- Q3'17 revenue $532.6 million

increased 22% as-reported, or 25% in constant currency from the

prior year period.

- Q3'17 YTD revenue $1,458.5 million

increased 11% as-reported, or 14% in constant currency from the

prior year period.

- Completed the acquisition of

Accucaps, a Canadian developer and manufacturer of over-the-counter

(OTC) and prescription softgel products.

- Announced Madhu Balachandran, former

Amgen Executive Vice President of Operations, joined our Board of

Directors.

Catalent, Inc. (NYSE:CTLT), the leading global provider of

advanced delivery technologies and development solutions for drugs,

biologics and consumer health products, today announced financial

results for the third quarter of fiscal year 2017, which ended

March 31, 2017.

Third quarter 2017 revenue of $532.6 million increased 22% as

reported and increased 25% in constant currency from $438.0 million

reported in the third quarter a year ago. For the first nine months

of fiscal year 2017, revenue was $1,458.5 million and increased 11%

as reported and 14% in constant currency, compared to the $1,315.9

million recorded in the prior-year period. All three of the

Company’s reporting segments posted constant currency revenue

growth for the quarter and year-to-date period when compared to the

comparable periods of the prior year.

Third quarter 2017 net earnings attributable to Catalent were

$26.0 million, or $0.21 per diluted share, compared to net earnings

of $10.7 million, or $0.09 per diluted share, in the third quarter

a year ago. For the first nine months of fiscal year 2017, net

earnings attributable to Catalent were $48.0 million, or $0.38 per

diluted share, compared to net earnings of $53.4 million, or $0.42

per diluted share, in the same period of the prior year.

Third quarter 2017 EBITDA from continuing operations of $93.8

million, as referenced in the GAAP to non-GAAP reconciliation

provided later in this release, increased 33% from $70.3 million in

the third quarter a year ago. For the first nine months of fiscal

year 2017, EBITDA from continuing operations was $241.7 million, an

increase of 1% compared to the $239.9 million recorded in the

prior-year period.

Third quarter 2017 Adjusted EBITDA (see the non-GAAP

reconciliation) was $117.8 million, or 22.1% of revenue, compared

to $80.7 million, or 18.4% of revenue, in the third quarter a year

ago. This represents an increase of 46% as reported and an increase

of 51% on a constant currency basis.

Third quarter 2017 Adjusted Net Income (see the non-GAAP

reconciliation) was $48.7 million, or $0.38 per diluted share,

compared to Adjusted Net Income of $26.4 million, or $0.21 per

diluted share, in the third quarter a year ago.

"We're pleased with our performance during the third quarter,

where we recorded double-digit organic revenue growth on a constant

currency across all three of our reporting segments, and closed our

second strategic acquisition of the fiscal year," said John

Chiminski, President and Chief Executive Officer of Catalent, Inc.

"The integrations of both acquisitions closed during the fiscal

year, Pharmatek and Accucaps, are progressing according to our

expectations and are already creating value for the company and our

shareholders."

Third Quarter 2017 Segment Highlights

Revenue Highlights by Business Segment

Revenue from the Softgel Technologies segment was $209.9 million

for the third quarter of fiscal 2017, an increase of 13% as

reported, or 14% in constant currency, compared to the third

quarter a year ago. The constant currency growth was attributable

to higher end-market demand for prescription products in Europe,

which includes increased volume at the Beinheim facility compared

to lower production levels in the prior year due to a temporary

suspension of operations. Increased demand for prescription

products in North America also contributed to the growth, but was

partially offset by lower end-market demand for consumer health

products in Asia Pacific. The acquisition of Accucaps contributed

6% of the segment's revenue growth during the quarter.

Revenue from the Drug Delivery Solutions segment was $234.6

million for the third quarter of fiscal 2017, an increase of 23% as

reported, or 27% in constant currency, over the third quarter a

year ago. The growth was primarily driven by favorable end-customer

demand for certain higher margin offerings within our U.S. oral

delivery solutions platform, increased volume related to our

biologics offering, and increased activity within the analytical

services platform. The acquisition of Pharmatek contributed 4% of

the segment's revenue growth during the quarter.

Revenue from the Clinical Supply Services segment was $97.5

million for the third quarter of fiscal 2017, an increase of 36% as

reported, or an increase of 44% in constant currency over the third

quarter a year ago. Approximately half of the revenue growth was

driven by lower-margin comparator sourcing volume, with the other

half of the growth coming from core storage, distribution,

manufacturing, and packaging volumes.

Segment EBITDA Highlights

Softgel Technologies segment EBITDA in the third quarter of

fiscal 2017 was $51.4 million, an increase of 45% as reported, or

48% in constant currency, versus the third quarter a year ago. The

increase was primarily attributable to a favorable mix shift to

higher margin prescription products in Europe and North America,

and increased volume and reduced costs at the Beinheim facility.

