- Reports Record Full Year Net Income of

$87.3 Million -

REX American Resources Corporation (NYSE: REX) today reported

financial results for its fiscal 2014 fourth quarter (“Q4 ‘14”) and

year ended January 31, 2015. REX management will host a conference

call and webcast today at 11:00 a.m. ET.

Conference Call:

212/271-4657

Webcast / Replay URL:

www.rexamerican.com/Corp/Page4.aspx

The webcast will be available for replay

for 30 days

REX American Resources’ Q4 ‘14 results principally reflect its

interests in seven ethanol production facilities. The operations of

One Earth Energy, LLC (“One Earth”) and NuGen Energy, LLC (“NuGen”)

are consolidated, while those of its five remaining plants are

reported as equity in income of unconsolidated ethanol

affiliates.

REX’s Q4 ‘14 net sales and revenue were $127.7 million, compared

with $146.1 million in Q4 ‘13. Primarily reflecting solid ethanol

crush spread margins in Q4 ‘14, the Company’s gross profit rose to

$30.0 million, compared to $26.3 million in the prior year period.

Reflecting the ethanol industry environment during the period and

strong plant operations, Q4 ‘14 equity in income of unconsolidated

ethanol affiliates increased to $7.9 million, from $7.6 million in

Q4 ‘13. The improved quarterly gross profit and income of

unconsolidated ethanol affiliates resulted in Q4 ‘14 net income

from continuing operations before income taxes and non-controlling

interests of $33.4 million, compared with $27.9 million in Q4

‘13.

Net income attributable to REX shareholders in Q4 ‘14 rose to

$20.3 million, compared to $15.9 million in Q4 ‘13, while Q4 ‘14

diluted net income per share attributable to REX common

shareholders was a record $2.55 per share, compared to $1.95 per

share in Q4 ‘13. Per share results in Q4 ‘14 and Q4 ‘13 are based

on 7,968,000 and 8,129,000 diluted weighted average shares

outstanding, respectively.

Net sales and revenue for the twelve months ended January 31,

2015 declined to $572.2 million, from $666.0 million in fiscal

2013, while gross profit for fiscal 2014 more than doubled to

$141.9 million, from $64.3 million in fiscal 2013. Fiscal 2014

equity in income of unconsolidated ethanol affiliates also

increased substantially to $32.2 million, compared with $17.2

million in fiscal 2013. This led to fiscal 2014 income from

continuing operations before income taxes and non-controlling

interests more than doubling to $152.8 million, compared with $59.9

million in fiscal 2013.

For fiscal 2014, REX reported net income attributable to REX

shareholders of $87.3 million, a 149% increase compared with $35.1

million in fiscal 2013, while diluted net income per share

attributable to REX common shareholders rose to a record $10.76 in

fiscal 2014, compared to $4.29 per share in fiscal 2013. Per share

results for the fiscal year ended January 31, 2015 and January 31,

2014, are based on 8,118,000 and 8,180,000 diluted weighted average

shares outstanding, respectively.

REX CEO, Stuart Rose, commented, “We are pleased to report

record fourth quarter and full year earnings and earnings per

share, reflecting the strength during fiscal 2014 of the ethanol

industry as well as the strategic locations and operational

efficiency of our plants and our talented and dedicated operating

team.”

Balance Sheet and Share Repurchase Program

At January 31, 2015, REX had cash and cash equivalents of $137.7

million, $82.9 million, of which was at the parent company, and

$54.8 million of which was at its consolidated ethanol production

facilities. This compares with cash and cash equivalents at January

31, 2014, of $105.1 million, $63.3 million of which was at the

parent company, and $41.8 million of which was at its consolidated

ethanol production facilities.

REX repurchased 161,224 common shares in Q4 ‘14 at an average

price per share of $60.94, bringing the total shares repurchased in

fiscal 2014 to 283,979 common shares at an average price per share

of $64.22. The Company is currently authorized to repurchase up to

an additional 497,582 shares of common stock. Reflecting all share

repurchases to date, REX has 7,899,607 shares outstanding.

