As filed with the Securities and Exchange Commission on June 23, 2017

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

PETMED EXPRESS, INC.

(Exact name of registrant as specified in its charter)

|

Florida

|

65-0680967

|

|

(State or other jurisdiction of incorporation or organization)

|

(I. R. S. Employer Identification No.)

|

420 South Congress Avenue

Delray

Beach, Florida 33

445

(Address, including zip code, of Principal Executive Offices)

2016 Employee Equity Compensation Restricted Stock Plan

2015 Outside Director Equity Compensation Restricted Stock Plan

(Full title of the plan)

Bruce S. Rosenbloom

Chief

Financial

Officer

PetMed Express, Inc.

420 South Congress Avenue

Delray

Beach, Florida 33

445

(

561

)

526

-

4444

(Name, address and telephone number, including area code, of agent for service)

Copy to:

Roxanne K. Beilly

Roxanne K. Beilly, P.A.

907 E 7

th

Street

Fort Lauderdale, Florida 33301

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer", "smaller reporting company" and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

[ ]

|

Accelerated filer

|

[√]

|

|

Non-accelerated filer

Emerging growth company [ ]

|

[ ]

|

Smaller reporting company

|

[ ]

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. [ ]

CALCULATION OF REGISTRATION FEE

|

Title of securities to be registered

|

|

Amount to be

registered (1)

|

|

|

Proposed

maximum

offering

price per

share (2)

|

|

|

Proposed

maximum

aggregate

offering

price (2)

|

|

|

Amount of

registration

fee (

6

)

|

|

|

Common Stock, par value $0.001 per share (3)

|

|

|

1,000,000

|

|

|

$

|

38.52

|

|

|

$

|

38,520,000

|

|

|

$

|

4,464.47

|

|

|

Common Stock, par value $0.001 per share (4)

|

|

|

451,000

|

|

|

$

|

38.52

|

|

|

$

|

17,372,520

|

|

|

$

|

2,013.48

|

|

|

Common Stock, par value $0.001 per share (5)

|

|

|

30,000

|

|

|

$

|

38.52

|

|

|

$

|

1,155,600

|

|

|

$

|

133.93

|

|

|

Total

|

|

|

1,481,000

|

|

|

|

|

|

|

$

|

57,048,120

|

|

|

$

|

6,611.88

|

|

(1) Pursuant to Rule 416(a), this registration statement shall also cover any additional shares of common stock which become issuable under our PetMed Express, Inc. 2016 Employee Equity Compensation Restricted Stock Plan and PetMed Express, Inc. 2015 Outside Director Equity Compensation Restricted Stock Plan by reason of any stock dividend, stock split, recapitalization or other similar transaction effected without the receipt of consideration which results in an increase in the number of outstanding shares of our common stock.

(2) Estimated in accordance with Rules 457 solely for the purpose of calculating the registration fee based on the average of the high and low prices of the Registrant’s common stock as reported on the NASDAQ Global Select Market on June 20, 2017.

(3) Represents shares available for awards that may be granted under the PetMed Express, Inc. 2016 Employee Equity Compensation Restricted Stock Plan.

(4) Represents shares available for awards that may be granted under the PetMed Express, Inc. 2015 Outside Director Equity Compensation Restricted Stock Plan.

(5) Represents shares granted under the PetMed Express, Inc. 2015 Outside Director Equity Compensation Restricted Stock Plan.

(6) Pursuant to Rule 429 of the Securities Act of 1933, as amended, the reoffer prospectus included herein also relates to (a) 234,667 shares of common stock included in the registration statement on Form S-8, File No. 333-145179, relating to the Company’s Amended and Restated PetMed Express, Inc. 2006 Employee Equity Compensation Restricted Stock Plan; and (b) 174,500 shares of common stock included in the registration statement on Form S-8, File No. 333-145180, relating to the Company’s Amended and Restated PetMed Express, Inc. 2006 Outside Director Equity Compensation Restricted Stock Plan. The filing fees in connection with the above referenced registration statements were previously paid at the time of filing, based on the then applicable fees.

Explanatory Note

This registration statement on Form S-8 (“Registration Statement”) of PetMed Express, Inc. (the “Company”), relates to two separate prospectuses for the registration of (1) 1,000,000 shares of the Company’s common stock which may be issued from time to time to participants under our PetMed Express, Inc. 2016 Employee Equity Compensation Restricted Stock Plan (the “2016 Employee Plan”) and 451,000 shares of the Company’s common stock which may be issued from time to time to participants under our PetMed Express, Inc. 2015 Outside Director Equity Compensation Restricted Stock Plan (the “2015 Director Plan”), and (2) 439,167 shares of the Company’s common stock for re-offer and/or re-sale by the individuals listed under the Selling Security Holder section of the re-offer prospectus under our 2015 Director Plan as well as our PetMed Express, Inc. 2006 Employee Equity Compensation Restricted Stock Plan, as amended and restated effective July 27, 2012 (the “2006 Employee Plan”) and our PetMed Express, Inc. 2006 Outside Director Equity Compensation Restricted Stock Plan, as amended and restated effective July 27, 2012 (the “2006 Director Plan”).

Section 10(a) Prospectus: Items 1 and 2 of Part I of this Registration Statement, and the documents incorporated by reference pursuant to Part II, Item 3 of this Registration Statement, constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act of 1933, as amended (the “Securities Act”).

Reoffer Prospectus: The material that follows Item 2, up to but not including Part II of this Registration Statement, of which the reoffer prospectus is a part, constitutes a “reoffer prospectus,” prepared in accordance with the requirements of Part I of Form S-3 under the Securities Act. Pursuant to Instruction C of Form S-8, the reoffer prospectus may be used for reoffers or resales of common shares that are acquired by the selling security holders named in the reoffer prospectus and deemed to be “control securities” under the Securities Act. The reoffer prospectus does not contain all of the information included in this Registration Statement, certain items of which are contained in exhibits to this Registration Statement as permitted by the rules and regulations of the Securities and Exchange Commission. Statements contained in the reoffer prospectus as to the contents of any agreement, instrument or other document referred to are not necessarily complete. With respect to each such agreement, instrument or other document filed as an exhibit to this Registration Statement, we refer you to the exhibit for a more complete description of the matter involved, and each such statement shall be deemed qualified in its entirety by this reference.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

Item 1. Plan Information

The document(s) containing the information specified in Item 1 of this Registration Statement will be sent or given to participants in the PetMed Express, Inc. 2016 Employee Equity Compensation Restricted Stock Plan and PetMed Express, Inc. 2015 Outside Director Equity Compensation Restricted Stock Plan as specified in Rule 428(b)(1) of the Securities Act. Such documents are not required to be and are not filed with the Securities and Exchange Commission either as part of this Registration Statement or as prospectuses or prospectus supplements pursuant to Rule 424 of the Securities Act. These documents and the documents incorporated by reference in this Registration Statement pursuant to Item 3 of Part II of this Registration Statement, taken together, constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act.

