UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

__________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): April 22, 2015

GROWBLOX SCIENCES, INC.

____________________________________________

(Exact Name of Registrant as Specified in Charter)

|

Delaware

|

000-51474

|

20-2903252

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

| |

|

|

| |

6450 Cameron Street #110A

Las Vegas, Nevada 89118

|

|

|

(Address of Principal Executive Offices)

|

| |

|

Registrant’s telephone number, including area code:

|

Phone: (844) 843-2569

|

| |

|

(Former Name or Former Address, if Changed Since Last Report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 3.02 Unregistered Sales of Equity Securities

Effective as of September 30, 2014, Growblox Sciences, Inc. (the “Company”) sold units of securities through a private placement at a price of $0.50 per unit. Each unit consisted of one share of common stock, one A warrant, expiring in three years, with an exercise price of $1.00 per share, and one B warrant, expiring in five years, with an exercise price of $2.00 per share. As a result of such offering, the Company issued an aggregate of 9,937,720 shares of common stock, 11,437,720 A warrants and 11,437,720 B warrants, inclusive of warrants issued to the placement agent and its affiliates. Such securities were issued in reliance on the exemption from registration provided by Section 4(2) of the Securities Act of 1933 (the “Securities Act”) and/or Rule 506 of Regulation D under the Securities Act, as amended. Pursuant to the Company’s registration statement on Form S-1 which became effective February 12, 2015, the common stock included in the units and the shares of common stock issuable under both the A warrants and B warrants were registered for resale.

In order to encourage the exercise of the Company’s B warrants, on February 12, 2015, the board of directors of the Company passed a resolution to temporarily reduce, until April 30, 2015, the exercise price of such warrants from $2.00 per share to $0.20 per share, and the holders of the B warrants were notified of such temporary exercise price reduction. As at April 29, 2015, B warrants to purchase 1,970,000 shares of company common stock were exercised at $0.20 per share, resulting in net proceeds of $394,000 to the Company. On April 30, 2015, the Company’s board of directors extended to 5:00 PDT on May 15, 2015 the temporary voluntary reduction of the exercise price of the B Warrants to $0.20 per share and notified the holders of the B Warrants .

On April 22, 2015, Cesar Cordero-Kruger purchased from the Company, for $592,200 or $0.21 per share, an aggregate of 2,820,000 shares of common stock of the Company. Such common stock was issued in reliance on the exemption from registration provided by Section 4(2) of the Securities Act of 1933 (the “Securities Act”) and/or Rule 506 of Regulation D under the Securities Act, as amended. The Company has agreed to register such common stock for resale under the Securities Act pursuant to a registration rights agreement.

On April 27, 2015, Lazarus Investment Partners LLLP and Lazarus Israel Investment Opportunities Fund, LLLP sold back to the Company for $0.01 each, warrants to purchase 3,000,000 and 1,000,000 shares, respectively.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

The following exhibit is filed with this Report:

|

10.1

|

Form of Securities Purchase Agreement with Cesar Cordero-Kruger.

|

|

10.2

|

Form of notice to holders of B Warrants of exercise price reduction.

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: April 30, 2015

|

GROWBLOX SCIENCES, INC.

|

By: /s/ Cathryn Kennedy

Cathryn Kennedy

Chief Financial Officer

Exhibit 10.1

SUBSCRIPTION AGREEMENT

This Subscription Agreement (this “Agreement”) is dated as of April 22, 2015, (the “Effective Date”) between Growblox Sciences Inc., a Delaware corporation (the “Company”), and Cesar Cordero-Kruger, an individual (the “Purchaser”).

INTRODUCTION:

This Agreement is being entered into with reference to the following:

A. Upon the terms and subject to the conditions set forth in this Agreement, the Purchaser wishes to purchase from the Company an aggregate of two million eight hundred and twenty thousand (2,820,000) shares of the common stock, $0.001 par value per share, of the Company (the “Subject Shares”); and

B. The Company is willing to sell to the Purchaser the Subject Shares;

NOW, THEREFORE, IN CONSIDERATION of the mutual covenants contained in this Agreement, and for other good and valuable consideration, the receipt and adequacy of which are hereby acknowledged, the Company and the Purchaser agree as follows:

PURCHASE AND SALE

1.1 Purchase and Sale of the Subject Shares and Delivery.

(a) Purchase and Sale. The Purchaser hereby agrees to purchase from the Company, and the Company hereby agrees to sell to such Purchaser, the two million eight hundred and twenty thousand (2,820,000) Subject Shares.

