UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 19, 2017

CERULEAN PHARMA INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

|

|

Delaware

|

|

001-36395

|

|

20-4139823

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

35 Gatehouse Drive

Waltham, MA

|

|

02451

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s Telephone Number, Including Area Code: (781)

996-4300

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions (see General Instructions A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☒

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Item 1.01. Entry into a Material Definitive Agreement.

Stock Purchase Agreement with Daré Bioscience, Inc.

On March 19, 2017, Cerulean Pharma Inc., a Delaware corporation (“Cerulean” or the “Company”), Daré Bioscience, Inc., a

Delaware corporation (“Daré”), and the holders of capital stock and securities convertible into capital stock of Daré named therein (the “Selling Stockholders”) entered into a Stock Purchase Agreement (the

“Stock Purchase Agreement”), pursuant to which, among other things, subject to the satisfaction or waiver of the conditions set forth in the Stock Purchase Agreement, each Selling Stockholder agreed to sell to Cerulean, and Cerulean agreed

to purchase from each Selling Stockholder, all of the outstanding shares of capital stock, including those issuable upon conversion of convertible securities, of Daré (the “Daré Shares”) owned by such Selling Stockholder (the

“Daré Transaction”).

The Selling Stockholders own (and will own upon conversion of all outstanding convertible securities of

Daré) 100% of the outstanding Daré Shares and following the consummation of the Daré Transaction, Daré will become a wholly owned subsidiary of Cerulean.

Subject to the terms and conditions of the Stock Purchase Agreement, at the closing of the Daré Transaction, the Selling Stockholders will collectively

receive a number of shares of Cerulean common stock equal to the product of the number of shares of Daré stock held by such Selling Stockholder multiplied by an exchange ratio calculated based on the relative valuations of each of Daré

and Cerulean at the closing of the Daré Transaction. Also in connection with the Daré Transaction, Cerulean will assume the (i) outstanding stock option awards of Daré, and (ii) outstanding warrants of Daré,

each of which will be adjusted to reflect the exchange ratio for the Daré Transaction. Immediately following the closing of the Daré Transaction, the shares issued to the Selling Stockholders in the Daré Transaction will

represent between approximately 51% and 70% (depending on the net cash positions of Cerulean and Daré at closing) of the outstanding equity securities of Cerulean as of immediately following the consummation of the Daré Transaction.

Each of Cerulean, Daré and the Selling Stockholders has agreed to customary representations, warranties and covenants in the Stock Purchase

Agreement including, among others, covenants relating to (1) using commercially reasonable efforts to obtain the requisite approvals of the stockholders of Cerulean to the Daré Voting Proposal described below,

(2) non-solicitation

of competing acquisition proposals by each of Cerulean and Daré, (3) Cerulean using commercially reasonable efforts to maintain the existing listing of the Company’s common

stock on The NASDAQ Stock Market, Inc. (“NASDAQ”), and (4) Cerulean’s and Daré’s conduct of their respective businesses during the period between the date of signing the Stock Purchase Agreement and the closing of the

Daré Transaction.

Consummation of the Daré Transaction is subject to certain closing conditions, including, among other things,

(1) approval of the issuance of the shares of the Company’s common stock in the Daré Transaction by the stockholders of Cerulean in accordance with applicable NASDAQ rules (the “Daré Voting Proposal”), (2) the

absence of any order, executive order, stay, decree, judgment or injunction or statute, rule or regulation that makes the consummation of the Daré Transaction illegal, or otherwise prohibits the consummation of the Daré Transaction,

and (3) the approval of the NASDAQ Initial Listing Application—For Companies Conducting a Business Combination that Results in a Change of Control with respect to the shares of Cerulean common stock to be issued in connection with the

Daré Transaction. Each party’s obligation to consummate the Daré Transaction is also subject to other specified customary conditions, including (1) the representations and warranties of the other party being true and correct

as of the date of the Stock Purchase Agreement and as of the closing date of the Daré Transaction, generally subject to an overall material adverse effect qualification, and (2) the performance in all material respects by the other party

of its obligations under the Stock Purchase Agreement. The Stock Purchase Agreement contains certain termination rights for both Cerulean and Daré, and further provides that, upon termination of the Stock Purchase Agreement under specified

circumstances, Cerulean may be required to pay Daré a termination fee of $300,000, or Daré may be required to pay Cerulean a termination fee of $450,000.

