Perion Network Ltd. (NASDAQ:PERI), a global technology leader in

high-quality advertising solutions for brands and publishers,

announced today its financial results for the third quarter and

nine months ended September 30, 2016.

Financial Highlights*(In

thousands, except per share data)

|

|

Three months ended |

|

|

September 30, |

|

|

2015 |

|

2016 |

|

Revenues |

$ |

|

52,637 |

|

|

$ |

74,460 |

|

GAAP Net Income (loss) from continuing operation |

$ |

|

(69,034 |

) |

|

$ |

2,884 |

|

Non-GAAP Net Income |

$ |

|

8,310 |

|

|

$ |

7,670 |

|

Adjusted EBITDA |

$ |

|

11,450 |

|

|

$ |

12,362 |

|

GAAP Diluted Earnings (Loss) Per Share from continuing

operation |

$ |

|

(0.97 |

) |

|

$ |

0.04 |

|

Non-GAAP Diluted Earnings Per Share |

$ |

|

0.12 |

|

|

$ |

0.10 |

* Reconciliation of GAAP to Non-GAAP measures

follows.

Josef Mandelbaum, Perion’s CEO commented,

“Perion delivered both sequential and year-over-year EBITDA growth

for the first time in two years, reflecting the stability of our

business and the continued reduction in expenses, which have

enabled us to deliver consistent profitability. This translated

into another excellent quarter of cash generation, whereby cash

flow from continuing operations was $9.6 million, and for the first

nine months of the year now stands at $21.7 million.”

“We have increased profits, despite lower than

expected revenues, which were impacted by: the cancellation in

September of approximately $3 million in previously booked ad

campaigns related to the presidential elections; and proactive

actions we took with a couple of download publishers, reducing

search-generated revenue by approximately $2 million,” concluded

Mr. Mandelbaum. “While we expect some lingering effect to carry

over into the fourth quarter, it will be our strongest quarter of

the year and we expect revenue and EBITDA to continue to grow

sequentially and on a year over year basis. We also expect

non-search revenue to be more than 50% of total revenue, in the

fourth quarter, for the first time in the past six years."

Financial Comparison for the Third

Quarter of 2016:

Revenues: The 41% year over

year increase in revenues is primarily due to the addition of the

Undertone business since Q4 2015. Search-generated revenues

declined marginally on a sequential basis, but remain relatively

stable, now for the past seven consecutive quarters.

Customer Acquisition and Media Buy Costs

(“CAC”): CAC in the third quarter of 2016 were $33.0

million, or 44% of revenues, as compared to $25.3 million, or 48%

of revenues in the third quarter of 2015. The increase in the

nominal cost compared to the third quarter of 2015 was due to the

media buy costs in the Undertone business, acquired in the fourth

quarter of 2015. However, as a percentage of revenues these

costs have decreased due to these expenses representing a lower

percentage of revenues in our Undertone business.

Net Income (loss): On a GAAP

basis, net income in the third quarter of 2016 was $4.9 million, as

compared to a net loss of $70.8 million in the third quarter of

2015. The loss in the third quarter of 2015 was primarily due

to a non-cash, $74.1 million impairment of goodwill and intangible

assets.

Non-GAAP Net Income: In the

third quarter of 2016, Non-GAAP net income was $7.7 million, or 10%

of revenues, compared to the $8.3 million, or 16% of revenues, in

the third quarter of 2015.

Adjusted EBITDA: In the third

quarter of 2016, adjusted EBITDA was $12.4 million, or 17% of

revenues, increasing sequentially and year over year, compared to

$11.5 million, or 22% of revenues, in the third quarter of

2015.

Cash and Cash Flow from

Operations: As of September 30, 2016, cash, cash

equivalents and short-term deposits, were $31.4 million. This

balance reflects the $22 million cash payment, and the elimination

of a $36 million future nominal acquisition obligation previously

announced. Cash provided by continuing operations in the third

quarter of 2016 was $9.6 million, bringing the total since the

beginning of the year to $21.7 million.

Perion currently satisfies all the financial

covenants associated with its debt.

Financial Outlook for the Fourth Quarter

of 2016:

Management today announced its financial outlook

for the fourth quarter of 2016 as follows:

- Revenue is expected to be in the range of $78 - $82

million.

- Adjusted EBITDA is expected to be in the range of $12.5 - $13.5

million.

