UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

November 6, 2015

CABO VERDE CAPITAL INC.

(Exact name of registrant as specified in its

charter)

000-49955

(Commission file number)

Nevada

(State or other jurisdiction of incorporation

or organization)

91-2060082

(I.R.S. Employer Identification No.)

Av. Eng. Duarte Pacheco, n.° 143/145, 2°

-8135-104, Almancil, Portugal

(Address of principal executive

office)

(011) 351 917 264 626

(Issuer’s telephone number)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

( ) Written communications pursuant to Rule 425 under the Securities

Act (17CRF 230.425)

( ) Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CRF 240.14a-12)

( ) Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CRF 240.14d-2(b))

( ) Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CRF 240.13e-4(c))

ITEM 3.03. MATERIAL MODIFICATION TO

RIGHTS OF SECURITY HOLDERS

[Reference is made to the disclosure set forth under Item 5.01.

Changes in Control of Registrant of this Current Report on Form 8-K, which disclosure is incorporated herein by reference.]

ITEM 5.01. CHANGES IN CONTROL OF REGISTRANT.

On November 5, 2015, the Company returned to the transfer

agent the certificates for, and cancelled, 246,750,000 outstanding shares of common stock. Following the cancellation of these

shares, the Company has 53,056,005 shares of common stock outstanding at the close of business November 5, 2015.

At November 6, 2015, the stockholders of our Company who

owned more than 5% of the outstanding stock, and the percentage of the outstanding stock owned by each, were:

| Name and Address | |

No. of Shares | |

Percent of

Outstanding Stock |

| | |

| |

|

| Balwerk IX LDA | |

| 10,000,000 | | |

| 18.8 | % |

| Ave. Arriaga, 73-1 Sala 113 | |

| | | |

| | |

| Edeficio Marina Club | |

| | | |

| | |

| 9000-060 | |

| | | |

| | |

| Funchal, Madeira Portugal | |

| | | |

| | |

| | |

| | | |

| | |

| Cape Verde Development LDA. | |

| 5,000,000 | | |

| 9.4 | % |

| Edeficio Millennium | |

| | | |

| | |

| Rua Sena di Barcelos | |

| | | |

| | |

| Mindelo Sao Vicente | |

| | | |

| | |

| Cabo Verde | |

| | | |

| | |

| | |

| | | |

| | |

| Rutgerus Cornelis Johannes Willem se | |

| 7,780,000 | | |

| 14.6 | % |

| Carrer Apel Les Mestres 34, 08193 Bellaterra | |

| | | |

| | |

| Barcelona, Spain | |

| | | |

| | |

| | |

| | | |

| | |

| Sandra McQuinn | |

| 4,894,000 | | |

| 9.2 | % |

| 16 Carr Holme Gardens | |

| | | |

| | |

| Cabus | |

| | | |

| | |

| Preston, PR2 1LY United Kingdom | |

| | | |

| | |

[Reference

is made to the disclosures set forth under Item 8. Other Events of this Current Report on Form 8-K, which disclosures are

incorporated herein by reference.]

ITEM 5.02.

DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS

OF CERTAIN OFFICERS

On April 24, 2014, our Board of Directors authorized

the change of our name to Cabo Verde Capital Inc. from Watair Inc. in connection with the evaluation of certain real estate development

projects located in the Republic of Cape Verde, an island country spanning an archipelago of 10 islands in the central Atlantic

Ocean and the Company’s having entered into a Cooperation Agreement and elected additional directors to our Board. Pursuant

to the terms of the Cooperation Agreement, the Board on April 24, 2014 approved changing the Company’s name and appointed

John Duggan, PedroTeixeira and Mikhail Gurfinkle as directors to fill existing vacancies on the Board, and elected John Duggan

as Interim Chairman of the Board and President, and Pedro Teixeira as Interim Secretary, of the Company. Under the Cooperation

Agreement, the parties acknowledged that it is the intent of the parties that, if the Cape Verde Project did not proceed in a timely

fashion, or is abandoned, these directors would resign as directors and officers of the Company. On March 31, 2015, Pedro Teixeira

resigned as director and officer of the Company. On March 31, 2015 the Board appointed Brian Stevendale as a director and Chief

Executive Officer. On April 15, 2015, the Board appointed Scott Young as a director of the Company. On September 1, 2015, Mikhail

Gurfinkel resigned as a director of the Company. On October 26, 2015, Brian Stevendale resigned as a director and Chief Executive

Officer of the Company. On that same day, John Duggan assumed the title of Chief Executive Officer and Secretary of the Company.

MANAGEMENT

Our directors and officers as of the date of this report are as

follows:

| Name |

Age |

Office(s) |

| |

|

|

| John P. Duggan |

63 |

President, Chief Executive Officer and Treasurer |

| |

|

|

| Scott E. Young |

57 |

Director and Secretary |

Management Biographies

John P. Duggan

Mr. Duggan has had a successful career as a tax consultant and business

manager, spanning more than 35 years, in 3 countries and in a varied professional environment, and was a Senior Tax Partner in

the Lisbon, Portugal office of Price Waterhouse from 1991 to 2010. He specialized, from 1999 onwards, in personal tax, migration

and human resources consulting. He is involved in a number of cultural and social organizations, including the Irish Association

in Portugal, the Royal British Club and a Commission to consider development of the leisure boating industry in Portugal. Mr. Duggan

is fluent in Portuguese, and also is conversant in French and German. Mr. Duggan received a BA in Mathematics from Trinity College,

Dublin in 1974 and is a Fellow of Chartered Accountants Ireland.

Scott E. Young

Scott Young is an experienced investment banker with extensive cross-border

transaction experience in Europe, North America, the Middle East and Asia. Mr. Young founded Gemini Capital in London, and has

been its managing director since 2013. Gemini Capital is a consulting firm involved in providing strategic advice to a wide range

of entities, including private businesses, multinational companies, family offices, private equity groups and sovereign wealth

funds. Prior thereto Mr. Young was with Morgan Stanley & Company in New York in the International Capital Markets group September

1985 through May 1990. Earlier positions include Corporate Finance, Fixed Income and Equity Sales and Syndication with LF Rothschild

in New York as well as the US offices of the OECD in New York. Mr. Young has extensive relationships developed over 20 years with

a wide range of international clients across a variety of industries. Key areas of focus include: pioneering healthcare technologies

(stem cells for diabetes and drug delivery technologies); alternative energy, renewables and energy efficiency, mining and natural

resources and resort and property development. He received a degree in Economics and International Studies at the University of

North Carolina at Chapel Hill in May 1981, and his Law Degree (Juris Doctorate) and MBA at UNC-Chapel Hill in May 1985.

ITEM 5.03. AMENDMENT TO ARTICLES OF INCORPORATION OR BYLAWS;

CHANGE IN FISCAL YEAR.

