Report of Foreign Issuer (6-k)

May 03 2016 - 1:47PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2016

PEARSON plc

(Exact name of registrant as specified in its charter)

N/A

(Translation of registrant's name into English)

80 Strand

London, England WC2R 0RL

44-20-7010-2000

(Address of principal executive office)

Indicate by check mark whether the Registrant files or will file annual reports

under cover of Form 20-F or Form 40-F:

Form 20-F X Form 40-F

Indicate by check mark whether the Registrant by furnishing the information

contained in this Form is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934

Yes No X

3 May 2016

Pearson plc (the "Company")

Notification of Directors' and PDMRs' Interests

Long-Term Incentive Plan

In 2001, the Company established the Pearson Long-Term Incentive Plan (the "LTIP"). Its purpose is to link management's long-term reward with Pearson's financial performance and returns to shareholders. Since 2006, the annual LTIP awards have been based around three performance measures: relative total shareholder return, return on invested capital and earnings per share growth. The LTIP was renewed and approved by shareholders in 2011. The operation of the LTIP is governed by the remuneration policy approved by shareholders at the Annual General Meeting on 25 April 2014.

2016 Award

On 3 May 2016, the Company made a grant of performance-related restricted shares to executive directors and other members of the Pearson Executive under the LTIP. This represents the company's annual grant of long-term incentives to executive directors and other members of the Pearson Executive for 2016.

The awards will vest on 3 May 2019 as follows:

a) one-half of the award will be based on Pearson's earnings per share in 2018;

b) one-third of the award will be based on Pearson's return on invested capital in 2018; and

c) one-sixth of the award will be based on Pearson's total shareholder return performance relative to the constituents of the FTSE World Media Index over the three-year period 1 January 2016 to 31 December 2018

Subject to meeting the performance conditions in full, and the retention of shares that vest on 3 May 2019 for a further two years, the maximum number of shares that John Fallon, CEO, may receive is: 383,000 and the maximum number of shares that Coram Williams, CFO, may receive is: 222,000.

The awards are consistent with the remuneration policy approved by shareholders at the Annual General Meeting on 25 April 2014 and were made on the following basis:

|

Name

|

T

itle

|

Restricted shares awarded

|

Share price on date of award

|

Face value on date of award

|

|

£

|

% of base salary at date of award

|

|

John Fallon

|

CEO

|

383,000

|

805.00p

|

£3,083,150

|

395%

|

|

Coram Williams

|

CFO

|

222,000

|

805.00p

|

£1,787,100

|

347%

|

Subject to meeting the performance conditions in full, and the retention of shares that vest on 3 May 2019 for a further two years, the maximum number of shares that the other members of the Pearson Executive may receive is as follows:

|

Name

|

T

itle

|

Restricted shares awarded

|

|

Albert Hitchcock

|

Chief Technology and Operations Officer

|

200,000

|

|

Tim Bozik

|

President Global Product

|

180,000

|

|

Rod Bristow

|

President Core Markets

|

180,000

|

|

Don Kilburn

|

President North America

|

180,000

|

|

Gio Giovanelli

|

President Growth Markets

|

180,000

|

|

Bob Whelan

|

President Pearson Assessments

|

180,000

|

|

Michael Barber

|

Chief Education Advisor

|

150,000

|

|

Kate James

|

Chief Corporate Affairs and Global Marketing Officer

|

160,000

|

|

Melinda Wolfe

|

Chief Human Resources Officer

|

160,000

|

Further details of the LTIP and its performance measures are contained in Pearson's annual report and accounts.

This notification is made in accordance with DTR 3.1.4R.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

PEARSON plc

Date: 03 May 2016

By: /s/ STEPHEN JONES

-----------------------

Stephen Jones

Deputy Secretary

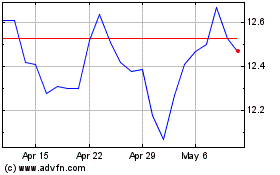

Pearson (NYSE:PSO)

Historical Stock Chart

From Mar 2024 to Apr 2024

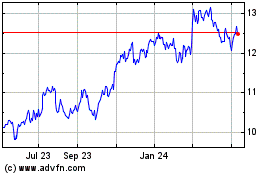

Pearson (NYSE:PSO)

Historical Stock Chart

From Apr 2023 to Apr 2024