The acquisition of Accucaps contributed 8% of the growth in the

segment EBITDA during the quarter.

Drug Delivery Solutions segment EBITDA in the third quarter of

fiscal 2017 was $59.5 million, an increase of 49% as reported, or

56% in constant currency. The increase was primarily driven by

increased demand for certain higher margin offerings with our U.S.

oral delivery solutions platform, and increased volume related to

our biologics offering; partially offset by unfavorable product mix

with respect to products utilizing our blow-fill-seal technology

platform. The acquisition of Pharmatek contributed 3% of the growth

in segment EBITDA during the quarter.

Clinical Supply Services segment EBITDA in the third quarter of

fiscal 2017 was $15.7 million, an increase of 30% as reported, or

43% in constant currency. The increase was primarily attributable

to higher demand for our core storage, distribution, manufacturing

and packaging services. Increased volume related to lower-margin

comparator sourcing activities also modestly contributed to the

segment's EBITDA growth.

See the section of this release captioned "Non-GAAP Financial

Measures" for an explanation of "segment EBITDA."

First Nine Months of Fiscal 2017 Segment Highlights

Revenue Highlights by Business Segment

Revenue from the Softgel Technologies segment was $598.2 million

for the first nine months of fiscal year 2017, an increase of 9% as

reported, or 10% in constant currency, compared to the same period

a year ago. The constant currency growth was attributable to higher

end-market demand for prescription products in Europe, which

includes increased volume at the Beinheim facility compared to

lower production levels in the prior year. Increased demand for

prescription products in North America also contributed to the

growth, but this was partially offset by lower end-market demand

for consumer health products in Asia Pacific. The acquisition of

Accucaps contributed 2% of the segment's revenue growth during the

period.

Revenue from the Drug Delivery Solutions segment was $639.9

million for the first nine months of fiscal year 2017, an increase

of 13% as reported, or 16% in constant currency, over the same

period a year ago. The strong performance was primarily driven by

favorable end-customer demand for certain higher margin offerings

within our U.S. oral delivery solutions platform, increased volume

related to our biologics offering, and increased activity within

the analytical services platform. The acquisition of Pharmatek

modestly contributed to the segment's year-to-date revenue

growth.

Revenue from the Clinical Supply Services segment was $249.5

million for the first nine months of fiscal year 2017, an increase

of 10% as reported, or an increase of 18% in constant currency over

the same prior-year period. This growth was due to higher volume

related to core storage, distribution, manufacturing, and packaging

services; as well as due to increased lower-margin comparator

sourcing activities.

Segment EBITDA Highlights

Softgel Technologies segment EBITDA for the first nine months of

fiscal year 2017 was $125.3 million, an increase of 20% as

reported, or 24% in constant currency, compared to the same period

a year ago. The increase was primarily attributable to a favorable

mix shift to higher margin prescription products in Europe and

North America, and increased volume and reduced costs at the

Beinheim facility. The acquisition of Accucaps contributed 3% of

the segment EBITDA growth during the period.

Drug Delivery Solutions segment EBITDA in the first nine months

of fiscal year 2017 was $151.5 million, an increase of 9% as

reported, or 14% in constant currency. The increase was understated

due to a $12.5 million resolution of volume commitments recorded in

the prior-year period. Excluding this event, segment EBITDA

increased 24% due to increased volume and favorable product mix

within our analytical services platform and biologics offering, as

well as due to increased volumes related to our integrated oral

solids development and manufacturing capabilities within our oral

delivery solutions platform. The acquisition of Pharmatek modestly

contributed to the year-to-date segment EBITDA growth.

Clinical Supply Services segment EBITDA in the first nine months

of fiscal year 2017 was $37.8 million, a decrease of 4% as

reported, or an increase of 7% in constant currency. The increase

was primarily attributable to higher demand for our core storage,

distribution, manufacturing and packaging services. Increased

volume related to lower-margin comparator sourcing activities also

modestly contributed to the segment EBITDA growth.

See the section of this release captioned "Non-GAAP Financial

Measures" for an explanation of "segment EBITDA."

Additional Financial Highlights

Third quarter 2017 gross margin of 31.4% increased 260 basis

points as-reported, from 28.8% in the third quarter a year ago. The

increase was primarily attributable to favorable product mix within

the Softgel Technologies and Drug Delivery Solutions segments.

Gross margin of 30.1% in the first nine months of fiscal year 2017

declined 30 basis points as-reported, from the 30.4% recorded in

the same period a year ago. The year-to-date decline was primarily

attributable to the $12.5 million resolution of volume commitments

recorded in the prior-year period, partially offset by a favorable

shift in product mix within the Softgel Technologies and Drug

Delivery Solutions segments.