Reincorporation of the Company in

Nevada

Following approvals

by our Board of Directors and stockholders, the reincorporation of the Company in Nevada was effective on November 6, 2015, by

the merger (the “Merger”) of the Company (a Delaware corporation, sometimes referred to as “Cabo Verde-Delaware”)

into its wholly-owned Nevada subsidiary, Cabo Verde Capital Inc. (“Cabo Verde-Nevada”), pursuant to an Agreement and

Plan of Merger, dated as of November 5, 2015 (the “Merger Agreement). Cabo Verde-Nevada was formed a with an authorized capital

stock of 500,000,000 shares of common stock, par value $.00001 per share, and 10,000,000 shares of preferred stock, par value $.00001

per share, identical to the authorized capital stock of the Company prior to the Merger. The effects of the reincorporation are

a change of the domicile of the Company from the State of Delaware to the State of Nevada, which means that the surviving corporation

will be governed by the laws of the State of Nevada; the persons now serving as executive officers and directors of Cabo Verde-Delaware

became, with the effectiveness of the Merger, the executive officers and directors, in their same capacities, in the surviving

corporation after the reincorporation; and, as a result of the reincorporation, Cabo Verde-Nevada’s Articles of Incorporation

and By-Laws became the Articles of Incorporation and By-Laws of the surviving corporation.

Reasons for the Reincorporation

The reincorporation in Nevada by a

merger with and into Cabo Verde (Nevada), the wholly-owned subsidiary of Cabo Verde (Delaware) was approved by our Board of Directors

on November 5, 2015, and on that same date by the written consent of a majority of the voting power of the outstanding shares of

our common stock.

After operating as a Delaware corporation

for a year, the Company’s Board of Directors gave approval in principle to the reincorporation at a meeting held on September

9, 2015, concluding that the benefits afforded to the Company as a Nevada corporation outweigh those of being a Delaware corporation.

Primarily, the reasons for the move to Delaware were to eliminate the potential exposure to a high level of franchise tax in Delaware,

to provide greater flexibility and simplicity in corporate transactions and to increase the marketability of our securities. The

principal reason for reincorporation from Delaware to Nevada is to eliminate our obligation to pay the annual Delaware franchise

tax which will result in significant savings to us in the future. Under Nevada law, there is no obligation to pay annual franchise

taxes and there are no capital stock taxes or inventory taxes. Otherwise, the general corporation laws of the States of Delaware

and Nevada are very similar since both states have liberal incorporation laws and favorable tax policies. For those reasons, our

board of directors on September 9, 2015, approved in principle the reincorporation of the Company in Nevada, and on November 5,

2015 approved the Merger and recommended to the Company’s shareholders for their approval the merger of Cabo Verde-Delaware

with and into Cabo Verde-Nevada, a wholly owned subsidiary of the Company, which was incorporated under the Nevada Revised Statutes

(“NRS”) on November 5, 2015, exclusively for the purpose of merging with Cabo Verde-Delaware. Prior to the Merger,

Cabo Verde-Nevada had no material assets or liabilities and did not carry on any business.

The Merger did not result in any change

in our business, management, location of our principal executive offices, assets, liabilities or net worth (other than as a result

of the costs incident to the Merger, which are immaterial). Our common stock will continue to trade without interruption in the

OTC Markets Group Pink Market.

The holders of our common stock will

have the statutory right to dissent to the reincorporation, receive an appraisal of their shares or require the Company to purchase

their shares. See “Dissent Rights of our Shareholders”.

Cabo Verde-Nevada had 100 shares of common

stock issued and outstanding at the time of the Merger, with only minimal capital necessary to pay its formation costs. The terms

of the merger provided that the 100 shares issued to Cabo Verde-Delaware were cancelled upon the effectiveness of the Merger, with

the result that our current shareholders will be the only shareholders of the surviving corporation. Cabo Verde-Delaware will cease

to exist as a result of the Merger.

The Merger was effective promptly after

filing Articles of Merger with the Secretary of State of Nevada and a Certificate of Merger with the Secretary of State of Delaware.

Upon the effectiveness of the Merger, the charter and By-Laws of Cabo Verde-Nevada, which are generally the same as the charter

and By-Laws of Cabo Verde-Delaware except for statutory references necessary to conform to the NRS and other differences attributable

to the differences between the NRS and the Delaware General Corporation Law (“DGCL”), now govern our corporate operations

and activities.

Upon completion of the Merger, each outstanding

share of common stock, par value $0.00001 per share, of Cabo Verde-Delaware was converted into one share of common stock, $0.00001

par value per share, of Cabo Verde-Nevada. As a result, the existing shareholders of Cabo Verde-Delaware have automatically become

shareholders of Cabo Verde-Nevada, Cabo Verde-Delaware will cease to exist and Cabo Verde-Nevada will continue to operate our business.

Stock certificates representing shares of Cabo Verde-Delaware stock will be deemed to represent the same number of shares of Cabo

Verde-Nevada stock following the reincorporation. Shareholders currently holding certificates for shares of common stock issued

by Cabo Verde-Delaware will be able to receive new certificates issued by Cabo Verde-Nevada upon the delivery of existing certificates

to the transfer agent. We will pay the transfer agent fees and expenses incurred in connection with the issuance and delivery of

Cabo Verde-Nevada stock certificates to our shareholders. The authorized capital stock of Cabo Verde-Nevada consists of 500,000,000

shares of common stock, $0.00001 par value, and 10,000,000 shares of Preferred Stock, $0.00001 par value, which is identical to

the authorized capital stock of Cabo Verde-Delaware, and there are 53,056,005 shares of common stock of Cabo Verde-Nevada issued

and outstanding following the Merger, which is the same number of shares of common stock of Cabo Verde-Delaware that were outstanding

prior to the Merger.

In addition, the directors and officers

of Cabo Verde-Delaware immediately prior to the Merger continue to serve as the directors and officers of the Company following

the effectiveness of the Merger.

Rights of Shareholders Will be Governed by Nevada

Law

After the reincorporation, the general corporation laws

of Nevada govern the rights of our shareholders rather than the general corporation laws of the State of Delaware. In the formation

of Cabo Verde-Nevada, we have endeavored to keep the substantive provisions of the charter and By-Laws, which are the governing

documents of the Company, identical to the charter and By-Laws of Cabo Verde-Delaware.

Dissent Rights of our Shareholders

Under Delaware law, our shareholders

are entitled, after complying with certain requirements of Delaware law, to dissent to the approval of the Merger pursuant to Section 262

of the DGCL and to be paid the “fair value” of their shares of Cabo Verde-Delaware stock exclusive of any element of

value arising from the accomplishment or expectation of the Merger. Shareholders electing to exercise appraisal rights must comply

with the provisions of Section 262 of the DGCL in order to perfect their rights. We will provide a notice to our stockholders

setting forth the manner in which they may comply with these statutory procedures should they so desire.

Item 8. Other

Events.

Restructure of Cape Verde Resort Project

The Company is currently restructuring its planned resort

casino project in the Republic of Cape Verde, an island country spanning an archipelago of 10 islands in the central Atlantic Ocean.

The project initially involved the licensing, construction and operation of two casinos in the Republic of Cape Verde (the “Project”).

As a part of our operational plan we entered into agreements with the owners of several properties that would become part of the

Cape Verde Project. To acquire these properties we issued an aggregate of 282,790,000 shares of our common stock, which shares

were held in escrow pending on our receiving financing commitments for the first stage of the Project and transfer of title to

the Company by the owners of the properties. We will need to raise substantial additional capital for our operations through sale

of equity securities and/or debt financing for the Project.