(b) Purchase Price. The purchase price for each of the Subject Shares shall be $0.21 per share, or an aggregate of Five Hundred and Ninety Two Thousand, Two Hundred ($592,200) Dollars (the “Purchase Price”). Receipt of the Purchase Price is hereby acknowledged by the Company.

1.2 Delivery of Stock Certificates. The Company shall cause to be delivered to the Purchaser a stock certificate registered in the name of the Purchaser representing all 2,820,000 Subject Shares on a date which shall be not later than April 30, 2015; provided, that for all purposes of this Agreement, the Purchaser shall be deemed to be the record and beneficial owner of all such Subject Shares as of the Effective Date of this Agreement.

ARTICLE II.

REPRESENTATIONS AND WARRANTIES

2.1 Representations and Warranties of the Company. The Company hereby represents and warranties to the Purchaser, as follows:

(a) Subject Shares. The issuance and sale of the Subject Shares to the Purchaser has been duly authorized by all necessary corporate action on the part of the Company and no consent or approval on any other third party is necessary to enable the Company to validly issue and sell the Subject Shares to the Purchaser. The Subject Shares, when issued and paid for by the Purchaser shall be fully paid, non-assessable, are owned by the Purchaser free and clear of any Liens, and free of preemptive and similar rights to subscribe for or purchase Subject Shares.

(b) Organization and Qualification. The Company is an corporation duly formed or otherwise organized, validly existing and in good standing under the laws of the the State of Delaware, with the requisite power and authority to own and use its properties and assets and to carry on its business as currently conducted. The Company is not in violation or in default of any of the provisions of its respective certificate or articles of formation, certificate or articles of incorporation, bylaws or other organizational or charter documents. The Company is duly qualified to conduct business and is in good standing as a foreign corporation or other entity in each jurisdiction in which the nature of the business conducted or property owned by it makes such qualification necessary, except where the failure to be so qualified or in good standing, as the case may be, could not have or reasonably be expected to result in: (i) a material adverse effect on the legality, validity or enforceability of material agreement, (ii) a material adverse effect on the results of operations, assets, business, prospects or condition (financial or otherwise) of the Company, or (iii) a material adverse effect on the ability of the Company to perform in any material respect on a timely basis its obligations under any material agreement binding upon the Company (any of (i), (ii) or (iii), a “Material Adverse Effect”) and no Proceeding has been instituted in any such jurisdiction revoking, limiting or curtailing or seeking to revoke, limit or curtail such power and authority or qualification.

(c) Authorization; Enforcement. The Company has the requisite corporate power and authority to enter into and to consummate the transactions contemplated by this Agreement and otherwise to carry out its obligations hereunder. The execution and delivery of this Agreement by the Company and the consummation by it of the transactions contemplated hereby and thereby have been duly authorized by all necessary action on the part of the Company and no further action is required by their managing member or managing members in connection herewith. This Agreement constitutes the valid and binding obligation of the Company, and enforceable against it in accordance with its terms, except: (i) as limited by general equitable principles and applicable bankruptcy, insolvency, reorganization, moratorium and other laws of general application affecting enforcement of creditors’ rights generally, (ii) as limited by laws relating to the availability of specific performance, injunctive relief or other equitable remedies and (iii) insofar as indemnification and contribution provisions may be limited by applicable law.