Third quarter 2017 selling, general and administrative expenses

were $100.9 million and represented 18.9% of revenue, compared to

$93.4 million, or 21.3% of revenue, in the third quarter a year

ago. Selling, general and administrative expenses for the first

nine months of fiscal year 2017 were $295.3 million and represented

20.2% of revenue, compared to $268.6 million, or 20.4% of revenue,

in the same period of the prior year.

Backlog for the Clinical Supply Services segment, defined as

estimated future service revenues from work not yet completed under

signed contracts was $329.8 million as of March 31, 2017, a 1%

decrease compared to the second quarter of fiscal year 2017. The

segment also recorded net new business wins of $98.6 million during

the third quarter, which represented a 18% increase year over year.

The segment’s trailing-twelve-month book-to-bill ratio was

1.2x.

Balance Sheet and Liquidity

As of March 31, 2017, Catalent had $2.0 billion in total debt,

and $1.8 billion in total debt net of cash and short-term

investments, which is essentially in-line with the total and net

debt levels as of December 31, 2016. As of March 31, 2017,

Catalent’s net leverage ratio was 4.2x, an improvement compared to

the 4.5x recorded in the prior quarter.

Fiscal Year 2017 Outlook

There is no change to Catalent’s previously issued financial

guidance. For fiscal year 2017, the company expects revenue in the

range of $1.940 billion to $1.980 billion. Catalent expects

Adjusted EBITDA in the range of $435 million to $450 million and

Adjusted Net Income in the range of $168 million to $183 million.

These guidance ranges continue to be consistent with the organic,

constant currency long-term CAGR growth expectations of 4-6% for

revenue and 6-8% for Adjusted EBITDA. The Company expects

self-funded capital expenditures in the range of $130 million to

$135 million and fully diluted share count in the range of 126

million to 128 million shares on a weighted average basis.

Earnings Webcast

The Company’s management will host a webcast to discuss the

results at 4:45 p.m. ET today. Catalent invites all interested

parties to listen to the webcast, which will be accessible through

Catalent’s website at http://investor.catalent.com. A supplemental slide

presentation will also be available in the “Investors” section of

Catalent’s website prior to the start of the webcast. The webcast

replay, along with the supplemental slides, will be available for

90 days in the “Investors” section of Catalent’s website at

www.catalent.com.

Board Member Appointment

On May 2, 2017 the Company's Board of Directors increased the

size of the Board from nine to ten members and appointed Madhavan

("Madhu") Balachandran as a director of the Company, effective

immediately. The Board also appointed Mr. Balachandran as a member

of the Board's Quality and Regulatory Compliance Committee, also

with immediate effect.

Mr. Balachandran was Executive Vice President, Operations of

Amgen Inc., a global biotechnology company, from August 2012 until

July 2016 and retired as an Executive Vice President in January

2017. Mr. Balachandran joined Amgen in 1997 as Associate Director,

Engineering. He became Director, Engineering in 1998, and, from

1999 to 2001, he held the position of Senior Director, Engineering

and Operations Services before moving to the position of Vice

President, Information Systems from 2001 to 2002. Thereafter, Mr.

Balachandran was Vice President, Puerto Rico Operations from May

2002 to February 2007. From February 2007 to October 2007, Mr.

Balachandran was Vice President, Site Operations, and, from October

2007 to August 2012, he held the position of Senior Vice President,

Manufacturing. Prior to his tenure at Amgen, Mr. Balachandran held

leadership positions at Copley Pharmaceuticals, now a part of Teva

Pharmaceuticals Industries Ltd., and Burroughs Welcome Company, a

predecessor through mergers of GlaxoSmithKline plc. Mr.

Balachandran holds a Master of Science degree in Chemical

Engineering from The State University of New York at Buffalo and an

MBA from East Carolina University.

About Catalent, Inc.

Catalent, Inc. (NYSE: CTLT) is the leading global provider of

advanced delivery technologies and development solutions for drugs,

biologics and consumer health products. With over 80 years serving

the industry, Catalent has proven expertise in bringing more

customer products to market faster, enhancing product performance

and ensuring reliable clinical and commercial product supply.

Catalent employs approximately 10,000 people, including over 1,400

scientists, at more than 30 facilities across 5 continents and in

fiscal 2016 generated $1.85 billion in annual revenue. Catalent is

headquartered in Somerset, N.J. For more information, please visit

www.catalent.com.