Item 2. Registrant Information and Employee Plan Annual Information

The Company will furnish without charge to each person to whom the prospectus is delivered, upon the written or oral request of such person, a copy of any and all of the documents incorporated by reference in Item 3 of Part II of this Registration Statement, other than exhibits to such documents (unless such exhibits are specifically incorporated by reference to the information that is incorporated). Those documents are incorporated by reference in the Section 10(a) prospectus. The Company will also furnish without charge to each person to whom the prospectus is delivered, upon the written or oral request of such person, a copy of other documents required to be delivered to employees pursuant to Rule 428(b). Requests should be directed to PetMed Express, Inc., Attention: Bruce Rosenbloom, Chief Financial Officer, at 420 South Congress Ave.,

Delray Beach, Florida 33445, telephone number (561) 526-4444.

REOFFER PROSPECTUS

PetMed Express, Inc.

439,167

Shares of Common Stock

This reoffer prospectus relates to the reoffer and resale of up to 439,167 shares of common stock, par value $0.001 per share of PetMed Express, Inc. (“we”, “us”, our”, “PetMed” or the “Company”) which may be offered for sale from time to time by the selling security holders (“Selling Security Holders”) as described below under the section entitled “Selling Security Holders.” The shares of common stock were acquired by the Selling Security Holders pursuant to the following Company benefit plans: the PetMed Express, Inc. 2016 Employee Equity Compensation Restricted Stock Plan (the “2016 Employee Plan”), the PetMed Express, Inc. 2015 Outside Director Equity Compensation Restricted Stock Plan (the “2015 Director Plan”), the PetMed Express, Inc. 2006 Employee Equity Compensation Restricted Stock Plan, as amended and restated effective July 27, 2012 (the “2006 Employee Plan”) and the PetMed Express, Inc. 2006 Outside Director Equity Compensation Restricted Stock Plan, as amended and restated effective July 27, 2012 (the “2006 Director Plan”, and collectively with the 2016 Employee Plan, the 2015 Director Plan and the 2006 Employee Plan, the “Plans”). We will not receive any proceeds from the sale of shares of common stock by the Selling Security Holders pursuant to this reoffer prospectus. These Selling Security Holders may resell all, a portion, or none of the shares of common stock to which this reoffer prospectus relates from time to time. The names of persons selling shares under this reoffer prospectus and the amount of such shares are set forth below under the section entitled “Selling Security Holders” to the extent we presently have such information. However, other affiliate Selling Security Holders may elect to sell shares under this reoffer prospectus as they receive them from time to time in the future or the Selling Security Holders described below under the section entitles “Selling Security Holders” may receive additional shares from time to time in the future and elect to sell the additional shares under this reoffer prospectus as they receive them in which case, as the amounts of shares to be reoffered, and names of other affiliate Selling Security Holders become known, we will supplement this reoffer prospectus with that information. Any securities covered by this reoffer prospectus which qualify for sale pursuant to Rule 144 may be sold under Rule 144 rather than pursuant to this reoffer prospectus. See “Selling Security Holders” beginning on page 13.

This reoffer prospectus has been prepared for the purpose of registering the shares of common stock under the Securities Act of 1933, as amended (the “Securities Act”) to allow for future sales by the Selling Security Holders, on a continuous or delayed basis, to the public without restriction. The registration of the common stock by the Selling Security Holders does not necessarily mean that the Selling Security Holders will offer or sell their respective shares. Each Selling Security Holder that sells shares of our common stock pursuant to this reoffer prospectus may be deemed to be an “underwriter” within the meaning of the Securities Act. Any commissions received by a broker or dealer in connection with resales of shares may be deemed to be underwriting commissions or discounts under the Securities Act.

You should carefully read this reoffer prospectus, including the information it incorporates by reference, and any accompanying prospectus supplement before making a decision to purchase shares of common stock from the Selling Security Holders. The shares of common stock registered hereby may be sold from time to time directly by, or through agents or broker-dealers acting as agents on behalf of, each of the Selling Security Holders in one or more transactions on the NASDAQ Global Select Market or on any stock exchange on which our common stock may be listed at the time of sale, in privately negotiated transactions, or through a combination of such methods, at market prices prevailing at the time of sale, at prices related to such prevailing market prices, at fixed prices (which may be changed) or at negotiated prices. We are paying the expenses incurred in registering the shares of common stock, but all selling and other expenses incurred by each Selling Security Holders will be borne by that Selling Security Holder. See “Plan of Distribution” beginning on page 15.

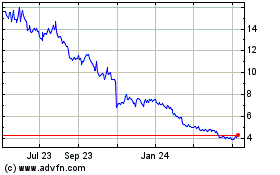

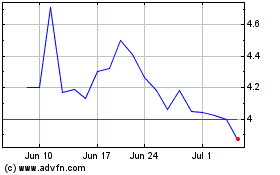

Our common stock is quoted on the NASDAQ Global Select Market under the symbol “PETS”. On June 20, 2017, the last reported sale price of our common stock was $38.79.

____________________

Investing in our common stock involves a high degree of risk. Before you make your investment decision, please read carefully the “RISK FACTORS” section beginning

on page

6

, where

specific risks associated with these securities are described.

____________________

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of the disclosures in this prospectus. Any representation to the contrary is a criminal offense.

This reoffer Prospectus does not constitute an offer to sell securities in any state to any person to whom it is unlawful to make such offer in such state.

The date of this prospectus is June 23, 2017.

TABLE OF CONTENTS

|

|

Page

No.

|

|

Prospectus Summary

|

4

|

|

Our Company

|

4

|

|

Cautionary Statement Regarding Forward-Looking Statements

|

5

|

|

Risk Factors

|

6

|

|

Use of Proceeds

|

13

|

|

Selling Security Holders

|

13

|

|

Plan of Distribution

|

15

|

|

Legal Matters

|

17

|

|

Experts

|

17

|

|

Indemnification

|

17

|

|

Where You Can Find More Information

|

17

|

|

Incorporation of Certain Documents by Reference

|

18

|

PROSPECTUS SUMMARY

This summary highlights important information about our business and about this reoffering. It does not include all information that is important to you in making a decision to purchase shares of common stock. For a more complete understanding of our business and the reoffering, you should read this entire reoffer prospectus, including the section entitled “Risk Factors” herein, our consolidated financial statements and the related notes thereto incorporated by reference into this reoffer prospectus, and all information incorporated by reference in this reoffer prospectus.

In this reoffer prospectus, unless otherwise stated or the context otherwise requires, references to “PetMed Express, Inc.,” “the Registrant,” “the Company,” “we,” “us,” and “our” refer to PetMed Express, Inc. and its subsidiaries on a consolidated basis.

Alternatively, the term “you” refers to a prospective purchaser of any shares of common stock.

OUR COMPANY

General

PetMed Express, Inc. and subsidiaries, d/b/a 1-800-PetMeds, is a leading nationwide pet pharmacy. The Company markets prescription and non-prescription pet medications, and other health products for dogs and cats, direct to the consumer. The Company offers consumers an attractive alternative for obtaining pet medications in terms of convenience, price, and speed of delivery.