(d) No Conflicts. The execution, delivery and performance by the Company of this Agreement, the issuance and sale of the Subject Shares and the consummation by it of the transactions contemplated hereby do not and will not: (i) conflict with or violate any provision of the Company’s certificate of incorporation, bylaws or other organizational or charter documents, (ii) conflict with, or constitute a default (or an event that with notice or lapse of time or both would become a default) under, result in the creation of any Lien upon any of the properties or assets of the Company, or give to others any rights of termination, amendment, acceleration or cancellation (with or without notice, lapse of time or both) of, any agreement, credit facility, debt or other instrument (evidencing a Company debt or otherwise) or other understanding to which the Company is a party or by which any property or asset of the Company is bound or affected, or (iii) conflict with or result in a violation of any law, rule, regulation, order, judgment, injunction, decree or other restriction of any court or governmental authority to which the Company is subject (including federal and state securities laws and regulations), or by which any property or asset of the Company is bound or affected; except in the case of each of clauses (ii) and (iii), such as could not have or reasonably be expected to result in a Material Adverse Effect.

(e) Filings, Consents and Approvals. The Company is not required to obtain any consent, waiver, authorization or order of, give any notice to, or make any filing or registration with, any court or other federal, state, local or other governmental authority or other person or entity in connection with the execution, delivery and performance by the Company of this Agreement, other than the Company’s filing of Form D with the Securities and Exchange Commission and such filings as are required to be made under applicable state Securities laws.

(f) Exchange Act Filings. The Company has filed on a timely basis all periodic reports and other filings required to be made by it under the Securities and Exchange Act of 1934, as amended (the “Exchange Act Filings”).

(g) Registration Statement. Subject to the filing of a post-effective amendment to reflect updated financial statements and consummation of transactions with Growblox Sciences Puerto Rico, LLC (the “Post-Effective Amendment”), the Company’s registration statement on Form S-1 (File No. 333-198967) previously filed with the Securities and Exchange Commission (the “Registration Statement”) is effective under Section 8A of the Securities Act of 1933, as amended, and no stop order or other suspension of the effectiveness of such Registration Statement is in existence.

(h) Disclosure. The Company understands and confirms that the Purchaser will rely on the accuracy of the Exchange Act Filings and the foregoing representations in effecting his Purchase of the Subject Shares. All of the disclosure furnished by or on behalf of the Company to the Purchaser regarding the Company is true and correct in all material respects and does not contain any untrue statement of a material fact or omit to state any material fact necessary in order to make the statements made therein, in light of the circumstances under which they were made, not misleading. The Company acknowledges and agrees that the Purchaser does not make and has not made any representations or warranties with respect to the transactions contemplated hereby other than those specifically set forth in Section 3.2 hereof.

(i) No General Solicitation. Neither the Company nor any person acting on behalf of the Company has offered or sold any of the Subject Shares by any form of general solicitation or general advertising.

2.2 Representations and Warranties of the Purchaser. The Purchaser hereby represents and warrants as of the date hereof to the Company as follows:

(a) Authority. The Purchaser is an individual with full power and authority to enter into and to consummate the transactions contemplated by this Agreement and otherwise to carry out his obligations hereunder and thereunder. The execution and delivery of this Agreement and performance by such Purchaser of the transactions contemplated by this Agreement have been duly authorized by all action on the part of such Purchaser. This Agreement has been duly executed by such Purchaser, and when delivered by such Purchaser in accordance with the terms hereof, will constitute the valid and legally binding obligation of such Purchaser, enforceable against him in accordance with its terms, except: (i) as limited by general equitable principles and applicable bankruptcy, insolvency, reorganization, moratorium and other laws of general application affecting enforcement of creditors’ rights generally, (ii) as limited by laws relating to the availability of specific performance, injunctive relief or other equitable remedies and (iii) insofar as indemnification and contribution provisions may be limited by applicable law.

(b) Own Account. The Purchaser understands that the Subject Shares are “restricted securities” and have not been registered under the Securities Act of 1933, as amended (the “Securities Act”) or any applicable state securities law and is acquiring the Subject Shares as principal for his own account and not with a view to or for distributing or reselling such Subject Shares or any part thereof in violation of the Securities Act or any applicable state securities law, has no present intention of distributing any of such Subject Shares in violation of the Securities Act or any applicable state Securities law and has no direct or indirect arrangement or understandings with any other persons to distribute or regarding the distribution of such Subject Shares in violation of the Securities Act or any applicable state Securities law. The foregoing representation and warranty shall not limit the Purchaser’s right to sell the Subject Shares pursuant to the Registration Statement or Post-Effective Amendment or otherwise in compliance with applicable federal and state Securities laws.