The Company has proceeded only with two of these projects,

a vacation resort on the island of São Vicente and a 10ha block of land on the island of Sal, and have issued 36,040,000

shares of common stock from escrow in consideration for these acquisitions. We have terminated the agreements with the owners of

the other properties, and as a result 246,750,000 shares of common stock have been released from escrow back to the Company. These

shares have been returned to the Company’s transfer agent by the Company and have been cancelled. The Company is continuing

to pursue the properties which were subject to termination. The implementation of these projects are predicated on the need to

secure additional financing, and resolutions of issues which arose during the due-diligence process by the Company.

Item 9.01 Financial Statements and Exhibits.

| Exhibit Number |

Description of Exhibit |

| |

|

| 3.1a |

Articles of Incorporation of Cabo Verde Capital Inc., filed herewith. |

| |

|

| 3.1b |

Certificate of Merger of Cabo Verde Capital Inc. (Delaware) with the Company, filed herewith. |

| |

|

| 3.2 |

By-Laws of the Company, filed herewith. |

| |

|

| 10.1 |

Agreement and Plan of Merger, dated as of November 5, 2015, between Cabo Verde Capital, Inc., a Delaware corporation, and the Company, filed herewith. |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

Date:

November 13, 2015

By

: /s/ John Duggan

John

Duggan

Chief

Executive Officer

Exhibit 3.1(a)

Exhibit 3.1(b)

EXHIBIT 3.2

As Adopted by the Board of Directors on November 5, 2015

BY-LAWS

OF

CABO VERDE CAPITAL INC.

ARTICLE I – OFFICES

The registered office of the Corporation shall

be located in the State of Nevada, and it may be changed from time to time by the Board of Directors. The Corporation may also

maintain offices at such other places within or without the United States as the Board of Directors may, from time to time, determine.

ARTICLE II - MEETINGS OF STOCKHOLDERS

SECTION 1 - ANNUAL MEETINGS.

The annual meeting of the stockholders of the Corporation shall

be held within six (6) months after the close of the fiscal year of the Corporation, or such other date as is fixed by the Board

of Directors, for the purpose of electing Directors, and transacting such other business as may properly come before the meeting.

SECTION 2 - SPECIAL MEETINGS.

Special meetings of the stockholders may be called at any time by

the Board of Directors or by the President, or as otherwise required by law.

SECTION 3 - PLACE OF MEETINGS.

All meetings of stockholders shall be held at the principal office

of the Corporation, or at such other places as shall be designated in the notices or waivers of such meetings.

SECTION 4 - NOTICE OF MEETINGS.

(a)

If under the provisions of the Nevada Private Corporations Law stockholders are required or authorized to take any action at a

meeting, the notice of the meeting must be in writing and signed by the President or a Vice President, or the Secretary, or an

Assistant Secretary, or by such other natural person or persons as the Directors may designate. The notice must state the purpose

or purposes for which the meeting is called and the time when, and the place, which may be within or without the State of Nevada,

where it is to be held.

(b)

A copy of the notice must be delivered personally or mailed postage prepaid to each stockholder of record entitled to vote at

the meeting not less than 10 nor more than 60 days before the meeting. If mailed, it must be directed to the stockholder at his

or her address as it appears upon the records of the Corporation, and upon the mailing of any such notice the service thereof

is complete, and the time of the notice begins to run from the date upon which the notice is deposited in the mail for transmission

to the stockholder. Personal delivery of any such notice to any officer of a corporation or association, or to any member of a

partnership, constitutes delivery of the notice to the Corporation, association or partnership.

(c)

Notice of any meeting need not be given to any person who may become a stockholder of record after the mailing of such notice

and prior to the meeting, or to any stockholder who attends such meeting, in person or by proxy, or submits a signed waiver of

notice either before or after such a meeting. Notice of any adjourned meeting of stockholders need not be given, unless otherwise

required by statute.

SECTION 5- QUORUM.

(a)

Except as otherwise provided herein, or by statute, or in the Articles of Incorporation (such articles and any amendments thereof

being hereinafter collectively referred to as the "Articles of Incorporation"), at all meetings of stockholders of the

Corporation, the presence at the commencement of such meetings in person or by proxy of stockholders holding of record a majority

of the voting power, which includes the voting power that is present in person or by proxy, regardless of whether the proxy has

authority to vote on all matters, constitutes a quorum for the transaction of business. The withdrawal of any stockholder after

the commencement of a meeting shall have no effect on the existence of a quorum, after a quorum has been established at such meeting.

(b)

Despite the absence of a quorum at any annual or special meeting of stockholders, the stockholders, by a majority of the votes

cast by the holders of shares entitled to vote thereat, may adjourn the meeting. At any such adjourned meeting at which a quorum

is present, any business may be transacted at the meeting as originally called if a quorum had been present.

SECTION 6 – VOTING.

(a)

Except as otherwise provided by statute or by the Articles of Incorporation, any corporate action, other than the election of

Directors, to be taken by vote of the stockholders, is approved if the number of votes cast in favor of the action exceeds the

number of votes cast against the action.

(b)

Except as otherwise provided by statute or by the Articles of Incorporation, at each meeting of stockholders, each holder of record

of stock of the Corporation entitled to vote thereat shall be entitled to one vote for each share of stock standing in his or

her name on the records books of the Corporation.

(c)

Unless elected pursuant to Section 78.320 of the Nevada Revised Statutes, Directors of the Corporation shall be elected at the

annual meeting of stockholders by a plurality of the votes cast at the election.

(d)

Each stockholder entitled to vote or to express consent or dissent without a meeting, may do so by proxy; provided, however, that

the instrument authorizing such proxy to act shall have been executed in writing by the stockholder himself or herself or by his

or her attorney-in-fact thereunto duly authorized in writing. No proxy shall be valid after the expiration of six (6) months from

the date of its execution, unless the person executing it shall have specified therein the length of time it is to continue in

force. Such instrument shall be exhibited to the Secretary at the meeting and shall be filed with the minutes of the meeting.

SECTION

7 - RECORD DATE.

The Directors may prescribe a period not exceeding 60 days before

any meeting of the stockholders during which no transfer of stock on the books of the Corporation may be made, or may fix, in advance,

a record date not more than 60 or less than 10 days before the date of any such meeting as the date as of which stockholders entitled

to notice of and to vote at such meetings must be determined. Only stockholders of record on that date are entitled to notice or

to vote at such a meeting. If a record date is not fixed, the record date is at the close of business on the day before the day

on which notice is given or, if notice is waived, at the close of business on the day before the meeting is held. A determination

of stockholders of record entitled to notice of or to vote at a meeting of stockholders applies to an adjournment of the meeting

unless the Board of Directors fixes a new record date for the adjourned meeting. The Board of Directors must fix a new record date

if the meeting is adjourned to a date more than 60 days later than the date set for the original meeting.

ARTICLE III - BOARD OF DIRECTORS

SECTION 1 - NUMBER, ELECTION AND TERM OF OFFICE.

(a)

The number of the Directors of the Corporation shall be not less than one (1) nor more than nine (9), unless and until otherwise

determined by vote of a majority of the entire Board of Directors.

(b)

Each Director shall hold office until the annual meeting of the stockholders next succeeding his or her election, and until his

or her successor is elected and qualified, or until his or her prior death, resignation or removal.

SECTION 2 - DUTIES AND POWERS.

The

Board of Directors shall have full control over the affairs of the Corporation and may exercise all powers of the Corporation,

except as are in the Articles of Incorporation or by statute expressly conferred upon or reserved to the stockholders.

