SCHEDULE 14C

Information Required in Proxy Statement

Pursuant to Section 14(c) of the Securities Exchange Act of 1934

Check the appropriate box:

o Preliminary Information Statement

x Definitive Information Statement

Bioheart, Inc.

(Name of Company As Specified In Charter)

Not Applicable

(Name of Person(s) Filing the Information Statement if other than Company)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

o Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

1) Title of each class of securities to which transaction applies:

Common Stock, par value $0.001 per share

Preferred Shares, par value $0.001 per share

2) Aggregate number of securities to which transaction applies:

855,691,815 common shares; 20,000,000 preferred shares

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11:

4) Proposed maximum aggregate value of transaction:

o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

1) Amount Previously Paid:

2) Form, Schedule or Registration Statement No.:

3) Filing Party:

4) Date Filed:

Bioheart, Inc.

13794 NW 4th Street, Suite 212,

Sunrise, Florida 33325

(954) 835-1500

bioheart@bioheartinc.com

PURSUANT TO SECTION 14 OF THE SECURITIES EXCHANGE ACT OF 1934,

AS AMENDED, AND REGULATION 14C AND SCHEDULE 14C THEREUNDER

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE REQUESTED NOT TO SEND US A PROXY

INTRODUCTION

This notice and information statement (the “Information Statement”) will be mailed on or about September 8, 2015 to the stockholders of record, as of August 26, 2015, to shareholders of Bioheart, Inc., a Florida corporation (the “Company”) pursuant to: Section 14(c) of the Exchange Act of 1934, as amended. This Information Statement is circulated to advise the shareholders of action already approved and taken without a meeting by written consent of the holders of a majority of the Company’s outstanding voting common and outstanding voting preferred stock, specifically, management, our two major investors, and 12 non-solicited shareholder, representing 687,185,709 voting capital shares (including 20,000,000 preferred shares that have 25 for 1 voting rights or 500,000,000 voting shares) (51.03% of the Company’s issued and outstanding voting stock as of the Record Date). Pursuant to Rule 14c-2 under the Securities Exchange Act of 1934, as amended, the corporate action described in this Notice can be taken no sooner than 20 calendar days after the accompanying Information Statement is first sent or given to the Company’s stockholders. Since the accompanying Information Statement is first being sent or given to security holders on September 8, 2015 to the corporate action described therein may be effective on or after September 28, 2015.

Please review the Information Statement included with this Notice for a more complete description of this matter. This Information Statement is being sent to you for informational purposes only.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT

TO SEND US A PROXY.

The actions to be effective twenty days after the mailing of this Information Statement are as follows:

(1) to effectuate a 1,000:1 Reverse Stock Split (pro-rata reduction of outstanding shares) of our issued and outstanding shares of Common Stock and Preferred Stock (the “Reverse Stock Split”); and

(2) change the name to U.S. Stem Cell, Inc.

Both the Reverse Stock Split and the Change of Name described in the accompanying Information Statement, effective as of the filing of amendment to the Company's Articles of Incorporation with the Florida Secretary of State, have been duly authorized and approved by the written consent of the holders of a majority of the voting capital shares of the Company’s issued and outstanding voting securities, your vote or consent is not requested or required. The accompanying Information Statement is provided solely for your information. The accompanying Information Statement also serves as the notice required by the Florida Business Corporations Act Law of the taking of a corporate action without a meeting by less than unanimous written consent of the Company’s stockholders.

By order of the Board of Directors,

Mike Tomas

Chief Executive Officer

The elimination of the need for a meeting of stockholders to approve this action is made possible by Florida Statutes which provides that the written consent of the holders of outstanding shares of voting capital stock, having not less than the minimum number of votes which would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted, may be substituted for such a meeting. In order to eliminate the costs involved in holding a special meeting of our stockholders, our Board of Directors voted to utilize the written consent of the holders of a majority in interest of our voting securities. This Information Statement is circulated to advise the shareholders of action already approved by written consent of the shareholders who collectively hold a majority of the voting power of our capital stock.

THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 PROVIDES A “SAFE HARBOR” FOR FORWARD LOOKING STATEMENTS. This Information Statement contains statements that are not historical facts. These statements are called “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements involve important known and unknown risks, uncertainties and other factors and can be identified by phrases using “estimate,” “anticipate,” “believe,” “project,” “expect,” “intend,” “predict,” “potential,” “future,” “may,” “should” and similar expressions or words. Our future results, performance or achievements may differ materially from the results, performance or achievements discussed in the forward-looking statements. There are numerous factors that could cause actual results to differ materially from the results discussed in forward-looking statements, including:

|

|

•

|

Changes in relationships and market for the development of the business of the Company that would affect our earnings and financial position.

|

|

|

•

|

Considerable financial uncertainties that could impact the profitability of our business.

|

|

|

•

|

Factors that we have discussed in previous public reports and other documents filed with the Securities and Exchange Commission.

|

This list provides examples of factors that could affect the results described by forward-looking statements contained in this Information Statement. However, this list is not intended to be exhaustive; many other factors could impact our business and it is impossible to predict with any accuracy which factors could result in which negative impacts. Although we believe that the forward-looking statements contained in this Information Statement are reasonable, we cannot provide you with any guarantee that the anticipated results will be achieved. All forward-looking statements in this Information Statement are expressly qualified in their entirety by the cautionary statements contained in this section and you are cautioned not to place undue reliance on the forward-looking statements contained in this Information Statement. In addition to the risks listed above, other risks may arise in the future, and we disclaim any obligation to update information contained in any forward-looking statement.

| |

|

Page

|

|

|

|

2

|

| |

|

|

|

|

5

|

| |

|

|

|

|

7

|

| |

|

|

|

|

8

|

| |

|

|

|

|

8

|

| |

|

|

|

|

8

|

| |

|

|

|

|

59

|

| |

|

|

|

|

63

|

| |

|

|

|

|

63

|

Bioheart, Inc.

13794 NW 4th Street, Suite 212,

Sunrise, Florida 33325

(954) 835-1500

bioheart@bioheartinc.com

This Information Statement is being furnished by Bioheart, Inc., a Florida corporation (“we,” “us,” “our” or the “Company”), in connection with action taken by the holders of a majority of the voting power of the Company’s issued and outstanding voting securities. By written consent as of August 26, 2015, the holders of a majority of the voting power approved a resolution to effectuate a 1,000:1 Reverse Stock Split. Under this Reverse Stock Split each 1,000 shares of our Common Stock will be automatically converted into 1 share of Common Stock. We are first sending or giving this Information Statement on or about September 8, 2015 to our stockholders of record as of the close of business on August 26, 2015 (the “Record Date”). Our principal executive offices are located at 13794 NW 4th Street, Suite 212, Sunrise, Florida 33325 and our main telephone number is (954) 835-1500.

BOARD AND SHAREHOLDER APPROVAL OF THE REVERSE STOCK SPLIT

By August 26, 2015, the Board of Directors and the holders of a majority of the voting power approved a resolution to effectuate a 1,000:1 Reverse Stock Split (“Reverse Stock Split”). Under this Reverse Stock Split each 1,000 shares of our Common Stock will be automatically converted into 1 share of Common Stock. To avoid the issuance of fractional shares of Common Stock, the Company will issue an additional share to all holders of fractional shares. The effective date of the Reverse Stock Split will be on or after September 28, 2015.

PLEASE NOTE THAT THE REVERSE STOCK SPLIT WILL NOT CHANGE YOUR PROPORTIONATE EQUITY INTERESTS IN THE COMPANY, EXCEPT AS MAY RESULT FROM THE ISSUANCE OF SHARES PURSUANT TO THE FRACTIONAL SHARES.