(c) Purchaser Status. At the time such Purchaser was offered the Subject Shares, he was, and as of the date hereof is an “accredited investor” as defined in Rule 501(a)(1), (a)(2), (a)(3), (a)(7) or (a)(8) under the Securities Act. The Purchaser is not required to be registered as a broker-dealer under Section 15 of the Exchange Act.

(d) Experience of The Purchaser. The Purchaser, either alone or together with his representatives, has sufficient knowledge, sophistication and experience in business and financial matters to be capable of evaluating the merits and risks of the prospective investment in the Company, and has so evaluated the merits and risks of such investment. The Purchaser is able to bear the economic risk of an investment in the Company and, at the present time, is able to afford a complete loss of such investment.

(e) General Solicitation. The Purchaser is not purchasing the Subject Shares as a result of any advertisement, article, notice or other communication regarding the Subject Shares published in any newspaper, magazine or similar media or broadcast over television or radio or presented at any seminar or any other general solicitation or general advertisement.

The Company acknowledges and agrees that the representations contained in Section 3.2 shall not modify, amend or affect such Purchaser’s right to rely on the representations and warranties made by the Company in this Agreement or any representations and warranties contained in any other document or instrument executed and/or delivered in connection with this Agreement or the consummation of the transaction contemplated hereby.

ARTICLE III.

OTHER AGREEMENTS OF THE PARTIES

3.1 Transfer Restrictions.

(a) The Subject Shares may only be disposed of in compliance with state and federal Securities laws. In connection with any transfer of Subject Shares other than pursuant to an effective registration statement or Rule 144, to the Company or to an Affiliate of a Purchaser, the Company may require the transferor thereof to provide to the Company an opinion of counsel selected by the transferor and reasonably acceptable to the Company, the form and substance of which opinion shall be reasonably satisfactory to the Company, to the effect that such transfer does not require registration of such transferred Subject Shares under the Securities Act. As a condition of transfer, any such transferee shall agree in writing to be bound by the terms of this Agreement and shall have the rights and obligations of a Purchaser under this Agreement.

(b) The Purchaser agrees to the imprinting, so long as is required by this Section 3.1, of a legend on any of the Subject Shares in the following form:

THIS SECURITY HAS NOT BEEN REGISTERED WITH THE SUBJECT SHARES AND EXCHANGE COMMISSION OR THE SUBJECT SHARES COMMISSION OF ANY STATE IN RELIANCE UPON AN EXEMPTION FROM REGISTRATION UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), AND, ACCORDINGLY, MAY NOT BE OFFERED OR SOLD EXCEPT PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT OR PURSUANT TO AN AVAILABLE EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND IN ACCORDANCE WITH APPLICABLE STATE SECURITIES LAWS AS EVIDENCED BY A LEGAL OPINION OF COUNSEL TO THE TRANSFEROR TO SUCH EFFECT, THE SUBSTANCE OF WHICH SHALL BE REASONABLY ACCEPTABLE TO THE COMPANY.

(c) The Company agrees that at such time as such legend is no longer required under this Section 3.1(c), it will, no later than three Trading Days following the delivery by a Purchaser to the Company or the Transfer Agent of a certificate representing the Subject Shares, as applicable, issued with a restrictive legend (such third Trading Day, the “Legend Removal Date”), deliver or cause to be delivered to such Purchaser a certificate representing such Subject Shares that is free from all restrictive and other legends. The Company may not make any notation on its records or give instructions to the Transfer Agent that enlarge the restrictions on transfer set forth in this Section 4. Certificates for Subject Shares subject to legend removal hereunder shall be transmitted by the Transfer Agent to the Purchaser by crediting the account of the Purchaser’s prime broker with the Depository Trust Company System as directed by such Purchaser.

(d) The Purchaser agrees with the Company that if such Purchaser sells any Subject Shares subject to registration requirements under the Securities Act, including any applicable prospectus delivery requirements, or an exemption therefrom, such Subject Shares will be sold in compliance with the plan of distribution set forth therein, and acknowledges that the removal of the restrictive legend from certificates representing Subject Shares as set forth in this Section 3.1 is predicated upon the Company’s reliance upon this understanding.