The Company markets its products through national advertising campaigns, which aim to increase the recognition of the “1-800-PetMeds” brand name, and “PetMeds” family of trademarks, increase traffic on its website at

www.1800petmeds.com

, acquire new customers, and maximize repeat purchases. Approximately 83% of all sales were generated via the Internet in fiscal 2017, compared to 81% in fiscal 2016. The Company’s sales consist of products sold mainly to retail consumers. The twelve-month average purchase was approximately $83 and $81 per order for the fiscal years ended March 31, 2017 and 2016, respectively.

Our fiscal year end is March 31, our executive offices are currently located at 420 South Congress Avenue, Delray Beach, Florida 33445, and our telephone number is (561) 526-4444. Our corporate website address is

www.1800petmeds.com

. The information on or accessible through our website is not incorporated by reference in this reoffer prospectus and you should not consider it to be a part of this reoffer prospectus.

Our Products

We offer a broad selection of products for dogs and cats. Our current product line contains approximately 3,000 SKUs of the most popular pet medications, health products, and supplies. These products include a majority of the well-known brands of medication. Generally, our prices are competitive with the prices for medications charged by veterinarians and retailers. In March 2010, we started offering for sale additional pet supplies on our website, which are drop shipped to our customers by third parties. These pet supplies include: food, beds, crates, stairs, strollers, and other popular pet supplies.

We research new products, and regularly select new products or the latest generation of existing products to become part of our product selection. In addition, we also refine our current products to respond to changing consumer-purchasing habits. Our website is designed to give us the flexibility to change featured products or promotions. Our product line provides customers with a wide variety of selections across the most popular health categories for dogs and cats. Our current products include:

Non-Prescription Medications (OTC) and supplies: Flea and tick control products, bone and joint care products, vitamins, treats, nutritional supplements, hygiene products, and supplies.

Prescription Medications (Rx): Heartworm and flea and tick preventatives, arthritis, thyroid, diabetes, pain medications, antibiotics, and other specialty medications, as well as generic substitutes.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain information included or incorporated by reference in this reoffer prospectus contains “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. Forward-looking statements are not based on historical facts, but rather reflect our current expectations, estimates and predictions about future results and events. These forward-looking statements may be identified by the use of words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “predict,” “project” and similar expressions as they relate to our Company or our management. In particular, certain statements included or incorporated by reference in this reoffer prospectus, including, but not limited to, those relating to our possible future results of operations, business and growth strategies, financing plans, anticipated cash requirements, regulatory developments, competitive position and the effects of competition, the industry in which we operate, and statements of management’s goals and objectives, and other similar expressions concerning matters that are not historical facts, are forward-looking statements.

We base our forward-looking statements on management’s beliefs and assumptions, using information currently available to it. Any forward-looking statements are not guarantees of future performance and are subject to known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to differ materially from any future results, performance and achievements expressed or implied by these statements. The risk factors described in the “Risk Factors” section of this reoffer prospectus and in documents incorporated by reference in this reoffer prospectus, are only certain, but not all, of the factors that could cause future results to differ materially from those expressed in our forward-looking statements. We do not intend, and undertake no obligation, to update our forward-looking statements to reflect future events or circumstances. Any forward-looking statements contained in or incorporated by reference in this reoffer prospectus reflect our current views with respect to future events and are subject to these and other risks, uncertainties and assumptions relating to our operations, results of operations, growth strategy and liquidity.

RISK FACTORS

An investment in our common stock involves a significant degree of risk. You should not invest in our common stock unless you can afford to lose your entire investment. You should consider carefully the following risk factors and other information in this

reoffer

prospectus before deciding to invest in our common stock.

We may inadvertently fail to comply with various state or federal regulations covering the dispensing of prescription pet medications which may subject us to reprimands, sanctions, probations, fines, suspensions, or the loss of one or more of our pharmacy licenses.

The sale and delivery of prescription pet medications is generally governed by state laws and state regulations, and with respect to controlled substances, by federal law. Since our pharmacy is located in the State of Florida, the Company is governed by the laws and regulations of the State of Florida. Each prescription pet medication sale we make is likely also to be covered by the laws of the state where the customer is located. The laws and regulations relating to the sale and delivery of prescription pet medications vary from state to state, but generally require that prescription pet medications be dispensed with the authorization from a prescribing veterinarian. To the extent that we are unable to maintain our license as a community pharmacy with the Florida Board of Pharmacy, or if we do not maintain the licenses granted by other state boards, or if we become subject to actions by the FDA, or other enforcement regulators, our dispensing of prescription medications to pet owners could cease, which could have a material adverse effect on our operations.

The Company is a party to routine litigation and administrative complaints incidental to its business. Management does not believe that the resolution of any or all of such routine litigation and administrative complaints is likely to have a material adverse effect on the Company’s financial condition or results of operations. While we make every effort to fully comply with all applicable state rules, laws, and regulations, from time to time we have been the subject of administrative complaints regarding the authorization of prescriptions prior to shipment. We cannot assure you that we will not continue to be the subject of administrative complaints in the future. We cannot guarantee you that we will not be subject to reprimands, sanctions, probations, or fines, or that one or more of our pharmacy licenses will not be suspended or revoked. If we were unable to maintain our license as a community pharmacy in the State of Florida, or if we are not granted licensure in a state that begins to require licensure, or if one or more of the licenses granted by other state boards should be suspended or revoked, our ability to continue to sell prescription medications and to continue our business as it is presently conducted could be in jeopardy.

We currently purchase a portion of our prescription and non-prescription medications from third party distributors and we are not an authorized distributor of these products. We do not have any guaranteed supply of medications at any pre-established prices.

The majority of our sales were attributable to sales of prescription and non-prescription medications. Historically, many of the major pharmaceutical manufacturers have declined to sell prescription and non-prescription pet medications directly to us. In order to assure a supply of these products, we purchase medications from various secondary sources, including a variety of domestic distributors. Our business strategy includes seeking to establish direct purchasing arrangements with major pet pharmaceutical manufacturing companies. If we are not successful in achieving this goal, we will continue to rely upon secondary sources. We cannot guarantee that if we continue to purchase prescription and non-prescription pet medications from secondary sources that we will be able to purchase an adequate supply to meet our customers’ demands, or that we will be able to purchase these products at competitive prices. As these products represent a significant portion of our sales, our failure to fill customer orders for these products could adversely impact our sales. If we are forced to pay higher prices for these products to ensure an adequate supply, we cannot guarantee that we will be able to pass along to our customers any increases in the prices we pay for these medications. This inability to pass along increased prices could materially adversely affect our gross margins, financial condition and results of operations.

Our failure to properly manage our inventory may result in excessive inventory carrying costs, or inadequate supply of products, which could materially adversely affect our financial condition and results of operations.

