UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report: (Date of earliest event reported): August 26, 2015

Chico’s FAS, Inc.

(Exact Name of Registrant as Specified in its Charter)

Florida

(State or Other Jurisdiction

of Incorporation)

|

| | |

| | |

001-16435 | | 59-2389435 |

(Commission File Number) | | (IRS Employer Identification No.) |

|

| | |

| | |

11215 Metro Parkway, Fort Myers, Florida | | 33966 |

(Address of Principal Executive Offices) | | (Zip code) |

(239) 277-6200

(Registrant’s Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| |

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition

On August 26, 2015, Chico’s FAS, Inc. (the “Company”) held a conference call with the investment community to discuss its financial results for the second quarter ended August 1, 2015. A copy of the transcript of the conference call is attached hereto as Exhibit 99.1.

The information presented herein shall not be deemed “filed” for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject the Company to liability pursuant to that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly stated by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits

|

| | |

| | |

Exhibit 99.1 | | Transcript of conference call held by Chico’s FAS, Inc. on August 26, 2015 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | | | |

| | | | | | |

| | | | CHICO’S FAS, INC. |

| | | |

Date: August 27, 2015 | | | | By: | | |

| | | | /s/ Todd E. Vogensen |

| | | | Todd E. Vogensen, Executive Vice President, |

| | | | Chief Financial Officer and Assistant Corporate Secretary |

INDEX TO EXHIBITS

|

| | |

| | |

Exhibit Number | | Description |

| |

Exhibit 99.1 | | Transcript of conference call held by Chico’s FAS, Inc. on August 26, 2015 |

Exhibit 99.1

|

| | | |

| | | corrected transcript |

Chico's FAS, Inc. | CHS | Q2 2015 Earnings Call | Aug. 26, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

PARTICIPANTS

Corporate Participants

Jennifer Powers Adkins – Vice President of Investor Relations, Chico’s FAS, Inc.

David F. Dyer – President & Chief Executive Officer, Chair of the Board, Chico’s FAS, Inc.

Todd E. Vogensen – Executive Vice President - Chief Financial Officer, Chico’s FAS, Inc.

Other Participants

Simeon A. Siegel – Analyst, Nomura Securities International, Inc.

Edward J. Yruma – Analyst, KeyBanc Capital Markets, Inc.

Adrienne Yih – Analyst, Wolfe Research LLC

Pamela N. Quintiliano – Analyst, SunTrust Robinson Humphrey, Inc.

Janet Lynne Knopf – Analyst, Oppenheimer & Co., Inc. (Broker)

Susan K. Anderson – Analyst, FBR Capital Markets & Co.

Betty Chen – Analyst, Mizuho Securities USA, Inc.

Dana L. Telsey – Analyst, Telsey Advisory Group LLC

MANAGEMENT DISCUSSION SECTION

Operator: Good morning, and welcome to the Chico’s FAS, Inc. Second Quarter Earnings Conference Call. All participants will be in a listen-only mode. [Operator Instructions] After today’s presentation there’ll be an opportunity to ask questions. [Operator Instructions]

I would now like to turn the conference over to Jennifer Powers Adkins, Vice President, Investor Relations. Please go ahead.

Jennifer Powers Adkins, Vice President of Investor Relations, Chico’s FAS, Inc.

Thanks, Emily, and good morning, everyone. Welcome to Chico’s FAS second quarter earnings conference call and webcast. Joining me today at our National Store Support Center in Fort Myers are Dave Dyer, CEO; and Todd Vogensen, CFO.

Before Dave begins his executive overview, we would like to remind you that our discussion this morning includes forward-looking statements and quarter-to-date data points, which are subject to and protected by the Safe Harbor statement found in our SEC filings and in today’s earnings release. These forward-looking statements are subject to a number of factors and uncertainties that could cause actual results to differ materially.

Also, our current and prior-year results discussed on this call exclude impairment, restructuring and strategic charges. A reconciliation to GAAP results is included in today’s press release for your reference.

1

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

| | | corrected transcript |

Chico's FAS, Inc. | CHS | Q2 2015 Earnings Call | Aug. 26, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

And with that, I’ll turn it over to Dave.

David F. Dyer, President & Chief Executive Officer, Chair of the Board

Thanks, Jennifer, and good morning, everyone. I’m pleased to report that in the second quarter our key initiatives continued to produce positive outcomes across our brands. Our initiatives included the disciplined inventory management, diligent cost control and the ongoing enhancement of our customer experience. These programs all contributed to the following encouraging results:

Adjusted earnings per share increased to $0.25 per share from $0.20 per share last year, up 25%. Gross margin improved by 140 basis points. SG&A grew less than total sales at 1.2% and our on hand inventory per selling square foot, excluding in transit, decreased by 5.7%. During the second quarter, total sales were up 1.4% and comparable sales were up approximately a 0.5% to last year, in line with our plan to increase gross margins at the expense of promotional sales.

As we discussed on our first quarter call, sales in May were somewhat soft, but our trends steadily improved throughout the quarter. Additionally, our conservative inventory position led to higher gross margin dollars as we had fewer units to clear relative to last year. Rather than our traditional clearance strategy to liquidate through outlets and online, because of lighter inventories, we were able to clear our inventory in frontline stores.

Our cost control efforts are also succeeding as planned. We realized SG&A leverage for the first time since the third quarter of 2012, despite the additional operating expense related to the 109 new stores from last year and incremental incentive compensation. Our on hand inventory per selling square foot decreased 5.7%.

As I mentioned in our first quarter call, the disruptions caused by the West Coast port issue led us to reroute merchandise to the East Coast. This transition added seven days to 10 days to our shipping time, which resulted in increased in-transit inventory levels. Our total inventory per selling square foot, including this increased in-transit, was up 3.6%.

Thus far in the third quarter, we’ve seen positive trends in White House and Soma. We’ve had the unfortunate and almost unbelievable bad luck to have one of the ships carrying fall merchandise collide with another ship while still in Asia, which caused a delay of about 500,000 units for Chico’s and White House. Over half of these units were for a key Chico’s pant program.

