Investors have been fretting about Viacom Inc.'s cable TV

fortunes and hoping the company will cook up new ways to profit in

the digital economy. On Tuesday, as the media company reports

quarterly results, it will have a new partnership to tout on that

front.

The shiny new object: a deal with Snapchat Inc., the popular

vanishing messages app that already carries content for

Viacom-owned networks Comedy Central and MTV. Viacom and Snapchat

are taking their deal a step further with a multiyear agreement

that allows the media company to sell advertising on Snapchat's

behalf.

For Snapchat, the move could help lure in more big advertisers

to the millennial-focused platform. Viacom gets a chance to flex

its ad sales muscles and direct some attention away from soft TV

ratings, a sagging share price and drama related to the declining

health of its 92-year-old controlling shareholder, Sumner

Redstone.

With the MTV generation now in adulthood, Viacom is keen for any

way to connect with the young viewers it has specialized in

reaching.

Under the deal, Viacom will have exclusive third-party rights to

directly sell advertising surrounding Snapchat's content. That

includes pop-up "Live Stories" that cull together posts from users

in specific geographic locations or during a holiday.

Viacom will also add two new channels to Snapchat's "Discover"

page, where media outlets such as CNN, Vox, Mashable and The Wall

Street Journal also have channels. MTV, which currently operates an

international channel, will now get a U.S. version. Comedy Central,

which produces a U.S. channel, will expand internationally. The

company said it would further invest in making programming geared

toward Snapchat.

"We had early on made a big commitment to developing premium,

original content for the channels we had on the platform," said

Viacom Chief Financial Officer Wade Davis. "Based on the success we

had, we started talking about what we could do beyond that."

Viacom Chief Executive Philippe Dauman, who succeeded Mr.

Redstone as executive chairman last week, will discuss the Snapchat

deal during the earnings call Tuesday, a person familiar with the

matter said.

Mr. Dauman has taken an unusually granular interest in Snapchat,

leading the company's efforts to work with the upstart messaging

app. Last fall, Mr. Dauman said he met with the app's CEO Evan

Spiegel at the bar at Toscana Restaurant in Los Angeles. He got so

involved in the creation of Comedy Central's icon on Snapchat that

he weighed in on its color, suggesting it visually pop on the

Discover page. It is the only green one.

The agreement comes as Snapchat tries to grow its revenue and

expand its fledgling advertising business. Ad buyers say that while

the app offers the potential to reach coveted young consumers, many

marketers are hanging on the sidelines due to Snapchat's expensive

prices and lack of ad sales organization.

"Since launching ads just over a year ago, Snapchat has

continuously worked to strengthen its advertising team and product

offerings, most recently restructuring the team," a Snapchat

spokeswoman said.

An accord between Snapchat and Viacom may feel like a teenager

letting his middle-aged dad tag along to the party because there is

a better chance of scoring some booze. Viacom has long held

relationships with the large ad buyers and brands that plunk down

major dollars. Snapchat, though it boasts 7 billion video views a

day, is a relative advertising newbie.

Marketers like General Electric Co., Coca-Cola Co. and Samsung

Electronics Co. have advertised on the platform. In May, Snapchat

raised more than $500 million in funding, valuing the startup at

$16 billion.

"There's a lot of TV buyers that want to buy Snapchat more and

more," said Imran Khan, chief strategy officer of Snapchat. Mr.

Khan said that the company will continue to sell "basically most of

our inventory," but that the Viacom deal "reduces friction" and

lets big brands buy Snapchat ads as part of a larger TV package.

Snapchat has a revenue-sharing agreement with Viacom for the ads it

sells.

Jeff Lucas, Viacom's ad sales chief, said that both companies

are targeting the same young viewers and are a "natural match."

"We identified early on the similarities in our audience with

Snapchat as they were starting out. They realized early on about

our access to the ad market in terms of selling against

millennials," said Mr. Lucas, who advises Snapchat on advertising

matters.

As the television industry struggles with falling ratings,

Viacom has hawked a new data-focused product to better target

viewers across its shows. Viacom's custom content hub "Velocity"

has also fashioned ways to integrate brands into television

programs.

The Snapchat deal allows Viacom to sell advertising on Discover

for its own content and for that owned by Snapchat. Last year

Snapchat abandoned its dedicated Snap Channel, but still posts its

own content to Discover. Last month it debuted a new political

campaign show called "Good Luck America." Viacom wouldn't sell ads

on the Discover pages of other media companies, Snapchat said.

Keach Hagey contributed to this article.

Write to Steven Perlberg at steven.perlberg@wsj.com

(END) Dow Jones Newswires

February 08, 2016 23:05 ET (04:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

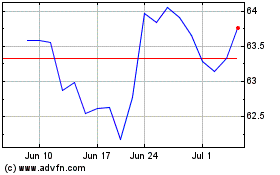

Coca Cola (NYSE:KO)

Historical Stock Chart

From Apr 2024 to May 2024

Coca Cola (NYSE:KO)

Historical Stock Chart

From May 2023 to May 2024