Conference Call:

Perion will host a conference call to discuss

the results today, November 8, 2016, at 10 a.m. ET. Details are as

follows:

- Conference ID: 2099863

- Dial-in number from within the United States:

1-888-684-1264

- Dial-in number from Israel: 1-809-258-350

- Dial-in number (other international): 1-913-312-0850

- Playback available until November 15, 2016 by calling

1-877-870-5176 (United States) or 1-858-384-5517 (international).

Please use PIN code 2099863 for the replay.

- Link to the live webcast accessible at

http://www.perion.com/ir-events

About Perion Network Ltd.

Perion is a global technology company that

delivers high-quality advertising solutions to brands and

publishers. Perion is committed to providing outstanding

execution, from high-impact ad formats to branded search and a

unified social and mobile programmatic platform. More information

about Perion may be found at www.perion.com, and follow Perion on

Twitter@perionnetwork.

Non-GAAP measures

Non-GAAP financial measures, consist of GAAP

financial measures adjusted to exclude acquisition related

expenses, share-based compensation expenses, restructuring costs,

loss from discontinue operations, accretion of acquisition related

contingent consideration, amortization of acquired intangible

assets and the related taxes thereon, non-recurring tax expenses,

as well as certain accounting entries under the business

combination accounting rules that require us to recognize a legal

performance obligation related to revenue arrangements of an

acquired entity based on its fair value at the date of acquisition.

Additionally, in September 2014, the Company issued convertible

bonds denominated in New Israeli Shekels and at the same time

entered into a derivative arrangement (SWAP) that economically

exchanges the convertible bonds as if they were denominated in US

dollars, when the bond was issued. The Company excludes from its

GAAP financial measures the fair value revaluations of both, the

convertible bonds and the related derivative instrument, and by

doing so, the non-GAAP measures reflect the Company’s results as if

the convertible bonds were originally issued and denominated in US

dollars, which is the Company’s functional currency. Adjusted

Earnings Before Interest, Taxes, Depreciation and Amortization

("Adjusted EBITDA") is defined as operating income excluding

stock-based compensation expenses, depreciation, restructuring

costs, acquisition-related items consisting of amortization of

intangible assets and goodwill and intangible asset impairments,

acquisition related expenses, gains and losses recognized on

changes in the fair value of contingent consideration arrangements

and certain accounting entries under the business combination

accounting rules that require us to recognize a legal performance

obligation related to revenue arrangements of an acquired entity

based on its fair value at the date of acquisition.

The purpose of such adjustments is to give an

indication of our performance exclusive of non-cash charges and

other items that are considered by management to be outside of our

core operating results. These non-GAAP measures are among the

primary factors management uses in planning for and forecasting

future periods. Furthermore, the non-GAAP measures are regularly

used internally to understand, manage and evaluate our business and

make operating decisions, and we believe that they are useful to

investors as a consistent and comparable measure of the ongoing

performance of our business. However, our non-GAAP financial

measures are not meant to be considered in isolation or as a

substitute for comparable GAAP measures, and should be read only in

conjunction with our consolidated financial statements prepared in

accordance with GAAP. Additionally, these non-GAAP financial

measures may differ materially from the non-GAAP financial measures

used by other companies. A reconciliation between results on a GAAP

and non-GAAP basis is provided in the last table of this press

release.

Forward Looking Statements

This press release contains historical

information and forward-looking statements within the meaning of

The Private Securities Litigation Reform Act of 1995 with respect

to the business, financial condition and results of operations of

Perion. The words “will,” “believe,” “expect,” “intend,” “plan,”

“should” and similar expressions are intended to identify

forward-looking statements. Such statements reflect the current

views, assumptions and expectations of Perion with respect to

future events and are subject to risks and uncertainties. Many

factors could cause the actual results, performance or achievements

of Perion to be materially different from any future results,

performance or achievements that may be expressed or implied by

such forward-looking statements, or financial information,

including, among others, the failure to realize the anticipated

benefits of companies and businesses we acquired and may acquire in

the future, risks entailed in integrating the companies and

businesses we acquire, including employee retention and customer

acceptance; the risk that such transactions will divert management

and other resources from the ongoing operations of the business or

otherwise disrupt the conduct of those businesses, potential

litigation associated with such transactions, and general risks

associated with the business of Perion including intense and

frequent changes in the markets in which the businesses operate and

in general economic and business conditions, loss of key customers,

unpredictable sales cycles, competitive pressures, market

acceptance of new products, inability to meet efficiency and cost

reduction objectives, changes in business strategy and various

other factors, whether referenced or not referenced in this press

release. Various other risks and uncertainties may affect Perion

and its results of operations, as described in reports filed by the

Company with the Securities and Exchange Commission from time to

time, including its annual report on Form 20-F for the year ended

December 31, 2015 filed with the SEC on March 24, 2016. Perion does

not assume any obligation to update these forward-looking

statements.