PLEASE NOTE THAT THE REVERSE STOCK SPLIT WILL HAVE THE EFFECT OF SUBSTANTIALLY INCREASING THE NUMBER OF SHARES THE COMPANY WILL BE ABLE TO ISSUE TO NEW OR EXISTING SHAREHOLDERS BECAUSE THE NUMBER OF AUTHORIZED SHARES WILL NOT BE REDUCED WHILE THE NUMBER OF SHARES ISSUED AND OUTSTANDING WILL BE REDUCED 1,000-FOLD.

PURPOSE AND MATERIAL EFFECTS OF THE REVERSE STOCK SPLIT

The Board of Directors believe that among other reasons, the large number of outstanding shares of our Common Stock have contributed to the difficulty with some business transactions, have contributed to a lack of investor and specialized fund interest in the Company, and has made it difficult to attract new investors, specialized funds and potential business candidates. As a result, the Board of Directors has proposed the Reverse Stock Split as one method to attract business and investor opportunities in the Company.

We have no present understandings or agreements that will involve the issuance of capital stock, apart from understandings and agreement disclosed in our filings with the Securities and Exchange Commission. However, we are engaged in negotiations with respect to transactions, including financings and acquisitions, which could involve the issuance of capital stock. As of the date herein, there are no definitive agreements, letters of intent of memorandums of understanding with respect to any transactions, financings or acquisitions apart from understandings and agreement disclosed in our filings with the Securities and Exchange Commission.

When a company engages in a Reverse Stock Split, it substitutes one share of stock for a predetermined amount of shares of stock. It does not increase the market capitalization of the company. An example of a reverse split is the following. A company has 10,000,000 shares of common stock outstanding. Assume the market price is $0.01 per share. Assume that the company declares a 1 for 10 reverse stock split. After the reverse split, that company will have 1/10 as many shares outstanding or 1,000,000 shares outstanding. The stock will have a market price of $0.10. If an individual investor owned 10,000 shares of that company before the split at $0.01 per share, he will own 1,000 shares at $0.10 after the split. In either case, his stock will be worth $100. He is no better off before or after. Except that such company hopes that the higher stock price will make that company look better and thus the company will be a more attractive investor or merger or purchase target for potential business. There is no assurance that that company's stock will rise in price after a reverse split or that a suitable investor, merger or purchaser candidate will emerge.

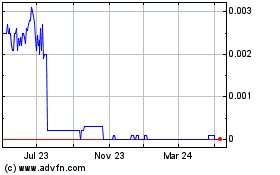

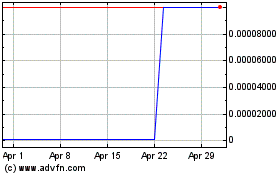

The Board of Directors believes that the Reverse Stock Split may improve the price level of our Common Stock and that the higher share price could help generate interest in the Company among investors and other business opportunities. In addition, the OTC Markets, in which our stock trades, requires a minimum price of $.01 to be listed on the OTCQB. The Reverse Stock Split, while not guaranteeing our ability to remain above $0.01 after the Reverse Stock Split, will improve the likelihood of trading above this minimum requirement. The effect of the reverse split upon the market price for our Common Stock cannot be predicted, and the history of similar stock split combinations for companies in like circumstances is varied. There can be no assurance that the market price per share of our Common Stock after the reverse split will rise in proportion to the reduction in the number of shares of Common Stock outstanding resulting from the reverse split. The market price of our Common Stock may also be based on our performance and other factors, some of which may be unrelated to the number of shares outstanding.

The reverse split will affect all of our stockholders uniformly and will not affect any stockholder's percentage ownership interests in the Company or proportionate voting power, except to the extent that the reverse split results in any of our stockholders owning a fractional shares which will be rounded up. All stockholders holding a fractional share shall be issued an additional share to round up their holdings. The principal effect of the Reverse Stock Split will be that the number of shares of Common Stock issued and outstanding will be reduced from 855,691,815 shares of Common Stock as of August 26, 2015 to approximately 855,691 shares of Common Stock, $0.0001 par value (depending on the number of fractional shares that are issued). The Reverse Stock Split will affect the shares of common stock outstanding. As a result, on the effective date of the Reverse Stock Split, the stated capital on our balance sheet attributable to our Common Stock will be reduced to less than the present amount, and the additional paid-in capital account shall be credited with the amount by which the stated capital is reduced. The per share net income or loss and net book value of our Common Stock will be increased because there will be fewer shares of our Common Stock outstanding.

The number of authorized, issued and outstanding, and available shares of common and preferred shares are disclosed in the tables below:

| |

Authorized Shares of Common Stock

|

Number of Issued and Outstanding

Shares of Common Stock

|

Number of Shares of Common Stock Available in

Treasury for Issuance

|

|

Pre-Reverse

Stock Split

(as of August 21, 2015)

|

2,000,000,000 shares of Common Stock

|

855,691,815shares of Common Stock

|

1,144,308,185 shares of Common Stock

|

|

Post-Reverse

Stock Split

|

2,000,000,000 shares of Common Stock

|

855,691 (1) shares of Common Stock

|

1,999,144,309(1) shares of Common Stock

|

|

(1)

|

Depending on the number of fractional shares that are issued.

|

| |

Authorized Shares of Preferred Stock

|

Number of Issued and Outstanding

Shares of Preferred Stock

|

Number of Shares of Preferred Stock Available in

Treasury for Issuance

|

|

Pre-Reverse

Stock Split

(as of August 21, 2015)

|

20,000,000 shares of Preferred Stock

|

20,000,000 shares of Series A Convertible Preferred Stock

|

0 shares of Preferred Stock

|

|

Post-Reverse

Stock Split

|

20,000,000 shares of Preferred Stock

|

20,000,000 shares of Series A Convertible Preferred Stock

|

0 shares of Preferred Stock

|

The Reverse Stock Split will not change the proportionate equity interests of our stockholders, nor will the respective voting rights and other rights of stockholders be altered. The Common Stock issued pursuant to the Reverse Stock Split will remain fully paid and non-assessable. The Reverse Stock Split is not intended as, and will not have the effect of, a “going private transaction” covered by Rule 13e-3 under the Securities Exchange Act of 1934. We will continue to be subject to the periodic reporting requirements of the Securities Exchange Act of 1934.

Stockholders should recognize that they will own fewer numbers of shares than they presently own (a number equal to the number of shares owned immediately prior to the filing of the certificate of amendment divided by 10). While we expect that the Reverse Stock Split will result in an increase in the potential market price of our Common Stock (presuming our common stock is subsequently listed), there can be no assurance that the Reverse Stock Split will increase the potential market price of our Common Stock by a multiple equal to the exchange number or result in the permanent increase in any potential market price (which is dependent upon many factors, including our performance and prospects). Also, should the potential market price of our Common Stock decline (presuming our common stock is subsequently listed), the percentage decline as an absolute number and as a percentage of our overall market capitalization may be greater than would pertain in the absence of a reverse split. Furthermore, the possibility exists that potential liquidity in the market price of our Common Stock (presuming our common stock is subsequently listed), could be adversely affected by the reduced number of shares that would be outstanding after the reverse split. Consequently, there can be no assurance that the reverse split will achieve the desired results.

SUMMARY OF REVERSE STOCK SPLIT

Below is a brief summary of the Reverse Stock Split:

s The issued and outstanding Common Stock shall be reduced on the basis of one post-split share of the Common Stock for every 1,000 pre-split shares of the Common Stock outstanding. The consolidation shall not affect any rights, privileges or obligations with respect to the shares of the Common Stock existing prior to the consolidation.

s Stockholders of record of the Common Stock shall have their total shares reduced on the basis of one post-split share of Common Stock for every 1,000 pre-split shares outstanding.

s As a result of the reduction of the Common Stock, the pre-split total of issued and outstanding shares of 855,691,815shall be consolidated to a total of approximately 855,961 issued and outstanding shares (depending on the number of fractional shares that are be issued).