Non-GAAP Financial Measures

Use of EBITDA from continuing operations, Adjusted EBITDA,

Adjusted Net Income and Segment EBITDA

Management measures operating performance based on consolidated

earnings from continuing operations before interest expense,

expense/(benefit) for income taxes, and depreciation and

amortization, and it is adjusted for the income or loss

attributable to non-controlling interest (“EBITDA from continuing

operations”). EBITDA from continuing operations is not defined

under U.S. GAAP and is not a measure of operating income, operating

performance or liquidity presented in accordance with U.S. GAAP and

is subject to important limitations.

The Company believes that the presentation of EBITDA from

continuing operations enhances an investor’s understanding of its

financial performance. The Company believes this measure is a

useful financial metric to assess its operating performance from

period to period by excluding certain items that it believes are

not representative of its core business and uses this measure for

business planning purposes.

In addition, given the significant investments that Catalent has

made in the past in property, plant and equipment, depreciation and

amortization expenses represent a meaningful portion of its cost

structure. The Company believes that EBITDA from continuing

operations will provide investors with a useful tool for assessing

the comparability between periods of its ability to generate cash

from operations sufficient to pay taxes, to service debt and to

undertake capital expenditures because it eliminates depreciation

and amortization expense. The Company presents EBITDA from

continuing operations in order to provide supplemental information

that it considers relevant for the readers of the Consolidated

Financial Statements, and such information is not meant to replace

or supersede U.S. GAAP measures. The Company’s definition of EBITDA

from continuing operations may not be the same as similarly titled

measures used by other companies.

Catalent evaluates the performance of its segments based on

segment earnings before non-controlling interest, other

(income)/expense, impairments, restructuring costs, interest

expense, income tax expense/(benefit), and depreciation and

amortization (“segment EBITDA”). Moreover, under the Company's

credit agreement, its ability to engage in certain activities, such

as incurring certain additional indebtedness, making certain

investments and paying certain dividends, is tied to ratios based

on Adjusted EBITDA, which is not defined under U.S. GAAP and is

subject to important limitations. Adjusted EBITDA is the covenant

compliance measure used in the credit agreement governing debt

incurrence and restricted payments. Because not all companies use

identical calculations, the Company’s presentation of Adjusted

EBITDA may not be comparable to other similarly titled measures of

other companies.

Management also measures operating performance based on Adjusted

Net Income/(loss) and Adjusted Net Income/(loss) per share.

Adjusted Net Income/(loss) is not defined under U.S. GAAP and is

not a measure of operating income, operating performance or

liquidity presented in accordance with U.S. GAAP and is subject to

important limitations. The Company believes that the presentation

of Adjusted Net Income/(loss) and Adjusted Net Income/loss per

share enhances an investor’s understanding of its financial

performance. The Company believes this measure is a useful

financial metric to assess its operating performance from period to

period by excluding certain items that it believes are not

representative of its core business and the Company uses this

measure for business planning purposes. The Company defines

Adjusted Net Income/(loss) as net earnings/(loss) adjusted for (1)

earnings or loss of discontinued operations, net of tax, (2)

amortization attributable to purchase accounting and (3) income or

loss from non-controlling interest in its majority-owned

operations. The Company also makes adjustments for other cash and

non-cash items included in the table below, partially offset by its

estimate of the tax effects as a result of such cash and non-cash

items. The Company believes that Adjusted Net Income/(loss) and

Adjusted Net Income/(loss) per share will provide investors with a

useful tool for assessing the comparability between periods of its

ability to generate cash from operations available to its

stockholders. The Company’s definition of Adjusted Net

Income/(loss) may not be the same as similarly titled measures used

by other companies.

The most directly comparable GAAP measure to EBITDA from

continuing operations and Adjusted EBITDA is earnings/(loss) from

continuing operations. The most directly comparable GAAP measure to

Adjusted Net Income/(loss) is net earnings/(loss). Included in this

release is a reconciliation of earnings/(loss) from continuing

operations to EBITDA from continuing operations and Adjusted EBITDA

and reconciliation of net earnings/(loss) to Adjusted Net

Income.

The Company does not provide a reconciliation of forward-looking

non-GAAP financial measures to their comparable GAAP financial

measures because it could not do so without unreasonable effort due

to the unavailability of the information needed to calculate

reconciling items and due to the variability, complexity and

limited visibility of the adjusting items that would be excluded

from the non-GAAP financial measures in future periods. When

planning, forecasting and analyzing future periods, the Company

does so primarily on a non-GAAP basis without preparing a GAAP

analysis as that would require estimates for various cash and

non-cash reconciling items that would be difficult to predict with

reasonable accuracy. For example, equity compensation expense would

be difficult to estimate because it depends on the Company’s future

hiring and retention needs, as well as the future fair market value

of the Company’s common stock, all of which are difficult to

predict and subject to constant change. It is equally difficult to

anticipate the need for or magnitude of a presently unforeseen

one-time restructuring expense or the values of end-of-period

foreign currency exchange rates. As a result, the Company does not

believe that a GAAP reconciliation would provide meaningful

supplemental information about the Company’s outlook.