| PERION NETWORK LTD. AND ITS

SUBSIDIARIES |

|

|

| CONSOLIDATED STATEMENTS OF OPERATIONS:

UNAUDITED |

| In

thousands (except share and per share data) |

|

|

|

|

Three months ended |

|

Nine months ended |

|

|

September 30, |

|

September 30, |

|

|

2015 |

|

2016 |

|

2015 |

|

2016 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

| Search |

$ |

|

45,498 |

|

|

$ |

38,397 |

|

$ |

|

129,210 |

|

|

$ |

|

120,590 |

|

| Advertising and other |

|

|

7,139 |

|

|

|

36,063 |

|

|

|

24,133 |

|

|

|

|

107,662 |

|

| Total

Revenues |

|

|

52,637 |

|

|

|

74,460 |

|

|

|

153,343 |

|

|

|

|

228,252 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Costs and

Expenses: |

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenues |

|

|

1,585 |

|

|

|

3,747 |

|

|

|

4,506 |

|

|

|

|

11,938 |

|

| Customer acquisition and media buy

costs |

|

|

25,304 |

|

|

|

32,990 |

|

|

|

60,395 |

|

|

|

|

102,065 |

|

| Research and development |

|

|

5,315 |

|

|

|

5,632 |

|

|

|

15,925 |

|

|

|

|

20,135 |

|

| Selling and marketing |

|

|

4,767 |

|

|

|

13,408 |

|

|

|

14,019 |

|

|

|

|

43,152 |

|

| General and administrative |

|

|

6,613 |

|

|

|

7,778 |

|

|

|

17,317 |

|

|

|

|

24,574 |

|

| Depreciation and amortization |

|

|

1,822 |

|

|

|

6,156 |

|

|

|

6,254 |

|

|

|

|

19,803 |

|

| Impairment, net of change in fair

value of contingent consideration |

|

|

74,119 |

|

|

|

- |

|

|

|

71,722 |

|

|

|

|

- |

|

| Restructuring costs |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

|

728 |

|

| Total Costs and

Expenses |

|

|

119,525 |

|

|

|

69,711 |

|

|

|

190,138 |

|

|

|

|

222,395 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (Loss)

from Operations |

|

|

(66,888 |

) |

|

|

4,749 |

|

|

|

(36,795 |

) |

|

|

|

5,857 |

|

| Financial expense,

net |

|

|

1,084 |

|

|

|

950 |

|

|

|

2,142 |

|

|

|

|

6,406 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (Loss)