Our current product line contains approximately 3,000 SKUs. A significant portion of our sales is attributable to products representing approximately 100 SKUs, including the most popular flea and tick, and heartworm preventative brands. We need to properly manage our inventory to provide an adequate supply of these products and avoid excessive inventory of the products representing the balance of the SKUs. We generally place orders for products with our suppliers based upon our internal estimates of the amounts of inventory we will need to fill future orders. These estimates may be significantly different from the actual orders we receive.

In the event that subsequent orders fall short of original estimates, we may be left with excess inventory. Significant excess inventory could result in price discounts and increased inventory carrying costs. Similarly, if we fail to have an adequate supply of some SKUs, we may lose sales opportunities. We cannot guarantee that we will maintain appropriate inventory levels. Any failure on our part to maintain appropriate inventory levels may have a material adverse effect on our financial condition and results of operations.

Resistance from veterinarians to authorize prescriptions, or attempts/efforts on their part to discourage pet owners from purchasing from internet mail-order pharmacies could cause our sales to decrease and could materially adversely affect our financial condition and results of operations.

Since we began our operations some veterinarians have resisted providing our customers with a copy of their pet’s prescription or authorizing the prescription to our pharmacy staff, thereby effectively preventing us from filling such prescriptions under state law. We have also been informed by customers and consumers that veterinarians have tried to discourage pet owners from purchasing from internet mail-order pharmacies. Although veterinarians in some states are required by law to provide a pet owner with a prescription if medically appropriate, if the number of veterinarians who refuse to authorize prescriptions should increase, or if veterinarians are successful in discouraging pet owners from purchasing from internet mail-order pharmacies, our sales could decrease and our financial condition and results of operations may be materially adversely affected.

Significant portions of our sales are made to residents of eight states. If we should lose our pharmacy license in one or more of these states, our financial condition and results of operations would be materially adversely affected.

While we ship pet medications to customers in all 50 states, approximately 50% of our sales for the fiscal year ended March 31, 2017 were made to customers located in the states of California, Florida, Texas, New York, Pennsylvania, North Carolina, Virginia, and Georgia. If for any reason our license to operate a pharmacy in one or more of those states should be suspended or revoked, or if it is not renewed, our ability to sell prescription medications to residents of those states would cease and our financial condition and results of operations in future periods would be materially adversely affected.

We face significant competition from veterinarians and online and traditional retailers and may not be able to compete profitably with them.

We compete directly and indirectly with veterinarians for the sale of pet medications and other health products. Veterinarians hold a competitive advantage over us because many pet owners may find it more convenient or preferable to purchase these products directly from their veterinarians at the time of an office visit. We also compete directly and indirectly with both online and traditional retailers. Both online and traditional retailers may hold a competitive advantage over us because of longer operating histories, established brand names, greater resources, and/or an established customer base. Online retailers may have a competitive advantage over us because of established affiliate relationships to drive traffic to their website. Traditional retailers may hold a competitive advantage over us because pet owners may prefer to purchase these products from a store instead of online or through catalog or telephone methods. In addition, we face growing competition from online and multichannel retailers, some of whom may have a lower cost structure than ours, as customers now routinely use computers, tablets, smartphones, and other mobile devices and mobile applications to shop online and compare prices and products in real time. In order to effectively compete in the future, we may be required to offer promotions and other incentives, which may result in lower operating margins and adversely affect the results of operations. We also face a significant challenge from our competitors forming alliances with each other, such as those between online and traditional retailers. These relationships may enable both their retail and online stores to negotiate better pricing and better terms from suppliers by aggregating the demand for products and negotiating volume discounts, which could be a competitive disadvantage to us.

The content of our website could expose us to various kinds of liability, which, if prosecuted successfully, could negatively impact our business.

Because we post product and pet health information and other content on our website, we face potential liability for negligence, copyright infringement, patent infringement, trademark infringement, defamation, and/or other claims based on the nature and content of the materials we post. Various claims have been brought, and sometimes successfully prosecuted, against Internet content distributors. We could be exposed to liability with respect to the unauthorized duplication of content or unauthorized use of other parties’ proprietary technology. Although we maintain general liability insurance, our insurance may not cover potential claims of this type, or may not be adequate to indemnify us for all liability that may be imposed. Any imposition of liability that is not covered by insurance, or is in excess of insurance coverage, could materially adversely affect our financial condition and results of operations.

We may not be able to protect our intellectual property rights, and/or we may be found to infringe on the proprietary rights of others.

We rely on a combination of trademarks, trade secrets, copyright laws, and contractual restrictions to protect our intellectual property rights. These afford only limited protection. Despite our efforts to protect our proprietary rights, unauthorized parties may attempt to copy our non-prescription private label or generic equivalents, when and if developed, as well as aspects of our sales formats, or to obtain and use information that we regard as proprietary, including the technology used to operate our website and our content, and our trademarks. Litigation or proceedings before the United States Patent and Trademark Office or other bodies may be necessary in the future to enforce our intellectual property rights, to protect our trade secrets and domain names, or to determine the validity and scope of the proprietary rights of others. Any litigation or adverse proceeding could result in substantial costs and diversion of resources, and could seriously harm our business and operating results. Third parties may also claim infringement by us with respect to past, current, or future technologies. We expect that participants in our market will be increasingly involved in infringement claims as the number of services and competitors in our industry segment grows. Any claim, whether meritorious or not, could be time-consuming, result in costly litigation, cause service upgrade delays, or require us to enter into royalty or licensing agreements. These royalty or licensing agreements might not be available on terms acceptable to us or at all.

If we are unable to protect our Internet addresses or to prevent others from using Internet addresses that are confusingly similar, our business may be adversely impacted.

Our Internet addresses,

www.1800petmeds.com

,

www.1888petmeds.com

,

www.petmedexpress.com

,

www.petmed.com

,

www.petmeds.com

,

www.petmeds.pharmacy

, and

www.1800petmeds.pharmacy

, are critical to our brand recognition and our overall success. If we are unable to protect these Internet addresses, our competitors could capitalize on our brand recognition. There may be similar Internet addresses used by competitors. Governmental agencies and their designees generally regulate the acquisition and maintenance of Internet addresses. The regulation of Internet addresses in the United States and in foreign countries has changed, and may undergo further change in the near future. Furthermore, the relationship between regulations governing Internet addresses and laws protecting trademarks and similar proprietary rights is unclear. Therefore, we may not be able to protect our own Internet addresses, or prevent third parties from acquiring Internet addresses that are confusingly similar to, infringe upon, or otherwise decrease the value of our Internet addresses.

Since all of our operations are housed in a single location, we are more susceptible to business interruption in the event of damage to, or disruptions in, our facility.

Our headquarters and distribution center are currently located in one location in South Florida, and most of our shipments of products to our customers are made from this sole distribution center. We have no present plans to establish any additional distribution centers or offices. Because we consolidate our operations in one location, we are more susceptible to power and equipment failures, and business interruptions in the event of fires, floods, and other natural disasters than if we had additional locations. Furthermore, because we are located in South Florida, which is a hurricane-sensitive area, we are particularly susceptible to the risk of damage to, or total destruction of, our headquarters and distribution center and surrounding transportation infrastructure caused by a hurricane. We cannot assure you that we are adequately insured to cover the amount of any losses relating to any of these potential events, business interruptions resulting from damage to or destruction of our headquarters and distribution center, or power and equipment failures relating to our call center or websites, or interruptions or disruptions to major transportation infrastructure, or other events that do not occur on our premises. The occurrence of one or more of these events could adversely impact our ability to generate revenues in future periods.