Use of Constant Currency

As changes in exchange rates are an important factor in

understanding period-to-period comparisons, the Company believes

the presentation of results on a constant currency basis in

addition to reported results helps improve investors’ ability to

understand its operating results and evaluate its performance in

comparison to prior periods. Constant currency information compares

results between periods as if exchange rates had remained constant

period over period. The Company uses results on a constant currency

basis as one measure to evaluate its performance. The Company

calculates constant currency by calculating current-year results

using prior-year foreign currency exchange rates. The Company

generally refers to such amounts calculated on a constant currency

basis as excluding the impact of foreign exchange or being on a

constant currency basis. These results should be considered in

addition to, not as a substitute for, results reported in

accordance with U.S. GAAP. Results on a constant currency basis, as

the Company presents them, may not be comparable to similarly

titled measures used by other companies and are not measures of

performance presented in accordance with U.S. GAAP.

Forward-Looking Statements

This release contains both historical and forward-looking

statements. All statements other than statements of historical fact

are, or may be deemed to be, forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended.

These forward-looking statements generally can be identified by the

use of statements that include phrases such as “believe,” “expect,”

“anticipate,” “intend,” “estimate,” “plan,” “project,” “foresee,”

“likely,” “may,” “will,” “would” or other words or phrases with

similar meanings. Similarly, statements that describe the Company’s

objectives, plans or goals are, or may be, forward-looking

statements. These statements are based on current expectations of

future events. If underlying assumptions prove inaccurate or

unknown risks or uncertainties materialize, actual results could

vary materially from Catalent, Inc.’s expectations and projections.

Some of the factors that could cause actual results to differ

include, but are not limited to, the following: participation in a

highly competitive market and increased competition may adversely

affect the business of the Company; demand for the Company’s

offerings which depends in part on the Company’s customers’

research and development and the clinical and market success of

their products; product and other liability risks that could

adversely affect the Company’s results of operations, financial

condition, liquidity and cash flows; failure to comply with

existing and future regulatory requirements; failure to provide

quality offerings to customers could have an adverse effect on the

Company’s business and subject it to regulatory actions and costly

litigation; problems providing the highly exacting and complex

services or support required; global economic, political and

regulatory risks to the operations of the Company; inability to

enhance existing or introduce new technology or service offerings

in a timely manner; inadequate patents, copyrights, trademarks and

other forms of intellectual property protections; fluctuations in

the costs, availability, and suitability of the components of the

products the Company manufactures, including active pharmaceutical

ingredients, excipients, purchased components and raw materials;

changes in market access or healthcare reimbursement in the United

States or internationally; fluctuations in the exchange rate of the

U.S. dollar and other foreign currencies including as a result of

the recent U.K. referendum to exit from the European Union; adverse

tax legislation initiatives or challenges to the Company’s tax

positions; loss of key personnel; risks generally associated with

information systems; inability to complete any future acquisitions

and other transactions that may complement or expand the business

of the Company or divest of non-strategic businesses or assets and

the Company’s ability to successfully integrate acquired business

and realize anticipated benefits of such acquisitions; offerings

and customers’ products that may infringe on the intellectual

property rights of third parties; environmental, health and safety

laws and regulations, which could increase costs and restrict

operations; labor and employment laws and regulations; additional

cash contributions required to fund the Company’s existing pension

plans; substantial leverage resulting in the limited ability of the

Company to raise additional capital to fund operations and react to

changes in the economy or in the industry, exposure to interest

rate risk to the extent of the Company’s variable rate debt and

preventing the Company from meeting its obligations under its

indebtedness. For a more detailed discussion of these and other

factors, see the information under the caption “Risk Factors” in

the Company’s Annual Report on Form 10-K for the fiscal year ended

June 30, 2016, filed with the Securities and Exchange Commission.

All forward-looking statements speak only as of the date of this

release or as of the date they are made, and Catalent, Inc. does

not undertake to update any forward-looking statement as a result

of new information or future events or developments except to the

extent required by law.