The Reverse Split of the Common Stock is expected to become effective after we file our Articles of Amendment to our Articles of Incorporation (the “Effective Date”). The Reverse Split will take place on the Effective Date without any action on the part of the holders of the Common Stock and without regard to current certificates representing shares of Common Stock being physically surrendered for certificates representing the number of shares of Common Stock each shareholder is entitled to receive as a result of the Reverse Split. New certificates of Common Stock will not be issued at this time.

We do not have any provisions in our Articles of Incorporation, by laws, or employment or credit agreements to which we are party that have anti-takeover consequences. We do not currently have any plans to adopt anti-takeover provisions or enter into any arrangements or understandings that would have anti-takeover consequences.

There are no adverse material consequences or any anti-takeover provisions in either our Certificate of Incorporation or Bylaws that would be triggered as a consequence of the Reverse Split. The Articles of Incorporation or bylaws do not address any consequence of the Reverse Split. See below for a discussion on the federal Income Tax consequences of the Reverse Split.

THE ACTION BY WRITTEN CONSENT

By August 26, 2015, Board of Directors and the holders of a majority of the voting power approved effectuating a 1,000:1 Reverse Stock Split (pro-rata reduction of outstanding shares) of our issued and outstanding shares of Common Stock (the “Reverse Stock Split”).

The holders of a majority of the votes of the Company’s outstanding voting securities are comprised of 21 stockholders (5 including management and 1 in which management is the manager) holding a total of holding of over 50.69% of the issued and outstanding shares of common stock. Thus, there would be a total of 1,355,691,815 voting capital shares of which 687,185,709 have voted in favor of the actions.

No Further Voting Required

We are not seeking consent, authorizations, or proxies from you. Florida Business Corporations Act and our bylaws provide that actions requiring a vote of the stockholders may be approved by written consent of the holders of outstanding shares of voting capital stock having not less than the minimum number of votes which would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted. The approval by at least a majority of the outstanding voting power of our voting securities is required to approve the increase in the authorized shares of common stock.

Notice Pursuant to the Florida Business Corporations Act

Pursuant to Florida Business Corporations Act, we are required to provide prompt notice of the taking of corporate action by written consent to our stockholders who have not consented in writing to such action. This Information Statement serves as the notice required by the Florida Business Corporations Act.

The Florida Business Corporations Act does not provide dissenters’ rights of appraisal to our stockholders in connection with the matters approved by the Written Consent.

As used herein, “we”, “us”, “our”, “Bioheart”, “Company” or “our company” refers to Bioheart, Inc. and all of its subsidiaries unless the context requires otherwise

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Information Statement contains certain forward-looking statements regarding management’s plans and objectives for future operations including plans and objectives relating to our planned marketing efforts and future economic performance. The forward-looking statements and associated risks set forth in the information statement include or relate to, among other things, acceptance of our proposed services and the products we expect to market, our ability to establish a customer base, managements’ ability to raise capital in the future, the retention of key employees and changes in the regulation of our industry. These statements may be found under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Description of Business,” as well as in the information statement generally. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors, including, without limitation, the risks outlined under “Risk Factors”. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in the information statement will in fact occur.

The forward-looking statements herein are based on current expectations that involve a number of risks and uncertainties. Such forward-looking statements are based on assumptions described herein. The assumptions are based on judgments with respect to, among other things, future economic, competitive and market conditions, and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control. Accordingly, although we believe that the assumptions underlying the forward-looking statements are reasonable, any such assumption could prove to be inaccurate and therefore there can be no assurance that the results contemplated in forward-looking statements will be realized. In addition, as disclosed elsewhere in the “Risk Factors” section of the information statement, there are a number of other risks inherent in our business and operations which could cause our operating results to vary markedly and adversely from prior results or the results contemplated by the forward-looking statements. Management decisions, including budgeting, are subjective in many respects and periodic revisions must be made to reflect actual conditions and business developments, the impact of which may cause us to alter marketing, capital investment and other expenditures, which may also materially adversely affect our results of operations. In light of significant uncertainties inherent in the forward-looking information included in the information statement, the inclusion of such information should not be regarded as a representation by us or any other person that our objectives or plans will be achieved.

Any statement in the information statement that is not a statement of an historical fact constitutes a “forward-looking statement”. Further, when we use the words “may”, “expect”, “anticipate”, “plan”, “believe”, “seek”, “estimate”, “internal”, and similar words, we intend to identify statements and expressions that may be forward- looking statements. We believe it is important to communicate certain of our expectations to our investors. Forward-looking statements are not guarantees of future performance. They involve risks, uncertainties and assumptions that could cause our future results to differ materially from those expressed in any forward-looking statements. Many factors are beyond our ability to control or predict. You are accordingly cautioned not to place undue reliance on such forward-looking statements. Important factors that may cause our actual results to differ from such forward-looking statements include, but are not limited to, the risks outlined under “Risk Factors” herein. The reader is cautioned that our company does not have a policy of updating or revising forward-looking statements and thus the reader should not assume that silence by management of our company over time means that actual events are bearing out as estimated in such forward-looking statements.

Corporate History and Business Overview

We were incorporated in the State of Florida in August 1999. Our principal executive offices are located at 13794 NW 4th Street, Suite 212, Sunrise, Florida 33325 and our telephone number is (954) 835-1500. Information about us is available on our corporate web site at www.bioheartinc.com. Information contained on the web site does not constitute part of, and is not incorporated by reference in, this report.

We are an emerging enterprise in the regenerative medicine / cellular therapy industry. We are focused on the discovery, development and commercialization of cell based therapeutics that prevent, treat or cure disease by repairing and replacing damaged or aged tissue, cells and organs and restoring their normal function. Our business includes the development of proprietary cell therapy products as well as revenue generating physician and patient based regenerative medicine / cell therapy training services, cell collection and cell storage services, the sale of cell collection and treatment kits for humans and animals, and the operation of a cell therapy clinic.

US Stem Cell Training, (“SCT”), an operating division of our company, is a content developer of regenerative medicine / cell therapy informational and training materials for physicians and patients. SCT also provides in-person and online training courses which are delivered through in-person presentations at SCT’s state of the art facilities and globally at university, hospital and physician’s office locations as well as through online webinars. Additionally, SCT provides hands-on clinical application training for physicians and health care professionals interested in providing regenerative medicine / cell therapy procedures.

Vetbiologics, (“VBI”), an operating division of our company, is a veterinary regenerative medicine company committed to providing veterinarians with the ability to deliver the highest quality regenerative medicine therapies to dogs, cats and horses. VBI provides veterinarians with extensive regenerative medicine capabilities including the ability to isolate regenerative stem cells from a patient’s own adipose (fat) tissue directly on-site within their own clinic or stall-side.

US Stem Cell Clinic, LLC, (“SCC”), a partially owned investment of our company, is a physician run regenerative medicine / cell therapy clinic providing cellular treatments for patients afflicted with neurological, autoimmune, orthopedic and degenerative diseases. SCC is operating in compliance with the FDA 1271s which allow for same day medical procedures to be considered the practice of medicine. We isolate stem cells from bone marrow and adipose tissue and also utilize platelet rich plasma.

Bioheart’s comprehensive map of products and services:

Regenerative medicine is defined as the process of replacing or regenerating human cells, tissues or organs to restore normal function. Among the categories of therapeutic technology platforms within this field are cell therapy; tissue engineering; tools, devices and diagnostics; and aesthetic medicine. Bioheart's business model is focused on two of these areas. First, cell therapy, in which we introduce cells (adult, donor or patient, stem cell or differentiated) into the body to prevent and treat disease; and second, we are a provider of services and products to physicians and veterinaries who provide or seek to provide cellular therapies and direct patient care for individuals and animals who may benefit from cellular therapy.