Under the Stock Purchase Agreement, the Company has agreed that promptly following the closing of the Daré

Transaction, it will take all action necessary to fix the number of members of the board of directors of Cerulean at five (5); to cause to be elected to the board of directors the three (3) such directors to be identified by Daré; and to

obtain the resignations of certain of the Company’s existing directors and officers. In addition, the Company has agreed to take all action necessary to cause certain persons to be appointed as executive officers of the Company.

In connection with the Daré Transaction, Cerulean will change its name to Daré Bioscience, Inc., subject to the consummation of the Daré

Transaction. In addition, if necessary, Cerulean may seek stockholder approval to effect a reverse split of Cerulean common stock at a ratio to be determined by Cerulean, which is intended to ensure that the listing requirements of NASDAQ are

satisfied.

Also in connection with the Stock Purchase Agreement, certain stockholders holding in the aggregate approximately 17% of the outstanding

common stock of Cerulean as of the date of the Stock Purchase Agreement have each entered into a support agreement in favor of Daré (the “Support Agreement”), pursuant to which such stockholders agree, among other things, to vote

all of their shares of Cerulean capital stock in favor of the Daré Transaction and against any competing proposal.

The foregoing descriptions of

the Stock Purchase Agreement, the Daré Transaction and the Support Agreement, and the transactions contemplated thereby, in each case, do not purport to be complete and are qualified in their entirety by reference to the Stock Purchase

Agreement, which is filed as Exhibit 2.1 hereto and which is incorporated herein by reference, and to the Support Agreement, which is filed as Exhibit 10.1 hereto and which is incorporated herein by reference. The Stock Purchase Agreement and the

Support Agreement have been included to provide investors and security holders with information regarding their terms. They are not intended to provide any other factual information about Cerulean, Daré, the Selling Stockholders or their

respective subsidiaries and affiliates. The Stock Purchase Agreement contains representations and warranties by Daré and the Selling Stockholders, on the one hand, and by Cerulean, on the other hand, made solely for the benefit of the other.

The assertions embodied in those representations and warranties are qualified by information in confidential disclosure schedules delivered by each party in connection with the signing of the Stock Purchase Agreement, and certain representations and

warranties in the Stock Purchase Agreement were made as of a specified date, may be subject to a contractual standard of materiality different from what might be viewed as material to investors, or may have been used for the purpose of allocating

risk between the Selling Stockholders and Daré. Accordingly, the representations and warranties in the Stock Purchase Agreement should not be relied on by any persons as characterizations of the actual state of facts about Cerulean at the

time they were made or otherwise. In addition, information concerning the subject matter of the representations and warranties may change after the date of the Stock Purchase Agreement, which subsequent information may or may not be fully reflected

in Cerulean’s public disclosures.

Asset Purchase Agreement with Novartis Institutes for BioMedical Research, Inc.

On March 19, 2017, Cerulean entered into an Asset Purchase Agreement (the “Asset Purchase Agreement”) with Novartis Institutes for BioMedical

Research, Inc., a Delaware corporation (“Novartis”). Under the Asset Purchase Agreement, and subject to the satisfaction or waiver of the conditions set forth therein, Cerulean agreed to sell and assign to Novartis all of its right, title

and interest in and to the patent rights,

know-how

and third-party license agreements relating to the Company’s proprietary Dynamic Tumor Targeting™ platform technology (the “Platform”).