More products. Better treatments. Reliably

supplied.™

Catalent, Inc. and Subsidiaries

Consolidated Statements of

Operations

(Dollars in millions, except per share

data)

Three Months Ended March 31,

FX impact

Constant

CurrencyIncrease/(Decrease)

2017 2016 Change $

Change % Net revenue $ 532.6 $ 438.0 $ (13.3 ) $ 107.9 25 %

Cost of sales 365.2 311.8 (7.9 ) 61.3 20 %

Gross margin 167.4 126.2 (5.4 ) 46.6 37 % Selling, general and

administrative expenses 100.9 93.4 (1.3 ) 8.8 9 % Impairment

charges and (gain)/loss on sale of assets 1.8 (0.3 ) (0.1 ) 2.2 *

Restructuring and other 0.1 1.8 0.5 (2.2 ) *

Operating earnings 64.6 31.3 (4.5 ) 37.8 * Interest expense, net

22.6 21.7 (0.5 ) 1.4 6 % Other (income)/expense, net 7.3

(4.2 ) (0.8 ) 12.3 * Earnings from continuing operations,

before income

taxes

34.7 13.8 (3.2 ) 24.1 * Income tax expense 8.7 3.1

(0.4 ) 6.0 * Net earnings 26.0 10.7 (2.8 ) 18.1 * Less: Net

earnings/(loss) attributable to noncontrolling

interest, net of tax

— — — — * Net earnings attributable to

Catalent $ 26.0 $ 10.7 $ (2.8 ) $ 18.1 *

Weighted average shares outstanding 125.0 124.8

Weighted average diluted shares outstanding 126.8 125.8

Earnings per share attributable to Catalent: Basic

Net earnings 0.21 0.09

Diluted Net earnings 0.21 0.09

* - percentage not meaningful

Catalent, Inc. and Subsidiaries

Selected Segment Financial Data

(Dollars in millions)

Three Months Ended March 31,

FX impact

Constant

CurrencyIncrease/(Decrease)

2017 2016 Change $

Change % Softgel Technologies Net revenue $ 209.9 $

185.1 $ (1.3 ) $ 26.1 14 % Segment EBITDA 51.4 35.4 (1.0 ) 17.0 48

%

Drug Delivery Solutions Net revenue 234.6 190.5 (6.7 )

50.8 27 % Segment EBITDA 59.5 39.9 (2.6 ) 22.2 56 %

Clinical

Supply Services Net revenue 97.5 71.5 (5.4 ) 31.4 44 % Segment

EBITDA 15.7 12.1 (1.6 ) 5.2 43 % Inter-segment revenue elimination

(9.4 ) (9.1 ) 0.1 (0.4 ) 4 % Unallocated Costs (32.8 ) (17.1 ) 0.4

(16.1 ) 94 %

Combined Total

Net revenue $ 532.6 $ 438.0 $ (13.3 ) $ 107.9

25 % EBITDA from

continuing operations $ 93.8 $ 70.3 $ (4.8 ) $ 28.3

40 %

Refer to the Company's description of non-GAAP measures

including segment EBITDA as referenced above.

Catalent, Inc. and Subsidiaries

Consolidated Statements of

Operations

(Dollars in millions, except per share

data)

Nine Months Ended March 31,

FX impact

Constant

CurrencyIncrease/(Decrease)

2017 2016 Change $

Change % Net revenue $ 1,458.5 $ 1,315.9 $ (40.6 ) $ 183.2

14 % Cost of sales 1,019.1 916.1 (22.7 ) 125.7

14 % Gross margin 439.4 399.8 (17.9 ) 57.5 14 % Selling, general

and administrative expenses 295.3 268.6 (4.7 ) 31.4 12 % Impairment

charges and (gain)/loss on sale of assets 2.3 0.8 — 1.5 *

Restructuring and other 4.5 3.4 0.3 0.8

24 % Operating earnings 137.3 127.0 (13.5 ) 23.8 19 % Interest

expense, net 67.5 66.7 (2.1 ) 2.9 4 % Other (income)/expense, net

3.4 (7.1 ) (2.1 ) 12.6 * Earnings from continuing

operations, before income

taxes

66.4 67.4 (9.3 ) 8.3 12 % Income tax expense 18.4 14.3

(1.9 ) 6.0 42 % Net earnings 48.0 53.1 (7.4 ) 2.3 4 %

Less: Net earnings/(loss) attributable to noncontrolling

interest, net of tax

— (0.3 ) — 0.3 * Net earnings attributable to

Catalent $ 48.0 $ 53.4 $ (7.4 ) $ 2.0 4 %

Weighted average shares outstanding 124.9 124.8

Weighted average diluted shares outstanding 126.5 125.9

Earnings per share attributable to Catalent: Basic

Net earnings 0.38 0.43

Diluted Net earnings 0.38 0.42

Catalent, Inc. and Subsidiaries

Selected Segment Financial Data

(Dollars in millions)

Nine Months Ended March 31,

FX impact

Constant

CurrencyIncrease/(Decrease)

2017 2016 Change $

Change % Softgel Technologies Net revenue $ 598.2 $

550.2 $ (7.0 ) $ 55.0 10 % Segment EBITDA 125.3 104.8 (5.0 ) 25.5

24 %

Drug Delivery Solutions Net revenue 639.9 568.2 (17.4 )