As a result, we postponed this important promotion by two weeks since it obviously didn’t make sense to advertise goods that we did not have on hand. These ships, and of course, the market volatility of the last few days have resulted in our quarter-to-date total company comparable sales according to our unaudited daily flash sales report to be down about 4% with total sales also down about 4%. We do not believe these results are indicative of our current business trends, and we believe that the total company comp should be positive for the third quarter.

Now I’d like to give you additional details on our performance by brand. The Chico’s brand second quarter comparable sales were up about 1% driven by great fashion and reduced and more strategic discounting. Denim and cropped pants performed well and knits are once again the strongest category. I’ve always said that when knits are working, the business thrives. As we drive more traffic online and to the stores, we now have the opportunity to increase each sale as we outfit her from head-to-toe.

2

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

| | | corrected transcript |

Chico's FAS, Inc. | CHS | Q2 2015 Earnings Call | Aug. 26, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

I’d also like to reiterate the fact that the Chico’s customer remains incredibly loyal. Looking back at the past 12 months, our retention rate of high-value customers who account for nearly two-thirds of the brand sales were again well over 90%. The Chico’s loyalty program is continuing to deliver benefits including shopping frequency and spend, both of which were up year-over-year. Our investments in omni-channel are also delivering returns. Chico’s multichannel shoppers are increasing at a nearly double-digit pace. This is especially great news given that multichannel customers spend two times and more than those shopping only in stores.

On the fashion front, we’re excited to see new trends in pant silhouettes. For fall, we’re featuring gauchos, wide leg and stirrups, as well as straight-leg and slim-leg. Statement jackets are also in and we’ll have many styles for her to choose from, fringe, fur, textured, modo, and crop. These styles are terrific and you may have noticed that our television campaign just started for the pants.

Now turning to White House | Black Market. Second quarter comparable sales were down 1.9%. This year, we anniversaried a significant level of promotional activity and excess inventory that took place in the second quarter last year. While we don’t normally call out margin by brand, White House | Black Market did increased gross margin by over 200 basis points in the quarter. Again, our decision to purchase inventory more conservatively enabled us to reduce the level of clearance product and deliver a higher gross margin than last year, more than offsetting the decrease in comparable sales.

The brand’s most successful categories in the second quarter were woven tops, jackets and bottoms, as we featured fewer prints and more sophisticated color palette to go along with our signature black-and-white designs. In wovens, it was all about new fashion silhouettes, jackets in newer proportions and new fabric bridged summer professional apparel with polished casual. New fashionable lengths and shapes and bottoms were also well-received. Non-apparel however was challenging for us as it accounted for the larger share of the decline compared to last year. Taking all of that into account we’re pleased with the improving performance that we experienced as the quarter progressed.

As you’ve been hearing in our quarterly updates, we’ve been fine-tuning the White House | Black Market brand to get back in touch with what is the most important to our customer, that is collections that inspire and are also an affordable luxury. We’ve relaunched our accessory business and we’ve been evolving the apparel aesthetic. We’re seeing an encouraging response. The brand style today is more relaxed, modern and cosmopolitan than a year ago. It’s not a radical change, but a thoughtful progression. We’re not going after different demographic, we love where we sit in the marketplace. However, we do see an opportunity to attract new customers within the current customer demographic.

White House | Black Market’s revamped loyalty program is in full swing after relaunching last February. Like our Chico’s customer, the White House | Black Market customer is incredibly loyal with their retention value of high-value customers being nearly as high as Chico’s. Over the last year, loyalty program drove increased spend, shopping frequency and retention. We’re also seeing double-digit increases in our very valuable multichannel customers.

Now moving on to Soma, the brand delivered a comparable sales increase of 5.1%, the 25th consecutive quarter of positive comps. Bras, panties and sleepwear showed substantial sales gains over last year. Our Semi-Annual Sale exceeded expectations with much of the traffic driven from our very effective TV campaign. Now that Soma is getting to be a larger share of our portfolio and a key growth driver, I want to provide a little extra commentary on the brand.

3

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

| | | corrected transcript |

Chico's FAS, Inc. | CHS | Q2 2015 Earnings Call | Aug. 26, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

Historically, we’ve talked about longer and more sustained ramp-up in productivity of our Soma stores. Stores that are five-plus years old are as productive as our Chico’s or White House | Black Market stores. At this point, only 30% of the Soma fleet is six years or more old. 70% of our fleet is still on the maturity curve. With about 300 stores domestically, Soma still has plenty of room to grow.

Our extensive customer information is also pointing to future growth. We have found that we have customers who are either very loyal to bras, or very loyal to sleepwear. What a great opportunity it is to give them offers to come in and try the products that they’re not currently buying. As this initiative gains traction, we may start to see newer stores reaching a higher level of productivity faster than in the past, and the older stores enjoying additional productivity gains.

Moreover, the new Soma Rewards program celebrated its first anniversary in the second quarter. Our Soma Rewards anniversary email drove Soma’s highest ever online traffic day, even higher than Cyber Monday. We’re driving more and more customers to the brand, and like Chico’s and White House | Black Market, shopping frequency and spend increased over the last year.

Summing up, Soma’s growth translates into more than just higher sales for Chico’s FAS. Soma’s merchandise also has higher margins than our other brands. As Soma continues to grow and mature, we’ll be able to further leverage expenses, driving higher profit margin for the brand and for the company overall.

As for Boston Proper, the news is that we recently began exploring strategic alternatives for the direct-to-consumer business, and we’ve decided to close the stores. While we believe the brand has great potential as a direct marketer, store performance has not met our expectations and we’ve concluded that our time, our capital, and our efforts will generate more significant opportunities in our other brands.

As for the second quarter performance, Boston Proper sales decreased 4% compared to last year. We saw positive trends in customer response rate, which unfortunately were not enough to offset promotional pressure. While we’re not prepared to discuss the timing or other details with regard to the expiration process, Todd will shortly give you more details on the pro forma view of the company’s financials absent the Boston Proper brand.

Finally, returning to Chico’s FAS overall, I’d like to share a few thoughts about our ongoing priority to enhance customers experience with all of our brands. We staunchly believe that the customer experience is paramount in differentiating our brands and winning both new and existing customers.