Cerulean also agreed to transfer and assign to Novartis any agreements that Cerulean has with third parties conducting research, development, or manufacturing activities with the Platform, except to the extent such agreements relate solely to the

manufacture or development of the clinical product candidates CRLX101 and CRLX301 (the “Products”) (such transactions, collectively, the “Novartis Transaction”).

At the closing of the Novartis Transaction, Novartis will pay to Cerulean a purchase price of $6,000,000, and

will also deliver offers of employment or engagement to certain employees of Cerulean who are knowledgeable in the practice and development of the Platform. In addition, Cerulean will assign, and Novartis will assume, the BlueLink License (as

defined below).

The Asset Purchase Agreement also contains customary representations and warranties that Cerulean, on the one hand, and Novartis, on the

other hand, made solely for the benefit of the other. The assertions embodied in those representations and warranties are qualified by information in confidential disclosure schedules delivered by Cerulean in connection with the signing of the Asset

Purchase Agreement, and certain representations and warranties in the Asset Purchase Agreement were made as of a specified date or may be subject to a contractual standard of materiality different from what might be viewed as material to investors.

Accordingly, the representations and warranties in the Asset Purchase Agreement should not be relied on by any persons as characterizations of the actual state of facts about Cerulean at the time they were made or otherwise. In addition, information

concerning the subject matter of the representations and warranties may change after the date of the Asset Purchase Agreement, which subsequent information may or may not be fully reflected in Cerulean’s public disclosures.

Consummation of the Novartis Transaction is subject to Cerulean obtaining, pursuant to Delaware law, the approval of the holders of at least a majority of the

Cerulean common stock for the sale of substantially all of its assets in the Novartis Transaction (the “Novartis Voting Proposal”). Each party’s obligation to consummate the Novartis Transaction is also subject to other specified

customary conditions, including (1) the representations and warranties of the other party being true and correct as of the closing date of the Novartis Transaction, generally subject in the case of Novartis’ representations and warranties

to an overall materiality qualification, and (2) the performance in all material respects by the other party of its obligations under the Asset Purchase Agreement, including in the case of Cerulean by obtaining all necessary corporate and

third-party consents.

The Asset Purchase Agreement includes customary termination provisions as well as indemnification provisions pursuant to which the

parties agree to indemnify each other, subject to certain thresholds and caps on liability as set forth in the Asset Purchase Agreement.

The foregoing

descriptions of the Asset Purchase Agreement and the Novartis Transaction, and the transactions contemplated thereby, in each case, do not purport to be complete and are qualified in their entirety by reference to the Asset Purchase Agreement, which

is filed as Exhibit 2.2 hereto and which is incorporated herein by reference. The Asset Purchase Agreement has been included to provide investors and security holders with information regarding their terms, and is not intended to provide any other

factual information about Cerulean, Novartis or their respective subsidiaries and affiliates.

Asset Purchase Agreement and License Agreement with

BlueLink Pharmaceuticals, Inc.

On March 19, 2017 (the “Effective Date”), Cerulean and BlueLink Pharmaceuticals, Inc., a Delaware

corporation and wholly-owned subsidiary of NewLink Genetics Corporation (“BlueLink”), entered into an Asset Purchase Agreement (the “BlueLink Agreement”), pursuant to which Cerulean sold to BlueLink all of Cerulean’s right,

title and interest in and to the Products and the accompanying intellectual property rights and

know-how,

in exchange for an aggregate purchase price of $1,500,000 to be paid within five days of March 20,

2017 (the “BlueLink Transaction” and, together with the Daré Transaction and the Novartis Transaction, the “Strategic Transactions”).

In connection with the BlueLink Agreement, Cerulean agreed, within thirty (30) days following the Effective Date, to use commercially reasonable efforts

to assist in certain contract or consent negotiations with third parties, and also to purchase a tail to Cerulean’s clinical trial insurance to cover all liabilities,

subject to the applicable policy limits, arising from the clinical trials of the Products conducted by or on behalf of Cerulean on or before the Effective Date. BlueLink is responsible for all

liabilities arising after the Effective Date related to any assigned contracts, other than liabilities arising after the Effective Date due to the breach by Cerulean of any assigned contracts.