89.1 16 % Segment EBITDA 151.5 139.5 (7.5 ) 19.5 14 %

Clinical

Supply Services Net revenue 249.5 226.0 (16.7 ) 40.2 18 %

Segment EBITDA 37.8 39.5 (4.3 ) 2.6 7 % Inter-segment revenue

elimination (29.1 ) (28.5 ) 0.5 (1.1 ) 4 % Unallocated Costs (72.9

) (43.9 ) 1.7 (30.7 ) 70 %

Combined Total

Net revenue $ 1,458.5 $ 1,315.9

$ (40.6 ) $ 183.2 14 %

EBITDA from continuing operations $ 241.7 $ 239.9 $

(15.1 ) $ 16.9 7 %

Refer to the Company's description of non-GAAP measures

including segment EBITDA as referenced above.

Catalent, Inc. and Subsidiaries

Reconciliation of Earnings/(Loss) from

Continuing Operations to EBITDA from Continuing Operations and

Adjusted EBITDA*

(Dollars in millions)

Quarter Ended

TwelveMonthsEnded

March 31, 2016 June 30, 2016

September 30, 2016 December 31,

2016 March 31, 2017 March 31,

2017 Earnings from continuing operations $ 10.7 $ 58.1 $ 4.6

$ 17.4 $ 26.0 $ 106.1 Interest expense, net 21.7 21.8 22.1 22.8

22.6 89.3 Income tax expense/(benefit) 3.1 19.4 0.2 9.5 8.7 37.8

Depreciation and amortization 34.8 35.1 35.8

35.5 36.5 142.9 EBITDA from continuing

operations 70.3 134.4 62.7 85.2 93.8 376.1 Equity compensation 3.6

2.1 6.9 4.9 4.6 18.5 Impairment charges and (gain)/loss on sale of

assets (0.3 ) 1.9 — 0.5 1.8 4.2 Financing related expenses

and other

— — — 4.3 — 4.3 US GAAP Restructuring and

Other (1)

1.8 5.6 1.1 3.3 0.1 10.1 Acquisition, integration and other special

items 7.8 5.8 4.8 3.9 8.4 22.9 Foreign Exchange loss/(gain)

(included in other, net) (2) (2.0 ) (4.7 ) (0.5 ) (3.2 ) 9.2 0.8

Other adjustments (0.5 ) (3.3 ) — (0.8 ) (0.1 ) (4.2 )

Adjusted EBITDA $ 80.7 $ 141.8 $ 75.0 $ 98.1

$ 117.8 $ 432.7 FX impact (unfavorable) —

(4.4 ) Adjusted EBITDA - Constant Currency $ 80.7 $

122.2

* Refer to the Company's description of non-GAAP measures

including Adjusted EBITDA as referenced above.

(1) Restructuring and Other costs for the three months ended

December 31, 2016 includes settlement charges of $3.2 million for

certain customer claims related to the temporary Beinheim facility

suspension.

(2) Foreign exchange loss of $0.8 million for the twelve months

ended March 31, 2017 includes: (a) $3.4 million of unrealized

gains related to foreign trade receivables and payables, (b) $3.2

million of unrealized losses on the ineffective portion of the

Company's net investment hedge, and (c) $0.2 million of unrealized

losses on inter-company loans. The foreign exchange adjustment was

also affected by the exclusion of realized foreign currency

exchange rate losses from the settlement of inter-company loans of

$0.7 million. Inter-company loans are between Catalent entities and

do not reflect the ongoing results of the Company's trade

operations.

Catalent, Inc. and Subsidiaries

Reconciliation of Net Earnings/(Loss)

to Adjusted Net Income*

(Dollars in millions)

Quarter Ended

TwelveMonthsEnded

March 31, 2016 June 30, 2016

September 30, 2016 December 31,

2016 March 31, 2017 March 31,

2017 Net earnings $ 10.7 $ 58.1 $ 4.6 $ 17.4 $ 26.0 $ 106.1

Amortization (1) 11.4 11.4 11.0 11.1 11.0 44.5 Equity compensation

3.6 2.1 6.9 4.9 4.6 18.5 Impairment charges and loss on sale of

assets (0.3 ) 1.9 — 0.5 1.8 4.2 Financing related expenses — — —

4.3 — 4.3 U.S. GAAP restructuring (2) 1.8 5.6 1.1 3.3 0.1 10.1

Acquisition, integration and other special items 7.8 5.8 4.8 3.9

8.4 22.9 Foreign exchange loss/(gain) (included in other

(income)/expense, net) (2.0 ) (4.7 ) (0.5 ) (3.2 ) 9.2 0.8 Other

adjustments (0.5 ) (3.3 ) — (0.8 ) (0.1 ) (4.2 ) Estimated tax

effect of

adjustments(3)

(6.5 ) (6.1 ) (6.5 ) (6.5 ) (10.7 ) (29.8 ) Discrete income tax

expense/(benefit) items(4) 0.4 (5.9 ) (1.8 ) (0.2 ) (1.6 )

(9.5 ) Adjusted net income $ 26.4 $ 64.9 $ 19.6

$ 34.7 $ 48.7 $ 167.9

* Refer to the Company's description of non-GAAP measures

including Adjusted Net Income as referenced above.