(e) The Purchaser has carefully reviewed all of the terms of the Operating Agreement and hereby agrees to be bound by and comply with all of the restrictions on Transfer of the Subject Shares and Subject Shares acquired by such Purchaser, as provided in such Operating Agreement.

3.2 Acknowledgment. The Company acknowledges that its obligations under this Agreement are unconditional and absolute and not subject to any right of set off, counterclaim, delay or reduction, regardless of the effect of any such dilution or any claim the Company may have against any Purchaser and regardless of the dilutive effect that such issuance may have on the ownership of the other stockholders of the Company.

3.3 Furnishing of Information. If after the date hereof the Company becomes subject to the rules and regulations of the Exchange Act and as long as any Purchaser owns Subject Shares, the Company covenants to timely file (or obtain extensions in respect thereof and file within the applicable grace period) all reports required to be filed by the Company after the date hereof pursuant to the Exchange Act. As long as any Purchaser owns Subject Shares, if the Company is not required to file reports pursuant to the Exchange Act, it will prepare and furnish to the Purchaser periodic reports as to the Business and activities of the Company (the “Company Reports”) which shall be provided to Purchaser no less often then semi-annually.

3.4 Registration of Subject Shares. The Company hereby covenants and agrees to register the Subject Shares for resale in accordance with the Registration Rights Agreement annexed hereto as Exhibit A and made a part hereof (the “Registration Rights Agreement”).

3.5 Use of Proceeds. The Company shall use the net proceeds from the sale of the Subject Shares for working capital purposes.

3.6 Fees & Expenses. The Company shall be obligated to pay all professional fees up to incurred in connection with the registration of the Subject Shares in accordance with Section 3.4 above.

ARTICLE IV.

MISCELLANEOUS

4.1 Entire Agreement. This Agreement, together with the exhibits and schedules thereto, contain the entire understanding of the parties with respect to the subject matter hereof and thereof and supersede all prior agreements and understandings, oral or written, with respect to such matters, which the parties acknowledge have been merged into such documents, exhibits and schedules.

4.2 Notices. Any and all notices or other communications or deliveries required or permitted to be provided hereunder shall be in writing and shall be deemed given and effective on the earliest of: (a) the date of transmission, if such notice or communication is delivered via facsimile at the facsimile number set forth on the signature pages attached hereto at or prior to 5:30 p.m. (New York City time) on a Trading Day, (b) the next Trading Day after the date of transmission, if such notice or communication is delivered via facsimile at the facsimile number set forth on the signature pages attached hereto on a day that is not a Trading Day or later than 5:30 p.m. (New York City time) on any Trading Day, (c) the second (2nd) Trading Day following the date of mailing, if sent by U.S. nationally recognized overnight courier service or (d) upon actual receipt by the party to whom such notice is required to be given. The address for such notices and communications shall be as set forth on the signature pages attached hereto.

4.3 Amendments; Waivers. No provision of this Agreement may be waived, modified, supplemented or amended except in a written instrument signed, in the case of an amendment, by the Company and Purchaser. No waiver of any default with respect to any provision, condition or requirement of this Agreement shall be deemed to be a continuing waiver in the future or a waiver of any subsequent default or a waiver of any other provision, condition or requirement hereof, nor shall any delay or omission of any party to exercise any right hereunder in any manner impair the exercise of any such right.

4.4 Headings. The headings herein are for convenience only, do not constitute a part of this Agreement and shall not be deemed to limit or affect any of the provisions hereof.

4.5 Successors and Assigns. This Agreement shall be binding upon and inure to the benefit of the parties and their successors and permitted assigns. The Company may not assign this Agreement or any rights or obligations hereunder without the prior written consent of the Purchaser (other than by merger). Any Purchaser may assign any or all of its rights under this Agreement to any Person to whom such Purchaser assigns or transfers any Subject Shares, provided that such transferee agrees in writing to be bound, with respect to the transferred Subject Shares, by the provisions of this Agreement that apply to the “Purchaser.”