SECTION 3 - ANNUAL AND REGULAR MEETINGS; NOTICE.

(a)

A regular annual meeting of the Board of Directors shall be held immediately following the annual meeting of the stockholders,

at the place of such annual meeting of stockholders.

(b)

The Board of Directors, from time to time, may provide by resolution for the holding of other regular meetings of the Board of

Directors, and may fix the time and place thereof.

(c)

Notice of any regular meeting of the Board of Directors shall not be required to be given and, if given, need not specify the

purpose of the meeting; provided, however, that in case the Board of Directors shall fix or change the time or place of any regular

meeting, notice of such action shall be given to each Director who shall not have been present at the meeting at which such change

was made within the time limited, and in the manner set forth in Paragraph (b) Section 4 of this Article III, with respect to

special meetings, unless such notice shall be waived in the manner set forth in Paragraph (c) of such Section 4.

SECTION 4 - SPECIAL MEETING; NOTICE.

(a)

Special meetings of the Board of Directors shall be held whenever called by the President or by a majority of the Directors, at

such time and place as may be specified in the respective notices or waivers of notice thereof.

(b)

Except as otherwise required by statute, notice of special meetings shall be mailed directly to each Director, addressed to him

or her at his or her residence or usual place of business, at least four (4) days before the day on which the meeting is to be

held, or shall be sent to him or her at such place by telegram or facsimile, or shall be delivered to him or her personally or

given to him or her orally, not later than three (3) days before the day on which the meeting is to be held. A notice, or waiver

of notice except as required by statute, need not specify the purpose of the meeting.

(c)

Notice of any special meeting shall not be required to be given to any Director who shall attend such meeting without protesting

prior thereto or at its commencement, the lack of notice to him or her or who submits a signed waiver of notice, whether before

or after the meeting. Notice of any adjourned meeting shall not be required to be given.

SECTION 5 – CHAIRMAN.

At all meetings of the Board of Directors, the Chairman of the Board,

if any and if present, shall preside. If there shall be no Chairman, or he shall be absent, then the President shall preside, and

in his or her absence, a Chairman chosen by the Directors shall preside.

SECTION 6 - QUORUM AND ADJOURNMENTS.

(a)

At all meetings of the Board of Directors, the presence of a majority of the Directors then in office shall be necessary and sufficient

to constitute a quorum for the transaction of business, except as otherwise provided by law, by the Articles of Incorporation

or by these By-Laws.

(b)

A majority of the Directors, present at the time and place of any regular or special meeting, although less than a quorum, may

adjourn the same from time to time without notice, until a quorum shall be present.

SECTION 7 - MANNER OF ACTING.

(a)

At all meetings of the Board of Directors, each Director present shall have one vote, irrespective of the number of shares of

stock, if any, which he or she may hold.

(b)

Except as otherwise provided by statute, by the Articles of Incorporation, or by these By-Laws, the action of a majority of the

Directors present at any meeting at which a quorum is present shall be the act of the Board of Directors.

(c)

Unless otherwise required by the Articles of Incorporation or statute, any action required or permitted to be taken at any meeting

of the Board of Directors or any Committee thereof may be taken without a meeting if a written consent thereto is signed by all

the members of the Board or Committee. Such written consent shall be filed with the minutes of the proceedings of the Board or

Committee.

(d)

Unless otherwise prohibited by amendments to the Articles of Incorporation or statute, members of the Board of Directors or of

any Committee of the Board of Directors may participate in a meeting of such Board or Committee by means of a conference telephone

or a similar communications method by which all persons participating in the meeting can hear each other. Such participation constitutes

presence in person at the meeting.

SECTION 8 – VACANCIES.

Any vacancy in the Board of Directors, occurring by reason of an

increase in the number of Directors, or by reason of the death, resignation, disqualification, removal (unless vacancy created

by the removal of a Director by the stockholders shall be filled by the stockholders at the meeting at which the removal was effected)

or inability to act of any Director, or otherwise, shall be filled for the unexpired portion of the term by a majority vote of

the remaining Directors, though less than a quorum, at any regular meeting or special meeting of the Board of Directors called

for that purpose.

SECTION 9 – RESIGNATION.

Any Director may resign at any time by giving written notice to

the Board of Directors, the President or the Secretary of the Corporation. Unless otherwise specified in such written notice, such

resignation shall take effect upon receipt thereof by the Board of Directors or such officer, and the acceptance of such resignation

shall not be necessary to make it effective.

SECTION 10 – REMOVAL.

Any Director may be removed with or without cause at any time by

the affirmative vote of stockholders holding of record in the aggregate at least a two-thirds majority of the outstanding shares

of stock of the Corporation at a special meeting of the stockholders called for that purpose.

SECTION 11 – SALARY.

No stated salary shall be paid to Directors, as such, for their

services, but by resolution of the Board of Directors a fixed sum and expenses of attendance, if any, may be allowed for attendance

at each regular or special meeting of the Board; provided, however, that nothing herein contained shall be construed to preclude

any Director from serving the Corporation in any other capacity and receiving compensation therefor.

SECTION 12 – CONTRACTS.

(a)

A contract or other transaction is not void or voidable solely because: (1) the contract or transaction is between the Corporation

and (A) one or more of its Directors or officers; or (B) another corporation, firm or association in which one or more of its

directors or officers are Directors or officers of the Corporation, or are financially interested; (2) a common or interested

Director or officer (A) is present at the meeting of the Board of Directors or a Committee thereof which authorizes or approves

the contract or transaction; or (B) joins in the execution of a written consent which authorizes or approves the contract or transaction

pursuant to subsection 2 of Nevada Revised Statutes 78.315; or (3) the vote or votes of a common or interested Director are counted

for the purpose of authorizing or approving the contract or transaction, if one of the circumstances specified in subsection (b)

exists.

(b)

The circumstances in which a contract or other transaction is not void or voidable pursuant to subsection (a) are: (1) the fact

of the common directorship, office or financial interest is known to the Board of Directors or Committee, and the Board or Committee

authorizes, approves or ratifies the contract or transaction in good faith by a vote sufficient for the purpose without counting

the vote or votes of the common or interested Director or Directors; (2) the fact of the common directorship, office or financial

interest is known to the stockholders, and they approve or ratify the contract or transaction in good faith by a majority vote

of stockholders holding a majority of the voting power (The votes of the common or interested Directors or officers must be counted

in any such vote of stockholders); (3) the fact of the common directorship, office or financial interest is not known to the Director

or officer at the time the transaction is brought before the Board of Directors of the Corporation for action; or (4) the contract

or transaction is fair as to the Corporation at the time it is authorized or approved.

(c)

Common or interested Directors may be counted in determining the presence of a quorum at a meeting of the Board of Directors or

a Committee thereof which authorizes, approves or ratifies the contract or transaction, and if the votes of the common or interested

Directors are not counted at the meeting, then a majority of the disinterested Directors may authorize, approve or ratify a contract

or transaction.

SECTION 13 – COMMITTEES.

(a)

Unless it is otherwise provided in the Articles of Incorporation, the Board of Directors may designate one or more Committees

which, to the extent provided in the resolution or resolutions, have and may exercise the powers of the Board of Directors in

the management of the business and affairs of the Corporation, and may have power to authorize the seal of the Corporation to

be affixed to all papers on which the Corporation desires to place a seal.