before Taxes on Income |

|

|

(67,972 |

) |

|

|

3,799 |

|

|

|

(38,937 |

) |

|

|

|

(549 |

) |

| Taxes on income |

|

|

1,062 |

|

|

|

915 |

|

|

|

7,584 |

|

|

|

|

(3,078 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income

(Loss) from Continuing Operations |

|

|

(69,034 |

) |

|

|

2,884 |

|

|

|

(46,521 |

) |

|

|

|

2,529 |

|

| Net income (Loss) from

discontinued operations |

|

|

(1,812 |

) |

|

|

2,021 |

|

|

|

(5,371 |

) |

|

|

|

(2,647 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income

(Loss) |

$ |

|

(70,846 |

) |

|

$ |

4,905 |

|

$ |

|

(51,892 |

) |

|

$ |

|

(118 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Earnings

(Loss) per Share - Basic: |

|

|

|

|

|

|

|

|

|

|

|

| Continuing operations |

$ |

|

(0.97 |

) |

|

$ |

0.04 |

|

$ |

|

(0.66 |

) |

|

$ |

|

0.03 |

|

| Discontinued operations |

$ |

|

(0.03 |

) |

|

$ |

0.03 |

|

$ |

|

(0.08 |

) |

|

$ |

|

(0.03 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Earnings

(Loss) per Share - Diluted: |

|

|

|

|

|

|

|

|

|

|

|

| Continuing operations |

$ |

|

(0.97 |

) |

|

$ |

0.04 |

|

$ |

|

(0.66 |

) |

|

$ |

|

0.03 |

|

| Discontinued operations |

$ |

|

(0.03 |

) |

|

$ |

0.03 |

|

$ |

|

(0.08 |

) |

|

$ |

|

(0.03 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted

average number of shares continuing and discontinued |

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

71,242,091 |

|

|

|

76,573,397 |

|

|

|

70,831,856 |

|

|

|

|

76,357,173 |

|

| Diluted |

|

|

71,242,091 |

|

|

|

77,739,340 |

|

|

|

70,831,856 |

|

|

|

|

76,381,693 |

|

|

|

| PERION NETWORK LTD. AND ITS

SUBSIDIARIES |

|

|

| CONDENSED CONSOLIDATED BALANCE SHEETS:

UNAUDITED |

| In

thousands |

|

|

| |

December 31, |

|

September 30, |

| |

2015 |

|

2016 |

|

ASSETS |

|

|

|

|

|

| |

|

|

|

|

|

| Current Assets: |

|

|

|

|

|

| Cash and cash equivalents |

$ |

|

17,519 |

|

|

$ |

|

23,578 |

|

| Short-term bank deposit |

|

|

42,442 |

|

|

|

|

7,836 |

|

| Accounts receivable, net |

|

|

66,662 |

|

|

|

|

50,327 |

|

| Prepaid expenses and other current

assets |

|

|

17,396 |

|

|

|

|

18,483 |

|

| Total Current

Assets |

|

|

144,019 |

|

|

|

|

100,224 |

|

| |

|

|

|

|

|

| Property and equipment,

net |

|

|

12,714 |

|

|

|

|

13,936 |

|

| Goodwill and intangible

assets, net |

|

|

269,765 |

|

|

|

|

240,260 |

|

| Deferred taxes |

|

|

12,344 |

|

|

|

|

4,223 |

|

| Other assets |

|

|

3,456 |

|

|

|

|

1,483 |

|

| |

|

|

|

|

|

| Total

Assets |

$ |

|

442,298 |

|

|

$ |

|

360,126 |

|

| |

|

|

|

|

|

| LIABILITIES AND

SHAREHOLDERS' EQUITY |

|

|

|

|

|

| |

|

|

|

|

|

| Current

Liabilities: |

|

|

|

|

|

| Accounts payable |

$ |

|

40,388 |

|

|

$ |

|

28,080 |

|

| Accrued expenses and other

liabilities |

|

|

22,857 |

|

|

|

|

13,894 |

|

| Short-term loans and current

maturities of long-term and convertible debt |

|

|

23,756 |

|

|

|

|

23,978 |

|

| Deferred revenues |

|

|

7,731 |

|

|

|

|

5,218 |

|

| Payment obligation related to

acquisitions |

|

|

11,893 |

|

|

|

|

9,106 |

|

| Total Current

Liabilities |

|

|

106,625 |

|

|

|

|

80,276 |

|

| Long-Term

Liabilities: |

|

|

|

|

|

| Long-term debt, net of current

maturities |

|

|

46,920 |

|

|

|

|

40,893 |

|

| Convertible debt, net of current

maturities |

|

|

28,371 |

|

|

|

|

22,061 |

|

| Payment obligation related to

acquisition |

|

|

37,231 |

|

|

|

|

- |

|

| Deferred taxes |

|

|

19,456 |

|

|

|

|

6,029 |

|

| Other long-term liabilities |

|

|

3,858 |

|

|

|

|

4,642 |

|

| Total

Liabilities |

|

|

242,461 |

|

|

|

|

153,901 |

|

| |

|

|

|

|

|

| Shareholders'

