- iONTRAC 1st Detect Patents

Strengthen Competitive Position -

Astrotech Corporation (NASDAQ: ASTC) reported its financial

results for the quarter ended September 30, 2015, the first quarter

of fiscal year 2016.

“Astrotech continues to execute our plan to commercialize the

breakthrough technologies of our three subsidiaries,” said Thomas

B. Pickens III, Chairman and CEO of Astrotech Corporation. “1st

Detect is positioned to turn the corner from a research and

development (R&D) focus to an operating company. In the first

quarter of fiscal year 2016, we increased investment in R&D and

sales. In October, we launched our next generation process chemical

analyzer, and the quantity and quality of interest received at the

premier petrochemical and refining industry conference confirmed

1st Detect is developing the right suite of products.

“We believe ongoing successes of our current subsidiaries and

future technologies will bear significant value for our

shareholders,” concluded Pickens.

Highlights

- Astrotech’s first quarter of fiscal

year 2016 loss from continuing operations was $3.5 million,

compared to $1.3 million in the first quarter of fiscal year 2015.

The increase reflects 1st Detect’s larger sales team and R&D

investment.

- At September 30, 2015, the company

had $28.6 million in cash, short term investments, and an indemnity

receivable; there was no debt.

- 1st Detect

develops, manufactures, and sells chemical analyzers for

applications like explosive trace detection, food processing

plants, and clean-room manufacturing lines, among others. Recent

1st Detect highlights are as follows:

- Unveiled the next generation iONTRAC

Process Chemical Analyzer that delivers cost effective laboratory

performance and improves industrial processing efficiencies while

providing customers with “All the Data, All the Time.”

- Received very positive feedback from

the petrochemical and refining industry at the Gulf Coast

Conference which took place October 20th – 22nd.

- Received two U.S. patents during the

third quarter bringing the total issued to 11 U.S. and nine

international and pending to 11 U.S. and 17 international.

- Astral Images, which is setting

the standard for film digital conversion, advanced conversations

with leaders in digital media and entertainment.

- Astrogenetix, which is using the

power of the unique microgravity environment of space to develop

novel therapeutic products, continued in conjunction with NASA the

pursuit of an investigational new drug (“IND”) application with the

Food and Drug Administration for salmonella.

About Astrotech Corporation

Astrotech Corporation (NASDAQ: ASTC) identifies and

commercializes emerging, disruptive technologies through its

closely held subsidiaries. Management employs creativity in

execution as well as sources investment opportunities from various

government laboratories, agencies, universities, and corporations,

as well as through its own internal research. Sourced from Oak

Ridge Laboratory’s mass spectrometer research, 1st

Detect develops, manufactures, and sells chemical analyzers

that streamline processes for industrial use in the food and

beverage, semiconductor, pharmaceutical, research, and

environmental markets as well as for government applications used

in explosive and chemical warfare detection for the Department of

Homeland Security and the military. Sourced from decades of image

research from the laboratories of IBM and Kodak and combined with

classified satellite technology from government laboratories,

Astral Images sells film to digital image enhancement,

defect removal and color correction software, and post processing

services providing economically feasible conversion of television

and feature 35mm and 16mm films to the new 4K ultra-high definition

(“UHD”), high-dynamic range (“HDR”) format necessary for the new

generation of digital distribution. Sourced from NASA’s extensive

microgravity research, Astrogenetix is applying a fast-track

on-orbit discovery platform using the International Space Station

to develop vaccines and other therapeutics. Demonstrating its

entrepreneurial strategy, Astrotech management sold its

state-of-the-art satellite servicing operations to Lockheed Martin

in August 2014. Astrotech has operations throughout Texas and is

headquartered in Austin. For information please visit

www.astrotechcorp.com.

“Safe Harbor” Statement

This press release contains forward-looking statements that are

made pursuant to the Safe Harbor provisions of the Private

Securities Litigation Reform Act of 1995. Such forward-looking

statements are subject to risks, trends, and uncertainties that

could cause actual results to be materially different from the

forward-looking statement. These factors include, but are not

limited to, whether we are able to commercialize our products,

whether the market will accept our products, whether our products

will perform as expected and whether we will obtain the approvals

and licenses necessary to commercialize our products, as well as

other risk factors and business considerations described in

Astrotech’s Securities and Exchange Commission filings including

the annual report on Form 10-K. Any forward-looking statements in

this document should be evaluated in light of these important risk

factors. Astrotech assumes no obligation to update these

forward-looking statements.