A failure of our information systems and customer-facing technology systems or any security breach or unauthorized disclosure of confidential information could have a material adverse effect on our business.

Our business is dependent upon the efficient operation of our information systems. In particular, we rely on our information systems to effectively manage our business model strategy, with tools to track and manage sales, inventory, marketing, customer service efforts, the preparation of our consolidated financial and operating data, credit card information, and customer information. The failure of our information systems to perform as designed or the failure to maintain and enhance or protect the integrity of these systems could disrupt our business operations, adversely impact sales and the results of operations, expose us to customer or third-party claims, or result in adverse publicity.

Through our information technology, we are able to provide an improved overall shopping and interconnected retail experience that empowers our customers to shop and interact with us from computers, tablets, smartphones and other mobile devices. We use our websites and our mobile app both as sales channels for our products and also as methods of providing product and other relevant information to our customers to drive online sales. Our online programs, communities and knowledge center allow us to inform, assist and interact with our customers. We also continually seek to enhance all of our online properties to provide an attractive user-friendly interface for our customers, as evidenced by our recent redesign of our website. Disruptions, failures or other performance issues with these customer-facing technology systems could impair the benefits that they provide to our online business and negatively affect our relationship with our customers.

Additionally, we collect, process, and retain sensitive and confidential customer information in the normal course of our business. Despite the security measures we have in place and any additional measures we may implement in the future, our facilities and systems, and those of our third-party service providers, could be vulnerable to security breaches, computer viruses, lost or misplaced data, programming errors, human errors, acts of vandalism, or other events. Any security breach or event resulting in the misappropriation, loss, or other unauthorized disclosure of confidential information, whether by us directly or our third-party service providers, could damage our reputation, expose us to the risks of litigation and liability, disrupt our business, or otherwise affect our results of operations.

Our operating results are difficult to predict and may fluctuate, and a portion of our sales are seasonal.

Factors that may cause our operating results to fluctuate include:

|

|

●

|

Our ability to obtain new customers at a reasonable cost, retain existing customers, or encourage reorders;

|

|

|

●

|

Our ability to increase the number of visitors to our website, or our ability to convert visitors to our website into customers;

|

|

|

●

|

The mix of medications and other pet products sold by us;

|

|

|

●

|

Our ability to manage inventory levels or obtain an adequate supply of products;

|

|

|

●

|

Our ability to adequately maintain, upgrade, and develop our website, the systems that we use to process customers’ orders and payments, or our computer network;

|

|

|

●

|

Increased competition within our market niche;

|

|

|

●

|

Price competition;

|

|

|

●

|

New products introduced to the market, including generics;

|

|

|

●

|

Increases in the cost of advertising;

|

|

|

●

|

The amount and timing of operating costs and capital expenditures relating to expansion of our product line or operations;

|

|

|

●

|

Disruption of our toll-free telephone service, technical difficulties, or systems and Internet outages or slowdowns; and

|

|

|

●

|

Unfavorable general economic trends.

|

Because our operating results are difficult to predict, we believe that quarter-to-quarter comparisons of our operating results are not a good indication of our future performance. The majority of our product sales are affected by the seasons, due to the seasonality of mainly heartworm, and flea and tick medications. For the quarters ended June 30, 2016, September 30, 2016, December 31, 2016, and March 31, 2017, Company sales were 29%, 25%, 21%, and 25%, respectively. In addition to the seasonality of our sales, our annual and quarterly operating results have fluctuated in the past and may fluctuate significantly in the future due to a variety of factors, including weather, many of which are out of our control. Any change in one or more of these factors could materially adversely affect our financial condition and results of operations in future periods.

We are subject to payment-related risks that could increase our operating costs, expose us to fraud or theft, subject us to potential liability and potentially disrupt our business.

We accept payments using a variety of methods, including credit and debit cards, PayPal, and checks, and we may offer new payment options over time. Acceptance of these payment options subjects us to rules, regulations, contractual obligations and compliance requirements, including payment network rules and operating guidelines, data security standards and certification requirements, and rules governing electronic funds transfers. These requirements may change over time or be reinterpreted, making compliance more difficult or costly. For certain payment methods, including credit and debit cards, we pay interchange and other fees, which may increase over time and raise our operating costs. We rely on third parties to provide payment processing services, including the processing of credit cards, debit cards, and other forms of electronic payment. If these companies become unable to provide these services to us, or if their systems are compromised, it could potentially disrupt our business. The payment methods that we offer also subject us to potential fraud and theft by criminals, who are becoming increasingly more sophisticated, seeking to obtain unauthorized access to or exploit weaknesses that may exist in the payment systems. If we fail to comply with applicable rules or requirements for the payment methods we accept, or if payment-related data is compromised due to a breach or misuse of data, we may be liable for costs incurred by payment card issuing banks and other third parties or subject to fines and higher transaction fees, or our ability to accept or facilitate certain types of payments may be impaired. As a result, our business and operating results could be adversely affected.

Our stock price fluctuates from time to time and may fall below expectations of securities analysts and investors, and could subject us to litigation, which may result in you suffering a loss on your investment.

The market price of our common stock may fluctuate significantly in response to a number of factors, many of which are out of our control. These factors include: quarterly variations in operating results; changes in accounting treatments or principles; announcements by us or our competitors of new products and services offerings; significant contracts, acquisitions, or strategic relationships; additions or departures of key personnel; any future sales of our common stock or other securities; stock market price and volume fluctuations of publicly-traded companies; and general political, economic, and market conditions. In some future quarter our operating results may fall below the expectations of securities analysts and investors, which could result in a decrease in the trading price of our common stock. In the past, securities class action litigation has often been brought against a company following periods of volatility in the market price of its securities. We may be the target of similar litigation in the future. Securities litigation could result in substantial costs and divert management's attention and resources, which could seriously harm our business and operating results.

We may issue additional shares of preferred stock that could defer a change of control or dilute the interests of our common stockholders. Our charter documents could defer a takeover effort which could inhibit your ability to receive an acquisition premium for your shares.

Our charter permits our Board of Directors to issue up to 5.0 million shares of preferred stock without stockholder approval. Currently there are 2,500 shares of our Convertible Preferred Stock issued and outstanding. This leaves slightly less than 5.0 million shares of preferred stock available for issuance at the discretion of our Board of Directors. These shares, if issued, could contain dividend, liquidation, conversion, voting, or other rights which could adversely affect the rights of our common stockholders and which could also be utilized, under some circumstances, as a method of discouraging, delaying, or preventing a change in control. Provisions of our articles of incorporation, bylaws and Florida law could make it more difficult for a third party to acquire us, even if many of our stockholders believe it is in their best interest.