All living complex organisms start as a single cell that replicates, differentiates (matures) and perpetuates in an adult organism through its lifetime. Cellular therapy is the process that uses cells to prevent, treat or cure disease, or regenerate damaged or aged tissue. To date, the most common type of cell therapy has been the replacement of mature, functioning cells such as through blood and platelet transfusions. Since the 1970s, first bone marrow and then blood and umbilical cord-derived stem cells have been used to restore bone marrow, as well as blood and immune system cells damaged by the chemotherapy and radiation that are used to treat many cancers. These types of cell therapies are standard of practice world-wide and are typically reimbursed by insurance.

Within the field of cell therapy, research and development using stem cells to treat a host of diseases and conditions has greatly expanded. Stem cells (in either embryonic or adult forms) are primitive and undifferentiated cells that have the unique ability to transform into or otherwise affect many different cells, such as white blood cells, nerve cells or heart muscle cells. Our cell therapy development efforts are focused on the use of adult stem cells; those cells which are found in the muscle, fat tissue and peripheral blood.

There are two general classes of cell therapies: Patient Specific Cell Therapies ("PSCTs") and Off-the-Shelf Cell Therapies ("OSCTs"). In PSCTs, cells collected from a person (“donor”) are transplanted, with or without modification, to a patient (“recipient”). In cases where the donor and the recipient are the same individual, these procedures are referred to as “autologous”. In cases in which the donor and the recipient are not the same individual, these procedures are referred to as “allogeneic.” Autologous cells offer a low likelihood of rejection by the patient and we believe the long-term benefits of these PSCTs can best be achieved with an autologous product. In the case of OSCT, donor cells are expanded many fold in tissue culture, and large banks of cells are frozen in individual aliquots that may result in treatments for as many as 10,000 people from a single donor tissue. By definition, OSCTs are always allogeneic in nature.

Various adult stem cell therapies are in clinical development for an array of human diseases, including autoimmune, oncologic, neurologic and orthopedic, among other indications. While no assurances can be given regarding future medical developments, we believe that the field of cell therapy holds the promise to better the human experience and minimize or ameliorate the pain and suffering from many common diseases and/or from the process of aging.

According to Robin R. Young’s Stem Cell Summit Executive Summary-Analysis and Market Forecasts 2014-2024, the United States stem cell therapy market is estimated to grow from an estimated $237 million in 2013 to more than $5.7 billion in 2020.

Specific to cellular therapy, we are focused on the discovery, development and commercialization of autologous cellular therapies for the treatment of chronic and acute heart damage as well as vascular and autoimmune diseases.

In our pipeline, we have multiple product candidates for the treatment of heart damage, including MyoCell and Myocell SDF-1. MyoCell and MyoCell SDF-1 are autologous muscle-derived cellular therapies designed to populate regions of scar tissue within a patient’s heart with new living cells for the purpose of improving cardiac function in chronic heart failure patients.

MyoCell SDF-1 is intended to be an improvement to MyoCell. MyoCell SDF-1 is similar to MyoCell but the myoblast cells to be injected for use in MyoCell SDF-1 are modified prior to injection by an adenovirus vector or non-viral vector so that they will release extra quantities of the SDF-1 protein, which expresses angiogenic factors.

AdipoCell is a patient-derived cell therapy proposed for the treatment of lower limb ischemia and potentially, among other autoimmune diseases, rheumatoid arthritis. We hope to demonstrate that these product candidates are safe and effective complements to existing therapies for chronic and acute heart damage.

Our Clinical Development Pipeline Chart:

Our mission is to advance to market novel regenerative medicine and cellular therapy products that substantially benefit humankind. Our business strategy is, to the extent possible, finance our clinical development pipeline through revenue (cash in-flows) generated through the marketing and sales of unique educational and training services, animal health products and personalized cellular therapeutic treatments.

A fundamental shift in venture capital investment strategies where, management believes, financial sponsorship is now directed toward commercial or near commercial enterprises has required Bioheart to adapt its mission combining immediate revenue generating opportunities with longer-term development programs. Accordingly, we have developed a multifaceted portfolio of revenue generating products and services in our US Stem Cell Training, Vetbiologics, and US Stem Cell Clinic, operating divisions that will, if successful, financially support its clinical development programs. Our goal is to maximize shareholder value through the generation of short-term profits that increase cash in-flows and decrease the need for venture financings – a modern biotechnology company development strategy.

Today, our company is a combination of opportunistic business enterprises. We estimate that the products and services we offer through US Stem Cell Training, Vetbiologics, and US Stem Cell Clinics has the potential, although we cannot provide assurances as to if and when it will be accomplished, to drive up to $100 million dollars in cumulative peak annual revenues. What we are establishing is a foundation of value in the products and services we are and plan to sell from US Stem Cell Training, Vetbiologics, and US Stem Cell clinics. Our strategy is to expand the revenues generated from each of these operating divisions and to reinvest the profits we generate into our clinical development pipeline.

On January 29th, 2015 we announced an update and diversification of our clinical development pipeline. Our cardiovascular and vascular product candidates have been streamlined, putting, we believe, our best opportunities at the forefront of our efforts. The MYOCELL and MYOCELL SDF-1 candidates will, in our opinion, advance forward in the treatment of chronic heart failure (CHF). We are in active prospective partnering discussion for the MYOCELL SDF-1 program. Partnering, we contend, will enhance our capabilities, reduce our development cost through cost sharing and potentially accelerate our time to approval and commercialization. We will apply our ADIPOCELL technology to the treatment of critical limb ischemia. Additionally, we have expanded and diversified our clinical development pipeline to include autoimmune disease, specifically applying ADIPOCELL to the treatment of Rheumatoid Arthritis (RA). We believe that updating and diversifying our clinical development programs increases the probability of our success, brings operational and fiscal clarity to our company, and will ultimately enhance shareholder value.

We will continue to evaluate and act upon opportunities to increase our top line revenue position and that correspondingly increase cash in-flows. These opportunities include but are not limited to the development and marketing of new products and services, mergers and acquisitions, joint ventures, licensing deals and more.

Further, if the opportunity presents itself whereby we can raise additional capital at a reasonable fair market value, our management will do so. Accordingly, we plan to continue in our efforts to restructure, equitize or eliminate legacy balance sheet issues that are obstacles to market capitalization appreciation and capital fund raising.

Biotechnology Product Candidates

Specific to biotechnology, we are focused on the discovery, development and, subject to regulatory approval, commercialization of autologous cell therapies for the treatment of chronic and acute heart damage as well as degenerative diseases. In our pipeline, we have multiple product candidates for the treatment of heart damage, including MyoCell, Myocell SDF-1, and Adipocell. MyoCell and MyoCell SDF-1 are clinical muscle-derived cell therapies designed to populate regions of scar tissue within a patient’s heart with new living cells for the purpose of improving cardiac function in chronic heart failure patients.

MyoCell SDF-1 is intended to be an improvement to MyoCell. MyoCell SDF-1 is similar to MyoCell except that the myoblast cells to be injected for use in MyoCell SDF-1 will be modified prior to injection by an adenovirus vector or non-viral vector so that they will release extra quantities of the SDF-1 protein, which expresses angiogenic factors. AdipoCell is a patient-derived cell therapy proposed for the treatment of acute myocardial infarction, chronic heart ischemia, and lower limb ischemia. We hope to demonstrate that these product candidates are safe and effective complements to existing therapies for chronic and acute heart damage.