(b)

The Committee or Committees must have such name or names as may be stated in the By-Laws of the Corporation or as may be determined

from time to time by resolution adopted by the Board of Directors.

(c)

Each Committee must include at least one Director. Unless the Articles of Incorporation provide otherwise, the Board of Directors

may appoint natural persons who are not Directors to serve on Committees.

ARTICLE IV - OFFICERS

SECTION 1 - NUMBER, QUALIFICATIONS, ELECTION AND TERM OF OFFICE.

(a)

The officers of the Corporation shall consist of a President, a Secretary, a Treasurer, or a President and Secretary-Treasurer,

and such other officers, including a Chairman of the Board of Directors, and one or more Vice Presidents, as the Board of Directors

may from time to time deem advisable. Any officer other than the Chairman of the Board of Directors may be, but is not required

to be, a Director of the Corporation. Any two or more offices may be held by the same person.

(b)

The officers of the Corporation shall be elected by the Board of Directors at the regular annual meeting of the Board following

the annual meeting of stockholders.

(c)

Each officer shall hold office until the annual meeting of the Board of Directors next succeeding his or her election, and until

his or her successor shall have been elected and qualified or until his or her death, resignation or removal.

SECTION 2 – RESIGNATION.

Any officer may resign at any time by giving written notice of such

resignation to the Board of Directors, or to the President or the Secretary of the Corporation. Unless otherwise specified in such

written notice, such resignation shall take effect upon receipt thereof by the Board of Directors or by such officer, and the acceptance

of such resignation shall not be necessary to make it effective.

SECTION 3 – REMOVAL.

Any officer may be removed, either with or without cause, and a

successor elected by a majority vote of the Board of Directors at any time.

SECTION 4 – VACANCIES.

A vacancy in any office by reason of death, resignation, inability

to act, disqualification or any other cause, may at any time be filled for the unexpired portion of the term by a majority vote

of the Board of Directors.

SECTION 5 – CHAIRMAN OF THE BOARD.

The Chairman of the Board, if one is elected, shall preside at all

meetings of stockholders and at all meetings of the Board of Directors, and shall perform such other duties and have such other

powers as the Board of Directors may from time to time prescribe.

SECTION 6 – PRESIDENT.

The President shall be the Chief Executive Officer of the Corporation,

shall have general and active management of the business of the Corporation and shall see that all orders and resolutions of the

Board of Directors are carried into effect. He or she shall execute bonds, mortgages and other contracts requiring a seal, under

the seal of the Corporation, except where required or permitted by law to be otherwise signed and executed and except where the

signing and execution thereof shall be expressly delegated by the Board of Directors to some other officer or agent of the Corporation.

If a Chairman of the Board is not elected or, if one is elected, in the absence of the Chairman of the Board or in the event of

his or her inability or refusal to act, the President shall preside at all meetings of stockholders and at all meetings of the

Board of Directors, and shall perform such other duties and have such other powers as the Board of Directors may from time to time

prescribe.

SECTION 7 – VICE PRESIDENT.

The Vice President, or if there be more than one, the Vice Presidents

in the order determined by the Board of Directors (or if there be no such determination, then in the order of their election),

in the absence of the President or in the event of his or her inability or refusal to act, shall perform the duties and exercise

the powers of the President and shall perform such other duties and have such other powers as the Board of Directors may from time

to time prescribe.

SECTION 8 – SECRETARY AND ASSISTANT SECRETARIES.

The Secretary shall attend all meetings of the Board of Directors

and all meetings of the stockholders and shall record all the proceedings of such meetings in a book to be kept for that purpose,

and shall perform like duties for the standing Committees when required. He or she shall give, or cause to be given, notice of

all meetings of the stockholders and special meetings of the Board of Directors, and shall perform such other duties and have such

other powers as may from time to time be prescribed by the Board of Directors or the President. He or she shall have custody of

the corporate seal of the Corporation; he or she, or an Assistant Secretary, shall have authority to affix the same to any instrument

requiring it; and when so affixed, it may be attested by his or her signature or by the signature of such Assistant Secretary.

The Board of Directors may give general authority to any other officer to affix the seal of the Corporation and to attest the affixing

by his or her signature.

The Assistant Secretary, or if there be more than one, the Assistant

Secretaries in the order determined by the Board of Directors (or if there be no such determination, then in the order of their

election), shall, in the absence of the Secretary or in the event of his or her inability or refusal to act, perform the duties

and exercise the powers of the Secretary and shall perform such other duties and have such other powers as the Board of Directors

may from time to time prescribe.

SECTION 9 – TREASURER AND ASSISTANT TREASURERS.

The Treasurer shall have the custody of the corporate funds and

securities and shall keep full and accurate accounts of receipts and disbursements in books belonging to the Corporation and shall

deposit all moneys and other valuable effects in the name and to the credit of the Corporation in such depositories as may be designated

by the Board of Directors. He or she shall disburse the funds of the Corporation as may be ordered by the Board of Directors, taking

proper vouchers for such disbursements, and shall render to the President and the Board of Directors, at its regular meetings,

or when the Board of Directors so requires, an account of all his or her transactions as Treasurer and of the financial condition

of the Corporation.

If required by the Board of Directors, he or she shall give the

Corporation a bond (which shall be renewed every six years) in such sum and with such surety or sureties as shall be satisfactory

to the Board of Directors for the faithful performance of the duties of his or her office and for the restoration to the Corporation,

in case of his or her death, resignation, retirement or removal from office, of all books, papers, vouchers, money and other property

of whatever kind in his or her possession or under his or her control belonging to the Corporation.

SECTION 10 - SURETIES AND BONDS.

In case the Board of Directors shall so require, any officer, employee

or agent of the Corporation shall execute to the Corporation a bond in such sum, and with such surety or sureties as the Board

of Directors may direct, conditioned upon the faithful performance of his or her duties to the Corporation, including responsibility

for negligence for the accounting for all property, funds or securities of the Corporation which may come into his or her hands.

SECTION 11 - SHARES OF STOCK OF OTHER CORPORATIONS.

Whenever the Corporation is the holder of shares of stock of any

other corporation, any right or power of the Corporation as such stockholder (including the attendance, acting and voting at stockholders'

meetings and execution of waivers, consents, proxies or other instruments) may be exercised on behalf of the Corporation by the

President, any Vice President or such other person as the Board of Directors may authorize.

ARTICLE V - SHARES OF STOCK

SECTION 1 - CERTIFICATES OF STOCK.

(a)

The certificates representing shares of the Corporation's stock shall be in such form as shall be adopted by the Board of Directors,

and shall be numbered and registered in the order issued. The certificates shall bear the following: the corporate seal, the holder's

name, the number of shares of stock and the signatures of: (1) the Chairman of the Board, the President or a Vice President and

(2) the Secretary, Treasurer, any Assistant Secretary or Assistant Treasurer.

(b)

No certificate representing shares of stock shall be issued until the full amount of consideration therefor has been paid, except

as otherwise permitted by law.

