

|

|

|

5.1

|

|

Opinion

of Sichenzia Ross Ference Kesner LLP

|

|

|

|

|

|

23.1

|

|

Consent

of EisnerAmper LLP

|

|

|

|

|

|

23.2

|

|

Consent

of Sichenzia Ross Ference Kesner LLP (contained in Exhibit 5.1).

|

|

*

|

To

be filed by amendment or by a Current Report on Form 8-K and incorporated by reference herein.

|

Item

17. Undertakings

(a)

The undersigned registrant hereby undertakes:

(1)

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i)

To include any prospectus required by section 10(a)(3) of the Securities Act of 1933;

(ii)

To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent

post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set

forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if

the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high

end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule

424(b) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering

price set forth in the “Calculation of Registration Fee” table in the effective registration statement.

(iii)

To include any material information with respect to the plan of distribution not previously disclosed in the registration statement

or any material change to such information in the registration statement;

provided,

however

, Paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) of this section do not apply if the registration statement is on

Form S-3 or Form F-3 and the information required to be included in a post-effective amendment by those paragraphs is contained

in reports filed with or furnished to the Commission by the registrant pursuant to section 13 or section 15(d) of the Securities

Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus

filed pursuant to Rule 424(b) that is part of the registration statement.

(2)

That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall

be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at

that time shall be deemed to be the initial bona fide offering thereof.

(3)

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold

at the termination of the offering.

(4)

That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

(A)

Each prospectus filed by the registrant pursuant to Rule 424(b)(3)shall be deemed to be part of the registration statement as

of the date the filed prospectus was deemed part of and included in the registration statement; and

(B)

Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance

on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information

required by section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement

as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale

of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and

any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement

relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities

at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration

statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by

reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with

a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement

or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date;

or (5) That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the

initial distribution of the securities, the undersigned registrant undertakes that in a primary offering of securities of the

undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities

to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the

undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i)

Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant

to Rule 424;

(ii)

Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred

to by the undersigned registrant;

(iii)

The portion of any other free writing prospectus relating to the offering containing material information about the undersigned

registrant or its securities provided by or on behalf of the undersigned registrant; and

(iv)

Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

(b)

The registrant hereby undertakes that for purposes of determining any liability under the Securities Act of 1933, each filing

of the registrant’s annual report pursuant to section 13(a) or section 15(d) of the Securities Exchange Act of 1934 (and,

where applicable, each filing of an employee benefit plan’s annual report pursuant to section 15(d) of the Securities Exchange

Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement

relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial

bona fide offering thereof.

(c)

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and

controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that

in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act

and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment

by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful

defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the

securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling

precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy

as expressed in the Act and will be governed by the final adjudication of such issue.

(d)

The registrant hereby undertakes that:

(1)

For purposes of determining any liability under the Securities Act, the information omitted from the form of prospectus filed

as part of this registration statement in reliance upon Rule 430A and contained in a form of prospectus filed by the registrant

pursuant to Rule 424(b)(1) or (4) or 497(h) under the Securities Act shall be deemed to be part of this registration statement

as of the time it was declared effective.

(2)

For the purpose of determining any liability under the Securities Act, each post-effective amendment that contains a form of prospectus

shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities

at that time shall be deemed to be the initial bona fide offering thereof.

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it

meets all of the requirements for fling on Form S-3 and has duly caused this registration statement to be signed on its behalf

by the undersigned, thereunto duly authorized, in the City of South Plainfield, State of New Jersey, on July 7, 2017.

|

|

POLARITYTE,

INC.

|

|

|

|

|

|

|

By:

|

/s/

Denver Lough

|

|

|

|

Denver

Lough

|

|

|

|

Chief

Executive Officer (Principal Executive Officer)

|

|

|

By:

|

/s/

John Stetson

|

|

|

|

John

Stetson

|

|

|

|

Chief

Financial Officer (Principal Financial and Accounting Officer)

|

Each

person whose signature appears below constitutes and appoints Denver Lough and John Stetson, and each of them severally, as his

true and lawful attorney in fact and agent, with full powers of substitution and resubstitution, for him and in his name, place

and stead, in any and all capacities, to sign any or all amendments (including post effective amendments) to the Registration

Statement, and to sign any registration statement for the same offering covered by this Registration Statement that is to be effective

upon filing pursuant to Rule 462(b) under the Securities Act of 1933, as amended, and all post effective amendments thereto, and

to file the same, with all exhibits thereto, and all documents in connection therewith, with the Securities and Exchange Commission,

granting unto said attorney-in-fact and agent, each acting alone, full power and authority to do and perform each and every act

and thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as he or she might

or could do in person, hereby ratifying and confirming all that said attorney-in-fact and agent, each acting alone, or his or

her substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant

to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the

capacities held on the dates indicated.

|