At January 31, 2015, REX had lease agreements as landlord for

four former retail store locations. REX has three owned former

retail stores that were vacant at January 31, 2015, which it is

marketing to either lease or sell. The Company sold four former

retail store locations during fiscal 2014.

The following table summarizes select data related to the

Company’s consolidated alternative energy interests:

Three Months

Ended

Twelve Months

Ended

January 31, January 31,

2015

2014

2015

2014

Average selling price per gallon of ethanol $ 1.81 $ 1.86 $ 2.00 $

2.20 Average selling price per ton of dried distillers grains $

117.08 $ 203.69 $ 166.00 $ 233.27 Average selling price per pound

of non-food

grade corn oil

$

0.28

$

0.36

$

0.32

$

0.38

Average selling price per ton of modified distillers grains $ 57.51

$ 97.83 $ 63.47 $ 114.91 Average cost per bushel of grain $ 3.54 $

4.50 $ 3.99 $ 6.27 Average cost of natural gas (per mmbtu) $ 5.22 $

5.41 $ 6.10 $ 4.54

Supplemental Data Related to REX’s Alternative Energy

Interests:

REX American Resources Corporation Ethanol Ownership

Interests/Effective Annual Gallons Shipped as of January 31,

2015 (gallons in millions)

Entity

Trailing Twelve

Months Gallons Shipped

Current REX Ownership

Interest

REX’s Current Effective

Ownership of Trailing Twelve Month Gallons

Shipped

One Earth Energy, LLC (Gibson City, IL)

110.6 74% 81.8

NuGen Energy, LLC (Marion, SD)

115.9 99% 114.7

Patriot

Holdings, LLC (Annawan, IL) 126.2

27% 34.1

Big River Resources West Burlington, LLC

(West Burlington, IA) 108.0 10%

10.8

Big River Resources Galva, LLC (Galva, IL)

119.0 10% 11.9

Big River United

Energy, LLC (Dyersville, IA) 124.9

5% 6.2

Big River Resources Boyceville, LLC

(Boyceville, WI)

57.8 10% 5.8

Total

762.4 n/a 265.3

About REX American Resources Corporation

REX American Resources has interests in seven ethanol production

facilities, which in aggregate shipped approximately 762 million

gallons of ethanol over the twelve month period ended January 31,

2015. REX’s effective ownership of the trailing twelve month

gallons shipped (for the twelve months ended January 31, 2015) by

the ethanol production facilities in which it has ownership

interests was approximately 265 million gallons. Further

information about REX is available at www.rexamerican.com.

This news announcement contains or may contain forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Such statements can be identified by use of

forward-looking terminology such as “may,” “expect,” “believe,”

“estimate,” “anticipate” or “continue” or the negative thereof or

other variations thereon or comparable terminology. Readers are

cautioned that there are risks and uncertainties that could cause

actual events or results to differ materially from those referred

to in such forward-looking statements. These risks and

uncertainties include the risk factors set forth from time to time

in the Company’s filings with the Securities and Exchange

Commission and include among other things: the impact of

legislative changes, the price volatility and availability of corn,

dried and modified distillers grains, ethanol, corn oil, gasoline

and natural gas, ethanol plants operating efficiently and according

to forecasts and projections, changes in the national or regional

economies, weather, the effects of terrorism or acts of war,

changes in real estate market conditions and the impact of Internal

Revenue Service audits. The Company does not intend to update

publicly any forward-looking statements except as required by

law.