First with our POS system has now been rolled out to virtually all of our White House | Black Market and Soma stores, about half – over half of our fleet. The new system will fully be installed in the Chico’s stores by the end of the year as planned. iPads with the customer book application that we talked about last quarter have been distributed with the new POS system. The Soma and White House | Black Market brands are currently piloting the customer book application in their brands.

As we discussed in the last call, the customer book application is an exciting opportunity that enables our store associates to leverage our extensive customer information. Every associate will be able to pull up a customer’s profile and immediately see what she’s purchased in any store or in any other channel. This will facilitate courteous, suggestive selling while the customer is in the store. Additionally, the associate will be able to contact customers when new collections arrive or

4

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

| | | corrected transcript |

Chico's FAS, Inc. | CHS | Q2 2015 Earnings Call | Aug. 26, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

promotions are active. The customer book puts more power in our associates’ hands than they had with their own personal paper appointment books.

Our website redesign efforts kicked into gear this quarter with a new look that will be live for the Chico’s brand this year. Among other benefits, the site’s responsive design will serve up an optimal view no matter what type of device a customer is using. In addition, we’re amplifying our social presence and growing our community of engaged and loyal followers.

We are, as always, hyper-focused on new customer acquisition and our marketing strategies will help us achieve that growth. A recent McKinsey study revealed that baby boomers are the fastest-growing users of social media. Social media expands our opportunity to inspire deeper engagement and loyalty among new and existing customers by enhancing their understanding of and connection to our brands.

We are piloting our blog for Chico’s, which is now on the website to inspire deeper engagement with our customers. The blog will syndicate our content and marketing across all touch points, embrace storytelling for the brand and add an editorial aspect to our brand building efforts. Our other brands will follow.

And with that, I’m going to turn the call over to Todd and I’ll be back in a minute to wrap up. Here’s Todd.

Todd E. Vogensen, Executive Vice President – Chief Financial Officer

All right. Thanks, Dave, and good morning, everyone. Through consistent execution of the plan we laid out at the beginning of the year, we continue to effectively improve margins and control expenses. This led to year-over-year adjusted earnings per share growth of 25%.

For the second quarter, net sales increased 1.4% to $680 million compared to $671 million in last year’s second quarter, primarily reflecting 23 net new stores for a square footage increase of 1.3% and the comparable sales increase of 0.5%. On a consolidated basis, an increase in average dollar sale was partially offset by a decrease in transaction count.

Gross margin in the quarter increased by over 4% to $366 million compared to $351 million in last year’s second quarter. Gross margin rate for the quarter was 53.8% of net sales, a 140-basis point increase from last year. The margin improvement was primarily driven by less discounts resulting from our disciplined inventory management.

SG&A grew by 1.2% to $308 million compared to $305 million last year. SG&A was 45.3% of net sales, an improvement of 10 basis points versus last year, primarily reflecting our cost control efforts.

Adjusted operating income for the quarter increased by $10.8 million, a 23% increase from the same period last year. As a result, adjusted operating margin increased 150 basis points to 8.5%.

Turning to the balance sheet, we ended the quarter with $157 million in cash and short-term investments after repaying $26.5 million of our current portion of debt and distributing $11.1 million to our shareholders through our dividend.

5

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

| | | corrected transcript |

Chico's FAS, Inc. | CHS | Q2 2015 Earnings Call | Aug. 26, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

We consistently emphasize the importance of investing in the business and returning our excess cash flow to our shareholders. Our activities over the last year and a half demonstrate our commitment to that principle. Over the last six quarters, we’ve generated $232 million in free cash flow and we’ve returned 140% of it to shareholders through dividends and share repurchases. Additionally, during the quarter our banks completed our accelerated share repurchase program and delivered an additional 3.9 million shares to us bringing the total shares repurchased this year to 14.6 million shares at a cost of $250 million.

Moving down the balance sheet, I’d like to highlight the continued progress we’re making related to inventory management. Inventory was down 5.7% on a selling square foot basis excluding in-transits. The benefit of our conservative inventory management was aided by a decrease in average unit cost related to the more balanced assortment at White House | Black Market. We ended the period with overall inventory in line with plan.

Capital expenditures totaled $23 million in the second quarter primarily related to the implementation of our new point-of-sale system and investments in stores. We opened eight new stores in the quarter and closed 12 stores.

As Dave mentioned, we’ve made the decision to close our Boston Proper stores and evaluate strategic alternatives for the Boston Proper direct-to-consumer business. For your modeling purposes, I’d like to provide some data points on our financial performance excluding Boston Proper’s results.

For the full year of 2014, excluding Boston Proper, our consolidated gross margin rate would have been higher by 40 basis points and our SG&A as a percent of sales would have been lower by 30 basis points. For the first half of 2015, excluding Boston Proper again, our gross margin rate improvement would have been 130 basis points, 10 basis points higher than we reported, and SG&A would’ve been flat to 2014 as a percent of sales, better than the 20 basis points of deleverage that we reported.

For the overall company, we had solid performance in line with our expectations in the first half of the year. We had positive sales growth and significant growth in gross margin and adjusted profit margin. Our inventory and cost control initiatives are taking hold and delivering bottom line benefit for us.

As we look forward to the remainder 2015, we continue to expect a modestly positive increase in comparable sales through a recovery in our average unit retail. We continue to expect improvement in gross margin rate over last year with the majority of our second half opportunity occurring in the fourth quarter.

Our expectations are to manage SG&A to offset the headwinds of incentive compensation and occupancy costs resulting in SG&A growth that is in line with sales growth.

We continue to evaluate our store fleet to maximize productivity, mitigate operating expense increases and maximize the transfer of sales from closing stores. We still expect to open approximately 40 new stores this year. Last quarter we estimated that we would close 135 stores to 140 stores over the next three years. However, that estimate did not include the closure of our Boston Proper stores which will be incremental.

6

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

| | | corrected transcript |

Chico's FAS, Inc. | CHS | Q2 2015 Earnings Call | Aug. 26, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

So including Boston Proper, we now estimate that we’ll close 160 stores to 165 stores over the next three years, 70 stores to 75 stores of which we’ll close this fiscal year. We’ve already closed 20 of those stores through the second quarter.

