Artesian Resources Corporation Reports 4th Quarter and 2016 Year-End Earnings

March 08 2017 - 7:23PM

Artesian Resources Corporation (NASDAQ:ARTNA), a leading provider

of water, wastewater services and related services on the Delmarva

Peninsula, today announced revenue and income for 2016.

Revenues were $79.1 million, up 2.7% from $77.0 million in

2015. Net income increased 14.6% to $13.0 million, compared

to $11.3 million in 2015. Diluted net income per common share

was up 11.9% at $1.41 for 2016 compared to $1.26 for 2015.

Water sales revenues increased 2.4% to $70.6

million, from $68.9 million in 2015. The increase in water

sales revenue is due to an overall increase in water consumption,

an increase in the number of customers served and two increases in

the Distribution System Improvement Charges (DSIC) placed into

effect in 2016.

Non-utility revenue was $4.7 million, up from

$4.4 million in 2015, a 6.5% increase, primarily from customer

enrollments in the Service Line Protection Plans. The Service

Line Protection Plans provide coverage for all material and labor

required to repair or replace participants’ leaking water service

or clogged sewer lines and internal plumbing lines.

Operating expenses, excluding depreciation and

income taxes, decreased $70,000, or 0.2%, for the year ended

December 31, 2016 compared to the year ended December 31,

2015. Utility operating expenses decreased $0.5 million, or

1.4%, for the year ended December 31, 2016 compared to the year

ended December 31, 2015. The decrease is primarily related to

decreased payroll, employee benefit costs and purchased power

expense. The ratio of operating expenses, excluding

depreciation and income taxes, to total revenues was 54.1% for 2016

compared to 55.6% for 2015. “We have vigilantly acted to

control expenses and to implement efficiencies. These efforts

have resulted in our ability to reduce utility operating expenses

in 2016,” said Dian C. Taylor, Chair, President and CEO.

Depreciation and amortization expense increased

$0.4 million, primarily due to continued investment in utility

plant in service providing supply, treatment, storage and

distribution of water. Income tax expense increased $0.5

million as a result of improved profitability compared to 2015.

Interest expense decreased $0.4 million,

primarily due to a reduction in the annual interest rate on the

Series S First Mortgage Bond from 6.73% to 4.45% effective March 1,

2016.

“We continued to take proactive measures in 2016

to control expenses while at the same time investing in

infrastructure improvements to continue to assure high quality and

reliable service to our customers. In 2016 we invested $28.2

million in improvements to enhance existing treatment facilities,

improve sources of supply, upgrade and automate meter reading

equipment, replace aging mains and upgrade computer hardware and

software, while seeking efficiencies whenever possible,” said Dian

Taylor.

Net income increased 48.6% to $2.7 million for

the three months ended December 31, 2016 compared to $1.8 million

for the same period in 2015. Diluted net income per common

share increased 42.9% to $0.30 for the three months ended December

31, 2016 compared to $0.21 for the same period in 2015.

For the three months ended December 31, 2016,

revenues were $19.4 million, an increase of 3.6% from the $18.8

million recorded for the same period in 2015. Water sales

revenue increased 3.4% to $17.1 million for the three months ended

December 31, 2016. The increase in water sales revenue is the

result of an increase in water consumption, an increase in the

number of customers served and two increases in the Distribution

System Improvement Charge.

Operating expenses, excluding income taxes and

depreciation, decreased by 6.8% to $10.9 million for the three

months ended December 31, 2016 compared to $11.6 million for the

same period in 2015. The decrease in operating expenses is

the result of decreases in payroll and employee benefits costs, and

in consulting and legal fees.

Interest expense decreased 5.4% from $1.7

million for the three months ended December 31, 2015 to $1.6

million for the three months ended December 31, 2016 primarily due

to the decrease in the Series S First Mortgage Bond interest

rate.

Other Highlights include:

- Completed 8 water main renewals in 2016 replacing nearly 6

miles of aging water mains, ranging in age from 45 to 74 years

old.

- Instituted a large meter replacement program in July 2016 to

replace obsolete customer meters with technology that detects low

flows not detected by the older meters. To date we have

replaced 1,699 meters.

- Partnered with Sussex County to interconnect our regional

wastewater systems in several locations and to share transmission

and treatment infrastructure to cost-effectively serve each of our

growing service areas.

- Entered into an agreement with Allen Harim Foods, LLC located

in Harbeson, Delaware to dispose of 1.5 million gallons per day of

treated process wastewater by means of spray irrigation.

- Granted the water franchise to serve the historic town of

Odessa and reached agreement with the Odessa Fire Company and the

Cantwell Water Company for purchase of their respective water

assets. We have provided service to the Odessa Fire Company’s

fire station since May 2013 and are excited that our partnership

with Odessa will now allow us to be able to provide reliable, high

quality water to the residents of Odessa who have previously relied

upon individual private wells.