4.6 No Third-Party Beneficiaries. This Agreement is intended for the benefit of the parties hereto and their respective successors and permitted assigns and is not for the benefit of, nor may any provision hereof be enforced by, any other Person.

4.7 Governing Law. All questions concerning the construction, validity, enforcement and interpretation of this Agreement shall be governed by and construed and enforced in accordance with the internal laws of the State of Delaware, without regard to the principles of conflicts of law thereof. Each party agrees that all legal proceedings concerning the interpretations, enforcement and defense of the transactions contemplated by this Agreement and any other Transaction Documents (whether brought against a party hereto or its respective affiliates, directors, officers, shareholders, partners, members, employees or agents) shall be commenced exclusively in the state and federal courts sitting in the City of San Juan, Commonwealth of Puerto Rico. Each party hereby irrevocably submits to the exclusive jurisdiction of the state and federal courts sitting in the City of San Juan for the adjudication of any dispute hereunder or in connection herewith or with any transaction contemplated hereby or discussed herein (including with respect to the enforcement of any of this Agreement), and hereby irrevocably waives, and agrees not to assert in any suit, action or proceeding, any claim that it is not personally subject to the jurisdiction of any such court, that such suit, action or proceeding is improper or is an inconvenient venue for such proceeding. Each party hereby irrevocably waives personal service of process and consents to process being served in any such suit, action or proceeding by mailing a copy thereof via registered or certified mail or overnight delivery (with evidence of delivery) to such party at the address in effect for notices to it under this Agreement and agrees that such service shall constitute good and sufficient service of process and notice thereof. Nothing contained herein shall be deemed to limit in any way any right to serve process in any other manner permitted by law. If either party shall commence an action, suit or proceeding to enforce any provisions of this Agreement, then, the prevailing party in such action, suit or proceeding shall be reimbursed by the other party for its reasonable attorneys’ fees and other costs and expenses incurred with the investigation, preparation and prosecution of such action or proceeding.

4.8 Survival. The representations and warranties contained herein shall survive the Closing and the delivery of the Subject Shares.

4.9 Execution. This Agreement may be executed in two or more counterparts, all of which when taken together shall be considered one and the same agreement and shall become effective when counterparts have been signed by each party and delivered to each other party, it being understood that the parties need not sign the same counterpart. In the event that any signature is delivered by facsimile transmission or by e-mail delivery of a “.pdf” format data file, such signature shall create a valid and binding obligation of the party executing (or on whose behalf such signature is executed) with the same force and effect as if such facsimile or “.pdf” signature page were an original thereof.

4.10 Severability. If any term, provision, covenant or restriction of this Agreement is held by a court of competent jurisdiction to be invalid, illegal, void or unenforceable, the remainder of the terms, provisions, covenants and restrictions set forth herein shall remain in full force and effect and shall in no way be affected, impaired or invalidated, and the parties hereto shall use their commercially reasonable efforts to find and employ an alternative means to achieve the same or substantially the same result as that contemplated by such term, provision, covenant or restriction. It is hereby stipulated and declared to be the intention of the parties that they would have executed the remaining terms, provisions, covenants and restrictions without including any of such that may be hereafter declared invalid, illegal, void or unenforceable.

4.11 Replacement of Subject Shares. If any certificate or instrument evidencing any Subject Shares is mutilated, lost, stolen or destroyed, the Company shall issue or cause to be issued in exchange and substitution for and upon cancellation thereof (in the case of mutilation), or in lieu of and substitution therefor, a new certificate or instrument, but only upon receipt of evidence reasonably satisfactory to the Company of such loss, theft or destruction. The applicant for a new certificate or instrument under such circumstances shall also pay any reasonable third-party costs (including customary indemnity) associated with the issuance of such replacement Subject Shares.

4.12 Remedies. In addition to being entitled to exercise all rights provided herein or granted by law, including recovery of damages, each of the Purchaser and the Company will be entitled to specific performance under this Agreement. The parties agree that monetary damages may not be adequate compensation for any loss incurred by reason of any breach of obligations contained in this Agreement and hereby agree to waive and not to assert in any action for specific performance of any such obligation the defense that a remedy at law would be adequate.