Our capital expenditure estimate remains at approximately $100 million for fiscal 2015, inclusive of $30 million from our point-of-sale implementation. And our tightly managed inventory should continue to produce on hand inventory growth less than sales growth. Please note that we may continue to see an increase in in-transit inventories similar to this quarter. The transition of receiving merchandise via the East Coast ports will result in incremental days of transportation to our distribution center.

We expect our weighted average diluted shares outstanding to be approximately 137 million for the third quarter and 139 million for the full year of 2015 assuming no further material changes in shares outstanding.

Overall, we view 2015 as a year where we are resetting our business to earn our way back to growth. We’re optimizing the productivity of our store fleet, controlling inventory and expenses, and investing for growth where we meet our risk-adjusted return hurdles.

Going forward, we will be able to focus on the health of our three core brands ensuring that we present the right merchandise, carry appropriate levels of inventory, control expenses, and deliver a stellar customer experience to drive future growth in our business. These priorities are designed to deliver long-term value creation for our company and our shareholders. We’re encouraged by our performance and we look forward to updating you on our progress as we move forward.

And with that, I’ll turn the call back over to Dave.

David F. Dyer, President & Chief Executive Officer, Chair of the Board

Thank you, Todd. I am really proud of how our teams are executing. We are improving the customer experience, controlling inventory and expenses, improving our merchandise, and leveraging our customer data through innovative and advanced applications. In short, there’s plenty going on that we are genuinely excited about.

In closing, I believe that this momentum that we are seeing will continue into the fall. We are performing against the initiatives we laid out at the end of the fourth quarter of last year, and continue to see positive results.

We are making strong progress on our path to double-digit operating margins, our focus on providing amazing personal service continues to be a key differentiator, combined with our dedicated teams, our disciplined capital and inventory management and our loyal customer base, we are well-positioned for future growth.

With that, back to Jennifer.

Jennifer Powers Adkins, Vice President of Investor Relations, Chico’s FAS, Inc.

7

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

| | | corrected transcript |

Chico's FAS, Inc. | CHS | Q2 2015 Earnings Call | Aug. 26, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

Thank you, Dave. That concludes our prepared comments. At this time, we’d be happy to take your questions. In the interest of time and consideration to others, please limit yourself to one question. Thanks.

I’ll turn the call back over to Emily.

8

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

| | | corrected transcript |

Chico's FAS, Inc. | CHS | Q2 2015 Earnings Call | Aug. 26, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

QUESTION AND ANSWER SECTION

Operator: Thank you. We will now begin the question-and-answer session. [Operator Instructions] Our first question is from Simeon Siegel of Nomura. Please go ahead.

<Q – Simeon Siegel – Nomura Securities International, Inc.>: Thanks. Good morning, guys.

<A – Dave Dyer – Chico’s FAS, Inc.>: Morning.

<A – Jennifer Powers Adkins – Chico’s FAS, Inc.>: Morning.

<Q – Simeon Siegel – Nomura Securities International, Inc.>: So just given the impressive year-to-date gross margin performance, can you share any color on the magnitude of what you’d expect for gross margin recapture? I guess how much opportunity do you still see in AUC? And then just quickly, for the quarter-to-date commentary, can you share any color on any brand discrepancies there? Thanks.

<A – Todd Vogensen – Chico’s FAS, Inc.>: Yeah, so I’d say from a gross margin perspective, we’ve talked about in the past getting back around 250-ish basis points of gross margin, getting back near to where we were at a few years ago, and that continues to be the focus. Really the big driver is going to be continued inventory management, and allowing that to drive us into a position where we have to discount less deeply to drive what will ultimately be healthier sales. And so that is definitely the plan going forward, and we continue to see opportunity there.

<A – Dave Dyer – Chico’s FAS, Inc.>: Yeah, based on our best year, we gave up over 350 basis points, I believe, in margin totally. And to get back 250 basis points, just kind of an intermediate goal, we think that that certainly is achievable as we get out of this kind of promotional morass that everybody has been in the last two years. And I’m really pleased with the progress our company is making.

<A – Todd Vogensen – Chico’s FAS, Inc.>: Excellent. Thanks, Simeon.

<Q – Simeon Siegel – Nomura Securities International, Inc.>: Best of luck, guys.

Operator: The next question is from Brian Tunick of the Royal Bank of Canada. Please go ahead.

<Q>: Yes. Hi. This is [ph] Kate (25:46) on for Brian. Thank you for taking our question. I guess on White House | Black Market, just given the deceleration relative to the first quarter, could you just speak about any merchandising steps or anything that maybe you think affected the comp trend, or really should we think about it as being a function of the less promotional stance year-over-year? Thank you.

<A – Dave Dyer – Chico’s FAS, Inc.>: I think a lot of it has to do with the less promotional stance over the year. I mean we’ve made some major changes in merchandising, but that’s more reflective of what’s happening in fall. So if you look back at the second quarter trend, while we have made some changes in merchandising that were certainly evident in the last month of the quarter, I think most of the changes you see are in fall. So I would say that their margin increases by just cutting out the promotional non-sense that we all have been going through, not only in our brands, but as an industry over the last couple of years is really the big breakthrough. I think as we look forward for the brands in the second half, you may remember that last year, and certainly in White House |

9

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

| | | corrected transcript |

Chico's FAS, Inc. | CHS | Q2 2015 Earnings Call | Aug. 26, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

Black Market we had a fourth quarter, was very, very promotional and with liquidation. So you’ll probably see more margin gains towards the fourth quarter than you will earlier in the year. But we plan to continue marching forward.

<Q>: Great. Best of luck.

<A – Dave Dyer – Chico’s FAS, Inc.>: Thanks.

Operator: Our next question is from Ed Yruma of KeyBanc Capital Markets. Please go ahead.

<A – Dave Dyer – Chico’s FAS, Inc.>: Hi, Ed.

<Q – Ed Yruma – KeyBanc Capital Markets, Inc.>: Hi. Thanks and good morning. I guess two quick ones. First, on inventory, obviously you guys have made tremendous strides there. It seems like you’re really bearing fruits with these various [ph] hard line (27:34) initiatives. Is there any more incremental reductions in inventory as we go forward, or at this point, you’re starting to see that equilibrium? And then two, how do we think about the long-term growth algorithm for the business; you’ve always had square footage growth; you had Boston Proper; your thoughts around square footage or concept store growth change going forward? Thank you.