About Artesian Resources

Artesian Resources Corporation operates as a

holding company of wholly-owned subsidiaries offering water,

wastewater services and related services on the Delmarva

Peninsula. Artesian Water Company, Inc., the principal

subsidiary, is the oldest and largest investor-owned water utility

on the Delmarva Peninsula and has been providing water service

since 1905. Artesian supplies 7.6 billion gallons of water

per year through 1,260 miles of water main to approximately 301,000

people.

| Artesian Resources Corporation |

| Condensed Consolidated Statement of Operations |

| (In thousands, except per share amounts) |

| (Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

Year Ended |

| |

|

December 31, |

|

December 31, |

| |

|

2016 |

|

2015 |

|

2016 |

|

2015 |

| Operating

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

| Water

sales |

|

$ |

17,147 |

|

|

$ |

16,589 |

|

|

$ |

70,587 |

|

$ |

68,932 |

| Other

utility operating revenue |

|

|

1,064 |

|

|

|

1,076 |

|

|

|

3,816 |

|

|

3,694 |

|

Non-utility operating revenue |

|

|

1,206 |

|

|

|

1,085 |

|

|

|

4,686 |

|

|

4,398 |

| |

|

|

19,417 |

|

|

|

18,750 |

|

|

|

79,089 |

|

|

77,024 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

| Utility

operating expenses |

|

|

9,055 |

|

|

|

9,949 |

|

|

|

35,658 |

|

|

36,148 |

|

Non-utility operating expenses |

|

|

678 |

|

|

|

600 |

|

|

|

2,602 |

|

|

2,305 |

|

Depreciation and amortization |

|

|

2,353 |

|

|

|

2,239 |

|

|

|

9,188 |

|

|

8,837 |

| State and

federal income taxes |

|

|

1,859 |

|

|

|

1,332 |

|

|

|

8,331 |

|

|

7,784 |

| Property

and other taxes |

|

|

1,120 |

|

|

|

1,099 |

|

|

|

4,491 |

|

|

4,368 |

| |

|

|

15,065 |

|

|

|

15,219 |

|

|

|

60,270 |

|

|

59,442 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

Income |

|

|

4,352 |

|

|

|

3,531 |

|

|

|

18,819 |

|

|

17,582 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Allowance

for funds used during construction |

|

|

62 |

|

|

|

96 |

|

|

|

222 |

|

|

249 |

|

Miscellaneous |

|

|

(43 |

) |

|

|

(50 |

) |

|

|

557 |

|

|

472 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Income Before

Interest Charges |

|

|

4,371 |

|

|

|

3,577 |

|

|

|

19,598 |

|

|

18,303 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest

Charges |

|

|

1,648 |

|

|

|

1,742 |

|

|

|

6,644 |

|

|

6,998 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net

Income |

|

$ |

2,723 |

|

|

$ |

1,835 |

|

|

$ |

12,954 |

|

$ |

11,305 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted

Average Common Shares Outstanding - Basic |

|

|

9,122 |

|

|

|

9,035 |

|

|

|

9,098 |

|

|

8,960 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

Income per Common Share - Basic |

|

$ |

0.30 |

|

|

$ |

0.21 |

|

|

$ |

1.42 |

|

$ |

1.26 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted

Average Common Shares Outstanding - Diluted |

|

|

9,187 |

|

|

|

9,095 |

|

|

|

9,161 |

|

|

9,005 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

Income per Common Share - Diluted |

|

$ |

0.30 |

|

|

$ |

0.21 |

|

|

$ |

1.41 |

|

$ |

1.26 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Artesian Resources Corporation |

| Condensed Consolidated Balance Sheet |

| (In thousands) |

| (Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

December 31, |

|

December 31, |

|

|

|

|

|

|

| |

|

2016 |

|

2015 |

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

| Utility

Plant, at original cost less |

|

|

|

|

|

|

|

|

|

|

|

|

|

accumulated depreciation |

|

$ |

425,502 |

|

|

$ |

405,606 |

|

|

|

|

|

|

|

| Current

Assets |

|

|

14,635 |

|

|

|

14,444 |

|

|

|

|

|

|

|

|

Regulatory and Other Assets |

|

|

10,839 |

|

|

|

11,576 |

|

|

|

|

|

|

|

| |

|

$ |

450,976 |

|

|

$ |

431,626 |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Capitalization

and Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' Equity |

|

$ |

139,023 |

|

|

$ |

132,331 |

|

|

|

|

|

|

|

| Long Term

Debt, Net of Current Portion |

|

|

102,331 |

|

|

|

103,647 |

|

|

|

|

|

|

|

| Current

Liabilities |

|

|

19,328 |

|

|

|

22,403 |

|

|

|

|

|

|

|

| Net

Advances for Construction |

|

|

8,169 |

|

|

|

8,752 |

|

|

|

|

|

|

|

|

Contributions in Aid of Construction |

|

|

112,106 |

|

|

|

99,847 |

|

|

|

|

|

|

|

| Other

Liabilities |

|

|

70,019 |

|

|

|

64,646 |

|

|

|

|

|

|

|

| |

|

$ |

450,976 |

|

|

$ |

431,626 |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Contact:

Nicholle Taylor

Investor Relations

(302) 453-6900

ntaylor@artesianwater.com

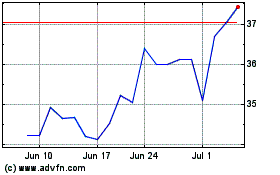

Artesian Resources (NASDAQ:ARTNA)

Historical Stock Chart

From Mar 2024 to Apr 2024

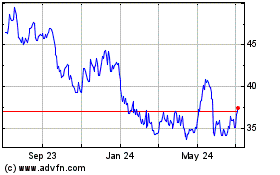

Artesian Resources (NASDAQ:ARTNA)

Historical Stock Chart

From Apr 2023 to Apr 2024