- statements of operations follow -

REX AMERICAN RESOURCES CORPORATION

AND SUBSIDIARIES Consolidated Statements of Operations

(in thousands, except per share amounts)

Unaudited

Three Months

Ended

Twelve Months

Ended

January 31, January 31,

2015

2014

2015

2014

Net sales and revenue $ 127,651 $ 146,073 $ 572,230 $ 666,045 Cost

of sales

97,677

119,729

430,291

601,757

Gross profit 29,974 26,344 141,939 64,288 Selling, general

and administrative expenses (4,058 ) (5,318 ) (19,422 ) (17,846 )

Equity in income of unconsolidated ethanol affiliates 7,907 7,617

32,229 17,175 Interest and other income 113 76 369 234 Interest

expense (338 ) (850 ) (2,074 ) (3,898 ) Loss on disposal of real

estate and property and equipment, net

(230

)

-

(238

)

-

Losses on derivative financial instruments, net

-

(9

)

(1

)

(39

)

Income from continuing operations before income taxes and

non-controlling interests

33,368

27,860

152,802

59,914

Provision for income taxes

(9,616

)

(9,726

)

(49,649

)

(20,751

)

Income from continuing operations including non-controlling

interests

23,752

18,134

103,153

39,163

Income (loss) from discontinued operations, net of tax 256 (217 )

234 325 Gain on disposal of discontinued operations, net of tax

199

16

327 741

Net income including non-controlling interests 24,207 17,933

103,714 40,229 Net income attributable to non-controlling interests

(3,859

)

(2,059

)

(16,377

)

(5,156

)

Net income attributable to REX common shareholders

$

20,348 $ 15,874

$ 87,337 $

35,073 Weighted average shares

outstanding – basic

7,968

8,089 8,109

8,137 Basic income per share from

continuing operations* $ 2.50 $ 1.99 $ 10.70 $ 4.18 Basic income

(loss) per share from discontinued operations* 0.03 (0.03 ) 0.03

0.04 Basic income per share on disposal of discontinued operations*

0.02

-

0.04

0.09

Basic net income per share attributable to REX common

shareholders

$

2.55

$

1.96

$

10.77

$

4.31

Weighted average shares outstanding – diluted

7,968 8,129

8,118 8,180

Diluted income per share from continuing operations* $ 2.50 $ 1.98

$ 10.69 $ 4.16 Diluted income (loss) per share from discontinued

operations*

0.03

(0.03

)

0.03

0.04

Diluted income per share on disposal of discontinued operations*

0.02

-

0.04

0.09

Diluted net income per share attributable to REX common

shareholders

$

2.55

$

1.95

$

10.76

$

4.29

Amounts attributable to REX common shareholders: Income from

continuing operations, net of tax $ 19,893 $ 16,075 $ 86,776 $

34,007 Income (loss) from discontinued operations, net of tax

455

(201

)

561

1,066

Net income

$ 20,348

$ 15,874 $

87,337 $ 35,073

* Certain amounts differ from those

previously reported as a result of certain real estate assets being

reclassified as discontinued operations.

- balance sheets follow -

REX AMERICAN RESOURCES CORPORATION AND

SUBSIDIARIES Consolidated Balance Sheets (in

thousands) Unaudited

January 31,

2015

2014

CURRENT ASSETS: Cash and cash equivalents $ 137,697 $ 105,149

Restricted cash - 500 Accounts receivable 8,794 16,486 Inventory

18,062 19,370 Refundable income taxes 3,019 268 Prepaid expenses

and other 5,810 4,891 Deferred taxes-net

2,363

2,146

Total current assets 175,745 148,810 Property and

equipment-net 194,447 202,258 Other assets 6,366 5,388 Equity

method investments 80,389 71,189 Restricted investments and

deposits

- 223

TOTAL ASSETS

$ 456,947

$ 427,868 LIABILITIES AND EQUITY

CURRENT LIABILITIES: Current portion of long term debt $ - $

12,226

Accounts payable – trade 9,210 6,626 Derivative financial

instruments - 1,141 Accrued expenses and other current liabilities

10,347

12,147

Total current liabilities

19,557

32,140

LONG TERM LIABILITIES: Long term debt - 63,500 Deferred

taxes 42,768 19,613 Other long term liabilities

1,658

1,862

Total long term liabilities

44,426

84,975

COMMITMENTS AND CONTINGENCIES EQUITY: REX shareholders’

equity: Common stock, 45,000 shares authorized, 29,853 shares

issued at par 299 299 Paid in capital 144,791 144,051 Retained

earnings 444,438 357,101 Treasury stock, 21,954 and 21,753 shares,

respectively

(239,557

)