<A – Todd Vogensen – Chico’s FAS, Inc.>: Thanks, Ed. So we’ll start with the inventory. Truly, as we go into Q3, we still expect to see inventory growth slower than sales growth, and that will – it’s kind of a long-term philosophy that we’ll be looking at. If you recall, last year in Q4, we had cut back on receipts and we ended up in a pretty favorable position at the end of the year, and I think that’s continued as we go through this year. So it’ll probably even out a little bit more as we go towards the future, but controlling that inventory really has become a core piece of what we’re doing and we’d expect to continue to see good progress relative to our sales growth.

<A – Dave Dyer – Chico’s FAS, Inc.>: Long-term?

<A – Todd Vogensen – Chico’s FAS, Inc.>: Long-term, for long-term growth, what I’d say is we have a number of things that we are doing as we look to invest in customer experience, there is a number of initiatives underway that we really think will continue to put us ahead of the competition and drive sales for both online and in-store. And then, really the ace in the hole for us is Soma. So with Soma at a much earlier stage in its growth, we feel like our portfolio is balanced in a nice way where we not only are able to generate a significant amount of cash each year, but we also have a growth vehicle that will continue to drive the top line particularly as Soma becomes more material to the overall company.

<Q – Ed Yruma – KeyBanc Capital Markets, Inc.>: Great. Thanks so much, guys.

<A – Dave Dyer – Chico’s FAS, Inc.>: Yeah.

Operator: Your next question is from Adrienne Yih of Wolfe Research. Please go ahead.

<Q – Adrienne Yih – Wolfe Research LLC>: Good morning. Can you hear me?

<A – Todd Vogensen – Chico’s FAS, Inc.>: Absolutely. Good morning.

<Q – Adrienne Yih – Wolfe Research LLC>: Good morning. So congratulations. Nicely done. I was wondering if you could talk about some of the fashion trends that are upon us and how strongly

10

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

| | | corrected transcript |

Chico's FAS, Inc. | CHS | Q2 2015 Earnings Call | Aug. 26, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

they resonate with the Chico’s customer. Clearly a lot of the – I’m already seeing much of it at White House | Black Market. And then if you can give us the expectations for any further impact from the devaluation of the yuan going forward. How long might that take to start to flow through the financials? Thank you.

<A – Dave Dyer – Chico’s FAS, Inc.>: For the fashion trends, I think that are alive and well at Chico’s; I mean, and White House | Black Market and Soma as well. But starting with, there’s a lot of news in bottoms. I think the gaucho, even one of my all-time favorites from many years ago, the stirrup pant is back. We’re seeing all sorts of shapes in legs and I think that that’s big news. You’ll be seeing that in both the White House commercials and in the Chico’s commercials.

Chico’s is doing very well in knit tops again, which is very exciting to see. White House on the other hand is doing great in wovens and we’re actually seeing some improvement in the knit tops as well, but the wovens, the new silhouette, we call it the, is it; is it a dress or is it a shirt and is its are doing unbelievably well. And there’s just all sorts of new shapes in wovens that are going on now and new hemlines that are terrific.

We still see not as much dress business as we would like. We’re continuing to focus on it and to try to build it again, to build it back, because we think that’s important in the long-term, but really the customer just hasn’t voted as much for dresses as we would probably have liked to have seen in our assortments. And Chico’s also, the jackets, I think you’re going to see a television commercial on jackets with us, and we think the jackets and the silhouettes that we’re having there is really going to be good. Chico’s has always had a very, very strong jacket business.

<Q – Adrienne Yih – Wolfe Research LLC>: Okay.

<A – Dave Dyer – Chico’s FAS, Inc.>: And we think that those styles are really back at it. A couple of new bra launches that’ll be going on in bra as we come into later in the year and some new things that we’ve got going on in Soma. So I feel really good about where the fashion is right now. I think there’s reasons for the customer to buy. White House has gone through a little bit of kind of soul-searching and inner direction as they have looked to refocus on their branding, and refocus on their assortments, and I think you will see a lot of change in product there, but products that the customers are absolutely loving. Our current assortment that is just in the stores, our fall one is doing tremendous, fall two looks even more beautiful. You will see less print, you’re still going to see print, but less print. But you’ll see a lot of texture, and you’ll see just some beautiful quality silhouettes that I just think are fabulous. And again, all of this is going to be supported by our television campaigns. When you see the fall two delivery in the stores, I think that not only you’re going to like it, you’re going to be out there buying.

<Q – Adrienne Yih – Wolfe Research LLC>: When is fall two hitting?

<A – Dave Dyer – Chico’s FAS, Inc.>: It will be in for towards the end of the month. I don’t have the catalog right in front of me, but it will be coming up.

<Q – Adrienne Yih – Wolfe Research LLC>: All right. I’ll put it on my calendar. And then...

<A – Dave Dyer – Chico’s FAS, Inc.>: Okay. [indiscernible] (33:37).

<Q – Adrienne Yih – Wolfe Research LLC>: The AUC?

11

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

| | | corrected transcript |

Chico's FAS, Inc. | CHS | Q2 2015 Earnings Call | Aug. 26, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

<A – Todd Vogensen – Chico’s FAS, Inc.>: Yeah, Chinese currency. So generally what I’d tell you is our sourcing organization has been doing a lot of heavy lifting around continuing to diversify country of origin, look for better sources of supply and that has generally been benefiting our average unit costs in little bits here and there along the way, and we expect that to continue. The Chinese currency devaluation is good news, but it’s also not a huge number.

<Q – Adrienne Yih – Wolfe Research LLC>: Right.

<A – Todd Vogensen – Chico’s FAS, Inc.>: So it’s something that will flow through over time that I wouldn’t necessarily expect it to have a material impact to overall financials.

<Q – Adrienne Yih – Wolfe Research LLC>: The oil and the cotton probably is more impactful to you at this point?