USE OF PROCEEDS

The Selling Security Holders are selling all of the shares of common stock covered by this reoffer prospectus for their own account. Accordingly, we will not receive any of the proceeds from the resale of the shares of common stock. We have agreed to bear the expenses relating to the registration of the shares of common stock, other than brokerage commissions and expenses, if any, incurred by a Selling Security Holder which will be borne by that Selling Security Holder.

SELLING SECURITY HOLDERS

This reoffer prospectus relates to shares of common stock that are being registered for reoffer and resale by Selling Security Holders who have received or acquired, or may hereafter receive or acquire, the shares of common stock pursuant to the Plans. The Selling Security Holders may resell all, a portion, or none of the shares of common stock from time to time.

The following table sets forth:

|

|

•

|

the name of each Selling Security Holder and the nature of his position or office with the Company,

|

|

|

•

|

the number of common stock owned beneficially, directly or indirectly, by each Selling Security Holder as of the date of this reoffer prospectus,

|

|

|

•

|

the maximum number of shares of common stock that may be offered by the Selling Security Holders pursuant to this reoffer prospectus, whether or not the Selling Security Holder has any present intention to do so, and

|

|

|

•

|

the number of common stock and the percentage of common stock that would be beneficially owned by each Selling Security Holder assuming the sale of all shares of common stock offered hereby.

|

Information concerning the identities of the Selling Security Holders, the number of shares of common stock that may be sold by each Selling Security Holder and information about the shares of common stock beneficially owned by the Selling Security Holders may from time to time be updated in supplements to this reoffer prospectus, which will be filed with the Securities and Exchange Commission in accordance with Rule 424(b) of the Securities Act if and when necessary. The names of persons selling shares of common stock under this reoffer prospectus and the amount of such shares are set forth below to the extent we presently have such information. However, other Selling Security Holders may elect to sell shares of common stock pursuant to this reoffer prospectus as they receive them from time to time in the future in which case, as their names and amounts of shares of common stock to be reoffered become known, we will supplement this reoffer prospectus with that information.

Information on the shares of common stock offered pursuant to this reoffer prospectus, as listed below, does not necessarily indicate that the Selling Security Holder presently intends to sell any or all of the shares so listed. Because the Selling Security Holders identified in the table may sell some, none or all of the shares of common stock owned by them which are included in this reoffer prospectus, no estimate can be given as to the number of shares of common stock available for resale hereby that will be held by the Selling Security Holders upon termination of the offering made hereby. We have therefore assumed, for the purposes of the following table, that the Selling Security Holders will sell all of the shares of common stock owned by them, which are being offered hereby, but will not sell any other shares of our common stock that they presently own.

The number of shares of common stock included in the figures are included in accordance with Rule 13d-3. Under such rule, beneficial ownership includes any shares of common stock as to which the individual has sole or shared voting power or investment power and also any shares of common stock that the individual has the right to acquire within 60 days of the date of this reoffer prospectus through the exercise of any stock option or other right. Unless otherwise indicated in the footnotes, each person has sole voting and investment power (or shares such powers with his or her spouse) with respect to the shares of common stock shown as beneficially owned. Percentage of beneficial ownership is based on 20,525,107 shares of common stock outstanding as of June 23, 2017.

|

Name and

Relationship of

Selling Security

Holder

|

|

Number of Shares of

Common Stock

Beneficially Owned

as of June 23, 2017

|

|

|

Maximum Number of

Shares of Common

Stock Which may be

Offered Pursuant to

this Offering

|

|

|

Number of Shares of

Common Stock

Beneficially Owned

Assuming Sale of all

Shares Offered

Hereby

|

|

|

Percentage of

Shares of Common

Stock Owned

Assuming Sale of all

Shares Offered

Hereby

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Menderes Akdag,

Chief Executive Officer, President, Director (1)

|

|

|

520,000

|

|

|

|

210,000

|

|

|

|

310,000

|

|

|

|

1.5%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gian M. Fulgoni,

Director (2)

|

|

|

68,400

|

|

|

|

33,000

|

|

|

|

35,400

|

|

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Robert C. Schweitzer, Director, Chairman of the Board (3)

|

|

|

88,334

|

|

|

|

60,500

|

|

|

|

27,834

|

|

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ronald J. Korn,

Director (4)

|

|

|

72,333

|

|

|

|

65,000

|

|

|

|

7,333

|

|

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Frank J. Formica,

Director (5)

|

|

|

46,000

|

|

|

|

46,000

|

|

|

|

-

|

|

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bruce S. Rosenbloom, Chief Financial Officer, Treasurer (6)

|

|

|

25,767

|

|

|

|

24,667

|

|

|

|

1,100

|

|

|

|

*

|

|

|

(*)

|

less than 1% of the issued and outstanding shares.

|

|

|

|

|

(1)

|

Mr. Akdag’s holdings include 210,000 shares issued under the 2006 Employee Plan, which includes 80,000 restricted shares subject to forfeiture in one-half increments before March 16, 2018, and 2019, in the event of termination of employment.

|

|

(2)

|

Mr. Fulgoni’s holdings include 25,500 shares issued under the 2006 Director Plan, which includes 2,500 restricted shares subject to forfeiture before July 25, 2017 and 5,000 restricted shares subject to forfeiture in one-half increments before July 24, 2017 and 2018 in the event of cessation of service as a director, and 7,500 shares issued under the 2015 Director Plan, which are subject to forfeiture in one-third increments before July 29, 2017, 2018, and 2019, in the event of cessation of service as a director.

|

|

(3)

|

Mr. Schweitzer’s holdings include 53,000 shares issued under the 2006 Director Plan, which include 2,500 restricted shares subject to forfeiture before July 25, 2017 and 5,000 restricted shares subject to forfeiture in one-half increments before July 24, 2017 and 2018 in the event of cessation of service as a director, and 7,500 shares issued under the 2015 Director Plan, which are subject to forfeiture in one-third increments before July 29, 2017, 2018, and 2019, in the event of cessation of service as a director.

|

|

(4)

|

Mr. Korn’s holdings include 57,500 shares issued under the 2006 Director Plan, which includes 2,500 restricted shares subject to forfeiture before July 25, 2017 and 5,000 restricted shares subject to forfeiture in one-half increments before July 24, 2017 and 2018 in the event of cessation of service as a director, and 7,500 shares issued under the 2015 Director Plan, which are subject to forfeiture in one-third increments before July 29, 2017, 2018, and 2019, in the event of cessation of service as a director.

|

|

(5)

|

Mr. Formica’s holdings include 38,500 shares issued under the 2006 Director Plan, which includes 2,500 restricted shares subject to forfeiture before July 25, 2017 and 5,000 restricted shares subject to forfeiture in one-half increments before July 24, 2017 and 2018 in the event of cessation of service as a director, and 7,500 shares issued under the 2015 Director Plan, which are subject to forfeiture in one-third increments before July 29, 2017, 2018, and 2019, in the event of cessation of service as a director.