The BlueLink Agreement also includes indemnification provisions pursuant to which each party agreed to indemnify the other, subject to certain thresholds and

caps on liability as set forth in the BlueLink Agreement.

Also in connection with the BlueLink Agreement, Cerulean and BlueLink entered into a license

agreement in favor of BlueLink (the “BlueLink License”), pursuant to which Cerulean agreed to grant to BlueLink an exclusive, worldwide, perpetual, sublicensable right and license, under the Platform, to research, develop and commercialize

the Products. Pursuant to the Asset Purchase Agreement between Cerulean and Novartis, Novartis will assume the BlueLink License upon the closing of the Novartis Transaction.

BlueLink may terminate the BlueLink License upon sixty (60) days’ notice to Cerulean (or, following consummation of the Novartis Transaction,

Novartis) for any or no reason. Cerulean (or, following consummation of the Novartis Transaction, Novartis) may terminate upon a material breach of the BlueLink License by BlueLink, subject to a sixty

(60)-day

cure period. In addition, BlueLink agreed to indemnify Cerulean or its assigns for certain claims arising from a breach of the BlueLink License or the research, development and/or commercialization of the Products by BlueLink.

Each of the BlueLink Agreement and the BlueLink License contains customary representations and warranties that Cerulean, on the one hand, and BlueLink, on the

other hand, made solely for the benefit of the other. In the case of the BlueLink Agreement, the assertions embodied in those representations and warranties are qualified by information in confidential disclosure schedules delivered by Cerulean in

connection with the signing of the agreement. In addition, certain representations and warranties in the BlueLink Agreement and the BlueLink License, as applicable, were made as of a specified date or may be subject to a contractual standard of

materiality different from what might be viewed as material to investors. Accordingly, the representations and warranties in the BlueLink Agreement and the BlueLink License should not be relied on by any persons as characterizations of the actual

state of facts about Cerulean at the time they were made or otherwise. In addition, information concerning the subject matter of the representations and warranties may change after the date of the BlueLink Agreement or the BlueLink License, as

applicable, which subsequent information may or may not be fully reflected in Cerulean’s public disclosures.

The foregoing descriptions of the

BlueLink Agreement, the BlueLink Transaction and the BlueLink License, and the transactions contemplated thereby, in each case, do not purport to be complete and are qualified in their entirety by reference to the BlueLink Agreement, which is filed

as Exhibit 2.3 hereto and which is incorporated herein by reference, and to the BlueLink License, which is filed as Exhibit 10.2 hereto and which is incorporated herein by reference. The BlueLink Agreement and the BlueLink License have been included

to provide investors and security holders with information regarding their terms, and are not intended to provide any other factual information about Cerulean, BlueLink or their respective subsidiaries and affiliates.

Hercules Capital, Inc., the lender under Cerulean’s existing term loan credit facility (the “Loan Facility”), consented to the BlueLink

Transaction, and released its liens and security interests in the assets to be assigned therein, subject to approval by Cerulean’s board of directors of the repayment in full of the Loan Facility. Cerulean’s board approved the repayment as

set forth below in Item 1.02 of this Current Report on Form

8-K.

Item 1.02. Termination of a Material Definitive Agreement.

Cerulean has entered into a payoff letter dated as of March 17, 2017, with Hercules Capital, Inc. (formerly known as Hercules Technology Growth Capital,

Inc.) (“Hercules”), pursuant to which it agreed to pay off and thereby terminate its Loan and Security Agreement dated as of January 8, 2015 (the “Loan Agreement”) with Hercules as lender.