equity: |

|

|

|

|

|

| Ordinary shares |

|

|

206 |

|

|

|

|

209 |

|

| Additional paid-in capital |

|

|

227,258 |

|

|

|

|

232,961 |

|

| Treasury shares at cost |

|

|

(1,002 |

) |

|

|

|

(1,002 |

) |

| Accumulated other comprehensive

income (loss) |

|

|

(794 |

) |

|

|

|

6 |

|

| Accumulated deficit |

|

|

(25,831 |

) |

|

|

|

(25,949 |

) |

| Total

Shareholders' Equity |

|

|

199,837 |

|

|

|

|

206,225 |

|

| |

|

|

|

|

|

| Total

Liabilities and Shareholders' Equity |

$ |

|

442,298 |

|

|

$ |

|

360,126 |

|

|

|

| PERION NETWORK LTD. AND ITS

SUBSIDIARIES |

|

|

| CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS: UNAUDITED |

| In

thousands |

| |

Nine months ended September 30, |

| |

2015 |

|

2016 |

| Operating

activities: |

|

|

|

|

|

| Net loss |

$ |

|

(51,892 |

) |

|

$ |

|

(118 |

) |

| Loss from discontinued operations,

net |

|

|

(5,371 |

) |

|

|

|

(2,647 |

) |

| Net income (loss) from

continuing operations |

|

|

(46,521 |

) |

|

|

|

2,529 |

|

| |

|

|

|

|

|

| Adjustments required to

reconcile net income to net cash provided by operating

activities: |

|

|

|

|

|

| Depreciation and amortization |

|

|

6,254 |

|

|

|

|

19,803 |

|

| Impairment of goodwill and

intangible assets |

|

|

78,286 |

|

|

|

|

- |

|

| Stock based compensation

expense |

|

|

4,923 |

|

|

|

|

4,985 |

|

| Issuance of ordinary shares related

to employees' retention |

|

|

63 |

|

|

|

|

- |

|

| Foreign currency translation |

|

|

- |

|

|

|

|

928 |

|

| Accrued interest, net |

|

|

(451 |

) |

|

|

|

306 |

|

| Deferred taxes, net |

|

|

186 |

|

|

|

|

(5,342 |

) |

| Change in payment obligation

related to acquisition |

|

|

(5,581 |

) |

|

|

|

1,271 |

|

| Fair value revaluation -

convertible debt |

|

|

544 |

|

|

|

|

1,588 |

|

| Net changes in operating assets and

liabilities |

|

|

(8,316 |

) |

|

|

|

(4,398 |

) |

| Net cash provided by

continuing operating activities |

|

|

29,387 |

|

|

|

|

21,670 |

|

| Net cash used in

discontinued activities |

|

|

(4,635 |

) |

|

|

|

(3,303 |

) |

| Net cash

provided by operating activities |

$ |

|

24,752 |

|

|

$ |

|

18,367 |

|

| Investing

activities: |

|

|

|

|

|

| Purchases of property and

equipment |

$ |

|

(1,519 |

) |

|

$ |

|

(1,011 |

) |

| Capitalization of development

costs |

|

|

(2,243 |

) |

|

|

|

(3,724 |

) |

| Change in restricted cash, net |

|

|

50 |

|

|

|

|

(132 |

) |

| Investments in short-term deposits,

net |

|

|

(40,919 |

) |

|

|

|

34,606 |

|

| Cash paid for acquisition, net of

cash acquired |

|

|

(4,533 |

) |

|

|

|

- |

|

| Net cash

provided by (used in) investing activities |

$ |

|

(49,164 |

) |

|

$ |

|

29,739 |

|

| Financing

activities: |

|

|

|

|

|

| Exercise of stock options and

restricted share units |

|

|

15 |

|

|

|

|

1 |

|

| Payment made in connection with

acquisition |

|

|

(1,534 |

) |

|

|

|

(28,052 |

) |

| Proceeds from short-term loans |

|

|

- |

|

|

|

|

26,000 |

|

| Repayment of convertible debt |

|

|

- |

|

|

|

|

(7,620 |

) |

| Repayment of short-term loans |

|

|

- |

|

|

|

|

(26,000 |

) |

| Repayment of long-term loans |

|

|

(1,725 |

) |

|

|

|

(6,390 |

) |

| Net cash used

in financing activities |

$ |

|

(3,244 |

) |

|

$ |

|

(42,061 |

) |

| Effect of exchange rate

changes on cash and cash equivalents |

|

|

(11 |

) |

|

|

|

14 |

|

| Net increase

(decrease) in cash and cash equivalents |

|

|

(23,032 |

) |

|

|

|

9,362 |

|

| Net cash used in

discontinued activities |

|

|

(4,670 |

) |

|

|

|

(3,303 |

) |

| Cash and cash

equivalents at beginning of period |

|

|

101,183 |

|

|

|

|

17,519 |

|

| Cash and cash

equivalents at end of period |

$ |

|

73,481 |

|

|

$ |

|

23,578 |

|

|

|

| PERION NETWORK LTD. AND ITS

SUBSIDIARIES |

|

|

| RECONCILIATION OF GAAP TO NON-GAAP RESULTS:

UNAUDITED |

| In

thousands (except share and per share data) |

|

|

| |

Three months ended |

|

Nine months ended |

| |

September 30, |

|

September 30, |

| |

2015 |

|

2016 |

|

2015 |

|

2016 |

| |

|

|

|

|

|

|

|

|

|

|

|

| GAAP net income

(loss) from continuing operations |

$ |

|

(69,034 |

) |

|

$ |

|

2,884 |

|

|

$ |

|

(46,521 |

) |

|

$ |

|

2,529 |

|

| Acquisition related expenses |

|

|

507 |

|

|

|

|

- |

|

|

|

|

1,209 |

|

|

|

|

179 |

|

| Valuation adjustment on acquired

deferred revenues |

|

|

- |

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

359 |

|

| Share based compensation |

|

|

1,890 |

|

|

|

|

1,457 |

|

|

|

|

4,923 |

|

|

|

|

4,985 |

|

| Amortization of acquired intangible

assets |

|

|

1,208 |

|

|

|

|

5,178 |

|

|

|

|

4,334 |

|

|

|

|

16,801 |

|

| Restructuring costs |

|

|

- |

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

728 |

|

| Impairment of acquired intangible

assets |

|

|

74,119 |

|

|

|

|

- |

|

|

|

|

78,286 |

|

|

|

|

- |

|

| Change in fair value of contingent

consideration related to acquisition |

|

|

- |

|

|

|

|

- |

|

|

|

|

(6,564 |

) |

|

|

|

- |

|

| Fair value revaluation of

convertible debt and related derivative |

|

|

194 |

|

|

|

|

(422 |

) |

|

|

|

302 |

|

|

|

|

134 |

|

| Accretion of payment obligation

related to acquisition |

|

|

- |

|

|

|

|

63 |

|

|

|

|

357 |

|

|

|

|

1,270 |

|

| Taxes related to amortization of

acquired intangible assets |

|

|

(574 |

) |

|

|

|

(1,490 |

) |

|

|

|

(842 |

) |

|

|

|

(5,810 |

) |

| Non-GAAP net

income from continuing operations |

$ |

|

8,310 |

|

|

$ |

|

7,670 |

|

|

$ |

|

35,484 |

|

|

$ |

|

21,175 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP net

income from continuing operations |

$ |

|

8,310 |

|

|

$ |

|

7,670 |

|

|

$ |

|

35,484 |

|

|

$ |

|

21,175 |

|

| Taxes on income |

|

|

1,636 |

|

|

|

|

2,405 |

|

|

|

|

8,426 |

|

|

|

|

2,732 |

|

| Financial expense, net |

|

|

890 |

|

|

|

|

1,309 |

|

|

|

|

1,483 |

|

|

|

|

5,002 |

|

| Depreciation |

|

|

614 |

|

|

|

|

978 |

|

|

|

|

1,920 |

|

|

|

|

3,002 |

|

| Adjusted

EBITDA |

$ |

|

11,450 |

|

|

$ |

|

12,362 |

|

|

$ |

|

47,313 |

|

|

$ |

|

31,911 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP

diluted earnings per share |

$ |

|

0.12 |

|

|

$ |

|

0.10 |

|

|

$ |

|

0.47 |

|

|

$ |

|

0.26 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shares used in

computing non-GAAP diluted earnings per share |

|

|

71,490,533 |

|

|

|

|

78,877,949 |

|

|

|

|

70,831,856 |

|

|

|

|

79,798,457 |

|

Contact Information:

Perion Network Ltd.

Investor relations

Neta Fishman

+972 (73) 398-1000

investors@perion.com

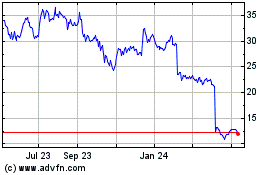

Perion Network (NASDAQ:PERI)

Historical Stock Chart

From Mar 2024 to Apr 2024

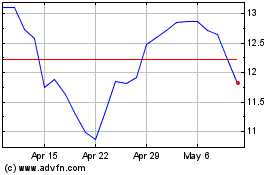

Perion Network (NASDAQ:PERI)

Historical Stock Chart

From Apr 2023 to Apr 2024