Tables follow

ASTROTECH CORPORATION AND

SUBSIDIARIES

Condensed Consolidated Statements of

Operations and Comprehensive Income

(In thousands, except per share data)

(Unaudited)

Three Months Ended September 30,

2015 2014 Revenue $ — $ 320 Cost of

revenue — 277

Gross profit —

43 Operating expenses: Selling, general and

administrative 2,286 1,960 Research and development 1,264

692 Total operating expenses 3,550 2,652

Loss from operations (3,550 ) (2,609

) Interest and other expense, net 99 12

Loss from continuing operations before income taxes

(3,451 ) (2,597 ) Income tax (expense)

benefit (2 ) 1,325

Loss from continuing operations

(3,453 ) (1,272 ) Discontinued

operations Income from discontinued operations — 1,303 Income

tax expense — (2,378 ) Gain on sale of discontinued operations —

25,630

Income from discontinued operations

— 24,555 Net (loss) income

(3,453 ) 23,283 Less: Net loss attributable to

noncontrolling interest (89 ) —

Net (loss) income

attributable to Astrotech Corporation (3,364 )

23,283 Less: Deemed dividend to State of Texas — 531

Net (loss) income attributable to common stockholders

$ (3,364 ) $ 22,752

Amounts attributable to Astrotech Corporation: Loss

from continuing operations, net of tax $ (3,364 ) $ (1,272 ) Income

from discontinued operations, net of tax — 24,555

Net (loss) income attributable to Astrotech Corporation

$ (3,364 ) $ 23,283

Weighted average common shares outstanding: Basic and

diluted 20,705 19,548

Basic and diluted net (loss) income

per common share: Net loss attributable to Astrotech

Corporation from continuing operations $ (0.16 ) $ (0.09 ) Net

income from discontinued operations — 1.25 Net (loss)

income attributable to Astrotech Corporation $ (0.16 ) $ 1.16

ASTROTECH CORPORATION AND

SUBSIDIARIES

Condensed Consolidated Balance

Sheets

(In thousands, except share data)

(Unaudited)

September 30,2015

June 30, 2015

Assets Current assets Cash and cash equivalents $

1,356 $ 2,330 Short-term investments 21,193 23,161 Accounts

receivable, net of allowance 221 198 Inventory 783 509 Indemnity

receivable 6,100 6,100 Prepaid expenses and other current assets

580 296

Total current assets 30,233

32,594 Property and equipment, net 3,631 3,108 Long-term

investments 6,257 8,516

Total assets $

40,121 $ 44,218

Liabilities and stockholders’ equity Current liabilities

Accounts payable $ 261 $ 398 Accrued liabilities and other 1,501

1,801 Income tax payable — 190

Total current

liabilities 1,762 2,389 Other liabilities 146

101

Total liabilities 1,908

2,490 Commitments and contingencies

Stockholders’ equity Preferred stock, no par value,

convertible, 2,500,000 authorized shares; no issued and outstanding

shares, at September 30, 2015 and June 30, 2015 — — Common stock,

no par value, 75,000,000 shares authorized; 21,864,548 shares

issued at September 30, 2015 and June 30, 2015; 20,700,673 and

20,743,973 shares outstanding at September 30, 2015 and June 30,

2015, respectively 189,096 189,007 Treasury stock, 1,163,875 and

1,120,575 shares at cost at September 30, 2015 and June 30, 2015,

respectively (2,789 ) (2,672 ) Additional paid-in capital 1,193

1,139 Accumulated deficit (149,386 ) (146,022 ) Accumulated other

comprehensive loss (111 ) (23 )

Equity attributable to

stockholders of Astrotech Corporation 38,003 41,429

Noncontrolling interest 210 299

Total

stockholders’ equity 38,213 41,728

Total liabilities and stockholders’ equity $

40,121 $ 44,218

View source

version on businesswire.com: http://www.businesswire.com/news/home/20151109005496/en/

Company ContactAstrotech CorporationEric Stober,

512-485-9530Chief Financial OfficerorInvestor Relations

ContactLHACathy Mattison and Kirsten

Chapman415-433-3777ir@astrotechcorp.com

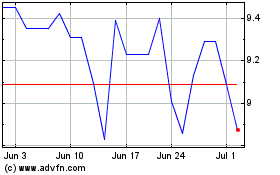

Astrotech (NASDAQ:ASTC)

Historical Stock Chart

From Apr 2024 to May 2024

Astrotech (NASDAQ:ASTC)

Historical Stock Chart

From May 2023 to May 2024