Pursuant to the payoff letter, Cerulean will pay, on or about March 20, 2017, a total of $12.4 million to Hercules, representing the principal,

accrued and unpaid interest, fees, costs and expenses outstanding under the Loan Agreement in repayment of Cerulean’s outstanding obligations under the Loan Agreement. This payoff amount includes a final end of term charge (“End of Term

Charge”) to Hercules in the amount of $1.4 million, representing 6.7% of the aggregate original principal amount advanced by Hercules.

Upon the

payment of the $12.4 million pursuant to the payoff letter, all outstanding indebtedness and obligations of the Company owing to Hercules under the Loan Agreement will be deemed paid in full, and the Loan Agreement will be terminated.

Cerulean originally entered into the Loan Agreement in January 2015 and borrowed $15.0 million and $6.0 million in two tranches in January 2015 and

November 2015, respectively. As of March 1, 2017, Cerulean had repaid to Hercules $10.0 million in principal under the terms of the Loan Agreement. In addition to principal and interest, Cerulean had agreed to make a final payment to

Hercules of the End of Term Charge. Cerulean’s obligations under the Loan Agreement were secured by a lien on substantially all of the assets of the Company, other than intellectual property, provided that such lien on substantially all assets

included any rights to payments and proceeds from the sale, licensing or disposition of intellectual property. The Loan Agreement contained customary covenants and representations, including financial reporting obligations and limitations on

dividends, indebtedness, collateral, investments, distributions, transfers, mergers or acquisitions, taxes, corporate changes, deposit accounts, and subsidiaries.

The foregoing description of the payoff letter does not purport to be complete and is qualified in its entirety by reference to the payoff letter, which is

filed as Exhibit 10.3 hereto and which is incorporated herein by reference.

Item 3.02. Unregistered Sales of Equity Securities.

The disclosure included in Item 1.01 of this Current Report on Form

8-K

is incorporated into this Item 3.02 by

reference. The shares of common stock of Cerulean to be issued to the Selling Stockholders pursuant to the Stock Purchase Agreement will be issued pursuant to exemptions from registration provided by Section 4(a)(2) and/or the private offering safe

harbor provisions of Regulation D of the Securities Act of 1933, as amended (the “Securities Act”), and/or Regulation S of the Securities Act, based on the following factors: (i) the number of offerees or purchasers, as applicable,

(ii) the absence of general solicitation, (iii) investment representations obtained from the Selling Stockholders, including with respect to their status as an accredited investors or not a “U.S. person,” (iv) the provision of

appropriate disclosure, and (v) the placement of restrictive legends on the certificates or book-entry notations reflecting the securities.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers

Retention Agreements

On

March 19, 2017, Cerulean’s board of directors determined, upon the recommendation of the Compensation Committee of the board, to enter into retention agreements with certain executive officers,

including three of Cerulean’s named executive officers: Mr. Christopher D. T. Guiffre, President & Chief Executive Officer, Mr. Adrian Senderowicz, Senior Vice

President & Chief Medical Officer, and Ms. Alejandra Carvajal, Vice President, General Counsel. These retention agreements supersede the provisions of such executive officers’ employment agreements and retention letters with the

Company providing for post-separation benefits.

The retention agreements of Mr. Senderowicz and Ms. Carvajal provide that each such executive

will be entitled to receive, (i) upon the timely execution of a release of claims agreement entered into contemporaneously with the retention agreement, a retention bonus (a “Retention Amount”) equal to his or her base salary for six

(6) months (less all applicable taxes and withholdings), (ii) upon executing a reaffirmation of such release of claims on the executive’s termination date, an additional lump sum payment (a “Health Assistance Payment”) in the

amount of six (6) times the Company’s current monthly contribution to Company-provided health and dental insurance coverage currently in effect with respect to such executive’s coverage elections (less all applicable taxes and

withholdings), and (iii) upon a change in control of the Company, the management change in control bonus described below under the caption “Management Change in Control Bonuses.” If the executive is terminated by the Company for Cause

(as defined in the retention agreement), or leaves the Company within the six (6)-month period following the date of the retention agreement for any reason without the agreement of the Company, the executive will be required to repay the Retention

Amount in full, and will no longer be eligible to receive a Health Assistance Payment or the management change in control bonus.