We have completed various clinical trials for MyoCell including the SEISMIC Trial, a 40-patient, randomized, multicenter, controlled, Phase II-a study conducted in Europe and the MYOHEART Trial, a 20-patient, multicenter, Phase I dose-escalation trial conducted in the United States. We were approved by the U.S. Food and Drug Administration, or the “FDA”, to proceed with a 330-patient, multicenter Phase II/III trial of MyoCell in North America and Europe, or the MARVEL Trial. We completed the MyoCell implantation procedure on the first patient in the MARVEL Trial on October 24, 2007. Thus far, 20 patients, including 6 control patients, have been treated. Initial results for the 20 patients were released at the Heart Failure Society of American meeting in September, 2009, showing a significant (35%) improvement in the 6 minute walk for those patients who were treated, and no improvement for those who received a placebo. On the basis of these results, we have applied for and received approval from the FDA to reduce the number of additional patients in the trial to 134, for a total of 154 patients.

We have also initiated the MIRROR trial, which is a Phase III, double-blind placebo controlled study for centers outside the US. The SEISMIC, MYOHEART, MARVEL and MIRROR Trials have been designed to test the safety and efficacy of MyoCell in treating patients with severe, chronic damage to the heart. Upon regulatory approval of MyoCell, we intend to generate revenue in the United States from the sale of MyoCell cell-culturing services for treatment of patients by qualified physicians.

We received approval from the FDA in July of 2009 to conduct a Phase I safety study on 15 patients of a combined therapy (Myocell with SDF-1), which we believe was the first approval of a study combining gene and cell therapies. We initially commenced work on this study, called the REGEN Trial, during the first quarter of 2010. We suspended activity on the trial in 2010 while seeking additional funding necessary to conduct the trial.

We are seeking to secure sufficient funds to reinitiate enrollment in the MARVEL and REGEN trials. If we successfully secure such funds, we intend to re-engage a contract research organization, or CRO, investigators and certain suppliers to advance such trials.

We have completed the Phase I Angel Trial for AdipoCell (adipose derived stem cells). Five patients were enrolled and treated in the second quarter of 2013.

We have also initiated several Institutional Review Board studies using adipose derived stem cells for various indications including dry macular degeneration, degenerative disc disease, erectile dysfunction and chronic obstructive pulmonary disease.

MyoCell

MyoCell is a clinical therapy intended to improve cardiac function for those with congestive heart failure and is designed to be utilized months or even years after a patient has suffered severe heart damage due to a heart attack or other cause. We believe that MyoCell has the potential to become a leading treatment for severe, chronic damage to the heart due to its perceived ability to satisfy, at least in part, what we believe to be an unmet demand for more effective and/or more affordable therapies for chronic heart damage. MyoCell uses myoblasts, cells that are precursors to muscle cells, from the patient’s own body. The myoblasts are removed from a patient’s thigh muscle, isolated, grown through our proprietary cell culturing process, and injected directly in the scar tissue of a patient’s heart. A qualified physician performs this minimally invasive procedure using an endoventricular catheter. We entered into an agreement with a Johnson & Johnson company to use its NOGA® Cardiac Navigation System along with its MyoStar™ injection catheter for the delivery of MyoCell in the MARVEL Trial. These cells can also be delivered with our MyoCath catheter.

When injected into scar tissue within the heart wall, myoblasts have been shown to be capable of engrafting in the damaged tissue and differentiating into mature skeletal muscle cells. In a number of clinical and animal studies, the engrafted skeletal muscle cells have been shown to express various proteins that are important components of contractile function. By using myoblasts obtained from a patient’s own body, we believe MyoCell is able to avoid certain challenges currently faced by other types of cell-based clinical therapies including tissue rejection and instances of the cells differentiating into cells other than muscle. Although a number of therapies have proven to improve the cardiac function of a damaged heart, no currently available treatment, to our knowledge, has demonstrated an ability to generate new muscle tissue within the scarred regions of a heart.

Our completed clinical trials of MyoCell to date, l have been primarily targeted to patients with severe, chronic damage to the heart who are in Class II or Class III heart failure according to the New York Heart Association, or NYHA, heart failure classification system. The NYHA system classifies patients in one of four categories based on how limited they are during physical activity. NYHA Class II heart failure patients have a mild limitation of activity and are generally comfortable at rest or with mild exertion while NYHA Class III heart failure patients suffer from a marked limitation of activity and are generally comfortable only at rest.

In addition to studies we have sponsored, we understand that myoblast-based clinical therapies have been the subject of at least eleven clinical trials involving more than 325 enrollees, including at least 235 treated patients. Although we believe many of the trials are different from the trials sponsored by us in a number of important respects, it is our view that the trials have advanced the cell therapy industry’s understanding of the potential opportunities and limitations of myoblast-based therapies.

We believe the market for treating patients in NYHA Class II or NYHA Class III heart failure is significant. According to the AHA Statistics and the European Society of Cardiology Task Force for the Treatment of Chronic Heart Failure, in the United States and Europe there are approximately 5.2 million and 9.6 million, respectively, patients with heart failure. The AHA Statistics further indicate that, after heart failure is diagnosed, the one-year mortality rate is high, with one in five dying and that 80% of men and 70% of women under age 65 who have heart failure will die within eight years.

We believe that approximately 60% of heart failure patients are in either NYHA Class II or NYHA Class III heart failure based upon a 1999 study entitled “Congestive Heart Failure Due to Diastolic or Systolic Dysfunction – Frequency and Patient Characteristics in an Ambulatory Setting” by Diller, PM, et. al.

MyoCath Product Candidate

The MyoCath was developed by Bioheart co-founder Robert Lashinski specifically for delivering new cells to damaged tissue. It is a deflecting tip needle injection catheter that has a larger needle which is 25 gauge for better flow rates and less leakage than systems that are 27 gauge. This larger needle allows for thicker compositions to be injected which helps with cell retention in the heart. Also, the MyoCath needle has more fluoroscopic brightness than the normally used nitinol needle, enabling superior visualization during the procedure. Seeing the needle well during injections enables the physician who is operating the catheter to pinpoint targeted areas more precisely, thus improving safety. The MyoCath competes well with other biological delivery systems on price and efficiency and allows the physician to utilize standard fluoroscopy and echo equipment found in every cath lab. The MyoCath is used to inject cells into cardiac tissue in therapeutic procedures to treat chronic heart ischemic and congestive heart failure. The MyoCath catheters are currently produced by a contract manufacturer on an as needed basis.

AdipoCell

Bioheart has successfully completed various trials using adipose stem cells. In August 2013, the Company canceled its license agreement with the Ageless Regenerative Institute for adipose derived stem cells called LipiCell. Bioheart has entered into a term sheet agreement with Invitrx to License their adipose derived stem cell products. Bioheart has changed its adipose derived stem cell product name to AdipoCell.

Bioheart has funded and completed enrollment of 5 patients in the Angel Trial in Mexico utilizing adipose derived cells. Preliminary 3 month follow up data in the study was reported in September 2013. At the 3 month time point, patients are demonstrating an average improvement in exercise capacity or a six minute walk test of 47 meters. In addition, 60% percent or a majority of the patients are walking greater than 65 meters further at 3 months post stem cell injection.

The patients are also reporting an average improvement of 13 points in their Minnesota Living with Heart Failure questionnaire. An improvement of 5 points or greater is considered “clinically meaningful” and 80% of the patients in the trial had a greater than 5 point improvement.