<A – Todd Vogensen – Chico’s FAS, Inc.>: It is. I mean, and it’s interesting, typically raw materials have not been as big a piece of our overall cost to manufacture, and it’s still not, but the changes have been significant enough that we are seeing just little benefits here and there that are coming through.

<Q – Adrienne Yih – Wolfe Research LLC>: Great. Thank you, and best of luck. I’ll be looking for that product, Dave.

<A – Dave Dyer – Chico’s FAS, Inc.>: All right. Great.

<A – Todd Vogensen – Chico’s FAS, Inc.>: Thanks, Adrienne.

<Q – Adrienne Yih – Wolfe Research LLC>: Bye.

<A – Dave Dyer – Chico’s FAS, Inc.>: You will be styling.

Operator: Our next question is from Pam Quintiliano of SunTrust. Please go ahead.

<Q – Pam Quintiliano – SunTrust Robinson Humphrey, Inc.>: Great. Thanks so much for taking my question, and congratulations on executing well in this environment and getting through that inventory. So two quick questions for you. As far as the timing and shift of the pants promo that you mentioned, can you give us actually when it occurred last year, when occurring this year? And then how do we think about it as a sales and traffic driver in general at Chico’s? Does she wait for this event every year, or do you think she’s been holding back; were you seeing anything in traffic reflecting that? And then also, just more about the Boston Proper divestiture, and where you are in that process, and just any timeframe you have in mind for completion of it?

<A – Dave Dyer – Chico’s FAS, Inc.>: Well, Chico’s normally begins fall in August with some strong marketing. And what happened this year is our major marketing with all these new pant silhouettes which we are really excited about. And it was the strangest damn thing I’ve ever seen with two boats colliding in China. In all my years, I have never heard of that. But then with having to make sure that it was repaired and capable of sailing, I mean we literally lost close to a month in terms of receiving goods.

And as a result, we took a lot of our marketing that was scheduled to start in the first couple of weeks and we pushed it to the end of the month. Even at that, we were able to – we had to get goods off the boat when it finally landed and rush them to our distribution center. I mean, there were

12

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

| | | corrected transcript |

Chico's FAS, Inc. | CHS | Q2 2015 Earnings Call | Aug. 26, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

even other problems. The boat [ph] off led (36:30). It was supposed to go to New York first, unload the whole boat. It decided to go to Savannah, so we only got half of our goods off and then it went to New York. So we’ve been flying goods like crazy everywhere trying to get them into the stores for this last half of the month.

And our television commercials have started and now we have the assortment in the stores that we think that we should see sales picking up, although the environment as we’ve talked about particularly for the Chico’s customer with the market volatility in the last, I’d say three days or four days, it certainly hasn’t been helpful. We think that this too will pass, and our marketing will kick in and the customer will be back shopping with us again rather than watching the ticker tape.

<A – Todd Vogensen – Chico’s FAS, Inc.>: Okay.

<Q – Pam Quintiliano – SunTrust Robinson Humphrey, Inc.>: And can I just ask on that, the shelf life of that product, are you going to have to mark down ahead of when you had planned, or is it okay?

<A – Dave Dyer – Chico’s FAS, Inc.>: Yeah, yeah.

<Q – Pam Quintiliano – SunTrust Robinson Humphrey, Inc.>: Okay.

<A – Dave Dyer – Chico’s FAS, Inc.>: It last all the way through the season and some of those silhouettes will probably even go into spring.

<A – Todd Vogensen – Chico’s FAS, Inc.>: Yeah.

<A – Dave Dyer – Chico’s FAS, Inc.>: So not a problem.

<Q – Pam Quintiliano – SunTrust Robinson Humphrey, Inc.>: And as far as...

<A – Dave Dyer – Chico’s FAS, Inc.>: Just lost sales opportunity like an empty airplane seat.

<A – Todd Vogensen – Chico’s FAS, Inc.>: Yeah.

<Q – Pam Quintiliano – SunTrust Robinson Humphrey, Inc.>: Okay. And then the Boston Proper, just any more information you could provide on that?

<A – Todd Vogensen – Chico’s FAS, Inc.>: We’re early in the process, so it’s probably early to give too much detail, so we’ll stay away from timing and expectations. But something that just from a transparency perspective we wanted to get out there in front of investors at this point as we move through the process. So more to come.

<A – Dave Dyer – Chico’s FAS, Inc.>: Yeah. And I would just say that I love Boston Proper. I think it’s a great team and a great brand. When we bought it, our whole thing was that we thought that we could have 300 stores, 400 stores and that it would be a $400 million to $600 million business over time. When we saw that the stores are really not working and we didn’t think it was prudent to continue to invest in the stores, after we had 20 stores out there, then we looked at it, and as far as the direct business, it’s a great direct business, but in the scope of our mega brands, without the stores, we think that it would get lost in our company and really be better able to achieve the great destiny that that brand’s going to have with somebody who could spend full time on it. So that was the decision.

13

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

| | | corrected transcript |

Chico's FAS, Inc. | CHS | Q2 2015 Earnings Call | Aug. 26, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

<Q – Pam Quintiliano – SunTrust Robinson Humphrey, Inc.>: Well, best of luck with getting that process done, and congrats again on the quarter.

<A – Todd Vogensen – Chico’s FAS, Inc.>: All right. Thank you.

Operator: Our next question is from Anna Andreeva of Oppenheimer. Please go ahead.

<Q – Janet Lynne – Oppenheimer & Co., Inc. (Broker)>: Hi. Good morning. It’s Janet Lynne on for Anna. Congrats on the great results. I was just wondering on the quarter-to-date comp trend if you are seeing any variation by geography or store format? And then congrats on the SG&A leverage, I guess from the rationalization; do you have any color on the cadence of that for the back half and for next year, any lumpiness that we should expect?

<A – Todd Vogensen – Chico’s FAS, Inc.>: Yeah, so in terms of sales and traffic we’re – truth be told, really across all store formats and geographies for quite a while now we’ve seen relatively similar results. Traffic even between outlet centers and frontline centers, between lifestyle centers and malls has really been directionally consistent for quite some time and that will continue we expect. Second question was?

<Q – Janet Lynne – Oppenheimer & Co., Inc. (Broker)>: On the SG&A leverage?