|

|

(6)

|

Mr. Rosenbloom’s holdings include 24,667 shares issued under the 2006 Employee Plan, which includes 3,334 restricted shares subject to forfeiture before July 25, 2017, 6,667 restricted shares subject to forfeiture in one-half increments before July 24, 2017, and 2018, and 10,500 restricted shares subject to forfeiture in one-third increments before July 22, 2017, 2018, and 2019, in the event of termination of employment.

|

PLAN OF DISTRIBUTION

The Selling Security Holders and any of their pledgees, donees, transferees, assignees and successors-in-interest may, from time to time, sell any or all of their shares of common stock on any stock exchange, market or trading facility on which the shares of common stock are traded or in private transactions. These sales may be at fixed or negotiated prices. The Selling Security Holders may use any one or more of the following methods when selling the shares of common stock:

|

|

•

|

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits investors;

|

|

|

|

|

|

|

|

•

|

|

block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

|

|

|

|

|

•

|

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

|

|

|

|

|

•

|

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

|

|

|

|

|

|

|

•

|

|

privately negotiated transactions;

|

|

|

|

|

|

|

|

•

|

|

to cover short sales;

|

|

|

|

|

|

|

|

•

|

|

broker-dealers may agree with the Selling Security Holders to sell a specified number of such shares of common stock at a stipulated price per share;

|

|

|

|

|

|

|

|

•

|

|

a combination of any such methods of sale; and

|

|

|

|

|

|

|

|

•

|

|

any other method permitted pursuant to applicable law.

|

The Selling Security Holders may also sell shares under Rule 144 adopted under the Securities Act, if available, rather than under this reoffer prospectus.

Unless otherwise prohibited, the Selling Security Holders may enter into hedging transactions with broker-dealers or other financial institutions in connection with distributions of the shares of common stock or otherwise. In such transactions, broker- dealers or financial institutions may engage in short sales of the shares in the course of hedging the position they assume with a Selling Security Holder. The Selling Security Holders may also engage in short sales, puts and calls, forward-exchange contracts, collars and other transactions in our securities and may sell or deliver shares of common stock in connection with these trades. If a Selling Security Holder sells shares short, he or she may redeliver the shares to close out such short positions. The Selling Security Holders may also enter into option or other transactions with broker-dealers or financial institutions which require the delivery to the broker-dealer or the financial institution of the shares. The broker-dealer or financial institution may then resell or otherwise transfer such shares of common stock pursuant to this reoffer prospectus. In addition, the Selling Security Holder may loan his or her shares to broker-dealers or financial institutions who are counterparties to hedging transactions and the broker-dealers, financial institutions or counterparties may sell the borrowed shares of common stock into the public market. A Selling Security Holder may also pledge shares to his or her brokers or financial institutions and under the margin loan the broker or financial institution may, from time to time, offer and sell the pledged shares of common stock. To our knowledge, no Selling Security Holder has entered into any agreements, understandings or arrangements with any underwriters, broker-dealers or financial institutions regarding the sale of his or her shares of common stock other than ordinary course brokerage arrangements, nor are we aware of any underwriter or coordinating broker acting in connection with the proposed sale of shares of common stock by a Selling Security Holder.

The Selling Security Holders and any broker-dealers or agents that are involved in the sale and distribution of the shares of common stock may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. Discounts, concessions, commissions and similar selling expenses, if any, that can be attributed to the sale of the shares of common stock will be paid by the Selling Security Holder and/or the purchasers.

The Selling Security Holders and any other person participating in such distribution will be subject to applicable provisions of the Exchange Act, and the rules and regulations thereunder, including, without limitation, Regulation M of the Exchange Act, which may limit the timing of purchases and sales of any of the shares of common stock by the Selling Security Holders and any other participating person. Regulation M may also restrict the ability of any person engaged in the distribution of the shares of common stock to engage in market-making activities with respect to the shares of common stock. All of the foregoing may affect the marketability of the shares of common stock and the ability of any person or entity to engage in market-making activities with respect to the shares of common stock.

We have advised the Selling Security Holders that, at the time a resale of the shares of common stock is made by or on behalf of a Selling Security Holder, a copy of this reoffer prospectus is to be delivered.

Sales of securities by us and the Selling Security Holders or even the potential of these sales may have an adverse effect on the market price for shares of our common stock.

LEGAL MATTERS

Certain legal matters relating to the validity of the shares of common stock offered by this prospectus will be passed upon for us by Roxanne K. Beilly, P.A., 907 SE 7

th

Street, Fort Lauderdale, Florida 33301.

EXPERTS

Our consolidated financial statements incorporated in this reoffer prospectus by reference to our Annual Report on Form 10-K as of March 31, 2017 and 2016, and for the years then ended, have been audited by RSM US LLP, an independent registered public accounting firm, and are so incorporated in this reoffer prospectus in reliance on the report given on the authority of said firm as experts in auditing and accounting.

INDEMNIFICATION

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to our directors, officers and controlling persons pursuant to the provisions described in Item 6 of Part II of the Registration Statement, or otherwise, we have been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

WHERE YOU CAN FIND MORE INFORMATION

Our Company files annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission. You may read and copy any public offering document we file, including a copy of the Registration Statement on Form S-8 of which this reoffer prospectus is a part, without charge at the Securities and Exchange Commission’s Public Reference Room, 450 Fifth Street, N.W., Room 1024, Washington D.C. 20549. You can also request copies of all or any portion of these documents by writing the Public Reference Section of the Securities and Exchange Commission and paying certain prescribed fees. Please call the Securities and Exchange Commission at 1-800-SEC-0330 for further information on the Public Reference Section. Additionally, these documents are available to the public from the Securities and Exchange Commission’s web site at

www.sec.gov.

You may obtain any of these documents at no cost, by writing or telephoning us at the following address:

PetMed Express, Inc., Attention: Chief Financial Officer, 420 South Congress Avenue, Delray Beach, Florida 33445, telephone number (561) 526-4444.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The Securities and Exchange Commission allows the Company to “incorporate by reference” into this reoffer prospectus the information that the Company files with the Securities and Exchange Commission, which means that the Company can disclose important information to you by referring you to those documents. The information incorporated by reference is an important part of this reoffer prospectus, and information that the Company files later with the Securities and Exchange Commission will automatically update and supersede this information. In all cases, you should rely on the later information over different information included in this reoffer prospectus. The Company incorporates by reference the documents listed below and any future filings that the Company makes with the Securities and Exchange Commission under section 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the termination of this offering:

● Annual Report on Form 10-K for the year ended March 31, 2017, filed on May 23, 2017;

● Definitive Proxy Statement for our 2017 Annual Meeting of Stockholders, filed on June 12, 2017, and

● The description of the common stock of the Company in its Registration Statement on Form 10-SB filed on January 10, 2000, including any amendment or report filed to update that description.