Business Strategy

Our principal objective is to become a leading regenerative medicine company that discovers, develops and commercializes novel, autologous cell therapies, and related devices, for the treatment and improved care of patients suffering from chronic and acute heart damage as well as lower limb ischemia. Our secondary objective is the discovery, development and commercialization of autologous cell therapies for the treatment of degenerative diseases. The number of heart failure patients is expected to increase from 25 million worldwide today to over 50 million in five years. Our focus is on serving these patients. To achieve our primary objective, we plan to pursue the following strategies:

Obtain initial regulatory approval of MyoCell and/or MyoCell SDF-1 by targeting patients with severe heart damage. In July 2007, we treated the final patient in the Phase II SEISMIC Trial, which was comprised of 40 patients, including 26 treated patients. The SEISMIC study results demonstrated that 94% of MyoCell treated patients improved or did not worsen in heart failure class while only 6% worsened, while in the control group receiving only drugs 42% worsened. 84% of MyoCell treated patients improved or did not worsen in exercise capacity and only 16% worsened, while 69% of the control patients worsened. The average improvement in 6 minute walk was 62 meters. This compares very favorably with the current gold standard in advanced heart failure treatment, Bi-Ventricular pacing, where they achieved 16 to 20 meters improvement over control patients in the Phase II MIRACLE trial that led to commercial approval of this product. By targeting a class of patients for whom existing therapies are very expensive, unavailable or not sufficiently effective, we hope to expedite regulatory approval of MyoCell and/or MyoCell SDF-1. Obtain regulatory approval of MyoCell and/or MyoCell SDF-1 to treat patients with less severe heart damage. If we obtain initial regulatory approval of MyoCell for the Class III Subgroup, we intend to continue to sponsor clinical trials in an effort to demonstrate that MyoCell and/or MyoCell SDF-1 should receive regulatory approval to treat all patients in NYHA Class II, NYHA Class III and NYHA Class IV heart failure and, provided we believe we have a reasonable basis to support such an indication, we intend to seek regulatory approval for these patients.

Continue existing studies with adipose derived stem cells and endothelial progenitor cells. We have initiated studies for the applications of lower limb ischemia, acute myocardial infarction and chronic heart ischemia. We have treated patients in the clinical program called the ANGEL trial utilizing adipose derived cells or AdipoCell for congestive heart failure patients. Using the clinical data from the trial in Mexico and preclinical studies, Bioheart plans to apply to the FDA to begin a Phase I study in the US. Bioheart has completed several preclinical studies demonstrating the safety and efficacy of this product including a study led by Keith March, MD, PhD, Director of the Vascular and Cardiac Center for Adult Stem Cell Therapy at the Indiana University. The adipose cells showed a tendency toward cardiomyocyte regeneration, prominent angiogenesis (growth of new blood vessels) and reduction in the infarction size. In addition, Bioheart has several studies for the use of adipose derived stem cells.

Continue to develop our pipeline of cell-based therapies and related devices for the treatment of chronic and acute heart damage. In parallel with our efforts to secure regulatory approval of MyoCell, we intend to continue to develop and test other product candidates for the treatment of chronic and acute heart damage. These efforts are expected to initially focus on MyoCell SDF-1, AdipoCell, MyoCath and MyoCath II product candidates.

Develop our sales and marketing capabilities. In advance of U.S. regulatory approval of our MyoCell product candidate, we intend to internally build a sales force to cover the U.S. market and to utilize dealers in foreign markets which we anticipate will market MyoCell, MyoCell SDF-1 and our heart failure focused products primarily to interventional cardiologists and heart failure specialists. We are currently marketing our adipose derived stem cell therapy product in the U.S. and foreign markets.

Continue to refine our MyoCell and MyoCell SDF-1 cell culturing processes.

Expand and enhance our intellectual property rights. We intend to continue to expand and enhance our intellectual property rights.

License, acquire and/or develop complementary products and technologies. We intend to strengthen and expand our product development efforts through the license, acquisition and/or development of products and technologies that support our business strategy.

Industry Background

Myocardial Infarction (Heart Attack)

Myocardial infarction, or MI, commonly known as a heart attack, occurs when a blockage in a coronary artery severely restricts or completely stops blood flow to a portion of the heart. When blood supply is greatly reduced or blocked for more than a short period of time, heart muscle cells die. If the healthy heart muscle cells do not replace the dead cells within approximately two months, the injured area of the heart becomes unable to function properly. In the healing phase after a heart attack, white blood cells migrate into the affected area and remove the dead heart muscle cells. Then, fibroblasts, the connective tissue cells of the human body, proliferate and form a collagen scar in the affected region of the heart. Following a heart attack, the heart's ability to maintain normal function will depend on the location and amount of damaged tissue. The remaining initially undamaged heart muscle tissue must perform more work to adequately maintain cardiac output. Because the uninjured region is then compelled to work harder than normal, the heart can progressively deteriorate until it is unable to pump adequate blood to oxygenate the body properly leading to heart failure and ultimately death.

Congestive Heart Failure (CHF)

Congestive heart failure, or “CHF”, is a debilitating condition that occurs as the heart becomes progressively less able to pump an adequate supply of blood throughout the body resulting in fluid accumulation in the lungs, kidneys and other body tissues. Persons suffering from NYHA Class II or worse heart failure experience high rates of mortality, frequent hospitalization and poor quality of life. CHF has many causes, generally beginning in patients with a life-long history of high blood pressure or after a patient has suffered a major heart attack or some other heart-damaging event. CHF itself may lead to other complicating factors such as pulmonary hypertension, edema, pulmonary edema, liver dysfunction and kidney failure. Although medical therapy for CHF is improving, it remains a major debilitating condition.

Classifying Heart Failure

The NYHA heart failure classification system provides a simple and widely recognized way of classifying the extent of heart failure. It places patients in one of four categories based on how limited they are during physical activity. NYHA Class I heart failure patients have no limitation of activities and suffer no symptoms from ordinary activities. NYHA Class II heart failure patients have a mild limitation of activity and are generally comfortable at rest or with mild exertion. NYHA Class III heart failure patients suffer from a marked limitation of activity and are generally comfortable only at rest. NYHA Class IV heart failure patients generally suffer discomfort and symptoms at rest and should remain confined to a bed or chair.

The risk of hospitalization and death increases as patients progress through the various stages of heart failure. The risk of hospitalization due to heart failure for patients in NYHA Class II, NYHA Class III and NYHA Class IV is approximately 1.2, 2.3 and 3.7 times greater than for patients in NYHA Class I heart failure according to a 2006 American Heart Journal article entitled “Higher New York Heart Association Classes and Increased Mortality and Hospitalization in Patients with Heart Failure and Preserved Left Ventricular Function”' by Ahmed, A et al.

Similarly, according to this same article, the risk of death from all causes for patients in NYHA Class II, NYHA Class III and NYHA Class IV is approximately 1.5, 2.6 and 8.5 times greater than for patients in NYHA Class I heart failure.

The following chart illustrates the various stages of heart failure, their NYHA classifications and the associated current standard of treatment.

|

NYHA

|

|

|

|

|

|

|

|

Class

|

|

NYHA Functional Classification(1)

|

|

Specific Activity Scale(2)(3)

|

|

Current Standard of Treatment(4)

|

| |

|

|

|

|

|

|

| I |

|

Symptoms only with above normal physical activity

|

|

Can perform more than 7 metabolic equivalents

|

|

ACE Inhibitor, Beta-Blocker

|

|

II

|

|

Symptoms with normal physical activity

|

|

Can perform more than 5 metabolic equivalents

|

|

ACE Inhibitor, Beta-Blocker, Diuretics

|

|

III

|

|

Symptoms with minimal physical activity

|

|

Can perform more than 2 metabolic equivalents

|

|

ACE Inhibitor, Beta-Blocker, Diuretics, Digoxin, Bi-ventricular pacers

|

|

IV

|

|

Symptoms at rest

|

|

Cannot perform more than 2 metabolic equivalents

|

|

ACE Inhibitor, Beta-Blocker, Diuretics, Digoxin, Hemodynamic Support, Mechanical Assist Devices, Bi-ventricular pacers, Transplant

|

_____________

Symptoms include fatigue, palpitations, shortness of breath and chest pain; normal activity is equivalent to walking one flight of stairs or several blocks.