<A – Todd Vogensen – Chico’s FAS, Inc.>: Yeah, so through the rest of this year, we obviously have headwinds on occupancy as well as we hope incentive compensation. As we roll into next year, we’ll be wrapping around on those, which should give us more of a consistent base that we’ll be comparing against. We did do our reorganization in the first quarter about midway through, so there were SG&A savings related to head count that we just had a partial quarter for in first quarter, but really going forward we should be on a more level base.

<Q – Janet Lynne – Oppenheimer & Co., Inc. (Broker)>: Okay. Great. And then a quick follow-up on Soma. It sounds like you’re really making substantial progress there. Could you give us any more color on the margin profile at this division?

<A – Todd Vogensen – Chico’s FAS, Inc.>: Yeah, I think we said our merchandise margins are a bit better than apparel brands, which you would expect. That’s kind of the industry norm, so we have that good base to grow from, and now we’re in a position where each year we’ve seen progressively better operating margins, both dollars and percents. And just need to continue along our path of growing that top line so that we can leverage the investments that we have in not only occupancy, but I think we’ve talked about in the past, the process to design, develop, and bring to market bras is fairly complex and takes a reasonable amount of infrastructure. So now we’re at the point of just getting the top line growth so that we can start to leverage that infrastructure.

<Q – Janet Lynne – Oppenheimer & Co., Inc. (Broker)>: Great. Thank you so much.

<A – Todd Vogensen – Chico’s FAS, Inc.>: Thank you.

Operator: Our next question is from Susan Anderson of FBR. Please go ahead.

<Q – Susan Anderson – FBR Capital Markets & Co.>: Good morning. Congrats on a great quarter. Just to follow up on Soma, maybe if you could talk about solid – I mean there were solid comps in the quarter, but maybe a little bit slower from last quarter. Is there anything going on in the

14

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

| | | corrected transcript |

Chico's FAS, Inc. | CHS | Q2 2015 Earnings Call | Aug. 26, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

industry or competitive environment, or maybe just the brand maturing? And then also, should we think about it being accretive now to EBIT margin going forward?

<A – Todd Vogensen – Chico’s FAS, Inc.>: Yeah, so in terms of the 5% comp, I might defer to Dave a little bit, there’s going to be little swings here and there from each quarter. I think the more important thing is 25th consecutive quarter of positive comps. There is a very consistent and long-term trend towards growing the top line in our existing business, and that is part of their plan as they go forward. So I wouldn’t read too much either way into that. In terms of accretive to overall company profit margins, as they continue to increase their profit margin, that obviously continues to help everything. It helps along with SG&A leverage, as they become a bigger portion of the company, it helps on gross margin leverage. So all those types of things move in the right direction as we continue to grow that brand.

<Q – Susan Anderson – FBR Capital Markets & Co.>: Great. That’s helpful. And then on the closed stores, I don’t know if you’d give any color, I know it’s still kind of early, but just on any sales retention you’re getting there going to other stores or online?

<A – Todd Vogensen – Chico’s FAS, Inc.>: We’re continuing to see positive results. We’ve actually also kicked off a new program where we’re going out and being a lot more proactive about how we market to current customers, people that are in the stores that are going to be closing, and make sure that we’re providing a good transition path for those folks to whatever their nearest store or to online. And I believe that’s going to be a good positive result for us. But generally, the expectations are I guess what we’ve been seeing from our sales transfer has been right in line with what we’d expect to see and we’re very happy with that result.

<Q – Susan Anderson – FBR Capital Markets & Co.>: Great. Thanks. Good luck next quarter.

<A – Todd Vogensen – Chico’s FAS, Inc.>: Thanks.

Operator: Our next question is from Betty Chen of Mizuho Securities. Please go ahead.

<Q – Betty Chen – Mizuho Securities USA, Inc.>: Good morning. Congratulations on a great quarter. I was wondering if you can talk a little bit about the White House accessories. Certainly, that seem to be broadening the category at the brand. And I think, Dave, you mentioned earlier that that was encouraging so far. Can you remind us what it is as a percent of sales and what you think the longer term opportunity might be? And then my second question is regarding marketing plans. How should we think about the marketing dollars in the back half and how that might be allocated amongst the brands? Thanks.

<A – Dave Dyer – Chico’s FAS, Inc.>: Well, the accessory business at White House is coming on strong. I mean, one of the things that you’ve done, you’ve seen that we took a little sabbatical in shoes and bags, but we’re back for the fall collections, and I can tell you that those are selling very well. The handbags that we have at, some of them at $250 basically online have just sold out. So I mean there’s a lot of good news going on in accessories. I believe that the jewelry presentation is about as good as it’s been in a long time. So total accessories are really working well for White House again. And that’s good because it’s kind of the outfit completer, and when you look at units per transaction, when you watch the way we sell in a fitting room, we’re always adding jewelry, adding belts, adding scarves, adding shoes, adding bags, and so anything that we can do to have a successful accessory business really does help our average dollar sale and our units per transaction. So that’s a key.

15

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

| | | corrected transcript |

Chico's FAS, Inc. | CHS | Q2 2015 Earnings Call | Aug. 26, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

In terms of marketing dollars, I think that our marketing dollars are probably going to be very similar to what they were in last year. We have gone through, over the last year or so, gone through a very extensive study of how we spend and where we spend using marketing mix analytics to really determine where we’re overspending and under spending in media and where we can shift, and overall, I would say that we’re probably under spending in paid search and digital ads. And I think that you’ll be seeing us shift some of the marketing dollars that were in other areas such as catalogs to both paid search and digital marking. So I think we’re beginning to fine-tune the dollars that we have. We are going back, and if we do think that there is a good opportunity, obviously we’re going to take it, but it’s a shot here or there based on our marketing intelligence. But I feel good about, not only our marketing campaigns, but the mix of our marketing going forward into fall.

<Q – Betty Chen – Mizuho Securities USA, Inc.>: Great. And Dave, how big do you think the accessories opportunity could be for White House?

<A – Dave Dyer – Chico’s FAS, Inc.>: Much bigger than it is.