(1) Represents the amortization attributable to purchase

accounting for previously completed business combinations.

(2) Restructuring and Other costs for the three months ended

December 31, 2016 includes settlement charges of $3.2 million for

certain customer claims related to the temporary Beinheim facility

suspension.

(3) The tax effect of adjustments to Adjusted Net Income is

computed by applying the statutory tax rate in the jurisdictions to

the income or expense items which are adjusted in the period

presented; if a valuation allowance exists, the rate applied is

zero.

(4) Discrete period income tax expense / (benefit) items are

unusual or infrequently occurring items primarily including:

changes in judgment related to the realizability of deferred tax

assets in future years, changes in measurement of a prior year tax

position, deferred tax impact of changes in tax law, and purchase

accounting.

Catalent, Inc. and Subsidiaries

Consolidated Balance Sheets

(Dollars in millions)

March 31, 2017 June

30, 2016 ASSETS Current assets: Cash and cash

equivalents $ 241.2 $ 131.6 Trade receivables, net 402.6 414.8

Inventories 193.9 154.8 Prepaid expenses and other 90.7 89.0

Total current assets 928.4 790.2 Property, plant, and equipment,

net 968.9 905.8 Other non-current assets, including intangible

assets 1,387.9 1,395.1

Total assets $

3,285.2 $ 3,091.1 LIABILITIES

AND SHAREHOLDERS' EQUITY Current liabilities: Current portion

of long-term obligations and other short-term borrowings $ 23.7 $

27.7 Accounts payable 137.6 143.7 Other accrued liabilities 228.8

219.8 Total current liabilities 390.1 391.2 Long-term

obligations, less current portion 2,025.3 1,832.8 Other non-current

liabilities 227.1 231.2 Commitment and contingencies (1) Total

shareholders' equity 642.7 635.9

Total liabilities and

shareholders' equity $ 3,285.2 $

3,091.1

(1) Please refer to note 12 of the consolidated financial

statements within our March 31, 2017 Form 10-Q.

Catalent, Inc. and Subsidiaries

Consolidated Statements of Cash

Flows

(Dollars in millions)

Nine Months Ended March 31,

2017 2016 CASH FLOWS FROM OPERATING

ACTIVITIES: Net cash provided by operating activities

199.3 121.4 CASH FLOWS FROM

INVESTING ACTIVITIES: Acquisition of property and equipment and

other productive assets (87.8 ) (107.8 ) Proceeds from sale of

property and equipment 0.7 — Payment for acquisitions, net of cash

acquired (169.9 ) —

Net cash (used in)/provided by

investing activities (257.0 ) (107.8

) CASH FLOWS FROM FINANCING ACTIVITIES: Net change in

other borrowings (5.9 ) 0.6 Proceeds from borrowing, net 397.4 —

Payments related to long-term obligations (213.9 ) (13.9 ) Call

premium payments and financing fees paid (6.4 ) — Purchase of

Redeemable Noncontrolling Interest Shares — (5.8 ) Cash paid, in

lieu of equity, for tax withholding obligations (2.8 ) (8.0 )

Net cash provided by/(used in) financing activities

168.4 (27.1 ) Effect of foreign

currency on cash (1.1 ) (3.9 )

NET INCREASE/(DECREASE) IN CASH

AND EQUIVALENTS 109.6 (17.4 )

CASH AND EQUIVALENTS AT

BEGINNING OF PERIOD 131.6 151.3

CASH AND

EQUIVALENTS AT END OF PERIOD $ 241.2

$ 133.9

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170504006406/en/

Investor:Catalent, Inc.Thomas Castellano,

732-537-6325investors@catalent.com

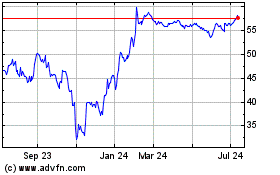

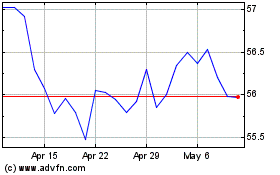

Catalent (NYSE:CTLT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Catalent (NYSE:CTLT)

Historical Stock Chart

From Apr 2023 to Apr 2024