(c)

To the extent permitted by law, the Board of Directors may authorize the issuance of certificates for fractions of a share of

stock which shall entitle the holder to exercise voting rights, receive dividends and participate in liquidating distributions,

in proportion to the fractional holdings; or it may authorize the payment in cash of the fair value of fractions of a share of

stock as of the time when those entitled to receive such fractions are determined; or it may authorize the issuance, subject to

such conditions as may be permitted by law, of scrip in registered or bearer form over the signature of an officer or agent of

the Corporation, exchangeable as therein provided for full shares of stock, but such scrip shall not entitle the holder to any

rights of a stockholder, except as therein provided.

SECTION 2 - LOST OR DESTROYED CERTIFICATES.

The holder of any certificate representing shares of stock of the

Corporation shall immediately notify the Corporation of any loss or destruction of the certificate representing the same. The Corporation

may issue a new certificate in the place of any certificate theretofore issued by it, alleged to have been lost or destroyed. On

production of such evidence of loss or destruction as the Board of Directors in its discretion may require, the Board of Directors

may, in its discretion, require the owner of the lost or destroyed certificate, or his or her legal representatives, to give the

Corporation a bond in such sum as the Board may direct, and with such surety or sureties as may be satisfactory to the Board, to

indemnify the Corporation against any claims, loss, liability or damage it may suffer on account of the issuance of the new certificate.

A new certificate may be issued without requiring any such evidence or bond when, in the judgment of the Board of Directors, it

is proper to do so.

SECTION 3 - TRANSFER OF SHARES.

(a)

Transfer of shares of stock of the Corporation shall be made on the stock ledger of the Corporation only by the holder of record

thereof, in person or by his or her duly authorized attorney, upon surrender for cancellation of the certificate or certificates

representing such shares of stock with an assignment or power of transfer endorsed thereon or delivered therewith, duly executed,

with such proof of the authenticity of the signature and of authority to transfer and of payment of taxes as the Corporation or

its agencies may require.

(b)

The Corporation shall be entitled to treat the holder of record of any share or shares of stock as the absolute owner thereof

for all purposes and, accordingly, shall not be bound to recognize any legal, equitable or other claim to, or interest in, such

share or shares of stock on the part of any other person, whether or not it shall have expenses or other notice thereof, except

as otherwise expressly provided by law.

ARTICLE VI - DIVIDENDS

Subject to applicable law, dividends may be declared and paid out

of any funds available therefor, as often, in such amount, and at such time or times as the Board of Directors may determine.

ARTICLE VII - FISCAL YEAR

The fiscal year of the Corporation shall end on December 31, and

may be changed by the Board of Directors from time to time subject to applicable law.

ARTICLE VIII - CORPORATE SEAL

The corporate seal shall be in such form as shall be approved from

time to time by the Board of Directors.

ARTICLE IX - INDEMNITY

SECTION 1 – INDEMNIFICATION.

The Corporation shall indemnify, subject to the provisions of Section

4 of this Article IX, any person (each, an "Indemnitee") who was or is a party to or is threatened to be made a party

to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (each,

a "Proceeding") (other than one brought by or in the right of the Corporation) by reason of the fact that he or she is

or was a Director, an officer, employee or agent of the Corporation or is or was serving at the request of the Corporation as a

director, an officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise against expenses

(including attorneys' fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by him or her in

connection with such Proceeding if Indemnitee acted (x) in good faith, and (y) in a manner he or she reasonably believed to be

in or not opposed to the best interests of the Corporation. The termination of any Proceeding (other than one brought by or in

the right of the Corporation) by judgment, order, settlement, conviction or upon a plea of NOLO CONTENDERE or its equivalent, shall

not, of itself, create a presumption that Indemnitee did not meet the standard of conduct described above.

SECTION 2 – OTHER ENTITIES.

The Corporation shall indemnify, subject to the provisions of Section

4 of this Article IX, any person who was or is a party to any proceeding by or in the right of the Corporation to procure a judgment

in its favor by reason of the fact that he or she is or was a Director, officer, employee or agent of the Corporation or is or

was serving at the request of the Corporation as a director, officer, employee or agent of another corporation, partnership, joint

venture, trust or other enterprise against expenses (including attorneys' fees), judgments, fines and amounts paid in settlement

actually and reasonably incurred by him or her in connection with such Proceeding if Indemnitee acted (x) in good faith, and (y)

in a manner he or she reasonably believed to be in or not opposed to the best interests of the Corporation, except that no indemnification

shall be made in respect of any Proceeding as to which such person has been adjudged by a court of competent jurisdiction, after

exhaustion of all appeals therefrom, to be liable to the Corporation or for amounts paid in settlement to the Corporation unless

and only to the extent that a court of competent jurisdiction determines upon application that in the view of all the circumstances

of the Proceeding the person is fairly

and reasonably entitled to indemnity for such expenses as the court

deems proper.

SECTION 3 – EXPENSES. To the extent that a Director, officer,

employee or agent of the Corporation has been successful on

the merits or otherwise in defense of any Proceeding referred to in

Sections 1 and 2 of this Article IX, or in defense of any claim, matter or issue therein, he or she shall be indemnified against

expenses (including attorneys' fees) actually and reasonably incurred by him in connection therewith.

SECTION 4 – APPLICABLE STANDARD.

Any indemnification under Sections 1 and 2 of this Article IX (unless

ordered by a court) shall be made by the Corporation only as authorized in the specific case upon a determination that indemnification

of the director, officer, employee or agent is proper in the circumstances because he or she has met the applicable standard of

conduct set forth in such Sections 1 and 2. Such determination shall be made (a) by the stockholders, (b) by the Board of Directors

by a majority vote of a quorum consisting of Directors who are not parties to such proceeding, (c) if a majority vote of a quorum

consisting of Directors who are not parties to such proceeding so orders, by independent legal counsel in a written opinion, or

(d) a quorum consisting of directors who are not parties to such proceeding cannot be obtained, by independent legal counsel in

a written opinion.

SECTION 5 - CIVIL OR CRIMINAL PROCEEDINGS.

Expenses incurred by an officer or director in defending a civil

or criminal Proceeding shall be paid by the Corporation as they are incurred and in advance of the final disposition of such Proceeding,

upon the receipt by the Corporation of a written undertaking by or on behalf of such person to repay such amount if it is ultimately

determined by a court of competent jurisdiction that he is not entitled to indemnification by the Corporation. The provisions contained

in this Section 5 shall not affect the rights of the advancement of expenses to which any person other than an officer or Director

of the Corporation is entitled.

Section 6 – ADVANCEMENT OF EXPENSES.

The indemnification and advancement of expenses authorized in or

ordered by a court pursuant to this Article IX (a) shall not be deemed exclusive of any other rights to which those seeking indemnification

may be entitled under any under the Articles of Incorporation, agreement, vote of stockholders or disinterested directors or otherwise,

both as to action in his or her official capacity and as to action in another capacity while holding such office, except that indemnification

(unless order by the court) may not be made to or on behalf of director or officer if a final adjudication is establishes that

his or her acts or omissions involved intentional misconduct, fraud or knowing violation of law or the payment of dividends in

violation of the revised Nevada Statutes, and (b) shall continue as to a person who has ceased to be a Director, officer, employee

or agent and shall inure to the benefit of the heirs, executors and administrators of such a person.

SECTION 7 - INSURANCE.