Based upon the Goldman Activity Classification of Heart Failure, which classifies severity of heart failure based on estimated metabolic cost of various activities; the four classes of the Goldman Activity Classification system correlate to the NYHA Classes.

7 metabolic equivalents = shovel snow, carry 24 lbs. up 8 stairs, recreational sports; 5 metabolic equivalents = garden, rake, dance, walk 4 mph on level ground, have intercourse; 2 metabolic equivalents = shower without stopping, strip and make bed, dress without stopping.

Source: American College of Cardiology/ American Heart Association 2005 Guideline Update for the Diagnosis and Management of Chronic Heart Failure in the Adult.

Diagnosis and Management of Heart Failure

Heart disease has been the leading cause of death from 1950 on within the United States, according to the U.S. Department of Health and Human Services. In addition, heart failure is the single most frequent reason for hospitalization in the elderly according to a 2007 study entitled “Long-Term Costs and Resource Use in Elderly Participants with Congestive Heart Failure” by Liao, L., et al. The American College of Cardiology/ American Heart Association 2005 Guideline Update for the Diagnosis and Management of Chronic Heart Failure in the Adult, or the ACC/ AHA Guidelines, provides recommendations for the treatment of chronic heart failure in adults with normal or low LVEF. The treatment escalates and becomes more invasive as the heart failure worsens. Current treatment options for severe, chronic heart damage include, but are not limited to, heart transplantation and other surgical procedures, bi-ventricular pacers, drug therapies, ICDs, and ventricular assist devices. Therapies utilizing drugs, ICDs and bi-ventricular pacers are currently by far the most commonly prescribed treatments for patients suffering from NYHA Class II or NYHA Class III heart failure. Since the therapies generally each address a particular feature of heart disease or a specific subgroup of heart failure patients, the therapies are often complementary and used in combination.

Drug Therapies

The ACC/AHA Guidelines recommend that most patients with heart failure should be routinely managed with a combination of ACE inhibitors, beta-blockers and diuretics. The value of these drugs has been established by the results of numerous large-scale clinical trials and the evidence supporting a central role for their use is, according to the ACC/AHA Guidelines, compelling and persuasive. ACE inhibitors and beta blockers have been shown to improve a patient’s clinical status and overall sense of well-being and reduce the risk of death and hospitalization. Side effects of ACE inhibitors include hypotension, worsening kidney function, potassium retention, cough and angioedema. Side effects of beta-blockers include fluid retention, fatigue, bradycardia and heart block and hypotension.

Bi-Ventricular Pacers

The ACC/AHA Guidelines recommend bi-ventricular pacers for persons who, in addition to suffering from heart failure, have left and right ventricles that do not contract in sync, known as ventricular dyssynchrony and who have a LVEF less than or equal to 35%, sinus rhythm and NYHA Class III or NYHA Class IV symptoms despite recommended optimal medical therapy. Bi-ventricular pacers are surgically implanted electrical generators that function primarily by stimulating the un-damaged portion of the heart to beat more strongly using controlled bursts of electrical currents in synchrony. Compared with optimal medical therapy alone, bi-ventricular pacers have been shown in a number of clinical trials to significantly decrease the risk of all-cause hospitalization and all-cause mortality as well as to improve LVEF, NYHA Class and Quality of Life. According to the ACC/AHA Guidelines, there are certain risks associated with the bi-ventricular pacer including risks associated with implantation and device-related problems.

Implantable Cardioverter Defibrillators

ACC/AHA Guidelines recommend ICDs primarily for patients who have experienced a life-threatening clinical event associated with a sustained irregular heartbeat and in patients who have had a prior heart attack and a reduced LVEF. ICDs are surgically implanted devices that continually monitor patients at high risk of sudden heart attack. When an irregular rhythm is detected, the device sends an electric shock to the heart to restore normal rhythm. In 2001, ICDs were implanted in approximately 62,000 and 18,000 patients in the United States and Europe, respectively. Although ICDs have not demonstrated an ability to improve cardiac function, according to the ACC/AHA Guidelines, ICDs are highly effective in preventing sudden death due to irregular heartbeats. However, according to the ACC/AHA Guidelines, frequent shocks from an ICD can lead to a reduced quality of life, whether triggered appropriately or inappropriately. In addition, according to the ACC/AHA Guidelines, ICDs have the potential to aggravate heart failure and have been associated with an increase in heart failure hospitalizations.

Heart Transplantation and Other Surgical Procedures

According to the ACC/AHA Guidelines, heart transplantation is currently the only established surgical approach for the treatment of severe heart failure that is not responsive to other therapies. Heart transplantation is a major surgical procedure in which the diseased heart is removed from a patient and replaced with a healthy donor heart. Heart transplantation has proven to dramatically improve cardiac function in a majority of the patients treated and most heart transplant recipients return to work, travel and normal activities within three to six months after the surgery. In addition, the risk of hospitalization and mortality for transplant recipients is dramatically lower than the risk faced by patients in NYHA Class III or NYHA Class IV heart failure. Heart transplants are not, for a variety of reasons, readily available to all patients with severe heart damage. The availability of heart transplants is limited by, among other things, cost and donor availability. In addition to the significant cost involved and the chronic shortage of donor hearts, one of the serious challenges in heart transplantation is potential rejection of the donor heart. For many heart transplant recipients, chronic rejection significantly shortens the length of time the donated heart can function effectively and such recipients are generally administered costly anti-rejection drug regimens which can have adverse and potentially severe side effects.

There are a number of alternate surgical approaches under development for the treatment of severe heart failure, including cardiomyoplasty, a surgical procedure where the patient’s own body muscle is wrapped around the heart to provide support for the failing heart, the Batista procedure, a surgical procedure that reduces the size of an enlarged heart muscle so that the heart can pump more efficiently and vigorously, and the Dor procedure. According to the ACC/AHA Guidelines, both cardiomyoplasty and the Batista procedure have failed to result in clinical improvement and are associated with a high risk of death. The Dor procedure involves surgically removing scarred, dead tissue from the heart following a heart attack and returning the left ventricle to a more normal shape. While the early published single-center experience with the Dor procedure demonstrated early and late improvement in NYHA Class and LVEF, according to the ACC/AHA Guidelines, this procedure’s role in the management of heart failure remains to be defined.

Ventricular Assist Devices

Ventricular assist devices are mechanical heart pumps that replace or assist the pumping role of the left ventricle of a damaged heart too weak to pump blood through the body. Ventricular assist devices are primarily used as a bridge for patients on the waiting list for a heart transplant and have been shown in published studies to be effective at halting further deterioration of the patient’s condition and decreasing the likelihood of death before transplantation. In addition, ventricular assist devices are a destination therapy for patients who are in NYHA Class IV heart failure despite optimal medical therapy and who are not eligible for heart transplant. According to the ACC/AHA Guidelines, device related adverse events are reported to be numerous and include bleeding, infection, blood clots and device failure. In addition, ventricular assist devices are very expensive, with the average first-year cost estimated at approximately $225,000.

