Stocks Rise With Advancing Metals

November 21 2016 - 11:52AM

Dow Jones News

By Riva Gold and Akane Otani

U.S. stocks rose with commodity prices Monday, putting the

S&P 500 and Nasdaq Composite on track for fresh closing

records.

U.S. crude oil rose 3.4% to $47.93 a barrel after Iraq's oil

minister said Sunday the country would offer new proposals at next

week's meeting of the Organization of the Petroleum Exporting

Countries, where officials are expected to discuss a supply

cut.

Energy shares gained. Drilling contractor Transocean rose 4.3%,

Chesapeake Energy gained 6.1% and Marathon Petroleum added

5.8%.

Metals prices also rose, buffeted by a retreat in the dollar.

Gold was up 0.4% at $1,214 an ounce and copper extended a multiweek

rally following Chinese President Xi Jinping's statement over the

weekend that his government would support a Free Trade Area of the

Asia Pacific. Many investors expect this to mean increased imports

by China, the world's largest metal consumer.

On Monday, the Dow Jones Industrial Average rose 52 points, or

0.3%, to 18920, near its closing record of 18923.06. The S&P

500 rose 0.5% and was trading above its Aug. 15 record closing

level of 2190.15. The Nasdaq Composite added 0.6%, passing its

record close of 5339.52 reached on Sept. 22.

In government bond markets, the yield on the 10-year U.S.

Treasury note fell to 2.321% from 2.337% on Friday. The 10-year

note had posted its steepest two-week yield gain since 2001. Yields

move inversely to prices.

"Our bond guys said the implementation of Trump's platform will

result in stronger economic growth, stronger inflation, and the Fed

will tighten rates," said Phil Orlando, chief equity market

strategist at Federated Investors.

"When we saw that, we immediately increased our equity

allocation and took it out of Treasurys," he said, favoring

economically sensitive U.S. stocks such as financials and

industrials instead.

Currency markets have tracked the bond market closely since the

election, with the dollar mostly rising alongside a decline in the

price of the 10-year Treasury note.

"It's all about yield," said Simon Derrick, chief currency

strategist at BNY Mellon.

The WSJ Dollar Index, which measures the U.S. currency against

16 others, cooled on Monday from its longest winning streak since

2009. The index fell 0.4% and was on track for its first loss in 11

sessions.

Elsewhere, the Stoxx Europe 600 was up 0.3%, following gains in

Asia.

Investors in Europe were also watching the weekend's political

developments in France and Germany. Nicolas Sarkozy's campaign to

reclaim the French presidency ended abruptly after a surge of

support for his former prime minister, leaving François Fillon and

Bordeaux Mayor Alain Juppé set to advance to a runoff next

Sunday.

German Chancellor Angela Merkel also said Sunday she would run

for a fourth term next year, ending months of speculation.

Local politics have started to take a toll, strategists said.

With the euro, "for the first time in quite a while, people are

focusing on something other than pure-yield," Mr. Derrick said,

adding "there's been a realization that political uncertainty is

perhaps greater."

Italian 10-year bond yields rose to as high as 2.111% from

2.017% on Friday, ahead of a coming referendum on constitutional

reform. They later pulled back to 2.008%, according to

Tradeweb.

Earlier, the Nikkei Stock Average added 0.8% to reach its

highest close since January.

The Shanghai Composite also advanced 0.8% to its highest close

since January, even as the Chinese yuan was fixed lower for a 12th

straight session, hit by a recent appreciation of the dollar.

Write to Riva Gold at riva.gold@wsj.com and Akane Otani at

akane.otani@wsj.com

(END) Dow Jones Newswires

November 21, 2016 11:37 ET (16:37 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

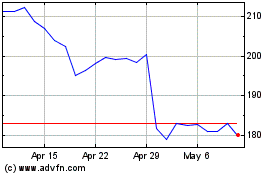

Marathon Petroleum (NYSE:MPC)

Historical Stock Chart

From Aug 2024 to Sep 2024

Marathon Petroleum (NYSE:MPC)

Historical Stock Chart

From Sep 2023 to Sep 2024