The Corporation may purchase and maintain insurance or make "other

financial arrangements" on behalf of any person who is or was a Director, officer, employee or agent of the Corporation, or

is or was serving at the request of the Corporation as a director, officer, employee or agent of another Corporation, partnership,

joint venture, trust or other enterprise against any liability asserted against him or her and incurred by him or her and liability

and expenses incurred by him or herein any such capacity, or arising out of his status as such, whether or not the Corporation

would have the power to indemnify him or her against such liability under the provisions of this Article IX; provided, that no

arrangement made pursuant to this Section 7, shall provide protection to a person which has been adjudged by a court of competent

jurisdiction, after exhaustion of all appeals therefrom, to be liable acts or omissions which involved intentional misconduct,

fraud or knowing violation of law or the payment of dividends in violation of the revised Nevada Statutes, except with respect

to advancement of expenses or indemnification order by the court.

SECTION 8 – CORPORATION.

For purposes of this Article IX, references to "the Corporation"

shall include, in addition to the resulting corporation, any constituent corporation (including any constituent of a constituent)

absorbed in a consolidation or merger which, if its separate existence had continued, would have had power and authority to indemnify

its directors, officers, employees or agents, so that any person who is or was a director, officer, employee or agent of such constituent

corporation shall stand in the same position under the provisions of this section with respect to the resulting or surviving corporation

as he or she would have with respect to such constituent corporation if its separate existence had continued.

SECTION 9 - OTHER ENTERPRISES.

For purposes of this Article IX, references to "other enterprises"

shall include employee benefit plans; references to "fines" shall include any excise taxes assessed on a person with

respect to an employee benefit plan; and references to "serving at the request of the corporation" shall include any

service as a Director, officer, employee or agent of the Corporation which imposes duties on, or involves services by, such director,

officer, employee or agent with respect to an employee benefit plan, its participants or beneficiaries; and a person who acted

in good faith and in a manner he or she reasonably believed to be in the interest of the participants and beneficiaries of an employee

benefit plan shall be deemed to have acted in a manner "not opposed to the best interests of the corporation" as referred

to in this Article IX.

SECTION 10 - OTHER FINANCIAL ARRANGEMENTS.

For purposes of this Article IX, references to "other financial

arrangements" shall include the creation of a trust fund, the establishment of a program of self-insurance, the securing of

its obligation of indemnification by granting a security interest or other lien on any assets of the Corporation, and the establishment

of a letter of credit, guaranty or surety.

SECTION 11 - SEVERABILITY.

If any provision of this Article IX shall be held invalid, illegal

or unenforceable for any reason whatsoever: (i) the validity, legality and enforceability of the remaining provisions of this Article

IX (including, without limitation, portions of any paragraph of this Article IX containing any such provision held to be invalid,

illegal or unenforceable, that are not themselves invalid, illegal or unenforceable) shall not in any way be affected or impaired

thereby; and (ii) to the fullest extent possible, the provisions of this Article IX (including, without limitation, portions of

any paragraph of this Article IX containing any such provision held to be invalid, illegal or unenforceable, that are not themselves

invalid, illegal or unenforceable) shall be construed so as to give effect to the intent manifested by the provision held invalid.

SECTION 12 – EFFECT OF REPEAL OR MODIFICATION.

Any

repeal or modification of this Article IX shall not result in any liability for a director with respect to any action or omission

occurring prior to such repeal or modification.

ARTICLE X - AMENDMENTS

SECTION 1 - BY STOCKHOLDERS.

All By-Laws of the Corporation shall be subject to alteration or

repeal, and new By-Laws may be made, by the affirmative vote of stockholders holding of record in the aggregate at least a majority

of the outstanding shares of stock entitled to vote in the election of Directors at any annual or special meeting of stockholders,

provided that the notice or waiver of notice of such meeting shall have summarized or set forth in full therein, the proposed amendment.

SECTION 2 - BY DIRECTORS.

The Board of Directors shall have power to make, adopt, alter, amend

and repeal, from time to time, these By-Laws; provided, however, that the stockholders entitled to vote with respect thereto as

in this Article X above-provided may alter, amend or repeal By-Laws or amendments thereto made by the Board of Directors, except

that the Board of Directors shall have no power to change the quorum for meetings of stockholders or of the Board of Directors

or to change any provisions of the By-Laws with respect to the removal of Directors or the filling of vacancies in the Board resulting

from the removal by the stockholders. If any provision of these By-Laws regulating an impending election of Directors is adopted,

amended or repealed by the Board of Directors, there shall be set forth in the notice of the next meeting of stockholders for the

election of Directors, the By-Laws so adopted, amended or repealed, together with a concise statement of the changes made.

CERTIFICATE OF SECRETARY

THIS IS TO CERTIFY that I am the duly elected,

qualified and acting Secretary of

Cabo Verde Capital Inc.

----------------------------------

and that the above and foregoing Amended and Restated By-Laws constituting

a true original copy were duly adopted as the Amended and Restated By-Laws of said Corporation.

IN WITNESS WHEREOF, I have hereunto set my hand.

DATED:

-----------------------

-------------------------------

SECRETARY

EXHIBIT 10.1

AGREEMENT AND PLAN OF MERGER

AGREEMENT AND PLAN OF MERGER

dated as of November 5, 2015 (herein called "this Agreement"), between Cabo Verde Capital Inc., a Delaware corporation

(herein called “CVC-Delaware”), and Cabo Verde Capital Inc., a Nevada corporation (herein called "CVC-Nevada"),

said corporations being hereinafter sometimes collectively called the "constituent corporations".

WHEREAS, the authorized

capital stock of CVC-Nevada consists of 500,000,000 shares of Common Stock, par value $.00001 per share ("CVC-Nevada Common

Stock"), of which 100 shares of CVC-Nevada Common Stock are duly issued and outstanding and owned by CVC-Delaware, and 10,000,000

shares of Preferred Stock, par value $.00001 per share ("CVC-Nevada Preferred Stock"), of which -0- shares are issued

and are outstanding as of the date hereof; and

WHEREAS, CVC-Delaware has

an authorized capital stock of 500,000,000 shares of voting Common Stock, par value $.00001 per share (the "CVC-Delaware Common

Stock"), of which as of the date hereof 53,056,005 shares of CVC-Delaware Common Stock have been duly issued and are outstanding,

and 10,000,000 shares of Preferred Stock, par value $.00001 per share (“CVC-Delaware Preferred Stock”), -0- shares

of which are issued and outstanding; and

WHEREAS, the Board of Directors

of CVC-Delaware and the Board of Directors of CVC-Nevada deem it advisable and for the general welfare of said corporations and

the shareholders of each, that such corporations merge and consolidate under, and pursuant to, the provisions of the Nevada Private

Corporations Law (“Nevada Corporations Law”) and the Delaware General Corporation Law (“Delaware General Corporation

Law”). The Board of Directors of each of the constituent corporations have by resolution duly adopted and approved this Agreement,

and this Agreement has been duly approved by the stockholders of CVC-Delaware by the written consent of such stockholders duly

adopted on November 5, 2015, in accordance with the Delaware General Corporation Law.