The Company makes copies of these filings available, free of charge, on its website at

www.1800petmeds.com

. You may also request a copy of these filings at no cost, by writing or telephoning the Company at the following address: PetMed Express, Inc., Attention: Chief Financial Officer, 420 South Congress Avenue, Delray Beach, Florida 33445, telephone number (561) 526-4444.

This reoffer prospectus is part of a Registration Statement that the Company filed with the Securities and Exchange Commission. You should rely only on the information incorporated by reference or provided in this reoffer prospectus, any prospectus supplement and the Registration Statement. The Company has not authorized anyone to provide you with different information. You should not assume that the information in this reoffer prospectus and any prospectus supplement is accurate as of any date other than the date on the front of the document.

PART II

INFORMATION REQUIRED IN REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents, which have heretofore been filed by the Company with the Security and Exchange Commission pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”), are incorporated by reference herein and shall be deemed to be a part hereof:

● Annual Report on Form 10-K for the year ended March 31, 2017, filed on May 23, 2017;

● Definitive Proxy Statement for our 2017 Annual Meeting of Stockholders, filed on June 12, 2017, and

● The description of the common stock of the Company in its Registration Statement on Form 10-SB filed on January 10, 2000, including any amendment or report filed to update that description.

All documents subsequently filed by the Company pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, prior to the filing of a post-effective amendment which indicates that all securities offered have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference in the Registration Statement and to be part thereof from the date of filing of such documents. Any statement contained in a document incorporated or deemed to be incorporated herein by reference shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies, supersedes or replaces such statement. Any such statement so modified, superseded or replaced shall not be deemed, except as so modified, superseded or replaced, to constitute a part of this Registration Statement.

We hereby undertake to provide without charge to each person, including any beneficial owner, to whom a copy of the Registration Statement has been delivered, on the written or oral request of any such person, a copy of any or all of the documents referred to above which have been or may be incorporated by reference herein, other than exhibits to such documents (unless such exhibits are specifically incorporated by reference in such documents). Written or oral requests for such copies should be directed to PetMed Express, Inc., Attention: Bruce Rosenbloom, Chief Financial Officer, at 420 South Congress Avenue, Delray Beach, Florida 33445, telephone number (561) 526-4444.

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts and Counsel.

Not applicable.

Item 6. Indemnification of Directors and Officers.

As a corporation incorporated in the State of Florida, we are subject to the Florida Business Corporation Act (the “Florida Act”). Section 607.0831 of the Florida Act provides that a director is not personally liable for monetary damages to the corporation or any other person for any statement, vote, decision, or failure to act regarding corporate management or policy unless (1) the director breached or failed to perform his or her duties as a director and (2) the director’s breach of, or failure to perform, those duties constitutes (a) a violation of the criminal law, unless the director had reasonable cause to believe his or her conduct was lawful or had no reasonable cause to believe his or her conduct was unlawful, (b) a transaction from which the director derived an improper personal benefit, either directly or indirectly, (c) a circumstance under which the liability provisions of Section 607.0834 are applicable, (d) in a proceeding by or in the right of the corporation to procure a judgment in its favor or by or in the right of a shareholder, conscious disregard for the best interest of the corporation, or willful misconduct, or (e) in a proceeding by or in the right of someone other than the corporation or a shareholder, recklessness or an act or omission which was committed in bad faith or with malicious purpose or in a manner exhibiting wanton and willful disregard of human rights, safety, or property. A judgment or other final adjudication against a director in any criminal proceeding for a violation of the criminal law estops that director from contesting the fact that his or her breach, or failure to perform, constitutes a violation of the criminal law; but does not estop the director from establishing that he or she had reasonable cause to believe that his or her conduct was lawful or had no reasonable cause to believe that his or her conduct was unlawful.

Under Section 607.0850(1) of the Florida Act, a corporation has the power to indemnify any person who was or is a party to any proceeding (other than an action by, or in the right of the corporation), by reason of the fact that he or she is or was a director, officer, employee or agent of the corporation or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise against liability incurred in connection with such proceeding, including any appeal thereof, if he or she acted in good faith and in a manner he or she reasonably believed to be in, or not opposed to, the best interests of the corporation and, with respect to any criminal action or proceeding, had no reasonable cause to believe his or her conduct was unlawful. The termination of any proceeding by judgment, order, settlement or conviction or upon a plea of nolo contendere or its equivalent shall not, of itself, create a presumption that the person did not act in good faith and in a manner which he or she reasonably believed to be in, or not opposed to, the best interests of the corporation or, with respect to any criminal action or proceeding, has reasonable cause to believe that his or her conduct was unlawful.

Under Section 607.0850(2) of the Florida Act, a corporation has the power to indemnify any person, who was or is a party to any proceeding by or in the right of the corporation to procure a judgment in its favor by reason of the fact that the person is or was a director, officer, employee, or agent of the corporation or is or was serving at the request of the corporation as a director, officer, employee, or agent of another corporation, partnership, joint venture, trust, or other enterprise, against expenses and amounts paid in settlement not exceeding, in the judgment of the board of directors, the estimated expense of litigating the proceeding to conclusion, actually and reasonably incurred in connection with the defense or settlement of such proceeding, including any appeal thereof. Such indemnification shall be authorized if such person acted in good faith and in a manner he or she reasonably believed to be in, or not opposed to, the best interests of the corporation, except that no indemnification shall be made under this subsection in respect of any claim, issue, or matter as to which such person shall have been adjudged to be liable unless, and only to the extent that, the court in which such proceeding was brought, or any other court of competent jurisdiction, shall determine upon application that, despite the adjudication of liability but in view of all circumstances of the case, such person is fairly and reasonably entitled to indemnity for such expenses which such court shall deem proper.

In addition, under Section 607.0850(3) of the Florida Act, to the extent that a director, officer, employee or agent of the corporation has been successful on the merits or otherwise in defense of any proceeding referred to in Sections 607.0850(1) or 607.0850(2) described above, or in defense of any claim, issue or matter therein, he or she shall be indemnified against expenses actually and reasonably incurred by him or her in connection therewith.

Under Section 607.0850 of the Florida Act, the indemnification and advancement of expenses provided pursuant to Section 607.0850 of the Florida Act are not exclusive, and a corporation may make any other or further indemnification or advancement of expenses of any of its directors, officers, employees, or agents, under any bylaw, agreement, vote of shareholders or disinterested directors, or otherwise, both as to action in his or her official capacity and as to action in another capacity while holding such office. However, indemnification or advancement of expenses shall not be made to or on behalf of any director, officer, employee or agent if a judgment or other final adjudication establishes that his or her actions, or omissions to act, were material to the cause of action so adjudicated and constitute: (a) a violation of the criminal law, unless the director, officer, employee or agent had reasonable cause to believe his or her conduct was unlawful; (b) a transaction from which the director, officer, employee or agent derived an improper personal benefit; (c) in the case of a director, a circumstance under which the above liability provisions of Section 607.0834 are applicable; or (d) willful misconduct or a conscious disregard for the best interests of the corporation in a proceeding by or in the right of the corporation to procure a judgment in its favor or in a proceeding by or in the right of a shareholder.