<Q – Betty Chen – Mizuho Securities USA, Inc.>: Okay. Great. Thank you. Congratulations.

<A – Dave Dyer – Chico’s FAS, Inc.>: All right. Thanks.

<A – Todd Vogensen – Chico’s FAS, Inc.>: Thanks, Betty.

Operator: Our next question is from Dana Telsey of Telsey Advisory Group. Please go ahead.

<Q – Dana Telsey – Telsey Advisory Group LLC>: Good morning, everyone and congratulations on the improvement. Dave, any updates on the CEO search and how that is progressing? And then as you think of each of the brands, with the promotional cadence becoming cleaner in the second quarter, how do you think of the back half for each of them? And with inventory levels, is that the key component to helping to drive the reduced level of promotions? Thank you.

<A – Dave Dyer – Chico’s FAS, Inc.>: You lost me at CEO search. I guess I could tell you but I’d have to shoot you. I’ll just say that the board is certainly progressing, and I think in due time, I said I would be here until next spring, and be involved in the company at least through next June as a director and that’s the plan, and I think we’re progressing well on the search. What was the second question?

<A – Todd Vogensen – Chico’s FAS, Inc.>: Promotions, and what drives decreased promotions over time?

<A – Dave Dyer – Chico’s FAS, Inc.>: The best thing to drive decreased promotions is being very articulate with your inventory. Inventory is what got us into trouble over the last couple of years, mainly, we were betting on growth, and when growth didn’t come, our inventory is backed up, and we really had to liquidate. And I think that it caught a lot of people in apparel industry what happened after in 2013 and 2014 was really surprising based on the momentum that we had all had in like 2010 to 2012 and inventory backed up. So we have really taken a stance on inventory.

For us, at Chico’s, inventory actually reports into finance, to Mr. Todd here, and we look at it as one of the biggest financial decisions that we make and our ability to control inventory and to get higher turn off of that inventory and create less liquidations has been a huge goal for the company, and it’s paying off. I would say that the excess inventory was the major contributor to our loss of margin

16

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

| | | corrected transcript |

Chico's FAS, Inc. | CHS | Q2 2015 Earnings Call | Aug. 26, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

over the last several years, and the control of inventory is going to be the major contributor to getting our margin back.

<Q – Dana Telsey – Telsey Advisory Group LLC>: Thank you.

<A – Todd Vogensen – Chico’s FAS, Inc.>: Thanks, Dana.

Operator: This concludes our question-and-answer session. I’d like to turn the conference back over to Jennifer for any closing remarks.

Jennifer Powers Adkins, Vice President of Investor Relations, Chico’s FAS, Inc.

Okay. Thank you, Emily. That concludes our call for this morning. Thank you all for joining us, and we appreciate your continuing interest in Chico’s FAS.

Operator: The conference is now concluded. Thank you for attending today’s presentation. You may now disconnect.

Disclaimer

The information herein is based on sources we believe to be reliable but is not guaranteed by us and does not purport to be a complete or error-free statement or summary of the available data. As such, we do not warrant, endorse or guarantee the completeness, accuracy, integrity, or timeliness of the information. You must evaluate, and bear all risks associated with, the use of any information provided hereunder, including any reliance on the accuracy, completeness, safety or usefulness of such information. This information is not intended to be used as the primary basis of investment decisions. It should not be construed as advice designed to meet the particular investment needs of any investor. This report is published solely for information purposes, and is not to be construed as financial or other advice or as an offer to sell or the solicitation of an offer to buy any security in any state where such an offer or solicitation would be illegal. Any information expressed herein on this date is subject to change without notice. Any opinions or assertions contained in this information do not represent the opinions or beliefs of FactSet CallStreet, LLC. FactSet CallStreet, LLC, or one or more of its employees, including the writer of this report, may have a position in any of the securities discussed herein.

THE INFORMATION PROVIDED TO YOU HEREUNDER IS PROVIDED "AS IS," AND TO THE MAXIMUM EXTENT PERMITTED BY APPLICABLE LAW, FactSet CallStreet, LLC AND ITS LICENSORS, BUSINESS ASSOCIATES AND SUPPLIERS DISCLAIM ALL WARRANTIES WITH RESPECT TO THE SAME, EXPRESS, IMPLIED AND STATUTORY, INCLUDING WITHOUT LIMITATION ANY IMPLIED WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE, ACCURACY, COMPLETENESS, AND NON-INFRINGEMENT. TO THE MAXIMUM EXTENT PERMITTED BY APPLICABLE LAW, NEITHER FACTSET CALLSTREET, LLC NOR ITS OFFICERS, MEMBERS, DIRECTORS, PARTNERS, AFFILIATES, BUSINESS ASSOCIATES, LICENSORS OR SUPPLIERS WILL BE LIABLE FOR ANY INDIRECT, INCIDENTAL, SPECIAL, CONSEQUENTIAL OR PUNITIVE DAMAGES, INCLUDING WITHOUT LIMITATION DAMAGES FOR LOST PROFITS OR REVENUES, GOODWILL, WORK STOPPAGE, SECURITY BREACHES, VIRUSES, COMPUTER FAILURE OR MALFUNCTION, USE, DATA OR OTHER INTANGIBLE LOSSES OR COMMERCIAL DAMAGES, EVEN IF ANY OF SUCH PARTIES IS ADVISED OF THE POSSIBILITY OF SUCH LOSSES, ARISING UNDER OR IN CONNECTION WITH THE INFORMATION PROVIDED HEREIN OR ANY OTHER SUBJECT MATTER HEREOF.

The contents and appearance of this report are Copyrighted FactSet CallStreet, LLC 2015. CallStreet and FactSet CallStreet, LLC are trademarks and service marks of FactSet CallStreet, LLC. All other trademarks mentioned are trademarks of their respective companies. All rights reserved.

17

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

Chicos FAS (NYSE:CHS)

Historical Stock Chart

From Mar 2024 to Apr 2024

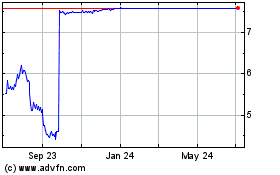

Chicos FAS (NYSE:CHS)

Historical Stock Chart

From Apr 2023 to Apr 2024