4.13 Saturdays, Sundays, Holidays, etc. If the last or appointed day for the taking of any action or the expiration of any right required or granted herein shall not be a Business Day, then such action may be taken or such right may be exercised on the next succeeding Business Day.

4.14 Construction. The parties agree that each of them and/or their respective counsel have reviewed and had an opportunity to revise this Agreement and, therefore, the normal rule of construction to the effect that any ambiguities are to be resolved against the drafting party shall not be employed in the interpretation of this Agreement or any amendments thereto.

4.15 WAIVER OF JURY TRIAL. IN ANY ACTION, SUIT, OR PROCEEDING IN ANY JURISDICTION BROUGHT BY ANY PARTY AGAINST ANY OTHER PARTY, THE PARTIES EACH KNOWINGLY AND INTENTIONALLY, TO THE GREATEST EXTENT PERMITTED BY APPLICABLE LAW, HEREBY ABSOLUTELY, UNCONDITIONALLY, IRREVOCABLY AND EXPRESSLY WAIVES FOREVER TRIAL BY JURY.

(Signature Pages Follow)

IN WITNESS WHEREOF, the parties hereto have caused this Subject Shares Purchase Agreement to be duly executed by their respective authorized signatories as of the date first indicated above.

|

PURCHASER

_____________________________

Cesar Cordero-Kruger

|

Address for Notice:

|

|

GROWBLOX SCIENCES, INC.

By:_____________________________

Name: Craig Ellins

Title: President

|

|

| |

|

6450 Cameron Street Suite 110A

Las Vegas, NV 89118

Date: April 30, 2015

Dear Warrant Holder:

You are receiving this communique because of your status as a holder of B Warrants of Growblox Sciences, Inc., a Delaware corporation (the “Company”). Your B Warrants entitle you to purchase shares of common stock of the Company for the price of $2.00 per share. The number of common shares you are entitled to purchase is equal to the number of B Warrants that you hold.

On February 12, 2015, the board of directors of the Company passed a resolution to temporarily reduce, until April 30, 2015, the exercise price of such warrants from $2.00 per share to $0.20 per share and notified you of such temporary reduction, Due to interest recently expressed by certain warrant holders, the Board of Directors of the Company has now determined to extend the date of the temporary reduction to $0.20 per share of the exercise price of the B Warrants to 5:00 pm PDT on May 15, 2015. The Warrants may be exercised at the exercise price of $0.20 per share if you elect to exercise your warrants by such date. The common shares you will receive upon the exercise of your Warrants have been registered for resale by you pursuant to a Registration Statement on Form S-1 filed with the Securities and Exchange Commission and which became effective on February 11, 2015.

If you desire to participate in this temporary exercise price reduction, send your certificate representing your B Warrants as applicable along with the filled out NOTICE OF EXERCISE for each Warrant certificate, together with either:

(a) a check payable to Growblox Sciences, Inc. for the total exercise price to:

Growblox Sciences, Inc.

6450 Cameron Street Suite 110A

Las Vegas, Nevada 89118, or

(b) a wire payment in accordance with the wire instructions below:

Growblox Sciences, Inc.

Kirkwood Bank of Nevada

9436 W. Lake Mead Rd.

Las Vegas, NV 89148

Account Number: 10002190

Routing Number: 122402405

If you have any questions regarding the exercise of your Warrants, please contact the following:

Cathryn Kennedy, Chief Financial Officer, 702-576-5704

Very truly yours,

Growblox Sciences, Inc.

Board of Directors

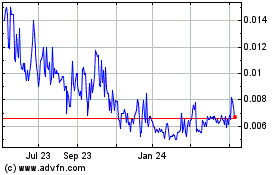

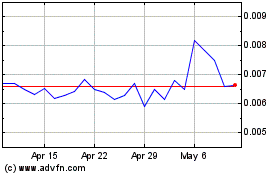

GB Sciences (PK) (USOTC:GBLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

GB Sciences (PK) (USOTC:GBLX)

Historical Stock Chart

From Apr 2023 to Apr 2024