We believe the heart failure treatment industry generally has a history of adopting therapies that have proven to be safe and effective complements to existing therapies and using them in combination with existing therapies. It is our understanding that there is no one or two measurement criteria, either quantitative or qualitative, that define when a therapy for treating heart failure will be deemed safe and effective by the FDA. We believe that the safety and efficacy of certain existing FDA approved therapies for heart damage were demonstrated based upon a variety of endpoints, including certain endpoints (such as LVEF) that individually did not demonstrate large numerical differences between the treated patients and untreated patients. For instance, the use of bi-ventricular pacers with optimal drug therapy has proven to significantly decrease the risk of all-cause hospitalization and all-cause-mortality as well as to improve LVEF, NYHA Class and quality of life as compared to the use of optimal drug therapy alone. In the Multicenter InSync Randomized Clinical Evaluation (MIRACLE) trial, one of the first large studies to measure the therapeutic benefits of bi-ventricular pacing, 69% of the patients in the treatment group experienced an improvement in NYHA Class by one or more classes at six-month follow-up versus a 34% improvement in the control group. However, patients in the treatment group experienced on average only a 2.1% improvement in LVEF as compared with a 1.7% improvement for patients in the control group. Although a number of the therapies described above have proven to improve the cardiac function of a damaged heart, no currently available heart failure treatment has demonstrated an ability to generate new muscle tissue within the scarred regions of a heart.

Our Proposed Solution

We believe that MyoCell has the potential to become a leading treatment for severe chronic damage to the heart due to its perceived ability to satisfy, at least in part, what we believe to be a presently unmet demand for more effective and/or more affordable therapies for chronic heart damage.

MyoCell

The human heart does not have cells that naturally repair or replace damaged heart muscle. Accordingly, the human body cannot, without medical assistance, repopulate regions of scar tissue within the heart with functioning muscle. MyoCell is a clinical therapy designed to improve cardiac function by populating regions of scar tissue within a patient’s heart with myoblasts derived from a biopsy of a patient’s thigh muscle. Myoblasts are precursors to muscle cells that have the capacity to fuse with other myoblasts or with damaged muscle fibers to regenerate skeletal muscle. When injected into scar tissue within the heart wall, myoblasts have been shown to be capable of engrafting in the damaged tissue and differentiating into mature skeletal muscle cells. In a number of clinical and animal studies, the engrafted skeletal muscle cells have been shown to express various proteins that are important components of contractile function. By using myoblasts obtained from a patient’s own body, we believe MyoCell is able to avoid certain challenges currently faced by other cell-based clinical therapies intended to be used for the treatment of chronic heart damage including tissue rejection and instances of the cells differentiating into cells other than muscle.

Our clinical research to date suggests that MyoCell may improve the contractile function of the heart. However, we have not yet been able to demonstrate a mechanism of action. The engrafted skeletal muscle tissues are not believed to be coupled with the surrounding heart muscle by the same chemicals that allow heart muscle cells to contract simultaneously. The theories regarding why contractile function may improve include:

the engrafted muscle tissue can contract in unison with the other muscles in the heart by stretching or by the channeling of electric currents;

the myoblasts acquire certain characteristics of heart muscle or fuse with them; and/or

the injected myoblasts release various proteins that indirectly result in a limit on further scar tissue formation.

As part of the MyoCell therapy, a general surgeon removes approximately five to ten grams of thigh muscle tissue from the patient utilizing local anesthesia, typically on an outpatient basis. The muscle tissue is then express-shipped to a cell culturing site. At the cell culturing site, our proprietary techniques are used to isolate and remove myoblasts from the muscle tissue. We typically produce enough cells to treat a patient within approximately 21 days of his or her biopsy. Such production time is expected to continue to decrease as we continue to refine our cell culturing processes. After the cells are subjected to a variety of tests, the cultured cells are packaged in injectate media and express shipped to the interventional cardiologist. Within four days of packaging, the cultured myoblasts are injected via catheter directly into the scar tissue of the patient’s heart. The injection process takes on average about one hour and can be performed with or without general anesthesia. Following treatment, patients generally remain in the hospital for approximately 48-72 hours for monitoring.

The MyoCell injection process is a minimally invasive procedure which presents less risk and considerably less trauma to a patient than conventional (open) heart surgery. Patients are able to walk immediately following the injection process and require significantly less time in the hospital compared with surgically treated patients. In the 69 patients who have received MyoCell injections delivered via percutaneous catheter, only two minor procedure-related events (2.9%) have been reported. In both cases, however, no complications resulted from the event, with the patients in each case remaining asymptomatic at all times during and after the procedure.

We use a number of proprietary processes to create therapeutic quantities of myoblasts from a patient’s thigh muscle biopsy. We have developed and/or licensed what we believe are proprietary or patented techniques to:

|

·

|

transport muscle tissue and cultured cells;

|

|

·

|

disassociate muscle tissue with manual and chemical processes;

|

|

·

|

separate myoblasts from other muscle cells;

|

|

·

|

culture and grow myoblasts;

|

|

·

|

identify a cell population with the propensity to engraft, proliferate and adapt to the cardiac environment, including areas of scar tissue; and

|

|

·

|

maintain and test the cell quality and purity.

|

We have also developed and/or licensed a number of proprietary and/or patented processes related to the injection of myoblasts into damaged heart muscle, including the following:

|

·

|

package the cultured cells in a manner that facilitates shipping and use by the physician administering MyoCell;

|

|

·

|

methods of using MyoCath;

|

|

·

|

the use of an injectate media that assists in the engraftment of myoblasts;

|

|

·

|

cell injection techniques utilizing contrast media to assist in the cell injection process; and

|

|

·

|

cell injection protocols related to the number and location of injections.

|

Assuming we secure regulatory approval of MyoCell for the treatment of all NYHA Class II and NYHA Class III patients, we believe MyoCell will provide a treatment alternative for the millions of NYHA Class II and NYHA Class III patients in the United States and Europe who either do not qualify for or do not have access to heart transplant therapy. Furthermore, we anticipate that the time incurred and cost of identifying patients qualified to receive MyoCell as well as the cost of MyoCell, including any ICD, drug and bi-ventricular pacer therapies that are simultaneously prescribed, if any, will be less expensive than the current cost of heart transplant therapy. Moreover, MyoCell is less invasive than a heart transplant and is not subject to the tissue rejection and immune system suppression issues associated with heart transplants.

We believe there is still a large population of patients exhibiting symptoms consistent with NYHA Class II and NYHA Class III heart failure that is seeking an effective or more effective therapy for chronic heart damage than ICDs, bi-ventricular pacers and drug therapies. We hope to demonstrate that MyoCell is complementary to various therapies using ICDs, bi-ventricular pacers and drugs. In the MYOHEART and SEISMIC Trials, enrolled patients are required to have an ICD and to be on optimal drug therapy to be included in the study. While we do not require patients to have previously received a bi-ventricular pacer to participate in our clinical trials, we plan to accept patients in our MARVEL Trial who have had prior placement of a bi-ventricular pacer. We are hopeful that the results of our future clinical trials will demonstrate that MyoCell is complementary to existing therapies for treating heart damage.

Metrics Used to Evaluate Safety and Efficacy of Heart Failure Treatments

The performance of therapies used to treat damage to the heart is assessed using a number of metrics, which compare data collected at the time of initial treatment to data collected when a patient is re-assessed at follow-up. The time periods for follow-up are usually three, six and twelve months. Statistical data is often accompanied by a p-value, which is the mathematical probability that the data are the result of random chance. A result is considered statistically significant if the p-value is less than or equal to 5%. The common metrics used to evaluate the efficacy of these therapies include:

|

Metric

|

|

Description

|

| |

|

|

|

NYHA Class

|

|

The NYHA heart failure classification system is a functional and therapeutic classification system based on how much cardiac patients are limited during physical activity.

|

|

Six-Minute Walk Distance

|

|

Six-Minute Walk Distance is an objective evaluation of functional exercise capacity which measures the distance a patient can walk in six minutes. The distance walked during this test has been shown to correlate with the severity of heart failure.

|

|

LVEF

|

|