The retention agreement

of Mr. Guiffre provides that he will be entitled to receive, (i) upon the timely execution of a release of claims agreement entered into contemporaneously with the retention agreement, a Retention Amount equal to his base salary for six

(6) months (less all applicable taxes and withholdings), (ii) upon executing a reaffirmation of such release of claims on his termination date, (A) a Health Assistance Payment in the amount of twelve (12) times (or, if his termination

is in connection with a change in control, eighteen (18) times) the Company’s current monthly contribution to Company-provided health and dental insurance coverage currently in effect with respect to such executive’s coverage

elections (less all applicable taxes and withholdings) and (B) an additional lump sum payment (a “Severance Payment”) equal to his base salary for six (6) months (or, if his termination is in connection with a change in control,

twelve (12) months) (less all applicable taxes and withholdings), and (iii) upon a change in control of the Company, the management change in control bonus under the caption “Management Change in Control Bonuses.” In addition, if

Mr. Guiffre is terminated in connection with a change in control of the Company, he will be entitled to receive an additional lump sum payment equal to 1.5 times his 2016 cash performance bonus (less all applicable taxes and withholdings) (a

“Severance Bonus”) upon executing a reaffirmation of his release of claims on his termination date. If Mr. Guiffre is terminated by the Company for Cause (as defined in the retention agreement), or leaves the Company within the six

(6)-month period following the date of the retention agreement for any reason without the agreement of the Company, he will be required to repay the Retention Amount in full, and will no longer be eligible to receive a Health Assistance Payment,

Severance Payment, Severance Bonus or management change in control bonus.

The foregoing description of the retention agreements does not purport to be

complete and is qualified in its entirety by reference to the full text of each retention agreement, which are filed as Exhibits 10.4, 10.5 and 10.6 hereto and which are incorporated herein by reference.

Management Change in Control Bonuses

On March 19,

2017, Cerulean’s board of directors determined, upon the recommendation of the Compensation Committee of the board, that it was in the best interests of the Company to grant members of management the right to receive a change in control bonus

upon the closing of the Daré Transaction. These bonuses would be paid in lieu of and supersede any payments that would otherwise be due upon a

change in control as a result of the Daré Transaction pursuant to the Company’s existing executive bonus pool, which was previously disclosed in the Company’s Current Report on

Form

8-K

filed with the SEC on November 8, 2016.

Each of Cerulean’s named executive officers identified

in the table below shall be entitled to receive a cash bonus in an amount up to the maximum amount set forth next to his or her name upon the closing of the Daré Transaction, regardless of whether such individual remains employed by Cerulean

upon such closing date:

|

|

|

|

|

|

|

Name

|

|

Maximum Cash Award

|

|

|

Christopher D. T. Guiffre

|

|

$

|

125,525.63

|

|

|

Gregg Beloff

|

|

$

|

51,276.81

|

|

|

Adrian Senderowicz

|

|

$

|

104,732.57

|

|

|

Alejandra Carvajal

|

|

$

|

78,573.29

|

|

The final cash bonus amount payable to each such member of management upon the closing of the Daré Transaction shall be

determined in the sole discretion of the Compensation Committee.

Item 5.03. Amendments to Articles of Incorporation or Bylaws; Change in Fiscal

Year

On March 19, 2017, Cerulean’s board of directors adopted an amendment (the

“By-law

Amendment”) to Cerulean’s Amended and Restated

By-laws.

