UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) October 14, 2015

EBIX, INC.

(Exact name of registrant as specified in its charter)

|

| | | | |

Delaware | | 0-15946 | | 77-0021975 |

(State or other jurisdiction | | (Commission File Number) | | (IRS Employer |

of incorporation) | | | | Identification No.) |

|

| | |

1 Ebix Way Johns Creek, Georgia | | 30097 |

(Address of principal executive offices) | | (Zip Code) |

Registrant's telephone number, including area code (678) 281-2020

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01 Other Events.

Ebix, Inc. (the “Company”) has exercised the $50 million accordion feature under the Credit Agreement (the “Credit Agreement”) dated August 5, 2014, among the Company, Regions Bank as Administrative Agent (“Regions”) and certain lenders listed below (“Lenders”).

The exercise of the accordion feature increases the Aggregate Revolving Commitment under the Credit Agreement to $240 million from the prior amount of $190 million. In connection with the exercise of the accordion feature, TD Bank, NA has joined the syndicated bank group. Below are the amended Lenders, Revolving Commitments and Revolving Commitments Percentages:

|

| | | | | | | | | | | |

| | | | | | | |

Lender | | Revolving Commitment | | Revolving Commitment Percentage |

Regions Bank | | $ | 75,000,000 | | | 31.3 |

| % |

MUFG Union Bank, N.A. | | $ | 60,000,000 | | | 25.0 |

| % |

Silicon Valley Bank | | $ | 50,000,000 | | | 20.8 |

| % |

Fifth Third Bank | | $ | 30,000,000 | | | 12.5 |

| % |

TD Bank, NA | | $ | 25,000,000 | | | 10.4 |

| % |

| | | | | | | |

TOTAL | | $ | 240,000,000 | | | 100.0 |

| % |

On October 14, 2015, the Company issued a press release announcing the exercise of the accordion feature and the joinder of TD Bank, NA as a Lender under the Credit Agreement. A copy of this press release is being filed as Exhibit 99.1 to this Form 8-K and is incorporated herein by reference in its entirety.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

No. Exhibit

99.1 Press Release dated October 14, 2015

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| EBIX, INC. |

| |

| |

| By: | /s/ Robert Kerris |

| Name: | Robert Kerris |

| Title: | EVP, Chief Financial Officer & Corporate Secretary |

| | | |

Dated: October 14, 2015

EXHIBIT 99.1

EXHIBIT 99.1

Ebix Increases Credit Facility to $240 Million

with Addition of TD Bank to Lending Group

ATLANTA, GA - October 14, 2015 - Ebix, Inc. (NASDAQ: EBIX), a leading international supplier of On-Demand software and E-commerce services to the insurance, financial and healthcare industries, today announced the expansion of its existing credit facility from $190.0 million to $240 million, to fund its growth and share repurchase initiatives. The $50.0 million increase in the bank line was the result of members of the existing bank group expanding its share of the credit facility as also the addition of TD Bank, N.A. to the Banking Syndicate, which further diversifies Ebix’s lending group under the credit facility to five participants.

The increase in total commitments was executed under the accordion feature of the credit facility, which allowed for an increase in total commitments under the facility up to $240.0 million, in the aggregate. The credit facility originally closed August 5, 2014 and all other terms remain substantially unchanged.

The syndicated bank group comprises leading financial institutions that include Regions Bank, MUFG Union Bank, N.A., Fifth Third Bank, TD Bank N.A. and Silicon Valley Bank. Regions Capital Markets, a division of Regions Bank, served as Lead Arranger on the transaction.

Robin Raina, President and CEO, Ebix Inc. said, “We are excited to have the support of leading financial institutions like Regions Bank, MUFG Union Bank, Fifth Third Bank, Silicon Valley Bank and now TD Bank towards funding our future growth and share repurchase initiatives. We were able to get the credit line increased by $50 million with only one new bank being needed to fund this. That by itself is a testament to the strength of our existing bank group and their continued faith in the fundamental operating and financial strength of Ebix.”

About Ebix, Inc.

A leading international supplier of On-Demand software and E-commerce services to the insurance, financial and healthcare industries, Ebix, Inc., (NASDAQ: EBIX) provides end-to-end solutions ranging from infrastructure exchanges, carrier systems, agency systems and risk compliance solutions to custom software development for all entities involved in the insurance industry.

With 40+ offices across Australia, Brazil, Canada, India, New Zealand, Singapore, the US and the UK, Ebix powers multiple exchanges across the world in the field of life, annuity, health and property & casualty insurance while conducting in excess of $100 billion in insurance premiums on its platforms. Through its various SaaS-based software platforms, Ebix employs hundreds of insurance and technology professionals to provide products, support and consultancy to thousands of customers on six continents. For more information, visit the Company’s website at www.ebix.com.

CONTACT:

Aaron Tikkoo - 678-281-2027 or atikkoo@ebix.com

David Collins, Tanya Kamatu or Chris Eddy, Catalyst Global - 212-924-9800 or ebix@catalyst-ir.com

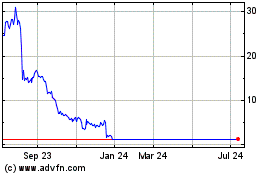

Ebix (NASDAQ:EBIX)

Historical Stock Chart

From Aug 2024 to Sep 2024

Ebix (NASDAQ:EBIX)

Historical Stock Chart

From Sep 2023 to Sep 2024