(222,170

)

Total REX shareholders’ equity 349,971 279,281 Non-controlling

interests

42,993

31,472 Total equity

392,964

310,753

TOTAL LIABILITIES AND EQUITY

$

456,947 $ 427,868

- statements of cash flows follow -

REX AMERICAN RESOURCES CORPORATION

AND SUBSIDIARIES Consolidated Statements of Cash Flows

(in thousands) Unaudited

Years Ended January 31,

2015

2014

CASH FLOWS FROM OPERATING ACTIVITIES: Net income $ 103,714 $ 40,229

Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization 16,787 17,284

Impairment charges on real estate 68 55 Income from equity method

investments (32,229 ) (17,175 ) Dividends received from equity

method investments 22,889 5,804 Derivative financial instruments

(1,141 ) (1,648 ) Gain on disposal of real estate and property and

equipment (275 ) (1,015 ) Deferred income tax 22,473 15,987 Excess

tax benefit from stock option exercise (441 ) (64 ) Changes in

assets and liabilities: Accounts receivable 7,692 (4,919 )

Inventory 1,308 5,549 Prepaid expenses and other assets (1,929 )

(1,490 ) Income taxes refundable (1,985 ) 1,480 Accounts

payable-trade 2,030 1,721 Accrued expenses and other liabilities

(1,745 ) 2,637

Net cash provided by operating activities

137,216 64,435 CASH

FLOWS FROM INVESTING ACTIVITIES: Capital expenditures (9,927 )

(3,518 ) Repayment of note receivable 6 681 Proceeds from sale of

real estate and property and equipment 1,778 8,876 Restricted cash

500 (500 ) Restricted investments and deposits

323

1,293

Net cash (used in) provided by investing activities

(7,320 )

6,832

CASH FLOWS FROM FINANCING ACTIVITIES: Payments of long term

debt

Loan

(75,726 ) (31,203 ) Stock options exercised 931 1,072 Payments to

non-controlling interests holders (4,856 ) (1,638 ) Excess tax

benefit from stock option exercises 441 64 Treasury stock acquired

(18,138 )

(3,486 ) Net cash used in financing

activities

(97,348 )

(35,191 ) NET INCREASE IN CASH AND CASH

EQUIVALENTS 32,548 36,076 CASH AND CASH EQUIVALENTS-Beginning of

year

105,149 69,073

CASH AND CASH EQUIVALENTS-End of year

$

137,697 $ 105,149

Non cash financing activities - Cashless exercise of stock

options

$ 100 $

- Non cash investing activities – Accrued

capital expenditures

$ 804

$ 250

Non cash investing activities – Loan

receivable granted in connection

with sale of real estate

$ 475

$ -

REX American Resources CorporationDouglas Bruggeman, (937)

276-3931Chief Financial OfficerorJCIRJoseph Jaffoni, Norberto Aja,

(212) 835-8500rex@jcir.com

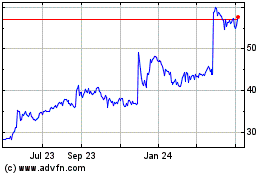

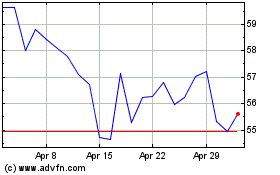

REX American Resources (NYSE:REX)

Historical Stock Chart

From Mar 2024 to Apr 2024

REX American Resources (NYSE:REX)

Historical Stock Chart

From Apr 2023 to Apr 2024