The

By-law

Amendment, which was effective upon adoption by the board, among other things, designates

the Court of Chancery of the State of Delaware as the sole and exclusive forum for any stockholder to bring (1) any derivative action or proceeding brought on behalf of Cerulean, (2) any action asserting a claim of breach of a fiduciary

duty owed by any current or former director, officer, other employee, agent or stockholder of Cerulean to Cerulean or Cerulean’s stockholders, including, without limitation, a claim alleging the aiding and abetting of such a breach of fiduciary

duty, (3) any action asserting a claim arising pursuant to any provision of the General Corporation Law of the State of Delaware (the “DGCL”), the certificate of incorporation or the

by-laws

of

Cerulean (as each may be amended from time to time), or as to which the DGCL confers jurisdiction on the Court of Chancery of the State of Delaware, or (4) any action asserting a claim governed by the internal affairs doctrine or other

“internal corporate claim” as that term is defined in Section 115 of the DGCL.

The foregoing description of the

By-law

Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the

By-law

Amendment, which is filed as Exhibit 3.1 hereto

and which is incorporated herein by reference.

Item 8.01. Other Events

On March 20, 2017, Cerulean issued a joint press release with Daré announcing that the companies and the shareholders of Daré have entered

into the Stock Purchase Agreement, as well as Cerulean’s entry into the Asset Purchase Agreement and the BlueLink Agreement.

In addition, Cerulean

announced a restructuring including the elimination of approximately 58% of its workforce, to a total of eight full-time equivalent employees, under a plan expected to be completed during the second quarter of 2017. Affected employees are being

offered transition benefits.

A copy of the joint press release is attached hereto as Exhibit 99.1 and is incorporated by reference herein. The

information contained on the websites referenced in the press release is not incorporated herein.

Item 9.01. Financial Statements and Exhibits.

See the Exhibit Index attached hereto.

Additional Information about the Proposed Transactions and Where to Find It

In connection with each of the proposed Daré Transaction and the proposed Novartis Transaction, Cerulean intends to file relevant materials with the

Securities and Exchange Commission (the “SEC”), including a definitive proxy statement on Schedule 14A (the “Proxy Statement”). The Proxy Statement will be sent to stockholders of Cerulean seeking their approval of the

Daré Voting Proposal, the Novartis Voting Proposal and related matters. Investors and stockholders of Cerulean are urged to read these materials when they become available because they will contain important information about Cerulean,

Daré, the proposed Daré Transaction, Novartis, the proposed Novartis Transaction and related transactions. The Proxy Statement, any amendments or supplements thereto (when they become available) and other documents filed by Cerulean

with the SEC may be obtained free of charge through the SEC web site at

www.sec.gov

. They may also be obtained for free by directing a written request to: Cerulean Pharma Inc., 35 Gatehouse Drive, Waltham, MA, Attention: Corporate

Secretary.

This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any

securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under or applicable exemption from the securities laws of any such

jurisdiction.

Participants in the Solicitation

Cerulean, Daré and each of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the

stockholders of Cerulean in connection with the Daré Voting Proposal. Cerulean, Novartis and each of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of

Cerulean in connection with the Novartis Voting Proposal. Information regarding the interests of these directors and executive officers in the proposed transaction described herein will be included in the Proxy Statement described above. Additional

information regarding the directors and executive officers of Cerulean is included in its proxy statement for its 2016 annual meeting of stockholders, which was filed with the SEC on April 28, 2016, and is supplemented by other public filings

made, and to be made, with the SEC by Cerulean.

Cautionary Note on Forward-Looking Statements

Any statements in this Current Report on Form

8-K

about future expectations, plans and prospects for the Company,

including statements about the expected timing, consummation and benefits of the strategic transactions described herein, future management of the Company, approval of the transactions by the Company’s stockholders, the ability of the parties

to satisfy other closing conditions, the Company’s strategy and future operations and other statements containing the words “anticipate,” “believe,” “estimate,” “expect,” “intend,”