NOW, THEREFORE, the parties

hereto hereby agree as follows:

ARTICLE I

Merger

CVC-Delaware shall be merged

and consolidated into CVC-Nevada, which shall be the surviving corporation, all on the effective date of the merger, and the terms

and conditions of such merger, the mode of carrying it into effect, the conversion of the shares of CVC-Delaware and other details

and provisions deemed necessary or proper shall be as herein set forth, all in accordance with the Nevada Corporations Law and

the Delaware General Corporation Law. The merger is intended to qualify as an F Reorganization under Section 368(a)(1)(F) of the

Internal Revenue Code of 1986. The separate existence and corporate organization of CVC-Delaware will cease on the effective date

of the merger as herein provided, and thereafter CVC-Nevada and CVC-Delaware shall be a single corporation, to-wit, CVC-Nevada

(hereinafter sometimes referred to as the "Surviving Company").

ARTICLE II

Effectiveness of Merger

The merger and consolidation

shall not become effective before the completion of the following: (a) this Agreement shall have been adopted, approved and authorized

by each constituent corporation as provided in the Nevada Corporations Law and the Delaware General Corporation Law, and as provided

in Article IX hereof; (b) such approval, adoption and authorization shall have been certified upon this Agreement by

the Secretary or an Assistant Secretary of each of the constituent corporations under the seals thereof; and (c) Articles

of Merger shall have been filed with the Secretary of State of the State of Nevada, and said Secretary of State shall certify that

the Articles of Merger shall have been so filed, all in accordance with the Nevada Revised Statutes, and a Certificate of Ownership

shall have been filed with the Office of the Secretary of the State of Delaware, and said Secretary of State shall certify that

the Certificate of Ownership shall have been so filed, all the foregoing in accordance with the statutes of Delaware. The merger

and consolidation shall become effective on the day when the Articles of Merger shall have been filed with the Office of the Secretary

of the State of Nevada, and as used herein the "effective date of the merger" shall mean the date as of which the merger

and consolidation shall become effective as aforesaid.

ARTICLE III

Articles of Incorporation of Surviving

Company

On the effective date of

the merger, the Articles of Incorporation of CVC-Nevada shall be the Articles of Incorporation of the Surviving Company (the “Surviving

Company’s Articles of Incorporation”), until thereafter amended as provided by law. The Surviving Company’s Articles

of Incorporation provide for the name of the Surviving Company to be “Cabo Verde Capital Inc.”.

ARTICLE IV

By-Laws of Surviving Company

On the effective date of

the merger, the By-Laws of CVC-Nevada shall be the By-Laws of the Surviving Company (the “Surviving Company’s By-Laws”)

until the same shall thereafter be altered, amended or repealed in accordance with law and the Surviving Company’s Articles

of Incorporation and By-Laws.

ARTICLE V

Management of Surviving Company

On the effective date of

the merger, the Board of Directors and officers of CVC-Delaware shall be and constitute the directors and officers of the Surviving

Company.

If on the effective date

of the merger a vacancy shall exist in the Board of Directors or in any of the offices of the Surviving Company, such vacancy may

thereafter be filled in the manner provided by the Surviving Company’s By-Laws.

ARTICLE VI

Conversion of Stock, Other Securities

On the effective date of

the merger, as defined above, the outstanding shares of stock and other securities of the constituent corporations shall become

and be converted as set forth in this Article.

(a) On the effective date

of the merger, the outstanding shares of stock and other securities of CVC-Delaware shall by virtue of the merger and without any

action on the part of the holders thereof, automatically become and be converted or cancelled, as the case may be, as follows:

(1) CVC-Delaware

Common Stock. Each certificate or certificates representing shares of CVC-Delaware Common Stock outstanding immediately

prior to the effective date of the merger shall constitute a certificate or certificates representing that same number of shares

of CVC-Nevada Common Stock, and the holders thereof shall have precisely the same rights under the laws of the State of Nevada

which they would have had if such shares of CVC-Delaware Common Stock had been issued by the Surviving Company.

(2) Other Securities.

No other outstanding securities of CVC-Delaware or options to purchase such securities, shall be changed into or entitle the

holder or holders to receive securities or to receive any other consideration in connection with the merger.

(b) On the effective date

of the merger, the outstanding shares of CVC-Nevada Common Stock held by CVC-Delaware shall be cancelled.

ARTICLE VII

Vesting of Rights, Immunities, Privileges,

Etc. in Surviving Company

On the effective date of

the merger, all the rights, immunities, privileges, powers and franchises of each of the constituent corporations, both of a public

and private nature, all property, real, personal and mixed, all debts due on account, as well as for stock subscriptions as all

other things in action or belonging to each of the constituent corporations, and all and every other interest, shall vest in the

Surviving Company without further act or deed as effectively as they were vested in the constituent corporations; and the title

to any real estate, whether vested by deed or otherwise, in either of the constituent corporations shall not revert or be in any

way impaired by reason of the merger.

The Surviving Company shall

thenceforth be responsible for all debts and liabilities of each of the constituent corporations and all said debts and liabilities

shall thenceforth attach to the Surviving Company and may be enforced against it to the same extent as if said debts and liabilities

had been incurred or contracted by it, nor shall the rights of creditors thereof, or any liens upon the property of either of the

constituent corporations be impaired by the merger, and all rights of creditors and all liens upon the property of either of the

constituent corporations shall be preserved unimpaired.

ARTICLE VIII

Assets, Liabilities, on Books of Surviving

Company

On the effective date of

the merger, the assets, liabilities, reserves and accounts of each constituent corporation shall be taken up on the books of the

Surviving Company at the amounts at which they, respectively, were carried on the books of said constituent corporations.

ARTICLE IX

Required Vote for Approval

There shall be required

for the approval of this Agreement by the stockholders of CVC-Delaware the vote of a majority of the outstanding stock. There shall

be required for the approval and adoption of this Agreement by CVC-Nevada the approval by vote or written consent of the Board

of Directors of CVC-Delaware.

ARTICLE X

Termination; Abandonment

This Agreement and the

merger may be terminated and abandoned by resolution of the Board of Directors of either constituent corporation at any time prior

to the effective date of the merger, whether before or after the aforementioned action by stockholders of the constituent corporations,

if circumstances develop which in the opinion of such Board make proceeding with the merger inadvisable. In the event of the termination

and abandonment of this Agreement and the merger pursuant to the foregoing provisions of this Article X, this Agreement shall become

void and have no effect, without any liability on the part of either of the parties or its stockholders or directors or officers

in respect thereof.

ARTICLE XI

Counterparts

This Agreement may be executed

in any number of counterparts, each of which shall be an original, but such counterparts shall together constitute but one and

the same instrument.

IN WITNESS WHEREOF, this

Agreement has been signed by the Chief Executive Officer and the Secretary of CVC-Nevada and by the Chairman of the Board and Secretary

of CVC-Delaware, and each of the parties has caused its corporate seal to be hereunto affixed, all as of the day first above written.

CABO VERDE CAPITAL INC.

(Delaware)

| | By: /s/ John Duggan

Chief Executive Officer |

[Corporate Seal]

Attest:

____________________

Secretary

CABO VERDE CAPITAL INC.

(Nevada)

| | By: /s/ John Duggan

Chief Executive Officer |

[Corporate Seal]

Attest:

_____________________

Secretary

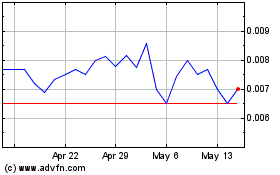

Cabo Verde Capital (PK) (USOTC:CAPV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cabo Verde Capital (PK) (USOTC:CAPV)

Historical Stock Chart

From Apr 2023 to Apr 2024