“may,” “plan,” “predict,” “project,” “target,” “potential,” “will,” “would,” “could,” “should,” “continue,” and similar expressions,

constitute forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those indicated by such forward-looking statements as a result of various important factors,

including: turnover resulting from changes in the Company’s management, the uncertainties inherent in the initiation and conduct of clinical trials, availability and timing of data from clinical trials, whether results of early clinical trials

or preclinical studies will be indicative of the results of future trials, the adequacy of any clinical models, uncertainties associated with regulatory review of clinical trials and applications for marketing approvals and other factors discussed

in the “Risk Factors” section of our Quarterly Report on Form

10-Q

filed with the SEC on November 3, 2016, and in other filings that we make with the SEC. In addition, the forward-looking

statements included in this Current Report on Form

8-K

represent the Company’s views as of the date hereof. The Company anticipates that subsequent events and developments will cause the Company’s

views to change. However, while the Company may elect to update these forward-looking statements at some point in the future, the Company specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as

representing the Company’s views as of any date subsequent to the date hereof.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

CERULEAN PHARMA INC.

|

|

|

|

|

|

|

Date: March 20, 2017

|

|

|

|

By:

|

|

/s/ Christopher D.T. Guiffre

|

|

|

|

|

|

|

|

|

|

|

|

|

Christopher D.T. Guiffre

|

|

|

|

|

|

|

|

President and Chief Executive Officer

|

EXHIBIT INDEX

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

|

|

|

2.1*

|

|

Stock Purchase Agreement dated as of March 19, 2017, entered into by and among Cerulean Pharma Inc., Daré Bioscience, Inc. and equityholders of Daré Bioscience, Inc. named therein.

|

|

|

|

|

2.2*

|

|

Asset Purchase Agreement dated as of March 19, 2017, entered into by and between Cerulean Pharma Inc. and Novartis Institutes for BioMedical Research, Inc.

|

|

|

|

|

2.3*

|

|

Asset Purchase Agreement dated as of March 19, 2017, entered into by and between Cerulean Pharma Inc. and BlueLink Pharmaceuticals, Inc.

|

|

|

|

|

3.1

|

|

Amendment to Amended and Restated

By-laws

of Cerulean Pharma Inc.

|

|

|

|

|

10.1

|

|

Support Agreement dated as of March 19, 2017, entered into by and among Cerulean Pharma Inc., Daré Bioscience, Inc. and shareholders of Cerulean Pharma Inc. named therein.

|

|

|

|

|

10.2

|

|

License Agreement dated as of March 19, 2017, entered into by and between Cerulean Pharma Inc. and BlueLink Pharmaceuticals, Inc.

|

|

|

|

|

10.3

|

|

Payoff Letter dated as of March 17, 2017, entered into by and between Cerulean Pharma Inc. and Hercules Capital, Inc. (formerly known as Hercules Technology Growth Capital, Inc.)

|

|

|

|

|

10.4

|

|

Retention Agreement dated as of March 19, 2017, entered into by and between Cerulean Pharma Inc. and Christopher D. T. Guiffre.

|

|

|

|

|

10.5

|

|

Retention Agreement dated as of March 19, 2017, entered into by and between Cerulean Pharma Inc. and Adrian Senderowicz.

|

|

|

|

|

10.6

|

|

Retention Agreement dated as of March 19, 2017, entered into by and between Cerulean Pharma Inc. and Alejandra Carvajal.

|

|

|

|

|

99.1

|

|

Joint Press Release dated March 20, 2017.

|

|

*

|

All schedules (or similar attachments) have been omitted from this filing pursuant to Item 601(b)(2) of Regulation

S-K.

The Company will furnish copies of any schedules to the

Securities and Exchange Commission upon request.

|

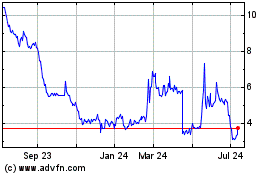

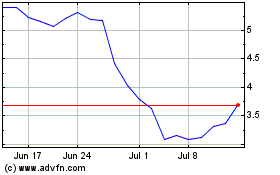

Dare Bioscience (NASDAQ:DARE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dare Bioscience (NASDAQ:DARE)

Historical Stock Chart

From Apr 2023 to Apr 2024